As a general rule, an employee’s tax status depends on the number of days spent in Russia over the next 12 consecutive months. If an employee stays in Russia for more than 183 calendar days, he is recognized as a resident, less - as a non-resident. The status may change throughout the year. For example, if the employee often goes on business trips abroad or if he is a foreigner. In particular, personal income tax rates, the list of income on which tax must be paid, and the employee’s right to deductions depend on the employee’s status. Therefore, when an employee's status changes, the amount of tax payable may change. For example, if a non-resident employee has become a resident, as a general rule you need to recalculate personal income tax at a rate of 13%, while the employee can use deductions. As a result of such recalculation, an overpayment amount may arise that must be counted against personal income tax on subsequent payments to the employee in the current year.

And if, on the contrary, the employee has lost his resident status and you recalculate the tax at a rate of 30%, there will be an under-withheld tax that must be withheld from subsequent payments.

Tax status of an individual

When calculating personal income tax, attention should first be paid to the issue of residence rather than citizenship. Tax residency is determined by the individual’s membership in the state’s tax system. The concepts of currency, migration, any other and tax resident are different.

The Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control” establishes, for example, that currency residents of Russia are every citizen of the Russian Federation and foreigners permanently residing in the territory of the Russian Federation with a residence permit. Citizens of the Russian Federation who continuously reside outside the country for at least 183 days are exempt from restrictions related to the status of currency resident.

The concept of a tax resident is defined in Article 207 of the Tax Code of the Russian Federation. This is an individual who is actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months. At the same time, the provisions of the Tax Code of the Russian Federation do not contain requirements for the continuity of the flow of the indicated 183 days (letters of the Ministry of Finance of Russia dated 02/15/2017 No. 03-04-05/8334, dated 09/01/2016 No. 03-04-05/51258, dated 04/26/2012 No. 03 -04-06/6-123, Federal Tax Service of Russia dated August 30, 2012 No. OA-3-13/ [email protected] ).

Tax resident status ensures the use of benefits and deductions when calculating income tax in all countries. An employee may be a tax resident of several states at the same time or, conversely, be a tax non-resident everywhere.

Rules for determining tax status vary from country to country. To avoid double taxation, most countries enter into appropriate agreements providing for tax exemptions, offsets, tax deductions and other tax benefits.

Article 232 of the Tax Code of the Russian Federation provides that the tax agent may not withhold personal income tax if the income is paid to a resident of a foreign state with which the Russian Federation has concluded an international agreement. For example, a resident of a foreign state can receive income on the territory of the Russian Federation. Similarly, a non-resident of the Russian Federation can receive income abroad. In accordance with such agreements, non-residents of the Russian Federation do not pay personal income tax on income from Russian companies received abroad, but include it in the income declaration (in Form 3-NDFL).

Tax resident status and its features

Whether a person is a resident of a country determines in which country he will pay income tax and what tax rules will apply to him. Articles 207, 209, 210 and 224 of the Tax Code regulate residency issues in Russia.

A resident of the Russian Federation is obliged to declare all income, including income received outside the country, and pay taxes on it; The tax base is calculated as the sum of all taxable income, excluding the amounts of required tax deductions. The tax amount for a resident is calculated on an accrual basis from the beginning of the year based on the results of each month. A non-resident pays tax only on income received in Russia; no tax deduction is provided. The tax amount for a non-resident is calculated separately for each amount of accrued income (per month).

Personal income tax rates for non-residents

The income of individuals who are not tax residents of the Russian Federation may be taxed at rates of 0, 13, 15, 30%, depending on the source and type of income, as well as the status of a non-resident taxpayer (Articles 207, 224 of the Tax Code of the Russian Federation) .

Individuals - non-residents of the Russian Federation, performing work on the territory of a foreign state and receiving remuneration for performing labor duties from sources in a foreign state are not recognized as taxpayers for personal income tax in accordance with paragraph 1 of Article 207 of the Tax Code of the Russian Federation. For example, at a rate of 0% personal income tax is calculated on the income of employees of separate divisions located outside the Russian Federation. According to paragraph 3 of Article 224 of the Tax Code of the Russian Federation, income from Russian sources received by individuals who are not tax residents of the Russian Federation is taxed at a rate of 30%.

