Every month, legal entities and individual entrepreneurs who have officially employed employees submit SZV-M reports to the Pension Fund of Russia. Sometimes accountants make mistakes: they incorrectly indicate the full name, INN, SNILS, or forget to enter data on some employees. In this article you will learn how to correct the SZV-M and avoid a fine for submitting a supplementary form.

To prepare SZV-M, we recommend using the “My Business” service for entrepreneurs and accountants. It automates reporting and reduces the likelihood of errors to zero.

Submission deadlines and composition of SZV-M

This document is submitted to the pension fund every month before the 15th day of the month following the reporting month. For example, a report for March must be submitted by April 15. If the fifteenth falls on a weekend or holiday, the filing deadline is moved to the next business day. In particular, April 15th falls on a Sunday, which means the filing date is moved to the 16th.

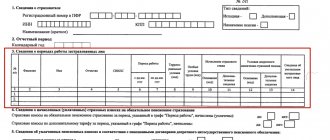

The form consists of four sections:

- Details of the policyholder: information about the employer is indicated. In particular, registration number in the Pension Fund of Russia, name, tax identification number and checkpoint.

- Reporting period: enter a code corresponding to the serial number of the month for which the documentation is submitted. For example, January is code “01”, February is “02” and so on. The year is entered in a separate column.

- Type of form: depending on whether the report is being submitted for the first time for a specific period or not, one of three codes is entered - “output”, “additional”, “o”; indicated only if the report is submitted for the first time.

- Information about the insured persons: the full name of each employee, as well as SNILS and INN are indicated.

Key rules for correcting SZV-M

In 2021, it is allowed to correct errors in reporting:

- on their own initiative;

- as directed by the Pension Fund.

If you independently identify an inaccuracy, immediately send corrective information to the Pension Fund. This is permitted only if notification is received that the report has been accepted by the Pension Fund and the submission deadline (15th of the month) has not expired.

If the Pension Fund finds an error, it is given 5 working days to submit a form with accurate information. Only those errors pointed out by the controller can be corrected without penalty. The rest will be punished with a fine.

SZV-M: canceling or supplementing

Canceling reporting is applied if incorrect information about the insured persons was entered into it. If the report does not reflect all information about employees, then a supplementary form is used. Such definitions are given directly in the reporting form. In practice, employees authorized to prepare SZV-M have difficulty distinguishing between these two concepts.

Currently, there are three conditions when additional SZV-M is applied. Below is a sample of filling out this form for April 2021.

What to indicate in the supplementary form

The report was approved by Resolution of the Pension Fund of the Russian Federation No. 83p dated 02/01/2016. In it, the employer indicates the personal data of employees who are in an employment relationship or provide services (perform work) under civil law contracts (CPL):

- FULL NAME. - Full Name;

- TIN - individual taxpayer number;

- SNILS - insurance number of an individual personal account.

IMPORTANT!

If the organization does not have employees receiving payments, then a zero report is not submitted. The format does not provide for a blank document. If only the founder receives payments, then the data is provided for him.

SZV-M supplementary form: deadlines for submission

Before submitting the supplementary SZV-M, you should familiarize yourself with the deadlines for its submission. According to existing legislation, it is submitted before the 15th day of the month following the reporting month. That is, it must be provided before the end of the reporting campaign. Otherwise, the organization faces a fine of 500 rubles for each employee in respect of whom an error was made. This is stated in Article 17 of Federal Law No. 27-FZ. Therefore, it is advisable to leave a time gap between the date of submission of the form and the deadline prescribed by law.

Canceling report SZV-TD

The SZV-TD form and the procedure for its preparation were put into effect by Resolution of the Pension Fund Board of December 25, 2019 No. 730p.

Up to the 15th day inclusive, information is submitted by employers based on the results of the previous month, in which personnel events took place: transfer, assignment of qualifications, filing an application to switch to an electronic work record or to maintain a paper work record book, and others. When hiring or dismissing an employee, information is submitted to the Pension Fund no later than the next working day after the date of issue of the order.

As a result, employee data is accumulated in the Pension Fund's electronic database. It is possible that errors may be made when filling out the SZV-TD. To correct them, the personnel officer needs to:

- cancel erroneous data;

- if necessary, provide new, correct information.

All this can be done in one SZV-TD report.

Report SZV-M and SZV-Stazh: general provisions

SZV-M and SZV-Stazh are forms of individual personalized accounting containing data about employees of the organization or employees of individual entrepreneurs. Control over the provision of personalized accounting information is assigned to the territorial bodies of the Pension Fund of Russia.

SZV-M includes individual data about the employee (full name, SNILS, INN), SZV-Experience - information about the periods of insurance coverage and the grounds for early registration of a pension.

Who serves

Reporting forms SZV-M and SZV-Stazh are submitted by all employers (both legal entities and entrepreneurs), regardless of the form of ownership, organizational structure, income level, or number of employees.

