If in the accounting period the company's income turned out to be less than its expenses, the income tax base is recognized as equal to zero and no tax is payable. Of course, in the business world, ups and downs are possible, and if this happened once, and the amount of this negative difference is small, then most likely there will be no questions for the company. Systematic demonstration of losses or a serious excess of expenses over income in the income tax return may raise suspicions among controllers of illegal actions. In this case, the organization will have to prepare a written explanation for the losses to the tax office. We will consider a sample of drawing up such a document, as well as cases in which it is required to be drawn up, below.

How to behave?

and it’s no secret that not a single chief accountant wants his company to be included in the list of “lucky ones” for conducting on-site events to audit financial and economic activities by tax authorities. But what should he do if the annual report turns out to be a loss, and the tax inspectorate demands to explain the reasons for its occurrence?

In this situation, there are two options for behavior:

- leave the annual report as is, but at the same time you need to competently and convincingly write explanations for the company’s losses;

- artificially correct reporting in such a way that unprofitability ultimately “disappears.”

Having chosen one option or another, you must understand what tax risks you can expect and what consequences they can bring for the company.

If you have at your disposal all the properly completed documentation that can confirm the validity of the expenses incurred, then there is no need to artificially adjust the reporting, i.e., there is no need to remove the company’s losses, since they will be lost to you forever. In such a situation, it would be more appropriate if you prepare an explanation for the losses to the tax office. We will consider a sample of such an explanatory note below.

But sometimes it is not possible to explain the reasons for the occurrence of a negative balance. Then you can correctly correct the profit and loss statement and thereby hide the loss. But you must understand that deliberate distortion of reporting may result in fines for the company. It would be better if, before submitting your reports to the tax office, you look at them again to see if you have taken into account all the income.

Is there a fine possible if the requirement is ignored?

Tax liability for failure to comply with the inspection's requirement to provide explanations to the Tax Code of the Russian Federation has not been established. Art. 126 of the Tax Code of the Russian Federation does not apply to this situation, since we are not talking about the requisition of documents (Article 93 of the Tax Code of the Russian Federation), but Art. 129.1 is not applicable, since this is not a counter check (Article 93.1 of the Tax Code of the Russian Federation).

Administrative liability under Art. 19.4 of the Code of Administrative Offenses of the Russian Federation in this case cannot be attracted either. This article applies for failure to appear at the tax authority, and not for refusal to give explanations, which the Federal Tax Service of the Russian Federation itself draws attention to (see clause 2.3 of the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837).

Thus, tax authorities have no right to fine people for failure to submit explanations. But still, despite the absence of legal grounds for the fine, it is more appropriate to provide explanations, since this is in the interests of the taxpayer himself. After all, refusal to do so may result in additional tax charges and sanctions, which will then require time and money to appeal.

What criteria are used to consider companies that have shown a loss?

Typically, there are three types of losses:

- a fairly large loss;

- the loss is repeated over two tax periods;

- the loss was shown last year and in the interim quarters of the current year.

What should newly registered enterprises do? Loss is a common occurrence for new businesses. In addition, tax legislation requires accounting for expenses in the period in which they are incurred, despite the fact that income has not yet been received. If a company was created and suffered a loss during the same year, then the tax authorities most likely will not consider it as problematic.

However, if you show a loss for more than one year, the inspectorate will require you to explain the reasons for this situation, since it may consider that you are deliberately reducing profits. Therefore, we recommend that if you have a loss, submit a balance sheet and profit and loss statement with an explanatory note, this will allow you to avoid unnecessary questions.

Results

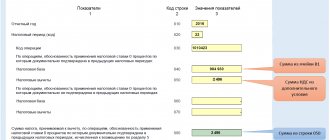

If tax officials have questions regarding the reporting submitted to the Federal Tax Service (inconsistencies in figures, clarification with a tax reduction, declaration with a loss), they will ask the taxpayer for clarification. You should not ignore such a request (it is sent in the form of a demand): comprehensive explanations will help resolve questions and avoid possible checks caused by inconsistencies in reporting. Explanations can be given both on paper and electronically. But if we are talking about issues related to the VAT return, then taxpayers submitting such a declaration electronically must also provide explanations on it electronically.

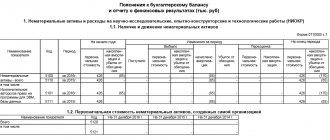

What indicators do tax authorities pay attention to when auditing an unprofitable company?

- On the ratio of debt and equity capital. It is considered acceptable if the amount of equity capital is greater than borrowed capital. In this case, it will be better if the growth rate of borrowed capital is lower.

- On the growth rate of current assets. It is considered normal if this indicator is greater than the growth rate of non-current assets.

- On the growth rate of accounts receivable and accounts payable. These indicators should be almost the same. Tax officials may be interested in the reason for the increase or decrease in these indicators.

What should an explanatory note about losses look like?

