For a legal entity, borrowing money from a licensed financial and credit institution is a complex and costly procedure. Applying for a loan requires collecting a large amount of paperwork. Interest is paid for the use of borrowed funds, the rate of which is unilaterally set by the lender. In addition, the loan agreement obliges the borrower to regularly report to the lender about his financial situation. An easier way is to borrow the required amount from another legal entity. It is important to know how to make accounting entries regarding the issuance of a loan.

Features of obtaining a loan

A legal entity-lender does not need to obtain a special license if such business transactions are episodic in nature and loans are not issued on an ongoing basis (explanations of the Supreme Arbitration Court of the Russian Federation dated August 10, 1994 No. S1-7/OP-555).

Recipients of free funds available to the lender can be founders, business partners, individual entrepreneurs, employees or ordinary citizens (Clause 1 of Article 807 of the Civil Code of the Russian Federation). Funds can be transferred to the borrower in Russian rubles or foreign currency.

A feature of such agreements is the possibility of transferring for use for a specified period not only financial assets, but also property assets (part of fixed or current assets). A legal entity can provide funds or act as their recipient. Postings for obtaining a loan are a reflection of transactions with borrowed funds in accounting.

Conditions affecting loan accounting

A loan is a transfer of funds (or other means of payment) on debt that occurs between individuals or legal entities, as well as between a legal entity and an individual.

A credit institution never participates in this procedure, since operations with its participation, despite the same nature of the relationship, have different names: loan and deposit (for an individual) or deposit (for a legal entity). Accounting entries arise only for legal entities that can both borrow funds from legal entities or individuals and give them to the same entities, but the nature of the accounting entries does not depend on with whom exactly (a legal entity or individual) the borrowing agreement was concluded. At the same time, there are points that affect the correspondence of accounts used in these records.

For the organization giving the loan, it matters:

- Whether the loan is interest-bearing or interest-free;

- what types of activities (usual or other) does this process include for her?

It is important for the recipient of funds:

- for how long they were taken: less or more than a year;

- whether borrowed funds are invested in the creation of an investment asset.

Each of these conditions will affect the selection of account correspondence in the record of transactions performed in connection with the loan.

You will find a selection of forms for drawing up a loan agreement in various situations in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Specifics of loan accounting

The key factor in the correct display of loan transactions in accounting is the lender’s understanding of the question: whether the funds lent are a financial investment for the company.

Monetary or material assets lent are recognized as a financial investment under the following conditions:

- the relationship between the lender and the borrower is secured by a formal agreement;

- the lender assumes all potential risks of non-payment or non-repayment of the loan;

- the transferred assets will generate stable income for the company during the contract period (financial assets or material assets are transferred for use at interest at a rate agreed in advance).

If these three conditions are not met, the agreement concluded between the parties concerned is an interest-free loan agreement.

The second factor of correct accounting is the period for which the loan is provided. Short-term loans are issued for a period of less than 12 months, long-term - for a period of more than a year. The account number on which it will be recorded depends on the loan term.

Accounting entries for credit transactions

Since 2008, in response to the requirement to receive accrued interest on placed funds, banks began to create reserves for possible losses.

Provisions for this debt at accrued interest are created separately for current interest and separately for overdue interest.

In accounting, the creation of a reserve for accrued interest is reflected by the posting:

D-t

706 06 (symbol 25302),

Kit

474 25.

Personal accounts are opened on account 474 25 to record reserves for interest claims. The reserve is formed in the currency of the Russian Federation (rubles).

Accounting for credit lines and overdrafts

A lending agreement may provide for the issuance of a loan either on a one-time basis or in tranches based on a credit line agreement.

A loan can also be issued in the form of an overdraft, i.e., lending to a client’s settlement (current) account for a short period of time to pay for settlement documents when there is a temporary insufficiency of funds on it.

Overdraft is a form of lending to a bank client account or LORO correspondent account in the absence of funds to make current payments. Overdraft is provided only if it is provided for in the agreement. In fact, an overdraft is a form of lending. This does not mean that the bank cannot obtain collateral for an overdraft.

