Tax Code >> Chapter 28

Article 356 General provisions

Article 357 Taxpayers

Article 358 Object of taxation

Article 359 Tax base

Article 360 Tax period. Reporting period

Article 361 Tax rates

Article 361.1 Tax benefits

Article 362 Procedure for calculating the amount of tax and amounts of advance payments for tax

Article 363 Procedure and terms for payment of tax and advance payments of tax

Article 363.1 Tax return

Chapter 28 of the Tax Code of the Russian Federation Transport tax

| Chapter 27 | Chapter 29 |

Comments on Chapter 28 of the Tax Code of the Russian Federation - Transport tax

Transport tax

Vehicle tax is a mandatory component of the tax base of all civilized countries. This payment relates to regional taxes and fees, the amount of which is set separately in each region. The competence of regional authorities also includes the adoption of resolutions establishing transport tax benefits. In the Tax Code of the Russian Federation, transport tax is described in Chapter 28, which regulates all the main provisions of this type of taxation.

Transport tax rates are set taking into account the technical characteristics of taxable objects, which include cars, buses, special equipment, motorcycles, scooters, yachts, and boats. At the same time, the period during which the vehicle is owned by the person paying this fee is taken into account.

The Tax Code of the Russian Federation defines the following important points regarding transport tax:

- objects of taxation;

- length of the tax period;

- method of calculating transport tax;

- preferential categories of citizens and vehicles

According to current legislation, the 2017 transport tax continues to be calculated using regional rates.

TAX CODE - Chapter 28. TRANSPORT TAX

Article 356. General provisions Transport tax (hereinafter in this chapter - tax) is established by this Code and the laws of the constituent entities of the Russian Federation on tax, is put into effect in accordance with this Code by the laws of the constituent entities of the Russian Federation on tax and is obligatory for payment on the territory of the corresponding constituent entity of the Russian Federation When introducing a tax, the legislative bodies of a constituent entity of the Russian Federation determine the tax rate within the limits established by this Code, the procedure and terms for its payment. When establishing a tax, the laws of the constituent entities of the Russian Federation may also provide for tax benefits and grounds for their use by the taxpayer.

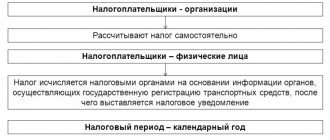

Article 357. Taxpayers Taxpayers (hereinafter in this chapter - taxpayers) are persons to whom, in accordance with the legislation of the Russian Federation, vehicles are registered, recognized as an object of taxation in accordance with Article 358 of this Code, unless otherwise provided by this article. For vehicles registered in the name of individuals, acquired and transferred by them on the basis of a power of attorney for the right to own and dispose of a vehicle before the official publication of this Federal Law, the taxpayer is the person specified in such a power of attorney. In this case, the persons on whom the specified vehicles are registered notify the tax authority at their place of residence about the transfer of the specified vehicles on the basis of a power of attorney. Persons who are organizers of the Olympic Games and Paralympic Games are not recognized as taxpayers in accordance with Article 3 of the Federal Law “On the Organization and on the holding of the XXII Olympic Winter Games and the XI Paralympic Winter Games in 2014 in the city of Sochi, the development of the city of Sochi as a mountain climatic resort and amendments to certain legislative acts of the Russian Federation”, in relation to vehicles owned by them and used in connection with the organization and the holding of the XXII Olympic Winter Games and the XI Paralympic Winter Games in 2014 in the city of Sochi and the development of the city of Sochi as a mountain climatic resort. (Part three was introduced by Federal Law of December 1, 2007 N 310-FZ)

Article 358. Object of taxation 1. The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis. , non-self-propelled (towed vessels) and other water and air vehicles (hereinafter in this chapter - vehicles), registered in the prescribed manner in accordance with the legislation of the Russian Federation.2. The following are not subject to taxation: 1) rowing boats, as well as motor boats with an engine power of no more than 5 horsepower; 2) passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received through social welfare authorities in the manner prescribed by law; 3) fishing sea and river vessels; 4) passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations whose main activity is passenger and (or) cargo transportation; 5) tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products ; 6) vehicles owned by the right of economic management or operational management to federal executive authorities, where military and (or) equivalent service is legally provided for; 7) vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by the authorized body; airplanes and helicopters of air ambulance and medical services; 9) ships registered in the Russian International Register of Ships.