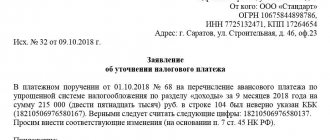

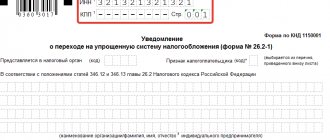

How to write an explanation to the tax office? There is no standard form as such; explanations are written in free form on the official letterhead of the enterprise and signed by the manager. The note is drawn up in the name of the head of the tax office, which sent a request for clarification of losses.

The main emphasis in the letter should be on explaining the reasons for the negative financial result. Here it is very important to back up all words with facts that influenced the emergence of a situation where the enterprise’s expenses exceeded its income. It is very good if the company has documents that can be used to confirm that this is normal business activity aimed at making a profit, and there will be no losses in the next reporting period. To prove that you have taken a number of steps to achieve positive results, you can attach a copy of the business plan, a breakdown of accounts payable and other similar tools to the explanatory note.

What does a “loss-making” declaration mean?

This means that at the end of the year, instead of profit, a tax loss was formed, as a result of which there will be no income tax indicator for payment. Tax loss is the negative difference between income and expenses that are taken into account for tax purposes.

The task of the Federal Tax Service is to ensure the modern calculation of taxes and the flow of funds into the budget. The Federal Tax Service is often overly attentive to companies operating in the red. For tax authorities, losses are a sign of a number of illegal actions of the director - tax evasion, withdrawal of assets, deliberate bankruptcy, fraud, etc.

Explanation 1. Reduction in prices for goods, works and services sold

The reasons for this decrease may be the following factors.

1. The selling price is reduced due to a decrease in market prices or a decline in demand. The consumer will not buy a product with a price higher than the market price, and by selling it at a loss, you can get at least some revenue and not go into an even greater loss. This explanation can be supported by the following documents:

- by order of the manager on the establishment of new prices and the reasons for such changes;

- a report from the marketing department, which will reflect the market situation and provide an analysis of the decline in demand for goods shipped by the enterprise.

2. Product expiration date expires. To prove this reason, you can attach the following documents:

- act of the inventory commission;

- an order from the manager to reduce prices for goods.

3. Buyer's refusal to order. You can justify this reason by attaching an agreement to terminate the contract or an official letter from the buyer in which he writes about his refusal.

4. Seasonal nature of goods, works and services sold. Seasonal fluctuations in demand are typical for such areas as construction, tourism, etc. To justify this reason, you will also need an order from the manager to reduce prices.

5. The price reduction is explained by the development of a new sales market. At the same time, your arsenal should include marketing research, plans, and development strategies. It will not be superfluous if you provide copies of supply contracts to new points of sale or documents for opening a new division in another region.

Sample explanatory note

For a clear understanding of how to write explanations to the tax office regarding losses, the sample presented below will help us.

To the boss

Inspectorate of the Federal Tax Service of Russia No. 6

in Kazan

Skvortsov A.S.

EXPLANATIONS

Having studied your request regarding the provision of explanations explaining the formation of the loss, Romashka LLC reports the following.

During nine months of 2014, the revenue of Romashka LLC from the sale of products amounted to 465 thousand rubles.

Costs taken into account in tax accounting amounted to 665 thousand rubles, including:

- material costs – 265 thousand rubles.

- labor costs – 200 thousand rubles.

- other expenses – 200 thousand rubles.

Compared to the same period last year, these costs increased by 15 percent, including:

- material costs – by 10%;

- labor costs – by 4%;

- other expenses – by 1%.

From these indicators it is clear that the increase in the company’s expenses was mainly associated with an increase in prices for materials and raw materials necessary for the production of our products. In addition, it is worth noting that the company, in order to motivate its employees, increased wage costs.

Also, due to the market situation and the level of competition, the Company was unable to implement the planned increase in prices for the goods sold.

In connection with the above, it can be argued that the loss is a consequence of objective reasons.

Next, you can include a description of the further development of the enterprise in the explanations for tax losses. An example of such a description:

Currently, the management of the enterprise is already conducting negotiations, the purpose of which is to attract new buyers and customers, and is also considering the issue of improving the products, which will increase the income of the enterprise several times. The company plans to achieve a positive financial result based on the results of 2015.

Explanatory note on taxes

Currently, businesses may be required to provide an explanation to the tax office regarding VAT. This is the case if, when sending them an updated declaration, the amount of tax payments is less than that indicated in the original version.

The explanation for VAT, as well as the explanation for losses to the tax office, is drawn up in any form and supported by the signature of the head of the organization. It indicates the indicators that have changed in the declaration, which became the reason for reducing the tax amount. Among other things, it would not be superfluous to indicate the reason why different information was indicated in the original declaration. This may be an error in calculation due to misunderstanding of legislation or program failure and other similar factors.

What to do if a company receives a notice demanding an explanation of losses

After the company’s declaration statements with recording of unprofitability are submitted to the tax service, you can expect a notification with a requirement to explain the current situation. What to do in this case? Experts explain that there are two options:

- Legal - the annual statements remain unchanged, and an explanation is written for all losses.

- It is illegal to make corrections to an already prepared report for the entire year with falsification of information in order to artificially (on paper) get rid of unprofitability.