The term “buy 1C: Accounting” indicates that the buyer does not purchase the software product itself, but the right to use it. The current provision in Russia, PBU 14/2007, classifies such software as an intangible asset that must be reflected in the balance sheet.

If payment for the purchase was made in a one-time payment, then the expenses incurred are classified as deferred expenses, after which the write-off will occur in installments throughout the entire term of the agreement for using the program.

In some cases, the license agreement does not establish deadlines. In such a situation, the user independently, taking into account his accounting policies, determines the period of operation of the purchased software.

For example, consider a situation in which a company purchased a license for the right to use the 1C program, paying 13 thousand rubles for it. The funds are charged to deferred expenses and will be written off to account 26 “General business expenses” with a write-off period of 24 months in equal installments.

How to capitalize a 1C program in 1C 8.3

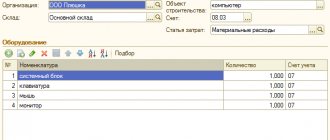

Let's look at how to reflect the purchase of a 1C program in 1C 8.3 using the following example.

On July 24, the Organization, in accordance with the license agreement, received, under an acceptance certificate from FIRST BIT LLC, non-exclusive rights to use the 1C:ERP Enterprise Management 2 program worth 360,000 rubles. The period of use of the program specified in the contract is 2 years.

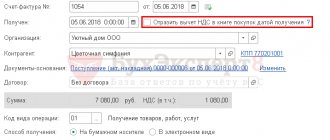

Accounting for the costs of acquiring the 1C program (non-exclusive right) is reflected in the document Receipt (act, invoice) transaction type Services (act) in the section Purchases - Purchases - Receipts (acts, invoices).

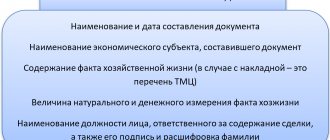

The document states:

- Nomenclature is a software product from the Nomenclature directory, Type of nomenclature - Services .

Follow the Accounts :

- Cost account - 97.21 “Other deferred expenses”;

- Deferred expenses (FPR) - parameters for automatic uniform recognition of costs for the purchase of the 1C program (software).

According to the recommendations of the Ministry of Finance for auditors (Appendix to the Letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 N 07-04-18/01), the RBP is reflected:

- in the balance sheet in Section I “Non-current assets” on line 1190 “Other non-current assets” - if the period for writing off the RBP is more than 12 months;

- in Section II “Current assets” on line 1210 “Inventories” - if the write-off period is less than 12 months.

Study the regulatory regulation of cost accounting for the acquisition of software (non-exclusive right)

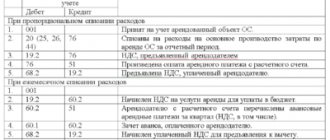

Postings according to the document

The document generates transactions:

- Dt 97.21 Kt 60.01 - reflection of the costs of the non-exclusive right in the expenses of the future period.

Find out more about how to reflect deferred expenses in 1C 8.3 Accounting

Software accounting system: exclusive rights

Such a right to use software usually arises if the program is developed by order of a company in accordance with the stated requirements. In this case, the software is taken into account in tax and accounting as an intangible asset (intangible asset).

Software should be registered at its original cost, which includes the costs incurred when purchasing the product. If the cost of the software does not exceed 100,000 rubles, then in tax accounting the asset is recognized as non-depreciable (clause 1 of Article 256 of the Tax Code of the Russian Federation), i.e. a program worth up to 100,000 rubles. can be fully written off as costs at the time of commissioning.

The useful life (USL) in tax accounting is determined according to the technical documentation for the software. If it is impossible to establish it, the company has the right to determine the service life itself, which cannot be less than 2 years (clause 2 of Article 258 of the Tax Code of the Russian Federation).

In accounting, a limit on the cost of software to identify it as a depreciable intangible asset has not been established, therefore depreciation should be calculated for all intangible assets with a known SPI. For assets with undetectable SPI, depreciation is not calculated, but annually enterprises are required to review and clarify the service life of intangible assets, confirming the impossibility of determination or establishing it (clause PBU 14/2007).

The exclusive right to software does not have a time frame, therefore, in accounting, the exclusive right to software is determined based on the period in which it is planned to be used. In practice, in order to avoid discrepancies in tax and accounting, enterprises set the same period of use for software.

Accounting for non-exclusive rights

Intangible assets received for use must be accounted for in an off-balance sheet account (clause 39 of PBU 14/2007):

- Dt 012 “Non-exclusive rights to software” - for the cost of the non-exclusive right received for use.

