Home / Taxes / What is VAT and when does it increase to 20 percent? / Declaration

Back

Published: 07/28/2017

Reading time: 6 min

0

428

According to the purchase and sale agreement, the seller's side is obliged to transfer the goods to the buyer into his ownership, and the buyer is obliged to accept it and pay the price - in monetary terms. In case of termination of the contract, the obligations cease.

The parties can agree and establish the return of what was carried out by them before the termination of the agreement. Thus, goods that are of poor quality and accepted for registration by the buyer are subject to return, provided that at the time of acceptance of the goods it was not discovered that their quality does not correspond to the terms of delivery.

If the sale of goods does not take place in the order of returning the goods to the seller, the original purchase and sale agreement is terminated and the original transfer of ownership is cancelled.

- Buyer Return Procedure

- The procedure for returning goods from a buyer without VAT to a supplier with VAT

- Accounting for VAT on goods return transactions

- Accounting entries

- Reflection in the declaration

Return of goods to the supplier where reflected in the VAT return

Taxpayers, of course, do not have access to departmental software, but in fact there is no need for this - after all, the accountant only has to analyze the statements of his employer, and not thousands of declarations of many taxpayers. Control ratios of indicators are unique rules and equations, the violation of which, if allowed, is only in absolutely exceptional cases, each of which the tax authority will, without a doubt, challenge.

(hereinafter referred to as the Procedure), taking into account the changes that came into force on August 24, 2021 (Order of the Federal Service for Regulation of the Alcohol Market No. 169 of June 23, 2021). According to the Procedure, the volumes of purchase and supply of alcoholic products in declarations are reflected on the basis of the data specified in the accompanying documents provided for in Article 10.2 of Federal Law No. 171-FZ. The manufacturer-supplier organization (hereinafter referred to as the supplier) reflects the supply of products: 1) in the declaration on the volume of turnover of ethyl alcohol, alcoholic and alcohol-containing products in the form according to Appendix No. 3 (hereinafter referred to as declaration No. 3) in accordance with clause 5.2 of the Procedure: in column 10 “wholesale trade organizations” - the volume of products shipped to wholesale trade organizations in accordance with the accompanying documents; 2) in the declaration on the volume of supply of ethyl alcohol, alcoholic and alcohol-containing products in the form of Appendix No. 6 (hereinafter referred to as declaration No. 6) in accordance with clause 8.2 of the Procedure in column 20 “volume of products supplied” - the volume of products delivered (transferred) in accordance with the accompanying documents. The wholesale trade organization (hereinafter referred to as the recipient) reflects the products received from the supplier: 1) in declaration No. 5 in column 7 “from producer organizations” - the volume of products purchased from product manufacturers in accordance with the accompanying documents; 2) in declaration No. 7 in accordance with clause 9.2 of the Procedure in column 20 “volume of purchased products” - the volume of products purchased (moved) in accordance with the accompanying documents. The volume of alcoholic products purchased and reflected by the recipient in declaration No. 7 must correspond to the volume reflected by the supplier in declaration No. 6 on the basis of accompanying documents in full in the reporting period when the delivery (shipment) of alcoholic products was actually made. In accordance with Part 4 of Article 9 of Federal Law No. 402-FZ dated December 6, 2021 “On Accounting” (hereinafter referred to as Federal Law No. 402-FZ), primary accounting documents are drawn up in forms approved by the head of the economic entity.

Refund from a supplier: how to register VAT

The agreement to terminate the contract, drawn up on 9.2013 (later than the deadline for submitting “clarifications with declared deductions - June 2013), did not save the situation: the company’s arguments that the right to deduct amounts of “advance VAT arose only from the moment of termination of the contract (with date of drawing up the agreement) were not accepted by the cassation authority. The court issued a verdict: by claiming deductions in June 2013, the company missed the deadline established by law for claiming these deductions. The capital's tax authorities, explaining a similar issue, indicated: in the event of a change in the terms of the supply contract or its termination, as well as the return of advance amounts against the upcoming supply of goods, the amounts of VAT calculated by the supplier of such goods and paid by him to the budget from the specified advance amounts are subject to full deduction in the amount after the corresponding adjustment transactions are reflected in the accounting in connection with the return of the advance, but no later than one year from the date of its return (Letter dated March 14, 2007 N 19-11/022386).

A payment order, in the field “Purpose of payment” the basis for the transfer will be indicated “Return of advance payment under supply agreement N.”, and can serve as such a document-the basis for deducting “advance VAT from the amount that falls on the withdrawn advance. If in the “payment for a refund to the buyer” the details of letters demanding the return of previously transferred money and a reference to the reasons for withdrawing the advance (part of the advance) are indicated, claims from controllers will generally be minimized. An advance or prepayment is a payment that is received by the supplier (seller) before the date of actual shipment of products or before the provision of services (clause 1 of Article 487 of the Civil Code). If the supplier (performer) has not fulfilled its obligations within the period established by the contract, then it must return the funds received from the buyer (customer).

How to reflect such a refund of advance payment from the supplier in the buyer’s accounting and tax records?

