Accountants submit a new report to the Federal Tax Service. Photo by klerk.ru The introduction of numerous restrictions, a decline in labor activity, and a decrease in sales are not all that entrepreneurs and businessmen have faced this year. One of these very unfavorable moments was expressed in the fact that many counterparties, in the eyes of the Federal Tax Service, suddenly became unreliable.

Because of this, a new type of reporting has emerged that entrepreneurs are forced to provide to the government body.

The counterparty has lost its cover in the form of a trade secret

Everything goes to the point that when choosing a counterparty, you should know more about him than his own mother. The mother does not need to know everything, but you need to know everything about the counterparty. Moreover, in recent years there has been little left of the concept of a trade secret. Since July 2017, in accordance with the changes made to Article 102 of the Tax Code of the Russian Federation, the classification of secrecy has been removed from a significant part of the information provided by taxpayers to the Federal Tax Service.

The counterparty cannot hide behind a trade secret in relation to the following information:

- contained in the constituent documents of a legal entity,

- confirming the fact of making entries about a legal entity or individual entrepreneur in the relevant state registers,

- giving the right to carry out entrepreneurial activities,

- on violations of the legislation of the Russian Federation and prosecution for such violations,

- about persons who have the right to act without a power of attorney on behalf of a legal entity.

- data on the average number of employees,

- data on the amounts of taxes and fees paid by the organization,

- data on the amounts of arrears and debts on penalties, fines,

- data on the amounts of income and expenses based on the materials of the accounting (financial) statements.

One of the reasons for disclosing data about taxpayers, according to official statements by the Federal Tax Service, is precisely transparency for potential partners. Lifting the tax secrecy regime on some information about taxpayers gives companies the opportunity to get to know a potential partner more and assess risks at the stage of their selection.

Check if the company is bankrupt

If the company is bankrupt, you will see this in the extract from the Unified State Register of Legal Entities. But it happens that a legal entity is still at the stage of bankruptcy proceedings, and there is no information about this in the register. And if you enter into an agreement with him, you will simply lose money - it will be very, very difficult to get it back.

Look at the unified register of bankruptcy information. Indicate the company name and TIN, or the last name, first name and patronymic of an individual entrepreneur. If there is a case, study it and see why the counterparty may go bankrupt. Ideally, if there is no information about it.

Where to get information about the counterparty. Recommendations from the Federal Tax Service

To protect yourself from entering into transactions with unscrupulous business partners, the Federal Tax Service recommends conducting an independent audit in several areas.

Sources of information about the counterparty:

- electronic services of the Federal Tax Service and other official resources, including various tax services, data from the State Registration Bulletin, database of the bailiff service, etc.

- data from open sources, including those posted in the media and on the Internet, for example, on the company’s official website, on its pages in social networks, on review sites, etc.

- if there are subscriptions, use various databases to check the counterparty, for example “SPARK”, etc.

- The counterparty's address must be real. To check it, you need not to be lazy and go to the specified address. You must be sure that company officials are where they are officially stated to be.

- documents confirming the right of the counterparty to carry out the declared type of activity (licenses, certificates), powers of the official signing the agreement, and primary accounting documents (internal orders, protocols on the election of the head of the organization, powers of attorney). As well as documents that allow you to evaluate the resources of the counterparty, that is, its production capacity, personnel, etc. You must be sure that the counterparty has enough resources to implement the contract. These documents must be requested from the potential counterparty. Remember, the information listed above is not a trade secret of the company.

Track changes across all regular partners

There are two tabs on the main page of the service: “Tracking” and “Recently Watched”. They will help save time. This way you can quickly find companies you've recently checked out and see up-to-date information.

Inspectors recommend auditing companies every quarter before reporting and before major transactions and payments. But the service allows you not to waste a lot of time on this.

Once you have checked the organization, click on the “Track changes” button. You will see all the important changes that have occurred with your partner on the main page of the service in the “Tracking” tab.

But only regular users of the service can use the tracking function.

A comprehensive approach to due diligence

The Federal Tax Service recommends taking screenshots of pages from the Internet with information about the counterparty, saving these screenshots, and also printing them. However, you need to know that if the fact of execution of the transaction is not confirmed, a printout from the site will not be considered significant evidence when tax authorities assess the legality of including income tax expenses in the taxable base or applying VAT deductions. An integrated approach is required to exercise due diligence when choosing a counterparty. It is part of this comprehensive approach that the counterparty report is.