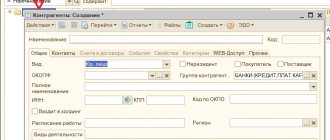

In 1C there is no special off-balance sheet account for accounting for non-exclusive rights, so you need to create it yourself, for example, 012 “Non-exclusive rights to software”.

Acceptance of a non-exclusive right for off-balance sheet accounting is documented in the document Transaction entered manually, type of operation Transaction in the section Transactions – Accounting – Transactions entered manually.

Features of accounting software

An electronic program is the result of intellectual work, which can be developed in-house or purchased from a manufacturer or dealer. By purchasing software, a company acquires exclusive or non-exclusive rights to use it. This aspect influences how software accounting should be carried out. Under a license agreement for the use of software, a company receives non-exclusive rights (license), and under an agreement for the alienation of exclusive rights, the same exclusive right to use the software.

Reflection in accounting of costs for the purchase of 1C software

To automatically account for the monthly costs of purchasing a 1C program, you need to run the procedure Closing the month, a routine operation Write-off of deferred expenses in the section Operations - Closing the period - Closing the month.

Postings according to the document

Accounting for software costs for July

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for July.

Accounting for software costs for August

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for August.

Similarly, the cost of purchasing the 1C program is recorded for the following months before the expiration of the non-exclusive right.

To access the section, log in to the site.

Accounting software: postings

The purchase of software under exclusive rights is recorded in accounting with the following entries:

| Operations | D/t | K/t |

| Costs for purchasing software are taken into account | 08/5 | 60 |

| Software put into operation | 04 | 08/5 |

| Calculation of monthly depreciation in accounting for intangible assets with a known SPI | 20,26,44 | 05 |

| Software - tax accounting: | ||

| — if the cost of purchasing the software does not exceed 100,000 rubles. its full cost is written off as expenses | 20,26,44 | 04 |

| - if the cost of the software is above 100,000 rubles. - depreciation is calculated | 20,26,44 | 05 |

Example

In July 2021, a company operating on OSNO acquired exclusive rights to software for organizing personnel records management worth RUB 300,000. Registration of the transfer of the right to the software, registration was completed in July 2021, and a state fee in the amount of 7,500 rubles was paid. The validity period of the exclusive right is 60 months. In tax and accounting, depreciation on intangible assets is calculated using the straight-line method.

| Operations | D/t | K/t | Sum |

| Software costs taken into account: | |||

| Cost of the right to use the software invoiced by the supplier | 08/5 | 60 | 300000 |

| Payment of state duty | 08/5 | 76 | 7500 |

| Putting the software into operation | 04 | 08/5 | 307500 |

| Depreciation calculation from August 2021 (307500 / 60 months) | 20,26,44 | 05 | 5125 |

At the end of the SPI (60 months), the cost of the software will be fully included in expenses. If a company wants to extend the exclusive right, then the software does not need to be written off in accounting, but continues to be accounted for at zero residual value. The accountant will have to include the amount of state duty paid in connection with current expenses.

Application solutions

Next come all the main configurations - BP, UT, UPP, ERP and others.

You need to understand that purchasing a product allows only one user to work with it at one time.

If collaboration is required, additional licenses must be purchased. If users work with the database on the same local network, then an additional license is purchased for 1, 5, 10, 20 or 50 workstations. They are cheaper than an application solution.

As an alternative, you can immediately buy a kit for 5 users, for example, “Accounting Prof for 5 users.”

Important ! If you buy only a license for several workstations (software or hardware), then 1C will start and work. But this is an illegal use of 1C.

Sometimes the cheapness and efficiency of such a solution can create the illusion of legality.

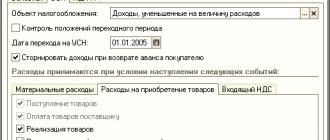

Set up before first use: 1C 8 Accounting - instructions

Before you begin actively using the software, it must be configured to suit the wishes of the owner and the accounting policies of the organization itself. First, you should go to the section called “Main”. Here you can find all the important points for correcting system parameters.

If you open “functionality”, here you can check the overall performance and select the level of complexity that is used in the enterprise. It is possible to enable or disable those types that will not be used in the organization. There are 3 options:

- complete - it is considered that the most complex type of accounting is maintained here, in which all sections are used;

- selective – you are allowed to choose the sections for which you need to control;

- the main one is that the company conducts accounting operations that do not involve currency or production.

Then you should fill in all the fields that will be in the “accounting parameters” tab. After this, you can move on to accounting policies.