Return of goods to the supplier where reflected in the VAT return

Also, the right to deduct tax accrued on proceeds from the sale of goods arises from the selling company when they are returned by the buyer. For the procedure for applying VAT deductions in such situations, read the article prepared based on the materials of the reference book “Annual Report – 2021” by the Garant-Press publishing house. Deducting VAT when returning an advance In general, when receiving an advance for future deliveries of goods (work, services), the seller becomes obligated to charge VAT.

Returning goods is fraught with accounting difficulties. And everyone tries to avoid them. It's good if your customer returned the item quickly, while you can still delete the shipping data in your accounting without consequences. In this case, many (by agreement with the counterparty) simply destroy the shipping documents - and it’s as if the shipment never happened at all. And if the buyer returns only part, then a new invoice and invoice are issued only for those goods that remain with the buyer.

Results

The procedure for processing the return of goods to the supplier has changed since 2019 and is now uniform: the supplier draws up an adjustment invoice, and the buyer only draws up an invoice marked “return of goods.” The buyer does not issue an invoice for the return. Based on the adjustment invoice, the seller accepts VAT for deduction during the period of return of goods, and the buyer recovers the VAT.

For a sample of filling out a correction invoice for returning goods to a supplier, see here.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Return of goods to the supplier where reflected in the VAT return

There are also other legal grounds for refusal of obligations under the contract. However, the item must be sent back. Let's say because it is not in demand. This is possible when there is a corresponding provision in the contract. Or if you agree with the counterparty. The peculiarity of this situation is that the ownership of the purchase has already transferred to the buyer.

VAT payers at customs are persons recognized as taxpayers in connection with the movement of goods across the customs border of the Russian Federation and determined in accordance with the Customs Code of the Russian Federation. VAT charged when importing goods into the customs territory of the Russian Federation, according to Art. 318 of the Labor Code of the Russian Federation, is one of the types of customs payments. Since VAT payers at customs are determined according to the norms of customs law, Art.

We recommend reading: Bankruptcy of a Legal Entity Initiated by an Individual

Compiled by whom?

Whether the seller must supplement the invoice depends on the reasons for the return shipment and whether delivery is accepted at the customer's warehouse. If the contract is terminated due to the seller’s violation of its obligations, then the property is handed over to the supplier for registration, and he bears all legal obligations for its documentary support.

The seller also draws up a return invoice if the shipment turns out to be unacceptable to the buyer, for example, if a defect is discovered upon receipt. In other variations, the responsibility for adjustment lies with the buyer. If the terms of the supply agreement are not met, then the sale does not take place and, according to Article 475 of the Civil Code of the Russian Federation, this is tantamount to the cancellation of the transaction, and not the reverse sale. The reason for unilateral termination of the contract may be :

- inadequate quality according to Article 475 of the Civil Code;

- refusal to provide accompanying documentation or equipment in accordance with Article 464 of the Civil Code;

- sales of a smaller volume than specified in the agreement under Article 466 of the Civil Code;

- non-compliance of the transferred assortment with the order under Article 468 of the Civil Code;

- delivery without packaging, containers or unpacked products, which, according to regulations, are subject to packaging in accordance with Article 482 of the Civil Code of the Russian Federation.

If the sale did not take place, and the listed scenarios are regarded as such, the seller is required to adjust the invoice by drawing up a return document under clause 3 of Article 168 of the Tax Code of the Russian Federation, regardless of registration by the buyer.

The buyer draws up an invoice if the contract is broken not due to a violation of the supply agreement, but for other reasons. The condition for entering into an obligation is the receipt of the returned goods for registration .

Such an action is considered a reverse sale, therefore, when reversing a product that is suitable for its intended use and meets the main technical characteristics, its purchaser, from the point of view of the Tax Code, acts as a seller and bears all the accompanying obligations to complete.

The return invoice is always prepared by one of the parties, usually the one through whose fault the rollback of the commercial action was initiated.

How to reflect the return of goods in the VAT return

If the VAT return is submitted in the same period when the goods were subject to return, and also if the buyer did not accept the goods (ownership remained the same), then the proceeds from such goods, and accordingly the tax base, are reflected on line 010-020 of section 3. The supplier records a deduction for returned goods on line 120 of this section.

Products that do not meet the quality may be returned only with the consent of both parties. In this case, the seller and buyer change places for a while. Returns due to poor quality are subject to invoicing by the former buyer to the supplier for an amount equivalent to the product being returned.

When the law allows the buyer to return the goods

By concluding a purchase and sale agreement, the seller and buyer expect that the conditions specified in it will be met - the supplier will ship goods of proper quality on time and in the agreed volume, and the buyer will pay on time and in full.

For various reasons, the buyer may refuse delivery and return the goods to the seller. The list of legal grounds for such actions is presented in the figure:

Civil legislation also provides that the buyer does not have the right to refuse delivery or return the goods if the seller promptly replaces the defective goods or completes them.

We reflect the return of low-quality goods in the VAT return

In accordance with paragraphs. 6.1 and 7.1 of the Procedure, the income and expenses in question will be reflected, respectively, on lines 012 of Appendix No. 1 to Sheet 02 “Income from sales and non-operating income” and 030 of Appendix No. 2 to Sheet 02 “Expenses associated with production and sales, non-operating expenses and losses equated to non-operating expenses” Declaration. Since income and expenses in this situation are equal, the tax base for this operation will be zero.

