Any business transactions, in accordance with the requirements of Russian legislation, must be documented, including foreign trade. However, the composition of the documents when executing a transaction with a foreign organization is significantly different - traditional primary accounting documents are not suitable in this case.

Did you know:

Russia is among the TOP 20 importing countries with an import volume of 242.8 billion dollars. based on the results of 2021. Despite the significant decline in global foreign trade associated with the pandemic, which according to WTO forecasts will range from 13 to 32% by the end of 2021, the structure of Russian imports will not change radically. Traditionally, the largest share of goods consists of machinery, equipment and apparatus, chemical products and vehicles, and in the structure of imports of services, according to the Central Bank of the Russian Federation, travel, business services and transport predominate.

Why is it necessary when selling?

When selling products, the supplier is obliged to present the amount of VAT tax for payment to the buyer (Article 168 of the Tax Code of the Russian Federation). An invoice is a document certifying the fact of sale of goods, as well as its cost. It is necessary to confirm the amount of VAT both on sales of products and to confirm the fact of purchase and incoming VAT.

More details about why an invoice is needed can be found here.

Results

In terms of its purpose, the invoice does not at all correspond to the invoice used in Russian practice, despite the fact that a number of details present in them coincide.

It can be correlated, rather, with the domestic Russian consignment note, but it is intended for processing international deliveries. In addition, the invoice is regarded as an invoice for payment if the shipment carried out on it is not paid. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What information should be included?

To include an invoice in tax accounting, you must provide the following information:

- Issue number and date.

- Details of the supplier and buyer (name, tax identification number, checkpoint, address).

- Name and address of the consignee and shipper.

- Number of the payment and settlement document in case of acceptance of the advance.

- List of goods, unit of measurement (if it is possible to indicate it).

- Quantity of goods indicated on the invoice.

- Name of currency (No. 229-FZ dated July 27, 2010), (643 – Russian ruble, 840 – US dollar, 978 – euro).

- Price per unit of measurement excluding tax.

- The cost of the total quantity does not include tax.

- Excise duty amount for excisable products.

- Tax rate (0%, 10%, 18%).

- The amount of tax charged to the buyer according to the applicable tax rates.

- The cost of the total quantity, taking into account the amount of tax.

- Country of origin of the product.

- Customs declaration number (DT).

What does it mean to issue an invoice?

The original invoice and 5 copies must be included with the shipment (invoices and Air Waybill (AWB) should be placed in the adhesive pocket for international shipments). It is recommended to place another copy of the document inside the package.

Invoicing does not mean simply issuing a bill. A commercial invoice can also be used as a waybill for goods being transported.

Expert opinion

Anisimov Stepan Sergeevich

Retired customs major, with 17 years of work experience.

One of the main functions of the invoice is that, based on the information specified in it, the amount of customs fees for imported goods is determined. More details on how customs duties are calculated here. Also, based on the invoice data, VAT is calculated, which the importer must pay.

What types are there?

For export

Reference! Export refers to the removal of goods outside the country for sale in foreign markets.

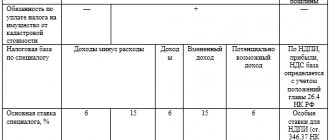

Exports are subject to VAT at a rate of 0% (Article 164 of the Tax Code of the Russian Federation). This tax rate should be confirmed by providing the appropriate package of documents within 180 calendar days from the date of export of goods under the customs export regime.

This package provides:

- contract with a foreign counterparty;

- customs declaration;

- accompanying documents for products and transport with customs marks.

If the buyer is a Russian company, then the 0% VAT rate is prohibited. After 180 days, the sale of exports is not reflected in the VAT return. The export invoice is issued in one copy, since the buyer does not need to provide it.

The 0% rate is indicated in the “tax rate” column, and a zero amount is indicated in the “tax amount” column. If the documents have not been submitted to the tax authorities within the prescribed period, then it is necessary to issue an invoice with a tax rate of 10% or 18%.

Important! When exporting goods, the tax rate is 0%.

For import

Import of goods means the import of imported products produced outside the country into which they are imported for the purpose of consumption or resale. There is no need to issue an invoice for imports. This is due to the fact that an invoice is a document with which the seller presents the buyer with VAT accrued under Russian legislation (Article 169 of the Tax Code of the Russian Federation).

Obviously, a foreign supplier cannot present such VAT, and therefore does not have the opportunity to issue an invoice. When importing, VAT is paid at customs, and the basis for the deduction is the customs declaration (Article 171 of the Tax Code of the Russian Federation).

When importing goods, an invoice is not issued, but below you can see a sample of the invoice containing the imported goods.