There are exceptions to this rule:

1. Personal income tax in the amount of 13% is withheld from the income of non-residents from labor activities:

- as a highly qualified specialist in accordance with Federal Law No. 115-FZ dated July 25, 2002 “On the legal status of foreign citizens in the Russian Federation”;

- participants in the State program to assist the voluntary resettlement of compatriots living abroad to the Russian Federation, as well as members of their families who jointly moved to permanent residence in the Russian Federation;

- citizens or stateless persons recognized as refugees or granted temporary asylum on the territory of the Russian Federation in accordance with Federal Law No. 4528-1 of February 19, 1993 “On Refugees”;

- foreign citizens of the countries participating in the Treaty on the EAEU (Belarus, Kazakhstan, Armenia, Kyrgyzstan);

- employed on the basis of a patent in accordance with Article 227.1 of the Tax Code of the Russian Federation.

2. Personal income tax in the amount of 15% is withheld from the income of non-residents in the form of dividends from equity participation in the activities of Russian organizations.

The status of a resident of the Russian Federation ensures the application of personal income tax rates:

- 13% - in relation to income in the form of wages;

- 35% - for income from winnings and prizes.

Only for individuals with the tax status of a resident of the Russian Federation, tax benefits and deductions are available.

An employee who enters into an employment contract or a civil contract with an employer must confirm his tax resident status. The tax agent is responsible for the correct determination of the status of an individual, as well as for the calculation and payment of personal income tax. If an individual does not submit the requested documents about the time of his stay in the Russian Federation, the tax agent has the right to calculate the tax in the manner prescribed for non-residents, that is, at a rate of 30% (see letter of the Ministry of Finance of Russia dated August 12, 2013 No. 03-04-06/32676) .

In fact, the personal income tax rate can be 3, 5, 6, 7, 10, 12, 15 and other percent for some income of individuals (dividends, income on securities, royalties) who are not tax residents of the Russian Federation. The personal income tax rate can be established by an international treaty, and in accordance with paragraph 1 of Article 7 of the Tax Code of the Russian Federation, the norms of international treaties of the Russian Federation have priority over the norms of the Tax Code of the Russian Federation.

Who are non-residents?

In accordance with paragraph 2 of Art. 207 of the Tax Code of the Russian Federation, tax residents are individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months. The period of stay of an individual in the Russian Federation is not interrupted by periods of his departure outside the territory of the Russian Federation:

- for short-term (less than six months) treatment or training;

- to perform labor or other duties related to the performance of work (provision of services) in offshore hydrocarbon fields.

In addition, regardless of the actual time spent in the Russian Federation, tax residents of the Russian Federation are recognized as Russian military personnel serving abroad, as well as employees of state authorities and local governments sent to work outside the Russian Federation (Clause 3 of Article 207 of the Tax Code of the Russian Federation ).

From the above provisions it follows that tax residents are any people who are on the territory of the Russian Federation for 183 calendar days or more over the next 12 consecutive months, as well as Russian military personnel serving abroad, and employees of municipal and state authorities sent abroad. frontier

A tax non-resident is an individual who stays on the territory of the Russian Federation for less than 183 calendar days over the next 12 consecutive months (Clause 2 of Article 207 of the Tax Code of the Russian Federation).

Please note that the citizenship of the country, place of birth or residence of an individual does not affect the determination of tax status. A citizen of the Russian Federation can also be a tax non-resident for personal income tax.

If a Russian citizen is a non-resident, personal income tax in relation to his income is calculated and transferred to the budget in the same way as in relation to other non-residents. There are no special rules. According to paragraph 3 of Art. 224 of the Tax Code of the Russian Federation, the tax rate is set at 30% in relation to all income received by individuals who are not tax residents of the Russian Federation.