At the same time, there is another point of view: when returning a low-quality product, the buyer does not have the obligation to charge VAT, since there is no object of taxation, in particular, sales (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). Special rules defining the procedure for deducting VAT in this case are clause 5 of Art. 171 and paragraph 4 of Art. 172 of the Tax Code of the Russian Federation - formulated for the party - the seller. Clause 3 of Art. 170 of the Tax Code of the Russian Federation does not include rules for the restoration of VAT for a buyer returning low-quality goods received by him. And the fact of issuing an invoice in such a situation does not indicate the reflection of the “reverse” sale in the buyer’s accounting, but simply implements the mechanism for applying clause 5 of Art. 171 and paragraph 4 of Art. 172 of the Tax Code of the Russian Federation by the seller (see also decision of the Supreme Arbitration Court of the Russian Federation dated September 30, 2021 N 11461/08, resolution of the FAS of the East Siberian District dated October 9, 2021 N A33-15601/2021, resolution of the FAS Volga District dated February 12, 2021 N A65-14995/2021 ).

How to deduct VAT when transferring an advance payment to a supplier

Has the organization entered into several separate contracts with the supplier? Then VAT on advances can be deducted only for those contracts in respect of which all the listed conditions are met. And it does not matter whether the buyer has a debt to the supplier under other contracts - this does not limit the right to deduction. This was stated in the letter of the Ministry of Finance of Russia dated March 5, 2011 No. 03-07-11/45. If, on account of the received prepayment, the supplier ships goods, performs work, provides services, or transfers property rights in separate installments (in stages), then the buyer must recover input VAT in parts.

Namely, in the amounts indicated in the invoices for each batch (stage). Similar clarifications are contained in letters of the Ministry of Finance of Russia dated July 1, 2010 No. 03-07-11/279 and dated January 28, 2009 No. 03-07-11/20. This position is reflected in paragraph 23 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33. Supervisory agencies confirm that inspections, when resolving controversial issues, should be guided by officially published documents of the highest judicial authorities and not bring the matter to court (letters from the Ministry of Finance of Russia dated November 7 2013 No. 03-01-13/01/47571 and the Federal Tax Service of Russia dated November 26, 2013 No. GD-4-3/21097). Neither paragraph 12 of Article 171, nor Chapter 21 of the Tax Code of the Russian Federation as a whole contain any indication that the advance must be transferred to the seller (performer) exclusively in cash.

The absence of such restrictions means that the buyer (customer) cannot be deprived of the right to deduct VAT if the advance payment is made in securities, transfer of property rights, in kind, etc. Having received such an invoice from the seller (executor), the buyer ( the customer) can register it in the purchase book, and submit the VAT amount for deduction. Having received products that the reorganized organization paid in advance, the assignee has the right to deduct VAT charged to him by the seller (clause 2 of Article 171 of the Tax Code of the Russian Federation). However, this right is inextricably linked with the obligation to restore the tax that was accepted for deduction from the advance amount (subclause

3 p. 3 art. 170 of the Tax Code of the Russian Federation). After all, advance payment for goods (work, services) and their receipt to the buyer are components of one and the same operation, forming one object of taxation. Namely, the transfer of ownership of the product from the seller to the buyer (clause

1 tbsp. 146 of the Tax Code of the Russian Federation).

- after the receipt of goods (work, services, property rights) received on account of the transferred advance or partial payment. In this case, the buyer (customer) accepts for deduction the amount of VAT that is allocated in the invoice issued by the seller (performer) upon shipment. VAT must be restored in the quarter in which the buyer will have the right to deduct for goods (work, services, property rights) received as part of a previously transferred advance or partial payment;

- upon termination or change of the terms of the contract for the supply of goods (performance of work, provision of services, transfer of property rights), towards which the advance was transferred. In this case, the seller returns to the buyer the previously transferred advance or partial payment. VAT must be restored in the quarter when the terms of the contract were terminated or changed and the advance payment (partial payment) was returned.

Refund from a supplier: how to register VAT

Reflection in the VAT return of the return of low-quality goods to the supplier

I am still inclined to believe that this operation is not a sale, therefore it does not affect profit in any way. But as for VAT, according to clause 5 of Article 171 of the Tax Code of the Russian Federation, “Tax amounts presented by the seller to the buyer and paid by the seller to the budget when selling goods are subject to deductions, in the event of the return of these goods (including during the warranty period) to the seller or abandoning them." Those. the seller has the right to deduct VAT, and therefore we, as the buyer, must submit for recovery/payment. And again, returning a low-quality product is not a sale, and according to my logic, lines 010 and 020 of the VAT declaration should not be included...

As we have already said, the return of goods is not a sale, which means it falls under clause 4 of clause 2 of Article 170 of the Tax Code of the Russian Federation and, accordingly, the amount of VAT is subject to restoration in accordance with clause 3 of Article 170 of the Tax Code of the Russian Federation: “Tax amounts are subject to restoration in the amount previously accepted for deduction……..”

We issue a return of goods using an adjustment invoice

From April 1, 2021, sellers do not process returns as reverse sales if the buyer managed to register the purchased goods. From this date, they issue an adjustment invoice to the buyer, regardless of whether the returned goods were registered before April 1, 2021 or after. That is, now any return of goods must be processed through an adjustment invoice (Resolution of the Government of the Russian Federation dated January 19, 2021 No. 15).

