| In many organizations, in order to encourage the work of employees, they pay them bonuses. But not everywhere there is a provision on bonuses for employees. Of course, employers can say that there is a section on bonuses in the wage regulations. | Articles on the topic: - Simple: labor relations and payments - Disputes over wages - Early retirement for medical workers |

But we recommend issuing a separate document regulating the conditions for assigning and paying bonuses in order to avoid unnecessary questions from employees and tax authorities. We’ll talk about how to develop bonus regulations in this article.

The procedure for material incentives for employees

The Labor Code of the Russian Federation does not contain a definition of the concept of bonuses, nor does it oblige employers to award bonuses to employees. At the same time, the Labor Code contains rules by which bonuses can be awarded, and also determines the procedure for fixing the procedure for bonuses.

So, according to the provisions of Art. 129 of the Labor Code of the Russian Federation, wages are not a single payment. It is divided into various components such as:

- Payments for employees performing their duties. The amount of such payments depends on various criteria, namely: the qualifications of employees, the complexity of the work performed, its quantitative and qualitative indicators, and working conditions.

- Compensation payments. These are various types of additional payments that are subject to accrual to employees subject to certain conditions. For example, such additional payments are awarded in northern climate zones, for special working conditions in hazardous industries, etc.

- Incentive payments. They include bonuses, allowances, and additional payments.

Due to the requirements of Art. 191 of the Labor Code of the Russian Federation, bonuses are a method of rewarding an employee who properly performs job duties, i.e. in fact, he works well and is not subject to penalties. The employer himself determines the amount of incentive payments, the terms and procedure for calculation. The bonus regulations may reflect the conditions for payment of bonuses, the procedure for their implementation, size, grounds for refusal to accrue, etc. Below we will talk about how to compose a document. A sample provision on bonuses for employees can be found at the end of the article.

What does the regulation contain?

There is no established specific form of regulation on employee incentives. This means that each company independently publishes this document. There are points that make up the regulations, namely :

- name of the company and document (regulations or regulations);

- current date of compilation;

- it must be indicated that this document is an internal order of the company and is formed in accordance with current legislation;

- purpose of the order (that is, its purpose);

- conditions (for example, bonuses are paid at the discretion of management);

- a list of grounds for assigning and depriving bonuses (for example, for deprivation - failure to meet planned targets, and for assignment - exceeding the plan and other merits);

- work of the payment fund (that is, if there are reserves, the bonus is paid without delay);

- indication of the amount of bonus incentives;

- periods, as well as terms for assigning and accruing bonuses (once a month, year, quarter, etc.);

- other information about the assignment of bonuses (for example, that lists of employees scheduled for payment are formed 1.5-2 weeks before payment, etc.);

- the date on which the incentive regulations come into force;

- rules for amending the document;

- at the end, the general director puts his cliche (full name, signature, position).

Why draw up a provision on bonuses for employees?

The document is drawn up in order to systematize the procedure for rewarding employees in the organization and outline the criteria, subject to which payments will be made.

If the provision is in force, it is binding on both the employer and the employees. This approach allows you to avoid misunderstandings between employees and management, ensure uniformity in the payment of bonuses to different employees, determine the size of bonuses and the cases when they are payable.

In addition, employees who know what they can be rewarded for strive to bring their work performance to the required level - to fulfill the plan, produce the required quantity of products, and bring its quality to the required level.

The provision can clearly indicate situations in the event of which an employee will be deprived of bonuses. If the bonus constitutes a significant share of the salary, employees will want to receive it by any means, and accordingly will fulfill all the conditions that the employer requires and which are specified in the bonus regulations.

Employee bonus system and its main elements

Any organization has its own procedure for awarding bonuses to employees, regulated by local documents. This is a staff bonus system. There are also criteria and indicators for bonuses for employees. These are elements of the incentive payment system that determine how, to whom, and in what volume bonuses should be given.

