Income tax: OSAGO

Expenses for compulsory motor liability insurance when calculating income tax are included in other expenses associated with production and sales (clause 2 of article 263 of the Tax Code of the Russian Federation).

Situation: is it necessary to include the costs of compulsory motor liability insurance in accounting and taxation in the initial cost of a car?

No no need.

The costs of compulsory motor third party liability insurance are not included in the initial cost of the car. They should be written off as current expenses. The basis is clause 11 of PBU 10/99 and article 263 of the Tax Code of the Russian Federation.

It does not matter that a car without an MTPL policy will not be registered with the traffic police and it will not be able to pass technical inspection (clause 2 of article 4, clause 1 of article 32 of the Law of April 25, 2002 No. 40-FZ). This does not change the essence of insurance costs. After all, in the future you will still need to obtain an MTPL policy every year and pay insurance premiums. And this has nothing to do with car registration. Thus, the costs of compulsory motor liability insurance are not directly related to the purchase of a car. Therefore, they do not need to be included in its initial cost.

A similar point of view is reflected in the letter of the Federal Tax Service of Russia for Moscow dated March 2, 2006 No. 20-12/16322.

Insurance costs and its main types

These expenses are expressed in the form of payment of an insurance premium, i.e. remuneration to the insurer for its services (Article 954 of the Civil Code of the Russian Federation). Depending on the terms of the contract, it can be paid in a lump sum or in installments.

An enterprise may use different types of insurance in its activities:

- Personal (life and health of their employees).

- Property – in terms of the risks of loss or damage to the company’s property.

- Responsibility, which, in particular, includes the well-known compulsory motor liability insurance.

- Other risks (financial, legal, technical, etc.).

Introduction to the issue of refund of insurance premium

If the obligations of the parties under the contract are terminated as a result of its cancellation ahead of schedule, the insurance buyer has the right to demand that the beneficiary review the joint venture and transfer its part back, based on its entire size and the duration of the agreement for the unfinished period, starting from the day of termination and ending on the day expiration of the policy agreement.

The statutes provide no reason why an insurer would retain a greater portion of the joint venture than an amount proportional to the length of the contract.

Insurance in accounting (BU)

To account for calculations for compulsory and voluntary insurance, an account is used. 76, to which separate sub-accounts are opened.

When the insurance premium is paid, the accounting entries will be as follows:

DT 76 – CT 51 (50) - premium amount paid

These services are not subject to VAT, so there will be no tax postings here (clause 7, clause 3, article 149 of the Tax Code of the Russian Federation).

From the point of view of accounting, the insurance premium refers to “ordinary” expenses (clauses 5, 6 of PBU 10/99). The contract may have a validity period covering several reporting periods. Current regulatory documents do not contain specific instructions on how costs should be taken into account in this case - immediately, or distributed over periods. The organization can determine the methodology itself, reflecting the chosen option in its accounting policies.

For the first option, when the entire insurance premium is written off at once, the postings will be as follows:

DT 20 (23,25,26,44) – CT 76 – the amount is charged to expenses in full.

The cost account is selected based on the category of assets the insured object belongs to.

If you decide to distribute costs over several periods, then you should use account 97 “Deferred expenses”. That part of the premium that relates to the first month of the contract is written off as shown above. The remaining premium is distributed over the months until the expiration of the policy:

DT 97 – KT 76.1 – the remaining part is assigned to RBP,

DT 20 (23,25,26,44) – CT 97 – monthly attribution to expenses.

If an insured event occurs, the company receives insurance compensation. The accounting entries will be as follows:

DT 76 – CT 91.1 – insurance compensation accrued;

DT 51 – CT 76 – funds received from the insurer.

Thus, compensation under an insurance policy from the point of view of accounting is other income.

Cost accounting in this case does not depend on the type of contract or object. These can be accounting entries for motor vehicle, cargo, personal insurance, etc.

The exception is mandatory insurance contributions to extra-budgetary funds. They are taken into account in a special manner (in fact, they can be considered payments similar to taxes) and are not discussed in this article.

Example

The company purchased an MTPL policy for a passenger car it owned. The policy period is 1 year, the cost is 2400 rubles. The accounting policy states that costs associated with compulsory motor liability insurance are reflected using accounts. 97 "RBP". The car was involved in an accident, damage amounted to 10 thousand rubles. was compensated by the insurance company of the person responsible for the accident. According to the MTPL agreement, the accounting entries are as follows:

DT 76.1 – CT 51 (RUB 2,400) – MTPL policy has been paid for for a period of 1 year;

DT 26 – CT 76.1 (200 rub.) – expenses for the first month of the policy are written off (2400 / 12 months);

DT 97 - CT 76.1 (RUB 2,200) - the balance of the premium is allocated to the RBP;

DT 26 – CT 97 (200 rub.) – monthly write-off;

DT 26 – CT 60 (RUB 10,000) – repair costs after an accident;

DT 76.1 – CT 91.1 (RUB 10,000) – insurance compensation accrued;

DT 51 – CT 76.1 (RUB 10,000) – compensation received from the insurer.