The following are not subject to taxation: 1) rowing boats, as well as motor boats with an engine power of no more than 5 horsepower; 2) passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received through social welfare authorities in the manner prescribed by law; 3) fishing sea and river vessels; 4) passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations whose main activity is passenger and (or) cargo transportation; 5) tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products ; 6) vehicles owned by the right of economic management or operational management to federal executive authorities, where military and (or) equivalent service is legally provided for; 7) vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by the authorized body; airplanes and helicopters of air ambulance and medical services; 9) ships registered in the Russian International Register of Ships.

Article 359. Tax base 1. The tax base is determined: 1) in relation to vehicles with engines (except for vehicles specified in subclause 1.1 of this clause) - as the engine power of the vehicle in horsepower; 1.1) in relation to air transport means for which the thrust of a jet engine is determined - as the nameplate static thrust of a jet engine (the total nameplate static thrust of all jet engines) of an air vehicle at take-off mode in terrestrial conditions in kilograms of force; 2) in relation to non-self-propelled (towed) water vehicles for which gross tonnage is determined - as gross tonnage in registered tons; 3) in relation to water and air vehicles not specified in subparagraphs 1, 1.1 and 2 of this paragraph - as a unit of vehicle.2. In relation to vehicles specified in subparagraphs 1, 1.1 and 2 of paragraph 1 of this article, the tax base is determined separately for each vehicle. In relation to vehicles specified in subparagraph 3 of paragraph 1 of this article, the tax base is determined separately.

Article 360. Tax period. Reporting period 1. The tax period is a calendar year.2. Reporting periods for taxpayers who are organizations are recognized as the first quarter, second quarter, third quarter.3. When establishing a tax, the legislative bodies of the constituent entities of the Russian Federation have the right not to establish reporting periods.

Article 361. Tax rates 1. Tax rates are established by the laws of the constituent entities of the Russian Federation, respectively, depending on engine power, jet engine thrust or gross tonnage of vehicles, category of vehicles per one horsepower of vehicle engine power, one kilogram of jet engine thrust , one registered ton of vehicle or unit of vehicle in the following sizes: +— Passenger cars with engine power (per horsepower): up to 100 hp. (up to 73.55 kW) inclusive 5 over 100 hp. up to 150 hp (over 73.55 kW to 110.33 kW) inclusive 7 over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive 10 over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive 15 over 250 hp (over 183.9 kW) 30 Motorcycles and scooters with engine power (per horsepower): up to 20 hp. (up to 14.7 kW) inclusive 2 over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive 4 over 35 hp (over 25.74 kW) 10 Buses with engine power (per horsepower): up to 200 hp. (up to 147.1 kW) inclusive 10 over 200 hp (over 147.1 kW) 20 Trucks with engine power (per horsepower): up to 100 hp. (up to 73.55 kW) inclusive 5 over 100 hp. up to 150 hp (over 73.55 kW to 110.33 kW) inclusive 8 over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive 10 over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive 13 over 250 hp (over 183.9 kW) 17 Other self-propelled vehicles, machines and mechanisms on pneumatic and caterpillar tracks (with each horsepower) 5 Snowmobiles, motor sleighs with engine power (with each horsepower): up to 50 hp. (up to 36.77 kW) inclusive 5 over 50 hp (over 36.77 kW) 10 Boats, motor boats and other water vehicles with engine power (per horsepower): up to 100 hp. (up to 73.55 kW) inclusive 10 over 100 hp (over 73.55 kW) 20 Yachts and other sailing-motor vessels with engine power (per horsepower): up to 100 hp. (up to 73.55 kW) inclusive 20 over 100 hp (over 73.55 kW) 40 Jet skis with engine power (per horsepower): up to 100 hp. (up to 73.55 kW) inclusive 25 over 100 hp (over 73.55 kW) 50 Non-self-propelled (towed) vessels, for which gross tonnage is determined (for each registered ton of gross tonnage) 20 Airplanes, helicopters and other aircraft with engines (for each horsepower) 25 Airplanes with jet engines (from each kilogram of traction force) 20 (introduced by Federal Law of August 20, 2004 N 108-FZ) Other water and air vehicles that do not have engines (from a vehicle unit of 200 vehicles) 2. Tax rates specified in paragraph 1 of this article, may be increased (decreased) by the laws of the constituent entities of the Russian Federation, but not more than five times.3. It is allowed to establish differentiated tax rates for each category of vehicles, as well as taking into account the useful life of the vehicles.

