Article 346.24 of the Tax Code of the Russian Federation obliges firms and individual entrepreneurs who have chosen the simplified tax system to keep tax records through the Book of Income and Expenses (hereinafter referred to as KUDiR, Book). Violation of this requirement threatens the company with a fine of up to 10 thousand rubles per tax period. If the violation affects more than one such period, the fine will be up to 30 thousand rubles (Article 120). The KUDiR matrix, as well as the rules for filling it out, were approved by order of the Federal Tax Service of Russia dated October 22, 2012 No. 135n. If we talk about the 1C: Accounting program, then it allows you to implement the functionality of creating a Book in absolute compliance with the law.

Setting up KUDiR in 1C 8.3

Before you start creating this income and expense accounting book in 1C 8.3, check the program settings. If you have problems with the formation of KUDiR and some expenses do not fall into the book, carefully double-check the settings. Most of the problems lie here.

Where is the income and expense accounting book 1C 8.3? In the “Main” menu, select the “Accounting Policy” item in the “Settings” section.

You will see a list of configured accounting policies by organization. Open the position you need.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

In the accounting policy setup form, at the very bottom, click on the “Set up taxes and reports” hyperlink.

In our example, the “Simplified (income minus expenses)” tax system was selected.

Now you can go to the “STS” section of this setting and configure the procedure for recognizing income. This is where it is indicated which transactions reduce the tax base. If you have a question why an expense does not fall into the book of expenses and income in 1C, first of all look at these settings.

Some items cannot be unchecked as they are required to be filled out. The remaining flags can be set based on the specifics of your organization.

After setting up the accounting policy, let's move on to setting up the printing of the KUDiR itself. To do this, in the “Reports” menu, select the “STS Book of Income and Expenses” section of the “STS” section.

The ledger report form will open in front of you. Click on the "Show Settings" button.

If you need to detail the records of the received report, check the appropriate box. It is better to clarify the remaining settings with your tax office, having learned the requirements for the appearance of KUDiR. These requirements may vary between inspections.

We will set up any reports, even if they are not in 1C

We will make reports in the context of any data in 1C. We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email.

Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

Order report customization

Filling out KUDiR in 1C: Accounting 3.0

In addition to the correct settings, before generating KUDiR, it is necessary to complete all operations for closing the month and check the correctness of the sequence of documents. All expenses are included in this report after they are paid.

The D&R accounting book is generated automatically and quarterly. To do this, you need to click on the “Generate” button in the form where we just made the settings.

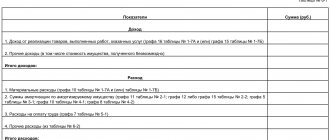

The book of income and expenses contains 4 sections:

- Section I. This section reflects all income and expenses for the reporting period quarterly, taking into account the chronological sequence.

- Section II. This section is filled out only if the simplified tax system is “Income minus expenses”. This contains all costs for fixed assets and intangible assets.

- Section III. This contains losses that reduce the tax base.

- Section IV. This section displays amounts that reduce tax, for example, insurance premiums for employees, etc.

If you have configured everything correctly, then KUDiR will be formed correctly.

Expense accounting

As for expenses: first of all, you need to remember the procedure for recognizing expenses (setting up accounting policies).

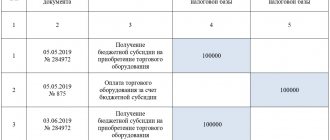

Example 2.

- On January 1, 2016, funds were written off to pay the supplier:

- KUDiR for 2021 has been formed:

As you can see, column 5 “Expenses taken into account when calculating the tax base” is empty. At the same time, we remember that according to the procedure for recognizing expenses, before an expense in the form of payment to the supplier is recognized, delivery must be made.

- 01.2016 – goods were received on prepayment in the amount of 11,200 rubles:

- KUDiR was formed:

As you can see, the cost of the received goods was included in the KUDiR. Input VAT, in this case, is displayed as a separate line.

Example 3.

What happens if the prepayment is excluded from the previous example?