Registration of tax status in “1C: Salary and Personnel Management 8” (rev. 3)

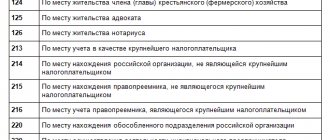

In order to take into account all possible personal income tax rates, the 1C: Salaries and Personnel Management 8 program, edition 3, provides for registration of the taxpayer’s tax status in the employee’s card using the Income Tax link in the Status field (Fig. 1).

Rice. 1. Taxpayer status

The Established from field indicates the date of the tax period from which the selected status is valid. The history of changes in taxpayer status can be viewed at the link of the same name.

The user can specify one of the following statuses:

- Resident;

- Non-resident;

- Highly qualified foreign specialist;

- Member of the crew of a vessel registered in the Russian International Register of Ships;

- Participant in the program for the resettlement of compatriots;

- A refugee or someone who has received temporary asylum on the territory of the Russian Federation;

- Citizen of a country party to the Treaty on the EAEU;

- Non-resident employed on the basis of a patent.

If the status of a tax resident is not confirmed by the Federal Tax Service in the prescribed form, then it is necessary to determine whether the non-resident has grounds for establishing an exclusive status that ensures the application of a personal income tax rate of 13% to “salary” income. In general, the status of Non-Resident is established, and personal income tax is calculated at a rate of 30%.

What is the procedure for determining the time of stay in the Russian Federation?

To determine the status of an employee (resident or non-resident), you must:

1) count 12 months from the date of receipt of income, since the tax status of the individual who is the recipient of the income is determined by the tax agent from whom the individual receives the corresponding income on each date of its payment;

note :

The 12 months counted are the billing period. It may coincide with a calendar year or fall on different years, that is, begin in one and end in another calendar year. The main thing is that the 12 months follow one after another. For example, the billing period may be from 06/05/2017 to 06/04/2018.

2) count the number of days when an individual was in the territory of the Russian Federation during the previous 12 months. The time spent on the territory of the Russian Federation is calculated in calendar days. It is not necessary that these days continuously follow each other (clause 2 of Article 207 of the Tax Code of the Russian Federation).

When determining the tax status, the actual days of an individual’s presence in the Russian Federation are important, that is, all days when he was in the territory of the Russian Federation are taken into account. Thus, the calculation of the time a person spends on the territory of the Russian Federation includes:

- days of a person’s arrival in the Russian Federation and days of his departure from the Russian Federation (letter of the Ministry of Finance of the Russian Federation dated 02.15.2017 No. 03-04-05/8334, Federal Tax Service of the Russian Federation dated 04.24.2015 No. OA-3-17 / [email protected] );

- time when a person was abroad for short-term treatment or training. Short-term means treatment (training) abroad for less than six months. There are no restrictions on age, types of educational institutions, medical institutions, diseases, or list of foreign countries.

Note:

Days when an individual was abroad (on vacation, business trip, etc.) are not included in the calculation of time spent in the Russian Federation.

Simultaneous application of different personal income tax rates depending on the type of income of an individual

As a general rule, the income of non-resident individuals of the Russian Federation is taxed at a personal income tax rate of 30%. However, for income from labor activities of designated non-residents - highly qualified foreign specialists, citizens of EAEU countries, etc., a rate of 13% is applied.

The labor activity of a foreign citizen is understood as work in Russia on the basis of an employment or civil law contract for the performance of work or provision of services (Article 2 of Federal Law No. 115-FZ of July 25, 2002 “On the legal status of foreign citizens in the Russian Federation”). However, the Tax Code of the Russian Federation does not specify what exactly is considered income from labor activity. Therefore, it is not always clear to the employer at what rate personal income tax should be withheld from certain payments to this category of employees.

| 1C:ITS For more information about what income of highly qualified foreign non-resident specialists is subject to personal income tax at a rate of 13%, see the reference book “Income Tax for Individuals” in the “Taxes and Contributions” section. |

Example 1

| Non-resident employee of the Russian Federation S.S. Gorbunkov, who has the status of “Highly Qualified Foreign Specialist” and works under an employment contract, was accrued in January 2021: a salary of 100,000 rubles, dividends of 100,000 rubles, and a subscription to a fitness club of 100,000 rubles. |

Salary payments, vacation pay, sick leave payments and business trips clearly relate to work activities, and personal income tax is calculated at a rate of 13%.