Under the “personal settings” item, you can select individual parameters that will be convenient for logging in.

Distributed information bases (RIB)

Sometimes distributed database technology is used. Moreover, the bases are not located in the same local network, for example, the central base is in the central office, but the base nodes are at peripheral points and exchange between them is carried out via the Internet, FTP or e-mail.

In this case ( important ) you need to buy a license for the application solution for each point and center. It's quite expensive.

If several users work simultaneously with the base at the point, you need to buy licenses for additional workstations.

Varieties of “1C: Accounting 8.3” available for purchase

Each enterprise can choose a version that is convenient for itself, which will most accurately meet all the needs of the organization.

Let's look at the main configurations available for purchase:

- basic – automates accounting and maintenance of tax periods within one PC; in addition, certain options are provided for starting individual entrepreneurs and small businesses;

- simplified – a variation of the previous version, configured for accounting according to the simplified tax system;

- entrepreneur - with a simple interface, for people who do not have special knowledge;

- prof - a solution for a stable, growing enterprise, there are several modes, including multi-user, with client support;

- corp – maximum opportunities;

- autonomous institution - for him state. structures and companies that use targeted financing;

- state-owned companies are a separate offer that is used by municipalities.

Classifications (rev. 3.0)

In “1C: Accounting 8” (rev. 3.0), services provided to customers are divided into the following types:

- production services for which a planned cost has been established;

- services for the manufacture of products from customer-supplied raw materials;

- other services, the costs of providing which are recorded on account 20 “Main production”;

- trade services;

- other services.

The above classification is based on the accounting account, which summarizes information about the costs of providing services.

Production services for which a planned cost has been established

Production services for which the planned cost has been established include services the cost of which is formed on accounts 20.01 “Main production” or 23 “Auxiliary production” (hereinafter referred to as account 20.01). In this case, the cost may include costs accounted for in account 25 “General production expenses” and 26 “General operating expenses” (if provided for by the accounting policy). To reflect such sales transactions (rev. 3.0), the document Act on the provision of production services is intended. When posting a document in accounting, the recognition of revenue is reflected (Debit 62, 76 Credit 90.01 “Revenue”), the accrual of VAT (Debit 90.03 “Value Added Tax” Credit 68.02 “Value Added Tax”) and the write-off of the planned cost Credit 20.01). When performing routine month-closing operations, additional entries (with a plus or minus) are entered for the amount of the difference between the actual and planned cost for the Debit of account 90.02 and the Credit of account 20.01. If in the current month the services for which the planned cost was established were not actually provided (the document Certificate of Provision of Production Services was not entered for them), but there were turnovers for these services in the debit of account 20.01, the costs incurred are recognized as work in progress (WIP) , i.e. they are not written off to account 90.02.

Services for the manufacture of products from customer-supplied raw materials

A type of production services for which a planned cost is established is the provision of services for the manufacture of products from customer-supplied raw materials. The cost of such services is formed on account 20.02 “Production of products from customer-supplied raw materials.” To reflect such sales operations (rev. 3.0), the document Sales of processing services is intended. When posting a document, accounting records the recognition of revenue (Debit 62, 76 Credit 90.01 “Revenue”), the accrual of VAT (Debit 90.03 Credit 68.02) and the write-off of the planned cost of services (Debit 90.02 Credit 20.02). When performing routine month-closing operations for the amount of the difference between the actual and planned cost, additional entries (with a plus or minus) are entered in the debit of account 90.02 and the credit of account 20.02. If processing services were not provided in the current month (the document Sales of processing services was not entered for them), but there were turnovers for these services in the debit of account 20.02, the costs incurred are recognized as work in progress, i.e. they are not written off to account 90.02 . Work in progress is assessed taking into account the number of products that are manufactured but not presented to the customer for payment.

Other services - costs are included in account 20

Other services, the costs of providing which are accounted for on account 20, include production and other types of services, the cost of which is also formed on account 20.01 or 23 (hereinafter referred to as account 20.01), but in accordance with the adopted accounting policy for each product item is not calculated (see below - Analytical accounting of services by service name). To reflect the implementation of such (rev. 3.0), the documents Sales of goods and services and Provision of services are intended. The second document is used when the same services are provided to a group of customers. When carrying out these documents, only the recognition of revenue and the accrual of VAT are reflected in accounting. The costs of providing these services are written off not at the time the sales are reflected, but when performing routine month-end closing operations. In this case, the procedure for writing off expenses from account 20.01 to the debit of account 90.02 is determined by the settings of the Accounting Policy. By default, costs from account 20.01 are written off to account 90.02 in full, regardless of whether revenue for the corresponding item group is reflected in account 90.01. If the document Inventory of work in progress records work in progress, then the amount of costs minus the cost of work in progress is written off.

