Penalties and fines for taxes are penalties in the form of monetary payments for violation of legal requirements regarding the calculation and payment of taxes. And if the fine is, in most cases, a fixed amount established by law, then penalties are calculated as a percentage of a certain amount (for example, the amount of overdue debt) for each day, and their size directly depends on the duration of the unfulfilled obligation. Let's figure out how to account for penalties and fines on taxes.

Definition

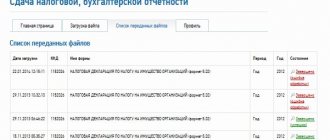

Submitting reports to tax authorities is the provision of a set of documents that reflect information about the payment of taxes. This process consists of two stages: preparing the declaration and calculating the advance.

No less important is the 6-NDFL report, which contains information about all persons who received income from a particular resident, about the amounts of accruals, payments, and deductions, which are the basis for taxation. For violation of deadlines, a fine is provided for late submission of reports to the Federal Tax Service.

Types of taxes

Let's consider all current types of reporting.

| Tax | Term | Payer |

| VAT | Quarterly, until the 25th of the next reporting month. | The report is provided by all organizations operating on the common taxation system at the place of registration. |

| Income tax | Quarterly, until the 28th of the next reporting month. | |

| Z-NDFL | Every year until April 30. | Individuals are tax agents. |

| 2-NDFL | Every year until April 1. | Individual entrepreneurs who have hired employees submit a report at the place of registration. |

| 6-NDFL | Quarterly, until the 1st day of the next reporting month. | |

| simplified tax system | Annually: individual entrepreneur – until April 30; LLC – until March 31. | At the place of registration. |

| UTII | Quarterly, until the 20th day of the next reporting month. | To the Federal Tax Service at the place of business. |

Sanctions

Let us consider in more detail what the fine is for late submission of reports to the Federal Tax Service. 2-NDFL, VAT and income tax are taxed at different rates. Therefore, the penalties for each of them are different.

| Responsibility | Tax | Administrative | Criminal |

| VAT | 5% of the tax amount monthly; 200 rub. for providing a paper report. Penalty - 0.003% of the Bank of Russia rate per day. Accounts may be seized. | 300 rub. or warning. | Fine up to 300 thousand. Forced labor for up to 2 years. Arrest for 6 months. Imprisonment for up to 2 years. |

| Income tax | The fine for late submission of reports to the Federal Tax Service is 200 rubles. | — | — |

| Transport tax | The fine for late submission of reports to the Federal Tax Service is 5% of the amount. | — | — |

| Land tax | |||

| 2-NDFL | 200 rub. per document | For physical persons – 100 rub. For officials – 500 rubles. Authorities – 1 thousand rubles. | — |

| 6-NDFL | For each month - 1 thousand rubles. After 10 days, the accounts are seized. | — | — |

| simplified tax system | For amounts paid but not declared – 1 thousand rubles. | — | — |

| UTII | 5% of the tax amount. | — | — |

PFR fine posting

And the minimum amount of the fine in accordance with the Tax Code is 1000 rubles for each month.

And even if the reporting, for example, is overdue by 5 months and 2 days, then you will have to pay the fine in 6 months.

But such a fine is charged monthly in case of failure to submit reports. The following question arises: what if the reporting is submitted, but incorrectly, and it needs to be clarified? In this case, the amount of the fine will not be 1000, but 500 rubles for each month of an incorrectly submitted form. The costs of paying the fine will also be charged to account 99, expenses (

Example

The income tax return was submitted on 12/16/15, although the deadline was set for 10/28/15. On the same day, an advance payment of 2 million rubles was paid. In April 2021, the organization submitted the following declaration, indicating the reduced tax amount.

The fine for late submission of reports to the Federal Tax Service, the accrual entries for which will be presented in the balance sheet below, is:

- provision of documents for the 3rd quarter of 2015 – 200 rubles;

- submitting an annual declaration late - 1 thousand rubles. + 300 rub. from the manager.

To what account should fines be attributed?

Reasons for accruing tax fines In accounting, there are several reasons for accruing fines and penalties:

- Understatement of tax liability.

- Late submission of the report;

- Payment of tax and insurance premiums within unspecified terms;

Fine and penalty: what are their differences It should be noted that a fine and penalty are different concepts:

- The fine is assessed immediately when the above reasons occur.