Article 362. Procedure for calculating the amount of tax and the amount of advance payments for tax 1. Taxpayers who are organizations calculate the amount of tax and the amount of advance payment for tax independently. The amount of tax payable by taxpayers who are individuals is calculated by the tax authorities on the basis of information submitted to the tax authorities by the authorities carrying out state registration of vehicles on the territory of the Russian Federation.2. The amount of tax payable to the budget at the end of the tax period is calculated in relation to each vehicle as the product of the corresponding tax base and tax rate, unless otherwise provided by this article. The amount of tax payable to the budget by taxpayers who are organizations is determined as the difference between the calculated amount of tax and the amounts of advance tax payments payable during the tax period.2.1. Taxpayers who are organizations calculate the amount of advance tax payments at the end of each reporting period in the amount of one-fourth of the product of the corresponding tax base and tax rate.3. In case of registration of a vehicle and (or) deregistration of a vehicle (deregistration, exclusion from the state ship register, etc.) during the tax (reporting) period, the calculation of the tax amount (the amount of the advance tax payment) is carried out taking into account coefficient, defined as the ratio of the number of full months during which the vehicle was registered to the taxpayer to the number of calendar months in the tax (reporting) period. In this case, the month of registration of the vehicle, as well as the month of deregistration of the vehicle, is taken as a full month. In case of registration and deregistration of a vehicle within one calendar month, the specified month is taken as one full month.4. Bodies carrying out state registration of vehicles are required to report to the tax authorities at their location about vehicles registered or deregistered with these authorities, as well as about the persons to whom the vehicles are registered, within 10 days after their registration or deregistration from registration.5. Bodies carrying out state registration of vehicles are required to report to the tax authorities at their location information about vehicles, as well as about the persons on whom the vehicles are registered, as of December 31 of the past calendar year until February 1 of the current calendar year, as well as about all related changes that occurred during the previous calendar year. The information specified in paragraphs 4 and 5 of this article is submitted by the authorities carrying out state registration of vehicles in forms approved by the federal executive body authorized for control and supervision in the field of taxes and fees.6. When establishing a tax, the legislative body of a constituent entity of the Russian Federation has the right to provide for certain categories of taxpayers the right not to calculate or pay advance tax payments during the tax period.

Article 363. Procedure and terms for payment of tax and advance payments of tax 1. Payment of tax and advance payments of tax is made by taxpayers at the location of vehicles in the manner and terms established by the laws of the constituent entities of the Russian Federation. At the same time, the deadline for payment of tax for taxpayers who are organizations, cannot be established earlier than the period provided for in paragraph 3 of Article 363.1 of this Code.2. During the tax period, taxpayers who are organizations pay advance tax payments, unless otherwise provided by the laws of the constituent entities of the Russian Federation. Upon expiration of the tax period, taxpayers who are organizations pay the amount of tax calculated in the manner prescribed by paragraph 2 of Article 362 of this Code.3. Taxpayers who are individuals pay transport tax on the basis of a tax notice sent by the tax authority.

