Home Accounting and HR Accounting

A balance sheet is a form of financial reporting that must be submitted to the tax office by almost all organizations conducting financial and economic activities, as well as entrepreneurs working under the basic tax accounting system.

Today we will look in detail at the essence of the balance sheet form, what types of this financial reporting form exist, how to fill them out, when and where to submit them.

Read our material to the end, we hope it will be useful to you, we will also look a little at the latest innovations.

General information about the balance sheet

According to the law, all economic entities are required to maintain their internal financial records and submit reports to the tax authorities. These reports may have different compositions and forms, and different deadlines for submission.

Large firms must submit all five forms of standard accounting reporting to the tax office, and small firms can independently choose which type of standard or abbreviated reports they will submit to the Federal Tax Service, for example, you can submit 5 forms or only 2 reports - Balance Sheet and Profit Report.

For companies and individual entrepreneurs operating under a simplified tax system, it is possible to submit a Balance Sheet and Profit Report in a simplified format. Let us consider further in detail the essence of the balance sheet form, as well as the full and simplified form of this report.

The balance sheet is a form of reporting that most fully presents information about its financial and economic activities for the current and previous periods, as well as its financial condition for these periods. This form of reporting reflects the sources of income, assets and liabilities at the disposal of an economic entity.

The annual balance sheet is always drawn up, but on the basis of operational records from accounting registers, which are confirmed by supporting primary documents for the entire reporting period. Usually the Balance is provided for the year. It is important that the accounting registers reflect all financial and business transactions for the year, without omissions, distortions or errors.

When preparing reports, it is important to understand that the tax office may require any primary documents for the reporting period or even documents for previous reporting periods for several years. Therefore, it is important to always have a file of primary documents filled out in accordance with all the rules and ensure that they are correctly reflected in all accounting registers.

When submitting any financial statements to regulatory government agencies, it is important that all reports due for submission are submitted on time and without errors. If the deadline for submitting all necessary reports is violated, or if they are inaccurate or distorted, serious fines are provided and sometimes even criminal charges may be applied.

In itself, filing incorrect reports or simply not submitting them, entails incorrect tax assessments, and for under-assessed or unpaid taxes on time, penalties are also provided, and daily penalties are charged for late payment of the accrued tax.

It is also important to note here that the Balance Sheet and other necessary final annual reports are also submitted by those economic entities that did not operate this year, since the lack of activity is not a sufficient reason for exemption from submitting reports to the tax office. For such cases, so-called “zeros” are provided; it is possible to submit reports in a simpler, abbreviated form.

The balance sheet, like other reports, can be submitted in paper or digital form. Reports in paper form can be submitted in person to the tax office or sent by mail in an envelope. The easiest way to submit reports is using electronic services via the Internet. For example, you can do this through Kontur, the websites of the Federal Tax Service or State Services and other services. In order to send reports digitally, you must have the appropriate electronic keys and enter into agreements for digital document flow.

In general, all companies that operate on Russian territory must submit a balance sheet, and only entrepreneurs who, depending on annual revenue and the applicable taxation system, can choose the procedure for their financial and economic accounting and reporting package.

Inventory

Before preparing annual financial statements, the organization is required to conduct an inventory. This obligation applies to all companies, regardless of their tax regime or legal form. The purpose of inventory is to ensure the reliability of accounting data and financial statements. To do this, during the inventory, the presence, condition and assessment of the organization's assets and liabilities are checked and documented.

This inventory is planned. To carry it out, the manager must approve the inventory regulations. The timing of such an inventory is from January 1 to December 31 of the reporting year.

An annual inventory is carried out on all assets and liabilities of the company, the verification is complete.

There are other reasons for conducting an inventory, unscheduled. They are established by the Regulations on accounting and financial reporting, Federal Law 402-FZ and PBU 4/99). This:

- change of financially responsible persons;

- identification of facts of theft, abuse or damage to property;

- natural disasters, fire or other emergencies;

- liquidation or reorganization of an organization.

