What the law says

Based on clauses 2 and 6 of Art. 288 of the Tax Code of the Russian Federation, if a company has several separate divisions on the territory of one constituent entity of Russia, then it may not distribute profits to each of them. The amount of tax payable to the budget of this region in this case is determined by the share of profit calculated from the totality of indicators of separate divisions located on the territory of a constituent entity of the Russian Federation.

At the same time, the organization itself chooses the separation through which it will pay taxes to the budget of this region.

The Inspectorate of the Federal Tax Service, in which the company is registered for tax purposes at the location of its separate divisions, must be notified of the decision by December 31 of the year preceding the tax period.

Notifications are provided if:

- the organization has changed the tax payment procedure;

- the number of structural units on the territory of a constituent entity of the Russian Federation has changed;

- There have been other changes affecting the tax payment procedure.

Personal income tax

From 2021, it is allowed to pay personal income tax if the company has an OP in a centralized manner, namely:

- to the budget at the location of one of these OPs;

- or at the location of the parent organization, if it and its OP are located on the territory of the same municipality.

All inspectorates in which the agent company is registered at the location of each OP must be notified of the choice of a tax authority no later than the 1st day of the tax period (clause 2 of Article 230 of the Tax Code of the Russian Federation).

Tax authorities must be notified of the centralized payment of personal income tax in 2021 no later than January 11, 2021. This is the first working day after the New Year holidays. The notification form can be found in Appendix No. 1 to the order of the Federal Tax Service dated December 6, 2021 No. ММВ-7-11/ [email protected]

Notification form from 2021

By letter dated December 26, 2021 No. SD-4-3/26867, the Federal Tax Service of Russia approved the new recommended form and electronic format for notification of changes in the procedure for paying corporate income tax (Appendices No. 1 and No. 2). The same letter sets out the procedure for filling out and submitting the notification form (Appendices No. 3 and No. 4).

For this reason, the previous forms of notifications have become invalid (letters of the Federal Tax Service dated December 30, 2008 No. ШС-6-3/986, dated April 20, 2012 No. ED-4-3/6656, dated 04.25.2012 No. ED-4-3/7006) .

Please note that the new form of income tax notification from 2020 combines notifications that were previously different forms:

- on the selection of the responsible unit (notification No. 1);

- about separate divisions for which tax will not be paid through the responsible division (notification No. 2);

- notification to the State Tax Committee (notification No. 3).

In the “Attribute of notification content” field on the title page, indicate the following number:

- “1” – if only notification No. 1 is submitted to the tax authority;

- “2” – if only notification No. 2 is submitted;

- “3” – if only notification No. 3 is submitted;

- “4” – if notifications No. 1 and No. 2 are simultaneously submitted to the tax authority.

In fact, the composition of the information transmitted to the Federal Tax Service remains the same. The notification form has simply become more structured:

- now familiar places are provided for each field;

- there are no tables or blank lines to fill.

From our website, notifications 1 and 2 about changes in the procedure for paying corporate income tax from 2021 are available for free using the direct link here:

NOTICE OF PAYMENT OF INCOME TAX

Read also

20.11.2019

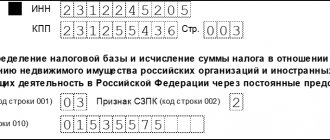

Title page

The title page of the notification contains the following information:

- TIN and checkpoint of the organization;

- code of the tax authority to which the notification is submitted (see notification submission scheme);

- date of notification;

- code of the reason for submitting the notification (for example, code “01” when switching to paying tax at the location of the responsible OP);

- attribute of the contents of the notification (for example, if the notification includes a title page and notification 1, then attribute “1” is selected);

- full name of the organization in accordance with the constituent documents;

- contact phone number (without spaces or dashes).

In the field “This notice is compiled on ____ pages”

the number of pages on which the notification is compiled is indicated. The field value is filled in automatically and recalculated when its composition changes (sections are added/removed).

When filling out the field “with supporting documents or their copies on ___ sheets”

the number of sheets of supporting documents or their copies is reflected. Such documents may be: the original or a certified copy of a power of attorney confirming the authority of the taxpayer’s representative, etc.

In the section of the title page “I confirm the accuracy and completeness of the information:”

reflected:

- Manager - if the document is submitted by the taxpayer;

- Authorized representative - if the document is filed by a representative of the taxpayer. In this case, the name of the representative and details of the document confirming his authority are indicated.

Features of compilation

The rules for drawing up a notification depend on who its recipient is:

- External users . For example, these could be counterparties, legal entities, government agencies and persons who do not work for the company. To compose the notification, a general letter form is used. The document may contain tables. It must be signed. It is advisable for the notice to include a signature. Sometimes the notice is sent along with a cover letter.

- Internal users . For example, these could be company employees. To draw up a document, a form is used that contains the necessary details: company name, name of the document.

