Employer reporting

Alexey Borisov

Leading expert on labor relations

Current as of August 31, 2020

SVZ-M is one of the mandatory forms of reporting by employers for employees. It is compiled based on the results of each month. Let's consider in what time and for which employees the SZV-M for September 2020 must be submitted.

SZV-M due date for September 2021

SZV-M is submitted no later than the 15th day of each month (clause 2.2 of Article 11 of the Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting..."). If the deadline for submitting the report falls on a weekend or holiday, it is postponed to the first working day (Letter of the Pension Fund of the Russian Federation dated December 28, 2016 No. 08-19/19045).

The deadline for submitting SZV-M for September 2021 is no later than 10/15/2020.

Responsibility for violations

Despite the fact that the SZV-M form is quite simple to fill out, errors do occur. Most often this is a violation of the deadline for submitting data. It also happens that not all employees are included in the report or, conversely, those who do not belong there are indicated. Data errors can be corrected, often without penalties. But for late submission of SZV-M, a fine is inevitable.

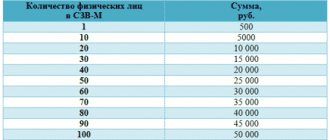

They charge 500 rubles for each employee in an incorrect report. This means that for companies with large staff, just one day late can be very costly.

Responsibility for violations in the field of personalized accounting is described in Law No. 27-FZ (Part 4, Article 17).

Who takes SZV-M for September 2021

The SZV-M report is submitted by:

- Employers for employees - with whom labor and civil law contracts have been concluded, as well as copyright and licensing agreements.

Individual entrepreneurs, lawyers, notaries do not rent SZV-M without employees.

- Organizations with several founders - if one of them is the CEO.

The report is submitted even when an employment contract has not been concluded with the director (Letter of the Ministry of Labor dated March 16, 2018 No. 17-4/10/B-1846).

- Companies with a single founder and director in one person.

The existence of an employment contract does not matter. Until March 2021, the Pension Fund allowed such companies not to submit SZV-M, citing the fact that there are no persons with whom labor and civil law contracts have been concluded, as well as payments accrued on their basis. And since there are no contracts and payments, then there is no need to submit a report (Letter of the Pension Fund of the Russian Federation dated July 27, 2016 No. LCH-08-19/10581).

But since March 2021, the Pension Fund has radically changed its position and obligated all companies, including those in which the only founder works as a director without an employment contract, to submit SZV-M. The reason is that labor relations without a properly executed contract arise when an employee is actually allowed to work (Letter of the Ministry of Labor dated March 16, 2018 No. 17-4/10/B-1846).

- SNT, DNT, HOA.

Submitted to the chairman if he is paid remuneration for the work performed. If the chairman works on a voluntary basis and does not receive anything for his work, the SZV-M does not need to be taken. But in this case, it is necessary to submit to the Pension Fund a charter that confirms the gratuitous activities of the chairman.

- Charity organisations.

They rent for volunteers, who are reimbursed for food costs in amounts exceeding the daily allowance if GPC agreements have been concluded with them.

- Separate units.

They rent out SZV-M only if they have a separate current account and pay their own salaries to employees. In this case, the SZV-M indicates the TIN of the parent organization and the checkpoint of the separate division.

Report on one founding director: to pass or not?

This situation is not that rare. In this case, the organization usually does not conduct activities and, naturally, the owner does not see the need to pay wages to himself.

Rostrud and the Pension Fund of the Russian Federation previously had completely different positions on this matter. The Pensions Authority has always insisted that the director is still an insured person and should be included in the report. In this case, the presence or absence of payments in his favor does not matter (letter of the Pension Fund of the Russian Federation dated May 6, 2016 N 08-22/6356).

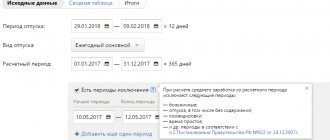

Procedure for filling out SZV-M for September 2021 - sample

The preparation of the report begins with entering information about the policyholder:

Registration number in the Pension Fund of Russia

It is assigned to each legal entity or individual entrepreneur upon registration with the Pension Fund and must be present on all reports sent to the fund. This is a 12-digit digital code, the correct filling of which can be checked, for example, on the Federal Tax Service website by requesting an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs.

Short name of the policyholder

Organizations take it from their constituent documents. If there is no “official” short name, the full name should be indicated.

Entrepreneurs indicate the abbreviation IP and their full name. An individual employer who is not an individual entrepreneur (for example, a lawyer or a notary) does not indicate anything other than his full name in this line.

TIN and checkpoint

Taken from the certificate issued by the Federal Tax Service. For a legal entity, a 10-digit TIN and a 9-digit KPP (reason code for registration) are used. Individual entrepreneurs and individuals who are not individual entrepreneurs indicate only a 12-digit TIN.