Inventory procedure

- Step 1. Creation of an inventory commission

- Step 2. Receiving the latest incoming and outgoing documents

- Step 3. Receiving a receipt from the financially responsible person

- Step 4. Preparation of inventory records (acts)

- Step 5. Verification and documentary evidence of the presence, condition and valuation of assets and liabilities

- Step 6. Summarizing the results identified by the inventory

- Step 7. Approval of inventory results

- Step 8. Reflection of inventory results in accounting

You can read more about these stages in the “Practical guide to annual financial statements 2016” of the Consultant Plus system.

Balance due dates

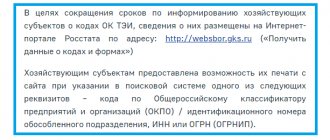

The balance is submitted to the tax office no later than March 31. Please note that starting from 2021, the Balance Sheet must be submitted only to the Federal Tax Service; this reporting is no longer required to be submitted to Rosstat.

Typically, a balance sheet is filed for an annual reporting period. But, for newly created companies, during the reorganization of the company, as well as during liquidation, this report is submitted for the period of the official existence of the organization in this reporting year. When an organization is liquidated (or reorganized), the report is submitted within 3 months (from the date of liquidation or reorganization according to the Unified State Legal Entity).

Sometimes it is important to accurately record the date of submission of reports:

- When submitting documents in person in paper form, this is the date on the tax inspector’s stamp;

- When sending statements by mail, this is the date of the mailing receipt;

- When sending a report digitally, this is the date of acceptance of your tax reporting, according to information confirmation from the Federal Tax Service website.

Who should report electronically?

Reporting in electronic form is not only convenient, but sometimes also necessary. By law, the following reports must be submitted in electronic format:

- annual financial statements;

- VAT declaration;

- calculation of insurance premiums (DAM), if the average number of employees for the last year is more than 10 people;

- reporting to the Pension Fund and Social Insurance Fund, if the number of employees is 25 or more.

In addition, the largest taxpayers and organizations and individual entrepreneurs whose average number of employees exceeded 100 people in the previous year can submit reports to the tax office only electronically.

Some of the most common errors in Balance and how to fix them

Let's look at typical mistakes when drawing up a Balance Sheet:

- Incorrect indication of the estimated value of assets; revaluation or inventory may be required to correct this error.

- Inconsistency of financial data in interrelated reporting forms, on different lines, for different reporting periods - the accountant needs to carefully check the data in the relevant accounting registers; it may be necessary to make adjustments to the previous ones in the reporting forms and submit updated forms to the tax office.

- Sometimes, after submitting the final reporting form, it may be revealed that inaccuracies were made, perhaps something was taken into account incorrectly, then it is also necessary to submit updated reporting forms with explanations to the tax office.

Features of preparing simplified reporting

To address some issues related to the topic of our article, the Ministry of Finance of the Russian Federation issued information message No. PZ-3/2015. This message contains the main concessions for those using simplified reporting:

- The decision to disclose any information should be based on the materiality of the data to users (including the identification of individual items from groups of items in reporting forms).

- You don't have to write down the information:

- about related parties;

- segments;

- for discontinued activities.

- Events after the reporting date are shown in financial statements only if it makes rational sense.

- When changes are made to accounting policies, the significant consequences of this fact can be reflected in the financial statements prospectively.

- Significant errors from previous years can be corrected by affecting other income or expenses of the current period, without adjusting retained earnings/loss.

Recommendations on the use of simplified accounting methods provided by the Institute of Professional Accountants will help you avoid making mistakes when preparing reports. Get free trial access to ConsultantPlus and go to the material.

Balance sheet in simplified form

Some organizations, as well as entrepreneurs, can conduct accounting and prepare reports in a simplified, abbreviated form. In fact, there are several types of simplified reporting forms; let us first consider the abbreviated form of the Balance Sheet for clarity.

