Every year, individual entrepreneurs on OSNO report their income in the 3-NDFL declaration. For 2021, the document must be submitted by April 30. In this material, we will consider tricky questions related to the 3-NDFL form for individual entrepreneurs, in particular: when an individual entrepreneur submits 3-NDFL, whether individual entrepreneurs submit 3-NDFL under the simplified tax system and UTII, how to fill out the zero 3-NDFL for individual entrepreneurs, etc.

3-NDFL for 2021 for individual entrepreneurs is submitted using the updated form. The need to submit 3-NDFL may arise for individual entrepreneurs under any taxation regime. We will tell you below how to fill out 3-NDFL for individual entrepreneurs on OSNO, simplified tax system or UTII.

IP on OSNO. Calculation of all taxes using an example.

Colleagues, good day! Help me sort out the deal from IP to OSNO Let’s say this is the situation! The individual entrepreneur works for OSN, without employees. The first income was received on 01/10/16. I provided the Federal Tax Service with a 4NDFL certificate on 02/10/16 indicating an estimated income of 300,000 rubles. (revenue 60,000,000 – expenses 59,700,000) Advance payments for personal income tax For 6 months before July 15, 2016 (300,000*13%*1/2) = 19,500 For 3 quarters until October 15, 2016 (300,000*13%*1/4) = 9750 For the 4th quarter until January 15, 2017 (300,000*13%*1/4) = 9750 TOTAL Income for the year from the bank 100,000,000 rubles. Revenue 100,000,000 including VAT, including 15,254,237 rubles. (RUR 84,745,762 revenue excluding VAT) Expenses only Purchase from a supplier with VAT RUR 95,500,000 incl. 14,567,797 (RUB 80,932,203 revenue excluding VAT) The bank received payment to the supplier with VAT 1,000,500 rubles including VAT. (without VAT 847,458 rubles) The remaining amount of 98,999,500 during the year was transferred to the individual entrepreneur card as an individual. persons and withdrawn as income of individual entrepreneurs.

Question about reporting. The individual entrepreneur only paid VAT during the year, according to the payment deadline, 686,440 rubles (157,797) and submitted VAT returns quarterly. Now, until December 31, 2016, you need to pay the Fixed contribution to the Pension Fund (insurance part) - 19,356.48 rubles. Fixed contribution of the Federal Compulsory Medical Insurance Fund - 3796.85 rubles.

By 04/01/2017, you need to pay a contribution to the Pension Fund for the amount of income exceeding 300,000.00 - 99,700,000.00 *1% = 997,000. The maximum contribution for 2021 is 154,851.84 rubles.

Submit your 3-NDFL declaration by April 30. And pay personal income tax by July 15 842,203 = 3,813,559*13% = 495,763 rubles (minus 39,000 previously paid advance payments) Total pay 456,763 rubles. Or 98,999,500*13% = 12,869,935 rubles.

Tax burden 686,440 +19356.48 + 3796.85 + 154,851.84 + 495,763 = 1,360,208 rubles.

Tell me what's wrong? What is the tax burden? Are taxes calculated correctly? Do you need to submit any more reports?

What sheets does an individual entrepreneur fill out?

There are many sheets in the 3-NDFL tax return, but individual entrepreneurs must fill out only 4:

- the first with general information;

- section 1 indicating the amount of tax;

- Section 2 with calculation of tax payable;

- Appendix 3 to reflect the results of business activities.

Other sheets may be needed to fill out if the individual entrepreneur had other income besides entrepreneurial activity.

Individual entrepreneurs who do not carry out any operations in the reporting year must fill out the declaration in the zero version, while the following pages of the 3-NDFL form are filled out - the title page and two sections where zeros or dashes are entered instead of total values.

How to calculate personal income tax for an entrepreneur using the general taxation system

The procedure for calculating and paying personal income tax for individual entrepreneurs, as well as for individuals employed, is regulated by the norms of Chapter 23 “Individual Income Tax”. The specifics of calculating personal income tax for individual entrepreneurs on OSNO, the timing, procedure for paying tax and advance payments on it are discussed in Article 227 of the Tax Code of the Russian Federation.

Income as objects of taxation

The object of personal income tax taxation is the income received by an entrepreneur as a result of business activities. Income includes:

— proceeds from sales;

- the cost of property received free of charge (for example, surplus goods during inventory).

The date of receipt of income is considered:

- the day of payment of income, receipt of income to the individual entrepreneur’s bank account or to the accounts of other persons on behalf of the individual entrepreneur;

— day of transfer of income in kind.

If an individual entrepreneur receives an advance on account of an upcoming sale, then it is included in income on the day it is credited to the account.

Tax deductions for personal income tax for an entrepreneur

When determining the tax base, individual entrepreneurs have the right to reduce it by tax deductions: standard, social, property, professional. The procedure for applying the first three groups of deductions is similar to their use when calculating the personal income tax of individuals employed.

A specific deduction for individual entrepreneurs is a professional tax deduction, which represents the amount of expenses actually incurred by the entrepreneur, which must be documented and directly related to the extraction of income (clause 1 of Article 221 of the Tax Code of the Russian Federation).

The expenses of individual entrepreneurs are determined in a manner similar to that for organizations (Article 252 of the Tax Code of the Russian Federation). Those. For individual entrepreneurs and organizations on OSNO, the composition of expenses is the same. If there is no documentary evidence of expenses, then the individual entrepreneur has the right to use a professional deduction in the amount of 20% of income.

Calculating tax

After the amount of income received and the amount of tax deductions (including expenses) have been calculated based on the results of the tax period, the difference between them is determined.

Individual entrepreneur income received from business activities and reduced by the amount of tax deductions is subject to taxation at a rate of 13%.

If the amount of deductions is greater than the amount of income received, then for a given tax period the tax base will be equal to zero, and accordingly the personal income tax will also be equal to zero. However, for individual entrepreneurs there is no possibility of transferring losses (the difference between deductions and income) to the next tax period, unless otherwise provided by Chapter 23 of the Tax Code of the Russian Federation.

Let's consider an example of calculating personal income tax for individual entrepreneurs on OSNO. The income of IP Gorelkin, received in the form of proceeds from the sale of goods to his bank account, for 2011 amounted to 600,000 rubles. (without VAT). IP Gorelkin has two children, 7 years old and 10 years old. For 2012, the entrepreneur has documented expenses for: purchase of goods 100,000 rubles, wages for employees 100,000 rubles, insurance premiums for employees 30,000 rubles, depreciation costs for commercial equipment 20,000 rubles, expenses for bank services 10,000 rubles, rental costs 30,000 rubles.

Standard tax deductions for children will be: 2 * 1400 rubles. = 2,800 rub.

