Land tax 2015, land tax rate

TAXATION 2021: deadlines for payment of land taxes, calculation of kbk codes.

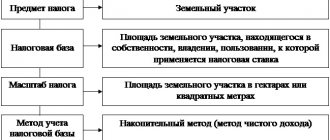

Land tax is a local fee. This means that the tax code sets only marginal rates, and the final calculation and payment of land tax is carried out on the basis of local laws. Payment deadlines and benefits for land tax are also established by the municipal administration. The object of taxation is land plots located in the region, owned by individuals and legal entities. The use of land occurs on the basis of the Land Code of Russia (federal law of October 25, 2001 N 136-FZ). In accordance with this code, all land plots are included in the state cadastre, where the value of taxable property is indicated. The value of land is used to determine the tax base.

The scheme for paying land taxes is different for individuals and organizations. The former pay land tax on the basis of a tax notice sent to them by the local Federal Tax Service. Tax officials calculate land tax based on the tariff rates in force in a given region; the payer only has to pay this fee. Enterprises and individual entrepreneurs using land must calculate the amount of land tax themselves. Payment of land taxes to the budget is made at the location of the land plot, this is done based on the results of the reporting and tax period. The tax period for this type of fee is considered to be a calendar year. We will tell you how land tax is calculated and paid for these categories of payers.

Calculation and payment of land tax by organizations and individual entrepreneurs.

Taxpayers - organizations, as well as individuals who are individual entrepreneurs, calculate the tax base and the amount of land tax each year independently. The calculation is based on data from the state land cadastre. The taxable base is considered to be land plots used for business activities, owned by them as property or in constant use (for individual entrepreneurs - also on the right of lifelong inheritable ownership of the land). Advance payments for land use tax are calculated in the same manner. At the end of the tax period, enterprises and individual entrepreneurs fill out and submit a land tax return to the Federal Tax Service.

Taxpayers for whom a quarter is defined as the reporting period calculate and pay advance land tax at the end of the 1st, 2nd and 3rd quarters of the year. The amount of the advance payment is a quarter of the tax rate, which is established at the beginning of the year by local legislation. At the end of the year, all advance payments are summed up and deducted from the amount that will need to be paid for the use of the land. However, there may not be an advance tax on land; it all depends on the decision of the local administration.

Land tax for individuals, payment.

Individuals pay taxes for the use of land in a slightly different way. In 2015, as in previous years, they do not need to delve into the intricacies of calculating land tax and even know its rate: the tax office will do everything for them. The tax authorities themselves will calculate the amount of contributions to the budget and send a tax notice. The law establishes that tax notification must arrive no later than a month before the expiration of the deadline for payment of land taxes, determined by local authorities. Moreover, employees of the Federal Tax Service will explain all unclear points, help fill out the necessary documents, or even do it for the taxpayer (usually this service is paid).

Calculation examples

Example 1. Calculation of land tax for a full calendar year

Object of taxation

Petrov I.A.

owns a plot of land in the Moscow region. The cadastral value of the plot is 2,400,385 rubles

.

Tax calculation

The tax rate for this land plot is provided in the amount 0,3%.

The land tax in this case will be equal to: 7,201 rubles.

(RUB 2,400,385 x 0.3/100).

Example 2. Calculation of land tax for an incomplete calendar year

Object of taxation

In October 2021 Petrov I.A.

registered the rights to a land plot located in the Moscow region. Its cadastral value is 2,400,385 rubles.

Tax calculation

The tax rate for this land plot is provided in the amount 0,3%

.

Land tax for three months of 2021 in this case will be equal to: 1,801 rubles.

(RUB 2,400,385 x 0.3 / 100 x 0.25),

Where, 0,25

– coefficient of time of land ownership (3 months / 12 months).

Example 3. Calculation of land tax for a share of land

Object of taxation

Petrov I.A.

owns ¾ of a land plot located in the Moscow region. Its cadastral value in 2021 is 2,400,385 rubles

.

Tax calculation

The tax rate for this land plot is provided in the amount 0,3%

.

The land tax in this case will be equal to: 5,401 rubles.

(RUB 2,400,385 x ¾ x 0.3 / 100).