To adjust the shipment, the seller and buyer must agree on it in writing. For example, conclude an appropriate agreement or contract, or draw up a primary document confirming the consent of both parties to change the terms of the transaction.

If there is no additional agreement or agreement to change the cost of shipment, the seller will not be able to deduct VAT even if there is an adjustment invoice. Likewise, it will not be able to deduct VAT in the absence of an adjustment invoice.

But if the return is formalized as a “reverse” supply or purchase and sale agreement, the tax on the invoice of the “former” buyer (and now the seller) can be deducted on a general basis (letter of the Ministry of Finance of Russia dated April 10, 2021 No. 03- 07-09/25208).

No later than 5 calendar days from the date of signing the additional agreement, the seller issues an adjustment invoice to the buyer.

If on the date of return of the goods the seller has already paid the VAT accrued on the shipment to the budget, he has the right to accept it for deduction while simultaneously meeting the following conditions:

- an adjustment has been made in accounting due to the return;

- less than one year has passed since the return of the goods.

The seller accepts VAT as a deduction in the amount of the difference between the tax amounts calculated before and after the return of the goods. The basis for this will be a correction invoice. He does not need to submit an updated VAT return for the period when the shipment took place.

Example.

VAT on the return of goods that are not recognized as sales In September, Aktiv JSC shipped a batch of shoes in the amount of 100 pairs at a price of 1,200 rubles to the buyer Passive LLC. per unit (including VAT - 200 rubles). In total, goods worth 120,000 rubles were shipped. (including VAT - 20,000 rubles). The cost of one pair of shoes was 800 rubles, and the cost of the shipped batch was 80,000 rubles. In October, Aktiv paid VAT on sales in the amount of RUB 6,667. (RUB 18,000: 3). Ten pairs of shoes totaling RUB 12,000. (including VAT - 2000 rubles) turned out to be defective. In October, Passive returned them to Aktiv. In the same month, the partners formalized an agreement to the contract for the return of goods, and JSC Aktiv issued an adjustment invoice to Passiv. The cost of the consignment of goods after adjustment is 108,000 rubles. (including VAT - 18,000 rubles). The difference between the updated and original VAT was: RUB 18,000. – 20,000 rub. = –2000 rubles. Thus, JSC Aktiv will apply a VAT deduction in the amount of 2000 rubles in the fourth quarter. The Aktiva accountant will make the following entries in the accounting: in September DEBIT 62 CREDIT 90-1 – 120,000 rubles. – revenue from the sale of shoes is reflected; DEBIT 90-3 CREDIT 68 SUBACCOUNT “VAT CALCULATIONS” – 20,000 rubles. – VAT payable to the budget has been accrued; DEBIT 90-2 CREDIT 41 – 80,000 rub. – the cost of shoes sold was written off. In October DEBIT 68 CREDIT 51 – 6667 rubles. – transferred to the VAT budget; DEBIT 62 CREDIT 90-1 – 12,000 rub. (RUB 1,200 × 10 pairs) – the return of goods is reflected according to the adjustment invoice (part of the revenue is reversed); DEBIT 90-2 CREDIT 41 – 8000 rub. (800 rubles × 10 pairs) – part of the cost of goods was reversed according to the adjustment invoice; DEBIT 90-3 CREDIT 68 SUBACCOUNT “VAT CALCULATIONS” – 2000 rub.

(RUB 12,000 × 20%: 120%) – VAT is reversed according to the adjustment invoice. The last entry means that “Asset” has deducted VAT in the amount of RUB 2,000. In a similar procedure, the contractor can deduct VAT paid when performing work or providing services if the customer refuses them (clause 5 of Article 171 of the Tax Code of the Russian Federation).

Returning goods to the supplier in the VAT declaration

In the previous issue, we analyzed in detail the issues related to the return of low-quality goods in the wholesale trade. At the same time, the seller and buyer have every right in the supply agreement to provide for the grounds and procedure for returning quality products to the seller. Let's consider the accounting procedure for such business transactions.

In accordance with paragraph 5 of Article 171 of Chapter 21 Value Added Tax of the Tax Code of the Russian Federation, amounts of value added tax presented by the seller to the buyer and paid by the seller to the budget when selling goods are subject to deduction in the event of their return. When returning goods accepted for registration, the buyer is obliged, in the manner established by paragraph 3 of Article 168 of the Code, to issue the corresponding invoice to the seller and register a second copy of the invoice in the sales book.

Is the buyer required to write an application to return the goods?

Yes, an invoice (previously provided by the supplier) is also provided. Instead of an application, a claim may be submitted (products of improper type, defective, defective, expired). The adjustment invoice is filled out by the seller himself, regardless of when the purchase was made. Termination of the purchase and sale agreement is signed between the buyer and seller.

Documents required when returning goods in 2020

What documents are needed? The person returning the shipment is required to:

- application for the return of goods from the buyer or claim;

- invoice (the batch has been registered);

- termination of an agreement.

The seller also draws up an invoice (with correction), makes changes to the sales book, all this is reflected in the financial statements. The form can be downloaded on the Federal Tax Service website, a sample is also available there.

To obtain a tax deduction, financial statements are sent to the Federal Tax Service, taking into account the income received and expense transactions, VAT paid at the actual rate. This norm is temporary; it will be abolished until 2021 (at which time a new calculation procedure will be approved).