Professional tax deduction:

100,000 + 100,000 + 30,000 + 20,000 + 10,000 + 30,000 = 290,000 rub.

Personal income tax = (600,000 – 290,000 – 2800) * 13% = 39,936 rubles.

Based on the calculations made, 3-NDFL is filled out - the entrepreneur’s reporting form on the general taxation system

What is 3-NDFL?

The report form and the procedure for drawing up Form 3-NDFL were approved by Order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 10/03/2018.

IMPORTANT!

The tax office has prepared a draft order approving the new form 3-NDFL and the procedure for filling it out; it is expected that the order will come into force starting with the 2021 tax period.

The current document is a form consisting of 13 pages, including a traditional title page and two main sections. The first section is only one page long and must be completed by all respondents. The second section, together with the annexes (the number of which takes up 9 pages, but they are filled out only if there is information that should be indicated in them depending on the taxpayer’s status.

The first section is only one page long and must be completed by all respondents. The second section, together with the annexes (the number of which takes up 9 pages, but they are filled out only if there is information that should be indicated in them depending on the taxpayer’s status.

The personal income tax return is an annual reporting form. It is intended not only to inform the Federal Tax Service about income received for the purpose of paying tax on them, but also for possible receipt of tax deductions.

Rules for filling out 3 personal income taxes for individual entrepreneurs on OSNO

Individual entrepreneurs on the regular taxation system are required to provide a 3-NDFL certificate in a modified form.

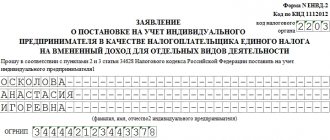

Filling out must begin from the first page; a zero and two dashes are entered in the correction field: “0—”. This means that the certificate form is primary. After the adjustment field, enter the reporting year. Next, code 34 is entered in the “tax period” column (period type - report for a calendar year). The next code that needs to be filled in is the category indicating the taxpayer. Individual entrepreneur, according to appendices 1 to 8 to the procedure for filling out the 3-NDFL certificate, is set to code 720.

Next, the entrepreneur must fill in the fields with information about himself: country, full name, date of birth, place of birth, contact phone number and passport details.

Important ! For individual entrepreneurs, the budget classification code (abbreviated as KBK) is 182 1 0100 110.

All this information takes up the first 2 appendices of certificate 3 personal income tax for individual entrepreneurs on OSNO.

Basic rules for filling out the declaration

The procedure for preparing the 3-NDFL report is established by the relevant instructions:

- The report can be generated on a computer or filled out manually on a printed form. Blue or black ink should be used.

- If the declaration is drawn up using a computer, then the Courier New font should be used, and the size should be 16-18 points.

- When filling out 3-NDFL, you need to remember that it should have one page per sheet. Duplex printing cannot be used. Each sheet of the declaration is numbered, and the title page must have the number “001”. In addition to the number, the TIN must be present on each sheet of the report.

- The data in the declaration must be transferred from the relevant supporting documents, which can be 2-NDFL certificates, settlement and payment documents.

- Data in reporting must be entered in such a way that only one character is present in the field.

- When a voluminous report is compiled and there is not enough space for information on one page, then another sheet of the same type is filled out.

- It is not permitted to correct errors in this reporting. If it was admitted, then the report should be completed again.

- Cost indicators should be expressed in rubles and kopecks. In this case, the tax amount is fixed without kopecks.

- Numeric and text fields must be filled out starting from the left cell.

- If the report contains appendices, the number of their pages should be indicated on the title page.

You might be interested in:

Information on the average number of employees: sample filling, form

How to calculate income and expenses

Moving on to filling out data on income and expenses, you need to start by filling out the type of business activity code - 01, OKVED - “31.02”.

Income and expenses of an individual entrepreneur are calculated quite simply. Income is reflected in line with code 030 in the certificate. On OSNO, income is calculated as follows: the entrepreneur’s revenue for the year minus accrued VAT in the amount of 20%. If an organization produces excisable products, then excise taxes in the established amount are also deducted. But simply subtracting 20% from the amount of revenue will be incorrect, since tax calculation has its own subtleties and can be calculated incorrectly. For example, in the reporting year, revenue amounted to 1,000,000 rubles.

We calculate income using the formula: 1,000,000*100/120 = 833,333.33 total income. This figure should be equal to the total of section VI in the book of income and expenses. If the numbers do not match, it is necessary to check the correctness of the accounting for profit accrual transactions (postings).

Income received in the Russian Federation

If an entrepreneur, in addition to income from private activities, had additional cash receipts, it is necessary to fill out the “Income received in the Russian Federation” tab.

Let's say that in 2021 an entrepreneur sold a house. Income received from the sale should be reflected in the “13%” block, and in the name of the source of payment write “Sale of the house.” Instead, you can indicate your full name. the individual to whom the property was sold.

The OKTMO code is not filled in because the house was sold to an individual:

Next, go down to the income block, click the “+” icon and add the type of income: you need to select code 1510 from the drop-down list:

Then we indicate the sale price and the month when the transaction was completed.

When are advance payments made?

Before submitting reports for the year, the individual entrepreneur is required to make advance payments in the following periods:

- From January 15 to July 15 for the half year;

- By September 15 for the period July-September;

- A quarter of the annual advance payment is due by January 15th.

The amounts of these advance payments are calculated independently by the tax agent and included in the notifications that are received by the individual entrepreneur. And according to this notification, payments must be made. If the notification does not arrive within the prescribed period, you must contact a tax agent.

The calculation is made on the basis of 4-personal income tax, if the individual entrepreneur had no profit last year (usually the first 2 years of the individual entrepreneur’s existence), or based on the results of the previous reporting year. The calculation mainly involves calculating the expected income in the current reporting year.

Note! In 2021, the procedure for making advance payments will be changed. You can view the changes on the Kontur Extern website and on the Federal Tax Service website.

Results

An individual entrepreneur who does not apply any of the special regimes is obliged to calculate and pay personal income tax on income received as a result of entrepreneurship. Such income is declared annually in a special report (declaration) 3-NDFL. Form 3-NDFL is the same for individual entrepreneurs and individuals, but they fill out different sheets (in addition to the required ones).

Sources:

- tax code of the Russian Federation

- Order of the Federal Tax Service dated October 7, 2019 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadlines for submitting reports for individual entrepreneurs

Submission of 3-NDFL is necessary for 2 main reasons. The first is receiving a tax deduction and the second is that it’s time to report your income and expenses to the tax service.

3-NDFL for the reporting year must be submitted no later than April 30 of the year following the reporting year. Moreover, if April 30 falls on a weekend, then the deadline for submission is the first working day after April 30. This period is the same for both individual entrepreneurs and individuals. Since next year's deadline does not fall on a holiday, the 2021 return must be submitted no later than April 30, 2021.