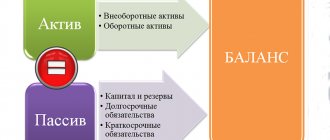

The Balance Sheet form has two main parts, assets and liabilities. In the Balance sheet form, it is necessary to enter not only data for the current reporting date, but also indicate balances as of the previous reporting date.

Each line of the balance sheet reflects the total balance of the corresponding asset or liability as of the reporting date for individual assets and liabilities.

Information for past periods is always transferred from previous reports, and current data is taken from accounting registers or from the electronic balance sheet of an accounting program (1C or others).

When filling out a report, dashes are usually placed in the empty lines.

The simplified form of this report itself has much fewer lines, and it looks simpler. Completing such a report requires significantly less time and effort. Let's consider the procedure for filling out the abbreviated Balance in detail.

Composition of simplified financial statements for 2020

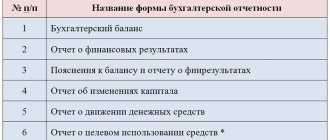

Let's start with the fact that, by virtue of paragraph 1 of Art. 14 of Law No. 402-FZ, accounting consists of:

- from the balance sheet;

- financial results report;

- applications to them.

For a sample of a simplified balance sheet, see ConsultantPlus, having received trial demo access to the K+ system for free:

The annexes, in turn, are (clauses 2, 4 of order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n):

- statement of changes in equity;

- cash flow statement;

- report on the intended use of funds;

- explanations for reporting.

For information on preparing appendices to financial statements, see the material “Filling out Forms 3, 4 and 6 of the Balance Sheet.”

Note that for non-profit organizations, a report on the intended use of funds is designated as a form of mandatory annual accounting reporting along with a balance sheet (clause 2 of Article 14 of Law No. 402-FZ). Not only NPOs, but also other companies if they received targeted funds must fill out this report.

As for those who apply simplified rules, Order No. 66n contains special relaxations. In mandatory forms, you can indicate aggregated indicators, combined by groups. These forms are:

- balance;

- income statement;

- report on the intended use of funds.

For these three reports, legislators provided abbreviated forms in the mentioned order No. 66n; they can be found in Appendix 5. Those who have the right to simplify reporting have the opportunity to choose whether to use the forms given in the order or develop them themselves.

According to sub. “b” clause 6 of Order No. 66n in the appendices to the main forms it is necessary to indicate only those data that may influence the opinion of users of the reporting on the results of the organization’s work or its financial condition. Accordingly, if such important information is not available, then it is not necessary to fill out the applications. This is confirmed by paragraph 17 of the information of the Ministry of Finance of the Russian Federation No. PZ-3/2015.

Filling out the Balance in a simplified form

The balance sheet, like any other form of reporting, must begin by filling out the title part, where the important details of the company are indicated:

- The name of the company, its organizational form, or indicate individual entrepreneur;

- Kind of activity;

- TIN and other basic statistical codes;

- Location;

- Reporting date.

Next, you need to fill out the tabular part containing information about the company’s property - its assets and liabilities. The Balance Sheet is approved, usually by the head or chief accountant of the organization. Don't forget to also set the date for preparing your reports.

In the tabular part of the simplified balance sheet form, it is necessary to provide data for the current reporting year and provide information for the previous 2 years.

As already noted, the balance sheet contains 2 parts - assets and liabilities. First, let's look at how to fill out the assets section.