In developed countries, overdraft is provided to the most reliable customers due to its high credit risk. In the United States, overdraft was prohibited for many years, and the ban on it as a lending tool was lifted only in the early 80s.

Typical terms of an overdraft agreement appear to be a maximum amount of funds provided, an interest rate for the use of those funds, and terms for repayment of the overdraft. It would be reasonable to stipulate in the agreement that the overdraft is provided subject to the condition of the “good” financial condition of the borrower client.

Payment documents are paid not from the overdraft account, but from the client’s bank account. By default, all funds received into the client's bank account must be transferred to repay the overdraft. However, in Russia this condition is not always met.

Overdrafts are accounted for in the accounts of section 4 for accounting for loans provided on balance sheet accounts of the second order under number 01.

The volume of the overdraft provided in accordance with the agreement is taken into account in the off-balance sheet accounts of Chapter “B” of Section 5.

The Bank of Russia provides for the existence of two types of credit lines when lending - “under the issuance limit” or “under the debt limit”. A combined form is also provided, including both of these conditions. The conditions for the functioning of overdrafts are set out by the Bank of Russia in Regulation No. 54-P.

The “issuance limit” means the conclusion of an agreement, the condition of which is the issuance of a certain amount of funds in total under the agreement (cumulatively). When issuing in tranches, when the moment comes when the amount of funds disbursed in tranches reaches the agreed amount, the credit line is considered exhausted regardless of whether the loan has been partially repaid.

If we talk about lending “under the debt limit,” then in this case it does not matter how much money is issued (cumulatively), but the main condition is the maximum debt of the borrower at each point in time.

Let us dwell on the comparison of overdraft and current account.

A current account is a single current and loan account opened by a bank for its client. According to the economic essence, an overdraft paired with a current account performs the function of a current account. However, this is true only until additional demands arise on the client’s current account that have a higher priority in the payment priority group than repayment of debt to the bank.

The bank keeps records of the credit line opened to the borrower on balance sheet accounts in accordance with the terms of placement of funds determined by the credit line agreement, for separate personal accounts opened in analytical accounting in the context of each part of the issued tranche.

If the actual term of individual parts (tranches) of the issued loan falls on the same time interval when reflecting the loan debt, then these individual tranches can be accounted by the bank on one personal account of the corresponding second-order balance sheet account.

When opening a credit line under the “issuance limit,” the bank makes the following accounting entry:

D-t

999 98,

K-t

off-balance sheet account 913 16 “Unused credit lines for the provision of loans.”

When issuing a tranche under a credit line for the specified amount, the following accounting entry is made:

D-t

off-balance sheet account 913 16 “Unused credit lines for granting loans”,

K-t

999 98.

When the last part of the loan (last tranche) is issued to the borrower, the following is posted:

D-t

off-balance sheet account 913 16 “Unused credit lines for granting loans”,

K-t

999 98.

In this case, off-balance sheet account 913 16 is closed.

When opening a credit line under the “debt limit,” the bank makes the following accounting entry:

D-t

999 98,

K-t

off-balance sheet account 913 17 “Unused limits for the provision of loans in the form of “overdraft”, as well as “under the debt limit”.

When providing a borrower client with a portion of a loan (tranche) under an open credit line, the following accounting entries are made:

D-t

off-balance sheet account 913 17 “Unused limits for the provision of loans in the form of “overdraft”, as well as “under the debt limit””,

K-t

999 98.

If the credit line agreement simultaneously provides for the establishment of a “disbursement limit” and a “debt limit” for the borrower, then off-balance sheet accounting of the amount of the borrower’s unused limit for receiving funds under such agreements is carried out in the manner described above, but during the entire term of the agreement on the opening of a credit line on an off-balance sheet account 913 17, the actual (real) value of the bank’s contingent obligations to place funds to the borrower must be reflected, defined as the minimum value of all quantitative restrictions on the size of the credit line provided for in the agreement, valid for each day (date).