How to deliver work to select a counterparty:

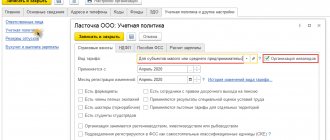

- Develop a document on the procedure for working with counterparties.

- Create internal regulations on due diligence and assign a responsible employee to this area.

- Collect information about the counterparty.

- Request a package of documents from a potential counterparty.

- Prepare a counterparty report demonstrating due diligence exercised.

What a counterparty report may include:

- Address, telephone and email of the organization, names of contact persons;

- Names of founders, presence of affiliated structures;

- Extracts from the Unified State Register of Individual Entrepreneurs, Unified State Register of Legal Entities, Rosstat;

- Financial indicators;

- Year the company was founded;

- The number of employees;

- Participation in tenders, availability of government contracts;

- Litigation.

See if the company is profitable

It happens that everything seems normal: the legal entity is registered as a taxpayer, there is no information about bankruptcy, there are no courts or enforcement proceedings. And there is no profit either. If in this case you enter into an agreement with a counterparty, you may simply not expect him to fulfill his obligations.

Check your profits on the Rosstat website. Indicate the year for which you need data and enter the Taxpayer Identification Number (TIN). And look in the report to see how the company is doing.

Rosstat usually provides information for previous years - for example, for 2021. It is unlikely that you will be able to find out the current financial position of the company, so you can use data from previous reporting periods. If a company remains in the red for several years in a row, there is clearly something wrong with it. And a small minus is not a reason to refuse cooperation: it may be the impact of the crisis.

Why do you need a counterparty audit and report?

- For the safety of the company. When choosing a partner, you must be confident in his reliability and that his obligations will be fulfilled.

- To check the Federal Tax Service. A report on the counterparty must be presented to the tax authorities during the audit or upon request.

- For tax deductions. If the Federal Tax Service manages to prove that the company did not exercise due diligence when choosing a counterparty, it will be accused of receiving an unjustified tax benefit and additional taxes will be charged: input VAT, which was accepted for reimbursement from the budget, and income tax.

Why you need to check the reliability of your counterparty

Previously, counterparties were checked at their own request, so as not to run into fraudsters. Now it is mandatory to do this - according to Resolution No. 53, every entrepreneur must conduct an inspection before concluding a contract. The logic is this: if you couldn’t recognize the scammer, it’s your own fault and you will be held accountable for it.

Indeed, if the counterparty turns out to be unscrupulous, this can lead to many problems. Here are some of them:

Losing money. The most obvious outcome is that you paid for the goods, are waiting for delivery, but it doesn’t arrive. The fraudster is already in the Canaries with your money and is not going to deliver anything, because of this, production stops, you do not fulfill your obligations to customers and lose even more money.

Additional taxes. The FTS (Federal Tax Service) monitors transactions. And according to Article 54.1 of the Tax Code of the Russian Federation, it may refuse to accept transaction costs or charge additional tax if you are working with an unreliable counterparty. In any case, you will have to pay more taxes than expected.

Checks from the Federal Tax Service. If you cooperate with unscrupulous counterparties, this is a reason for the tax office to send you an extraordinary audit. And if violations are discovered during it, this also threatens with problems - fines, recalculation of taxes, and so on.

Checks from law enforcement officers. This is possible if a criminal case is opened against your counterparty. As part of it, law enforcement agencies will check all companies with which he entered into contracts, including yours.

It’s better to spend half an hour or an hour checking your counterparty now than to lose several million rubles later or spend a month dealing with the Federal Tax Service, taxes or law enforcement. Evgenia Popova thinks :

“Verification of the counterparty has become almost a statutory obligation of companies. Firstly, this is due to VAT offset and export refunds. ASK VAT - a tax control program - includes not just control of the movement of goods turnover. It serves as a tool for identifying tax evasion schemes, identifying “purchase VAT” and invoices of imaginary transactions. And so to speak, one has to “whitewash” oneself in various ways. No one is safe from ending up in a chain where there is a shell company, and it may not be your direct supplier or buyer. But it will be up to you to prove to the Federal Tax Service inspectors that you were in no way involved in illegal actions. Secondly, electronic auctions for government contracts are the fulfillment of estimated obligations for the customer’s company. The counterparty contractor becomes your partner, who should not lead you to violations of the provisions of the budget code and entail criminal penalties. Thirdly, the transaction must first of all be reliable, and the obligations under the contract must be fulfilled by the parties. And litigation is not always a pleasant procedure.”

