The system of regulatory regulation of accounting in the Russian Federation is a multi-level model, including many legal acts.

Properly organized accounting is important not only for each specific organization, but also for the state financial system as a whole. Regulatory regulation of accounting 2020 in the Russian Federation at the legislative level has a clear structure and hierarchy. At the head of everything, however, is not the code, as in many other areas, but the Federal Law of December 6, 2011 No. 402 “On Accounting.” Absolutely all economic entities in Russia must act in accordance with its requirements. But on its basis, a large number of by-laws have been developed that all organizations must apply when conducting accounting.

Concept and organization of accounting in the Russian Federation

Organization of accounting is a set of system-forming elements and conditions of the accounting process necessary for the formation of complete and reliable information about the economic activities of an enterprise.

In order to comply with the law when carrying out business transactions, accounting must be organized at each enterprise. The head of the organization is responsible for this.

Depending on the volume of work, the manager can choose one or another form of accounting work:

- Approve the “Accounting” division in the organizational structure, headed by the chief accountant;

- Introduce into the staffing table the position of a single person accountant;

- Transfer, on contractual terms, the maintenance of accounting to a centralized accounting department, a consulting firm or a specialist accountant;

- Maintain accounting records in person.

The basic principles of accounting are determined by the legislation of the Russian Federation on accounting. The regulation of accounting on a national scale consists of the development and approval of regulatory documents for all enterprises on the territory of the Russian Federation:

- Federal Law on Accounting;

- Charts of accounts and instructions for use;

- Accounting Regulations (Standards);

- Other regulations and guidelines on accounting issues.

Manuals and internal regulations

Consideration of the question of what regulatory documents regulate accounting will be incomplete without mentioning the guidelines and recommendations that the Ministry of Finance regularly issues. Among them, a separate niche is occupied by letters from the Ministry of Finance, in which officials answer questions and express their position on various situations not directly regulated by law. Although such letters from the Ministry of Finance are not legal acts (clause 2 of the rules approved by Government Decree No. 1009 dated August 13, 1997), they really help accountants in resolving controversial situations and sometimes even help defend their position before regulatory authorities.

And finally, at the very bottom of the NPA pyramid are the internal documents of the organization:

- accounting policy;

- instructions;

- orders.

All of them are compiled in compliance with the requirements of higher federal laws and regulations. Their goal is to determine the accounting procedure in a particular organization: current legislation provides for variability in this matter.

Documents regulating the organization of accounting

- Federal Law “On Accounting” No. 402-FZ dated December 6, 2011;

- Regulations on accounting and financial reporting in the Russian Federation, approved. by order No. 34n dated July 29, 1998. (as amended on March 29, 2017);

- Chart of accounts for accounting of financial and economic activities of organizations and Instructions for its application, approved. by order No. 94n dated October 31, 2000. (as amended on November 8, 2010);

- “Regulations on accounting of long-term investments” (approved by letter of the Ministry of Finance of the Russian Federation dated December 30, 1993 No. 160);

- Civil Code of the Russian Federation;

- Accounting policy of the organization.

The Ministry of Finance of the Russian Federation forms a special group of normative documents regulating the accounting procedure for individual areas: standards:

- Accounting Regulations (PBU). They are developed taking into account the main provisions of international accounting standards.

List of current PBUs adopted by the Ministry of Finance of the Russian Federation

- PBU 1/2008 Accounting policy of the organization, approved. by order of the Ministry of Finance of Russia dated October 6, 2008 N 106n;

- PBU 2/2008 Accounting for construction contracts, approved. by order of the Ministry of Finance of Russia dated October 24, 2008 N 116n;

- PBU 3/2006 Accounting for assets and liabilities in foreign currency, approved. by order of the Ministry of Finance of Russia dated November 27, 2006 N 154n;

- PBU 4/99 Financial statements of the organization, approved. by order of the Ministry of Finance of Russia dated July 6, 1999 N 43n;

- PBU 5/01 Accounting for inventories, approved. by order of the Ministry of Finance of Russia dated 06/09/2001 N 44n;

- PBU 6/01 Accounting for fixed assets, approved. by order of the Ministry of Finance of Russia dated March 30, 2001 N 26n;

- PBU 7/98 Events after the reporting date, approved. by order of the Ministry of Finance of Russia dated November 25, 1998 N 56n;

- PBU 8/2010 Estimated liabilities, contingent liabilities and assets, approved. by order of the Ministry of Finance of Russia dated December 13, 2010 N 167n;

- PBU 9/99 Income of the organization, approved. by order of the Ministry of Finance of Russia dated 05/06/1999 N 32n;