In case of termination of the activities of the individual entrepreneur, the declaration must be submitted no later than 5 working days from the official date of liquidation of the individual entrepreneur.

Individual entrepreneurs on OSNO and special regimes are required to file a declaration, even if the tax turns out to be zero. This may happen if an individual entrepreneur is not subject to tax in accordance with the Tax Code, or in other situations provided for by legislative documents. Failure to submit a declaration or submission of it after the deadline will result in a fine.

Zero declaration 3-NDFL in the absence of activity and closure of individual entrepreneurs

If the taxpayer did not receive income from business activities during the tax period (year), he must still report to the Federal Tax Service by filing a declaration. How to fill out the 3-NDFL declaration for individual entrepreneurs in this case? Such a report is drawn up with zero indicators (letter of the Ministry of Finance of Russia dated December 25, 2007 No. 03-02-07/1-507).

When compiling it, the current form of the 3-NDFL declaration form is used.

The 3-NDFL declaration forms for individual entrepreneurs and ordinary individuals are identical, but they are filled out by these taxpayers differently.

The title page and sections 1, 2 are required for completion for both individual entrepreneurs and individuals. These are the ones that must be completed when filing a zero 3-NDFL declaration for an individual entrepreneur. The remaining sheets are filled out by both the individual entrepreneur and the individual as necessary.

Lack of activity can logically develop into the elimination of individual entrepreneur status. In such circumstances, the taxpayer also does not have the data to fill out the declaration columns. As a result, a zero 3-NDFL is submitted, and the report must be submitted within a short period of time, not exceeding 5 days from the date of registration of the fact of termination of the individual entrepreneur’s activities.

Personal appearance at the tax authority

Methods for filing a declaration can be divided into 3 methods. The first is the personal appearance of the responsible person at the tax authority at the place of registration and the direct delivery of documents to the tax inspector. This method is convenient because a gross error or lack of documents will most likely be noticed by the inspector immediately and promptly corrected by the person in charge. But, at the same time, the method is not suitable for those who do not have time to go to the authorities or cannot be in the city (or other locality) where they need to submit a declaration.

It must be taken into account that the human factor can also have an impact on personal appearance: sometimes inspectors refuse to accept documents, although there are no official grounds for this. In rare cases, they require a document that the taxpayer is not required to provide. And such documents, as a rule, take longer to check than those received by mail or through the website of the federal tax service.

Postal delivery

The second common method is submitting documents by mail. To do this, all the necessary documents are sent by mail and take the individual entrepreneur less time than going to the Federal Tax Service. In this case, inspectors must indicate the reason for refusing to accept documents in writing. Additional documents are obtained through an official request. In addition, this method is the most convenient when personal appearance at the tax authority is impossible.

Individual entrepreneur on the Federal Tax Service website

An even faster and easier way. Since 2015, there is no need to have an electronic digital signature for this. You need to create a personal account and, following step-by-step instructions, send documents. The advantage over regular mail is that it does not require time even to transport documents by the postal service. The documents are instantly received by the tax authority, and returns and any other operations are also carried out via the Internet without the requirement for personal appearance of the individual entrepreneur.

Note! All this is completely free and as fast as possible.

Reporting Methods

The taxpayer has the right to send a report to the Federal Tax Service in several ways:

- Directly to the inspector personally - the individual draws up a report in two copies and submits it to the Federal Tax Service. After receiving the report, he is left with a second copy with a tax mark.

- Through a representative - this method is similar to the previous one, only reports to the Federal Tax Service are submitted not by the individual entrepreneur or citizen himself, but by the person for whom the power of attorney is issued.

- When sent through a post office, the report is placed in an envelope, which must also contain a description of the contents. After this, you must send it by registered mail.

- Through an electronic document management system - for this method you must have a qualified electronic digital signature (EDS). If the report is submitted through a specialized program, then a special operator agreement is also required.

What are the fines?

Fines for individual entrepreneurs in different taxation systems are taken into account according to different rules. The declaration must be submitted even when the tax amount is equal to zero. If an individual entrepreneur has not submitted payment documents, he will be required to pay a minimum fine of 1,000 rubles; the same fine will apply for unpaid tax. Individual entrepreneurs on OSNO will not be fined for being late in submitting documents, since they themselves calculate 3-NDFL. Individual entrepreneurs on the simplified tax system, UTII and other taxation systems will be fined for delay.

If the final tax was zero, then the fixed fine is 1,000. In other cases, the fine is 5% of the total tax amount for each month of delay (minimum - 1,000 rubles, maximum - 30% of the total amount). For example, the total tax amount was 20,000, the filing of the declaration was overdue by 4 months. Total fine = 20,000*5%*4=16,000 rubles.

Important! A fine is imposed even in cases where the tax is paid on time, but the declaration itself is submitted after the deadline.

Below is an example of filling out 3-NDFL, where a sample payment order for 2021 will be presented. There you can see the current 2021 3 personal income tax for individual entrepreneurs on OSNO and see how to fill it out. The form can be downloaded from the Federal Tax Service website. Please note that the form must be for 2021.

The procedure for filling out a declaration seems complicated only at first glance. When filling it out again, an individual entrepreneur can do everything without outside help, but for accuracy, it is imperative to take into account the changes that are made almost every year.

Setting conditions

The first tab of the program is “Set conditions”. Here you need to enter primary data about the taxpayer. Select the type of declaration - “Z-NDFL”:

Then fill in the fields “Inspection number”, “Adjustment number” and “OKTMO”. Here you need to indicate the number of the tax office where the individual entrepreneur is registered. The correction number for initial filling is set to “0”; if a corrective declaration is submitted, then it is set to “1”. The OKTMO code can be found on the Federal Tax Service website using the “Find out OKTMO” service.

Next, we indicate the type of taxpayer – “Individual entrepreneur”. In the block about available income for the reporting period, put a tick next to the line “From entrepreneurial activity.”

If the entrepreneur had additional income during the reporting year, in addition to private activities, you need to check the corresponding line.

This item is indicated if, for example, an individual entrepreneur sold a car, house or apartment. The “Income received in the Russian Federation” field automatically becomes active.

What expenses reduce personal income tax from the activities of individual entrepreneurs?

According to paragraph 2 of Art. 54 of the Tax Code of the Russian Federation, individual entrepreneurs keep records of expenses in the manner determined by the Ministry of Finance of Russia.

The expenses that an individual entrepreneur makes as a result of his business activities are called professional deductions for the purposes of calculating personal income tax (Article 221 of the Tax Code of the Russian Federation).