Reporting period

The month (in two-digit format) and year (in four-digit format) are indicated. For September 2021, “09” and “2020” are entered in this line, respectively.

Form type

One of the letter codes is displayed, depending on the version of the submitted report:

- “out” - if the form is submitted for the first time;

- “additional” - if the report includes information that supplements previously sent information;

- “cancel” - if the purpose of the submitted form is to cancel previously provided incorrect data.

Information about the insured persons

The report includes all employees with whom contracts related to the payment of remuneration were in effect during the reporting period (in this case, September 2021).

The data is presented in the form of a table consisting of 4 columns:

- Serial number. The order in which the insured persons are included in the report does not matter. This can be alphabetical, chronological (as contracts are concluded), or even random order.

- Full name of the insured person. We give it in the nominative case. Please indicate your middle name if available.

- ILS insurance number. We deposit on the basis of the SNILS certificate.

- TIN of an individual. This detail, unlike the previous ones, is not strictly mandatory and if the employer does not have this information, it may not be included in the report.

Next, information about the person signing the report is indicated and his personal signature is placed. For a legal entity, this is the head or the person performing his duties (in the latter case, indicate the details of the document confirming the authority of the representative). The individual entrepreneur or other individual employer signs the report personally. In this case, in the line “Name of manager’s position” the status of the individual is indicated - entrepreneur, notary, lawyer, etc.

Sample SZV-M for September 2021

Where should reports be submitted?

Any business entity - both an individual entrepreneur and a company - must submit a completed report to the PF body that registered them as an employer. This means that companies ship at their location, and individual entrepreneurs ship at their place of registration.

If a company has representative offices or branches, they must submit this report regardless of the parent companies at their location. In this case, the report indicates the TIN of the parent organization, and the KPP - assigned to the branch during registration.

Features of the formation of SZV-M for September 2020

- In SZV-M for September 2021, include only those persons whose payments are subject to pension insurance. If a purchase and sale or lease of property agreement has been concluded with an individual, then there is no need to enter data about it in SZV-M.

- Information in the SZV-M form for September 2021 is submitted for each insured person with whom employment contracts and GPC agreements were concluded this month, continue to be valid, or have been terminated. The availability of payments for them does not matter. It does not matter how many days during September the agreement was valid. Even if we are talking about only one day, the employee must be included in the report. But if in the reporting period there were only payments, and the contract was not valid, there is no need to include such an employee in SZV-M.

- If employees are absent from work for any reason (long business trip, vacation, maternity leave), but their contracts are still valid in September, also include information about them in the report.

Useful information from ConsultantPlus - is it necessary to submit a zero report on the SZV-M form

Yes, you need to submit a SZV-M, regardless of whether you made payments to employees during the reporting month or not. We also recommend submitting Form SZV-M if the organization has only a manager with whom an employment contract has not been drawn up and who is its sole founder (read more...).

Is it necessary to hand over the form to the employee?

Clause 4 of Article 11 of Federal Law No. 27-FZ dated April 1, 1996 obliges, upon dismissal of employees (or termination of a civil contract), to issue them the SZV-M form, as well as Section 3 of the calculation of insurance premiums (their personalized accounting data) . These documents may be useful to the employee to confirm the insurance period when assigning a pension. It must be said that the law does not provide for any fines for failure to fulfill this obligation, but it is still better not to abuse this.

Form SZV-M. There is no need to give the employee a “full” report with data on all employees in the company, this is a violation of the Law “On Personal Data” (dated July 27, 2006 No. 152-FZ). The form issued must contain information only about the employee being dismissed. The report is issued for all months that this employee worked for you, for example, if he worked for 8 months, then he should receive 8 SZV-M reports for each month.

The above-mentioned Law also obliges to obtain from the dismissed person written confirmation of the transfer of personalized accounting information to him (form SZV-M and section 3 of the calculation of insurance premiums). The confirmation is drawn up in any form (download a sample example):

You can also create a “Journal of information transferred to the insured person upon dismissal” (also in a free format).

What does reconciliation of SZV-M with SZV-TD give?

Before sending to the Pension Fund of Russia, check SZV-M with SZV-TD and make sure that you have included all hired employees in the report and removed dismissed ones. This will save you from a fine.

If earlier fund specialists could check information about the insured person only by checking with the DAM (that is, not earlier than the end of the quarter), then with the advent of the SZV-TD report, the Pension Fund receives information about fired and hired employees the very next day and can quickly identify information incorrectly reflected in the SZV-M, or missing data.

If there are errors on the submitted form

1) If you have already submitted the report and at the same time noticed in time that errors were made, you need to fill out a new sheet in exactly the same way (with errors), but in the column “3. Form type" indicate "cancelling". Along with this sheet, fill out another new one, but already filled out correctly, and in the Form Type column indicate “supplementary”.

