Determining the storage periods for archival documents does not always fit into the provisions of standard and departmental lists. A way out of the situation may be to conduct an examination of the value of the document. However, there are also subtleties here, which the experienced archival specialist B.V. Albrecht will tell you about.

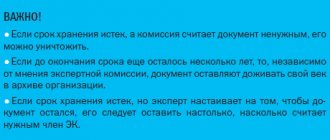

Examination of the value of documents is the most important and difficult stage of archival work, on which the further fate of the document depends, i.e., making a decision on its further storage or allocation for destruction. In essence, this is the classic definition of expertise, which can be found in all regulatory and methodological documents. At the same time, reality shows that the problems of examination and establishing periods for storing documents in the archive are much more complicated.

The concept of examination of the value of documents is given in Article 3 of the Federal Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation.” In the same law, Article 6 states that the federal government body in the field of archival affairs develops and approves Lists of standard administrative archival documents with storage periods.

These lists are the main regulatory and methodological documents for conducting examinations and establishing storage periods for all categories of standard organizational and administrative documents generated in the activities of all legal entities, regardless of their form of ownership.

Article 23 of this law determines that federal executive authorities develop and, after agreement with the central expert and verification commission of the federal authority in the field of archival affairs, approve industry-specific (departmental) lists of documents generated in the activities of bodies and organizations of this system.

These lists are the main regulatory and methodological documents when establishing storage periods for documents that reflect the specific (industry) activities of industry bodies and organizations. At the same time, the storage periods for standard organizational, administrative, scientific, technical and other special documentation established by industry (departmental) lists must correspond to the storage periods for identical types of documents specified in the list of standard documents.

It should be noted that at the present stage of development of state, economic and social structures of Russian society and the state, the creation of such documents as lists of archival documents with storage periods is significantly complicated for a number of objective reasons.

When developing sectoral (departmental) lists, this is primarily due to the fact that for most areas of economic activity the rigid vertical structure, which dominates the management of all sectors of economic (economic) activity, has disappeared. The structure of this vertical industry management system served as the basis for the development (compilation) of almost any industry list, when all types of bodies and organizations of the industry and the types of documents generated in them fit into a rigid scheme and the storage periods for documents in the archive formed in the categories of organizations were determined accordingly. data in a specific link of the list.

In modern conditions, when the old system of economic management has disappeared, creating sectoral lists according to the traditional scheme seems impossible. One of the ways out of this peculiar crisis is to create lists of documents not vertically, but horizontally, for mass groups, organizations homogeneous in their activities - primarily private ones. For example, for banks, insurance companies, trade organizations, audits, etc. It is most advisable to develop such lists for groups of organizations working (operating) in new, non-traditional areas of production and services, where it is important to determine the specific composition of documents generated in their activities, and their shelf life.

Why do we need a nomenclature of cases and how is it related to the storage periods of documents?

Let us analyze the storage periods for documents according to the nomenclature of cases using a practical example.

A graduate of the Financial Academy, Maria went to work at Virazh LLC, which is engaged in the renovation and construction of offices. Since the former student had no experience in financial matters, the management decided to assign her to the office for the duration of the probationary period - this way they could quickly become familiar with the structure of the company and study the specifics of its activities. This division consisted of 5 employees who dealt with various organizational issues, including responsibility for organizing the company’s document flow.

The department employee to whom Maria was assigned was developing a list of cases for the next year.

IMPORTANT! The list of cases for the next year is drawn up in the last quarter of the current year, approved by the head and put into effect on January 1 (clause 3.4.6 of the Rules for the operation of company archives dated 02/06/2002).

Maria was also involved in this work - she was tasked with setting storage periods for documents according to the nomenclature of cases opposite the names of case headings strictly according to the standard list.

IMPORTANT! The storage periods for documents are reflected in standard and departmental lists. From 02/18/2020, the basis for determining the deadlines is the List of standard documents and their storage periods, approved by order of the Federal Archive of Russia dated 12/20/2019 No. 236. The previously valid order of the Ministry of Culture dated 08/25/2010 No. 558 was cancelled.

Legal significance of an archival document

I would like to draw attention to another important aspect of classifying a number of types of documents as a permanent storage period, which is usually omitted by opponents - this is the legal significance of the document, its temporary legal effect and application.

In modern conditions of constant development and transformation of the legal field, thousands of legal acts are adopted, sometimes contradicting each other. Numerous legal conflicts inevitably arise about property rights, the legality of property seizure, privatization and compliance with legal norms.

Bankruptcy, loans-for-shares auctions, audit, securities market, issuers, competitions - these concepts have entered the economic life of society. Together with them, a huge layer of documents was formed covering these processes.

As a rule, the types of these documents have long-term legal application. Unfortunately, most regulations do not clearly indicate even the validity periods of these documents, not to mention the periods of their archival storage after the end of their immediate legal validity.

As practice shows, at present, court authorities and prosecutors are increasingly turning to documents on privatization, bankruptcy of legal entities and other documents reflecting certain economic and financial actions of organizations, and express dissatisfaction with their absence.