Example 4. Calculation of land tax taking into account benefits

Object of taxation

Combat veteran Petrov I.A.

owns a plot of land in the Moscow region. The cadastral value of the plot in 2021 is 2,400,385 rubles

.

Tax calculation

The tax rate for this land plot is provided in the amount 0,3%

.

The land tax in this case will be equal to: 7,172 rubles.

((RUB 2,400,385 – RUB 10,000) x 0.3 / 100),

where, 10,000 rub.

– a benefit that is provided to Petrov I.A. due to the fact that he is a combat veteran.

Land tax rate in 2015 in Moscow

As mentioned earlier, the land tax rate is determined by municipal legislation, but not higher than that established by Article 394 of the Tax Code. There are two maximum tax payments: 0.3 percent for land used for agricultural production and housing, and 1.5 percent for other land plots. The Moscow government has established three tax rates: - 0.1% for residential land and infrastructure; — 0.3% for summer cottages and sports facilities; — 1.5% for all other plots of land in Moscow.

Land tax rates are indicated as a percentage of the cadastral value , which, for obvious reasons, is different in the city center and on its outskirts. In addition, the amount of tax may depend on how the land is used, the right to make such adjustments is left to local authorities. For example, if a site is used for profit, the tax rate is usually higher than for land used for non-profit purposes. Finally, a number of citizens have the right to a land tax benefit, that is, part of the cadastral value is not subject to taxes to the budget.

Tax benefits on land tax for pensioners.

For some categories of citizens, land tax benefits are provided. This benefit is expressed in a non-taxable amount. The tax rate is mandatory reduced for Heroes of the Soviet Union and the Russian Federation, disabled people since childhood, veterans of the Great Patriotic War, combatants, Chernobyl survivors injured as a result of nuclear weapons testing. In some regions, additional benefits are provided - for example, for pensioners, low-income and large families, and internally displaced persons. If the tax deduction exceeds the contribution amount, then nothing is paid at all.

To receive the benefit, the taxpayer must submit supporting documents to the tax office. To find out what exemptions are provided for by local legislation for a specific individual, the easiest way is to contact the tax office at the location of the land plot. You can also use the Internet and at the same time find the land tax rate in 2015 to check whether the tax authorities calculate the amount of the fee correctly. It should be understood that in each region the benefits and rates are different, and those tax deductions that are valid, for example, for Moscow, do not apply in Novosibirsk.

Cadastral value

The cadastral value is determined separately for each land plot as of January 1 of the year, which is the tax period (paragraph 1, paragraph 1, article 391 of the Tax Code of the Russian Federation). If the land plot was formed during the tax period, the cadastral value is determined as of the date of registration of such land plot for cadastral registration (paragraph 2, paragraph 1, article 391 of the Tax Code of the Russian Federation).

If the cadastral value of the land is not determined, the tax is calculated based on the standard value of the land. For more information about this, see What property is subject to land tax. For example, this is how land tax is calculated in the Republic of Crimea and the city of Sevastopol before the approval of mass cadastral valuation of plots. This is stated in paragraph 8 of Article 391 of the Tax Code of the Russian Federation.

The cadastral value can be viewed on the official website of Rosreestr.

If the land plot is in common shared ownership, then the cadastral value of part of the land plot is determined in proportion to the share in the common property. According to the following formula:

| Cadastral value of the part of the land plot owned by the entrepreneur | = | Cadastral value of the entire land plot in common shared ownership | × | Share of a land plot owned by an entrepreneur by right of ownership, percentage |

Such rules are established by paragraph 1 of Article 392 of the Tax Code of the Russian Federation. Similar clarifications are given in the letter of the Ministry of Finance of Russia dated January 31, 2014 No. 03-05-06-02/3884.

If the land plot is jointly owned, then the cadastral value of the share owned by the entrepreneur is determined in equal parts (clause 2 of Article 392 of the Tax Code of the Russian Federation). For example, if the owners of a land plot are three taxpayers, then each of them owns 1/3 of this plot. This means that the cadastral value of the share owned by each taxpayer will be equal to 1/3 of the cadastral value of the entire plot.