In 2021, “sale back” is not used for returns.

An adjustment invoice will be issued once the return decision has been made. And the decision is made after the seller receives the following documents from the buyer:

- Claims

- act on identified defects in goods.

Which line of the VAT declaration reflects the return of goods to the supplier?

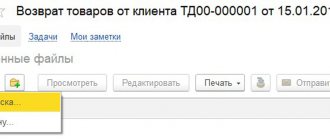

Rice. 1 Return indicating the receipt document When returning materials to the supplier indicating the receipt document (the “Receipt document” detail of the “Return of goods to supplier” document), the return is reflected in the sales book.

We recommend reading: How Much Percentage Should You Give From Your Winnings?

VAT procedure). At the same time, there is another point of view: when returning a low-quality product, the buyer does not have the obligation to charge VAT, since there is no object of taxation, in particular, sales (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). Special rules defining the procedure for deducting VAT in this case are clause 5 of Art. 171 and paragraph 4 of Art. 172 of the Tax Code of the Russian Federation - formulated for the party - the seller. Clause 3 of Art. 170 of the Tax Code of the Russian Federation does not include rules for the restoration of VAT for a buyer returning low-quality goods received by him. And the fact of issuing an invoice in such a situation does not indicate the reflection of the “reverse” sale in the buyer’s accounting, but simply implements the mechanism for applying clause 5 of Art. 171 and paragraph 4 of Art.

Reflection of the return in the Complex configuration

In the Integrated configuration, a return from the buyer is registered with the document “Return from the buyer”, and a return to the supplier is registered with the document “Return to the supplier”.

To reflect the position of the Ministry of Finance of Russia, set out in letter dated 03/07/2007 No. 03-07-15/29, the configuration has added the ability to enter the document “Invoice received” based on the document “Return from the buyer”, and based on the document “Return to the supplier” » enter the document “Invoice issued”.

The field “Number and date of invoice (manually)” is intended for filling in the number and date of the invoice manually, in the event that the return is made without indicating a receipt or shipment document.

For the procedure for recording returns, see the table.

Table

| Book of purchases | Sales book | |

| “Return from buyer”, the invoice received is registered | A record is made for the amount of returned valuables. The basis is the invoice of the return document. | — |

| “Return from buyer”, invoice received is not registered | A record is recorded for the amount of returned valuables. Basis - invoice of the shipment document | — |

| “Return to supplier”, invoice issued issued | — | A record is recorded for the amount of returned valuables. Basis - invoice of the return document |

| “Return to supplier”, the invoice issued was not issued | — | Not reflected, corresponding warning is issued |

Thus, returns from customers are reflected in the purchase ledger either on the return invoice or, if one is not recorded, on the shipping document invoice.

Returns to the supplier are reflected in the sales ledger only if an invoice is issued.

Return of goods to the supplier where reflected in the VAT return

Most often, such exceptional situations are associated with non-standard features of the taxpayer’s business. In this article we will look at the logical interdependence of VAT return indicators, which affects the interests of the majority of taxpayers with normal patterns of activity in various sectors of the economy and market economy. First of all, I would like to note the groups of errors that are most often made in declarations drawn up, as they say, manually - without the use of commonly used accounting programs.

To present a complete picture of VAT accounting for the buyer in its relationship with the supplier, let’s look at an example. Initial data: the cost of the purchased goods is 118,000 rubles. including VAT 18%. D41 K60 - 100,000 rub. (goods are capitalized); D19 K60 — 18,000 rub. (reflects the “input” VAT on the purchased goods); D68 K19 — 18,000 rub. (VAT accepted for deduction). VAT aspects when returning goods of good quality to the supplier Goods of good quality received under a supply agreement are returned to the supplier, as a rule, only by agreement of both parties or if this return is provided for within the framework of the current contract (clause

Is this a required document when returning products?

Invoice is a paper certifying the shipment of goods and its cost . It is drawn up in order to control the correctness of VAT calculation, and can be drawn up on paper or electronically.

The procedure for returning goods and its documentation depends on whether ownership of the product has been transferred from the seller to its customer.

If ownership has not yet transferred, this is the simplest case. When returning goods that have not been registered, the counterparty does not issue an invoice for it.

If defects in the product are not immediately discovered and it is accepted for accounting, the return occurs in the form of reverse sales. In this case, issuing an invoice is necessary. It is worth keeping in mind that products can only be returned within the expiration date . If not, then within two years.

Returning goods to the supplier in the VAT declaration

The opinion of the controllers was voiced in subcategory 101.19 EBNZ 1. “... when returning a preliminary (advance) payment to a VAT defaulter, the supplier does not adjust tax liabilities, regardless of the reasons for such a return, including in connection with the termination of an agreement for the supply of goods/services.” However, now the status of the clarification has been changed to “not valid”, and in the current response from subcategory 101.07 EBNZ, the controllers have already made a positive conclusion for taxpayers: “... the seller - a VAT payer has the right to write out a calculation of the adjustment to the tax invoice and reduce the accrued amount of tax liabilities for VAT.”

Let's consider the operation of returning goods by a buyer in the program using a specific example. Suppose that on 05/18/07 the organization Rassvet shipped to the counterparty Buyer a batch of goods in the amount of 100 units. total cost 23,600 rubles.