Fine for late submission of reports to the Federal Tax Service: postings Info

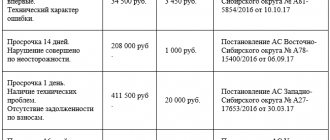

It is this point of view that underlies the decisions of arbitration courts (Resolutions of the FAS of the East Siberian District dated 01/11/2008 N A19-18641/06-33-52-F02-9586/07, FAS of the Ural District dated 06/18/2007 N F09-4526/ 07-C2, etc.), as well as the Presidium of the Supreme Arbitration Court of the Russian Federation (Resolution No. 6161/06 of October 10, 2006 in case No. A45-1098/05-45/40). Two arguments are given to justify this position. Therefore if

Legislation

Art. 119 of the Tax Code of the Russian Federation provides that failure by the payer to submit a tax return may result in a fine being imposed for late submission of reports - 5% of the tax amount on the return. The minimum amount of recovery cannot exceed 1 thousand rubles.

The fine for late submission of reports, which is imposed on the manager of the partnership, is 1 thousand rubles. for each month of delay.

The larger the collection amount and the longer the delay, the higher the fine rate. The minimum fine is 1 thousand rubles, and the maximum is 30% of the declared tax amount.

Late submission of reports to the Pension Fund

Many accountants have a pressing question: what will happen if they fail to timely submit reports not to the tax authorities, but to the Pension Fund, to which it is necessary to submit reports on accrued contributions and deductions? And here there is a main feature: from the beginning of 2021, all reporting, including social contributions, is submitted exclusively to the Federal Tax Service . Thus, legal entities should not submit such documents to the Pension Fund body starting from the 1st quarter of 2021.

Regarding the deadlines, if until 2021 different deadlines for submitting reports on social contributions were established depending on the form of submission (paper or electronic version), now there is no fundamental difference in how the subject will submit the necessary documents. The new calculation and submission methodology obliges taxpayers to submit any type of reporting by the 30th day of the month following the reporting period.

The uniform deadlines for submitting reports on insurance premiums are presented in Table 2.

Table 2 – Deadlines for submitting reports on insurance premiums for 2021 (click to expand)

| Reporting period | Due dates |

| 1st quarter 2017 | Until 05/02/2017 |

| 1st half of 2017 | Until July 31, 2017 |

| 9 months 2017 | Until October 30, 2017 |

| Reporting for 2021 | Until 01/30/2021 |

The Fiscal Service has the authority to impose a fine for late submission of such documents. The fine will be 5% of the amount of contributions that must be paid for this reporting. A fine of 5% is charged for each month of delay, including partial months.

Please also note: in 2021, the amount of the fine for late submission of reports in 2021 cannot exceed 30% of the amount that the company must pay to the budget. But also the amount of sanctions cannot be less than 1000 rubles.

Question: what to do when funds have been paid into the budget, but the declaration has not been submitted. In this case, the fine is calculated on the amount of the debt, that is, the difference between what had to be paid and what was paid. If such a difference is 0, then the company must pay the established minimum - 1000 rubles.

Example: An enterprise submitted reports on insurance premiums for the 2nd quarter via the Internet. 2021 08/25. 2021. In accordance with the submitted declaration, the amount of social contributions for three months amounted to 500 thousand rubles. How much of a fine will be imposed on the company?

Calculation: According to the established deadlines, for the 2nd quarter the company had to submit reports on social contributions by July 31, 2017. Consequently, the delay is not a full month, for which a penalty will be charged. The fine will be: 5% *500,000=25,000 rubles.

Another question arises: If the company paid only the minimum payment - 1000 rubles, then how to distribute it among all types of insurance premiums? Here, the Federal Tax Service recommends being guided by the size of the contributions themselves, in particular:

- 22% for compulsory pension insurance;

- 5.1% – for medical;

- 2.9% – for mandatory social services. insurance in case of temporary disability.

Regardless of the distribution, the entry for payment of a fine for late submission of social contributions is reflected in the accounting accounts as follows:

- A fine has been assessed for late submission of reports for social contributions:

D-t 99, K-t 69;

- The accrued fine has been paid

Dt 69, Kt 51

SZV-M: where to take it in 2021 and who should pay fines?

