Main features of Contour.Exten

Send reports quickly and without errors

When reporting to Externa, you can be sure that the report will not be lost and will be delivered on time. It will be accepted the first time - the built-in verification system will track possible errors already when filling it out. And you don't have to install or update anything yourself - everything happens automatically. Technical support will answer any question quickly and competently at any time.

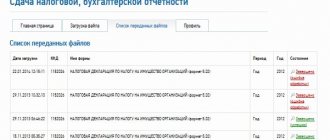

Monitor the reporting of service organizations

You no longer need to maintain tables in Excel and put sticky notes on the board - monitor the reporting of service organizations using an interactive table in Externa. The pivot table is compiled and updated automatically based on the reporting history. With it, you can easily figure out when which reports need to be submitted for each organization, and you will be able to see the status of submitted reports.

Receive notifications about requirements from the tax office

Receive requests from the tax office on time and respond to them electronically within the deadlines established by law. This will avoid fines and blocking of your current account. You can work from any computer by connecting using your login and password. Send requests for clarification to the tax office, receive notifications about changes in legislation, request certificates, reconciliation reports, extracts and other documents.

SMS will notify you about the submission of the report

Even if you are far from your computer, the SMS messaging service will allow you to always be aware of what is happening with reports. Just about those document flows for which you want to receive alerts, and the information will be promptly sent to your mobile phone. You won't miss any important changes. If desired, you can easily unsubscribe from the service or enable it again.

Work with electronic sick leave

In Kontur.Externe you can download, fill out and send electronic sick leave to the Social Insurance Fund. Including quarantine sick leave for persons 65+ years old. Regions with direct payments can also create a register based on electronic sick leave data and send it to the Social Insurance Fund.

Generate documents for paying taxes

In a couple of clicks, create payment orders and receipts PD (tax) and PD-4sb (tax). Select a current account - and Extern will automatically fill out the rest of the payment according to the tax return or tax payment request. You can download a file for online banking or print a payment order.

Report to the Pension Fund of the Russian Federation using the form SZV-TD

Submit the SZV-TD form for employees who experienced personnel events during the reporting period. Before submitting the SZV-TD for the first time, submit an application to the Pension Fund to connect to the electronic document flow of the Pension Fund.

When will the report be accepted?

Current regulations indicate that the day on which the tax return was sent by mail is recognized as the date indicated on the receipt received upon sending, or noted on the list of attachments.

In this case, no later than the day following the receipt of the declaration form by mail, it must be registered in a specialized software package. If this tax authority does not provide for electronic recording, it must be registered in a separate logbook for incoming correspondence, where it is assigned a unique number.

Additional features of Kontur.Extern

Hot legislative news in the legal reference system

Understand the intricacies of the legislation by reading opinion articles on each area of reporting. Study expert comments, cases from arbitration practice and real stories of accountants. Get qualified answers to complex questions in accounting, taxation and legal matters. In a single interactive directory, find the necessary accounting entries with the author’s analysis of typical business transactions.

Receive extracts from the Unified State Register of Legal Entities and Unified State Register of Individual Entrepreneurs - in one click

Through Extern you can order an extract from the Unified State Register of Legal Entities in a few clicks and receive open information about the counterparty. In the basic version of the counterparty verification service, you will have access to basic data about any legal entity or individual entrepreneur in Russia.

Exchange documents without paper or couriers

With your certificate, you will be able to send 50 electronic documents (invoices, trade-12, invoices, etc.) to your counterparties for free without duplicating them on paper. They will have the same legal significance as paper ones with a seal and signature, but at the same time they will reach the addressee in seconds.

Reconcile invoices with counterparties

External users have the opportunity to download a sales book and invite their counterparties for reconciliation. To take advantage of the opportunity to download purchase books, compare purchase and sales books with counterparties, you must purchase access to the Kontur.VAT+ service.

Be aware when they come to check you

Send reports using Kontur.Extern and use the basic functionality of the Expert analytical service for free. Based on the entered data from the financial statements, the program will automatically conduct a financial analysis of the enterprise. And using the methodology used by the Federal Tax Service, it will calculate the likelihood of tax and administrative audits.

Watch webinars on accounting and tax topics

Accounting and tax accounting are areas in which you constantly need to keep your finger on the pulse. Complex legislation, many subtleties, tax risks - Kontur.Schools experts will help you sort it all out. You can listen to webinars and test your knowledge right in the office or at home. Every month two new webinars are available to Extern subscribers.

