In current labor legislation there is the concept of “material assistance”. This type of assistance is a kind of support from the state or organization. This support is expressed in a system of benefits that certain categories of citizens can take advantage of. Citizens, depending on the source of assistance, will be divided into those who have the right to receive benefits from the employer and those who have the right to receive this benefit from the state.

Payment of financial assistance at the initiative of the employer

The most common cases of financial assistance payments are the assignment of financial assistance at the discretion of the employer. The provision of the amount is targeted in nature, providing for registration in each specific case. The list of grounds is stipulated in the collective agreement, regulations on remuneration or other internal act. In order to avoid disputes with the Federal Tax Service, the provisions on the provision of assistance must specify the procedure for applying, grounds, amounts, and a list of supporting documents.

Terms of assistance:

- The amount of financial assistance paid by order of the manager up to 4,000 rubles is not subject to contributions. Any amount over the limit is taxed as usual.

- When assigning financial assistance that is not subject to contributions within the limit, the number of tranches within one order or the number of payments under several orders of the employer does not matter. The amount of money and the valuation of non-monetary assistance is determined on an accrual basis during the calendar year.

- The maximum non-taxable amount of 4,000 rubles does not depend on the number of months worked by a person in the billing period.

The provision of financial assistance is not mandatory and is a payment based on a voluntary decision of the manager or other person authorized to manage the funds of the enterprise. The amount of the amount is not limited by law, with the exception of the tax position.

Financial assistance as a type of income

Such support, unlike other types of income, does not depend on:

- from the employee’s activities;

- from the results of the organization’s activities;

- from the cyclical nature of work periods.

The grounds for receiving financial assistance can be divided into two: general and targeted. It is provided when any circumstances arise in the employee’s life:

- anniversary, special event;

- difficult financial situation;

- illness of an employee or close family member;

- death of an employee or close family member;

- birth of a child;

- emergencies;

- vacation.

A complete list of grounds for calculating financial assistance, as well as their amounts, are established by the regulatory (local) document of the organization. In some cases, for example, due to illness, the amount of financial assistance will be determined by the decision of the manager.

One-time payments to employees due to special reasons

Separately, the legislation stipulates a list of grounds for providing one-time financial assistance, in which exemption arises regardless of the amount of the amount (clause 3, clause 1, article 422 of the Tax Code of the Russian Federation). The occurrence of special social reasons must be documented.

| Grounds for payment of financial assistance | Additional terms |

| Damage resulting from a natural disaster, terrorist attack or other emergency circumstances | Payment is made to compensate for financial loss or harm to health. Types of assistance include the provision of items in kind, specified by order |

| Death of a close relative | We consider relatives who are considered close in accordance with the RF IC - spouses, parents, children and those equivalent to them. Under certain conditions (cohabitation), brothers and sisters are considered family members |

| Birth of a child, adoption, appointment of guardianship | The payment is made to each parent or person equivalent to him. Assistance is provided up to 50,000 rubles for each child when applying within a year after the occurrence of the event |

In February of this year, employee K. of Vympel LLC received financial assistance for vacation in the amount of 7,500 rubles from the company. In May of this year the employee was provided with a one-time payment of 35,000 rubles in connection with the birth of a child. When determining the base for assessment of contributions, assistance at the birth of a child is not taken into account in connection with payment on another basis. Taxation is subject to 3,500 rubles - part of the amount of vacation assistance exceeding 4,000 rubles.

Documentation of the provision of financial assistance

In order to avoid misunderstandings with control authorities, the company must fulfill the basic condition of documentation - confirm the basis for the payment. When registering you will need:

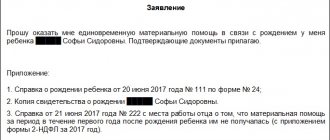

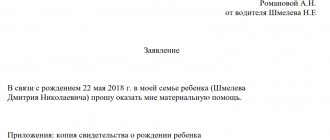

- Availability of an application submitted by the employee indicating the reasons for the need for financial assistance. The application is drawn up in the free form of a standard business letter. The assignment of assistance at the initiative of the employer does not require an application.

- Attachment of certificates confirming the reason for the employee’s application. Copies of birth certificate, death certificate, court decision, certificate from the Ministry of Emergency Situations and other forms are attached as documents.

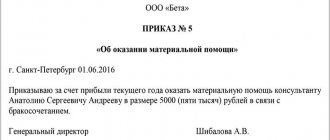

- Issuing an order from the manager indicating the basis for providing assistance. The form of the order is arbitrary with the obligatory mention of the parties, the purpose of the settlement transaction, and the amount provided.

The order is issued by the personnel authority, signed by the manager, the applicant and transferred to the accounting department for settlement. The document is stored for a long period of time simultaneously with other personnel orders relating to settlements with employees.

In addition to the employee’s personal request for financial assistance, there are cases where a memo is drawn up by the person’s immediate supervisor. An alternative option is possible if the employee is absent for a valid reason.