Dividends do not apply to income from employment, and the personal income tax rate is 15%. The personal income tax rate on in-kind income from paying for a subscription to a fitness club is 30%.

Accordingly, in January personal income tax was calculated in the amount of: 13,000 rubles, 15,000 rubles. and 30,000 rubles (Fig. 2).

Rice. 2. Certificate 2-NDFL

Consequently, form 2-NDFL contains three Sections 3 “Income taxed at the rate...” (Fig. 3).

Rice. 3. Printed form of certificate 2-NDFL

Personal income tax from a patent

The employee himself, regardless of whether he receives income, is required to pay monthly fixed advance payments for personal income tax to the tax office (1200 rubles/month + regional coefficient). If the foreigner does not pay, his patent is revoked.

This payment can be made monthly or several months in advance. The payment amount is fixed 1200 rubles. + the sum of regional coefficients (for example, in Moscow 4000 rubles)

After getting a job, the employer is obliged to withhold personal income tax from the employee’s salary at a rate of 13%. This results in double taxation: the employer contributes 13% + the worker pays for the patent.

How to avoid double taxation?

- An employee approaches his employer with a request to reduce the amount of tax.

- The employer applies to the tax office to reduce the amount of personal income tax. You must attach documents confirming that the employee has paid for the patent.

- The tax office sends a notification within 10 days, which gives the right to reduce the total amount of personal income tax by the amount of payments paid for the patent.

Changing the tax status of an individual

If an employee travels outside of Russia, he may lose his status as a tax resident of the Russian Federation. Tax residency in the Russian Federation is not interrupted if an individual travels outside the Russian Federation for no more than six months for treatment or training (clause 2 of Article 207 of the Tax Code of the Russian Federation). It is not interrupted in a number of other cases listed in the Tax Code of the Russian Federation. For example, when traveling outside the territory of the Russian Federation to perform labor or other duties related to the performance of work (provision of services) in offshore hydrocarbon fields.

On the other hand, any non-resident (including a highly qualified foreign specialist; a crew member of a ship registered in the Russian International Register of Ships; a participant in the program for the resettlement of compatriots; a refugee or someone who has received temporary asylum on the territory of the Russian Federation; a citizen of a country party to the Treaty on the EAEU; a non-resident, employed on the basis of a patent), having lived in the Russian Federation for 183 days over the past 12 months, becomes a tax resident.

When determining the tax status of an individual, it is necessary to take into account the 12-month period determined on the date of receipt of income, including those that began in one tax period (calendar year) and continued in another tax period (calendar year) (letter of the Ministry of Finance of Russia dated April 26, 2012 No. 03-04-06/6-123). During the year, tax agents (employers) calculate the taxpayer's status on the date of actual receipt of income in accordance with the provisions of Article 223 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of Russia dated August 30, 2012 No. OA-3-13 / [email protected] ).

The status of a resident of the Russian Federation acquired by an individual cannot change in a calendar year, provided that the person has been in Russia for more than 183 days this year. So, July 3 in a non-leap year is the 184th day of the year.

Thus, if as of July 3, 2018, an employee has not left Russia during the year, then his tax status for the current year—a resident of the Russian Federation—is already guaranteed. If an employee acquires the status of a resident of the Russian Federation, which cannot change in the current year, then the tax agent can independently recalculate the tax at a rate of 13% instead of 30%, guided by paragraph 3 of Article 226 of the Tax Code of the Russian Federation.

Starting from the month in which the taxpayer’s status changed, previously withheld personal income tax at a rate of 30% is counted towards payment of tax at a rate of 13%.

