Non-cash payments with suppliers, customers and personnel occupy an important place in the accounting of any organization. To reflect general information about non-cash transactions, the enterprise uses an accounting account. In the article we will talk about the peculiarities of reflecting transactions on this account, and also consider typical transactions and examples in the form of a table.

Cashless payments

When making non-cash payments to customers, funds can be transferred to the current account on the basis of the following documents:

- payment orders;

- letters of credit;

- checks;

- payment requests;

- collection orders;

- payment orders.

These types of settlement documents are provided for in Article 862 of the Civil Code of the Russian Federation and paragraph 1.1 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P.

For information on how to process and make payments using payment orders and checks, see:

- How to account for debiting funds from a current account;

- How to reflect transactions on special accounts in accounting.

Refund of erroneously transferred funds

Also, according to Art. 1102 of the Civil Code of the Russian Federation, if a person, without having legal rights to do so, received funds for use that were not intended for him, he is obliged to return them. Exceptions on this issue are set out in Art. 1109 of the Civil Code of the Russian Federation.

However, as mentioned earlier, if the funds have already been transferred and it is not possible to cancel the payment, the only way out is to write a letter requesting a refund and send it to the person who received the funds. If they refuse to return the money voluntarily, then in order to get the money back it is necessary to apply to the courts.

This is the only way to get your erroneously transferred amount back.

Payments for collection

In order to receive money into the current account during collection settlements, the recipient of the funds must issue a settlement document to the payer and transfer it to the bank (clauses 7.4, 7.7 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

When making collection payments, an organization can use the following settlement documents:

- payment requirements;

- collection orders.

This is stated in paragraphs 7.1, 7.4, 9.1 and 9.2 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P.

How the payer of funds should act in order for the bank to write off money from his account based on collection settlements, see How to account for the write-off of funds from a current account.

Refund methods.

If the error was discovered immediately, the funds will be returned quickly. Due to the fact that the bank takes time to carry out operations, payments do not go through instantly. As a rule, a timely contact with the bank with a request to revoke a payment order solves the problem that has arisen.

But how can you return erroneously transferred funds if several days have already passed? There are two ways to resolve the issue:

1. Voluntary.

The emphasis here is on the agreement between the two parties. If the counterparty is respectable and interested in further cooperation, then it will promptly respond to a letter about the return of erroneously transferred funds.

Expert opinion

Orlov Denis Ignatievich

Lawyer with 6 years of experience. Specialization: family law. Has experience in drafting contracts.

As a rule, organizations respond adequately to such incidents and treat mistakes made with understanding. At the same time, no one needs extra paperwork.

2. Judicial.

If the recipient independently refuses to return the erroneously transferred funds, then the sender can only resolve the matter in court. Only a statement of claim to the court with reasonable evidence of the current situation will help resolve the dispute.

Judicial practice has various examples of final results, both in favor of the injured party and vice versa. Therefore, it is better to entrust the process of paperwork and case management to qualified lawyers. This will significantly increase the chances of a positive resolution of the issue.

Calculations by payment requests

The unified form of payment request (form 0401061) was approved by Appendix 6 to the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P.

The legislation provides for two types of settlements for collection of payment claims:

- with acceptance;

- without acceptance.

Reason – clause 2.1 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P.

The organization stipulates the condition of acceptance or direct write-off in the agreement with the buyer, the bank (clause 2 of Article 862 of the Civil Code of the Russian Federation, clause 2.9 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

In settlements with payment requests with prior acceptance, the buyer has the right to refuse payment if the organization has violated the terms of the contract. At the same time, he must indicate the reasons for the refusal provided for in the contract (for example, failure to meet delivery deadlines, lack of certain documents for the goods, its low quality, etc.) (clause 2.9.1 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

When filling out a payment request with a preliminary acceptance, in the “Terms of payment” field, put the number “1” - a pre-given acceptance.

In the “Term for acceptance” field of the payment request, indicate the number of days for acceptance. The parties establish the deadline for acceptance in the contract (delivery, performance of work, provision of services). However, it cannot be less than five working days. If the parties have not specified a deadline for acceptance in the agreement, take it equal to five business days (unless a shorter period is provided for in the agreement with the bank).

This is stated in Appendix 1 to the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P.

On all copies of the payment request, the employee of the executing bank in the field “Final. acceptance period" indicates the date upon which the acceptance period expires. When calculating the date, working days are taken into account. The day the bank receives the payment request is not included in the calculation of the specified date. Such instructions are given in Appendix 1 to the Regulations approved by the Bank of Russia dated June 19, 2012 No. 383-P.