When asking for help from a manager, you do not need to provide certificates from your spouse’s place of work confirming that he has received the amounts. Payments are made regardless of assistance the family receives from another source.

One-time nature of assistance provided for social reasons

When issuing an order and making payments for the reasons specified in paragraphs. 3. clause 1 art. 422 of the Tax Code of the Russian Federation, attention must be paid to the one-time nature of the provision of assistance. A one-time payment refers to settlement transactions performed under one order. If payments are made in installments under different orders, the exemption for subsequent issuance or transfer of funds will apply to an amount not exceeding 4,000 rubles.

An example of taxation of contributions for amounts paid in different installments

At the beginning of the year, the company Novost LLC had a collective agreement provision for the payment of assistance at the birth of a child in the amount of 25,000 rubles. In March, grounds arose for payment to employee M., which was made in the specified amount in accordance with the order of the manager. In June, the team revised the terms of the contract, increasing the amount of assistance in connection with the birth of a child to 35,000 rubles. Employee M. was given an additional payment in the amount of 10,000 rubles. Since the amount was transferred in installments on the basis of different orders, contributions were assessed for the payment of 6,000 rubles, despite the fact that the specified amount does not exceed the limit of 50,000 rubles in accordance with paragraphs. 3. clause 1 art. 422 of the Tax Code of the Russian Federation.

Accounts when registering the accrual and payment of financial assistance

In enterprise accounting, assistance amounts are accrued from various sources. The use of profits from previous periods is permitted with the approval of the founders, when making decisions a quorum is observed. Payment of amounts is carried out by bank transfer or in cash through the cash register. Cases of providing assistance in kind are less common.

| Purpose of the operation | Account debit | Account credit |

| Calculation of financial assistance to a staff member | 91/2 | 73 |

| Providing financial assistance to a dismissed employee or a family member of a person | 91/2 | 76 |

| Calculation of contributions | 91/2 | 69 |

| Payment of financial assistance | 73, 76 | 50, 51 |

Question No. 1. From what sources is financial assistance provided in budget financing organizations?

The provision of financial assistance to public sector employees is carried out subject to the availability of funding as an expense item or from extra-budgetary sources.

Question No. 2. Is financial assistance provided in the absence of a provision in the collective agreement or other internal document of the enterprise on the grounds for issuance?

In the absence of approved provisions on the provision of financial assistance, the employer must rely on the conditions of the Tax Code of the Russian Federation.

Registration of financial assistance

To receive payment to an employee or former employee, you must write an application in any form. In the text part of the application, describe the circumstances in as much detail as possible. Attach documents confirming your life situation (certificate from the Ministry of Emergency Situations about a natural disaster, death certificate of a relative, birth or adoption certificate of a child, extract from the medical history, doctor’s report).

The manager, having considered the employee’s appeal, makes a decision on the amount of financial assistance based on the financial situation and complexity of the employee’s life situation.

Payment of financial assistance is made on the basis of an order (instruction) of the manager. The material may be divided into several parts and paid in several payments, for example, due to financial difficulties in the organization. But only one order is made. It should indicate the frequency of transfers. If several orders are created for one reason, then tax authorities recognize only the payment under the first order as financial assistance, and the rest are recognized as remuneration for work.

Features of providing financial assistance to former employees of the employer

In some cases, employers are ready to provide financial assistance to former employees. Companies often provide financial support to veterans who previously worked in production or in another field. Such payments are made only from the organization’s own funds, so taxes may be levied on the assigned amount of financial support.

The decision on the appointment and payment of financial assistance to former employees is made by the management of the company. Payments are made in accordance with all legal requirements. Funds are transferred through cash register services in the KO2 format. And since assistance is provided not to a current employee, but to a former one, the accountant must carefully examine the citizen’s identification documentation. When transferring funds, you should also indicate the TIN number and pension certificate of the former employee, which will be required in the future to confirm income data.

Conditions and procedure for receiving financial assistance

The provision of financial assistance to an employee and personal income tax is not related to entrepreneurial or other activities. To receive financial assistance from regional or federal authorities, as well as an employer, grounds are required.

The main role is played by obtaining the status of a low-income family, in which:

- The family member is not employed.

- A close relative retired. According to the new rules of pension reform, the return for women is 60 years, for men - 65.

- The citizen has the status of “pensioner” and lives alone from his family.

- The person has a disability group, i.e. with limited capabilities.

- The family has several young children.

Thus, only truly needy citizens have the right to receive financial assistance. To complete the procedure, social protection authorities are involved, and the level of income and living conditions are checked.

Applicants send a package of documentation and an application to the relevant departments. Based on the results of the review, the institution announces a verdict on the provision or refusal to receive financial assistance payments. In a situation where the application is not satisfied, the agency is obliged to provide legitimate reasons for the refusal in writing.

Tax on financial assistance

Please note: funds for one-time support are transferred when appropriate circumstances arise. At the same time, assistance has no connection with the person’s performance of any functions or actions and does not entail the imposition of obligations.

