To calculate wages for employees, the enterprise uses payroll form T-51. When paying accrued wages, it is necessary to fill out a payroll; this personnel document will be drawn up on the basis of the payroll. The standard form of payroll is T-53. How to fill out this form correctly? Let us dwell in more detail on the features of filling out the T-53 form. In the article, in addition to finding a completed sample form, you can also download the T-53 form itself.

First page design

- First of all, on the title page you must indicate the full name of the enterprise (in accordance with the registration documents), as well as the structural unit for which the statement is being drawn up (if there is one).

- Next, you need to enter the code according to the general classification of organizations and the number 70 in the “Corresponding account” column.

- Then the validity period of this statement is indicated, which must be at least 5 days from the moment of its signing (Regulation of the Bank of Russia No. 373-P dated 10/12/2011).

- It is imperative that the total amount accrued to employees for the calculated period be entered in the corresponding line of the first page of the payroll, both in digital and written form.

- After this, you must indicate the date of preparation of the payroll, as well as its serial number according to the internal document flow.

- The last thing that needs to be written on the title page of Form T-53 is the period for which the payment is made. Here you need to indicate specific dates.

Now visually:

Personal account, form

When calculating salaries in institutions, the unified form T-54 is also used; it is mandatory for use and is enshrined in Resolution of the State Statistics Committee No. 1 of 01/05/2004. It reflects the accrued earnings for each individual employee for the billing period (year or period of work). Employee personal card - the salary form for each employee is available for download.

Filling out the second sheet

The size of the payroll directly depends on the number of employees working at the enterprise - the more there are, the longer this document will be. The number of payroll sheets must be indicated in the appropriate column.

- The first column of the main table of the statement is reserved for the serial numbering of employees.

- The second is for entering a personnel number (this data is stored in the personal cards of the organization’s employees).

- The third contains the full names of the salary recipients (it is better, in order to avoid possible confusion, to do this with a full decoding of the name and patronymic).

- In the fourth column, the enterprise accountant enters the amount of funds accrued for disbursement for each individual person (in numbers).

- In the fifth column, each employee must sign for receipt of wages.

- The sixth column is intended for entering references to documents for cash settlements (this could be powers of attorney, statements from employees, etc.) If there are no separate notes on employees, then this column can be crossed out.

In the line below the table, you must once again indicate in numbers and in words the total amount of funds accrued for issuance

Results

The payroll is the primary document that is often used by enterprises when issuing salaries. This document is convenient because it only contains information about the payment of the specified funds. At the same time, all employees receiving funds sign on the same statement, which simplifies the processing of information.

Sources: Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Director's visa on form T-53

Without the signature of the head of the company, the T-53 payroll will not be considered valid, therefore, after filling out all its points and before transferring it to the cashier for issuing wages, the company’s accountant is obliged to submit it to the director for signature.

And one more signature will need to be placed after all funds have been paid to employees. The chief accountant of the enterprise will have to check the payroll and, if there are no violations, also sign it.

When and what form to fill out

So, officials provided three options for salary slips, which were approved by Resolution of the State Statistics Committee No. 1 of 01/05/2004. However, the company has the right to use its own individual form in its work. For example, by finalizing the unified formats: by eliminating or adding columns and fields.

IMPORTANT!

If an organization uses an individually developed form in its work, it must be approved. For example, as an appendix to the accounting policy or as a separate local order of the director.

Each of the unified statement formats is filled out in a certain situation:

- Payment. Form T-53. We fill it out when making cash payments to staff. That is, when wages are paid in cash from the institution’s cash desk. Form T-53 contains information exclusively about the amounts to be issued. There is no information about accruals made for the billing period in the payment document.

- Calculated. Form T-51. The documentation provides information about accruals made in the billing period (salary, incentives, compensation, bonuses). The format also provides for recording information about deductions made for the month. For example, alimony, writs of execution and taxes. But there is no information about payments on the form. Such a document is used only for non-cash payments when salaries are transferred to a bank card.

- Settlement and payment. Form T-49. The format combines two documents at once: settlement and payment. Information about accruals with deductions made, as well as amounts due for issuance is reflected here. Such a document should be used if salary money is issued in cash.

Let's repeat. For non-cash payments, fill out T-51. And for cash payments with personnel, make up T-53 and T-49, depending on the situation. Which document will be used in the work of your organization must be fixed in the accounting policy. Next you can send salary slips.

Corrections in payroll

In general, according to the rules for filling out a payroll form T-53, the cashier, before starting to issue funds on the payroll, is obliged to check whether everything in it is drawn up correctly.

If any errors are found, then this document must be returned to the accounting department for revision.

But sometimes situations arise when, for some reason, it is no longer possible to reissue the payroll. In this case, inaccurate information must be carefully crossed out, the correct information must be written on top, and the correction must be certified by the signatures of all the same employees who signed the initial version of the statement. Here you need to indicate the date of correction. If everything is done in accordance with these recommendations, the document will not lose its legal force.

Salary slip form: where to download for free

The salary slip form (the sample of which is unified) must contain all the necessary details. However, when printing forms, some editing is possible. So, the details may be arranged in a slightly different order, or some more may be added - if the company uses a special technology for processing accounting information. In this case, it is necessary to ensure the availability of all required details.

Most accountants prefer to use a ready-made salary slip form (you can download it for free in Excel format on our website, see the link below). In this form it is convenient to fill out the necessary details, and it is also quite simple to process them using the computing functions built into the office program.