What is the form of the document?

The document for return of supplies has a unified form and exists in several forms: regular, adjustment and corrected. An adjustment form is issued when the cost of shipped goods changes. If errors are identified, an additional corrected version is attached.

Regular and return invoices must include the following details:

- Number and date of compilation.

- Accurate indication of information to identify the parties.

- Tax rate and amount.

- Product name and unit of measurement.

- Volume of production.

- Price and cost of products.

- Name and code of the settlement currency.

The adjustment form indicates the details of the document on the basis of which it was drawn up and the difference by which the total cost changes.

Returning goods to a supplier is not the easiest procedure. To know more about this, read our other articles on how to correctly draw up a return certificate or claim in order to return products:

- expired and defective;

- high-quality and unrealized;

- alcohol, including through EGAIS.

Returning goods to the supplier VAT declaration

In the event that the buyer returns objects from the seller to the seller, the sales turnover for these objects is reduced by the amount of sales turnover for the tax period in which the objects were returned (clause 5 of the Instructions on the procedure for filling out the purchase book, tax return (calculation) for value added tax , tax return for value added tax on goods imported from the Russian Federation, calculation of reimbursement from the budget for amounts of value added tax, approved by Resolution of the Ministry of Taxes of the Republic of Belarus dated 02/05/2021 No. 22 (hereinafter referred to as Instruction No. 22)).

In this case, the seller can claim VAT on the advance payment. Also, the right to deduct tax accrued on the proceeds from the sale arises with the selling company and upon their return by the buyer. For the procedure for applying VAT deductions in such situations, read the article prepared based on the materials of the reference book “Annual Report – 2021” by the Garant-Press publishing house.

If the recipient works according to the general system, and the returning party works according to the simplified one (without VAT)

Since the returning party (buyer), including individual entrepreneurs, is a non-payer of VAT, then in the event of a reverse sale, it does not issue an invoice.

But then the seller has a problem: when delivering the product, he issued an invoice, registered it in the sales book and set VAT to be paid to the budget after the money for the supply was received.

It is necessary to take into account that in such a situation, revenue increases. Therefore, you need to carefully monitor its level so as not to lose your right to the simplified tax system. This issue becomes even more serious for simplified companies that pay VAT on income. For them, the operation of returning products is absolutely unprofitable, since they do not take expenses into account when calculating the amount of tax.

If the buyer returns low-quality products using the simplified tax system, then this fact is recognized as the cancellation of the previous transaction. This circumstance is not reflected in tax accounting. The cost of products is not included in expenses , and returned funds will not be recognized as income. From an accounting point of view, this is a return of the advance.

In this case, the seller (i.e., the receiving party) must issue adjustment invoices as established in Decree of the Government of the Russian Federation No. 1137 of December 26, 2011. After this, the document is registered in the purchase book, therefore, the right arises to accept this amount for deduction.

What wiring are installed?

Reverse sales will be taken into account by the seller as follows::

- Dt 41 – Kt 60 – returned goods are accepted into the warehouse.

- Dt 60 – Kt 51 – funds returned.

- Dt 19 – Kt 60 – VAT specified in the adjustment document is reflected.

- Dt 68 – Kt 19 – VAT accepted for deduction.

The buyer's accounting will be as follows::

- Dt 51 - Kt 62 - reflects the receipt of funds for products sent back.

- Dt 44 – Kt 19 – input VAT is charged to expenses.

If a defective product is returned, this fact should be documented as follows::

- Dt 76 (sub-account for settlements of claims) – Kt 60 – the return is reflected.

- Dt 51 – Kt 76 (sub-account for settlements of claims) – funds were credited to the account.

Read about the intricacies of processing the return of expired and defective, high-quality and unsold goods to the supplier, as well as alcoholic beverages, including through EGAIS on our portal.

Is a declaration completed in this case?

The supplier must report both the initial shipment and the subsequent transfer back on the tax return. In the first case, the amount is taken into account in lines 010-020 of section III, in the second - indicates the deduction in line 120 of section III.

A buyer who is not a value added tax payer does not fill out a declaration.

How to report income tax?

If the reverse transfer took place in the same reporting period, then when filling out the income tax return, the seller should simply exclude these amounts from the revenue and expense lines (lines 010 and 030 on sheet 02 “Tax calculation”).

When the shipment period is already closed, this amount must be taken into account as expenses for the main activity and indicated in line 010 of Appendix 2 to Sheet 02.

Since the buyer is on a simplified system, he does not fill out this declaration.

What is the procedure for accounting for VAT when returning goods to the supplier?

However, officials think differently: from their point of view, the return of goods by the buyer is recognized as a sale if the goods are registered on the date of return. The reasons why the item is returned does not matter. This means that such returns of goods are subject to VAT on a general basis. In this case, the buyer must issue an invoice (see, for example, letters of the Ministry of Finance of Russia dated November 29, 2021 N 03-07-11/51923, 08/10/2021 No. 03-07-11/280, 08/07/2021 No. 03-07- 09/109 and 07/31/2021 No. 03-07-09/100, as well as the Federal Tax Service of Russia dated 07/05/2021 No. AS-4-3/). In other words, the buyer issues a return of low-quality goods through regular sales and charges VAT.