Repayment of loans provided under a credit line opened to the borrower client in the form of an overdraft

Operations for repaying loans under credit line agreements, which imply the establishment of an “issuance limit” for the client-borrower, provide that when the borrower fully or partially repays the debt to repay the principal amount of the loan provided under an open credit line, the unused balance of the “issuance limit” on the off-balance sheet account 913 16 is not restored.

In addition, the off-balance sheet account 913 16 can be closed at the end of the period during which the borrower client can exercise the right to receive funds (loan), even if the limit is not fully selected.

When the borrower fully or partially repays the principal debt on a loan provided under a credit line under a “debt limit”, the limit is restored to the amount of funds returned to the creditor bank, and the following accounting entry is made:

D-t

999 98,

K-t

off-balance sheet account 913 17 “Unused limits for the provision of loans in the form of “overdraft”, as well as “under the debt limit”.

When the credit line agreement is terminated, the following accounting entries are made:

D-t

off-balance sheet account 913 17 “Unused limits for the provision of loans in the form of “overdraft”, as well as “under the debt limit””,

K-t

999 98.

In this case, off-balance sheet account 913 17 is closed.

Analytical accounting of lines and overdrafts is carried out in the context of each agreement separately.

Interest on overdrafts is accrued in accordance with the terms of the current agreement. This may be a daily accrual reflected on the balance sheet or accrual with other regularity, but in any case, the interest due to the bank must be accrued on the last working day of the month to the last calendar day of the month. Accounting entries are made:

D-t

474 27,

Kit

706 01.

Since overdrafts are provided primarily to reliable customers, loan receivables, as a rule, belong to the quality category, income from which is recognized.

Accounting for overdue debt on issued loans and accrued interest

Loans not repaid by borrowers on time are accounted for separately from current loan debt.

Overdue debt on loans issued in rubles and foreign currency is recorded on balance sheet accounts for:

· loans not repaid on time (account 458). Accounting for second-order accounts is carried out by groups of borrowers, and in analytical accounting in the context of individual contracts;

· overdue loans provided to other banks (account 324). Records are kept for each borrower and agreement.

Accounting for accrued but not received on time (overdue) interest on loans is carried out based on the quality category of the debt.

If interest income on a loan is recognized as such (this is quality category I, II or III), then interest continues to accrue on the balance sheet. A reserve for possible losses is created for them.

If interest is not recognized as income (III, IV or V quality categories), then from the date of reclassification they are recorded in off-balance sheet account 916 04 (916 03 - for interbank loans).

The issue of recognizing interest income on category III debt, as mentioned earlier, is decided by the bank independently.

Accounting for overdue debt on the principal debt is carried out on separate personal accounts of balance sheet account 458 for accounting for overdue loans.

Accounting for overdue recognized interest on loans is carried out on the active accounts of the balance sheet account 459 for accounting for overdue interest on loans, and for the interbank account - on account 325.

The scheme for reflecting the transfer into arrears in accounting is as follows:

D-t

458,

K-t

account for accounting of loan debt - for the amount of the principal debt;

D-t

459,

K-t

474 27 (requirements for receiving interest) - for the amount of accrued interest.

After transferring interest to accounts for overdue interest, the bank restores the reserve created for accrued interest and creates a reserve for overdue interest. In this case, the reserve is debited from account 474 25 (requirements for interest) to the credit of accounts 325 05 (for interbank loans) or 459 18 (for other loans).

If a loan is reclassified with a change in the category of debt quality into a group for which income is not recognized, then further interest is accrued on accounts 916 04 or 916 03.

Interest is accrued on a loan issued but not repaid within the time frame and in the manner stipulated by the loan agreement. If the next interest is not overdue and is recognized as income, then it is taken into account in the general manner.

The additional creation of the reserve for accrued interest is reflected by the posting:

D-t

706 06 (symbol 25302),

Kit

459 18, 325 05.

Accounting for overdue loans of banks on the principal debt is carried out on separate personal accounts of balance sheet account 324 for accounting for overdue loans granted to other banks. Accounting for overdue interest on interbank loans is carried out on balance sheet account 325 for accounting for overdue interest on interbank loans. The principle scheme for reflecting these transactions in accounting is not fundamentally different from conventional lending in any way, except for account numbers.