Article 363.1. Tax return 1. Taxpayers who are organizations, after the expiration of the tax period, submit to the tax authority at the location of the vehicles, unless otherwise provided by this article, a tax return. The form of the tax return is approved by the Ministry of Finance of the Russian Federation.2. Taxpayers who are organizations and pay advance tax payments during the tax period, at the end of each reporting period, submit to the tax authority at the location of the vehicles, unless otherwise provided by this article, a tax calculation for advance tax payments. Form of tax calculation for advance payments tax payments are approved by the Ministry of Finance of the Russian Federation.3. Tax returns are submitted by taxpayers no later than February 1 of the year following the expired tax period. Tax calculations for advance tax payments are submitted by taxpayers, with the exception of taxpayers applying special tax regimes established by Chapters 26.1 and 26.2 of this Code, not during the tax period later than the last day of the month following the expired reporting period.4. Taxpayers who, in accordance with Article 83 of this Code, are classified as the largest taxpayers, submit tax returns (calculations) to the tax authority at the place of registration as the largest taxpayers.

Rates and deadlines for payment of transport tax

The main indicators used in calculating vehicle tax are the regional rate, horsepower and the period of ownership of the vehicle. The formula for calculating this payment is the product of the following parameters:

- regional flat rate

- the number of horsepower indicated in the technical passport of the vehicle;

- number of months of ownership divided by 12

For elite class vehicles, the cost of which exceeds 3 million rubles, in most cases increasing coefficients are applied. Transport tax is paid by all owners of registered vehicles, regardless of whether the vehicle is in use, undergoing long-term repairs, or is simply parked in a garage.

Tax rate

Article 361 of the Tax Code of the Russian Federation establishes basic rates for transport tax, for example, for cars with a capacity of up to 100 hp. With. - 2.5, and up to 200 liters. With. inclusive - 5, however, constituent entities of the Russian Federation have the right to regulate their size.

Regions can increase or, conversely, decrease rates, but no more than ten times in each direction. You can view the tax rate by region in the relevant regulations of the constituent entities of the Russian Federation. If the region has not established its own rates, then the base rate of the Tax Code of the Russian Federation is used for calculation.

Regions can also introduce additional tax differentiation, for example, depending on the year of manufacture of the vehicle or its environmental class.

Increasing factor

In accordance with the second paragraph of Article 362 of the Tax Code of the Russian Federation, transport tax is calculated with increasing coefficients for expensive vehicles:

| Property name | Increasing factor |

| Cars costing from 3 to 5 million rubles are not older than three years | 1,1 |

| Cars costing from 5 to 10 million rubles are not older than five years | 2 |

| Cars costing from 10 to 15 million rubles are not older than ten years | 3 |

| Cars worth more than 15 million rubles are not older than twenty years | 3 |

Every year, the Ministry of Industry and Trade of the Russian Federation publishes information containing data on the use of coefficients on vehicles worth over three million rubles.

A table with coefficients for passing in 2021 can be downloaded here.

How to calculate tax

To calculate the cost of transport tax, the following formula is used:

- tax base (vehicle power) * number of months of vehicle ownership during the reporting period * rate * coefficient (if necessary).

Let's look at an example (using the base rates of the Tax Code of the Russian Federation):

Ivan Ivanov owned a 200 hp car in 2021. With. for five months. Ivanov’s car costs more than 3 million rubles and the calculation must take into account the coefficient of 1.1:

- 200 * 5 * 5 * 1,1 = 5500.

That is, for 2021 Ivanov must pay 5,500 rubles in transport tax.

Features of the transport tax benefit

Payment of transport tax is not provided for owners of motor boats with engines whose power is less than 5 hp, and vehicles equipped for the disabled. Other preferential categories of citizens and transport are listed in Art. 361.1. Tax Code of the Russian Federation "Transport Tax". To receive a transport tax benefit, a citizen must submit an application with supporting documents to the relevant tax authority.

The tax period for payment of transport tax is a calendar year. For enterprises that own vehicles, the tax periods include the first, second and third quarter. A notice of payment of transport tax must be sent to the taxpayer no later than 30 days before the end of the payment deadline.