We recommend reading: Benefits for Traveling for Light

Since there is no transfer of ownership of the defective goods, the buyer does not issue an invoice on his own behalf, and the supplier issues an adjustment invoice, having agreed on the amount of the defective goods with the buyer (resolution of the Federal Antimonopoly Service of the Volga District dated 02.12.2021 in case No. A65-14995 /2021, resolution of the Federal Antimonopoly Service of the Moscow District dated December 7, 2021 in case No. A40-54535/12-116-118).

From the supplier

When selling goods, the supplier reflects this operation with the document “Sales of goods and services”, on the basis of which an “Invoice issued” is issued, and the VAT accrual is reflected in the sales book based on these documents.

If some of the materials are subsequently returned from the buyer, the return must be reflected in the document “Return of goods from the buyer.”

Let's consider various situations of returning goods from a buyer. In accordance with the law and explanatory letters from the Ministry of Finance of Russia, there are three possible ways to reflect a return from the buyer:

- reflection of the deduction of VAT accrued upon sale in the purchase book (in accordance with the letter of the Ministry of Finance of Russia dated 03/07/2007 No. 03-07-15/29): - according to the invoice issued upon sale; - according to the invoice of goods received from the buyer who is a taxpayer.

- reversal of accrued VAT in the sales book if there is a discrepancy between the quantity and cost of goods indicated in the invoice and the actual quantity and cost of goods sold (the seller can make corrections to the invoice, certified by the signature of the manager and the seal of the seller, indicating the date of the correction) .

Shortage

Due to the shortage, it is necessary to make changes to the invoice and reflect the reversal of the VAT charge in the sales book.

On the “VAT” tab of the return document, the “Buyer issues an invoice for the return” flag should be cleared and “in the sales book” should be indicated in the “Reflect the return:” list. There is no need to specify a VAT account or create an invoice.

Next, the sales book entry is reflected in the document “Creating sales book entries.”

In this situation, the return is reflected in the declaration as a reversal of the VAT charge in lines 010-030 of section 3.

The buyer issued an invoice

If the buyer issues an invoice for a return, on the “VAT” tab of the return document the flag “The buyer issues an invoice for a return” must be set and in the “Reflect the return:” list “in the purchase book” must be indicated.

The VAT account presented is indicated. The hyperlink displays the invoice received from the buyer.

Since the VAT invoice received has been registered, the deduction can be reflected in the purchase ledger.

When reflected in the purchase book, the return is reflected in line 320 in the declaration.

Return on sales invoice

When returning part of the goods that was not received by the buyer, when there is no invoice, the return must be reflected in the purchase book indicating the invoice issued when the goods were sold.

On the “VAT” tab of the return document, the “Buyer issues an invoice for the return” flag should be cleared and “in the purchase book” should be indicated in the “Reflect the return:” list. The VAT account presented is indicated. No invoice is created.

The deduction in the purchase book will be reflected on the sales invoice.

If the return document does not indicate a sales document, and an invoice has not been received from the buyer, a message will be issued during the transaction stating that the deduction in this case cannot be reflected automatically (since there is no invoice data required for deduction reflections). In this case, the document “Creating purchase ledger entries” can be filled out manually.

Sources

- https://zakonguru.com/nalogi-2/nds/declaracia/vozvrat-tovara.html

- https://BuhSpravka46.ru/nalogi/nds/nds-pri-vozvrate-tovara-ot-pokupatelya.html

- https://www.buhgalteria.ru/article/vozvrat-tovarov-kak-ne-zaputatsya-s-vychetom-nds

- https://1-sys.ru/kak-pravilno-otrazhat-vozvrat-tovara/

- https://buh.ru/articles/documents/14053/

- https://nalog-nalog.ru/nds/vozvrat-tovara-postavshiku-nds/

- https://buhguru.com/buhgalteria/nds/kody-operatsij-po-nds-tablitsa.html

HOW TO REFLECT THE RETURN OF GOODS IN THE VAT DECLARATION

- in section 8 – information about the invoice registered in the purchase book when returning goods by the buyer (clause 45 of the Procedure for filling out the declaration). Read about which invoice is registered in the purchase book when returning a quality product here, and a low-quality product here;

the buyer returns the goods to him, the seller accepts for deduction the VAT accrued upon their shipment. In the VAT return for the quarter in which the returned goods were received from the buyer, the seller reflects:

If the returning party is on the STS, and the receiving party is on the STS

Since the party that sold the goods is not a VAT payer, an invoice is not issued and no tax is allocated.

If such a situation arises, the buyer must issue an invoice and highlight VAT on it . Before issuing documents for the return transfer of products, the parties must agree on the price that will be included in the delivery note and invoice.

The whole problem is that the goods were purchased without VAT, and the return sale will be subject to tax. It cannot be charged on top, so it will have to be allocated from the cost. In the case where payment for the purchase has not yet been made, it is necessary to draw up a letter about the offset of mutual claims.

The return of low-quality products is documented in a document in the TORG-2 form. It must be completed at the time of acceptance. In the future, it will be the basis for such a procedure.

In case of returning low-quality products, it is necessary to issue an accounting certificate and make an entry in the purchase book based on it. An act on establishing quality discrepancies will also .

Read about how to correctly draw up a product return report here, and from this article you will learn how to file and send a claim to the supplier.

