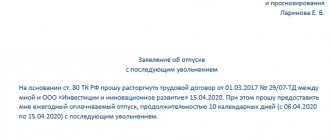

Going on vacation followed by voluntary dismissal is an employee’s right, enshrined in

Manufacturing enterprises can produce products daily and sell them immediately, while

For tax and accounting, one of the methods used is the accrual method, which is used

The role of the primary document in accounting Primary documents are documents with the help of which

It is difficult to imagine a company that does not print documents, does not sign them and does not make records.

In the last issue of the magazine we looked at the question of how to get rid of the old arrears reflected on

Main features of Kontur.Extern Send reports quickly and without errors By reporting to Extern you can

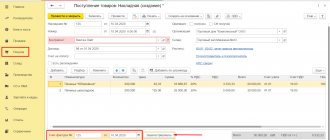

Making changes in the current tax period The procedure for making changes to the purchase book is regulated by the resolution

There are several options for deregistering a cash register: when contacting the tax office or through a personal

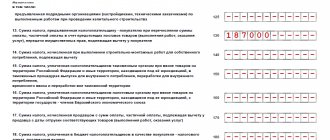

VAT tax deduction is the amount of input tax by which the taxpayer has the right to reduce