In accordance with paragraph 1 of Art. 221 of the Tax Code of the Russian Federation, the composition of the expenses of individual entrepreneurs is determined by Ch. 25 of the Tax Code of the Russian Federation, i.e. these include:

- Material costs.

- Labor costs.

- Depreciation.

- Other expenses related to business activities.

- Amounts of insurance contributions for pension and social insurance.

- Amounts of taxes, excluding personal income tax and VAT.

The taxes that are included in the professional deductions of individual entrepreneurs also include fixed contributions for compulsory health insurance and compulsory medical insurance.

New declaration form for the 2021 report

The Federal Tax Service of Russia published order No. ED-7-11/ [email protected] dated August 28, 2020, which approved a new form of personal income tax declaration (3-NDFL). The document will come into force on 01/01/2021, which means that the updated form must be applied from the report for 2020. The changes are related to the possibility of making an advance quarterly personal income tax payment by individual entrepreneurs (IP), lawyers and notaries.

Section 1 in the updated form was divided into two parts:

- To indicate information about the amounts of tax subject to payment (additional payment) to the budget (except for the amounts of tax paid in accordance with clause 7 of Article 227 of the Tax Code of the Russian Federation) or refund from the budget.

- To indicate the amounts of the advance payment for personal income tax, paid in accordance with clause 7 of Article 227 of the Tax Code of the Russian Federation.

New sheets have been added to the declaration:

- appendix to section 1 “Application for offset (refund) of the amount of overpaid personal income tax”;

- calculation to Appendix 3 “Calculation of advance payments paid in accordance with clause 7 of Art. 227 of the Tax Code of the Russian Federation."

The reporting deadlines have not changed.

Use ConsultantPlus instructions for free

Tax employees were prohibited from correcting errors in reporting forms. Now the entire package of documents is being returned without explanation. And for delay you will be punished with a fine. We have put together instructions that will help you fill out 3-NDFL correctly and pass it the first time:

- new form 3-NDFL;

- instructions for filling out a report for individual entrepreneurs;

- how to fill out and submit electronically through the tax website;

- rules and deadlines.

Procedure for accounting for individual entrepreneur expenses

There are 3 conditions under which an individual entrepreneur can take into account expenses to calculate personal income tax. Expenses should be:

- paid;

- used in the professional activities of individual entrepreneurs;

- confirmed by documents (invoices, acts, invoices).

If for some reason an entrepreneur cannot provide documentary evidence of his expenses, then in this case he can take advantage of a professional deduction in the amount of 20% of the amount of income received.

However, it is impossible to take into account both documented expenses and the 20% standard.

IP expenses have recognition criteria, which are reflected in the Procedure for accounting for income and expenses and business transactions for individual entrepreneurs adopted by the Ministry of Finance of Russia (order No. 86n dated August 13, 2002):

1. There is a connection between the income and expenses of an individual entrepreneur.

2. Expenses for the purchase of raw materials, materials, goods are recognized for taxation after their actual payment. The moment of their accounting is not related to the date of receipt of income from the sale of goods (work, services), for the production (fulfillment, provision) of which these expenses were incurred (see decision of the Supreme Court of the Russian Federation of June 19, 2017 No. AKPI17-283, decision of the Supreme Arbitration Court of the Russian Federation No. VAS-9939/10).

3. Amounts of accrued depreciation can be included in professional deductions only for property and results of intellectual activity owned by the individual entrepreneur and used by him in carrying out business activities. Even if the property is jointly owned by spouses, one of whom is an individual entrepreneur, accrued depreciation can also be used to reduce the income of an individual entrepreneur (letter of the Ministry of Finance of Russia dated December 7, 2012 No. 03-04-05/3-1377).

4. If the work is seasonal, it is also necessary to observe the principle of linking income received and expenses incurred.

An individual entrepreneur is exempt from the obligation to maintain accounting records, however, when accounting for expenses for remuneration of employees, an individual entrepreneur can also include in professional deductions the costs of remunerating an accountant, since, according to clause 23 of the procedure for accounting for income and expenses, an individual entrepreneur can reduce his income by any accruals by wages for employees who work under employment contracts.

If an individual entrepreneur applies several tax regimes, for example OSNO and UTII, then he must keep separate records of income and expenses for these regimes. An individual entrepreneur can include as expenses for calculating personal income tax only documented expenses associated with the general taxation regime.

For information on the specifics of paying personal income tax when applying tax regimes available to individual entrepreneurs, read the article “Should individual entrepreneurs pay personal income tax (cases and nuances)?” .

Penalty for failure to submit reports

The Tax Code determines that for violation of the deadlines within which the 3-NDFL tax return must be sent, several types of liability are provided:

- The zero declaration was not sent on time, i.e. the entrepreneur had no taxable income recorded. Then he will have to pay a fine of 1000 rubles, and still complete and submit the declaration.

- The declaration was not sent on time, but the tax calculated on it was paid on time. The fine will then be 5% of the tax amount indicated in it, but not more than 30% of its entire amount.

- The declaration has not been sent and the tax has not been paid. The entrepreneur will have to pay a fine of 20% of the tax amount, as well as pay penalties for late transfer of tax payments. If the tax authority can prove that the individual entrepreneur did not perform these actions intentionally, then the amount of the fine may double to 40%.

Important! In addition, the Federal Tax Service has the right, after 10 days from the deadline for filing a declaration, to block the bank accounts of an entrepreneur.

Tags

3-NDFL Reporting

“Non-entrepreneurial” ways to reduce personal income tax

In addition to the considered professional deduction, which arises for an individual entrepreneur as a result of business activities, an entrepreneur can also reduce his personal income tax through standard, social and property deductions. Their list is given in Art. 218–220 Tax Code of the Russian Federation.

Let's look at the features of using deductions using the example of training expenses.

Thus, the right to receive a deduction for children’s education expenses remains until they reach 24 years of age. When calculating the deduction for children's education, the amount of expenses for each child of 50,000 rubles can be taken into account.

Entrepreneur D.B. Mikhailov has two children.

My son attends the preschool department of school No. 2025 in Moscow. Expenses for the year for his maintenance at school amounted to 30,000 rubles.

He also attends an art school, where annual tuition is 25,000 rubles.

The daughter attends the State Budgetary Educational Institution “Sports School No. 7”, where the cost of classes per year is set at 54,000 rubles.

In connection with the expenses incurred by the individual entrepreneur, D.B. Mikhailov intends to claim a deduction for training expenses in the amount of 100,000 rubles. (50,000 rubles × 2), which will give him the opportunity to reduce the tax paid for the year by 13,000 rubles. (RUB 100,000 × 13%).

The total amount of expenses for which an entrepreneur can be provided with a social deduction, with the exception of expenses incurred for expensive treatment and education of children, cannot exceed 120,000 rubles.