If at the end of the year (tax period) there is uncredited tax, then its refund is carried out by the tax authority at the place of residence (registration) of the individual (clause 1.1 of Article 231 of the Tax Code of the Russian Federation). To do this, the taxpayer must submit a tax return, as well as documents confirming his status as a tax resident of the Russian Federation (letters of the Ministry of Finance of Russia dated February 27, 2018 No. 03-04-06/12086, dated September 26, 2017 No. 03-04-06/62127, No. 03 -04-06/62126, dated 02/15/2016 No. 03-04-06/7958, dated 04/15/2014 No. 03-04-06/17166, dated 10/03/2013 No. 03-04-05/41061, dated 11/15/2012 No. 03-04-05/6-1301, dated 04/16/2012 No. 03-04-06/6-113, Federal Tax Service of Russia dated 06/09/2011 No. ED-4-3/9150, dated 09/05/2011 No. ED-2- 3/ [email protected] ).

This approach is also valid when during the tax period an employee was transferred from the parent organization to a separate division (letter of the Ministry of Finance of Russia dated December 23, 2014 No. 03-04-06/66648).

If the tax status of an individual who is the recipient of income can be determined only at the end of the calendar year, then the recalculation of personal income tax in connection with the acquisition of the status of a resident of the Russian Federation and its return are carried out by the tax authority at the place of registration (stay) of the individual in accordance with paragraph 1.1 of Article 231 of the Tax Code of the Russian Federation.

To do this, the taxpayer must submit to the tax authority a declaration in form 3-NDFL, as well as documents confirming the status of a resident of the Russian Federation in this tax period (see letters of the Ministry of Finance of Russia dated January 16, 2013 No. 03-04-06/4-11, dated 09.08 .2012 No. 03-04-06/6-230, dated 09.21.2011 No. 03-04-06/6-226, Federal Tax Service of Russia dated 10.22.2012 No. AS-3-3/ [email protected] , dated 08.14.2012 No. ED-3-3/ [email protected] , dated March 21, 2012 No. ED-3-3/ [email protected] ).

| 1C:ITS For more information on how personal income tax is recalculated if the status of an individual changes from non-resident to resident during a calendar year, see the “Individual Income Tax” reference book. |

How to recalculate personal income tax if an employee has become a non-resident

As a general rule, if the employee became a non-resident on the date of receipt of income, the tax withheld earlier in the current year must be recalculated.

If there is a possibility that the employee may become a resident again before the end of the year, there is no need to recalculate the tax immediately. For example, if an employee ceased to be a resident in March, but there is a possibility that within a year he may become a resident again due to his upcoming return to the Russian Federation. In this case, recalculate the tax when the employee’s status can no longer change, that is, the employee has already been outside Russia for more than 183 calendar days in the current year. This conclusion can be drawn from the analysis of Letter of the Ministry of Finance of Russia dated October 3, 2013 N 03-04-05/41061.

Change of tax status in “1C: Salary and Personnel Management 8” (rev. 3)

A change in the tax status of an employee upon the occurrence of this fact should be reflected in the employee’s card using the Income Tax link, indicating in the Established from field the date of the tax period from which the status changes. Personal income tax recalculation occurs automatically.

Example 2

| Since 02/01/2018, employee S.S. Gorbunkov, who has the status of “Highly Qualified Foreign Specialist” and works under an employment contract (see Example 1), became a resident. |

In this case, personal income tax is automatically recalculated for other income (Fig. 4). Personal income tax, excessively accrued on income in kind, is displayed in the document Payroll for February 2018 in the amount of 17,364 rubles. Deductions for children have been applied since January 2018.

Rice. 4. Recalculation of personal income tax in the document “Payroll”

Please note that automatic recalculation of personal income tax on dividends is not provided in the program. Users can independently enter the Personal Income Tax Recalculation document in the Taxes and Contributions section. By clicking the Fill button, personal income tax is recalculated automatically (Fig. 5).

Rice. 5. Document “Recalculation of personal income tax”

What documents can confirm your resident status?