What to do if you haven’t received a receipt

Quite often, car owners are faced with the fact that tax payment notification does not arrive. This can happen for the following reasons:

- in the region there are tax benefits that the car owner is eligible for;

- the tax office has not received registration information , this especially often happens when cars are resold between individuals;

- the receipt was lost in the mail;

- the owner of the vehicle changed his place of residence and did not report this to the tax service;

- The vehicle owner has registered with the Federal Tax Service online service , so all notifications are now sent to him electronically.

In any case, the taxpayer must independently deal with this situation. You can do this in two ways:

- Visit the Federal Tax Service in person.

- Register on the Federal Tax Service website and request a notification in your personal account.

How the authorities use transport tax

Many car owners are concerned about where the money transferred in the form of vehicle tax goes and how it is used. This important point is regulated by Articles 14 of the Tax Code of the Russian Federation and 56 of the Budget Code of the Russian Federation, which voice the following provisions. Transport tax is transferred to the general regional budget without any specific purpose. That is, regional authorities can spend this money on almost anything, from the construction of socially important facilities to the improvement of urban areas.

Until January 1, 2003, these fees went to the funds of the road services involved in the improvement of roads. However, the high corruption component and well-established kickback schemes forced the Government of the Russian Federation to introduce a regional tax on transport, which is paid to the regional budget without legislative control over its use.

Transport tax 2021 – changes: has the tax been canceled or not?

Rumors about the abolition of the transport tax appeared after the President signed Law No. 436-FZ of December 28, 2017. This legal document provides for the rules for a partial tax amnesty, which will also affect the tax on vehicles of individuals. The essence of the amnesty is that tax debts and penalties calculated for the amount of debt are forgiven to car owners. This relief is typical only for outstanding amounts of obligations that arose before 2015 (in fact, the statute of limitations for them expires). That is, the transport tax itself has not yet been abolished.

There is a bill No. 480908-7 on the abolition of the tax by increasing fuel excise taxes, but it has not been adopted. At the same time, in 2021, as stated by the Chairman of the State Duma Committee on Transport, Evgeny Moskvichev, it is possible to introduce a bill that will replace the transport tax with an environmental tax. At the same time, regional differentiation of rates for the new tax is not provided, and cars that meet the environmental standards Euro-4 - Euro-6 are planned to be exempt from taxation.