In 2021, individual entrepreneur D.B. Mikhailov paid for his studies under the MBA program in the amount of 60,000 rubles. and an annual service program at a medical clinic in the amount of 80,000 rubles.

The total expenses incurred by IP Mikhailov D.B. for social needs amounted to 60,000 + 80,000 = 140,000 rubles.

However, due to existing restrictions on the amount, only 120,000 rubles can be taken into account as social deductions out of 140,000.

More information about the use of social deductions can be found here.

Deductions

Standard, social and property deductions for an entrepreneur, as an individual, can reduce the amount of personal income tax required to be paid.

Let's say an entrepreneur I.P. Shapovalov spent 55,000 rubles in 2021. for treatment and declares a refund of part of the expenses from the budget. He must indicate his right to a deduction for treatment in the “Deductions” tab, the “Social” deductions block:

In addition, the entrepreneur has one child, for whom a standard tax deduction is provided. He must also indicate this in the “Declaration” program:

You can see the difference between the option when individual entrepreneur Ivan Petrovich Shapovalov reports in Form 3-NDFL indicating only income and expenses for his activities, and the option when he additionally indicates the right to deduction, when viewing the document:

This amount Shapovalov I.P. must pay to the budget by April 30, 2021, reporting on his business activities:

And he will pay this amount if he indicates the right to deductions for children and treatment:

When the document is completely filled out, you need to save and print it. You can do this using the buttons on the panel at the top:

To make sure that the declaration is completed without errors, you can check the document using the “Check” button on the top panel. This will prevent you from missing any information required to be filled out.

The declaration is printed in two copies, one of which remains with the declarant, the second is provided to the tax authorities for verification. The deadline for filing the declaration is May 3, 2021.

Is the 2021 personal income tax for employees included in expenses under OSNO and simplified tax system “income minus expenses”

An entrepreneur pays personal income tax not only for himself. When paying income to employees, he becomes a tax agent for payroll tax and is obliged to calculate, withhold from employees and pay this tax to the budget.

Both under the OSNO and under the simplified tax system with the object “income reduced by the amount of expenses,” an individual entrepreneur can take into account the amount of the transferred personal income tax - but not as an independent expense, but as part of the costs of paying employees with whom an employment or civil law contract has been concluded. In other words, the salary is accepted as expenses without reducing it by the withheld personal income tax. This is confirmed by the Ministry of Finance of Russia (letters dated December 15, 2015 No. 03-11-06/2/5880 and dated December 19, 2008 No. 03-04-05-01/464).

How an entrepreneur can keep track of expenses under the simplified tax system, find out in the material “How to properly keep track of income and expenses of an individual entrepreneur?” .

To correctly calculate the tax base for personal income tax, an individual entrepreneur must take into account the features of recognizing expenses set out in the Tax Code of the Russian Federation, as well as in the Procedure for accounting for income and expenses and business transactions for individual entrepreneurs, approved by the Ministry of Finance of Russia.

1. No, it will not be on the basis of paragraph 3, paragraph 1, paragraph 2 of Art. 220 of the Tax Code of the Russian Federation (property that was owned for up to 3 years within 250 tr.) 2. It will not be if it was purchased in the interests of an individual, if it was purchased for business activities it will also not be, since it will be taken into account as part of non-current assets and transferred its cost to costs through the depreciation mechanism.

You can also take part in the discussion of similar issues on the forum

Hello! The individual entrepreneur combines OSNO (wholesale trade of petroleum products) and UTII (freight transportation by specialized transport). We have drawn up an Accounting Policy and have been conducting tax accounting on its basis for about two years. Regarding expenses, when determining the taxable base for personal income tax, it was written down: 1. VAT is deductible only for OSNO (trade in petroleum products), separate VAT accounting is not maintained. 2. We take the full amount of expenses according to OSNO (cost of goods, accountant’s salary and insurance deductions from it) 3. For expenses that cannot be clearly attributed to one of the types of activities, we prescribed: Distribution of total expenses of an individual entrepreneur is made monthly based on the share of income from different types activities, which include bank services, drivers' wages and insurance premiums from it, maintenance of electronic reporting, postal expenses, maintenance of office equipment, office supplies, repair and maintenance of cars, spare parts for cars, fuel and lubricants for cars, depreciation of property involved in activities of individual entrepreneurs, property tax that participates in the activities of individual entrepreneurs. The tax inspectorate told an individual entrepreneur that he cannot include in his divisible expenses when determining the taxable base for personal income tax expenses that are associated with activities under UTII (driver wages and insurance premiums from it, repair and maintenance of cars, spare parts for cars, Fuel and lubricants for cars, depreciation of property of an individual entrepreneur participating in the activities, property tax that participates in the activities of an individual entrepreneur) and that we are not lawfully understating our tax base for personal income tax. The individual entrepreneur has buyers: 1. with whom 2 contracts have been drawn up: the purchase and sale of petroleum products and the transportation of goods by specialized transport. We sold them the goods and delivered them ourselves. We issue UPD with status “1” for goods (with VAT) and UPD with status “2” for services (without VAT). 2. with whom an agreement has been concluded only for the transportation of goods by specialized transport. We issue UPD with status “2” for services (excluding VAT). It turns out that in the first option we partially use transport and can attribute part of the costs to OSNO. With the second option, of course not, there is only UTII.

Content

- How is personal income tax calculated for individual entrepreneurs?

- Income received

- Tax deductions

- Advance payments

- Personal income tax rate for individual entrepreneurs

- Calculation of personal income tax at the end of the year

- Personal income tax reporting for individual entrepreneurs

- Conclusion

Income tax is different for legal entities:

- Individual entrepreneurs pay personal income tax;

- Legal entities pay income tax.

Today we will talk about the peculiarities of paying personal income tax by individuals registered as individual entrepreneurs. And there are quite a lot of features here.

We are all accustomed to the fact that personal income tax is a tax that the employer withholds from our salaries (I’m talking about ordinary employees now). For individual entrepreneurs, the calculation and payment of this tax on income received from business activities looks different.

So, first things first!

How is personal income tax calculated for individual entrepreneurs on OSNO in 2021?

The tax is calculated from the difference between the income and expenses of the entrepreneur (professional deductions). The rate is standard, as for all individuals - 13%.

Data on income and expenses are taken from the Income and Expense Book, where a businessman must record all income and expense transactions in chronological order. The KUDiR form and the procedure for accounting for income and expenses for individual entrepreneurs are given in Order of the Ministry of Finance of Russia No. 86n , Ministry of Taxes of Russia No. BG-3-04/430 dated 08/13/2002 . Not all points from this order need to be applied; more on that below.