Accountant's question: starting from 2021, all reports are submitted to the Federal Tax Service, should the SZV-M form also be submitted there?

Answer: No, this form of personalized employee records for each month and in 2021 is submitted exclusively to the Pension Fund authorities.

Yes, the Pension Fund authorities are still responsible for monitoring the personalization of data of company employees.

To this body you must: (click to expand)

- Every month submit reports in the SZV-M form on the number of employees working at the enterprise. Important: the report in 2017 can be submitted until the 15th of the next month, and not until the 10th, as was the case in previous months;

- Once a year, submit annual reports on the insurance experience of each employee. Such a report is submitted before March 1 following the reporting period of the year.

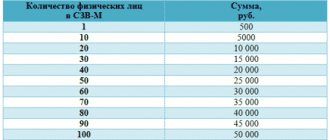

The fine is 500 rubles for each employee for whom reports were not submitted.

Example: Invest LLC submitted the SZV-M form for September on October 20 to the Pension Fund. The company employs 30 people.

Calculation: The penalty will be assessed because the return is due on October 15th. The fine is 500*30=15,000 rubles.

The posting will be similar to the posting that reflects the payment of a fine on social contributions:

- A fine has been assessed for late submission of reports for social contributions:

D-t 99, K-t 69;

- The accrued fine has been paid

Dt 69, Kt 51

Important: now the SZV-M form is submitted monthly before the 15th day of the month following the reporting month. It is still submitted to the Pension Fund, and not to the Federal Tax Service. The report to the Federal Tax Service, unlike the report on social contributions, will not be accepted.

Features of calculations

Let's look at some of the calculation nuances using an example.

A citizen sold a car in 2014 for 300 thousand rubles, which he purchased in 2012 for 350 thousand rubles. The citizen did not generate any income from this operation. Since we are talking about the sale of property that he owned for less than 3 years, according to the Tax Code the citizen was obliged to submit a declaration in form 3-NDFL by 04/30/2015. The citizen did not know about this obligation. In May, he received a letter from the Federal Tax Service demanding to report on the transaction. The citizen submitted a report on May 25 of that year. The fine for late submission of personal income tax reports to the Federal Tax Service, even if the declaration is “zero”, is 1 thousand rubles.

The individual entrepreneur filed a VAT return for the 2nd quarter of 2015 on August 25. The calculated tax amount is 30 thousand rubles. The duration of the delay is two months. The fine for late submission of reports to the Federal Tax Service for individual entrepreneurs is 10%, that is, 3 thousand rubles. What should an entrepreneur do in this case:

- voluntarily pay the fine;

- try to reduce the amount of the sanction by 2 times;

- do not take any action and wait for the bailiffs.

With the first and last options, everything is more or less clear. Let's take a closer look at the second one.

How to write off debts on penalties

Until 2015, an enterprise’s debt for penalties, interest and fines was considered uncollectible due to the completion of enforcement proceedings if 5 years had passed from the date the debt was formed. In this case, the amount of debt had to be less than the requirements for the debtor approved for initiating proceedings to declare him bankrupt.

Since 2015, writing off a debt, the collection of which is considered impossible due to the bailiff issuing a resolution to complete the enforcement proceedings when returning the writ of execution to the collector on 2 grounds, if more than 5 years have passed since the discovery of the arrears or the debt for fines/penalties, possibly in the next situations:

- If the amount of debt turns out to be no more than the claim against the debtor, approved at the legislative level due to the lack of an amount of money sufficient to compensate for the legal costs of initiating processes related to the bankruptcy case.

- If the court returned the petition to declare the debtor bankrupt or terminated the bankruptcy proceedings due to a lack of funds that would be sufficient to compensate for the legal costs of the procedures necessary to consider the bankruptcy case.

The writ of execution must be returned to the claimant after the initiation of legal proceedings in the following cases:

- If the debtor does not have property that could be recovered to pay off the debt. Or all the measures that the bailiff took within the framework of the law to search for such property were unsuccessful.

- If the location of the debtor could not be established. Or it was not possible to discover the location of his property. No information was found about whether the debtor has valuables and money in storage at the bank, in deposits, or in accounts (this does not mean situations where the law provides for the search for property or the debtor himself).