Tax return

Organizations that pay transport tax are required to report on this payment. So, in accordance with Art. 363.1 of the Tax Code of the Russian Federation, after the expiration of the tax period, namely, as mentioned above, the calendar year, enterprises submit a tax return. Such a declaration must be submitted to the tax office at the location of the vehicles no later than February 1 of the year following the expired tax period. Since 2011 in ch. 28 of the Tax Code of the Russian Federation, changes were made to abolish the obligation of organizations to submit tax calculations for advance tax payments. The legislator of a constituent entity of the Russian Federation, in his regulatory legal act, may oblige an organization to pay advance payments for transport tax. The previous version of the Tax Code of the Russian Federation provided that in this case, taxpayers must, at the end of each reporting period (Q1, Q2, Q3), submit to the tax authority at the location of the vehicles a tax calculation for advance tax payments. Only those organizations that, accordingly, did not make payments during the tax period, as well as enterprises using a simplified taxation system and paying the unified agricultural tax, did not submit tax calculations. Moreover, the latter did not submit interim calculations to the tax authority, regardless of the obligation to make quarterly advance payments. This preference was provided for in paragraph 3 of Art. 363.1 of the Tax Code of the Russian Federation in its current version until 2011. Starting from this year, no one has to submit transport tax calculations, regardless of the taxation regime and the procedure for paying the tax. Therefore, if your organization has switched or plans to switch from a simplified taxation regime to a general one, then starting from 2011, this will not result in the obligation to submit additional reporting on transport tax. The enterprise both submitted exclusively one annual declaration using the simplified tax system, and after “leaving” this regime, it will report in the same way. So, let's continue further and consider the procedure for submitting a transport tax return to the tax authority. As we have already discussed above, Art. 363.1 of the Tax Code of the Russian Federation indicates that reporting must be submitted at the location of the vehicles. In accordance with the norms of paragraph 5 of Art. 83 of the Tax Code of the Russian Federation, the location of vehicles is recognized as the place of their state registration (and in the absence of such, the location (residence) of the property owner). Registration of vehicles is carried out in accordance with the Rules for registration of motor vehicles and trailers for them in the State Road Safety Inspectorate of the Ministry of Internal Affairs of Russia (Appendix No. 1 to Order of the Ministry of Internal Affairs of Russia dated November 24, 2008 No. 1001 “On the procedure for registering vehicles”). According to clause 24 of these Rules, registration of vehicles for legal entities is carried out at the location of legal entities, determined by the place of their state registration, or at the location of their separate divisions. It turns out that a vehicle can be registered both at the location of the parent organization and at the location of a separate division, regardless of whether such a separate division is allocated to a separate balance sheet or whether it has a current account. It turns out that for vehicles registered at the location of the parent organization, the declaration must be submitted to the tax authorities at the location of this organization. If the car is registered at the location of a separate division, accordingly, tax reporting must be submitted to the tax authority at the location of this division. Quite often situations arise when a car is transferred for operation to a separate unit, where it is temporarily registered. In this case, reporting should still be submitted at the location of the parent organization. After all, the Tax Code of the Russian Federation clearly defines that it must be submitted to the tax authority at the location of the vehicles, which recognizes the place of their permanent registration. The Tax Code of the Russian Federation says nothing about the possibility of submitting reports at the place of temporary registration. By the way, please note that according to paragraph 1 of Art. 83 of the Tax Code of the Russian Federation, in order to conduct tax control, organizations are subject to registration with the tax authorities, including at the location of the vehicles they own. However, registration of organizations as a transport tax payer is carried out without his participation. The tax authority independently carries out this on the basis of data received from the authorities carrying out state registration of vehicles. The specified data must be submitted to the tax office within 10 days after registering the car (clause 4 of article 85 of the Tax Code of the Russian Federation). And one more point: organizations that fall under the criterion of the largest taxpayers must submit tax returns for transport tax to the tax authority at the place of registration as the largest taxpayers. This is stated in paragraph 4 of Art. 363.1 Tax Code of the Russian Federation.

Object of taxation and tax base

In Art. 358 of the Tax Code of the Russian Federation provides a list of vehicles that are subject to taxation. These include, in particular, cars, motorcycles, buses, airplanes and other vehicles registered in the prescribed manner in accordance with the legislation of the Russian Federation. Quite often in practice, questions arise about whether vehicles that are not used for their intended purpose or are in an impound lot are recognized as taxable. Do they need to pay transport tax? The answer to this question can be found in the Letter of the Ministry of Finance dated February 18, 2009 N 03-05-05-04/01. According to its provisions, the obligation to pay transport tax is made dependent on the registration of the vehicle, and not on its actual use. Therefore, even if the car has been in the garage for a long time, but at the same time has not been deregistered, transport tax must still be charged on it. The opinion of the courts on the issue under consideration is similar. Thus, in the Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated July 27, 2007 N A29-8682/2006a, the arbitrators indicated that transport tax must be paid regardless of the technical condition and actual use of vehicles. What if the car is stolen? Is it recognized in this case as subject to transport tax? In accordance with paragraphs. 7 paragraph 2 art. 358 of the Tax Code of the Russian Federation, vehicles that are on the wanted list are not subject to transport tax, provided that the fact of their theft is confirmed by a document issued by an authorized body. Such a document, in accordance with clause 17.4 of the Methodological Recommendations for the Application of Chapter 28 of the Tax Code of the Russian Federation (Order of the Ministry of Taxes and Taxes of Russia dated April 9, 2003 N BG-3-21/177), is issued by the bodies of the Ministry of Internal Affairs of Russia (GUVD, OVD, ATC, etc.) carrying out the work for the investigation and detection of crimes, including theft of vehicles. In this case, in the event of theft (theft) of a vehicle, taxpayers submit to the tax authority a document confirming the fact of theft (return) of the vehicle. If the theft is documented, the vehicle ceases to be subject to taxation and, accordingly, transport tax ceases to be paid on it. As for the tax base, it is determined differently depending on the type of vehicle. For example, for vehicles with engines, this is the engine power in horsepower.