What is income

This is all income from business activities: revenue from the sale of goods and services, interest received on loans and borrowings, fines and penalties from buyers, and other income.

Before determining income, you need to “clear” it of VAT. How to calculate income is stated in Article 223 of the Tax Code of the Russian Federation . The day of receipt of income is considered the day when the money arrived in the entrepreneur’s account (cash method). An advance received, for which there has not yet been a shipment, is also considered income.

is not subject to personal income tax ; it is given in Article 217 of the Tax Code of the Russian Federation.

Tax deductions

Income can be reduced by deductions: professional, standard, property and social.

Professional deductions ( clause 1 of Article 221 of the Tax Code of the Russian Federation ) are expenses of an entrepreneur that are associated with making a profit, excluding VAT. These are expenses for raw materials, materials, rent, wages, insurance premiums for yourself and employees, taxes paid (except for personal income tax and VAT), etc.

Clause 22 of the Procedure for Accounting for Income and Expenses, approved by Order No. 86n of the Ministry of Finance of Russia, states that material expenses of an individual entrepreneur can only be written off as expenses in terms of goods sold, work performed and services rendered. The Supreme Court, by decision dated 1 June 9, 2017 No. AKPI17-283, declared this clause invalid . The condition from paragraph 22 contradicts the rule established by Article 273 of the Tax Code of the Russian Federation , and therefore is not mandatory. Material costs can be taken into account as expenses immediately after payment, and raw materials and materials are taken into account as expenses as they are written off for production. But there is always a risk that the tax authorities will find fault if the individual entrepreneur deviates from the Order, although the court will certainly be on his side.

To take expenses into account when calculating tax, they must be:

- paid;

- used in business activities;

- documented. If there are no documents, the purchase cannot be included in expenses.

You can do it differently - reduce income by 20% , and count from the resulting amount. This is also a professional deduction; it is prescribed in Article 227 of the Tax Code of the Russian Federation . In this case , no supporting documents are needed That is, the individual entrepreneur chooses one thing - reduces income either by expenses or by 20%. The second option is beneficial if there are no supporting documents, or expenses were less than 20% of income.

Calculation example:

At the end of the year, the individual entrepreneur received 4,200,000 rubles in income.

The entrepreneur spent a total of 3,100,000 rubles on raw materials, rent, labor, insurance premiums and taxes, and there are supporting documents for everything.

The entrepreneur spent 20 thousand on treatment, he also has documents.

(4,200,000 - 30) x 13% = 140,400 rub.

We have described the procedure for calculating tax at the end of the year. But during the year, the individual entrepreneur must also pay advance payments for this tax, and at the end of the year they pay the tax after deducting these payments. We'll tell you how they are counted and paid.

Advance payments for personal income tax for individual entrepreneurs on OSNO

In 2021, they are still counted by the tax office, and the entrepreneur receives a notification from it and pays the amounts indicated in it. When the year ends, he himself calculates the tax on actual income, subtracts the advances already transferred from it, and pays the difference, if any.

How do tax authorities calculate advance amounts?

When an individual entrepreneur starts operating on the general taxation system, after receiving the first income, he must send a 4-NDFL declaration with the expected income to the tax office (within five days after the expiration of a month after receiving the first income). Based on these amounts, tax authorities must calculate the amount of the advance payment.

If an individual entrepreneur has been working for more than a year and has already submitted the 3-NDFL declaration based on the results of last year, he no longer needs . Tax authorities will calculate advances based on the indicators of last year’s 3-NDFL declaration.

Calculation of advance payments for personal income tax for individual entrepreneurs on OSNO, example:

The 4-NDFL or 3-NDFL declaration for 2021 indicates an income of 1,500,000 rubles. The tax authorities calculated the amount of advances for the coming year and sent them to the individual entrepreneur. In total, he must pay 195,000 rubles in 2021:

- 50% of the payment, that is, 97,500 rubles until July 15, 2019;

- 25%, that is, 48,750 rubles until October 15, 2021;

- 25%, that is, 48,750 rubles until January 15, 2021.

When the year ends and the individual entrepreneur already knows exactly how much he earned in 2021, he will calculate 13% of the profit, deduct the advances already transferred and transfer the rest. If the difference is negative, then you do not need to pay anything extra, and the overpayment can either be returned to your account upon application, or offset against future tax.

But if during the year the entrepreneur’s income greatly increases or decreases, and the deviation from the amounts in the declarations is more than 50% , you need to submit another Form 4-NDFL with the new amount of estimated income. The tax authorities will recalculate the advances up or down and send the entrepreneur a new notification.

Filling out pages

Appendix 2 to the order of the Federal Tax Service, which approved Form 3-NDFL, contains the procedure for filling out the declaration. Before filling out, you should re-read these instructions to avoid possible errors.

Data needs to be entered only in certain pages indicated above, the rest remain empty and do not need to be submitted to the tax office.

First, you need to determine how the form will be filled out and submitted - manually, typewritten, in a program, electronically.

If the form is filled out on paper, be sure to use a pen with blue or black ink. The letters must be clear - capitalized and printed, and must clearly fit into the designated spaces. Empty cells are filled with a short line in the center. Correcting errors is not allowed; if the form is damaged, you must print a new one.

If the declaration is drawn up in electronic form, then the font must be courier new, size 16-18, the finished sample can be printed without borders of the cells.

Important points:

- the cost is indicated in rubles and kopecks;

- tax amounts - in full rubles;

- income/expenses in foreign currency are converted into rubles on the date of receipt of this income/expense;

- each page must have a number, individual entrepreneur’s tax identification number, last name, initials, signature;

- You only need to fill out 4 sheets and submit them to the tax office;

- filling begins with Appendix 2, then the second section, the first and title page, after which the sheets are numbered and folded in order.

You need to fill out 3-NDFL based on the data in the Income and Expense Accounting Book (ILC), which the individual entrepreneur must maintain throughout the year. Individual entrepreneurs are not required to keep accounting records; for the declaration, it is enough to have a KUDR, which can be drawn up in any form convenient for an individual entrepreneur.

When filling out the declaration, the entrepreneur needs to independently determine the actual income and expenditure part of his annual financial result and reflect it on the pages of form 3-NDFL.

Individual entrepreneurs pay advance payments throughout the year based on expected profits. The Federal Tax Service, based on individual entrepreneur data, determines the amount of advances that are paid based on the results of each quarter no later than the 15th day of the month following the reporting period.

At the end of the year, the individual entrepreneur must determine the amount of the advance paid and the actual amount of tax that needs to be paid based on real data.

The difference between the advance payment and the income calculated in the declaration must be paid to the budget. The need for additional payment arises if the tax payable according to real data turns out to be more than the advances paid. If you overpay, an individual entrepreneur can count on a refund of the overpaid tax.