If the loan was secured by collateral, the collateral rights must be exercised no later than 30 days after the delay in payments of principal or interest.

Upon receipt of funds and a document for payment of interest and (or) principal, the amount is debited to the correspondent account, current account or cash register for individuals and credited for accounting for overdue debt and overdue interest:

D-t

301 02.202 02 (for individuals), cash, customer accounts,

Kt

459 (325) - for the amount of interest.

If interest was not recognized as income, then it was accounted for in off-balance sheet account 916 04. Now it is restored to income:

D-t

999 99,

Kit

916 04;

D-t

301 02, 202 02 (for individuals), cash, customer accounts,

K-t

706 01 - for the amount of interest received;

D-t

301 02, 202 02 (for individuals), cash,

K-t

458 (324) - for the amount of repayment of the principal overdue debt.

Fines, penalties and penalties for late repayment of loan debt and interest on it received from clients are accounted for in account 706 01 “Fines, penalties, penalties received” on a cash basis at the time of recognition or receipt by posting:

D-t

301 02, 202 02 (for individuals), cash, customer accounts,

K-t

706 01 - according to symbol 17101.

At the same time, the reserve for possible loan losses in the part of the repaid debt and the reserve created for interest claims in the part of the repaid interest are restored.

Criminal Code of the Russian Federation: Article 177. Malicious evasion of repayment of accounts payable

Malicious evasion by the head of an organization or a citizen from repaying accounts payable on a large scale or from paying for securities after the relevant judicial act has entered into legal force -

shall be punishable by a fine in the amount of up to two hundred thousand rubles, or in the amount of the wages or other income of the convicted person for a period of up to eighteen months, or by compulsory labor for a term of one hundred eighty to two hundred and forty hours, or by arrest for a term of four to six months, or by imprisonment for a term of up to two years.

Off-balance sheet accounting is carried out using an off-balance sheet payment order.

Repayment in kind and other disposal of loan agreements

As already indicated, if the loan is not repaid on time, the bank begins to carry out procedures to sell the collateral to repay the debt. Debt on a loan and interest can also be terminated by novation, repayment using compensation (singular form), as well as the sale of a loan agreement to another bank or organization (assignment of claims) or otherwise[1].

Repayment of amounts under the loan agreement is carried out in the order established by the agreement, and in the absence of priority - in the manner established by Article 319 of the Civil Code of the Russian Federation. In case of compensation or novation, interest recorded on the off-balance sheet, fines and penalties are subject to reflection in the income accounts.

The created reserve for possible loan losses is subject to restoration on income.

If the bank receives property under compensation, then it is accounted for in account 610 11 “Non-current inventories” (it accounts for property acquired as a result of transactions under compensation agreements, pledges before the credit institution makes a decision on its sale or use in its own activities) on separate personal accounts. Some types of property - financial assets (securities, precious metals, etc.) immediately appear on the corresponding balance sheet accounts.

Transactions are subject to accounting on the date of transfer of ownership rights. Then the bank can either use the tangible property in its activities, putting it into operation and reflecting it on the accounts, or sell it.

When replacing (novating) an obligation under a loan agreement with another, for example, a bill of exchange, the loan debt and interest debt under the loan agreement are written off, and the bill of exchange is accepted onto the bank’s balance sheet. Subsequently, repayment of the bill is formalized in accordance with the generally established procedure.

Reconciliation of debt amounts, current year loan payments and interest can be carried out using a notice in form 0403380.

Accounting for acquired and realized rights of claim (factoring)

About two years ago, an appendix “Procedure for accounting of transactions related to credit institutions carrying out transactions to acquire the right to claim from third parties the fulfillment of obligations in monetary form” appeared in the accounting rules. To account for investments in rights of claim, balance sheet account 478 was opened. Three active balance sheet accounts of the second order and one passive account for accounting for reserves for possible losses are opened on it.

On active accounts the following are taken into account separately:

· rights of claim under agreements for the provision (placement) of funds, the fulfillment of obligations under which is secured by a mortgage (478 01);

· rights of claim under agreements for the provision (placement) of funds (478 02);

· rights of claim acquired under financing agreements under the assignment of a monetary claim (478 03).

