Astral January 21, 2021 30502 Taxes The main differences between the simplified taxation system (STS) and OSNO

Hourly wages: pros and cons June 22, 2014, 00:00 | Katya Kozhevnikova 3

The meaning of an off-balance sheet account Keeping records of inventory items that were accepted for storage before

In current labor legislation there is the concept of “material assistance”. This type of assistance is a kind of support

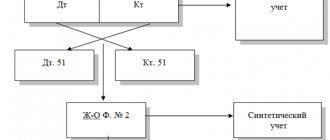

Non-cash payments with suppliers, customers and personnel occupy an important place in the accounting of any organization.

See the beginning: CFA - Long-term (non-current) assets CFA - Acquisition of fixed assets CFA -

For tax purposes, the Tax Code of the Russian Federation understands the concept of “income” as income received by a person both in

When submitting tax reports to the relevant authorities, your report may be returned with the found

Fulfillment of the obligation to pay taxes, fees, insurance premiums (penalties, fines) upon liquidation of an organization is regulated

Amendments to Law 54-FZ “On the Use of Cash Register Equipment” have come into force: from 2021