What expenses can be taken into account?

IP expenses can reduce the tax base if they:

- actually paid in the reporting year;

- related to business activities;

- are documented;

- justified.

The following expenses can be classified as expenses:

- for raw materials, starting materials, semi-finished products, goods, fixed assets (material);

- for depreciation;

- to pay salaries to employees, etc.

If the expenses do not meet the above conditions, then the individual entrepreneur may not take them into account, but take a professional deduction of 20% of the annual income as a reduction in the tax base.

That is, the entrepreneur himself chooses what exactly he will accept as expenses - a deduction in the form of 20% of income or actual expenses subject to compliance with the conditions established by the Tax Code of the Russian Federation.

If there are few expenses or they are not supported by documents, then it is better to use a professional deduction.

Title page

You can fill out the first page of 3-NDFL first:

| TIN | TIN of an individual entrepreneur. |

| Correction No. | It is set to “0—” for the initial supply. If the declaration is corrected, the correction number is indicated. |

| Taxable period | Period code – 34 for individual entrepreneurs. |

| Year | 2019, if the declaration is filled out by an individual entrepreneur in 2021. |

| Tax authority | Federal Tax Service code where the report is submitted. |

| Taxpayer information | Include

|

| Information about the identification document | Include:

|

| Status code | Tax residents of the Russian Federation put “1”, non-residents – “2”. |

| Telephone | Contact information must be indicated with the city code. |

| Section "Reliability..." | Information about the person submitting the 3-NDFL declaration to the Federal Tax Service. |

Example of filling out a title page:

Section 1

This section is final and is filled in last after all the data is reflected on other pages.

If an individual entrepreneur must pay tax, then “1” is entered in field 010, and the amount to be transferred in field 040.

If the individual entrepreneur does not have an obligation to pay, then “3” is put in 010, and dashes in 040.

If an individual entrepreneur wishes to return funds from the budget at the end of the year, then “2” is entered in 010, and the amount to be returned in 050.

Lines 030 and 040 are filled in with data on KBK and OKTMO; these codes are entered into form 3-NDFL in any case, regardless of the annual financial results of the individual entrepreneur.

Example of filling out section 1:

Section 2

The section is important; it calculates the individual entrepreneur’s tax to be paid based on the tax base. It is important that all amounts are indicated excluding VAT (if an individual entrepreneur is its payer).

Filling out the lines of the second section of 3-NDFL:

| 1. Calculation of the tax base | |

| 002 | Individual entrepreneurs indicate “3”, which means “other”. |

| 010 | Revenue for the year excluding receipts from foreign companies (must be equal to the value of field 050 app. 3). |

| 020 | Total annual tax-free income (receipts from foreign companies are not included). IPs put zeros in this line. |

| 030 | The total annual taxable income is calculated as indicator 010 - 020. Individual entrepreneurs in this field indicate revenue from line 010. |

| 040 | The amount of deduction (professional for individual entrepreneurs) taken into account for the reporting year (equal to the value of field 060 app. 3). |

| 050 | Not filled in. |

| 060 | The tax base is equal to the difference between lines 030 and 040. |

| 2. Tax calculation | |

| 070 | Tax = Base from field 060 multiplied by rate from field 001. |

| 110 | Advances from field 070 app. 3. |

| 150 | Tax payable - if the tax amount from field 070 is greater than advances from field 110, it is calculated as the difference between the indicators of lines 070 and 110. |

| 160 | Tax refundable, if tax from 070 is less than advances from 110, is calculated as the difference between 110 and 070. |

Example of filling out section 2:

Appendix 3

The application calculates income from the activities of individual entrepreneurs and the amount of professional deduction, which reduces the base for tax calculation.

Line by line filling is presented in the table:

| 1. Type of activity | |

| 010 | Code of the type of activity from Appendix 5 to the Filling Out Procedure, individual entrepreneurs indicate 01, which means entrepreneurial activity. |

| 020 | Primary activity code – OKVED, specified during registration of individual entrepreneurs. |

| 2. Indicators for the tax base and tax | |

| 030 | Amount of annual income excluding VAT. |

| 040 | The amount of annual expenses excluding VAT (divided into four components indicated in lines 041, 042, 043 and 044). This field is filled in if the individual entrepreneur is able to confirm the expenses with documents, and they are truly related to business activities. If this is not the case, then you should fill out field 060, which indicates a professional deduction in the amount of 20% of expenses. |

| 3. Total | |

| 050 | Income from line 030 (if an individual entrepreneur has filled out several appendices 3 at different tax rates, then the total income for all lines 030 is calculated and entered in this field). |

| 060 | Either expenses from line 040 or 20% of income from line 030 are indicated. |

| 070 | Advances paid during the year (calculated by the tax authorities based on information about the profit of the individual entrepreneur). |

| 4. Information provided by peasant farms | |

| 080 | Only peasant farms fill in. |

| 5. Information about self-adjustment | |

| 090-100 | It must be filled out if the individual entrepreneur adjusted the tax base independently in accordance with clause 6 of Article 105.3 of the Tax Code of the Russian Federation. |

Lines 110-150 are not filled out by individual entrepreneurs; they are intended for individuals without a business background to indicate income from sources from Annexes 1 and 2.

Example of filling out Appendix 3:

New uniform 2021

From 01/01/2019, the updated template of the reporting document 3-NDFL, regulated by the order of the tax department (FTS), approved on 10/03/2018 under registration number MMV-7-11/ [email protected]

It is this form of declaration that BGs must adhere to when reporting income tax to the state for the past 2018.

It should be noted that this form has significantly decreased (when compared with its previous versions). As before, it consists of a title part, two main sections and a number of relevant applications, filled out by private entrepreneurs as necessary.

You can read about what has changed in the new 3-NDFL declaration form since 2019 in this article.

How to fill out OSNO correctly for an individual entrepreneur?

The procedure for entering data into Form 3-NDFL is also regulated by the above-mentioned order of the Federal Tax Service. An individual entrepreneur must fill out the title part, the first section and the second section of the declaration in question. In addition, if it is necessary to record the entrepreneurial income of an individual, the relevant information is indicated in the third appendix of the reporting form.

For an individual entrepreneur, the recommended sequence for filling out the relevant declaration sheets is as follows:

- First, the necessary information is entered into the third appendix to the declaration, which directly reflects all business income of the individual individual entrepreneur.

- Then the second section of the reporting form is filled out, characterizing the actual tax base and the calculated value of personal income tax.

- After this, the final data is recorded in the first section of the declaration, which summarizes information about the tax amounts paid, additionally paid and refunded.