In international practice, the most well-known types of assignments are factoring and forfeiting[2]. They differ from each other in that with factoring, invoiced invoices (documents) are purchased, and with forfaiting, debt obligations, usually bills of exchange, are purchased.

In the civil legislation of Russia, financing for the assignment of a monetary claim is regulated by Chapter 4 of the Civil Code of the Russian Federation.

There are two types of acquisition of assignable claims:

· purchase of documents containing monetary claims;

· lending money with the condition of securing this debt by assigning a monetary claim. In this case, a complex agreement arises, the main part of which is debt, and the additional part is security.

The peculiarity of the second type of agreement is that “the presentation of a monetary claim, which is the subject of an assignment, for execution is not associated with non-fulfillment or improper fulfillment by the counterparty (client) of the main obligation”[3].

The second type of agreement should be distinguished from debts repaid with compensation. Arbitration courts also note that in order to determine the transferred rights, documents confirming the emergence of the right must be transferred - contracts, invoices, invoices, letters, etc.

Accounting for investments in acquired rights is carried out in the amount of actual costs for their acquisition. Analytical accounting is maintained in the manner adopted by the bank in the context of individual agreements, and if rights under a mortgage are acquired, then in the context of each mortgage.

At their nominal value, the rights of claim are reflected in a new off-balance sheet account 914 18.

Accounting for investments under the first type of agreement is quite simple. On the date of acquisition, the rights are reflected on the bank’s balance sheet when they are paid for using the following transaction:

D-t

478,

K-t

account for accounting for cash, current account, etc. or accounts for accounting for debt on factoring operations, if the funds are not immediately received.

Since the adoption of the application, accounts 474 01 and 474 02 are used only for accounting for receivables or payables in case of deferred payments.

At the same time, the nominal value of the acquired rights of claim is “hung” on the off-balance sheet:

D-t

914 18,

Kit

999 99.

If the assigned agreement was secured by property, then the property received under the primary assigned agreement is accounted for in account 913, and the pledged items are accounted for in account 912.

Securities received as collateral are recorded in the accounts of section “D”.

If the bank has acquired rights of claim under a loan agreement, then interest and other amounts due to the bank are accrued on it, based on the terms of the agreement, starting from a date not included in the scope of obligations under the acquired loan agreement.

The repayment or sale of receivables is reflected in account 612 12 “Disposal (sale) and repayment of acquired receivables.” The retiring agreement is written off to the debit of account 612 12 and to the credit for accounting for retiring debt (account 478).

Amounts received in repayment or for the implementation of contracts and debts are credited to account 612 in correspondence with cash accounts. If there is a deferment of payment, then the correspondence will be with the debt accounts.

The resulting balance on account 612 on the same day is attributed to financial results (income or expenses).

Positive result:

D-t

612 12,

Kit

706 01 (symbol 12401).

Negative result:

D-t

706 06 (symbol 22201),

Kit

612 12.

At the same time, the nominal value of the contract is written off from the off-balance sheet:

D-t

999 99,

Kit

914 18

Accounts for recording collateral for retired contracts and accounts for recording collateral are also closed.

In case of partial payment, in part of the repaid share, a proportional write-off of investments occurs and, accordingly, a proportional financial result is formed.

In case of partial repayment, the off-balance sheet is written off in the repaid part of the rights:

D-t

999 99,

Kit

914 18.

As for the contract of the second type, until the moment of repayment, accounting for amounts is similar to the first option, but repayment of assigned contracts is somewhat more complicated. The accounting scheme for such repayments is given in paragraph 2.2 of the application under consideration, i.e. the factoring operations account is debited in correspondence with the accounts for accounting for debt (loans), overdue debt (loans), interest claims, and at the same time accrued interest is credited to income accounts .

The appendix also discusses the situation when the bank acts as a seller of claims. He collects in account 612 all the debt of the bank client, penalties and fines, accrued interest, and restores the interest on the off-balance sheet and transfers it to income accounts.

