Author: Ivan Ivanov

To make payments for services rendered or goods supplied between enterprises or with individual entrepreneurs, accompanying documentation is drawn up. The seller issues an invoice to the buyer for payment. When unloading the goods - an invoice (provided that the seller pays value added tax).

An invoice for payment is the primary document issued to the buyer by the supplier of services or goods. It has the same meaning in relation to all participants in the transaction. The function of the account is a preliminary agreement on the transfer of funds specified in it. It can be registered by an individual entrepreneur or an enterprise.

Based on the invoice issued by the seller to the payer, the latter issues a payment order. For the supplier, and subsequently the recipient of funds, the role of the document is:

- in entering information about the point of receipt;

- in maintaining information about the name of a product or service, quantity and monetary value for a certain amount of time.

An account is not a mandatory accountable accounting document, since details and name may also contain other documents.

An invoice is a standard payment document issued to the buyer by the seller for services performed or goods delivered. This document is required in order to present the amount of tax on the difference between the cost of goods and services produced by the company to the tax authorities in order to receive a deduction.

The function of an invoice is to prove the rights of the party paying value added tax (VAT) and to receive a deduction for it.

If an error is detected in the form on the part of the taxpayer, VAT is not refundable.

Documents for a transaction with a client:

- The contract is the beginning of the transaction. In it, you and the client determine the terms of cooperation: what, for what price and in what time frame you do. If the client is a regular one, you can draw up one agreement for several transactions.

- The invoice contains the amount to be paid, a list of goods and services and the bank details of the seller. This is an optional document, but is usually used for convenience.

- A cash receipt, sales receipt or strict reporting form confirms payment. Give them to the client who pays in cash or by card. When paying by bank transfer, payment is confirmed by the payment order.

- Invoice is a document that the supplier issues to the buyer when shipping goods.

- An act of provision of services or completed work is a document that the customer and the contractor sign based on the results of the provision of services or completion of work.

- Invoice - usually issued by individual entrepreneurs and LLCs using the general taxation system, because they work with VAT. In rare cases, invoices are issued using the simplified tax system, UTII and patent - read more about this in the article.

- UPD replaces the act/invoice + invoice.

Submit reports in three clicks

Elba will take over the accounting.

The service will prepare reports and send them via the Internet. It will calculate taxes, reduce it by contributions - and you will receive ready-made payments for payment. Try 30 days free Gift for new entrepreneurs The promotion is valid for individual entrepreneurs under 3 months old

SF functionality

It remains to fully understand what the issued invoice confirms and what function it performs.

The main task of this documentation is to record that the transaction took place and the money was transferred or promised. It is recorded in the books and later becomes a reason for receiving a deduction.

Agreement

Describes the rights and obligations of the parties to the transaction. Typically, a contract contains the following sections:

- Subject of the agreement: what is the result of the transaction.

- Contract amount and payment procedure: when and how much to pay.

- Rights and obligations of the parties: how the work happens.

- Responsibility of the parties: what happens if you or your partner violate the deadlines.

- The procedure for changing and terminating a contract: how to terminate a contract or accept additional agreements to it.

- Details of the parties: what are your and your partner’s current accounts, INN, OGRN and addresses.

The agreement is usually drawn up in 2 copies and contains the signatures of each party.

If you use a standard contract form with clients and replace the necessary details in Word or Excel, use templates in Elba. Upload your agreement template, and Elba will automatically fill in the details of the counterparty from the directory.

For some transactions, a written contract is not necessary at all. For example, a purchase and sale agreement is considered concluded from the moment a cash receipt, sales receipt or other document is issued to the buyer, which confirms the fact of payment. This does not mean that during a retail purchase and sale it is impossible to conclude an agreement in writing - the law does not prohibit this.

Article: How people cheat in contracts

Templates of common agreements:

Service agreement template

Contract agreement template

Supply agreement template

Basic information

Accounting is unthinkable without knowledge of the basic principles of this process.

The invoice must necessarily contain the following information:

- assigned serial number, date of registration;

- addresses, full name, INN of the VAT payer, as well as the buyer;

- full name of the sender and recipient of the cargo, service, or other property;

- numbers of settlement documents;

- full name of the supplied goods;

- quantitative indicator of all supplied goods;

- tariff for the provision of goods, services (price per unit or other);

- excise tax amount – if the transaction involves excisable goods;

- tax amount;

- country of origin of the goods;

- serial number of the completed customs declaration - if it is available and necessary in a particular case.

What is the role of documents

Both types of documents have a similar role in accounting. They are required to conduct tax control over the commercial activities of the enterprise.

But this applies only to value added tax braiders (a certain category of them). If there are errors, the tax service has the legal right to refuse a deduction.

Normative base

Good knowledge of the regulatory framework is the basis of accounting. The official involved in the generation of invoices, as well as regular invoices, should study in as much detail as possible:

All the federal laws mentioned above represent amendments and changes related to the procedure for generating an invoice.

If there is a need to refer to the Tax Code, you should use only the latest edition. Since otherwise there is a high probability of making a mistake, the legislation is reformed annually.

The legal basis for the formation of various types of accounts of the type in question is

All actions with accounts should be carried out taking into account this provision.

When resolving any controversial issues between organizations and the tax service, the courts are always guided by the law outlined above.

Check

An optional document in which the seller indicates the price, quantity of goods and details for transferring payment.

You can come up with an invoice form for payment yourself or find a ready-made one on the Internet. An invoice can replace a contract if all essential terms of the transaction are included in it.

Invoice template

Elba has a ready-made invoice template. Select the counterparty, indicate the goods or services, their quantity, and the document is ready.

What details can’t you do without?