In these circumstances, with the obvious insufficiency of legal norms defining the retention periods for this information, professional archivists could not take on the burden of responsibility for establishing specific retention periods for these types of documents, and therefore also relied on maximum periods.

Experts in the archival industry quite rightly believe that it is not they, but the relevant government authorities (supervising, controlling, supervising) who should determine the storage periods for many specific types of documents that have legal significance and bear responsibility for these periods. Current practice does not yet make it possible to fully realize this important factor - determining the storage periods for a number of archival documents .

I would also like to remind you that not all archival documents that have a “permanent” storage period established in the List are promptly and automatically included in the Archive Fund of the Russian Federation.

In order to clarify this position, in the List of Standard Management Documents...(2010) on page 7, a note with one asterisk literally states the following: “The period of storage “permanently” of these types of documents in organizations that are not sources of acquisition of state, municipal archives, cannot be less than 10 years.” On page 12 of the List, a note with two asterisks indicates that during the liquidation of organizations that are not sources of acquisition of state and municipal archives, these types of documents can be accepted for storage on the principle of sampling organizations and documents.

Bearing in mind that out of 2.5 million registered legal entities, only about 120,000 (less than 5%) are sources of acquisition of state and municipal archives, the problem of fear of clogging the Archival Fund with unnecessary documents is largely removed. We can only talk about the length of time and the procedure for storing documents in the organizations that create them.

Thus, it must be recognized that the counter-arguments of the archivists who participated in the development of the List of Model Documents are no less thorough and have a normative basis in the form of the law.

Structure of the company's business portfolio

The list of cases of Virage LLC was formed based on the organizational structure of the company. The following departments took part in the document flow process:

- organizational issues division (office);

- personnel department;

- Department of Labor and Wages;

- Department of Economic Planning, Statistics and Finance;

- accounting and reporting department;

- Department of Tax Accounting and Declaration;

- labor protection department;

- production and technical department (PTO);

- other divisions.

Before putting storage periods next to those indicated in the nomenclature, Maria studied in detail the structure of the company and understood the functional purpose of each structural unit. Then she began to thoroughly understand the List approved by Order No. 236. Maria reflected information about the storage periods of certain documents in column 4 of the nomenclature. She started with the office and especially carefully studied the document flow of the department in which she was currently working.

Office documents: how long will they have to be stored?

The nomenclature of the office contained a list of a wide variety of files, the storage periods of which were strikingly different from each other. For example, a retention period of only 1 year applies to internal labor regulations (after replacement with new ones), and the collective agreement is required to be kept permanently.

The nomenclature of the office affairs was as follows (abbreviated):

| Case index | Case title | Number of storage units | Shelf life and article numbers according to the list | Note |

| 1 | 2 | 3 | 4 | 5 |

| 01. Office | ||||

| 01-01 | Charter of Virage LLC | Constantly Art. 28 | ||

| 01-02 | Collective agreement of Virage LLC | Constantly Art. 386 | Sent for information - until the need has passed | |

| 01-03 | Internal labor regulations of Virage LLC | 1 year Art. 381 | After replacing with new ones | |

| 01-04 | Orders of the director of Virage LLC on core activities | Constantly Art. 19 | ||

| 01-05 | Orders of the director of Virage LLC on administrative and economic activities | 5 years Art. 19 | ||

| 01-06 | Minutes of meetings with the manager | Constantly Art. 18 "e" | Minutes of operational meetings - 5 years | |

| 01-07 | Nomenclature of cases | Constantly Art. 157 | Structural divisions - 3 years | |

| — | — | — | — | — |

| Reserve | ||||

| Reserve | ||||

While filling out column 4 of the nomenclature, Maria drew attention to the last 2 lines in column 2 “Case title”. As it turned out, it is customary to leave several reserve lines in the nomenclature of any division of the company in case headings of cases appear that were not previously provided for in the nomenclature. Retention periods in these lines will be entered only after the reserve lines are filled with the names of cases - while Maria left them empty.

After entering the storage periods for documents reflected in the office nomenclature, Maria began documenting the personnel department.

What applies to documents of permanent storage?

- orders for core activities;

- acts of destruction of files and loss of documents;

- nomenclature of cases;

- staffing schedules;

- log of orders for core activities;

- inventory of files of permanent storage and personnel;

- targeted informatization programs;

- price tags, tariffs for products and services;

- statutory documents;

- registers of securities owners;

- annual balance sheets, estimates, plans and reports;

- annual reports to the Social Insurance Fund, Pension Fund and Federal Tax Service;

- privatization documents;

- lists of persons entitled to dividends;

- transaction passports;

- documents on long-term credit and investment activities (grants, tables, conclusions);

- documents on charitable activities.

We determine the storage periods for HR department documentation

HR documentation is distinguished by one nuance: many files are subject to storage for 50/75 years. Such a long storage period is provided for documents related to personal information about company employees.