If an entrepreneur acquires a building and the ownership of that part of the land plot that is occupied by this real estate is transferred to him, the cadastral value is determined in proportion to the entrepreneur’s share in the ownership of this land plot (paragraph 1, clause 3, article 392 of the Tax Code of the Russian Federation).

If the owners of the building are several taxpayers, then determine the cadastral value in proportion to the share of ownership (in area) of this building (paragraph 2, paragraph 3, article 392 of the Tax Code of the Russian Federation).

If the owners of the building are simultaneously:

- entrepreneur and state (municipal) institution,

- entrepreneur and state (municipal) unitary enterprise,

then in this case the cadastral value of the institution or enterprise is not determined. For example, if a building simultaneously belongs to an entrepreneur on the right of ownership, a state institution on the right of operational management and a unitary enterprise on the right of economic management, then the state institution and the unitary enterprise in this case have a limited right to use the land plot (Clause 3 of Article 36 of the Land Code of the Russian Federation ). Consequently, an entrepreneur must pay land tax on the entire plot, since an institution (enterprise) that has the right of limited use is not recognized as a payer of land tax (clause 1 of Article 388 of the Tax Code of the Russian Federation).

An example of calculating the cadastral value of a part of a land plot occupied by a building. The entrepreneur owns part of this building by right of ownership

The entrepreneur owns 150 sq. m of building. The total area of the building is 1500 sq. m. m. The cadastral value of the entire land plot, which is in common shared ownership, is 335,000 rubles. Cadastral value of the part of the land plot owned by the entrepreneur: RUB 335,000. × 150 sq. m: 1500 sq. m = 33,500 rub.

The cadastral value of a land plot in a situation where an entrepreneur owns one of the floors of a building is determined in proportion to the entrepreneur’s share in the common shared ownership (paragraph 2, clause 3, article 392 of the Tax Code of the Russian Federation).

If the land plot is located on the territory of several municipalities, then the cadastral value is determined separately for each part of the land plot:

| Cadastral value of part of the land plot | = | Cadastral value of the entire land plot | × | The area of part of the land plot located on the territory of the relevant municipality | : | Total land area |

This procedure is provided for in paragraph 1 of Article 391 of the Tax Code of the Russian Federation.

If an entrepreneur is entitled to a benefit in the form of a tax-free plot area established by local authorities, the cadastral value of the part of the plot that will be taxed is calculated:

| Cadastral value of the taxable part of the plot | = | Cadastral value of the entire land plot | × | (Area of the entire plot - Non-taxable plot area ) : Area of the entire plot |

To obtain information about the area of land falling within the territory of a particular municipality, contact the territorial office of Rosreestr.

During the year, the cadastral value may change, for example, by court decision. For information on what value to take into account then, see How land tax is calculated.

Deadline for payment of land taxes to the budget

When acquiring ownership of a land plot, the authorities registering the transaction in the land cadastre, in accordance with paragraph 4 of Article 85 of the NKRF, provide information to the tax authorities at the location within 10 days from the date of registration of rights to real estate (land). All information is submitted to the Federal Tax Service by February 1 of each year; that is, the amount of land tax for 2011 is calculated based on 2010 data. This information is submitted in the form established by Order of the Ministry of Finance dated September 7, 2005 No. 112n on approval of the form “Information on land plots, as well as on persons to whom the right of ownership, the right of permanent (perpetual) use or the right of lifelong inheritable possession is registered.” The same order provides recommendations for filling out the form. In this way, the tax office will know who must pay land tax and in what amount.

According to paragraph 1 of Article 397 of the Tax Code, the procedure and deadline for paying land taxes is determined by the legislative acts of the constituent entities of the Russian Federation. The only restriction provided for by the higher law is that it is not allowed to demand payment of tax on the use of land plots before the deadline established by paragraph 4 of Article 396. Note: as of January 1, 2011, this clause is no longer in force. Instead, two provisions apply: for organizations and individual entrepreneurs, according to paragraph 3 of Article 398, the deadline for submitting a tax return and paying land tax is set until February 1, and for individuals, based on paragraph 1 of the article, the payment deadline cannot be set earlier than November 1.

To pay or not?