It is also worth mentioning the documents that are evidence that the debt on penalties, fines and interest is recognized as hopeless for collection. Until 2015, the list consisted of only 2 documents - a certificate from the Federal Tax Service and a resolution of the bailiff. Today the list includes:

- A copy of the resolution on the completion of enforcement proceedings when returning the writ of execution to the claimant from the bailiff.

- Certificate from the Federal Tax Service on the amount of debt and arrears of interest, fines, penalties.

- A court ruling on the return of an application to declare the debtor bankrupt (or to complete the paperwork due to the lack of money to compensate for legal costs associated with the bankruptcy procedure).

How to reduce the amount of the fine?

The first step is to contact the Federal Tax Service and sign the Inspection Report. From this moment on, the citizen has 14 days to write a petition with reference to Art. 114 of the Tax Code of the Russian Federation on reducing the amount of the fine. This paragraph states that if there is at least one mitigating circumstance (Article 112), the amount of the fine can be reduced by half. Such circumstances include the occurrence of an offense as a result of a combination of difficult personal, family circumstances, financial situation or under the influence of other circumstances, in particular:

- prosecution for the first time;

- whether the individual entrepreneur has dependents.

The more such circumstances are indicated in the petition, the more opportunities there are to reduce the fine.

Requisites

Let's take a closer look at the payment details and the KBK for the fine for late submission of reports.

The budget classification code is indicated in each document on the transfer of funds to the budget. The entire list of identifiers can be found in the directory of the same name. How is the fine for late submission of reports to the Federal Tax Service indicated on the payment slip? KBK 1821160301001600014. The fine is listed under the same code:

- for notifying tax authorities about opening/closing an account late;

- gross violation of the rules of conducting NU;

- violation of the procedure for using property;

- provision of documents during a counter inspection later than required, etc.

Calculation of a fine for late submission of reports: postings

Let's take a closer look at how to reflect transactions on the accrual of fines in the form of an increase in the tax amount in the balance sheet.

| Wiring | Operation |

| DT99 KT68 | Additional NPP accrued. |

| DT90 KT68 | VAT accrued in arrears. |

| DT91 KT68 | Additional land, transport and property taxes have been assessed. |

| DT73 KT68 | Additional personal income tax has been added. |

| DT20 KT69 | Additional insurance premiums have been added. |

Accounting entries for fines and penalties

Here, taxpayers usually become the payers of sanctions, although in a number of cases (for example, a delay in the return of overpaid tax to the budget or the amount of VAT to be refunded), the same kind of responsibility is established for the tax authorities. Thus, a specific legal entity may turn out to be both a payer and a recipient of payments from both groups, and accounting entries for fines and penalties will arise not only when accounting for expenses on them, but also when reflecting income. How can accounting entries reflect fines or penalties that arise in relations with counterparties?

Expenses or income generated by a legal entity in this case are among others (clause 7 of PBU 9/99 and clause 11 of PBU 10/99, approved by orders of the Ministry of Finance of Russia dated May 6, 1999 No. 32n and No. 33n).

The chart of accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) recommends using account 91 to reflect them, the credit of which will show income, and the debit - expenses. The corresponding account for account 91 in the entry for reflecting a fine or penalty in accounting will be settlement account 76, to which the Chart of Accounts provides for the opening of a sub-account called “Settlements for claims.” Analytics in this sub-account is organized by counterparties and each emerging one.

That is, the entries for the accrual of penalties will have the following form: Dt 91 Kt 76 for the legal entity reflecting the claim addressed to it (i.e.

e. your expense); Dt 76 Kt 91 from the legal entity that filed the claim

Corporate income tax

The rules for calculating and reporting this tax cause a lot of controversy. Let's consider the situation in more detail.

Russian and foreign organizations that receive income in the Russian Federation pay income tax to the budget. They are also required to provide the Federal Tax Service with a declaration calculating the amount of the fee. In this case, the declaration must be submitted regardless of whether there is an obligation to pay tax at the place of location or registration. There are exceptions to this rule:

- large organizations that have separate divisions must submit reports to the Federal Tax Service at the place of registration of the largest division;

- non-profit organizations, for example, public sector employees, can submit a declaration at the end of the tax period.