Postings for leasing a car from the lessee

The use of special modes by legal entities is characterized by its own nuances, for example:

- when applying UTII, the calculation of tax payable is also carried out according to certain principles, which do not include the deduction from the tax base of the costs of payments under the leasing agreement.

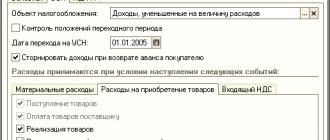

- when applying the simplified tax system “income”, leasing expenses cannot be written off as a reduction in the tax base in the same way as other expenses for conducting business;

We recommend reading: Arrow check balance by card number

Further in the material we will talk about accounting for car leasing from legal entities located on OSNO.

We will not touch upon tax accounting issues, since there are some discrepancies in the professional literature and publications due to the fact that the legal issues of leasing accounting in the Russian Federation are not fully regulated. The issues of distinguishing between accounting and tax entries are presented in detail in the articles:

- ;

- .

- ;

In the concluded leasing agreement

Features of tax accounting for insurance (TI)

The NU rules here differ significantly from the BU rules:

- Accounting for expenses can begin only after payment of the premium to the insurer.

- You can immediately write off costs only if the contract period is “within” the reporting period for income tax, i.e. quarter. If the contract is long-term, then the costs must be distributed evenly during its validity period (Clause 6 of Article 272 of the Tax Code of the Russian Federation)

- Tax accounting contains restrictions on costs that can be recognized for compulsory types of insurance, for example, for compulsory motor liability insurance, only within the established norms - insurance tariffs (clause 2 of Article 263 of the Tax Code of the Russian Federation). For voluntary types, expenses are taken into account in the actual amount (clause 3 of Article 263 of the Tax Code of the Russian Federation).

To minimize deviations between the two types of accounting, it is advisable to use account 97 for accounting for long-term contracts. In this case, subject to cost limits, tax differences do not arise.

The MTPL agreement was terminated early

The organization entered into an MTPL agreement with the insurance company for a period of one year from April 9, 2007 to April 8, 2008 in the amount of RUB 9,084.38. The fixed asset was sold on June 27, 2007, and the contract was terminated on July 6, 2007.

The organization made the following entries: for April - Debit 26 - Credit 97 - 546.06 rubles; for May - Debit 26 - Credit 97 - 758.16 rubles; June 27 - Debit 26 - Credit 97 - 681.44 rubles. (9084.38 rub. x 80 days: 366 days - - (546.06 rub. + 758.16 rub.)). The insurance company counted RUB 5,294.01 to be refunded.

How correctly should all transactions related to the closure of this contract be reflected in tax and accounting records, in particular the amount of the refund and the 23% commission that the insurance company withheld?

Accounting.

Expenses under MTPL agreements are taken into account by the organization as part of expenses for ordinary activities as other expenses (clauses 5, 7 and 9 of PBU 10/99).

Costs incurred by the organization in the reporting period, but related to the following reporting periods, are reflected in the balance sheet as a separate item as deferred expenses (clause 65 of the Regulations on Accounting and Financial Reporting in the Russian Federation). Account 97 “Deferred expenses” is intended for their accounting.

During the term of the agreement, the amount of the insurance premium recorded in the debit of account 97 is written off from the credit of this account to the debit of account 26 in the manner established by the organization.

Tax accounting.

Car owners must insure their civil liability in accordance with Federal Law No. 40-FZ dated April 25, 2002 “On compulsory civil liability insurance of vehicle owners.” Costs for compulsory types of property insurance are classified as other expenses (clause 2 of Article 263 of the Tax Code of the Russian Federation). Therefore, insurance premiums under the MTPL policy reduce taxable profit. The specific procedure for their tax accounting depends on the accounting policy of the policyholder.

With the accrual method, insurance premiums are expensed evenly throughout the entire term of the contract in proportion to the number of calendar days of its validity in the reporting period (clause 6 of Article 272 of the Tax Code of the Russian Federation). That is, tax accounting in this case fully corresponds to accounting.