- 01.2016 – material received from the supplier in the amount of 4,000 rubles. KUDiR for 2021 has been formed:

- 01.2016 – 3,000 rubles were paid to the supplier for the material received. KUDiR was formed:

In this example, we once again see that an entry in the Income and Expense Book appears only if the sequence of expense recognition is followed.

Manual adjustment

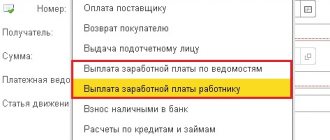

If, after all, KUDiR is not filled out exactly as you wanted, its entries can be corrected manually. To do this, in the “Operations” menu, select “STS Income and Expense Book Entries.”

In the list form that opens, create a new document. In the header of the new document, fill in the organization (if there are several of them in the program).

This document has three tabs. The first tab corrects the entries in section I. The second and third tabs are in section II.

If necessary, make the necessary entries in this document. After this, KUDiR will be formed taking into account these data.

What to do if the entry does not fall into KUDiR or the book is not filled out?

In addition to the above program algorithm, it should also be noted that the sequence of documents also plays a role. That is, if first of all the delivery was reflected in the system, and then payment was made “retroactively”, then re-posting of delivery documents is required, for example, so that the entry appears in KUDiR (this only applies to non-compliance with the sequence of entering documents into the system, or adjusting the amounts of documents) .

If we talk about fixed assets and intangible assets, then the corresponding records will appear in KUDiR only after the OS is put into operation or intangible assets are accepted for accounting.

As for records that should not appear in the report, there may be various options, for example:

- Also, the sequence of documents was not followed

- documents were used incorrectly to reflect a business transaction (it is implied that the document should not be used for this transaction, or the type of transaction in the document should be different)

- accounting policy is incorrectly configured

Analysis of accounting status

This report can help you visually check whether the book of income and expenses is filled out correctly. To open it, select “Accounting analysis according to the simplified tax system” in the “Reports” menu.

If the program keeps records for several organizations, you need to select in the report header the one for which the report is needed. Also set the period and click on the “Generate” button.

The report is divided into blocks. You can click on each of them and get a breakdown of the amount.

Checking the correctness of filling out KUDiR

In 1C 8.3 there is a report Analysis of the status of tax accounting according to the simplified tax system, which will help ensure that the KUDiR is filled out correctly. It’s easy to find: Reports – Accounting analysis – Analysis of the state of tax accounting according to the simplified tax system:

In the form that opens, just select the period, organization and click Generate. Each number can be deciphered by simply clicking on it:

On the PROFBUKH8 website you can read other free articles and video tutorials on the 1C Accounting 8.3 (8.2) configuration. A full list of our offers can be found in the catalog.

We recommend watching our video tutorial on the transition from OSNO to USN in 1C 8.3:

Give your rating to this article: (

4 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Entering balances for goods not sold during the period of application of the unified income tax and simplified tax system “income”

Note! Before entering balances, close the 2020 year and perform a balance sheet reformation (processing “Month Closing”). After entering balances, do not close the month for December again.

2.1 Identified balances of goods not paid to suppliers

2.2 The balances of goods paid to suppliers have been determined

When changing the object of taxation from the simplified tax system “income” to the simplified tax system “income minus expenses”, in order to enter balances for goods and subsequent correct reflection of income and expenses, it is necessary to determine the status of all goods in the balance as of December 31 of the year preceding the change in the object of taxation and indicate it when entering balances in the Consumption Status

:

- Not written off

- the receipt of the asset is reflected in the accounts, the costs of its acquisition are paid to the supplier; - Not written off, not paid

- the receipt of the asset is reflected in the accounting, the costs of its acquisition to the supplier have not been paid; - Not written off, accepted

- the receipt of the asset is reflected in accounting, the costs of its acquisition are recognized as tax accounting expenses according to the simplified tax system.

To determine the status of goods, we will use the reports:

- Account balance sheet

for account 41 (for subaccounts). - Debt to suppliers

;

Report “Account balance sheet” (Fig. 1):

- Section: Reports

–

Account balance sheet

. - Set the period to December 31, 2021, select the account on which goods are recorded (in example 41.01) and generate a report using the Generate

. In the example, as of December 31, 2020, account 41.01 contains three types of goods: “A4 paper 20 l” - 90 pcs. in the amount of RUB 17,100.00; - “Flat brush” – 30 pcs. in the amount of RUB 3,480.00.