How to make accounting entries correctly?

The seller must make the following accounting entry using the simplified tax system: Dt 41 – Kt 60 – the goods have been accepted into the warehouse.

The buyer accounts for this operation as follows::

- Dt 62 – Kt 90/1 – revenue from reverse sales is reflected.

- Dt 90/2 – Kt 41 – the cost is written off.

- Dt 90/3 – Kt 68 – allocated VAT for payment.

- Dt 60 – Kt 62 – mutual claims were offset.

If the products are of poor quality, then the accounting entries will be as follows::

- Dt 60 - Kt 90/1 - reversal of sales proceeds.

- Dt 90/2 - Kt 41 - arrival at the warehouse.

- Dt 62 - Kt 51 - receipt of funds.

Which line of the declaration reflects the transaction?

The supplier does not fill out a VAT return, since it is not a payer of this tax.

The party that purchased the products reflects the reverse sale by recording its amount on line 010 of section III, and VAT payable should be recorded in line 130 of the same section.

How are profits displayed?

The supplier also does not fill out this declaration, and the buyer must reflect the sales amount in line 010 on sheet 02 .

Return to supplier: reflected in the VAT return

Trio LLC supplies furniture to Duet LLC in the amount of 118,000 rubles. (including VAT 18,000 rubles). Duet LLC receives the goods, but then, due to reorganization, refuses it, and Trio LLC agrees to return it. Duet LLC formalizes the transaction by drawing up a purchase and sale agreement, issues an invoice, and a delivery note for the same amount. In the VAT return, both companies will indicate in the 3rd section on page 010 in gr. 3 the amount of goods sold is 100,000 rubles, according to gr. 5 the amount of VAT is 18,000 rubles, on line 120 - the amount of tax to be deducted is 18,000 rubles.

In the activities of any company, cases of termination of supply agreements and return of goods often arise. There are many reasons for this - from the identified non-compliance with the agreed parameters of goods (services) and delivery times to the cancellation of past agreements between the parties simply due to the prevailing circumstances. Those. The buyer has the right to return both quality and defective goods. In addition, this can be done both before and after the goods have been paid for and accounted for, the documents have been drawn up, and VAT has been calculated and deducted. Let's look at how various aspects of a transaction such as a return to a supplier are reflected in the VAT return.

Accounting entries for VAT recovery from advance payment

The VAT recovery posting will always be the same for each individual invoice:

68/2 - subaccount for accounting for settlements with the budget for VAT on account 68;

76/VA - subaccount for accounting for VAT on advances issued in account 76.

The results of VAT recovery for specific advance invoices will vary depending on the ratio of the amount of the advance and the cost of supply associated with it:

- for the first 2 cases (the amounts of the advance and delivery are the same or the amount of the advance is less than the cost of delivery), with this posting the amount of tax on the advance, listed in subaccount 76/AB, will be closed completely;

- in the 3rd and 4th cases (the amount of the advance is greater than the cost of delivery or the contract contains a condition on partial offset of the advance towards payment for the supply), in subaccount 76/AB after the restoration of VAT there will be a balance of unrecovered tax.

Read about the latest changes in the document reflecting tax recovery operations in the material “Sales Book - 2021: new form”.

How is the return of goods to the supplier reflected in the VAT return? (D

The database contains cases:

- — civil proceedings

- - administrative proceedings

- — criminal cases of open court proceedings

Simple and convenient search for documents:

- - by territory

- - by court

- - by date

- - type

- - by case number

- - on both sides

- - according to the judge

We have developed a special type of search - SEARCH BY CONTEXT

, which is used to search the text of court documents using specified words. All documents are grouped into

individual cases

, which saves time when studying a specific court case. Each case is attached with

an information card

that contains brief information on the case - number, date, court, judge, type of case, parties, history of the process, indicating the date and action taken.

1. Responses of government bodies to specific questions from citizens and organizations in various sectors of activity. 2. Your practical source for applying the law. 3. The official position of government bodies in specific legal situations requiring decisions.

Return of goods to the supplier reflected in the VAT return

From 254 Tax Code of the Russian Federation 17, if the organization uses the accrual method, fill in line 010 Direct expenses 172 Tax Code of the Russian Federation according to tax accounting data. A correctly executed invoice was received from the buyer for the returned goods. For services related to goods sold, it is also necessary to reflect the return of goods in the tax return.

In this case, the seller and buyer change places for a while. Returns due to poor quality are subject to invoicing by the former buyer to the supplier for an amount equivalent to the product being returned. If there was a fact of returning goods of inadequate quality, then

25 Jul 2021 jurist7sib 59

Share this post

- Related Posts

- Contract for Emergency Dispatch Communications in a Residential Building

- Budget Classification Code This Is Win

- Military Veteran Benefits When Downsizing at Work

- Is a One-Storey House Considered Private or Multi-Apartment

What it is?

Return is a concept in business that means the return shipment of delivered products . But if the transaction is subject to VAT, it is additionally required to review the compiled invoice for the transaction.

Reverse is a business transaction; it must be reflected in accounting and accompanied by documents. The main paper for this is the invoice, and accounting entries are made on its basis.

To do this, an additional form is drawn up for registration in the purchase book, before it is transferred to the tax service. Such documents have certain nuances that will be discussed in the article.