Due date Rosprirodnadzor accepts calculations annually until April 15. For 2019 calculations are required

Posting Penalties According to a Writ of Execution Through Bailiffs in State Institutions Note: If

List of violations To fill out and submit 6-NDFL without errors, we strongly recommend that you refer to the letter

An individual entrepreneur can pay his taxes and insurance premiums without leaving his home and

If the goods do not comply with the terms of the contract or are of poor quality, the buyer has the right to return it

Practice shows that the status of a tax resident or non-resident of the Russian Federation when filling out section 2 of the form

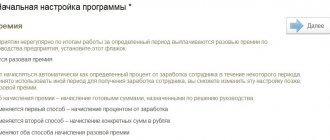

In this article, 1C experts talk about setting up calculation types in “1C: ZUP 8” ed.

In case of untimely or partial transfer of mandatory insurance contributions, the legislation of the Russian Federation provides for certain

Interest-free loan between legal entities tax consequences Good evening! I work as an accountant at a small

In Russia, the future pension of every working citizen does not depend on length of service, as it does