How to correctly write an investment inventory

The Tax Code establishes the requirement that if the declaration is delivered by mail, then an inventory of its contents must be included in the envelope. But if the shipment is made by regular or registered mail, the inventory must be completed yourself on the organization’s letterhead.

You might be interested in:

Form 6-NDFL: deadlines, instructions for filling

However, there is one caveat to this. As a rule, postal workers do not want to put stamps on this kind of inventory, confirming this by the fact that they cannot be responsible for the contents of such items. Therefore, in this situation, the signatures of the director and chief accountant must be present on the inventory.

If the shipping receipt is lost for some reason, then it will be impossible to confirm the fact of sending the item with an inventory alone.

Let's look at an example of how to draw up an inventory on a company's letterhead.

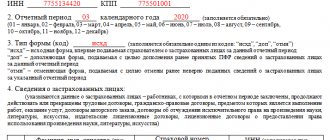

At the top of the sheet you need to put down the full name of the organization, registration codes TIN, KPP, OGRN, legal address, bank account information.

Then in the middle of the sheet you need to indicate the name of the form - “Attachment Inventory”.

After this, you need to list all the declarations that are in the envelope in list format. This is done in the format: tax return for (name of tax) for (name of period) for (number of pages in the declaration in numbers and words) - (number of copies).

After completing the transfer, the manager and chief accountant must put their signatures with the transcripts.

Additional modules

Reporting from 1C Preparation and sending of reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat from 1C

Zero reporting Preparation and submission of zero reporting to the Federal Tax Service, Pension Fund of Russia, Social Insurance Fund and Rosstat

VAT+ (Reconciliation) Reconciliation of invoices with counterparties

Alcohol reporting Generate, verify, sign and send declarations of forms 11 and 12 to FSRAR

Reporting to the RPN For organizations and individual entrepreneurs required to report to Rosprirodnadzor

Traffic light Automatic verification of counterparties and identification of material facts

What happens when the letter arrives at the tax office after the deadline for submitting reports?

If the declaration is delivered using postal mail, then according to the Tax Code, the day of its receipt is considered to be the date on which it was sent. Moreover, this rule works until 24:00 of the day that is defined as the deadline for submitting this type of declaration.

Attention! The tax office may decide to impose a fine if the declaration was sent within the prescribed period, but arrived at the Federal Tax Service after the deadline. However, this step is illegal. In particular, this was confirmed by the arbitration court, which considered that the sender is not punished for the delay of the item during shipment if it was submitted to the postal service and received on time.

However, if the fine was issued to the subject, then he will have to prove his innocence only through a trial.

How can you confirm the submission of reports?

The Tax Code requires that when delivering a declaration using the postal service, an inventory of the contents on a postal form must be included in the envelope. It will indicate exactly what documents were in it at the time of dispatch, which means that with its help it will also be possible to establish the fact that this particular declaration was sent. It is simply impossible to find out information about its contents from the receipt of acceptance of the letter for forwarding.

In addition, the rules for the provision of postal services state that the inventory is also considered evidence of the conclusion of an agreement for their provision between the sender and the postal service.

Before the inventory is sealed in an envelope, the postal employee must compare both copies with each other, as well as compare what is indicated in it with the contents in the envelope, after which a stamp is placed on each inventory.

At the same time, the inventory that remains in hand, thanks to this stamp, can be considered confirmation of the delivery of the item on time, even if the receipt is lost. However, sometimes during legal proceedings, the court does not agree with this, considering that only the receipt itself can confirm the shipment.

If the inspection did not receive the sent declaration and the account was blocked for this reason, the subject will need to provide:

- A copy of the submitted declaration;

- Available inventory with a stamp;

- Receipt of acceptance of the shipment.

Fines for violators

If a taxpayer who is required to report to the Federal Tax Service in electronic form submits a report “on paper”, he will have to pay a fine of 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

For policyholders who violate the procedure for submitting information to the Pension Fund in the form of electronic documents, a sanction of 1,000 rubles is provided. (Article 17 of Law No. 27-FZ).

An insured who does not comply with the procedure for submitting Form 4-FSS in electronic form will be fined 200 rubles. (clause 2 of article 26.30 of Law No. 125-FZ).

Note that in practice, submitting paper reports instead of electronic ones often leads to other, more unpleasant consequences for business. Violators simply risk ruining relations with representatives of regulatory authorities. Officials take violators seriously and treat their reports, as well as their activities, more skeptically than the reports of bona fide payers. In addition, controllers are beginning to more often use various formal grounds for refusing to accept reports. And this, in turn, is fraught with fines for violating reporting deadlines.