The abbreviated Balance Sheet includes several groups of assets:

- Tangible non-current assets - this includes the total balances of fixed assets Account 01 (minus depreciation Account 02), the cost of equipment found during installation Account 07, the balance of investments in assets Account 08;

- Intangible non-current assets - this includes the total balances of intangible assets Account 04 (less depreciation Account 05), deferred tax assets Account 09, financial investments Account 58;

- Inventories - on this line you need to add up materials Account 10, production balances Account 20 and for manufactured products Account 43, as well as the balance of inventory balances Account 41, balance of sales expenses Account 43;

- Cash - here it is necessary to add up and record the total amount of balances as of the reporting date at the cash desk of Account 50, the balance of current accounts in rubles and in currency Accounts 51 and 52, and also add transfers of Account 57;

- Current assets - you must indicate the balance of mutual settlements with your buyers / customers Account 62, as well as for your suppliers / contractors (Account 60), tax balances Account 68, 69, for settlements with employees (Account 70, 71, 73), as well as indicate the balances in the calculations for the founders of Account 75 and other counterparties of Account 76. If you made provisions for doubtful debts, then you need to subtract your existing balance of Account 63 (credit).

In the final asset line, you need to add up all the asset data presented above.

Now let's look at the second part of the balance sheet, which reflects liabilities, but unlike the debit balance of assets, the credit balance is usually indicated for liabilities. Liabilities are also usually formed into several groups by type:

- Capital and reserves - here you need to add up the balance of the company’s authorized capital, as well as reserve and additional capital (Account 80, 82 and 83), indicate the balance of retained earnings Account 84. You must subtract from this total amount if you have debit balances on your own shares and retained earnings (Account 81 and 84).

- Long-term loans of the company - loan balance Account 67;

- Other long-term obligations - for small businesses there are usually dashes here;

- Short-term loans of the company - balance Account 66;

- Accounts payable - here it is necessary to indicate the total credit balance of the accounts that have already been indicated above, but here the credit balance of Accounts 60, 62, 76, 70, 71, 73, 68, 69, 75-2 is taken.

- Other short-term liabilities of the company are the balance of future income, and if you have reserves for future expenses and deferred tax liabilities (Account 98, 96, 77).

In the final line of liabilities, it is necessary to add up all the above data on liabilities.

Note that if everything was done correctly, then the total data on assets and liabilities should be equal. If you have any difference in these data, then you need to double-check the data in the accounting registers and your total calculations. Sometimes such an error may occur due to the fact that you incorrectly accounted for or assigned an asset or liability to the wrong accounting group.

The Simplified Balance Sheet is usually submitted with the income statement form. This set of reports usually includes an explanatory note. In the explanatory part of the reporting, only the most important additional data is provided. For example, these could be provisions of your accounting policies that explain the procedure for compiling indicators for these reports or facts of activity that are not disclosed in the submitted reports. Also, the explanatory section may provide data on transactions with the owners of the company, data on dividend payments, changes in the authorized capital, etc.

Filling out a standard Balance

The Standard Balance Sheet is a more cumbersome and detailed form than the form discussed above. The general principle of filling out both balance forms is the same. Both of these forms have a title section at the top, which contains the details of the company, followed by a tabular section containing data on the assets and liabilities of the company.

The main difference between the full and simplified forms of the balance sheet is that the full form reflects more detailed data for each group of assets and liabilities.

As already noted, the balance sheet contains two main parts: assets and liabilities.

On the balance sheet, assets are divided into two main groups and several subgroups:

- Fixed assets

- Intangible non-current assets – balance of Account 04 (except for R&D), less depreciation of Account 05;

- R&D;

- Intangible assets - balances from Account 08.11;

- Material assets (exploration) – balances from Account 08.12;

- Fixed assets of the organization - balance of Account 01 (minus depreciation of Account 02);

- Investments in MC - balance of Account 03 (minus depreciation of Account 02);

- Investments - balance of Account 58 (minus Account 59), balance of Account 73 (for loans over 12 months);

- Deferred tax payments – balances of Account 09 (minus balance of Account 77, if any);

- Other noncurrent assets;

- The total amount for this entire section;

- Current assets

- Inventories - here we add up materials Account 10 (minus Account 14) or add up Accounts 15 and 16, balance total balances for production Account 20 (as well as 21, 23, 29, 44, 46) and finished products Account 43, goods Account 41 (minus , if there is Account 42), Account 45, sales expenses Account 43;

- VAT – Account 19;

- Accounts receivable - here you need to indicate the balances in mutual settlements with your buyers/customers (Account 62), as well as with suppliers/contractors (Account 60), balances for tax calculations (Account 68, 69), for settlements with employees (Account 70, 71, 73), as well as indicate balances for the founders of Account 75 and other debtors/creditors (Account 76). If you have reserves for doubtful debts, then you need to subtract your existing credit balance Account 63.