How to reflect receipt of financial assistance in tax reporting?

To understand how and when material assistance is reflected and whether it is subject to personal income tax, an example should be given.

Semenov Yu. G. officially contacted the employer on June 1, 19 with an application for payment of financial assistance in the amount of 50,000 rubles. The manager made a decision on June 4, 19 to transfer funds to the applicant in full. The accounting department made the appropriate accrual, transferred the money to the account and reflected the posting in the tax reporting.

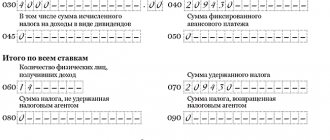

Form 2-NDFL

To reflect financial assistance, personal income tax and insurance contributions, it is necessary to take into account that the amount of up to 4,000 rubles transferred to the employee’s account must have code 2760, and the deduction is shown as 503 (Article No. 217, paragraph No. 28 of the Tax Code of Russia). For financial assistance provided at the birth of a child, the income code will be 2762, the deduction will be 504 - order of the Federal Tax Service No. ММВ-7-11/387.

Non-taxable support, regardless of the volume, is not indicated in form 2-NDFL. For example, the amount does not need to be shown in the certificate issued to the employee if there is a fire in his house. However, the causes of the emergency should not relate to the actions of the employee. The payment is quoted as assistance in connection with the occurrence of emergency circumstances. In this situation, the payment is not subject to reflection, and therefore is not subject to tax.

Taxation of financial aid in the amount of 4000 rubles

Whatever the tax system to which the organization belongs, the tax base is always calculated taking into account the assistance provided . However, the tax legislation in force in 2019 provides for the use of a deduction established at 4,000 rubles (enshrined in clause 28 of Article 217 of the Tax Code of the Russian Federation).

As a result of applying this benefit, the employee will be paid more wages by the amount of tax of 13% of these same 4,000 rubles, respectively, and this amount will not be transferred to the budget. Each employee can use this benefit only once a year . If financial assistance exceeds this amount, tax will be withheld from the difference .

Financial assistance: taxation 2021, insurance premiums

Is financial assistance subject to insurance premiums in 2020? Since financial assistance does not relate to income related to the employee’s performance of his work duties, it cannot be subject to contributions. However, this provision has a number of limitations. That is, the manager cannot pay his employees any amount as financial assistance. Since 2021, issues related to fees for employee insurance are explained in Chapter 34 of the Tax Code of the Russian Federation. Situations when you do not have to pay are contained in Art. 422 codes. Amounts from one-time financial assistance paid under the following circumstances are not calculated:

- the employee received money to compensate for damage caused by a natural disaster or emergency;

- the victim of a terrorist attack on the territory of the Russian Federation was compensated for damage to health;

- the employer helped with money in the event of the death of a member of his family;

- an amount of up to 50,000 rubles was paid as support for the birth of a child. Not only each parent, but also the adoptive parent and guardian have the right to it;

- the amount of financial assistance does not exceed 4,000 rubles during the year.

We remind you that 4000 rub. - this is tax-free financial assistance (2020). If payments are higher, they are subject to insurance premiums. In this case, the goals may be different, for example, for partial compensation of expenses for additional education, to cover the costs of purchasing medicines, for vacation. Note that the situations listed apply to all existing types of compulsory insurance: pension, medical, social, as well as injuries. In addition, they apply to assistance in both in-kind and cash forms. So, 4000 rubles for financial assistance. (taxation 2020) insurance premiums are not charged

Under what circumstances is financial assistance exempt from taxation in 2021?

As established by Art. 217 of the Tax Code of the Russian Federation, any financial assistance that will be a monetary social payment will be profit .

At the same time, the list of reasons for providing financial assistance to an employee of an organization cannot be limited by the norms of labor legislation.

Formally, we can assume that this type of assistance can be paid if a situation has arisen in the employee’s life that the organization’s management considers as a situation in which there is an urgent need to provide assistance .

However, when receiving this same assistance, the nuance of its taxation arises. In most cases, financial assistance whose total amount per year is less than 4,000 rubles is exempt from taxes. At the same time, there are cases of complete tax exemption, and they will depend on the severity of the life circumstances in the life of the citizen.

Financial assistance up to 4000 (taxation 2020)

Let's consider the taxation of financial assistance to an employee in 2021. Is financial assistance subject to personal income tax (2020)? The withholding of personal income tax is indicated in Chapter 23 of the Tax Code of the Russian Federation, and Article 217 of the Tax Code of the Russian Federation specifies whether financial assistance is subject to personal income tax. If you carefully read this article, it will become clear that income tax for individuals is not withheld in the same cases when insurance premiums are not collected. We are talking about the payment of money upon the birth of a child or the death of a family member, amounts up to 4,000 rubles (for any purpose). At the same time, we must remember that the 2-NDFL certificate will have different income codes and deduction codes each time - depending on the type of financial assistance provided and taxation or collection of insurance premiums (Order of the Federal Tax Service of Russia dated September 10, 2015 No. MMV-7-11).