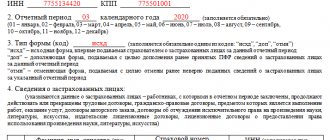

Do I need to submit a report on the counterparty to the tax office?

The entire regulatory framework related to the topic of due diligence when choosing a counterparty focuses on the fact that the taxpayer must independently conduct an audit of a potential partner and, if necessary, prove the fact of the audit. At present, there are no documents establishing the obligation of managers or officials responsible for maintaining accounting and tax records to send to the Federal Tax Service a report on the counterparty confirming that the counterparty has been verified for good faith. Instructions on this topic, coming from the Federal Tax Service, prescribe in more detail the algorithms for exercising due diligence, sources of information about the counterparty, however, for now, reporting on the work done to verify the counterparty is provided to the Federal Tax Service upon its request, and not systematically, on time and without fail.

Check your tax registration

Registration as a taxpayer confirms the accuracy of the information in the Unified State Register of Legal Entities and indicates that the company pays taxes. You can also check it on the Federal Tax Service website. Just indicate the TIN and see if there is registration:

If there is no registration, this is a big reason to be wary and refrain from concluding an agreement. A counterparty that is not registered with the Federal Tax Service is actually operating illegally.

How to obtain a counterparty's financial statements?

The shortest way to do this is to request it from the counterparty himself. However, there is always the possibility of data falsification in order to obtain a contract. After requesting the counterparty’s financial statements, it is recommended to compare them with Rosstat data. You can get the corresponding certificate in almost every reference and information system - Integrum, Kontur-Focus, UNIRATE24.

Based on the counterparty’s financial statements, although not directly, it is possible to establish its taxation system. So, if a company shows revenue of 68 million rubles and above, the company. A simplified taxation system is possible only for revenues below the specified amount.

Trust but check

Every company wants to see only honest and responsible representatives among its counterparties. But there are often times when, due to a partner’s dishonesty, deals break down or even cause losses. To avoid such troubles, you need to be confident in your future partner. Let's see how to check a counterparty's reporting.

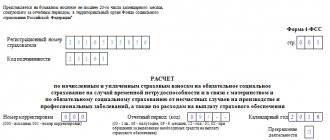

Checking reports

Now that you have verified that the counterparty exists, you need to analyze its financial statements. You will learn the maximum amount of information from the balance sheet. You can request the form (marked by the Federal Tax Service) directly from your partner or receive it through specialized systems.

The balance sheet confirms several important points regarding the company of interest:

- Does the enterprise submit reports to the Federal Tax Service and, therefore, operate?

- What funds does the company have at the reporting date?

You should not enter into an agreement with a company that regularly submits zero reports to the Federal Tax Service. Pay special attention to the columns that inform about the authorized capital, borrowed funds, fixed assets, and finances.

Having financial statements in hand, it is easy to draw up a graph showing the financial position of the enterprise, based on which you can make the right decision regarding cooperation. For example, you should not rush to apply for a “trade loan” with an enterprise that has a minimum authorized capital; you risk losing your finances if the company goes bankrupt.

Extract from the Unified State Register of Legal Entities

How can a counterparty be verified? The Unified State Register of Legal Entities provides information on the registration of business entities. If a potential partner attaches to all the documents he has collected a recently received extract confirming that he is registered with the state, then this will also be the basis for considering him reliable. In addition, this document can be used to check the details of the counterparty, which he indicates in contracts.

Such an extract can either be provided by the partner himself or obtained from the tax authority or on the appropriate resource.

We repeat: signs of an unscrupulous counterparty

- There is no information in the Unified State Register of Legal Entities at all, it does not coincide with the declared niche, they will soon be changed or the company will be excluded from there altogether.

- There is no registration with the Federal Tax Service as a taxpayer.

- There is registration, but at a mass address.

- The manager is disqualified and has no right to manage the company.

- There are legal proceedings with the counterparty or enforcement proceedings have been initiated against him.

- The company is bankrupt or is at the stage of bankruptcy proceedings.

- There is no profit, and the company has been operating in the red for several years in a row.

- The passport of an individual entrepreneur or founder, manager is invalid.

- The power of attorney on behalf of the company is fake or expired.

- One person runs several companies, also with opposing areas of activity.

There are many signs of scammers, but you should not refuse the deal after the first alarm bell. It happens that information in the Unified State Register of Legal Entities is changed due to the fact that the founder changed his last name. Or registration at a mass address was completed simply to save money on the office - after all, the company works remotely.