- PBU 10/99 Organizational expenses, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 33n;

- PBU 11/2008 Information on related parties, approved. by order of the Ministry of Finance of Russia dated April 29, 2008 N 48n;

- PBU 12/2010 Information on segments, approved. by order of the Ministry of Finance of Russia dated November 8, 2010 N 143n;

- PBU 13/2000 Accounting for state aid, approved. by order of the Ministry of Finance of Russia dated October 16, 2000 N 92n;

- PBU 14/2007 Accounting for intangible assets, approved. by order of the Ministry of Finance of Russia dated December 27, 2007 N 153n;

- PBU 15/2008 Accounting for expenses on loans and credits, approved. by order of the Ministry of Finance of Russia dated October 6, 2008 N 107n;

- PBU 16/02 Information on discontinued activities, approved. by order of the Ministry of Finance of Russia dated July 2, 2002 N 66n;

- PBU 17/02 Accounting for expenses on R&D and technological work, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 N 115n;

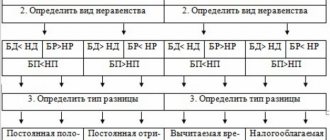

- PBU 18/02 Accounting for corporate income tax calculations, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 N 114n;

- PBU 19/02 Accounting for financial investments, approved. by order of the Ministry of Finance of Russia dated December 10, 2002 N 126n;

- PBU 20/03 Information on participation in joint activities, approved. by order of the Ministry of Finance of Russia dated November 24, 2003 N 105n;

- PBU 21/2008 Change in estimated values, approved. by order of the Ministry of Finance of Russia dated October 6, 2008 N 106n;

- PBU 22/2010 Correction of errors in accounting. accounting and reporting, approved. by order of the Ministry of Finance of Russia dated June 28, 2010 N 63n;

- PBU 23/2011 Cash flow statement, approved. by order of the Ministry of Finance of Russia dated 02.02.2011 N 11n;

- PBU 24/2011 Accounting for costs for the development of natural resources, approved. by order of the Ministry of Finance of Russia dated October 6, 2011 N 125n;

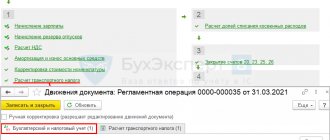

Mandatory details of the primary accounting system

Now let's move on to the nuances of preparing primary accounting documentation. As already mentioned, paragraph 2 of Article of the Law on Accounting contains a list of mandatory details of the “primary” accounting system. The absence of at least one of them deprives the document of the status of a primary accounting document. Therefore, it is important to monitor the presence of all required items in the document. To make this easier, the document should be divided into three parts: introductory, substantive and concluding. Each part must be checked separately.

Thus, in the introductory part of the accounting “primary” the following information must be indicated: the name and date of preparation of the document, as well as the name of the person (organization or individual entrepreneur) on whose behalf the document was drawn up.

The following is the content of the primary accounting document. It must reflect the essence of the fact of economic life (payment or receipt of money, transfer or receipt of property, etc.) and provide the appropriate measures (in kind or monetary). In this case, it is necessary to indicate the units of measurement (rubles, US dollars, kilograms, tons, pieces, etc.).

Finally, in the final part of the “primary report” you need to reflect the data of the responsible person. Namely: the name of the position, surname and initials of the person who made the transaction, operation and is responsible for its execution, or the person responsible for the execution of the accomplished event. The registration of the primary accounting document is completed by affixing the signature of the responsible person. If there are several responsible persons, then the details of all these persons must be indicated and their signatures must be affixed.

Generate invoices, acts, invoices and maintain accounting in a web service for individual entrepreneurs

According to the rules of paragraph 4 of Article of the Law on Accounting, the forms of primary accounting documents used by an organization are approved directly by its head (with the exception of public sector organizations). There is no longer a requirement for the mandatory use of unified forms in the Accounting Law.

Thus, in each organization it is necessary to determine the list of primary accounting documentation, and then, by order of the company, approve the forms of these documents. “Primary” forms can be developed completely independently (“from scratch”), or you can take the corresponding unified forms as a basis. It is also not prohibited to indicate in the order that the company will use one or another unified form without any changes or additions.

In the same organization, it is permissible to use all of the above options (for example, you can stipulate that some documents will be drawn up according to “their own” forms, and others - according to unified ones). The main thing is that two conditions are met. First: the primary forms must be approved by the head of the organization. And second: each approved form must contain all the mandatory details of the primary accounting document. Note that the form of the document can reflect only mandatory details, or mandatory and additional details (letter of the Ministry of Finance of Russia dated 02/04/15 No. 03-03-10/4547, communicated to the tax authorities by letter of the Federal Tax Service of Russia dated 02/12/15 No. GD- 4-3/ [email protected] ; see “The Ministry of Finance recalled the basic requirements for primary accounting documents”).