Maria also filled out the personnel nomenclature with retention periods, which are presented in the table (abbreviated):

| Case index | Case title | Number of storage units | Shelf life and article numbers according to the list | Note |

| 1 | 2 | 3 | 4 | 5 |

| 02. Personnel | ||||

| 02-01 | Staffing table | Constantly Art. 40 | ||

| 02-02 | Personal files of employees | 50 years - if the documents were completed after 01/01/2003; 75 years - if documents were completed before 01/01/2003. Art. 445 | ||

| 02-05 | Vacation schedules | 3 years Art. 453 | ||

| 02-06 | Lists of persons subject to military registration | 5 years Art. 457 | ||

| 02-07 | Lists of retired employees | 5 years Art. 462 "w" | ||

| 02-08 | Documents (memos, reports, certificates, characteristics) on bringing to justice violators of labor discipline | 3 years Art. 434 "d" | ||

| 02-09 | Journal of registration of employment contracts | 50 years - if the documents were completed after 01/01/2003; 75 years - if documents were completed before 01/01/2003. Art. 463 "b" | ||

| — | — | — | — | — |

| Reserve | ||||

| Reserve | ||||

Maria studied individual documents from the nomenclature in particular detail. She was interested in questions related to what regulatory requirements they should meet and how they should be filled out correctly.

Maria found answers to her questions on our website.

For example:

- You can learn about the type and content of the staffing table from the material “Unified Form No. T-3 - Staffing Schedule (form)” ;

- the timing of approval of the vacation schedule and punishment for its absence is discussed in the article “Unified Form No. T-7 - Vacation Schedule” .

WE FILE CASES FOR STORAGE

Depending on the storage period, cases can be processed partially or completely. All files opened in the organization and having a storage period of more than 5 years are partially documented, with the exception of personnel files. The following cases are subject to full registration for storage, in accordance with the 2015 Rules:

- permanent shelf life;

- temporary (over 10 years) storage period;

- documents on personnel ( all , including those that have a five-year shelf life).

Stages of design of each volume. Complete registration of each volume of the case for storage occurs in the following order:

1) numbering of case sheets;

2) drawing up an internal inventory of the case;

3) drawing up a document certifying the case;

4) filing or binding of case documents;

5) design of the cover (title page).

Stage one: numbering the volume sheets

If the documents were previously numbered by someone in the same upper right corner and the new numbering does not coincide with the old one, then cross out the old number and write a new one next to it. Numbers placed in other parts of the sheet do not need to be corrected. If the volume includes a brochure with its own page numbering, then each sheet, including the cover, receives its own number in the general order.

Each numbered volume can have a sticker with the following information:

- total number of sheets;

- missing numbers;

- letter numbers.

This information will be useful to us a little later when drawing up a document certifying the case.

If there are several missing and lettered numbers in the volume, then they must be taken into account when calculating the number of sheets. For example, if there are 100 sheets of numbers in a volume, but there are three missing numbers and two letter numbers, then the total number of sheets in the volume will be 99 (100 – 3 +2).

The 2015 rules say nothing about the number of corrections in volume numbering. Obviously, if there are too many errors, then it is better to renumber the sheets. However, what meaning this “too much” begins with is unknown. In this case, we recommend that you familiarize yourself with clause 75 of the Rules of Notarial Office Work (approved by the decision of the FNP Board of December 17, 2012, by order of the Ministry of Justice of Russia dated April 16, 2014 No. 78):

Extraction

from the Rules of notarial office work

75. […] If more than 5 errors are made when numbering the sheets in a case (volume), the sheets of the case (volume) are numbered again.

[…]

This rule is not necessary for general office work, but at least it gives an idea of the number of errors when it is better to renumber the volume.

Stage two: compiling an internal inventory of the volume

It is not always necessary to create an internal inventory of the volume's documents. Let's quote the 2015 Rules:

Extraction

from the Rules for organizing storage, acquisition, recording and use of documents of the Archival Fund of the Russian Federation

and other documents in government bodies, local governments and organizations

4.30. To record documents of certain categories of cases on paper (personal, court files, materials of criminal cases, cases on awarding academic degrees and conferring academic titles, cases related to the issuance of copyright certificates and patent inventions), an internal inventory of case documents is compiled.

[…]

The internal inventory is a kind of table of contents for the volume.

The secretary, if necessary, can create an internal inventory for other categories of cases. Here is what they say about this: Basic rules for the work of archives of organizations (approved by the decision of the Board of Rosarkhiv dated 02/06/2002):

Extraction

from the Basic Rules for the Operation of Organizational Archives

3.6.17. An internal inventory of case documents is compiled to record documents of permanent and temporary (over 10 years) storage, the recording of which is caused by the specifics of this documentation (especially valuable, personal, judicial, investigative cases, etc.), as well as to record cases of permanent and temporary ( over 10 years) storage, formed according to types of documents, the headings of which do not reveal the specific content of the document.