The list of documents that can confirm the tax status of an individual is not established by tax legislation. These may include:

- copies of passport pages with border crossing marks;

- migration card with data on entry into the Russian Federation and exit from the Russian Federation;

- certificates from the place of work (including from the previous place of work);

- orders for business trips, waybills, etc.;

- advance reports and accompanying documents (travel documents, residence documents);

- certificate of registration at the place of temporary residence;

- certificate received at the place of residence in the Russian Federation;

- agreements concluded with medical (educational) institutions;

- certificate of treatment (training) indicating the time of such treatment (training).

Note:

To confirm the status of a resident of the Russian Federation, an employee can submit a document issued by the tax authority. From 12/09/2017, this confirmation is issued in the form approved by Order of the Federal Tax Service of the Russian Federation dated November 7, 2017 No. ММВ-7-17/ [email protected] This document confirms the status of a tax resident for the calendar year (clause 7 of the Procedure approved by Order of the Federal Tax Service of the Russian Federation No. ММВ -7-17/ [email protected] ).

So, the employer has the right to independently determine the tax status of the employee by calculating the number of days that he spent in the Russian Federation during the specified period (letter of the Ministry of Finance of the Russian Federation dated February 22, 2017 No. 03-04-05/10518, Federal Tax Service of the Russian Federation dated September 19, 2016 No. OA-3 -17/ [email protected] ).

Note:

A residence permit of a foreign citizen does not confirm the tax status of a resident. According to paragraph 1 of Art. 2 of Federal Law No. 115-FZ[1], a residence permit is a document confirming the right of a foreign citizen to permanent residence in the Russian Federation, free entry into and exit from the country, and not the time of his stay on the territory of the Russian Federation.

Expanded capabilities of “1C: Salaries and personnel management 8 KORP” for personal income tax accounting

Accounting for personal income tax rates under international agreements

The CORP version of the 1C: Salary and Personnel Management 8 program, edition 3, provides expanded capabilities for personal income tax accounting. In accordance with international treaties of the Russian Federation, in order to avoid double taxation, the program can register the income of non-residents of the Russian Federation in the form of dividends, income on securities, royalties and calculate personal income tax at the specified rates of 3, 5, 6, 7, 10, 12, 15%.

A number of international treaties provide for a fractional tax rate (4.5%, 7.5%, 13.5%). However, the current electronic formats of 2-NDFL and 6-NDFL reports do not provide for the possibility of transmitting such data. Therefore, the program does not support these bets.

You can enable the functionality of using taxation in accordance with international treaties in the Settings menu - Payroll calculation - flag Use personal income tax rates provided for by international treaties of the Russian Federation.

At the same time, in the Dividends document it becomes possible to choose the personal income tax rate under an international agreement: 5, 10 or 12%. In the Author's Order Agreement document, you can similarly select the tax rate from the options 3, 5, 6, 7, 10, 15%. Personal income tax is calculated automatically at the specified rate.

New rates can also be specified in the Personal Income Tax Accounting Transaction document. Reports 2-NDFL and 6-NDFL correctly reflect the specified personal income tax rates and are automatically filled in using the data registered in the program.

Resident legal entities

The residence of a legal entity is determined by its membership in the tax system of the Russian Federation. A legal entity must be registered with the relevant authorities and pay taxes to the budget. To assign this status, take into account the place of registration of the company, the location of the governing body and the place of activity. A legal entity that is a resident of the Russian Federation is considered to be:

- organizations registered in Russia;

- foreign organizations in accordance with an international treaty;

- international organizations whose head office is located in Russia and is managed from the territory of the Russian Federation.

If a legal entity operates in Russia, but is created and registered abroad, it cannot be a resident.

On what payments to non-residents must personal income tax be withheld?

According to Art. 209 of the Tax Code of the Russian Federation, the object of taxation is income received by the taxpayer:

- from sources in the Russian Federation and (or) outside it - for individuals who are tax residents of the Russian Federation;

- from sources in the Russian Federation - for individuals who are not tax residents of the Russian Federation.