If an organization terminates an MTPL agreement early on its own initiative, for example, when replacing the owner of a vehicle (subclause “b” of clause 33.1 of the Rules for compulsory civil liability insurance of vehicle owners, approved by Decree of the Government of the Russian Federation of 05/07/2003 N 263; hereinafter referred to as the Rules), An application is submitted to the insurer to change the owner of the car and return the insurance payment. In addition to the application, a contract for the sale of the car is presented.

The insurance company is obliged to return to the policyholder part of the insurance premium for the unexpired term of the MTPL agreement.

The calculation of this period begins from the day following the day the insurer receives a written application from the policyholder for early termination of the MTPL agreement (clause 34 of the Rules). In this case, the insurance premium is returned from the moment the ownership of the car is transferred to another owner.

The Ministry of Finance of Russia, in a letter dated November 16, 2005 N 03-03-04/1/372, explained that in accordance with the structure of the tariff rate, 3% of the insurance premium under the MTPL agreement is sent by the insurer to reserves for compensation payments, 20% goes to cover the insurer’s expenses for the implementation of compulsory insurance.

Thus, the taxpayer takes into account expenses for compulsory motor liability insurance as part of other expenses within the limits of the amounts of paid insurance premiums, which contain the specified deductions in the amount of 23%. In case of early termination of the MTPL agreement, the organization includes the amounts received from the insurance company as income for profit tax purposes.

In this situation, the organization needs to make the following entries.

Debit 76/1 - Credit 51 - 9084.38 rub. — the insurance premium has been paid to the insurance company;

Debit 97 - Credit 76/1 - 9084.38 rubles. — expenses under the MTPL agreement are reflected as deferred expenses;

Debit 26 - Credit 97 - 546.06 rubles. (RUB 9,084.38: 366 days x 22 days) - expenses under insurance contracts are included as expenses.

FAQ

Question No. 1. A company paying tax under the “simplified” “Income minus expenses” took into account the returned part of the joint venture when paying taxes in the period when it was transferred to the account. What to do if a bill of exchange was issued to pay it?

Such income must be taken into account at the time of payment of the bill or its transfer by endorsement to another person.

Question No. 2. What number should be used to indicate the payment of the insurance premium after early termination of cooperation with the insurer, if an agreement was concluded with him on the fulfillment of counter obligations by offset?

The date of income is the day of certification of the netting act.

Question No. 3. Can the insurance company return part of the joint venture through an electronic wallet?

Yes. In this case, the payment system operator will reduce the balance of electronic money with the sender and increase its amount with the recipient at the same time.

Typical errors when trying to return

Mistake #1. When writing an application for the return of the joint venture, it is indicated that the policyholder wants to terminate the contract with the insurance company early.

Such a case will fall under clause 3, paragraph 2 of Art. 958 of the Civil Code of the Russian Federation (unilateral termination of the agreement, refusal of insurance), which provides for the refusal of partial payment of the joint venture. If we take insurance when issuing a loan by a bank as an example, the joint venture will not return to the borrower in the event that he refuses insurance before he has time to repay the loan.

Mistake #2. Recognition as expenses of the amount of joint venture that remained in the list of deferred expenses after the company sold the vehicle for which insurance was issued.

This amount of money should be reflected in the insurer's accounts receivable, after which debt collection measures should be taken. If the money is not returned due to statute of limitations or debt forgiveness, the funds are added to the list of unrealized expenses as debts impossible to collect.

Accountant's Directory

The insurance company's decision to pay compensation is reflected by PNO (600,000 x 20%) 99 68,120,000 The insurance company's decision to pay insurance compensation, Accounting statement Receipt of insurance compensation Cash received from the insurance company 51 76-1,600,000 Bank statement current account ——————————– Accounting for transactions under compulsory motor insurance and motor insurance contracts in “1s:accounting 8”

In this regard, it should be noted that the first line may contain other invoices: it all depends on the nature of the cargo being transported. So, for example, for materials and raw materials, count 10 should be used, for resold goods - 41, and so on.

Ways to get your insurance premium back

Early withdrawal from relations with the insurance company can occur for objective reasons, when the contract is no longer able to be fulfilled due to the absence of the object of insurance, and for subjective reasons, if the policyholder has expressed a desire to stop working with the insurer.

Full and partial refund of insurance premiums:

- A full refund is possible if the policyholder has paid off the loan with the bank within 1-2 months.

- A partial refund is possible if six months have passed since the loan was issued. If the amount of the insurance premium exceeds one hundred thousand rubles, it makes sense to ask the insurer for a statement with a distinction between the target distribution of funds

You can fill out the form for a refund on the day you receive a certificate of no debt obligations to the creditor.