[…]

Thus, it is possible to compile an internal inventory both with orders for the main activity (especially if, due to incorrect systematization, the numbering in it was violated), and also with correspondence, if this makes it easier to use the volumes.

The internal inventory form is given in the 2015 Rules (Appendix No. 27). The inventory has its own numbering of sheets, which can be entered automatically at the stage of creating a document in MS Word (Example 1).

Stage three: we draw up a document certifying the case

A certification sheet is drawn up for each volume of the case. The form of the sheet is also contained in the 2015 Rules (Appendix No. 8). It’s easy to fill out: we already know how many sheets there are in each volume, as well as how many missing and lettered numbers there are among them. As for the “features of physical condition”, we are talking about:

- about torn sheets;

- glued sheets;

- brochures, bound and sealed documents included in the volume;

- sheets of a larger format than most in the volume, and other non-standard documents for this volume (Example 2).

Stage four: stitching the volume

- Choosing a cover. Documents with a permanent shelf life are placed in cardboard covers specially designed for permanent storage documents (Fig. 1). It’s easier to find them on the websites of online stores, rather than in retail stores - the product is not the most popular, so people often forget to put it on the counter.

The cardboard binder is complemented by a flexible wide spine with an adhesive layer. The top and bottom covers have a crease with a 25 mm indentation from the left edge, which allows you to leaf through the case like a book and copy sheets without difficulty.

A volume decorated with such a cover looks like an ordinary book, only in a large format. Volumes designed in this way can be placed vertically on a shelf without fear that they will bend, crushing the contents.

- Making the cover. If management considers it too expensive, the secretary will have to pick up scissors, cardboard and create the covers himself. However, you can make decent covers only if you can find high-quality cardboard, cut into sheets equal to or slightly larger than A4. Nothing good will come from the usual “For children's creativity”.

To make your own cover, you will need cardboard, a sheet of vinyl vinyl (a durable, waterproof paper-based binding material) and double-sided tape.

The principle of stitching together purchased and homemade covers is the same:

1. Place the bottom cover, documents and top cover together, drill and sew the binding.

2. Wrap the soft material (if you make it yourself, a strip of vinyl vinyl) down behind the bottom cover and stick the tape tightly at the bottom (Fig. 2).

As a result, the homemade cover will look almost the same as in Fig. 3.

- We use a hole punch. Since documents are stitched in 4 punctures, it is better to use special hole punchers for 4 punctures, which punch a stack of documents from 150 to 300 sheets at a time (Fig. 4, 5).

You can also use a regular hole punch for 10 sheets with two holes, however, you will have to punch these ten sheets twice. The distance between the four holes should be 8 cm (in accordance with the recommendations of GOST 1791472 “Covers for long-term storage cases. Technical conditions”), so the value on the meter should be set to “888”.

Before punching holes in the volume, you need to arrange the case documents in the following order:

1) internal inventory (if it was created);

2) case documents;

3) certification sheet.

- We select a needle and thread. The sewing needle is too small, it is better to use a bag needle (the so-called “gypsy”) - long (about 12 cm) and with a wide eye. You will need a strong thread, but you can fold it several times using regular thread. You can also sew with bank twine, but it is not easy to thread it even into a “gypsy” needle.

The length of the thread for a standard tom is approximately 1 meter. It is best to determine the optimal length for yourself experimentally - already on the third volume you sew it will become clear how much it will be needed. There is no need to tie a knot at the end of the thread, as with normal sewing - the ends will still be cut to the optimal length. If the volume was pierced (punched, drilled) carefully, there will be no problems with threading, since the diameter of the needle is much smaller than the diameter of the hole from the drill or hole punch.

The direction of the needle and thread when sewing a volume is shown in Figure 6.

After both ends of the thread are pulled out from the back of the volume, they are tied (not tightly, so that the volume can not only be opened, but also, if necessary, make a copy of any document, but also not loosely, so that the sheets of the file do not “walk”) and are circumcised.

Please note: in general and personnel records management, it is not necessary to remove the ends of the threads from the inside of the cover and fasten them with a certification sticker. The ends are trimmed and, if possible, hidden under the cover. If there is no cover, they are simply displayed from the inside without any further manipulation.

Stage five: designing the title page (cover) of the volume

The form of the title page of the case is given in the Rules 2015 (Appendix No. 28). Filling it out usually does not cause any difficulties. Just remember that the top line of the cover “Name of the state (municipal) archive” remains blank. If the case ever ends up in the state archives, its employees will fill out this line themselves.

In the lower left corner of the title page the archival code of the case is affixed: fund number, inventory number and the number of this storage unit according to the inventory (Example 3).

We glue the title page onto the cover of the volume. It is best to use PVA glue, but then the case must be immediately placed under a press for several hours, otherwise the title page will stick unevenly and wrinkle in places. The least suitable materials for this are glue sticks (the cover will come off after a couple of hours) and office glue (too liquid and will ruin the title page so that no press can save it). Printing covers on sheets with an adhesive layer is expensive and ineffective: the “adhesive layer” on them is conditional, and the cover can be removed with one movement of the hand.