- The final stage is filling out the title part of the form (key information about the entrepreneur is provided).

If an individual entrepreneur participates in an investment community, the tax base for the corresponding income is calculated in the eighth appendix and recorded in the first appendix to the reporting form in question.

Other sheets of 3-NDFL are not directly related to the taxation of business income and are filled out by a private entrepreneur as necessary (for example, an individual entrepreneur reasonably claims personal income tax deductions; an individual entrepreneur receives additional income not related to entrepreneurship).

Appendix 3

As mentioned earlier, it is advisable for an individual entrepreneur to begin filling out 3-NDFL by entering the relevant information in the third appendix of this form.

Appendix 3 displays real information about the entrepreneurial income of an individual.

So, filling out the third application is carried out by the individual entrepreneur by indicating the necessary information in the following lines:

- 010 – the code of the type of activity being carried out is indicated (the value 01, corresponding to entrepreneurial activity, should be entered).

- 020 – the code of the main type of economic activity of the individual entrepreneur according to OKVED-2 is reflected.

- From 030 to 044, fill in the information necessary to calculate the tax base and determine the value of personal income tax (the real values of income and the actual values of costs taken into account as part of the professional deduction are indicated).

- From 050 to 070 the calculated values of the total indicators are shown. These lines of the tax return reflect the total amount of income, the amount of professional deduction, and the values of advance payments (both accrued and actually paid).

- 080 – the owner of a farm (peasant) farm indicates here the year of registration of such farm.

- From 090 to 100 - these lines of 3-NDFL are filled in if the individual entrepreneur independently adjusted the tax base and the value of personal income tax based on the results of the year due to the use of non-market prices when carrying out transactions with entities that are interdependent.

- From 110 to 150 - these lines of the 3-NDFL declaration are filled out to determine tax deductions of a professional nature, if an individual, being a tax resident of the Russian Federation, claims for deduction the corresponding expenses incurred under civil law agreements, royalties and other payments of a similar kind.

The total costs of an individual caused by his business activities, documented and taken into account when determining the professional deduction, are recorded on line 040 and detailed on the following lines:

- 041 – material costs,

- 042 – depreciation charges,

- 043 – remunerations/payments to individuals,

- 044 – other costs.

The total amount of individual entrepreneur expenses related to personal income tax deduction of a professional nature is determined and recorded on line 060 in one of two available ways:

- summing up the values indicated on line 040 for each type of activity performed (there is documentary evidence of costs);

- 20% of the total entrepreneurial income of an individual is taken (there is no documentary evidence of the declared costs).

An example of filling out the third application for an individual entrepreneur:

Section 2

Here the total value of taxable income, the value of the tax base, as well as the value of personal income tax that is paid, paid additionally or returned by the individual entrepreneur are calculated.

If tax rates are differentiated for different incomes of individual entrepreneurs, the second section of the declaration is filled out several times - according to the number of rates used.

First, the individual entrepreneur fills out the following lines in the second section of form 3-NDFL:

- 001 – tax rate of available income.

- 002 – a defining feature of the type of income (for entrepreneurial activities of an individual, the value 3 is indicated).

Lines for calculating the tax base of an individual:

- From 010 to 030 – the aggregate values of all income, taxable income, as well as those incomes that are not subject to personal income tax are filled in. All these values are given without the dividend component.

- 040 – the value of tax deductions is shown, which is taken from line 060 of the third application. The standard deduction from the fifth schedule is also reflected in line 040 of the second section. A zero value is entered in this line if the applicable tax rate does not correspond to 13%.

- 050 – the value of costs that reduce earned income.

- 060 – the value of the tax base is calculated and displayed. A zero value is entered if the calculation result is negative. If an individual takes into account exclusively business income and standard/professional deductions, the indicator corresponds to the difference between line 030 and line 040 of the second section.

The paid, additionally paid or refunded tax is calculated using the following lines:

- 070 – shows the personal income tax value calculated from the tax base according to line 060 of the second section.

- From 080 to 130 – information is filled in that allows you to calculate the value of personal income tax to be paid or refunded.

- 140 – shows the value of the tax paid by an individual under the PSN.

- 150 – paid/additional personal income tax is fixed.

- 160 – the returned personal income tax is reflected. The value of line 070 is subtracted from the sum of the values of lines 080 to 130. A zero value is entered if the calculation result is negative or zero.

An example of filling out the second section of 3-NDFL for individual entrepreneurs:

Section 1

The amounts of personal income tax paid, additionally paid or refunded are recorded here. The following lines are filled in:

- 010 – value 1 is indicated for personal income tax payment/additional payment; value 2 is indicated for personal income tax refund; the value 3 is indicated if there is no personal income tax.

- 020 – the required KBK is filled in.

- 030 – the required OKTMO is prescribed.

- 040 – amount of personal income tax payable/additional payment.

- 050 – personal income tax amount to be refunded.

An example of filling out the first section of a declaration for an individual entrepreneur:

Title page

The title component of the declaration in question is filled out as follows:

- TIN code of the entrepreneur;

- correction number;

- identifying code of the territorial structure of the tax authority;

- reporting year - when filling out a declaration in 2021, indicate 2021;

- identifying code of the country of citizenship of the individual entrepreneur (643 for the Russian Federation);

- category identification code (720 for business income);

- Full name of the individual entrepreneur;

- personal information of the individual entrepreneur;

- status (resident/non-resident);

- phone number;

- number of completed sheets, pages;

- confirmation of the completeness of the data;

- signature and date.

An example of filling out the title page of form 3-NDFL:

Personal income tax reporting for individual entrepreneurs

Here it is important to note three types of reports relating specifically to personal income tax:

- KUDIR for individual entrepreneurs on OSNO - the individual entrepreneur must keep a book where he reflects all business transactions (remember that only if KUDIR is maintained, the entrepreneur is released from the obligation to keep accounting records);

- 4-NDFL – information about estimated income (surrendered, as we said earlier, by entrepreneurs who either just registered as an individual entrepreneur or switched to OSNO from other regimes);

Important! 4-NDFL is submitted once. But, in principle, there may be a situation where it is necessary to file an adjustment return. Such a need arises in the event of a sudden change in business conditions, due to which the estimated income changes up or down by more than 50%.

If your estimated income has increased significantly, then it is not necessary to resubmit 4-NDFL - everything that you do not pay in advance, you will pay during the final payment at the end of the year. But if there is a sharp decrease in income, it is still better to file a 4-NFDL - this is beneficial for the individual entrepreneur. Based on the new information, the tax authorities will recalculate the advances, and you will no longer overpay them during the year.

- 3-NDFL - the personal income tax declaration itself is submitted once based on the results of the past year until April 30 of the next year.