Vehicle power

Situation: how to determine the power of a vehicle to calculate transport tax?

Determine the engine power according to the data specified in the technical documentation.

For example, according to the data of the vehicle passport (PTS) (clause 18 of the Methodological Recommendations, approved by order of the Ministry of Taxes and Taxes of Russia dated April 9, 2003 No. BG-3-21/177). If the technical documentation does not contain the necessary data, determine the power of the vehicle based on an examination carried out in accordance with Article 95 of the Tax Code of the Russian Federation (clause 22 of the Methodological Recommendations approved by Order of the Ministry of Taxes and Taxes of Russia dated April 9, 2003 No. BG-3-21/177) .

Situation: how to determine the tax base for transport tax if the engine power is indicated in kW in the technical documentation of the vehicle?

Recalculate the engine power using a special coefficient.

To calculate the tax base for transport tax, engine power must be expressed in horsepower (subclause 1, clause 1, article 359 of the Tax Code of the Russian Federation). If in the technical documentation this indicator is expressed in kW, it must be recalculated using the formula:

| Engine power expressed in hp. With. | = | Engine power expressed in kW | × | 1,35962 |

Round the result obtained according to the rules of arithmetic to the second decimal place. This procedure is provided for in paragraph 19 of the Methodological Recommendations, approved by order of the Ministry of Taxes and Taxes of Russia dated April 9, 2003 No. BG-3-21/177.

If the horsepower of a car (including a hybrid) is expressed in fractional numbers, then when calculating the fee, you should apply the tax rate established for the power interval in which the result falls (without rounding). For example, if the car engine power is 100.6 hp. p., you need to apply the tax rate established for cars over 100 liters. With. up to 150 l. With. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated October 31, 2012 No. 03-05-07-04/18.

When calculating the tax amount, do not round the engine power indicator either.

An example of determining the tax base for calculating transport tax. In the PTS, the engine power is indicated in kW

The organization purchased a truck with an engine power of 210 kW. The accountant determined the tax base for calculating transport tax as follows: 210 kW × 1.35962 = 285.52 liters. With.

The tax rate for this category of vehicles is 8.5 rubles/l. With.

The tax amount was: 285.52 l. With. × 8.5 rub./l. With. = 2426.92 rub.

When to transfer the tax amount

Taxpayers-organizations must remit transport tax no later than the date established by the legislation of the region. According to the provisions of Chapter 28 of the Tax Code of the Russian Federation, such a date cannot be earlier than February 1 of the year following the tax period.

The laws of the constituent entities of the Russian Federation may introduce reporting periods for transport tax. These are the first, second and third quarters, respectively. In regions where reporting periods have been introduced, organizations must make advance payments throughout the year. The size of such a payment is one-fourth of the product of the tax base and rate. Advance payments must be transferred within the period established by the law of the constituent entity of the Russian Federation. When paying the final tax amount, advance payments made during the year must be taken into account. Regions in which reporting periods have been introduced have the right to exempt certain categories of taxpayer organizations from advance payments.

Taxpayers - individuals (including individual entrepreneurs) do not make advance payments for transport tax. They only remit the total tax amount stated in the notice. Individuals are required to pay transport tax no later than December 1 of the year following the expired tax period.

In addition, individuals can voluntarily make the so-called single individual tax payment. To do this, you simply need to transfer a certain amount to the appropriate Federal Treasury account. The money will be written off to fulfill the obligation to pay “property” taxes, including transport tax. The inspection itself will decide how to offset the funds: against upcoming payments or towards payment of arrears.

Results

The tax base for transport tax for vehicles with an engine is the engine power expressed in horsepower. For non-propelled water vehicles, the tax is calculated on the basis of gross tonnage in registered tons, and for aircraft - on the basis of the static thrust force of the jet engine, expressed in kilograms. For other watercraft and aircraft, the tax base is taken as a unit of vehicle.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.