So, the algorithm for processing documents for permanent storage is as follows:

Papers of the “salary” department and their storage periods

The retention period for documentation related to the calculation and payment of wages in most cases does not exceed a 5-year period, with the exception of certain documents that cannot be destroyed for 50/75 years (for example, employee personal accounts). And local acts, on the basis of which settlements with personnel are carried out, are subject to permanent storage.

The nomenclature and storage periods for this type of document are presented in the table (abbreviated):

| Case index | Case title | Number of storage units | Shelf life and article numbers according to the list | Note |

| 1 | 2 | 3 | 4 | 5 |

| 03. Labor and wages | ||||

| 03-01 | Regulations on remuneration and bonuses | Permanently or 5 years after replacement with new ones Art. 294 "a" | ||

| 03-02 | Personal accounts for employee wages | 50 years - if the documents were completed after 01/01/2003; 75 years - if documents were completed before 01/01/2003. Art. 296 | ||

| 03-03 | Applications for financial assistance | 5 years Art. 298 | ||

| 03-04 | Payroll statements for the payment of wages to employees of Virage LLC | 6 years Art. 295 | In the absence of personal accounts: 50 years - if the documents were completed after 01/01/2003; 75 years - if documents were completed before 01/01/2003. | |

| 03-05 | Employees' sick leave certificates | 5 years Art. 618 | ||

| 03-06 | Writs of execution for employees of Virage LLC | 5 years after execution Art. 299 | ||

| — | — | — | — | — |

| Reserve | ||||

| Reserve | ||||

The names of the cases of this division of the company were familiar to Maria - during her internship, she assisted the payroll accountant and carried out individual calculations herself. But this is the first time I’ve heard about the storage periods for these statements, certificates and registers.

You can find out more about the form and procedure for filling out documentation related to salary calculations on our website. For example:

- A sample of filling out a pay slip for a company employee is available for viewing in the material “Unified Form No. T-51 - Pay Slip” ;

- You can find out more details about preparing a payroll slip from the material .

Periods during which tax documents cannot be disposed of

Studying the headings of the nomenclature files for the tax accounting and declaration department, Maria made the following conclusion for herself: this type of documentation refers to short-term storage papers. Almost all files of this department, including tax reporting and declarations, were subject to storage for 5 years:

| Case index | Case title | Number of storage units | Shelf life and article numbers according to the list | Note |

| 1 | 2 | 3 | 4 | 5 |

| 04. Tax accounting and declaration | ||||

| 04-01 | Tax accounting policy of Virage LLC | 5 years after replacement with new ones Art. 267 | ||

| 04-02 | Certificates of registration with the tax authority | until the need passes Art. 24 | ||

| 04-03 | Correspondence regarding tax disagreements | 5 years Art. 314 | ||

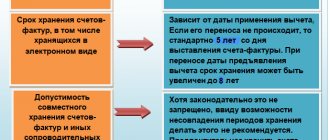

| 04-04 | Invoices | 5 years (before 02/18/2020 it was 4 years) Art. 317 | ||

| 04-05 | Documents (calculation of tax amounts, messages about the impossibility of withholding tax, tax accounting registers) on personal income tax | 5 years Art. 311 | In the absence of personal accounts: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 | |

| 04-06 | Declarations (calculations) for all types of taxes | 5 years Art. 310 | ||

| 04-07 | Calculations for insurance premiums (annual and quarterly) | 50 / 75 years Art. 308 | ||

| 04-08 | Cards for individual accounting of the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums | 6 years Art. 309 | In the absence of personal accounts: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 | |

| 04-09 | Registers for calculating land tax of Virage LLC | 5 years Art. 307 | ||

| 04-09 | Certificates of fulfillment of the obligation to pay taxes, fees, insurance premiums, penalties and tax sanctions, certificate of the status of settlements with the budget | 5 years Art. 305 | ||

| 04-10 | Certificates of income and tax amounts for individuals | 5 years Art. 312 | In the absence of personal accounts: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 | |

| — | — | — | — | — |

| Reserve | ||||

| Reserve | ||||

Maria was familiar with tax documentation only theoretically. Therefore, to expand her knowledge, she used the materials on our website, from where she learned not only about all types of invoices (regular, corrected and adjustment), but also became acquainted with the rules for preparing tax returns and other similar documents.

You can learn more about filling out an amended invoice from the material “In what cases is an amended invoice used?” .

A practical example of filling out an adjustment invoice is contained in the article “Sample of filling out an adjustment invoice (2019 - 2020)” .

“What is the procedure for filling out a VAT return (example, instructions, rules)” will help you fill out the VAT return correctly .

What to do with documents when liquidating a company

When liquidating organizations, including as a result of bankruptcy, documents generated in the course of their activities must be submitted to the state or municipal archive (Clause 10, Article 23, Federal Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation”) .