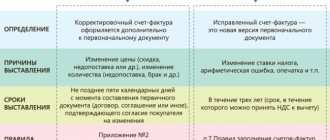

Proforma invoice

Proforma invoice is a preliminary document sent by the seller in the following cases:

- If the payment amount or certain characteristics of the product have not yet been fully agreed upon. Once the final contract amount has been approved, a commercial invoice is drawn up.

- If the contract provides for the payment of an advance by the buyer.

A commercial invoice and a proforma invoice are two almost identical documents. The difference is that proforma invoice contains preliminary data. This document is for informational purposes and allows the buyer to understand how much will need to be transferred for the goods.

The commercial invoice contains accurate data that is indicated on the basis of actual information about the shipment of goods.

A proforma invoice, in particular, is issued in cases where it is not possible to determine the exact weight of the goods before loading. For example, when loading a ship with bulk substances, you can find out the exact weight only after loading. But in order to begin loading, customs must provide a document, which is the proforma invoice, and then an invoice with accurate information is issued.

The proforma invoice may also indicate the size of possible deviations in the quantity of goods, if any are provided for in the contract.

Documents for inventory items

Upon shipment

Shipment means the transfer of material assets by the seller directly to the buyer , or to the carrier with further transfer to the buyer. To accompany this transaction, a standard invoice is issued in a standard form (clause 5 of Article 169 of the Tax Code of the Russian Federation), and in case of receipt of an advance payment for the goods, an advance invoice is issued, which indicates the number of the payment document (clause 5.1 of Article 169 Tax Code of the Russian Federation).

When selling

The basis for the sale of goods is an agreement (contract) for the purchase and sale of products. A sales contract is a written agreement between two parties to transfer products at an agreed price. A significant condition of this transaction is the price for the goods.

A purchase and sale agreement involves the transfer of funds at the time of conclusion, in contrast to a supply agreement, when payment can be made upon sale. Accordingly, for a transaction for the sale of products, either a standard invoice of a standard form or an advance invoice can be issued in the case of receiving an advance payment.

Upon delivery

Delivery means a transaction under which the seller undertakes to transfer the goods to the buyer within a certain period of time, and the buyer to accept and pay in accordance with the terms of the contract. Delivery is carried out by shipment, i.e. delivery of goods directly to the buyer or the recipient specified in the contract.

Thus, shipping is a mode of delivery, i.e. its main element, so there are no significant differences between them. The delivery of goods, as well as the shipment, are documented using similar documents.

The procedure for document flow of an import transaction

When working with Russian suppliers, everything is clear to an accountant. There are laws and regulations that describe the documentation of transactions. The basis for them is a contract. The product or service is paid for according to the issued invoice. Confirmations of the transaction are acts, UPD, delivery note, etc. Moreover, there are rules for working with them for all cases – both for paper and electronic document management.

If the counterparty is foreign, then the accountant will have to use a different set of documents. The main one is the contract.

. It must be compiled in two languages – ours and the counterparty’s. This is necessary to ensure that the document is interpreted unambiguously - all conditions must be understood equally by speakers of different languages. In its structure and wording, the document differs little from a standard contract.

Another story is the supporting documents. In foreign practice, there are no Russian consignment notes, UTD or our other primary documents. Accordingly, such concepts and rules for working with these documents are not legally established. Sometimes counterparties are ready to use acts drawn up in any form. And although this is convenient for an accountant - such a document can be accepted for accounting in Russia, counterparties cannot be forced to use it.

Who should exhibit?

Invoices are issued only by VAT payers. Enterprises that use simplified taxation systems (USN, UTII) may not issue invoices.

Read more about who issues the invoice here.

How is it filled out?

The invoice form is filled out strictly in the form established by the Legislation of the Russian Federation, in compliance with all requirements (Article 169 of the Tax Code of the Russian Federation). Deviation from the requirements may be grounds for denial of a tax deduction.

- The document can be filled out either by hand or using special programs.

- The form must indicate:

- details of the supplier and buyer;

- a complete list of supplied products;

- price;

- quantity;

- information about the VAT rate.

Who signs and how?

The invoice is certified by the head and chief accountant of the organization that issues it . If the company does not have the position of chief accountant, and this is confirmed by relevant documents, the document will be signed only by the manager. Signatures must be original; facsimiles are prohibited. A seal is not required.

How to register?

To register invoices, the law provides for: an accounting journal, a purchase book and a sales book.

- At the time of issuing or receiving invoices, the data is reflected in the accounting journal, outgoing invoices are registered by the date of their issuance, incoming invoices by the date of receipt.

- Invoices are entered into the sales books at the time of shipment of goods, in all cases when the obligation to calculate VAT arises.

- Invoices received from sellers are included in the purchase ledger as the right to VAT deductions arises.