- passport,

- a certificate of full repayment of the loan from the bank or an incident in which the occurrence of an insured event is excluded,

- account details,

- checks for payment of insurance payments.

In case of refusal to pay funds, you can forward the written refusal to Rospotrebnadzor or go to court with a statement of claim.

If the court decides in favor of the plaintiff, it makes sense to shift the litigation to the insurance company and demand compensation for moral damages for the illegal use of the misappropriated joint venture for commercial purposes. The court usually sides with the consumer of the service, based on the unreasonableness of paying the full cost of the insurer’s service when it is only partially performed.

If the insurance company recognizes a debt to the purchaser of the policy equal to the cost of the joint venture after the termination of fulfillment of obligations under the agreement before the agreed date, the insurer will not fully return the unaccounted for expenses of the joint venture. This is explained by the fact that a certain portion of the tariff (namely 23%) is made up of expenses under the MTPL agreement. The Ministry of Finance allows firms to take this part of the funds into account when paying corporate income taxes.

Rebus Company

When calculating the single tax, include insurance compensation as part of non-operating income. The date of recognition of such income is the day of actual receipt of funds into the current account (cash) of the organization.

Let us remind you that in connection with the recently introduced obligation of banks to report to the relevant accounting and control authorities about the receipt of funds in bank, including card, accounts of individuals, the Federal Tax Service Inspectorate in 2021 began mass mailings of letters to individuals who received insurance compensation in 2021 for damaged vehicles, with the requirement to declare income and pay personal income tax by April 30.

Accounting entries when returning an insurance premium

- Money spent on transport insurance (MTPL, CASCO) is included in the list of expenses for ordinary activities. They are added to the cost of products sold and affect account 76-1 “Calculations for property and personal insurance.” Read also the article: → “Accounting for property and personal insurance (account 76).”

- On the day when the company sends money as joint venture to the insurance company, the accountant is obliged to record the issuance of the advance (this is Debit 76-1 Credit 51 - paid to joint venture).

- Expenses for insurance are not subject to VAT.

- The cost item for the insurance policy begins to be recognized by accountants from the moment the joint venture payments begin, if it turns out that the agreement does not mention a specific date from which the contract is recognized as valid.

- If the contract is designed for a period of more than 30 days, the accountant posts monthly: Debit 20 (23/26/44..) Credit 76-1 - the cost of the joint venture for the current month is expensed.

- If the agreement is designed for a period of less than a month, the joint venture must be added by the accountant to the costs of the month in which the agreement was recognized as valid. Debit and Credit see clause 5-a.

- If the organization did not start using the services of the insurance company on the 1st day of the month, the amount must be written off in proportion to the number of days remaining until the end of the month.

- The returned funds from the unspent joint venture should be reflected by the following entry: Debit 51 Credit 76-1 - part of the insurance received. premiums taking into account the actual duration of the contract.

A practical example of BU and NU when returning an insurance premium

Organization N using the simplified tax system “Income minus expenses” acquired ownership of a passenger vehicle and spent money on compulsory motor liability insurance and comprehensive insurance. Less than a year later, it was resold. Under NU, the price of compulsory motor liability insurance was included as an expense, in accounting - as an expense for the duration of the contract with the insurer (1 year) on account 97, and was written off on account 20. CASCO was not included in NU, but in BU they repeated the actions with compulsory motor liability insurance.

So, at the beginning of the next year there was a balance on Debit 97 of the account, the costs of issuing the policy were not written off. A new car was soon purchased and the insurer transferred the unspent insurance amount to new policies.

Tax accounting for this case. On the date when the tax accounting of the organization was carried out, the accountant had to reflect 2 transactions:

- The balance of funds that were transferred by the insurer back to the company’s account as an excess payment to the joint venture under the insurance contract terminated early with it are included in the number of income subject to accounting when paying the single tax;

- The same amount of funds is taken into account in the list of expenses for insurance services under the second contract.

Regulations regarding the return of insurance premiums:

An example of calculating the returned insurance premium

An organization using the simplified tax system “Income minus expenses” uses a vehicle for the needs of the company and transfers money under the MTPL agreement paid for the year (from 02/1/15 to 01/31/16). Annual fear. the bonus is 4 thousand rubles. and is paid by the company in a lump sum on 02/1/15. When calculating the EUR for the first quarter of 2015, the accountant adds these 4 thousand rubles to expenses. And on March 2, 2015, the car was resold and the contractual relationship was terminated.

Then, on March 10, 2015, the insurer will return 3,682 rubles to JV account N, based on the actual duration of the agreement. When calculating the EUR for the first quarter of 2015, the company’s accountant will add the returned money to income (3,682 rubles).