Here are some more interesting points:

- According to the Ministry of Finance, monthly financial assistance to a person on maternity leave can be subject to personal income tax, taking into account standard tax deductions, the amounts of which are contained in paragraphs. 4 clause 1 of Article 218 of the Tax Code of the Russian Federation (Letter dated 02/17/2016 No. 03-04-05/8718). In other words, if an employer pays extra every month to a woman on maternity leave, he can reduce the amount of the extra payment by the so-called child deduction. Since this form of support may be a general type of financial assistance, and not a one-time payment in connection with the birth, although one reason is the birth of a baby;

- financial assistance, tax-free in 2021, is provided by the employer to family members of a deceased employee or former employee who previously retired due to disability, age or old age, or to the employee (pensioner) himself if one of his family members has died (Letters from the Ministry of Finance dated 16.12 .2014 No. 03-04-05/64847, dated 12/02/2016 No. 03-04-05/71785);

- if the fact of an emergency or terrorist act is not confirmed, the employer takes personal income tax from compensation (Letter of the Ministry of Finance dated January 20, 2017 No. 03-04-06/2414).

Financial assistance to employees: both in sorrow and in joy

From the article you will learn:

1. What payments relate to financial assistance, and what documents are used to document them.

2. In what order are insurance premiums and personal income tax calculated on amounts of financial assistance?

3. How to reflect financial assistance to employees in accounting and tax accounting.

“We care about you...” - this well-known advertising slogan reflects how important it is for people to feel cared for and supported. It is especially pleasant when such support, and financial support, is provided not only by family and friends, but also by the employer. Financial assistance can be paid to employees on a variety of occasions, both joyful (marriage, birth of a child) and sad (due to emergency circumstances, difficult financial situation, illness). The amount of financial assistance and the basis for its payment are set by the employer himself, so there can be many options. How an accountant can reflect such payments in accounting and correctly calculate taxes and contributions from them - this will be discussed in the article.

Documentation of financial assistance

First of all, let's define it. what payments can be classified as financial assistance. As such, neither the Tax nor the Labor Code contains a definition of financial assistance to employees. However, based on the norms of the Tax Code of the Russian Federation and the laws on insurance contributions relating to financial assistance, we can conclude that it includes social payments not related to the work activities of employees . That is, financial assistance does not depend on labor indicators (percentage of production plan fulfillment, sales volume, number of contracts concluded, etc.), unlike, for example, bonuses to employees, and does not relate to labor costs.

The decision to pay financial assistance to employees is made by the employer independently, without any restrictions. At the same time, the procedure and conditions for such social payments may be established in a collective agreement, regulations on remuneration or a separate regulation on the payment of financial assistance. The presence of rules governing the payment of financial assistance to employees in these local acts is not necessary, however, in cases where the payment of financial assistance is regularly practiced in the organization, it is advisable to make this process understandable and “transparent”. To do this, the following can be established in local regulations:

- a list of events upon the occurrence of which employees can count on financial assistance,

- the amount of financial assistance, as well as the procedure for its assignment and payment,

- list of documents that an employee must provide to receive financial assistance, etc.

Since local acts only provide for the possibility of paying financial assistance, the main document that serves as the basis directly for accruing it to a specific employee is the order of the manager. The order is drawn up in accordance with the employee’s application and supporting documents attached to it. For example, to receive financial assistance in connection with the birth of a child, the employee will need to attach a copy of the child’s birth certificate to the application.

Download a sample order for the assignment of financial assistance to an employee

Download a sample employee application for financial assistance

Personal income tax and insurance premiums on financial assistance amounts

The procedure for calculating personal income tax and insurance contributions to the Pension Fund, FFOMS and Social Insurance Fund for financial assistance to employees depends on the basis on which it is paid. In general , financial assistance paid to an employee does not exceed RUB 4,000.00. within one calendar year, not subject to personal income tax and contributions (clause 28 of article 217 of the Tax Code of the Russian Federation, clause 11 of part 1 of article 9 of Law No. 212-FZ, subclause 12 of clause 1 of article 20.2 of Law No. 125-FZ ). Amounts of financial assistance in excess of the specified amount are subject to personal income tax and contributions in the usual manner.

Special conditions for calculating personal income tax and insurance contributions are established for financial assistance paid on the following grounds:

- Financial assistance to parents (adoptive parents, guardians) in connection with the birth (adoption) of a child during the first year after birth (adoption).

Personal income tax is not charged on the amount of one-time financial assistance not exceeding RUB 50,000.00. for each child based on both parents (clause 8 of Article 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated July 1, 2013 No. 03-04-06/24978). Since the limit on the amount exempt from personal income tax is set for both parents, the employee must request a certificate from the second parent’s place of work confirming the amount of financial assistance received or non-receipt of financial assistance (in Form 2-NDFL or in any form).

