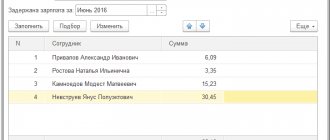

Calculation of compensation for salary delays in “1C: Salary and Personnel Management 8” In October 2021

Accounting entries for VAT when importing goods VAT entries when importing goods can be presented

The essence of the Unified Agricultural Tax 2021 The Unified Agricultural Tax system itself is one of 5 special tax regimes,

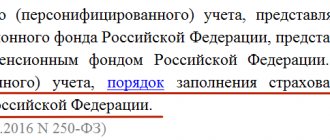

Source/official document: Resolution of the Pension Fund Board of February 1, 2016 No. 83p Where to submit: Pension Fund Frequency of submission:

As you know, Pension Fund employees often held employers accountable for completing the SZV-M form. However

Fixed assets in budget accounting - 2020-2021: introductory information In accordance with clause 21

The inkjet marker is designed for applying identifiers to goods, packaging and other products, and can

In order to collect receivables in court, you need to carefully prepare. Should be collected

What is downtime? Downtime occurs if an enterprise is forced to stop operations for a while. To idle time

What refers to inventories and inventories in the accounting of Russian organizations are those assets