The tax period is considered to be the calendar year, and the reporting period is the first quarter. The report must be submitted by March 28 of the following year. For violating this deadline, a fine of 5% of the unpaid tax for each month is charged, but not more than 30% of the amount and a minimum of 1 thousand rubles. This is provided for in Art. 119 of the Tax Code of the Russian Federation.

The declaration is used to calculate tax liabilities for each tax period. At the same time, Ch. 25 of the Tax Code of the Russian Federation does not provide for the provision of advance payment calculations to the Federal Tax Service. Any income tax reporting provided has always been called a declaration. Therefore, there have been disputes between taxpayers and inspectors for a long time - can the Federal Tax Service Inspectorate fine for a “delay” in submitting a “profitable” declaration? Over the years, this issue has been considered differently.

Systematization of accounting

Accounting for government agency settlements for damage and other income.

Account 209 00. The Tax Code of the Russian Federation is important in relation to the calculation of income tax, since the listed acts relate to the calculation of the single tax.

These clarifications were recognized as generally binding for all cases considered in the arbitration court.

However, these reporting forms are list-based, i.e. contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees. Accordingly, the accrued fine receivable for violation of contractual terms will be recognized as other income (clause 7 of PBU 9/99, Order of the Ministry of Finance dated October 31, 2000 No. 94n): Debit of account 76 “Settlements with various debtors and creditors”, subaccount “Settlements on claims” " - Credit to account 91 “Other income and expenses" Administrative fine: accounting entries Thus, the accrued fine for violation of traffic rules will correspond to the following accounting entry: Debit to account 91 - Credit to account 76 A similar entry will reflect the accrual of a fine by the labor inspectorate and other similar authorities. Consequently, payment of the administrative fine will be reflected as follows: Debit of account 76 – Credit of accounts 50 “Cash”, 51 “Cash accounts”, etc.

A separate sub-account “Administrative fines” can be opened for account 76.

In this case, analytical accounting on account 76 is maintained for the counterparty who issued the fine. Not a single entrepreneur is immune from tax sanctions in the Russian Federation.

This is due to citizens’ ignorance of their responsibilities, regular updates of the Tax Code and other acts.

Until 2010

In letter No. 03-02-07 of the Ministry of Finance, the legislator separated the concepts of “declaration” and “advance calculation”. The taxpayer had to provide two different documents to the Federal Tax Service. This was contrary to Art. 119 of the Tax Code of the Russian Federation.

In the Presidium of the Supreme Arbitration Court No. 71, the arbitration court ruled that it is impossible to levy a fine for late submission of an advance payment calculation. But the inspectors had a different opinion on this matter. The basis for tax calculations is the amount calculated in the declaration. A fine will be charged for late submission. But! In ch. 215 of the Tax Code of the Russian Federation does not relate the imposition of a fine to the payment of tax. That is, the basis for applying sanctions may be untimely filing of a declaration for any period, regardless of whether an advance payment was made or not. Until 2010, arbitration courts also did not have a common point of view on this issue.

Displaying tax penalties in accounting

To display the costs incurred that arise when fines and penalties are calculated, account 99 Profit and loss is used. For convenience, it is divided into two subcontos - penalties and fines. The debit of this account corresponds with the corresponding tax payment, which is displayed on the credit of accounts 68 and 69.

There are opinions in accounting circles that account 91 Other expenses can also be used to display accrued penalties and fines. However, in this case, a permanent tax liability arises, which somewhat complicates the process of accounting for them.

In addition, if accrued penalties and fines are displayed on 91 accounts, this will lead to a decrease in the tax base and will violate the authenticity of the information provided in the financial indicators of the organization.

Important! Penalties and fines recognized in accounting are not reflected in tax accounting, and therefore will not reduce your tax liability in any way.

Current position

The situation changed when Resolution No. 57 was published by the Supreme Arbitration Court in August 2013. It provided clarifications on all controversial issues. The Tax Code specifies inconsistencies between tax and advance payment. At the same time, in Art. 80 shows the distinction between two documents - a declaration and an advance payment calculation. In Art. 119 does not stipulate liability for failure to submit a declaration for calculating the advance payment, regardless of what this document is called in the Tax Code of the Russian Federation. These clarifications are mandatory for arbitration courts. For all other bodies they are advisory in nature.