According to the “Basic Rules for the Operation of Archives of Organizations”, approved. By the Board of Rosarkhiv dated 02/06/2002 all matters of permanent

If an organization works with cash, a certain percentage of errors is almost inevitable. Particularly frequent

The formation and maintenance of the Unified Register of Vehicles includes the collection by the Federal Accreditation Service

An invoice is a document intended for tax accounting. Based on the received invoice, accounting and

In accordance with Article 136 of the current Labor Code of the Russian Federation, the organization must make calculations according to

A unit of equity participation in a company can be with or without par value.

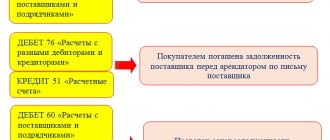

How does legislation affect the nuances of accounting for payments to a third party? In order of production

1. Taxpayers of value added tax (hereinafter in this chapter - taxpayers) are recognized as: (in

Classification of payers In accordance with Art. 19 of the Tax Code, taxpayers are individuals and

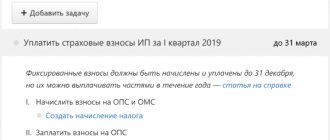

All individual entrepreneurs, regardless of the field of activity and the applicable taxation system, pay for themselves