The following documents of a liquidated organization must be submitted to the archive:

- documents on the personnel of the organization;

- documents whose temporary storage periods have not expired;

- documents related to the Archival Fund of the Russian Federation (documents can receive this status based on the results of an examination of their value).

All of the above documents are transferred by the liquidation commission or bankruptcy trustee for storage in the appropriate archive on the basis of an agreement. Before transferring the documentation, the liquidation commission will have to streamline it.

To do this, documents are grouped by type, chronology, and storage period. Then they are numbered, filed, sorted into packs and boxes. Then the documents with the inventory are transferred to the archive.

If an organization ceases to exist as a result of reorganization, the documentation is transferred to its legal successor (clause 3.3.4 of the Basic Rules for the Operation of Archives of Organizations).

Nuances of storage periods for some tax documents

From the knowledge she acquired at the academy, Maria remembered that the loss received by the company can be carried forward to future periods, reducing the volume of the tax base by its amount (or part of it). But in this case, how to store documentation related to confirmation of the amount of loss and the procedure for transferring to subsequent periods? Is it possible to get rid of the calculations and declarations justifying the loss 5 years after its receipt, as provided for in the list for primary documents?

IMPORTANT! In accordance with paragraph 4 of Art. 283 of the Tax Code of the Russian Federation, the company must have documents confirming the amount of the loss incurred.

What are these documents and what is their shelf life? Maria leafed through the entire Tax Code, but did not find this information. Then she turned to judicial practice, from which she found out that the amount of loss received can be confirmed with an income tax return and a primary report (Resolution of the Federal Antimonopoly Service of the Moscow Region dated August 31, 2010 No. KA-A40/9849-10-2). Officials of the Ministry of Finance include all primary accounting documentation that substantiates the financial results of the company as such confirmations (letter dated April 23, 2009 No. 03-03-06/1/276).

Thus, the primary accounting document must be kept during the entire period of loss transfer plus 4 years after its complete write-off. Fortunately, Virage LLC was a prosperous and profitable company, and this nuance associated with calculating the storage periods for tax and accounting documentation did not concern it.

For more information about the nuances of loss transfer, see the materials in this section of our website.

Submission of documents to the archive

Accounting documents should be stored in accordance with the regulations approved by letter No. 105 of the USSR Ministry of Finance dated July 29, 1983, in special cabinets and safes installed in a separate room called the “archive.” Recommendations for the arrangement of archives in organizations are defined in the Rules approved by the board of Rosarkhiv on February 6, 2002. These requirements are desirable, but not mandatory. No one will be punished for violating them. But documents and strict reporting forms must be stored in safes or special separate rooms equipped to ensure safety. Such requirements are defined in Decree of the Government of the Russian Federation dated May 6, 2008 No. 359. Similar storage conditions must be provided for documents classified as “trade secrets”. All other documents can be stored simply in cabinets or on racks. You can even do it right in the office of the chief accountant or manager. At the same time, it is advisable to store documents such as bank statements, cash orders, advance reports, acts and others in chronological order in bound form. If the organization has already undergone inspections by the Federal Tax Service and other services, or if it does not have enough space to store documents, it can transfer them to the municipal archive. There, documents are accepted according to the inventory, stitched and numbered. After the expiration of the storage period, documents can (and sometimes need to) be destroyed. For this purpose, a special commission is created that checks documents, records the fact of their destruction and draws up a report about it. By observing the rules established by law, the procedure and terms for storing documents, any businessman not only insures himself against troubles with inspection authorities, but also creates a documentary evidence base, which sooner or later he or his employees may need to defend their legal rights and interests.

Storage periods for accounting documentation

Starting to understand the storage periods for accounting documents, Maria began the most voluminous section of the nomenclature. Even the larger cases, united under the same headings, struck her with their diversity. Only accounting documentation had such a variety of forms and types. Starting from invoices and acts of work performed to inventory lists and reporting. Reporting was subject to permanent storage, in contrast to invoices, acts and other primary documents, the storage period of which did not exceed (according to the list) 5 years:

| Case index | Case title | Number of storage units | Shelf life and article numbers according to the list | Note |

| 1 | 2 | 3 | 4 | 5 |

| 05. Accounting and reporting | ||||

| 05-01 | Accounting policy for accounting of Virage LLC | 5 years Art. 267 | After replacing with new ones | |

| 05-02 | Annual financial report of the organization | Constantly Art. 268 "a" | ||

| 05-03 | Quarterly financial statements of the organization | 5 years Art. 268 "b" | ||

| 05-04 | Documents (protocols, acts, certificates, calculations, statements, conclusions) on revaluation, determination of depreciation, write-off of fixed assets and intangible assets | 5 years Art. 323 | After disposal of fixed assets and intangible assets | |

| 05-05 | Documents (minutes of meetings of inventory commissions, inventories, lists, acts, statements) on the inventory of assets and liabilities | 5 years Art. 321 | Subject to verification | |