Amounts received for assigned rights are credited to sales account 612. The balance of the sales account is assigned to the income account (706 01) or expenses account (706 06), respectively.

It should also be borne in mind that, according to paragraph 2 of Article 58 of the Federal Law “On Insolvency (Bankruptcy)”, the debtor’s management bodies can carry out transactions related to the assignment of claims rights only with the consent of the temporary manager.

Using the “old” off-balance sheet account 909 06 is unacceptable.

For the purposes of creating reserves (RVPS) for factoring operations, it should be borne in mind that the amount of credit risk is determined by payers with whom the bank may not have close relationships and, accordingly, financial information about their condition.

However, if the factoring agreement provides for the possibility of recourse, then in accordance with the Civil Code of the Russian Federation in this case, joint liability of the payer and the supplier is provided for.

For tax purposes, the assignment of claims is regulated by Article 155 of the Tax Code of the Russian Federation for the purposes of value added tax and Article 279 for profit tax.

[1] Belov V.A. Singular succession in obligation. - M.: CenterYurInform, 2002.

[2] Materials of the 1988 UNIDROIT Ottawa Convention “On International Factoring”.

[3] See commentary on Article 824 in the publication “Commentary to the Civil Code of the Russian Federation”, ed. O. N. Sadikova.

Issuance of a loan by a legal entity to another legal entity at interest

To process the issuance of interest-bearing loans to legal entities, debit part 58 of the “Financial Investments” account is used, on which a separate sub-account “Provided loans” is opened. Analytics on sub-accounting is carried out in the context of each borrower and each concluded agreement. The credit part of the transaction depends on the form in which the company's funds are transferred to the borrower (cash or in kind):

- Kt 50 “Cash desk” - cash;

- Kt 51 “Current accounts” - non-cash rubles;

- Kt 52 “Currency accounts” - non-cash currency;

- Kt 01 “Fixed assets”;

- Kt 10 “Materials, raw materials”;

- Kt 41 of the “Goods” account.

Example 1. An organization issued an interest-bearing loan in the amount of 150,000 rubles to a partner company. Funds were transferred from the current account. The transaction will be reflected in accounting by posting Dt 58 Kt 51. Description of the posting: “Loan issued at interest.” The transaction amount is RUB 150,000.

Example 2. The company provided a partner company with a property loan - an excavator worth 200,000 rubles. Displayed in accounting - Dt 58 Kt 01. Description of the posting - “Loan issued at interest.” The transaction amount is RUB 200,000.

To display current settlements for payments (monthly accrued remuneration at the rate stipulated by the agreement), account 76 “Settlements with various debtors and creditors” is used. Its debit part indicates the amount of accrued interest. The account is credited. 76 with scores of 90 or 91.

For a loan, 90 percent is displayed if the economic activity of issuing repayable loans is designated as the main one in the order on the accounting policy of the enterprise.

It is important to remember these important postings:

- After interest has been accrued under the loan agreement, the accounting entry looks like this: Kt 76 Dt 90(91).

- The receipt of funds from the borrower to pay interest on the loan is reflected in the accounting record: Dt 51(52) Kt 76.

- The fact of the refund is recorded in the accounting entry: Dt 51(52) Kt58.

Step-by-step instruction

On November 1, the Organization received a loan from a counterparty in the amount of RUB 450,000. for a period of 18 months at 15% per annum. According to the terms of the agreement, the principal amount of the debt is paid in equal installments monthly, interest is accrued monthly on the balance of the debt. Payment of debt and interest is made according to the payment schedule.

On November 30 and December 31, interest was accrued and the principal and interest were paid according to schedule.