Insurance premiums are not charged for the amount of one-time financial assistance not exceeding RUB 50,000.00. for each child per each parent (clause “c”, clause 3, part 1, article 9 of Law No. 212-FZ, subclause 3, clause 1, article 20.2 of Law No. 125-FZ, Letter of the Ministry of Labor dated November 20. 2013 No. 17-3/1926).

Example.

Employee of Kolos LLC Somova O.I. Based on the order of the manager, financial assistance was assigned for the birth of a child in the amount of 40,000.00 rubles. In accordance with the certificate from the place of work of Somov R.K. (the father of the child), he was awarded financial assistance at the birth of a child in the amount of 30,000.00 rubles, completely exempt from personal income tax. Thus, the accountant of Kolos LLC will calculate personal income tax on the amount of material assistance provided to O.I. Somova, equal to 20,000.00 rubles. (40,000.00 + 30,000.00 - 50,000.00). Insurance premiums from financial assistance to Somova O.I. are not accrued, since it did not exceed RUB 50,000.00.

! Please note: the amount of financial assistance not exceeding 50,000.00 rubles is not subject to personal income tax and contributions if it is a one-time payment. This means that even if the payment is made in several stages, the basis should be one order from the manager for the total amount of financial assistance, and not several different orders drawn up in connection with the same event (Letter of the Ministry of Finance of Russia dated October 31, 2013 No. 03-04 -06/46587).

- Financial assistance to an employee (former retired employee) in connection with the death of a member of his family, as well as financial assistance to family members of a deceased employee (former retired employee)

Personal income tax and insurance premiums are not charged on the entire amount of one-time financial assistance provided on this basis (clause 8 of Article 217 of the Tax Code of the Russian Federation, subsection “b”, clause 3, part 1, article 9 of Law No. 212-FZ, subsection 3 Clause 1, Article 20.2 of Law No. 125-FZ). In this case, family members include: spouses, parents, children, adoptive parents and adopted children, as well as the employee’s brother (sister) who lived with him (Letter of the Ministry of Finance of Russia dated November 14, 2012 No. 03-04-06/4-318).

! Please note: just as in the previous paragraph, in order to be exempt from personal income tax and insurance contributions, financial assistance must be one-time in nature. In addition, the employee must provide all necessary documents, such as a death certificate of a family member, a document confirming relationship (marriage certificate, birth certificate, etc.).

- Financial assistance in connection with a natural disaster or other emergency

Personal income tax is not charged on the entire amount of financial assistance provided to an employee on this basis. In this case, the employee must provide the necessary documents confirming the fact of a natural disaster or other emergency circumstance (certificate from the Ministry of Emergency Situations or another authorized government agency) (Letter of the Ministry of Finance dated 02/04/2013 No. 03-04-06/0-34).

Insurance premiums are not charged for the entire amount of one-time financial assistance if it is intended to compensate for material damage or harm to health caused by a natural disaster or other emergency (subclause “a”, paragraph 3, part 1, article 9 of Law No. 212-FZ, Subclause 3, Clause 1, Article 20.2 of Law No. 125-FZ).

Reflection of financial assistance in certificate 2-NDFL

The accrual of amounts of material assistance to employees, as well as the provision of corresponding tax deductions for personal income tax, is reflected in certificate 2-NDFL in the following order (Order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3 / [email protected] “On approval of the form of information on the income of individuals persons and recommendations for filling it out, the format of information on the income of individuals in electronic form, reference books,” Letters of the Ministry of Finance dated 05/08/2013 No. 03-04-06/16327, dated 03/02/2012 No. 03-04-06/9-54) :

| Basis of financial assistance | Revenue code | Deduction code |

| due to the death of a family member | The 2-NDFL certificate is not reflected | |

| due to a natural disaster or other emergency | ||

| in connection with the birth of a child during the first year of his life, if the amount of financial assistance does not exceed 50,000 rubles. based on both parents | ||

| on other grounds, if the total amount of financial assistance does not exceed 4,000 rubles. in a year | ||

| in connection with the birth of a child during the first year of his life, if the amount of financial assistance exceeds 50,000 rubles. based on both parents | 2762 | 508 |

| on other grounds, if the total amount of such financial assistance exceeds 4,000 rubles. in a year | 2760 | 503 |

Inclusion of financial assistance in tax expenses

Payments to employees in the form of financial assistance are social benefits not related to the performance of labor functions. Therefore, material assistance does not relate to labor costs and is not taken into account when calculating income tax , as is directly stated in the Tax Code of the Russian Federation (clause 23 of Article 270 of the Tax Code of the Russian Federation). Taxpayers using the simplified tax system also do not have the right to accept as expenses the amounts of financial assistance accrued to employees (clause 1 of article 346.16 of the Tax Code of the Russian Federation).