The program also supports an option in which costs on accounts 20.01, 23 will be written off to account 90.02 only for those item groups for which revenue is reflected on account 90.01 in the current month.

For other services, costs are not written off. They form work in progress. To support this option, you should specify in the Accounting Policy settings that costs are written off from account 20 “Main production” taking into account revenue.

Trade services

Trade services are understood as services, information on the costs of providing which is summarized in account 44.01 “Distribution costs in organizations engaged in trading activities.” Such services include the delivery of goods to customers, the provision of intermediary services for the sale of goods, etc. The documents Sales of goods and services, Report on retail sales, Report to the principal are intended to reflect such sales transactions (rev. 3.0). When posting these documents, accounting records reflect the recognition of revenue and the accrual of VAT. The costs of providing trade services do not need to be taken into account separately. They are included in distribution costs recognized as expenses for ordinary activities of the current period. In “1C: Accounting 8” (rev. 3.0), these costs are written off from account 44.01 to the debit of account 90.07 “Sales expenses” when performing the routine operation Closing account 44 “Costs of distribution”. There is no need to make any Accounting Policy settings to write off costs for the provision of trade services.

Other services

Other services are understood as services, information on the costs of providing which is summarized in accounts 44.02 “Business expenses in organizations engaged in industrial and other production activities” (delivery of products to customers) or 26 “General business expenses” (provision of intermediary services for the purchase of goods, brokerage services , dealers, etc.).

To reflect sales transactions in “1C: Accounting 8” (rev. 3.0), the documents Sales of goods and services, Report to the principal, Provision of services are intended. When posting these documents, accounting records reflect the recognition of revenue and the accrual of VAT.

Costs for the provision of other services in organizations engaged in industrial and other production activities are not required to be accounted for separately in account 44.02. They are part of business expenses, recognized in full as expenses for ordinary activities of the current period. In “1C: Accounting 8” (rev. 3.0), these costs are debited from account 44.02 to the debit of account 90.07 “Sales expenses” when performing the routine operation Closing account 44 “Distribution costs”. There is no need to make any adjustments to the Accounting Policy to write off the costs of providing such services.

There is also no need to set up an Accounting Policy if account 20 “Main production” is not used, and the costs of providing services are taken into account on account 26 “General business expenses”. When performing the routine operation Closing accounts 20, 23, 25, 26, the amount of costs for the provision of such services as part of general business expenses for the month is written off to the debit of account 90.08 “Administrative expenses”.

1C Accounting - how to use the most functional software

Interaction with the software will be constant. It has a built-in hint system that works like a teacher. Gradually, the user learns to manage it, filling out the most urgent documents first, expanding his abilities. He configures the accounting parameters once, and then only uses what has already been configured.

When all the initial settings are completed, you will not have to fill in most of the fields - the software will do this on its own. It will also correct individual lines if necessary and offer options that can be substituted.

The software allows you to create new directories, customize forms, change them and insert graphic reports.

Results

We looked at what the 1C accounting program in version 8 means, how to use it, and provided step-by-step instructions that make working in the software simple and convenient.

This is an indispensable software that optimizes the functioning of an enterprise of any size if it undergoes any operations. It makes it much easier to generate primary documentation and prepare reports for the tax service. This is a multifunctional solution that modern business cannot do without. Now the software has become a standard, without which it is too difficult to imagine an accountant and a functioning company as a whole. Number of impressions: 8478

Functions regardless of the type of taxation

This software supports a variety of methods for accounting taxes and primary documentation; those who are on UTII or simplified taxation can use it equally.

Suitable for any business, regardless of its size and direction, as we said above. At the same time, you can use it in companies that engage in wholesale, retail, commission and online trading. It is also convenient to use the software if the company performs contracting work, construction, or provides professional services - auditing, legal or household services. Everything is customizable depending on the need for guidance.

Technological supply

The simplest license is the “Technology Supply”. It allows you to work with an independently developed (“home-written”) configuration.

However, this license costs the same as Accounting Prof, the simplest 1C configuration.

Why then issue a technology supply license? Are there any pitfalls?

In fact, the license for technological supply was made only so that distributors of “home-written” configurations would not write to the client in the invoices “supply of Accounting Prof,” as was done before. Because Accounting Prof has nothing to do with self-recording records. Only in this case does it make sense to buy technological supplies. In other cases, it makes sense to take Prof. Accounting.