Obligations for the preparation and submission of SZV-M and SZV-Stazh are assigned, among other things:

- individuals registered as individual entrepreneurs with one or more employees;

- organizations that do not have employees, and whose activities are controlled by the director-sole founder;

- companies that are in the process of liquidation. In such cases, the report includes the individual liquidator with whom the GPC agreement was concluded, or members of the liquidation commission (if the agreement is executed for a company and not an individual).

The SZV-M and SZV-Stazh reports include all employees of the organization registered under employment contracts or brought to work on the basis of GPC agreements. The reports reflect information about employees who have worked in the organization from the 1st day.

Individual entrepreneurs submit reports SZV-M and SZV-Stazh for employees; information about themselves is not reflected in the reports.

Fines and liability

In accordance with the provisions of Art. 17 Federal Law No. 27 Submission of supplementary reports may imply a fine in the amount of 500 rubles. for each insured person . After all, the provision of a corrective form is direct evidence that erroneous information was included in the main document.

If, based on the results of the inspection, an act was drawn up containing information about the need to pay a fine, there is no need to immediately execute it. A businessman has the right to write an application to the Pension Fund in order to cancel the validity of the document and avoid the need to be punished.

In Art. 17 specifies violations for which a fine is imposed:

- failure to submit a document;

- ignoring reporting deadlines;

- failure to provide information on specific employees;

- entering erroneous data;

- pass of some employee.

By acting in accordance with the law, the fine can be reduced or the need to pay it can be avoided altogether.

Position of the judiciary

The courts have a different opinion on this matter. The position of officials contradicts the judicial practice that has developed recently. In a number of situations, fiscal authorities side with entrepreneurs and refuse to impose a fine for providing additional information late.

The judges note that, in accordance with the current legislation, fines will be paid by policyholders only if inaccurate information . However, being punished because errors were discovered and corrected in a timely manner is unfair.

In addition, an additional form may be submitted if the employer clarified or corrected the information submitted earlier, and this happened within five working days from the date of receipt of the relevant notification (of discrepancies). The court ruling also contains information that the policyholder is not at fault when independently correcting the error.

The Supreme Court expressed a similar position, reporting that:

- an entrepreneur who discovered a violation on his own and took measures to eliminate it is considered a respectable citizen;

- The law does not regulate the period during which the policyholder may independently identify an error or incompleteness of the information provided before it is discovered by the Pension Fund.

In this regard, the punishment imposed during the provision of clarifying information to the Pension Fund of the Russian Federation is a formality and is considered unacceptable.

There is also another court decision that employers must be aware of. We are talking about Resolution of the Constitutional Court of the Russian Federation No. 8-P of February 4, 2021. In accordance with the standards of current legislation, ignoring the deadlines for submitting the form is fraught with liability in the form of a fine, the amount of which is 500 rubles. for each person having an insurance policy. This is stated in Federal Law No. 27 of April 1, 1996.

Punishment is also discussed in Art. 15.33.2 Code of Administrative Offenses of the Russian Federation. In accordance with this legislative norm, an official can be fined in the amount of 300 to 500 rubles.

Deadlines

If the insurer made a mistake in the report, then the SZV-M must be corrected before the end of the reporting period (month). If the employer does this later, the Pension Fund of Russia fines him 500 rubles. for each worker for whom false information was provided.

- It is in the interests of the company to correct SZV-M as soon as possible. According to information from this report, the Pension Fund of the Russian Federation carries out indexation of pensions. If the Pension Fund overpays a pensioner due to erroneous data in the SZV-M report, then it recovers damages from the insured-employer.

- The more time has passed since the date of drawing up the canceling SZV-M report with errors, the higher the material damage. It is better for the employer not to wait until the Pension Fund employee finds errors, but to ask this regulatory body to send a notification of errors.

Upon notification from the Pension Fund of Russia, the company corrects the report without penalty within the first 2 weeks.

How to fill out a canceling SZV-TD if you incorrectly indicate the date of application

Ilyukhina A.N. in October, Vikhr LLC filed an application to continue maintaining the work record book.

The HR department employee mixed up the application submission date: instead of 10/06/2020, he indicated “10/05/2020” in SZV-TD.

As a result, the October 2021 report requires correction by filing two new forms:

- one - to cancel incorrect information (next to the date 05.10.2020 there will be an “X” sign);

- the second – to send current information (indicating the date 10/06/2020).

An example of a canceling SZV-TD in this case looks like this:

SZV-TD canceling: example of filling

Artemova N.A. She has been working as the head of the purchasing department at Vikhr LLC since 2013, but in November 2021 she decided to resign of her own free will.

Based on the results of November 2021, the HR department filed a SZV-TD with a single line - about the fact of dismissal on November 10, 2020 (the report was submitted on November 11, 2020). At the same time, the obligation to indicate information about work with this employer as of 01/01/2020 was overlooked.