2) If you forgot to include one of the employees in the reporting, then draw up a new sheet, include only “forgotten” employees there, and in column “3. Form type" indicate "complementary".

ATTENTION: The Pension Fund has developed a program for checking reports to the Pension Fund (in particular, the SZV-M form), submitted electronically. That is, before sending the form to the fund, it can be pre-checked for errors.

Link to the program: https://www.pfrf.ru/branches/bashkortostan/info/~srahovatelym/1423

Fines for SZV-M

If the report is submitted late or it includes incomplete (inaccurate) information, the violator may be fined 500 rubles. for each insured person (paragraph 3 of article 17 of Law No. 27-FZ).

For submitting a report on paper when you are required to generate it electronically, the fine will be 1,000 rubles. (paragraph 4 of article 17 of Law No. 27-FZ).

Instructions on the procedure for maintaining personalized records, approved. Order of the Ministry of Labor dated April 22, 2020 No. 211n establishes the conditions under which a fine can be avoided:

- Errors subject to correction were made in relation to persons included in the SZV-M with the “Initial” type.

- Errors were discovered and corrected by the policyholder himself or within 5 working days from the date of receipt of the notification from the Pension Fund.

Thus, if in the SZV-M for September 2021 you forgot to reflect information on individual employees and submit an additional SZV-M form for “forgotten” persons after the deadline for submitting this report, you will not be able to avoid the fine (paragraph 4, paragraph 40 of the Instructions , approved by Order of the Ministry of Labor No. 211n).

No TIN - what to do?

In accordance with Federal Law No. 136-FZ dated May 1, 2016, it is permitted not to indicate the TIN in the SZV-M form. The law provides wording that the TIN is indicated “if available.” There can be 2 situations:

1) The employee, in principle, has not previously been assigned a TIN. Then submit the SZV-M form without indicating the TIN of such an employee (leave the column empty), there will be no fines for this. The employee can then independently obtain a TIN from the tax office if he wants. However, tax authorities advise that in the future the SZV-M report should still include the TIN for each employee, because from 2021, they want to shift control over insurance premiums to the shoulders of the Federal Tax Service.

2) The employee does not remember his TIN. You can find it out on the tax website nalog.ru, then the sections “ALL SERVICES” - “FIND OUT INN”, then you just have to enter the employee’s passport data. If the TIN is not found in this way, it means that the employee did not receive it.

When can you avoid a fine for SZV-M?

Despite the fact that SZV-M has been submitted for several years, many disputes regarding fines due to errors in this form have to be resolved only in court. And often the courts support the policyholders. Here are a few court decisions that will help you avoid a fine or significantly reduce its size:

- The court reduced the fine by 10 times for being late in submitting the SZV-M, taking into account mitigating circumstances: the violation was committed for the first time, the period of delay was insignificant (4 days), there was no intent and no negative consequences for the budget (Resolution of the Central District Court of 06/02/2020 in the case No. A83-10587/2019).

- A grammatical error in SZV-M is not punishable by a fine (Resolution of the Administrative Court of the East Siberian District dated May 26, 2020 in case No. A78-11257/2019).

- There will be no fine if the fund misses the deadline for collecting sanctions, which must be calculated from the date established for submitting information about the accounting (Resolution of the Ural District Administrative District dated June 10, 2020 in case No. A34-14254/2019).

- An error in information about an employee, corrected within 5 days after receiving a notification from the Pension Fund of Russia, is not grounds for a fine (Resolution of the Administrative Court of the West Siberian District dated 03.03.2020 in case No. A75-9576/2019).

- Technical failure of the software (Determination of the RF Armed Forces dated 08.08.2019 No. 309-ES19-12439).

- A technical typo in SZV-M is not grounds for a fine (Determination of the RF Armed Forces dated September 28, 2018 No. 309-KG18-14482).

- It is impossible to fine a branch for being late with SZV-M (Resolution of the Supreme Court of the Russian Federation of December 10, 2018 No. 308-KG18-19977).

- An error in the SZV-M, corrected after the reporting deadline, but before its discovery by the Pension Fund of Russia, cannot be the basis for a fine (Determination of the RF Armed Forces dated November 29, 2018 No. 310-KG18-19510).

- The organization in the original SZV-M did not indicate information about 248 employees and only a year later supplemented the information that was missing. The Pension Fund of the Russian Federation fined her for this after an inspection, but the judges considered the prosecution to be unlawful, since the fund itself did not discover the error during the past period (Resolution of the Volga-Vyatka District Administrative District dated October 29, 2018 in case No. A82-1008/2018).

- The SZV-M was submitted late due to the accountant’s illness ─ the court reduced the fine by 11 times, recognizing the accountant’s disability as a mitigating circumstance (Determination of the RF Armed Forces dated July 4, 2018 No. 303-KG18-8663).