| 05-06 | Documents (copies of reports, applications, lists of employees, certificates, extracts from protocols, conclusions, correspondence) on the payment of benefits, payment of sick leave, financial assistance | 5 years Art. 298 | ||

| 05-07 | Primary accounting documents and related supporting documents (cash documents and books, bank documents, counterfoils of cash check books, orders, time sheets, bank notices and transfer requests, acts of acceptance, delivery, write-off of property and materials, receipts, invoices and advance reports , correspondence) | 5 years Art. 277 | Subject to verification. If disputes arise, disagreements remain until a decision is made on the case | |

| 05-08 | Agreements on financial liability of financially responsible persons | 5 years Art. 279 | After the dismissal (change) of the financially responsible person | |

| 05-09 | Accounting (budget) accounting registers (general ledger, order journals, memorial orders, account transaction journals, turnover sheets, accumulative sheets, development tables, registers, books (cards), statements, inventory lists) | 5 years Art. 276 | Subject to verification | |

| 05-10 | Cash book of Virage LLC | 5 years Art. 277 | Subject to verification. If disputes arise, disagreements remain until a decision is made on the case | |

| 05-11 | General ledger of Virage LLC | 5 years Art. 276 | ||

| 05-12 | Fixed asset accounting cards | Before the liquidation of the organization Art. 329 "a" | ||

| — | — | — | — | — |

| Reserve | ||||

| Reserve | ||||

You can find a detailed list of unified documents in the material “Unified forms of primary documents (list)” .

Details about each of these documents are described in separate articles posted on our website.

For example, about the nuances of preparing a consignment note from the material “Unified form TORG-12 - form and sample” .

Storage of HR documents

Personnel documents are almost always strict reporting documents. Moreover, they contain personal data of employees, so special storage conditions must be provided for them. Responsibility for the safety of both the documents themselves and the data contained in them lies with a specially authorized person - the personnel inspector. If such a position is not provided in the organization, then the chief accountant or manager will be responsible for personnel documents. Such an inspector is in charge of all personnel orders, employee registration cards, their statements, as well as work books. When generating primary documents, personnel documents and wage documents, you should be guided by the norms of the Federal Law “On Accounting”. As follows from this law, primary accounting documents can be accepted for accounting only on the condition that they are compiled in a form from albums of unified forms of primary accounting documentation. When registering labor relations with employees, it is necessary to use strictly defined unified forms approved by. Documents such as orders for hiring and dismissal, personal cards and statements of employees, orders for awards, bonuses and vacations, as well as personal accounts of employees must be stored for 75 years. Time sheets, staffing schedules, memos and business trip documents must be kept for at least 5 years. Employee vacation schedules and vacation orders can only be saved for the next year.

Nomenclature of files of the labor protection department and periods of their storage

After the storage periods for accounting and tax documents were reflected in the company’s nomenclature, Maria proceeded to a section that was completely unknown to her—the affairs of the labor protection department. All the case headings indicated in the nomenclature were present in the standard list approved by Order No. 326, so it was easy to set their storage periods:

| Case index | Case title | Number of storage units | Shelf life and article numbers according to the list | Note |

| 1 | 2 | 3 | 4 | 5 |

| 06. Occupational safety | ||||

| 06-01 | Health and safety instructions | constantly Art. 8 "a" | ||

| 06-02 | Reports on the implementation of special labor safety measures and documents for them (protocols, decisions, conclusions, lists of workplaces, information, data, summary statements, declarations of conformity, cards for special assessment of working conditions for specific workplaces, lists of measures to improve working conditions and labor protection) | 45 years Art. 407 | Under harmful and dangerous working conditions: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 | |

| 06-03 | Journals, accounting books: training on labor protection (introductory and on-the-job); preventive work on labor protection, testing knowledge on labor protection | 45 years old, art. 423 "a" 5 years old, art. 423 "b" | ||

| 06-04 | Fire safety briefing log | 3 years Art. 613 | ||

| 06-05 | Documents (reports, acts, lists, schedules, correspondence) of periodic medical examinations | 3 years Art. 635 | ||

| — | — | — | — | — |

| Reserve | ||||

| Reserve | ||||

As can be seen from the nomenclature, the labor protection department prepared a variety of journals, which had to be stored from 3 (for example, a fire safety briefing journal) to 45 years (SOUT documents).

WE PREPARE DOCUMENTS FOR REGISTRATION

- We remove unnecessary things. Most likely, until now the documents were kept in filing folders. It is too early to remove documents from them. To begin, let's look through each folder and remove from it drafts, doublet (repeated) copies of documents, sheets of notes, and from the documents themselves - paper clips and staplers.

- We divide things into volumes. At this stage, we determine how many volumes of the case will end up and how best to divide the documents into volumes: by month, by number of sheets, by counterparties, by last names, etc. In accordance with clause 4.20 of the Rules for organizing the storage, acquisition, recording and use of documents of the Archival Fund of the Russian Federation and other documents in government bodies, local governments and organizations (approved by order of the Ministry of Culture of Russia dated March 31, 2015 No. 526; hereinafter referred to as the 2015 Rules) Each case should contain no more than 250 sheets.