As a rule, more stringent requirements are imposed on the document for external users. There must be a signature and seal on it. Completeness of information is indicated: details of the sender and recipient, name of the company, name of the document.

Components of a notification

A standard notice typically includes the following information:

- Date . The date of signing the document is indicated. In this case, the digital method is used (for example, 09.09.18).

- Registration number . Represents an individual designation for each outgoing document. It may include both letters and numbers.

- Addressee . The recipient's details will need to be indicated even if it is an internal document. It is required to reflect the name of the department where the employee works and the full name of the employee.

- Heading . It should be brief and reflect the content of the document.

- Notification text . It is necessary to record the information about which the recipient needs to be notified.

The notification is signed by the head of the company or a person authorized to sign. It is also necessary to include a transcript of the painting in the document.

Distribution order

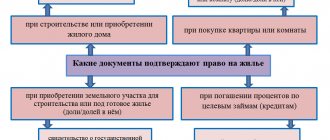

If a company is obliged to pay tax on taxes separately for each object of the branch network, then the tax base should be distributed between the GU and the OP. The final calculation of income tax for separate divisions directly depends on the following indicators:

- Distribution of the average headcount between the main unit and the subdivision or the amount of labor costs incurred between the head office and branches. In other words, the labor indicator is used. It is determined as a percentage as the ratio of the average number of employees in the branch or labor costs for the EP to similar numerical indicators for the organization as a whole.

- Residual value of property assets or property indicator. The value is calculated as the ratio of the residual value of the property that belongs to the OP to the total value of property assets for the organization as a whole.

Consequently, the share of profit attributable to the OP is determined by the formula:

Share of profit according to OP = (share of labor indicator + share of property indicator) / 2.

The resulting indicator is the tax base for the OP. Multiply the value by the rate to obtain the share of income tax for a separate division payable to the budget.

Please note that the company independently determines the composition of indicators in its accounting policies. So, for example, if there are no fixed assets owned by a branch, a value of zero is taken.

(ADVANCE PAYMENTS) THROUGH THE RESPONSIBLE DIVISION

The procedure for notifying the tax authorities of the decision to pay tax through one of the separate divisions (head office) Art. 288 of the Tax Code of the Russian Federation has not been established.

At the same time, how to do this is explained in the Letter of the Federal Tax Service of Russia dated December 30, 2008 N ShS-6-3/986. The letter is of a recommendation nature. However, local tax authorities will most likely be guided by it in their practical work (see, for example, Letter of the Federal Tax Service of Russia for Moscow dated February 17, 2010 N 16-15/016328). Therefore, let us consider the procedure set out in the aforementioned Letter of the Federal Tax Service of Russia.

In particular, to notify the tax authorities you need to:

1. Send a notification to the tax authority at the location of the responsible separate division. Since its form is not established, notification can be done in any order. In our opinion, in this case you can use the form recommended in the Letter of the Federal Tax Service of Russia dated December 30, 2008 N ShS-6-3/986.

The notification must indicate:

— full name of the organization in accordance with the constituent documents;

— INN/KPP at the location of the organization;

— full name of separate divisions;

— addresses of the locations of separate divisions;

— checkpoints assigned to the taxpayer by the tax authorities at the location of the separate divisions;

— name and code of the subject of the Russian Federation on whose territory the separate subdivisions are located.

It is also necessary to note the reason why the notification is submitted to the tax authority.

In addition, this notification must indicate the amount of monthly advance payments to the budget of the constituent entity of the Russian Federation, which must be transferred by the responsible unit in the first quarter. This amount is determined as the amount of monthly advance payments of all separate divisions located in one constituent entity of the Russian Federation, including the responsible division, payable by them in the fourth quarter of the tax period preceding the tax period from which your organization switches to paying tax through the responsible division.

The notification is signed by the head of the organization or a representative whose powers are confirmed in the prescribed manner (clause 3 of Article 29 of the Tax Code of the Russian Federation).

2. A copy of the notification must be submitted to the tax office with which the head office is registered.

If the head office and separate divisions are located in the same subject of the Russian Federation and a decision is made to pay income tax through the head office, then the notification is submitted only at the location of the head office.

3. Notify the tax authorities at the location of the separate divisions that the tax will not be paid through these divisions. In turn, these tax authorities must close the corresponding “RSB” cards and transfer them to the tax authority at the location of the responsible unit (Letter of the Federal Tax Service of Russia dated December 28, 2005 N MM-6-02/2005).

These notifications must be sent to the tax authorities before December 31 of the year preceding the tax period, from the beginning of which the tax will be paid through the responsible unit (paragraph 2, paragraph 2, article 288 of the Tax Code of the Russian Federation).