A prerequisite for settlements with payment requests without acceptance is that the bank servicing the payer (executing bank) has the right to write off funds from the payer’s account without his order (clause 2.9.1 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P) .

That is, in this case, when the recipient organization issues a payment request, the buyer cannot refuse payment. The bank debits the amount of debt from his account without acceptance. In practice, such calculations are used much less frequently, for example, when paying for utilities, electricity, etc.

In the payment request, in the “Payment Terms” field, indicate:

- number “1” if acceptance was given by the buyer in advance;

- number “2” if acceptance is required to write off funds.

This procedure is provided for in Appendix 1 to the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P.

Settlements by collection orders

The parties may provide in the agreement for collection payments through collection orders. To do this, the bank account agreement must contain the conditions for writing off funds under collection orders and information about recipients who have the right to submit such orders. To confirm this right, the recipient submits the relevant documents to the bank (clause 7.4 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P).

Draw up the collection order on form No. 0401071, approved by Appendix 4 to the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P. Such a document must contain a reference to the date, number of the contract with the buyer (customer) and its corresponding clause, providing for the right to indisputable write-off.

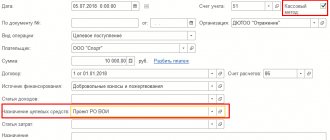

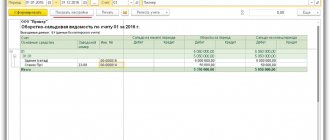

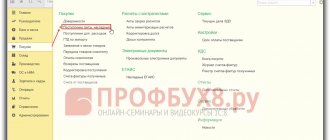

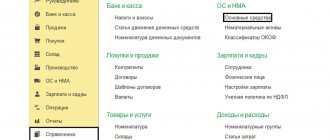

Reports for analysis of 51 accounts

The main reports that a modern accountant uses to obtain information are:

- Account balance sheet;

- Account analysis;

- Account card.

Let's look at examples of each of them in the 1C program.

Turnover balance sheet:

Account Analysis :

Account card:

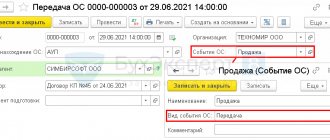

Accounting

Regardless of the method of settlement in accounting, reflect the receipt of funds to the current account on the basis of a bank statement with settlement documents attached to it (for example, payment and collection orders, payment requests, etc.) (Instructions for the chart of accounts). To learn whether it is possible to maintain document flow for banking transactions electronically, see How to organize accounting of transactions on a current account.

Reflect the receipt of funds to the organization’s current account in accounting by postings to the debit of account 51 “Current accounts”.

When you receive money from your counterparties, make the following entry in your accounting:

Debit 51 Credit 62 (58, 60, 66, 67, 76, 91…)

– money has been deposited into the current account from the counterparty.

What entries need to be made if the buyer paid for the goods with a bank card, see How to reflect retail sales of goods in accounting.

Receipt of interest on the free balance of funds on the current account is reflected as follows:

Debit 51 Credit 91-1

– interest has been received on the free balance of funds in the current account from the bank.

Reflect the return (reimbursement) of funds from the budget using the following posting:

Debit 51 Credit 68

– money has been credited to the current account regarding the return (reimbursement) from the budget.

When you receive funds from the Federal Social Insurance Fund of Russia, make an entry in your accounting:

Debit 51 Credit 69

– money has arrived in the current account regarding compensation from the Federal Social Insurance Fund of Russia.

Reflect the cash contributions received from the founders by posting:

Debit 51 Credit 75-1

– money was contributed as a contribution to the authorized capital.

If you have several current accounts in different banks, organize analytical accounting of funds in them. To do this, open separate sub-accounts for account 51. For example, account 51 sub-account “Current account in bank 1” and sub-account “Current account in bank 2”. Reflect the transfer of money between your own accounts in different banks by posting:

Debit 51 subaccount “Current account in bank 2” Credit 51 subaccount “Current account in bank 1”

– the transfer between your own current accounts is reflected (if the money is credited on the same day).

Or when transferring money not on the day of transfer:

Debit 57 Credit 51 sub-account “Current account in bank 1”

– funds are written off for crediting to another own current account (on the day when the write-off is reflected in bank statement 1);

Debit 51 sub-account “Current account in bank 2” Credit 57

– the receipt of funds from another current account is reflected (on the day the money is credited).

This procedure is established in the Instructions for the chart of accounts.