- The employer submitted the SZV-M a day late for a good reason (on the last day of submitting the report, the lights were turned off) ─ the judges sided with the employer, disagreeing with the imposition of a fine (Resolution of the Volga-Vyatka District Administrative Court dated July 17, 2017 No. A28-11249/2016) .

Changes from October 1, 2021

From October 1, the Instructions for personalized accounting are applied in a new edition (approved by order of the Ministry of Labor dated December 21, 2016 No. 766n). From October 1, it is no longer enough to send the SZV-M report to the fund; the Pension Fund must also accept them. Changes were made by Order of the Ministry of Labor of Russia dated June 14, 2018 No. 385n.

Also, from October 1, 2021, fines for supplementary SZV-M reports after the deadline for submitting the original data have officially been legalized. See “New requirements for SZV-M from October 1, 2021“.

Read also

20.11.2017

When a fine cannot be avoided

Let's talk about extraordinary cases when judges supported the Pension Fund of Russia and imposed a fine for SZV-M:

- The company received a protocol from the Pension Fund of the Russian Federation with the following set of information: about errors in SZV-M with their description, about the fund’s refusal to accept incorrect information and about the need to submit corrected statements. At the same time, the fund did not formalize or send the notification. The company submitted the adjustment later than 5 days from the date of receipt of the protocol. She was fined for this. The court equated the protocol to a notification and did not accept the arguments that the Pension Fund of the Russian Federation did not send a notification to the company (Resolution of the Court of Justice of the North-Western District dated April 23, 2020 in case No. A42-9736/2019).

- The company did not manage to submit SZV-M on time due to the fact that the programmer was on vacation, and the SZV-M program was not working on the last day of the deadline. In support, the company provided screenshots and a memo stating that it was impossible to provide information due to technical problems. However, the court did not consider the presented evidence to be objective and did not accept the company’s arguments (Resolution of the Administrative Court of the East Siberian District dated March 26, 2020 in case No. A19-13913/2019).

Let's sum it up

- The SZV-M for September 2021 must be submitted no later than October 15, 2020.

- The report is submitted on paper only if the number of employees does not exceed 24 people. For 25 or more employees, you will have to report electronically via TCS through EDI operators.

- From March 2021, SZV-M must be handed over to organizations with a single founder acting as a director, even if an employment contract has not been concluded with him.

- In order to properly defend yourself in court and not pay fines, you should take into account the current judicial practice on SZV-M.

If you find an error, please select a piece of text and press Ctrl+Enter.

Form of monthly reporting to the Pension Fund in 2019

Information about the insured persons

The information from the SZV-M report is needed by the Pension Fund in order to monitor working pensioners. Since February 2021, working pensioners will not have their pensions indexed. The pension fund needs to keep track of whose pension should be indexed, and to whom it is already paid.

In addition, the employer must create and submit to the Pension Fund a register of insured persons for additional insurance contributions to the funded pension, for whom he transfers funds.

This register in form DSV-Z is submitted no later than 20 days after the end of the reporting quarter. The procedure for submitting it to the Pension Fund of Russia is the same as for the SZV-M report.

Information about the insurance experience of the insured person

Information on the insurance experience of insured persons according to the approved form SZV-STAZH will be submitted by organizations for the first time in 2021 for the reporting year 2021. The report must be submitted no later than March 1, 2018.

Information about the policyholder for personalized accounting purposes

Using the EDV-1 form, information on the policyholder is transmitted for maintaining individual records in the Pension Fund. The form is submitted once a year no later than March 1st.

According to Appendix 5 to the Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p, simultaneously with the EDV-1 form, a file is submitted that contains a package of documents consisting of the SZV-STAZH, SZV-ISKH and SZV-KORR forms. These forms must include the following information:

- Data on the adjustment of the information of the insured person recorded on the individual personal account in the PRF (form SZV-KORR)

- Information on earnings and income, the amount of payments and paid insurance premiums during periods of employment, counted in the length of service of the insured person (form SZV-ISH)

| № | Reporting type (form) | Reporting period | Deadline |

| 1 | Information about the insured persons (Form SZV-M) | month | no later than the 15th day of the month following the reporting month |

| 2 | Register of insured persons for whom additional insurance contributions for a funded pension have been transferred and employer contributions have been paid (Form DSV-Z) | quarter | no later than 20 days from the end of the reporting quarter |

| 3 | Information on the policyholder transmitted to the Pension Fund for maintaining individual (personalized) records (Form EDV-1), as well as Information about the insurance experience of the insured persons (form SZV-STAZH), Information on earnings (remuneration), income, amount of payments and other remuneration, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (form SZV-ISH), Data on the adjustment of information recorded on the individual personal account of the insured person (form SZV-KORR) | year | no later than March 1 of the year following the reporting year |