! Please note: there is an exception to the rule “material assistance is not accepted as an expense for tax purposes” - this is financial assistance paid to employees for vacation. According to the position of the Ministry of Finance, financial assistance for vacation can be taken into account in labor costs when calculating income tax , however, for this the following conditions must be met (Letter of the Ministry of Finance of the Russian Federation dated September 2, 2014 No. 03-03-06/1/43912):

- the possibility of paying financial assistance for vacation must be provided for in the employment contract or the employment contract must indicate a collective agreement;

- The amount of financial assistance for vacation should depend on the amount of wages and compliance with labor discipline, i.e. it must be related to the employee’s performance of his job function.

Employers who apply the simplified tax system “income – expenses” also have the right to include in expenses the amount of financial assistance paid to employees for vacation (Letter of the Ministry of Finance of Russia dated September 24, 2012 No. 03-11-06/2/129).

Accounting for financial assistance

Since material assistance to employees does not relate to labor costs, its accrual is reflected in accounting in account 73 “Settlements with personnel for other operations.” The costs of paying financial assistance to employees (the amount of financial assistance and insurance premiums from it) are not considered expenses for ordinary activities, therefore they are written off to account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”.

An exception is financial assistance for vacation, which is part of the wage system (if it is provided for by collective and labor agreements): its accrual is reflected in account 70 “Settlements with personnel for wages” in correspondence with cost accounts 20 “Main production” (23, 25 , 26, 44).

| Account debit | Account credit | Content |

| Financial assistance paid for vacation | ||

| 20 “Main production” (23, 25, 26, 44) | 70 “Settlements with personnel for wages” | Financial assistance for vacation accrued |

| 70 “Settlements with personnel for wages” | 68-1 “Calculations for personal income tax” | Personal income tax withheld from the amount of financial assistance |

| 70 “Settlements with personnel for wages” | 50 “Cash desk” (51 “Cash accounts”) | Financial assistance paid for vacation |

| 20 “Main production” (23, 25, 26, 44) | 68 “Calculations for social insurance and security” | Insurance premiums have been calculated for the amount of financial assistance for vacation |

| Financial assistance paid to employees for other reasons (birth of a child, marriage, etc.) | ||

| 91-2 “Other expenses” | 73 “Settlements with personnel for other operations” | Financial assistance accrued to the employee |

| 73 “Settlements with personnel for other operations” | 68-1 “Calculations for personal income tax” | Personal income tax withheld from the amount of financial assistance |

| 73 “Settlements with personnel for other operations” | 50 “Cash desk” (51 “Cash accounts”) | Financial assistance was paid to the employee |

| 91-2 “Other expenses” | 68 “Calculations for social insurance and security” | Insurance premiums have been calculated for the amount of financial assistance |

If financial assistance is paid to individuals who are not employees (for example, former employees who have retired, or relatives of a deceased employee), then for calculations account 76 “Settlements with other debtors and creditors” is used in correspondence with account 91 “Other income and expenses "

***

To assess the feasibility of registering payments to employees as financial assistance, I recommend also reading articles on accounting for bonuses to employees, as well as gifts to employees.

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any questions, ask them in the comments to the article!

Normative base

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”

- Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

- Letter of the Ministry of Labor dated November 20, 2013 No. 17-3/1926

- Order of the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3/ [email protected] “On approval of the form of information on the income of individuals and recommendations for filling it out, the format of information on the income of individuals in electronic form, reference books”

- Letters from the Ministry of Finance of the Russian Federation:

- dated 07/01/2013 No. 03-04-06/24978

- dated October 31, 2013 No. 03-04-06/46587

- dated November 14, 2012 No. 03-04-06/4-318

- dated 02/04/2013 No. 03-04-06/0-34

- dated 05/08/2013 No. 03-04-06/16327

- dated 03/02/2012 No. 03-04-06/9-54

- from 02.09. 2014 No. 03-03-06/1/43912

- 24.09.2012 № 03-11-06/2/129

Find out how to read the official texts of these documents in the Useful sites section

When financial assistance is subject to insurance premiums

In all other cases not specified in the previous paragraph, financial assistance, if provided to employees, becomes subject to insurance contributions. This norm is contained in subsection. 11 clause 1 art. 422 of the Tax Code of the Russian Federation.

The deadlines for making contributions are as follows: according to clause 3 of Art. 431 of the Tax Code of the Russian Federation, the payer of insurance premiums is obliged to transfer them to the budget no later than the 15th day of the month following the month of accrual.

Example:

The collective agreement of Omega LLC contains a provision according to which employees of the organization have the right to receive financial assistance. The decision to allocate it is the prerogative of the manager, whose order indicates the corresponding amounts.

In February 2021, in accordance with his application, the employee of the enterprise, A.S. Chizhikov, was provided with financial assistance in the amount of 29,000 rubles. for paid treatment of the spouse during pregnancy.

In May 2021, another financial assistance was allocated to him, but already in connection with the birth of a child - in the amount of 30,000 rubles.