It is not at all necessary to come up with some kind of system for dividing documents into volumes; it is enough to follow this rule. The uniform distribution of sheets, firstly, allows you to create volumes that are approximately equal in thickness, and secondly, it makes it easier to find documents in your file. Thus, if the file contains approximately 300 sheets, then it is better to make two volumes of 150 sheets each, rather than 250 and 50.

Then we carefully remove the documents from the folders, distribute them into volumes and begin processing them for storage.

Planning and statistical documentation: how long to store it

The next section of the nomenclature was small in volume. It consisted mainly of plans and statistical reporting. All forecast and planning papers as a whole according to the list were ordered to be kept permanently. Only individual employee plans and reporting did not require such a long retention period - the period of time during which they cannot be disposed of is only 1 year.

| Case index | Case title | Number of storage units | Shelf life and article numbers according to the list | Note |

| 1 | 2 | 3 | 4 | 5 |

| 07. Planning, statistics and finance | ||||

| 07-01 | Economic and social development plans of Virage LLC | Constantly Art. 196 | ||

| 07-02 | Business plans of Virage LLC, documents (feasibility studies, conclusions, certificates, calculations) to them | Constantly Art. 197 | ||

| 07-03 | Annual plans of Virage LLC for main areas of activity | Constantly Art. 198 | ||

| 07-04 | Operational plans (quarterly, monthly) for all areas of activity | Until the need disappears Art. 201 | ||

| 07-05 | Individual employee plans | 1 year Art. 203 | ||

| 07-06 | Documents (tables, certificates, calculations) of summary statistical reports | Until the need passes Art. 338 | ||

| 07-07 | Individual employee reports | 1 year Art. 216 | ||

| — | — | — | — | — |

| Reserve | ||||

| Reserve | ||||

Why is it profitable to cooperate with Rentabox?

Today, off-site document storage is gaining increasing popularity - and this is understandable, because it is convenient, efficient, allows you to save time and not be distracted from primary tasks. The Rentabox company has innovative equipment and the necessary conditions for storing all kinds of papers. In addition, we comply with all legal regulations and requirements.

Here are just a few advantages of this service from Rentabox:

- Reducing unscheduled workload on employees (constant sorting of papers).

- Complete protection and safety.

- Significant cost savings (equipment of your own archive in the office will cost many times more).

- Freeing the office from a large number of unused papers.

- Temporary storage of documents outside the office is carried out in full compliance with legal regulations.

If you are looking for a convenient way to store important papers, contact the services of our company - we will help you rent boxes for storing documents and save your time and effort. Call now and place your order!

Where can I find out the storage periods for documents not included in the standard list?

The section of the nomenclature for cases formed or used in the production and technical department (PTO) included headings of cases that were not at all familiar to Maria. And in the standard list approved by Order No. 236, she did not find documents with similar names. Since the shelf life in column 4 of the nomenclature must be entered in any case, Maria turned to her immediate supervisor for help, who entrusted her with this task.

From him, Maria learned that the storage periods for company documents are determined on the basis of a standard list approved by Order No. 236, as well as departmental lists. For example, periods of storage of VET documents must be determined according to the List of standard archival documents generated in the scientific, technical and production activities of organizations, indicating storage periods (as amended by Order of the Ministry of Culture dated April 28, 2011 No. 412).

According to the specified list, Maria indicated in the nomenclature the corresponding storage periods for VET documentation:

| Case index | Case title | Number of storage units | Shelf life and article numbers according to the list | Note |

| 1 | 2 | 3 | 4 | 5 |

| 08. VET | ||||

| 08-01 | ||||

| 08-02 | Technological maps | Constantly Art. 141 | ||

| 08-03 | Technological rules and regulations | Before replacing with new ones Art. 143 | ||

| 08-04 | Technological process specifications | Before the liquidation of the organization Art. 145 | ||

| 08-05 | Technological passport | As long as the need exists Art. 197 | ||

| 08-06 | Tool setting chart | Before replacing with new ones Art. 213 | ||

| — | — | — | — | — |

| Reserve | ||||

| Reserve | ||||

Having studied the above list, Maria asked another question to her supervisor: how to determine the periods during which VET documents are subject to storage if they are not indicated in this list? You will find out the answer to this question in the next section.

Document storage. Storage periods, destruction and disposal of primary accounting documents

Procedure and terms of storage of accounting and tax accounting documents, personnel documents

Any organization, regardless of its types of activities, production volumes, or staff size, inevitably faces legal requirements for documenting financial and economic transactions and labor relations. This requirement is due not only to the need to streamline the production process, but also to the need to exercise state control over the activities of business entities. The legislation establishes certain requirements for the composition and form of documents used to document the production process, as well as requirements for the timing and procedure for storing and destroying these documents.

Requirements for storage periods of accounting and tax documents