It goes without saying that paying taxes is the responsibility of all citizens. However, many are in no hurry to take the received “payments” to the bank. But it is precisely such fees that go to the budget that are the basis for improving the city’s infrastructure, the quality of the road surface and the modernization of various systems.

The statistics are sad: about 30–60 percent of the planned amount goes to the treasury for land and property taxes. The situation is better with the payment of personal income tax when selling housing or land - you cannot do without filing a declaration and paying 13%.

All payments - property tax, transport tax, land tax - payable by individuals have different repayment deadlines. Typically, the tax is paid once a year at the end of the year. For example, last year the deadline for paying land fees ended on November 1. In 2015 it was reduced by one month.

Debt for land, property or transport taxes paid by individuals can be found on various Internet resources or directly on the Federal Tax Service website. Arrears of collection may result in the imposition of a fine for the owner, the amount of which is up to 20% of the amount of the debt.

But there is also an interesting detail in the legislation: if you have not paid tax for many years in a row, you can only collect the debt for the previous three calendar years. The rest is written off.

The Internet rules the land valuation!

But now let's return to the issue of revaluation of plots. As it turned out, the right to revaluate was granted to independent appraisers, who were kindly chosen by local and regional authorities. The competition was held through an auction, but in order to become its winner, participants had to share. "How?" - you ask.

A percentage of the future value of the contract! And since after the division there was still an amount at our disposal that was insufficient to carry out objective calculations, we decided to use the method of least resistance. It was expensive to travel to the sites and the budget did not allow it, so independent appraisers took advantage of the free capabilities of the World Wide Web.

We looked on the Internet for information about the sale of properties in a certain area and were guided by this price. Nevertheless, the work was done in good faith - different objects were structured by type of use (dachas, land for business, garages, etc.), and only then the average price for each type was displayed. But of course one fact was not taken into account: the real price is far from equal to the offer price! After all, every seller tries to offer the maximum - maybe they’ll buy it? Well, then everything depends on the urgency of the sale, the real demand for such an attractive offer. Many even immediately indicate: “bargaining is appropriate,” which means that the real purchase price can be several times cheaper!

The next unaccounted factor is infrastructure (social, transport, economic). No one took into account the remoteness of the sites from cities, whether it is convenient to get there, and whether it is even possible to get there by public transport. During the audit, the Accounts Chamber identified many such shortcomings. The result of such initiative was similar contradictions: two neighbors theoretically had land of absolutely equal value, but in practice it turned out that one neighbor lived in Monte Carlo, and the second in Uryupinsk.

The absurdity of such figures is off the scale, because the cadastral value of similar objects in the same area can differ by 2-3 times. And according to the assessment, the plot cannot be sold for such a maximum, no matter how hard you try. Naturally, checking real transactions with citizens and finding the truth is an almost impossible task, but the Accounts Chamber was able to do this at its level with the help of agreements on alienated lands. It turned out that in 65% of cases the real price of transactions was 5 times lower than the notorious cadastral valuation! And naturally, ordinary people only lose from this, because in most cases the cost is inflated.

Accounting for tax benefits

Local authorities can establish benefits for certain categories of entrepreneurs (clause 2 of Article 387 of the Tax Code of the Russian Federation). If the right to a benefit arises or terminates during the year, the land tax in relation to the preferential land plot is calculated taking into account the coefficient of absence of benefits (Cl).

The K coefficient is taken into account for benefits in the form:

- non-taxable area of land;

- exemption from land tax.

The coefficient Kl is not taken into account for benefits in the form:

- fixed tax-free amounts under paragraph 5 of Article 391 and paragraph 2 of Article 387 of the Tax Code of the Russian Federation;

- reducing the amount of tax;

- tax rate reduction.

| Coefficient Kl | = | Number of full months of the tax period during which there is no tax benefit | : | Number of calendar months in the tax period |

In this case, the month in which the right to a tax benefit arises, as well as the month in which this right is terminated, is taken to be a full month.

The tax is calculated using the formula:

| Land tax (including Kl) = Land tax × Kl coefficient |

This procedure follows from the provisions of paragraph 10 of Article 396 of the Tax Code of the Russian Federation.