All conditions were specified in Article 169 of the Tax Code. In order for the SF to be accepted for registration and studied, it must contain certain lines:

- The day on which the document was drawn up, and the serial number upon creation. The number is the one on which the transaction took place. Any numbering that the seller likes. The main thing is that the numbers should go in ascending order and remain consistent. But if the company violated the system and after 55 and 56 issued SF No. 22, then this will not affect the tax deduction in any way.

- The name of the selling organization, full address and all important identification numbers. Everything must be correct, without corrections or errors, easy to read and in a normal font. The abbreviated or full form must be made in such a way that it corresponds to the constituent documents and is consistent with the charter of the company. You can't do without a postal code.

- Everything is spelled out similarly on the buying side. You must correctly indicate where the client is located and where the shipment will be shipped. These lines may be of interest to the tax service.

- Recipient and sender of the cargo, their addresses. This information is necessary when selling products. When work is being performed or a service is being provided, such a line is not needed. When selling goods, you do not have to fill out this field completely. But if you write all the details, then it won’t be an error. The recipient must be described completely in accordance with the statutory documents. In this case, it does not depend on whether the buyer is the consignee or not.

- The name of the products sold, the units in which they are measured. You cannot make mistakes in these fields. It is important to write correctly whether products are counted in pieces, kilograms or liters.

- The number of products that were sold or the volume of services provided. This line indicates how many parts or watermelons were eventually sold to this buyer. The calculation and the total amount depend on this part.

- Price or tariff. Counts as a unit of measurement, if possible. Indicated without VAT or including it, depending on what is specified in the contract.

- Paper currency. How everything is calculated and payment will be made. A code is written that is listed in the All-Russian Classifier. It can be a ruble (643), a dollar (840), euro (978) or any other official currency.

- The total cost of products sold. Be sure to carefully calculate and indicate. Errors and adjustments are not allowed. More often, a document is prepared electronically, and all fields are filled in automatically, so the risk of making a mistake tends to zero.

- Tax rate. It could be 0%, 10% or 20% depending on how the company operates and what it sells. If the company is on a simplified basis or has been completely exempted from calculating and paying value added tax for any reason, then “Without VAT” is written in this line. We have already discussed above how this works and why it is recommended to write correctly.

- The amount of tax calculated. As a rule, programs calculate it automatically; accountants can calculate it manually.

- The full cost for the volume of products or services sold, including tax.

- The country in which everything was produced and the number from the customs declaration. This line is only relevant for goods that were sent from abroad.

You can simplify and optimize business processes using special software. On the Cleverens website you will find solutions suitable for various purposes and tasks.

Payment documents

Confirms payment for goods or services. This can be a payment order, payment request or cashier's check.

A cash receipt is issued using an online cash register. It is required to be used by everyone who accepts payments in cash and by bank cards. Exceptions are listed in paragraph 2 of Article 2 of Law 54-FZ. Under the patent, only some entrepreneurs must use the cash register, while the rest are exempt. Look at the list in the article, where you will also find information about the deferment until 2021 for individual entrepreneurs without employees and complete instructions for switching to online cash registers.

Article about online cash registers

The payment order remains with the entrepreneur when he transfers money via Internet banking. This document confirms the transfer of funds using certain details.

A sales receipt is an optional document that is issued at the buyer’s request.

The buyer needs a document to confirm that he not only spent a certain amount of money, but also bought certain goods - for example, on behalf of his manager. The form of the sales receipt has not been established, so you can develop your own with the required details: name of the document, number, date, name of the LLC or full name of the individual entrepreneur, INN, goods and services, amount of payment and signature with transcript and position.

Consignment note (N TORG-12)

Registers the sale of goods to another individual entrepreneur or LLC. It is usually not used for working with individuals.

The invoice is issued in two copies: the first remains with the supplier and records the shipment of goods, and the second is transferred to the buyer and is needed by him to accept the goods.

Usually the invoice is drawn up according to the standard TORG-12 form. But you can use your own template.

Invoice template

In Elba you can create an invoice based on an invoice.

New uniform in 2021

In connection with the increase in the basic VAT rate to 20%, a new form of invoice was introduced in accordance with the order of the Federal Tax Service of the Russian Federation dated December 19, 2018 No. ММВ-7-18/ [email protected] Changes were made to the electronic format of documents used for exchange via telecommunications communication channels. The order of the Federal Tax Service provides for a long transition period; until December 31, 2019, the right to apply the old format remains. Documents created using old formats must be accepted until December 31, 2022. Tax authorities recommend switching to the new format now in order to improve work efficiency.

Invoice form in Word format

Invoice

This document is required to be issued only by organizations and entrepreneurs that are VAT payers - mainly those who work on the general taxation system.

Organizations and individual entrepreneurs on the simplified tax system, UTII and patent usually do not pay VAT and therefore are not required to issue invoices. There are a few exceptions, which we covered in a separate article.

The invoice is issued in duplicate and signed by the supplier of the product or service. One copy is given to the buyer, the other remains with the seller. An invoice must be issued no later than 5 days after shipment of goods or provision of services.

An invoice is the basis for deducting VAT, so all organizations treat it with special trepidation.

In order not to study the form and rules for issuing an invoice, use Elba.

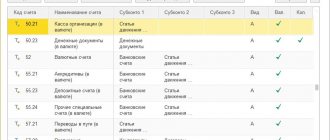

Log books and books

These are mandatory attributes of the functioning of any organization. Each taxpayer is required to draw up a tax return and maintain this documentation when transactions are eligible for taxation.

This is how VAT is calculated in cases of sales of products, provision of services or transfer of property rights. The selling party must register the issued paper in a special sales book. And the buyer will make a similar entry in her own, this time about purchases. This way she will confirm her right to receive a deduction. Then all these amounts will be taken into account in the declarations.