Article 346.24 of the Tax Code of the Russian Federation obliges firms and individual entrepreneurs who have chosen the simplified tax system to keep tax records

BCC for 2012 BCC for 2012, taking into account the changes announced by the Ministry of Finance

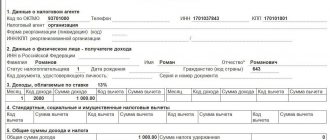

Many people are interested in how to fill out 3 personal income taxes for the child tax deduction, so you need to carefully

Maternity leave Pregnant women working in the company have the right to contact the manager with a request to provide

Taxation of maternity benefits in 2021 - these are the rules under which

What is the document for? This document is needed for deregistration at the previous place

By expanding its activities, a company may decide to open its branches and representative offices. Tax Code of the Russian Federation

Insurance premiums are deductions from employee income to extra-budgetary funds at established rates.

Penalties and fines for taxes - penalties in the form of monetary payments for violation of requirements

The tax when purchasing an apartment in 2021 for individuals is calculated independently, and the rate