As soon as the error was identified, the personnel officer compiled a new report, indicating in it:

- canceling the dismissal line (with the “X” sign);

- record of employment as of 01/01/2020 (hired in 2013);

- line about dismissal (again, but without any sign of cancellation).

The canceling SZV-TD, transferred to the Pension Fund later - November 13, 2020, in this situation has the form:

Form type

The information form can be submitted with three types:

- The initial one is the form that is submitted by the enterprise to its employees for the first time. In the document itself it is designated “Ikhd”;

- Additional - submitted only if you want to add information about an employee (perhaps you mistakenly forgot to indicate information about him in the original form). In the document, this form will have o;

- Cancellation - a form that is used to cancel incorrectly submitted information. The type of this form will be indicated in the report as “Cancel”.

Example 1.

Rosa LLC submits information for February 2021 for all its employees on March 10. In such a situation, the LLC accountant will put an o on the report.

Example 2.

Rosa LLC submitted information for February 2021 to the Pension Fund for employees on March 10, 2021. After submitting the report, the accountant found out that in SZV-M he forgot to indicate a new employee who started working on February 28, 2021. In this case, the accountant submits information with the “Additional” (supplementary) form type.

Example 3.

Rose LLC filed its February 2021 report in March 2021. Two days after filing, the accountant discovered that she had forgotten to exclude from the information an employee who was fired on January 31, 2021 and did not work a single day in February. In this case, the accountant must submit information with the “Cancel” type for this employee.

Accounting entries

All accounting documents are subject to detailed reflection in postings. The accrued fine is no exception, since it can also be displayed in accounting. This is done like this:

- Dt 99 Kt 69 – charging a fine;

- Dt 69 Kt 51 – payment of a fine by the organization.

To avoid such charges and penalties, it is necessary to ensure timely submission of reports containing the required set of information.

Additional information on fines for errors in filling out or failure to submit the SZV-M is presented in the video below.

How to correct errors in other sections of SZV-TD

The reporting verification programs presented on the official website of the Pension Fund allow you not only to prepare a report, but also to check it for errors.

SZV-TD with gross errors, which correspond to code 50, will not be accepted by the Pension Fund of Russia:

- the registration number and TIN of the policyholder must be correctly indicated and coincide with those available in the Pension Fund database;

- An employee's SNILS must be unique.

It turns out that such distortions will become a reason for refusing to accept the primary SZV-TD: such errors are corrected immediately, and not in the order of canceling the information.

We also recommend correcting less serious errors before submitting them to the Pension Fund: theoretically, the agency should draw the employer’s attention to them, but accept the report. For example:

- The employee's SNILS did not pass the check for compliance with the control number, i.e. specified incorrectly;

- The full name of the employee or the enterprise checkpoint differs from the information in the Pension Fund database.

As a result, information about the policyholder and the insured person is adjusted at the stage of drawing up the SZV-TD:

- Gross errors will cause refusal to accept information and will require corrections and re-submission of the initial report;

- Less critical inaccuracies also need to be corrected, because The department will definitely pay attention to them, although it will accept the report.

We talked in detail about error codes in SZV-TD here.

Signature and seal

If the policyholder reports “on paper”, then after filling out all sections, the SZV-M form must be signed, indicate the date of preparation and put a seal (if any). Let us remind you that currently organizations have the right not to have a round seal (see “LLCs and JSCs may refuse to use seals: how to do this and in which documents a seal still remains a mandatory requisite”). Let's give an example of filling.

Please note: the SZV-M form states that when signing the report, you must enter “name of the manager’s position.” However, as was said at the beginning of the article, policyholders who are individual entrepreneurs are also required to submit this form. In this regard, the question arises: should the individual entrepreneur leave the field blank, which is intended to indicate the position of the manager, or should the words “individual entrepreneur” be entered in this field? There is no answer to this question. But in any case, the entrepreneur must certify the SZV-M form with his personal signature.

Chances of court cancellation of fines

In court, the chances of canceling the fine issued to the company are quite high. According to the judges, when the company itself found and corrected the error, financial sanctions cannot be imposed on it (decision of the Supreme Court of the Russian Federation dated 02/08/2019 No. 301-KG18-24864).

A fine is also unlikely if the error was found by the Pension Fund of Russia specialists, and the company managed to submit the supplementary SZV-M form within 5 days after receiving the notification from the fund (Determination of the RF Armed Forces dated July 5, 2019 No. 308-ES19-975).

It is difficult to say how the courts will resolve such issues in the future - the Ministry of Labor has prepared a draft according to which the Pension Fund of Russia will legally fine employees if the supplementary SVZ-M was submitted after the deadline reporting date.

It will not be possible to cancel a fine issued to a manager even in court (Resolution of the Supreme Court of the Russian Federation dated July 19, 2019 No. 16-AD19-5).

Find out even more about fines, including for SZV-M, from the materials:

- “What is the penalty for failure to submit the SZV-M report?”;

- “What is the fine for an LLC for operating without a cash register”;

- “Amounts of fines for failure to submit tax reports.”