Let's look at step-by-step instructions for creating an example. PDF

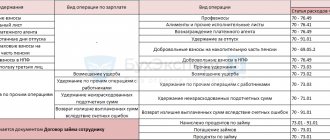

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receiving a loan from a counterparty | |||||||

| November 01 | 51 | 67.03 | 450 000 | 450 000 | Receiving a loan from a counterparty | Receipt to the current account - Receiving a loan from a counterparty | |

| Reflection in the accounting of accrued interest on the loan for November | |||||||

| November 30th | 91.02 | 67.04 | 5 363,01 | 5 363,01 | 5 363,01 | Interest accrual | Manual entry - Operation |

| Payment of loan principal for November | |||||||

| November 30th | 67.03 | 51 | 25 000 | 25 000 | Payment of principal | Write-off from the current account - Repayment of the loan to the counterparty | |

| Payment of interest for November | |||||||

| November 30th | 67.04 | 51 | 5 363,01 | 5 363,01 | Payment of interest | Write-off from the current account - Repayment of the loan to the counterparty | |

| Reflection in accounting of accrued interest on a loan for December | |||||||

| 31th of December | 91.02 | 67.04 | 5 414,38 | 5 414,38 | 5 414,38 | Interest accrual | Manual entry - Operation |

| Payment of loan principal for December | |||||||

| 31th of December | 67.03 | 51 | 25 000 | 25 000 | Payment of principal | Write-off from the current account - Repayment of the loan to the counterparty | |

| Reflection in accounting of accrued interest on a loan for December | |||||||

| 31th of December | 67.04 | 51 | 5 414,38 | 5 414,38 | Payment of interest | Write-off from the current account - Repayment of the loan to the counterparty | |

Obtaining a loan by a legal entity at interest

The receipt of a loan is recorded using the following entries:

- On account 66 – if repayable financial assistance was received for a period of up to 12 months. Accounting record of receipt of a cash loan Dt 50,51,52 Kt 66, property loan Dt 41 Kt 66.

- On account 67 - if the loan is long-term.

- After the repayment period of a long-term loan has become less than 12 months, the company has the right to transfer the amount of debt to account 66 by making an accounting entry Dt 67 Kt 66.

Servicing from the lender includes the following costs:

- payment for legal assistance;

- accrual and payment of interest according to the loan agreement.

The accounting entries for attorney fees would be as follows:

- Dt 60 Kt 51. Description of the business transaction: “Transfer of funds for the provision of legal assistance by payment order.”

- Dt 91.2 Kt 67. Description of the business transaction: “Based on the certificate of completion of work, legal services for drawing up the contract are included in expenses.”

The accounting entries for the calculation and payment of interest on a loan received look like this:

- Dt 91.2 Kt 66 – “Calculation of monthly interest.”

- Dt 66 Kt 51 – “Payment of monthly interest.”

Important! According to tax accounting rules, loan interest is written off every month and does not depend on the payment terms under the terms of the loan agreement.

After the contract has expired, the borrower returns the amount of the debt to the lender by entering the entry Dt 66 Kt 51 “The loan is repaid in full” into the accounting database.

Payment of principal for November and December

Accounting in 1C

Payment of the principal debt is reflected in the document Write-off from the current account type of operation Loan repayment to the counterparty in the Bank and cash desk section - Bank - Bank statements - Write-off.

Please pay attention to filling out the fields:

- Amount - the amount of the principal debt to be paid, according to the bank statement.

- Agreement - loan agreement with Agreement Type - Other .

- Type of payment - Debt repayment .

In our example, payments under the loan agreement are carried out in rubles, the term of the agreement is more than a year. PDF As a result of selecting such an agreement and the type of payment Debt Repayment in the document Write-off from the current account, the following is automatically set:

- Settlement account - 67.03 “Long-term loans”.

Payment of the principal debt for December and subsequent months is processed in the same way.

Postings according to the document

The document generates the posting:

- Dt 67.03 Kt - payment of the principal debt.

Display of interest-free loans in accounting

An interest-free loan (Articles 809, 810 of the Civil Code of the Russian Federation) is reflected in accounting using two entries. Its terms do not provide for the receipt of additional income from the withdrawal of funds and other material assets from circulation.

Contractual obligations do not include the accrual and payment of remuneration for the use of funds. Therefore, for the entire period of the contract, the loan will be listed in account 76 with the lender and account 66 with the lender. At the end of the agreement and upon full repayment of the amount, the debt will be closed.

Having issued an interest-free loan to another legal entity, the borrower organization will make a journal entry:

- Dt 76 Kt 51(52) “An interest-free loan was issued.”