However, in some cases it will not be possible to use independently developed forms of primary documentation. For example, forms of primary accounting documents established by authorized bodies in accordance with other federal laws and on their basis remain mandatory for use (information of the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012). In particular, only using unified forms can you create cash receipts and debit orders (KO-1 and KO-2), a cash book (KO-4), a book of accounting for funds accepted and issued by the cashier (KO-5), as well as settlement payroll and payroll statements (T-49 and T-53).

Maintain a cash book electronically for free

Federal Law of the Russian Federation on Accounting

The main legislative act regulating accounting is the federal law “On Accounting”, N 402-FZ dated December 6, 2011 . The Accounting Law regulates the following issues:

- Defines objects and basic requirements for accounting;

- Reveals the basic concepts used in the legislative regulation of accounting;

- Establishes the rights and obligations of officials of the enterprise, as well as liability for violation of the requirements of the legislation on accounting;

- Determines the main tasks of accounting, requirements for the preparation and maintenance of primary accounting documents and accounting registers;

- Establishes deadlines and general requirements for conducting an inventory of the property and liabilities of the enterprise;

- Establishes deadlines, general requirements and procedures for submitting financial statements;

Hierarchy of accounting regulations in Russia

If you figuratively imagine what documents regulate accounting in Russia, you will get a kind of pyramid of five levels, at the head of which is Federal Law No. 402 of December 6, 2011. Let’s look at what the levels of regulatory regulation of accounting 2021 look like in the diagram, and then consider each of levels separately.

All regulatory documents on accounting 2020 fit into one five-level system. At each level a separate goal is achieved. In particular, the federal law regulates only general norms and requirements, but the regulation on accounting and reporting in the Russian Federation, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n, which is lower in importance, regulates specifics. In it, managers and accountants will find answers about the practical application of the requirements of Federal Law No. 402 and other regulations. Everything is more or less clear with these two documents, but then there are regulatory accounting documents that accountants have to deal with almost every day:

- chart of accounts;

- numerous PBUs;

- document flow regulations.

To understand what regulatory documents govern accounting, let’s take a closer look at the lower levels.

Regulations on accounting and reporting of the Russian Federation

Regulations on accounting and financial reporting in the Russian Federation, approved. by order No. 34n dated July 29, 1998. establishes the procedure for organizing and maintaining accounting, drawing up and submitting financial statements by legal entities. It was developed on the basis of the Law “On Accounting” and clarifies the application of certain requirements of the law. The provision is secondary in relation to the Law “On Accounting” and is the basis for all regulatory documents developed by the Ministry of Finance of the Russian Federation. The regulation establishes the possibility of choosing from two or more options for reflecting individual business transactions. For example, an enterprise can choose the method and form of accounting, the method of assessing materials, methods of calculating depreciation of fixed assets and intangible assets, etc. In order for the accounting of an enterprise to comply with the requirements of the regulations, it is necessary to ensure constant monitoring of the state of the legislative and regulatory framework.

Results

The regulatory system in Russia has established clear accounting rules for all business entities, distinguishing four levels.

We advise you to read the article that reveals the differences between management accounting and accounting: “What is the difference between accounting and management accounting?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What changed

The previously approved program for the development of federal accounting standards for 2017-2018 (Order of the Ministry of Finance dated July 7, 2017 No. 85n) was declared invalid.

The new program adjusts, in particular, the timing of the entry into force of new accounting standards. Excluded from the development of Amendments to PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency.” The table below shows the updated program:

Regulatory levels of regulatory documentation

In order to help the Russian economy take its rightful place among other countries, our government, back in the mid-90s, established the beginning of reform in the field of accounting. This is being done with the expectation of a transition to international financial reporting standards, which our levels are still lagging behind.

Of course, this is not a matter of one day or even a year, but all the steps that have been taken in this direction indicate a readiness for close international business and financial cooperation, without which it is difficult to imagine a prosperous country in the modern world.

What has been done so far? We will look at what types of legislative acts were adopted and what they provide for in our publication.

The legislative framework

All legal relations relating to accounting, business accounting, compliance with the laws governing accounting, are satisfied with the established norms of both the labor legislation of our country and individual administrative provisions. This is precisely the difficulty of working in the accounting field - you must always be aware of the news of the legislative process, since they directly affect the implementation of accounting.