We would like to remind you that this period was not previously established by law. Therefore, the Russian Ministry of Finance explained that it is necessary to notify the tax authorities before the start of the tax period (Letters dated 02.12.2005 N 03-03-04/2/127, dated 21.04.2006 N 03-03-02/88). However, when disputes arose, the courts indicated that the taxpayer was not limited by any period, since the Tax Code of the Russian Federation does not contain such requirements (see, for example, Resolution of the Federal Antimonopoly Service of the West Siberian District dated January 29, 2007 N F04-9099/2006(30278- A70-15)).

Please note that you have the right to change the responsible separate division through which you pay tax. But this can only be done from the beginning of a new tax period, with the exception of cases of liquidation of such a division. This conclusion follows from Letter of the Ministry of Finance of Russia dated 02/04/2008 N 03-03-05/7, where officials considered the deadline for sending notifications when an organization selected a responsible unit.

If you already apply the procedure for paying tax through a responsible unit and have previously notified the tax authorities about this, you are not required to report this again (Letters of the Ministry of Finance of Russia dated January 25, 2010 N 03-03-06/1/22, dated February 4, 2008 N 03 -03-05/7).

In addition, you are obliged to notify the tax authorities of all changes that affect the procedure for paying tax on separate divisions (clause 2 of article 288 of the Tax Code of the Russian Federation, article 7 of the Federal Law of July 22, 2008 N 158-FZ (hereinafter referred to as Law N 158 -FZ)).

For example, this applies to cases when you liquidated one of the separate divisions or created one in the territory of a given region. If a division is created, you need to inform the tax authority about through which separate division you will pay tax on the new division. This must be done within 10 days after the end of the reporting period in which you created a separate division. You need to take similar actions if you liquidated the responsible division (paragraph 2, 7, paragraph 2, article 288 of the Tax Code of the Russian Federation, article 7 of Law No. 158-FZ).

Let us note that, according to the Russian Ministry of Finance, in such cases it is possible to pay tax to the regional budget through the selected responsible division based on the results of the reporting (tax) period in which it was created (Letter dated January 25, 2010 N 03-03-06/1 /22).

EXAMPLE

notifications to tax authorities about payment of tax to the budget of a constituent entity of the Russian Federation through the responsible department

Situation

The Alpha organization is registered in Moscow, is registered for tax purposes with the Federal Tax Service of Russia No. 28 for Moscow and has TIN 7728916548, KPP 772801001. The Alpha organization has two separate divisions in the Moscow region:

— “Beta” in the city of Fryazino, is registered for tax purposes with the Interregional Inspectorate of the Federal Tax Service of Russia No. 16 for the Moscow Region and has checkpoint 505002001;

— “Omega” in the city of Korolev, is registered for tax purposes with the Interregional Inspectorate of the Federal Tax Service of Russia No. 2 for the Moscow Region and has checkpoint 501803001.

Since 2010, the Alpha organization decided to pay income tax to the budget of the Moscow region through a separate Omega division in the city of Korolev.

The amount of monthly advance payments payable in the first quarter of 2010 to the budget of the Moscow region amounted to 123,000 rubles, including for the Beta division - 93,000 rubles, for the Omega division - 30,000 rubles.

Solution

Notification No. 1 will be filled out by the Alpha organization in one copy and submitted to:

— in the Interregional Inspectorate of the Federal Tax Service of Russia No. 2 for the Moscow Region (original);

- in the Federal Tax Service of Russia No. 28 for Moscow (copy).

In turn, the organization will fill out notification No. 2 for the separate division “Beta”, through which the tax will not be paid to the budget of the Moscow region. The Alpha organization will submit this notification to the Interregional Inspectorate of the Federal Tax Service of Russia No. 16 for the Moscow Region.

Samples of filling out notifications NN 1 and 2 are given in Appendices 1 and 2 to this section, respectively.

- Appendix 1 to section 22.4.1.1

- Appendix 2 to section 22.4.1.1

Calculation example for OP

Let's consider an example of calculating income tax for a separate division under the following conditions:

LLC "Vesna" (Moscow) has a branch "Winter" (St. Petersburg). The total tax base in the billing period is 5 million rubles.

Values of calculated indicators:

| Indicator name | Numeric value | |

| Overall for the company | Including for Zima LLC (branch) | |

| Average number of employees | 150 | 50 |

| Labor costs | 12 000 000 | 4 400 000 |

| Residual value of property | 50 000 000 | 18 000 000 |

The accounting policy of Vesna LLC determines that the indicator of the average number of employees and the residual value of fixed assets is used to distribute the base among non-residential assets.

Specific weight of the labor indicator = 50 / 150 × 100% = 34%.

Share of property indicator = 18,000,000 / 50,000,000 × 100% = 36%.

Profit share = (34% + 36%) / 2 = 35%.

We determine the tax base for the tax base for the branch = 5,000,000 × 35% = 1,750,000 rubles.

We calculate the profit tax of the OP “Winter” = 1,750,000 × 17% = 297,500 rubles.