Thus, it is necessary to withhold personal income tax only from the income of a non-resident that he received from sources in the Russian Federation. According to Art. 208 of the Tax Code of the Russian Federation, income from sources in the Russian Federation, in particular, includes:

- dividends and interest received from a Russian organization, as well as interest received from Russian individual entrepreneurs and (or) a foreign organization in connection with the activities of its separate division in the Russian Federation;

- insurance payments upon the occurrence of an insured event, including periodic insurance payments (rents, annuities) and (or) payments related to the participation of the policyholder in the investment income of the insurer, as well as redemption amounts received from a Russian organization and (or) a foreign organization in connection with with the activities of its separate division in the Russian Federation;

- income received from the use of copyright or related rights in the Russian Federation;

- income received from leasing or other use of property located in the Russian Federation;

- income from the sale of real estate located in the Russian Federation;

- income from the sale of shares or other securities in the Russian Federation, as well as participation interests in the authorized capital of organizations;

- income from the sale in the Russian Federation of shares, other securities, participation interests in the authorized capital of organizations, received from participation in an investment partnership;

- income from the sale of rights of claim against a Russian organization or a foreign organization in connection with the activities of its separate division on the territory of the Russian Federation;

- income from the sale of other property located in the Russian Federation and owned by an individual;

- remuneration for the performance of labor or other duties, work performed, service rendered, action performed in the Russian Federation;

- remunerations and other payments for the performance of labor duties received by crew members of ships sailing under the State Flag of the Russian Federation;

- other income received by the taxpayer as a result of his activities in the Russian Federation.

In addition, when determining the income of non-residents, the following nuances must be taken into account:

- General rules apply to the income of non-residents on the full or partial exemption of certain types of payments from personal income tax, the list of which is established by Art. 217 Tax Code of the Russian Federation;

- When identifying payments from which tax must be withheld, the agreement on the avoidance of double taxation between the Russian Federation and the country of which the employee is a resident is taken into account, since it may also provide grounds for exemption from personal income tax for certain payments.

* * *

In conclusion, we outline the main points related to the withholding of personal income tax from the income of employees who are tax non-residents of the Russian Federation:

- tax non-resident - an individual who stays in the Russian Federation for less than 183 calendar days within 12 consecutive months. In this case, the citizenship, place of birth or residence of an individual does not matter;

- income is generally taxed at a rate of 30%, unless otherwise provided by international agreements;

- tax deductions are not applied to the income of such employees;

- when changing tax status from non-resident to resident or vice versa, it is necessary to recalculate the amount of personal income tax on all employee income from the beginning of the tax period and apply the appropriate tax rate to them.

[1] Federal Law of July 25, 2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation.”

[2] Federal Law of February 19, 1993 No. 4528‑1 “On Refugees.”

Remuneration in a state (municipal) institution: accounting and taxation, No. 6, 2021

Is it necessary to apply tax deductions when calculating personal income tax on payments to non-residents?

In accordance with paragraph 1 of Art. 210 of the Tax Code of the Russian Federation, when determining the tax base for personal income tax, all income of the taxpayer that he received both in cash and in kind or the right to dispose of which he acquired is taken into account. Clause 3 of Art. 210 of the Tax Code of the Russian Federation establishes that for income for which a tax rate of 13% is provided, the tax base is determined as the monetary expression of such income subject to taxation, reduced by the amount of tax deductions enshrined in Art. 218 – 221 Tax Code of the Russian Federation.

Thus, the property tax deduction provided for in paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, applies only to the income of individuals recognized as tax residents in accordance with Art. 207 of the Tax Code of the Russian Federation.

Consequently, these tax deductions cannot be applied to the income of non-residents.

Note:

The income of both foreign citizens and citizens of the Russian Federation is subject to the same taxation in the Russian Federation, if these citizens are recognized as tax residents of the Russian Federation in accordance with the provisions of Art. 207 of the Tax Code of the Russian Federation. Thus, if an employee, according to this article, is a tax resident of the Russian Federation, he has the right to receive a property tax deduction in the prescribed manner.