The position of chief accountant in any type of enterprise plays a very important role. Only the manager himself can appeal to his decision, subject to the assumption of responsibility for resolving a certain issue. An accountant must be legally recognized in order to motivate his every action or refusal to follow instructions competently and professionally.

Primary documents and chart of accounts

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. Get free access for 14 days

Facts of economic life are reflected in accounting on the basis of primary accounting documents. Since 2013, organizations can develop forms of primary documents independently. The main thing is to enter all the required details into the forms and approve them in the accounting policy.

However, if there are no non-standard operations in the economic life of the organization, it is better not to create individual forms of documents. In order not to complicate the document flow, it is better to use the forms recommended by the State Statistics Committee.

If necessary, the list of documents can be supplemented.

In addition to the forms of primary documents, the accounting policy requires approval of the organization's chart of accounts and accounting registers. From the chart of accounts approved by the Ministry of Finance, select those that you will use. And for a more accurate classification, you can enter subaccounts.

If the company is small and its economic life does not involve non-standard operations, the manager does not need to dive into all these subtleties. The online service Kontur.Accounting already has an accounting policy that is suitable for most companies, all that remains is to read it and print the order prepared in the service.

And then the actual accounting begins, but that’s another topic.

The first level in the regulatory system

Regulatory regulation of accounting is carried out in this way. If we divide the system for regulating accounting, then first of all we need to highlight the acts adopted at the highest level - by the President of the Russian Federation himself and the government, who are more than anyone interested in modernizing accounting in our country and their level. Our financial strength and potential directly depend on this.

In this vein, legislative acts are adopted that indirectly or directly relate to the very process of organizing and conducting accounting at Russian enterprises.

The most important one was adopted back in 2011 and since then amendments or additions have been constantly being made to it, which qualitatively improve the legal content of this document, making it more relevant for the accounting department of the Russian Federation.

Legislative regulation of accounting

Every decision of a prospective business partner depends on the transparency of the information provided. Who would want to deal with a company whose accounting is not organized and systematized and does not meet modern accounting standards?

Why does the Russian Federation face such an important task - to carry out reform in the field of accounting? This is very simple to explain. Our country is just beginning to transition to a real market economy, but even with such colossal human and material resources, it can be difficult for us to compete with the economies of other countries that have a completely different approach to business and, in particular, to accounting.

Basic principles of accounting regulation

Let's consider the basic principles by which accounting is carried out:

- Compliance of accepted standards with the real needs of accountants and users of documentation.

- Unity of the regulatory system.

- Simplification of accounting methods, creation of a simplified reporting system.

- Application of international standards when approving standards at the federal and industry levels.

- Creation of conditions for the use of accepted standards.

- The impossibility of combining the establishment of standards and supervision of their implementation.

The regulatory system is established by Chapter 3 of the Federal Law “On Accounting”.

Functions of accounting regulators

The federal structure with the corresponding rights is vested with the following powers:

- Approval of the standard setting program.

- Organization of examination of standards development programs.

- Establishing standards for program design.

- Participation in work on international standards.

Functions of the Central Bank of the Russian Federation:

- Establishing industry standards and standardizing their use.

- Participation in the preparation of draft federal standards.

- Participation in work on international standards.

- Perform other functions that do not contradict federal laws.

The accounting system is also being formed by non-state structures. For example, these are professional communities. They have the right to take part in developing projects and setting standards along with government agencies. That is, the regulatory system is formed jointly.

Inventory accounting: FSBU 5/2019

FSBU 5/2019 must be applied from 2021 instead of PBU 5/01. The new standard regulates the procedure for accounting for inventories of a company.

MPZ include:

- materials, raw materials;

- goods for resale;

- finished products.

Accounting for incoming assets is carried out at their cost, which includes the cost of receipt agreed upon by the buyer and supplier, and all overhead costs associated with the acquisition of these assets. In this case, micro-enterprises can take into account related costs as part of current expenses. Other companies that maintain simplified accounting can include such expenses as current expenses, provided that there are no significant material and production balances.

For information about who is allowed to conduct simplified accounting, read the article “Features of accounting in small enterprises.”

IMPORTANT! Companies that have the right to use a simplified version of accounting may provide in their policies a simple method of accounting, without using double entry (clause 6.1, section 2 of PBU 1/2008).

Disposal of inventories can be carried out:

- at average cost;

- at the cost of each unit;

- FIFO method (the asset that was first registered is written off first).

ConsultantPlus experts explained how to apply the new Federal Accounting Standards in practice and what nuances to take into account when making changes to the accounting policies for 2021. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.