How to close a payroll

This stage is the final one. After the payroll has expired (five days), the cashier must formalize its closure. Moreover, this must be done even if wages were not issued to all employees. To close the statement you need:

- Write the word “deposited” opposite the names of those employees who did not receive the money due to them according to this statement;

- Count the funds issued and those that were deposited. Enter this information on the last sheet of the statement;

- Confirm the statement with a signature;

- Write out a cash order. In it you need to write the amount of funds issued, then enter the order number in the statement.

After this entire procedure has been completed, the statement must be submitted again to the accounting department.

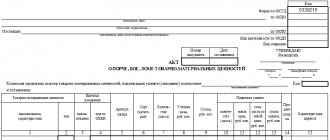

How to fill

The procedure for compiling the salary sheet is reflected in Resolution of the State Statistics Committee No. 1 of 01/05/2004. Let's look at the filling algorithm using the T-53 as an example. Let's start with the title page. We record the following information one by one:

- Name of company.

- Name of the structural unit, department, workshop.

- OKPO company.

- Deadline for issuing money.

- The total amount of payments in words and figures.

- Number and date of document preparation.

- Billing period.

Then the signatures (with transcript) of the director and chief accountant are affixed.

Let's move on to filling out the payroll table. We bring in the employees who are due payments one by one. Enter:

- Line number in order.

- Employee personnel number.

- Recipient's last name and initials.

- Amount in numbers.

- Signature box.

- Deposit marks or other.

Now we fill out the final part of the second page of the salary slip. We enter the amounts issued and deposited. We indicate the number of pages. We enter the details of the cash receipt order. We affix the signatures of the cashier and the responsible accountant.

Frequency of compilation

The payslip allows you to determine the amount of earnings an employee will receive for the past month.

At the same time, according to recent changes in legislation and letters from supervisory authorities, the organization is obliged to pay an advance not in a fixed amount, but to calculate it based on the number of days worked during this period and the accruals taken into account.

In this regard, it is advisable to determine the advance amount also using a payslip. Further, after the end of the month, the calculation is made using a new document, taking into account the total number of days worked and all necessary accruals. The amount of the salary advance issued is indicated in a separate column in the “Withheld and credited” block.

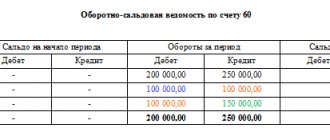

Accounting entries

Based on the data contained in the payslip, the following accounting entries are made. For basic salary, bonus, sick leave and vacation pay, they look like this:

| Debit | Credit | Operation |

| 20 | 70 | Accruals have been made for employees of primary production |

| 23 | 70 | Accrual for auxiliary production workers |

| 25 | 70 | Accrual for employees performing general production duties |

| 26 | 70 | Accrual for employees with administrative functions (management, accountants, etc.) |

| 44 | 70 | Payment to employees who are engaged in trade |

| 91 | 70 | Accrual for employees who do not directly participate in production activities |

The employee may also be entitled to other payments:

| Debit | Credit | Operation |

| 96 | 70 | Accrual of vacation pay from reserve funds |

| 69 | 70 | Accrual of sick leave from social insurance funds. Such an entry is not made if the region has switched to direct sick pay payments. |

| 84 | 70 | Material assistance was issued |

The payslip also takes into account the amounts that must be withheld from the employee’s earnings.

| Debit | Credit | Operation |

| 70 | 68 | Withholding personal income tax from earnings |

| 70 | 76 | Making other deductions (alimony) |

why is a cube more convenient?

Convenient online invoicing

Instantly send invoices by e-mail to your buyer

Debt control for each customer

Management reporting

Organized storage of all your documents

20% discount on accounting services from your accountant

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using CUBE right now

14 days

FREE ACCESS

Do you need help filling out documents or advice?

Get help from expert accountants to prepare documents

+7

[email protected] kub-24

Legal basis

The procedure for calculating and paying wages to company employees is regulated by the Labor Code of the Russian Federation.

It stipulates the methodology for calculating various types of remuneration for labor and compensation payments, the timing of their transfer, regulation of work and rest hours, and other aspects of the relationship between the employee and the employer. Salaries must be paid at least twice a month. The payment terms are set by the company management taking into account the rules of Article 136 of the Labor Code of the Russian Federation.

The salary of an employee who has worked a full month should not be less than the minimum wage established by the Government of the Russian Federation. Now it is 11,280 rubles. If in the subject of the Federation in which the organization operates, the minimum wage is set higher than the federal one, then the organization should be guided by it when establishing the minimum wage. This is the situation, for example, in Moscow (18,742) or St. Petersburg (17,000).

The employee goes on vacation: we prepare the calculation of vacation pay

Vacation is a pleasant event in all respects, but not for accounting workers during the holiday season.

In a large company, vacation pay has to be calculated regularly. Let's look at how this happens using an example. Brigantina LLC uses an automated program to prepare personnel and accounting documents, and when calculating the next main and (or) additional leaves, this system generates a unified form T-60 “Note-calculation on granting leave to an employee” - it is this that serves as the primary document in this situation.

How to correct an error made in the primary document, see this material.

The “Note-calculation on granting leave to an employee” of the unified form T-60 was approved by Resolution of the State Committee on Statistics dated January 5, 2004 No. 1. Form T-60 is available on our website:

IMPORTANT! The Labor Code regulates the procedure for granting basic (Articles 114, 115) and additional (Articles 116–119) leaves, and also describes the features of their provision (Articles 120–128).

An employee of Brigantina LLC, engineer P. G. Tarasov, will go on vacation for 28 calendar days from May 25. Let's look at how the accountant filled out the T-60 calculation certificate below.