For more information on registering a payment order when transferring money between your own accounts in different banks, see How to account for debiting funds from a current account.

When providing settlement services (including transferring funds to an organization's current account), the bank may charge a fee. For information on how to reflect such payments in accounting, see How to record expenses for banking services.

The procedure for reflecting the receipt of funds to the current account when calculating taxes depends on two factors:

- the taxation system that the organization applies;

- destination of received money.

BASIC

If an organization uses the accrual method, then the receipt of money in the current account will not affect the calculation of income tax in any way. This is due to the fact that the recognition of income in this case does not depend on the receipt of money in the organization’s current account (clause 1 of Article 271 of the Tax Code of the Russian Federation).

An example of how to reflect in accounting and taxation the receipt of money into a current account when making payments using collection orders. The organization uses the accrual method

On July 2, Alpha LLC entered into a long-term agreement for the provision of . According to the agreement, Hermes pays for the provided communication services on a monthly basis. The agreement provides for a collection form of payments (collection orders).

The agreement between Hermes and the bank servicing it contains a provision regarding the bank’s right to write off funds from the client’s account without his order.

In July, Alpha provided RUB 59,000. (including VAT – 9000 rubles). The Alpha accountant issued a collection order for this amount.

On August 1, Hermes submitted the following information to the bank servicing it:

- about the recipient of funds (“Alpha”), who has the right to issue collection orders to write off money in an indisputable manner (full name, legal and actual address, telephone number, INN, KPP, OGRN, bank details, information about the manager and chief accountant);

- on the agreement for the provision of communication services (agreement No. 344 dated July 2, concluded with Alfa).

Money to pay for services arrived in Alpha’s bank account on August 3.

For the services of executing a collection order, the bank servicing the organization wrote off a fee in the amount of 1,800 rubles from Alpha’s current account.

Alpha's accountant recorded the transactions as follows.

July 31:

Debit 62 Credit 90-1 – 59,000 rub. – revenue from the provision of communication services is reflected, and at the same time a collection order is issued to pay for them;

Debit 90-2 Credit 20 – 30,000 – the cost of sold communication services is taken into account as expenses;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 9000 rubles. – VAT is charged on revenue from the provision of communication services.

August 3rd:

Debit 51 Credit 62 – 59,000 rub. – money has been received from the buyer (collection order executed);

Debit 91-2 Credit 51 – 1800 rub. – reflects the bank’s remuneration for services rendered when making payments by collection orders.

Alpha uses the accrual method, so the receipt of revenue from the sale of services into the current account did not affect the calculation of income tax.

If an organization calculates income tax using the cash method, the reflection of received money in the current account depends on its purpose. This is due to the fact that income under the cash method is recognized at the moment the money is received in the current account (clause 2 of Article 273 of the Tax Code of the Russian Federation).

For example, if an organization receives proceeds from the sale of goods (work, services) into its current account, then it must be taken into account when calculating income tax at the time the funds are received (clause 2 of Article 273 of the Tax Code of the Russian Federation). This rule also applies to advance payments received (clause 8 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98).

When money arrives in the current account as an advance for upcoming deliveries of goods (work, services), the organization may have an obligation (clause 1 of Article 167 of the Tax Code of the Russian Federation).

simplified tax system

If an organization applies a simplification, then the reflection of money received in the current account depends on its purpose. This is due to the fact that income under this regime is recognized at the moment the money is received in the current account (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Thus, take into account the proceeds from the sale of goods (work, services) that were credited to the current account when calculating the single tax on the day the money is received into the account (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

An example of accounting when calculating a single tax when simplifying revenue received

LLC "Alpha" applies a simplified taxation system with the object of taxation "income".

On May 14, Alpha shipped a consignment of goods to the buyer for a total amount of 550,000 rubles. Payment for the shipped goods was received from the buyer to the company's bank account on May 21 (payment order dated May 21 No. 352).

The accountant reflected the amount of revenue received as income in the book of income and expenses for the six months.

How to return an erroneous payment?

There are two ways to get your money back:

You send a standard application to the recipient with a request to return the erroneously transferred amounts within the agreed period and to the specified details. In this case, you depend on the honesty and integrity of another person.

In a situation where the person who received your money refuses to independently and honestly return the money to your account, there is only one way out - to file a claim in court . In such a scenario, especially if large sums are involved, it is worth engaging qualified lawyers who will help you draw up a competent statement of claim and will act on your behalf in court.

Choosing a lawyer carefully will guarantee you a positive outcome.