- Investments (except for cash equivalents) - balance of Account 58 (less balance of Account 59), deposits of Account 55, settlements on existing loans Account 73;

- Cash and cash equivalents - here it is necessary to add up and record the total amount of balances as of the reporting date for the cash register of Account 50, current accounts in rubles and in foreign currency Accounts 51 and 52, special accounts in banks Account 55, and also add transfers of Account 57;

- Other current assets;

- The total amount of this section;

In the final asset line, you need to add up all the above data on assets - balance sheet.

Now let's look at the second part of the balance sheet, which reflects liabilities. For liabilities, the credit balance is usually indicated. Passives are also usually divided into several groups by type. On the balance sheet, liabilities are divided into three main groups and several subgroups:

- Capital and reserves

- Charter quantity – balance balance Account 80;

- Shares of the company - balance Account 81;

- Revaluation of fixed assets and intangible assets - balance Account 83;

- Additional inventory (without revaluations of OS and intangible assets);

- The company's reserve balance is Account 82;

- The balance of your retained earnings or loss is the balance from Account 84;

- The total amount of this section;

- Long-term liabilities of the company

- Loan balance – Account 67 (here you must indicate the company’s loans taken out for a period of more than a year, with accrued interest);

- Deferred tax liabilities at the end of the year - balance of Account 77 (minus balance of Account 09);

- Estimated liabilities of the company - balance from Account 96 (for a period of more than a year);

- Indicate the company's other obligations (for more than a year);

- The total amount of this section;

- Short-term liabilities of the company

- The balance of your company’s short-term loans is Account 66 (here you must indicate the company’s loans taken out for a period of up to a year, with accrued interest);

- Balance of accounts payable - here you need to indicate the total credit balance of the accounts that have already been indicated above, but here the credit balance of Accounts 60, 62, 70, 71, 73, 68, 69, 75-2, 76 is taken.

- Balance of other short-term liabilities of the company;

- Balance balance of future income - balances of Account 98, also indicate if there is Account 86;

- The balance of the company's estimated liabilities is the balance of Account 96 (for a period of up to a year);

- Indicate other obligations of the company for a period of up to a year;

- The sum of the lines for this section;

In the final line of liabilities, you need to add up all the above data on liabilities - balance.

The totals for assets and liabilities must be equal. If these amounts are unequal, then you need to double-check the data in the accounting registers, total calculations, and also check the correctness of the allocation of assets and liabilities into groups.

Balance Analysis

As is already clear from the above, the Balance Sheet contains a lot of important information about any company. Therefore, this reporting form may be requested from you not only by the tax office, but, for example, by the bank when issuing a loan. Some companies, when concluding important or large contracts, ask the partner company to provide them with a Balance Sheet.

When considering and analyzing the balance sheet, they often take into account the amount of the company’s turnover, the company’s individual assets that are important to them, the availability of equity capital, the company’s debt load, the amount of any debt and other significant data. The relationship between the individual articles of this report and each other is important; if the company has any financial problems, they will be immediately obvious to any specialist, just at one glance at the company’s Balance Sheet.

Another very important point is the dynamics of the financial indicators of the Balance Sheet. The indicators presented in the Balance Sheet for three years perfectly reflect the dynamics of the company's development - they can show the steady growth of the company, existing problems with development or stagnation, as well as a deterioration in the financial condition.

A competent specialist, having analyzed any Balance Sheet, will immediately see the strengths and weaknesses of the company and will even be able to suggest ways of financial recovery or the most effective points of growth for this organization.