As a result, contributions to compulsory social insurance will be charged only from 25,000 rubles. (29,000 – 4,000), since the non-taxable amount in the first case is 4,000 rubles. And financial assistance issued at the birth of a child is not subject to contributions at all, if it does not exceed 50,000 rubles. In this case, it is equal to 30,000 rubles.

Registration in the organization

When considering the possibility of providing the above assistance to an employee by an organization, it is important to remember that, based on the norms of the Labor Code of the Russian Federation, only the employer himself makes the decision to receive it. The main condition for making such payments will be their stipulation in a collective agreement or an internal regulatory act of the enterprise . There will be no exception by reflecting the possibility of this payment individually for each employee in the employment contract .

When introducing such conditions into regulations, the employer must remember that if he has designated these payments as mandatory, then in their absence the employee will defend his rights in court and demand the recovery of the funds due to him. In addition, the employer will be held administratively liable.

No matter how the possibility of providing financial assistance is secured, this payment will always be of a declarative nature . This means that in order to receive the above support, the employee must write an application for payment, and also, in certain life situations, provide the necessary supporting documents, based on which the employer will assess the severity of the current life situation. After writing the application, an order is issued. Without an order, payment is impossible.

Is it necessary to subject insurance premiums to payments made to employees who have already resigned?

In some cases, an organization needs to pay financial assistance to former employees, for example, due to difficult life circumstances. In this case, there is no need to accrue insurance premiums, because the base for calculating insurance premiums includes remunerations paid in favor of individuals subject to compulsory insurance under employment contracts or civil contracts (clause 1 of Article 420 of the Tax Code of the Russian Federation). Since there are no of the above agreements between the former employees and the organization, there are also no grounds for calculating contributions.

How to document tax-free financial assistance

To issue financial assistance to an employee, you will need two documents:

- a statement from the employee indicating the intended purpose of material support;

- order from the manager to allocate funds for the provision of financial assistance, indicating the amount.

If the purpose of financial assistance corresponds to the purposes specified in subparagraph. 3 p. 1 art. 422 of the Tax Code of the Russian Federation or in sub. 8 tbsp. 217 of the Tax Code of the Russian Federation, this must be indicated.

In current labor legislation there is the concept of “material assistance”. This type of assistance is a kind of support from the state or organization. This support is expressed in a system of benefits that certain categories of citizens can take advantage of. Citizens, depending on the source of assistance, will be divided into those who have the right to receive benefits from the employer and those who have the right to receive this benefit from the state.

Financial assistance partially subject to insurance contributions

In some cases, contributions are assessed in excess of the established limit.

- Lump sum payments to each parent related to the birth, adoption of a child, establishment of guardianship, assigned during the first year of the baby’s life (within a year after adoption, establishment of guardianship), in the amount of up to 50,000 rubles, are not subject to insurance premiums. A non-taxable amount is established for each child.

Example

The spouses work in the same organization.

The collective agreement of this company states that upon the birth of a child, the employee is paid financial assistance in the amount of 40,000 rubles. Both spouses wrote an application to receive funds. Is financial assistance given to the father and mother subject to insurance premiums? Despite the fact that the total amount of assistance is 80,000 rubles. exceeded the established limit, the funds are not subject to insurance premiums, since the amount paid at a time to each parent is less than 50,000 rubles.

- Contributions for other financial assistance to an employee in a total amount of up to 4,000 rubles issued during a calendar year are not charged.

Example

In 2021, the employee was given financial assistance twice due to his difficult financial situation: the first time in February in the amount of 2,000 rubles, the second time in June in the amount of 3,000 rubles.

Is financial assistance provided to an employee subject to contributions? The accounting department did not impose fees on the first payment, since the amount issued was less than the limit established by law (2000In June, the company assessed contributions from the amount of financial assistance that exceeded the limit: (2000 + 3000) – 4000 = 1000 rubles. – the amount of financial assistance subject to contributions.

Employers should take into account that for financial assistance over 4,000, insurance premiums are charged in full.

Example

The organization decided to provide the employee with financial assistance for vacation - in the amount of 80,000 rubles. The accounting department will charge insurance premiums for an amount exceeding 4,000 rubles:

80,000 – 4000 = 76,000 rub. The accounting department will calculate contributions from 76,000 rubles.

When assessing insurance premiums on amounts of financial assistance issued, the limit for its different types is taken into account separately.

Example

During the year, the employee received financial assistance from the organization twice - the first time in connection with the adoption of a child in the amount of 30,000 rubles, the second time - for vacation, in the amount of 20,000 rubles.

Maternity assistance in the amount of 30,000 rubles, issued upon adoption, is not subject to contributions, since its amount is less than the limit of 50,000 rubles.

With financial assistance for vacation in the amount of 20,000 rubles. Only the amount of the annual limit - 4000 rubles - is not taken into account, and the remaining part of the payment is subject to insurance premiums. Contributions will be calculated by the accounting department of the employing company from the excess of the limit:

200 00 – 4000 = 16 000 rub. – financial assistance subject to insurance contributions.