- When receiving funds back, the posting will be as follows - Dt 51 (52) Kt 76 “Repayment of the amount for a previously issued loan.”

- The organization receiving the borrowed funds records the transaction in the accounting records with entries Dt 51 (52) Kt 66 “Receiving an interest-free loan” or Dt 66 Kt 51 (52). "Repayment of an interest-free loan."

Results

The entry for accrual of interest on a loan occurs both for legal entities giving the loan (to a legal entity or individual) and for those receiving borrowed funds (from a legal entity or individual). The first accounts for the issued debt itself in account 58 (Dt 58 Kt 51 (50, 52)), and the interest on it in account 76, accruing them monthly in correspondence with the financial results account (Dt 76 Kt 91 (90)). The second, depending on the period for which the funds are borrowed, the amount of debt is attributed to account 66 or 67 (Dt 51 Kt 66 (67)) and interest is accrued there. If borrowed funds are not involved in the creation of an investment asset, then they are accrued by posting Dt 91 Kt 66 (67). Participation in the creation of an asset regarded as an investment requires taking into account interest on the loan in the cost of this asset (Dt 08 Kt 66 (67)).

Sources:

- Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of accounting for property loans

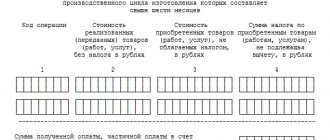

Having transferred for temporary use part of the assets in non-monetary form, the lender company, according to the norms of the Tax Code of the Russian Federation (clause 1, clause 1, article 146, clause 15, clause 3, article 149), must charge VAT.

Depending on the terms of the agreement, 58 or 76 accounts will be debited, and 68 will be credited.

After the contract is closed, VAT can be presented to the lending company. In this case, account 19 is debited, and accounts 76 or 58 are credited.

Issuance of loans to individuals

The company has the right to issue repayments or assets in non-monetary form to individuals. The latter are the founders, employees or outside citizens.

When drawing up an agreement, the personal data of an individual, passport details, as well as the address of actual residence and the telephone number valid at the time of drawing up the agreement are indicated.

Important! Loans issued by employees can be interest-bearing or interest-free. The decision to issue repayable financial assistance to an employee or founder is made by the company’s management or the meeting of shareholders.

In accounting, two accounts can be used to display interest-bearing loans:

- 58 “Financial investments”.

- 73 “Settlements with personnel for other operations.”

The decision on which account will be used to account for interest-bearing loans issued to individuals is made by the company independently. But it must be enshrined in the order on the Accounting Policy for accounting purposes. For interest-free loans, account 73 is always used.

Which accounts are involved in accounting entries for accounting for deposit transactions?

The deposit account refers to the so-called special accounts in the bank, for the accounting of which account 55 is intended in the accounting department. The Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, as amended on November 8, 2010) provides for several sub-accounts for this account. Deposits are accounted for in subaccount 55.3 “Deposit accounts”.

Since deposits are recognized as financial investments in accordance with clause 3 of PBU 19/02, they can also be taken into account in account 58 “Financial investments” by opening the corresponding sub-account.

NOTE! The organization establishes the method of accounting for the movement of money on deposit in its accounting policy.

Accounts 55 and 58 are active, so an increase in funds on deposit will be by debit, and a decrease in the deposit account or returned to the owner to the current account will be by credit.

As for the entries on the receipt of interest on the current account and, accordingly, their accrual, account 91 “Other income and expenses” will be involved in them. Subaccount 1 to this account “Other income” is intended to reflect various income, including interest received, from activities not related to the main one.

The terms of the bank deposit agreement may affect taxes and accounting for the depositor. Find out how to check the wording of the contract from the Transaction Guide from ConsultantPlus. Get trial access to the K+ system and study the material for free.

Issuance of money to the founder

When providing repayable financial or property funds to the founder, the same entries are used in accounting as when issuing a loan to an employee. 58 or 73 accounts are debited, and 50,51,10,01 and other accounts are credited, depending on the subject of the agreement. The return of borrowed funds to the company is reflected by reverse postings.