- "Paints 20 colors" — 95 pcs. in the amount of RUB 87,400.00.

Rice. 1

Report “Debt to suppliers” (Fig. 2):

- Section: Manager - Debt to suppliers

. - the Period

field to December 31, 2021. - Click the Show settings

on the

Grouping

and select the “Supplier”, “Contract”, “Document” checkboxes. - Generate

button . - By double-clicking on the cell with the document or the amount, decipher the unpaid balance to compare it with the balance of unsold goods according to the Account balance sheet

.

Rice. 2

Having analyzed and compared the data from the two reports, we obtain the following summary information as of December 31, 2020:

- goods not paid to suppliers: “Flat brush” 30 pcs. for a total amount of RUB 3,480.00. (invoice No. 18 dated 08/18/2020, supplier ORION LLC);

- “A4 paper 20 sheets.” 90 pcs. for a total amount of RUB 17,100.00. (invoice No. 18 dated 08/18/2020, supplier ORION LLC);

.

2.3 A batch was formed to account for remaining goods using the “FIFO” method

The document is generated if, in 2021, the tax system “Simplified (income)” and the method of assessing the labor income “According to average” are installed in the program settings. If the method of assessing inventories is “FIFO”, then skip this operation and proceed to operation 2.4.

Document “Operation” (Fig. 3):

- Section: Operations - Operations entered manually

. - Create

button .

Document type - Operation

. - In the from

, indicate the date of the document - December 31, 2021. - Fill out the tabular part using the Add

: In the

Debit

, indicate the goods account (in example 41.01), item and quantity.

When filling out the third subconto, create a new Batch

with the date December 31, 2021 (in the new document, indicate only the date corresponding to the date of the “Operation” document; do not fill in the remaining fields). Select the same document in the following rows of the tabular section when entering balances for other goods. Thus, the remaining goods will be transferred to batch accounting. - In the Credit

, indicate the same data for goods, but without the batch (goods account (in example 41.01), item and quantity). - In the Amount

, indicate the balance amounts for the goods. - In the same way, fill in the information for the rest of the remaining products.

.

Rice. 3

2.4 Introduced balances of goods for simplified taxation purposes

Document “Entering balances (Products)” (Fig. 4-5):

- Section: Main

–

Balance Entry Assistant

. - If the organization previously entered initial balances on the date of start of work with the program (link Date of entry of balances

indicating the date in blue), then for documents

Entering balances

generated on the date of transition to the simplified tax system with the object “income minus expenses”, the date is set directly in each document after unchecking the

Enter accounting balances

.

If the link Set the date for entering balances

is red (i.e., at the beginning of accounting in the information base, documents for entering balances were not created), then follow it and set the date before the start of accounting in the program, and then in the document

Entering balances

after withdrawal

Enter accounting balances

checkbox , set the date to 12/31/2020. - To create the document Entering Balances

, double-click the account in the list (in the example, account 41.01).

In the Enter balances

click the

Create

, then

the Balance entry mode

.

Uncheck the Entering balances for accounting

and

Entering balances for special registers

and click

OK

.

In the from

, indicate/check the date for entering balances – December 31, 2020.

Rice. 4

- Click the Add

to fill out the tabular part of the document.

In the Batch

the Batch

document previously created when filling out the

Operation

document (Fig. 5), (if in 2021 the “FIFO” method of assessing inventories was used, then in this column select the document that reflected the receipt of goods). - In the Expense Status

, select a status depending on whether the item has been paid to the supplier or not (see operations 2.1 and 2.2).

In the example: the product “A4 Paper” has been paid to the supplier - status Not written off

; - product “Paints 20 colors.” paid to the supplier - status Not written off

; - The product “Flat brush” has not been paid to the supplier - status Not written off, not paid

;

.

Rice. 5

Click the button to see the result of posting the document - entries have been made in the “Expenses under the simplified tax system” register (Fig. 6).

Rice. 6