Financial assistance for pensioners in 2021

Many pensioners are interested in the question of whether the government will repeat the one-time payment of 5,000 rubles, as it did in 2017. No, no such payment is planned. This was a single measure taken by the government in order to compensate for losses from rising prices.

From January 1, 2018, insurance pensions were indexed; the increase was 3.7 percent. In monetary terms, this is approximately 300-500 rubles.

Social pensions, received by those who do not have a single day of work experience (disabled people, disabled children, those who have lost their breadwinner, etc.), have increased by 4.1 percent since 04/01/2018. Depending on the disability group, this ranges from 175 to 500 rubles. Pensioners who are officially employed may not count on indexation in 2021.

Financial assistance to low-income families in 2021

Financial assistance to low-income citizens of the Russian Federation is currently provided in several forms. The most common option is cash payments that the state makes monthly. In addition, there is one-time monetary assistance in the form of a grant for training, a scholarship, assistance for the purchase of basic necessities, assistance in kind (food, medicine, etc.). A low-income family may be exempt from paying all taxes and fees when calculating material assistance in the form of benefits and subsidies.

Children who are raised in a family with low-income status have the right to receive education in higher and secondary educational institutions, taking part in a general competition for applicants. They can also count on help from the state, but for this at least one of the following conditions must be met:

- if the child is raised by only one parent who is recognized as a disabled person of the second or first group;

- if a child from a low-income family has scored the minimum number of points based on the exam results, which allows him to take part in the competition, since the exams are considered to have been passed successfully;

- the age of the child who wishes to enter a higher education institution does not exceed 20 years.

There are a number of innovations specifically for children raised in low-income families:

- out of turn children must be admitted to educational preschool institutions;

- in schools, children must have two meals a day, which are paid for by the state;

- Children should receive both a uniform for school and clothing for sports free of charge;

- Children under 6 years of age can receive the necessary medications for free, but only with a doctor’s prescription.

Parents who are part of a low-income family can count on the following benefits:

- preferential employment;

- lowering the retirement age;

- exemption from paying registration fees;

- obtaining a garden or summer cottage plot out of turn;

- obtaining a mortgage loan on preferential terms.

materialnaya_pomoshch.jpg

Related publications

Amounts paid in the form of financial assistance are not included in the wage fund. They are not stimulating and are not mandatory. The assignment of such payments is carried out at the request of employees, provided that the employer agrees and is financially able to provide material support to a member of its workforce.

Financial assistance 4000 rub. - income code in certificate 2-NDFL

Financial assistance paid in connection with the death of an employee or a member of his family is not subject to personal income tax, therefore, it does not need to be reflected in the 2-NDFL certificate.

Financial assistance paid for other reasons is reflected in 2-NDFL in full amount according to the codes:

- 2762 - at the birth of a child;

- 2760 - for treatment, anniversary, for other reasons.

At the same time, a deduction for financial assistance is indicated with the following codes:

- 508 - at the birth of a child (maximum 50,000 rubles);

- 503 - for other reasons (RUB 4,000).

Income tax

To determine income tax, provided that financial assistance is paid to the employee in the reporting period, the expenditure side of the organization’s balance sheet may be increased . But this rule does not apply to all types of financial assistance.

Read more: Question about returning the work book upon dismissal

The expenditure portion cannot include material assistance that is not related to the employee’s work functions, for example, to a flood victim.

How many times a year can financial assistance be given in 4000

The number of financial assistance payments to one employee is not limited in any way. But you need to keep in mind that the deduction is only provided in the amount of 4,000 per year for all payments. For example: Ivanov I.I. financial assistance paid:

- in March - 2000 rubles;

- in June - 5,000 rubles;

- in August - 1000 rubles.

Material assistance paid in March will not be subject to personal income tax; in June, 3,000 rubles will need to be taxed. (that is, the balance of the annual deduction in the amount of 2000 rubles has been provided), and financial assistance in August will be taxed in full.

Amounts of non-taxable income will be indexed in 2018

According to the project, income of payers in the form of the cost of vouchers to sanatorium-resort and health-improving organizations in Belarus, purchased for children under the age of 18 and paid for (reimbursed) from the funds of Belarusian organizations and (or) individual entrepreneurs, will be exempt from taxation in the amount not exceeding 781 rub. for each child from each source during the tax period (now – 705 rubles).

We recommend that you read: Where to Change Your Passport at 45 in Moscow

Limit on income benefits in the form of payment for insurance services of insurance organizations of the Republic of Belarus, including under voluntary life insurance contracts, additional pensions, medical expenses received from organizations and individual entrepreneurs who are the place of main work (service, study), including pensioners , who previously worked in these organizations and for these individual entrepreneurs, as well as from trade union organizations as members of such organizations, it is planned to increase to 3,184 rubles. (now – 2,874 rubles) from each source during the tax period.