Elements of the employee bonus system are:

- employee bonus criteria - indicators that the work of personnel must meet in order for monetary remuneration to be accrued;

- a list of employees who are entitled to receive a bonus;

- procedure for calculating bonuses;

- procedure, terms of accrual and issuance of bonuses;

- sources of bonuses;

- procedure and grounds for reducing the volume of bonuses.

Since there are no clear requirements regarding the list of elements of the bonus system at the legislative level, each enterprise determines them at its own discretion.

Let's look at the existing bonus systems:

- Bonuses for current activities.

- Project bonus.

- Bonus programs.

- Awards that generate enterprise loyalty.

- Bonuses as part of the management system.

This system is similar to the traditional monthly payroll system. That is, if an employee works well, without any comments, then bonuses are given to him monthly. Typically, the incentive payment is a certain percentage of the salary. This type of bonus is in great demand because it increases employee motivation to work and is quite simple to calculate.

The most obvious bonus model. If an employee completes a predetermined amount of work, he receives a bonus. He is informed about the size of the bonus before solving the assigned tasks.

The amount here depends on the percentage that the manager is willing to pay to employees. It is he who determines the amount of funds planned for disbursement. This value, as a rule, depends on the personal interest of the employer in allocating a specific amount for the payment of bonuses. This type of incentive is effective if the company attaches great importance to group work, when department employees perform similar job functions.

An example here is the usual thirteenth salary that companies give to staff on New Year’s Eve. It is difficult to say why such bonuses are paid, but this phenomenon has already become a tradition.

The largest Russian baby food company was thinking about how to increase productivity. As a result, it was decided to pay bonuses to staff in case of successful implementation of the proposals.

Bonuses are also classified according to the accrual method. Some companies form bonuses from top to bottom, creating a bonus fund based on additional profit. Others build a scheme from the bottom up, that is, they immediately include the issuance of incentive amounts in the budget as part of the wage fund.

Every enterprise strives to create a flexible and universal bonus system.

You may also be interested in: How to make your business successful

What conditions should be included in the provision?

When drawing up a sample regulation on bonuses for employees of an enterprise, it is necessary to pay attention to the following significant points:

- Indicate as clearly as possible the criteria that an employee must meet to receive bonuses. If the criteria are not provided, then bonuses are awarded simply like that - without reason; accordingly, the employer is responsible for monthly transfers of amounts to employees and cannot refuse payments. If for some reason there are no bonus conditions in the regulation, it is necessary to include the conditions for depreciation in its text. This will avoid the need to pay bonuses to an employee who does not deserve them.

- The Regulations can include a clause stating that bonuses are paid only if the organization has the financial capacity for such accruals. In addition, an additional criterion for the transfer can be indicated by the employer’s will to do so (i.e., the need to issue an appropriate order containing a voluntary order for payment).

Principles of bonuses for company employees

There are special bonus principles:

- fair and reasonable bonuses;

- financial interest of employees in achieving the desired results;

- general collective interest in work;

- encouraging creative approaches to activities, responsibility, and the desire to produce quality goods and services;

- simple determination of the bonus amount;

- a clear and clear understanding by employees of the relationship between work practice and financial incentives;

- flexible changes in the concept of bonuses in accordance with new goals and objectives of material incentives;

- publicity of the bonus concept as a combination of material and moral incentives in work.

The criteria for bonuses for employees must correspond to the types of production tasks, depending on the labor contribution to the development of the company made by each employee and the entire team as a whole. There should be very few criteria. At the same time, it is necessary that they are sufficient to ensure a connection between incentives and main production goals with the results of the work of hired personnel.

Recommended articles on this topic:

- Modern problems of small business development and ways to solve them

- Automation of business processes – real benefit or an extra headache?!

- Personnel outsourcing: types, pros and cons

What is the difference between bonus, annual bonus and salary provisions?

All the provisions listed above have the same legal nature. All of them are local acts of the head of the organization (rarely, but situations are possible when provisions on the payment of bonuses, including annual ones, are adopted in the form of collective agreements).

The salary regulations and the bonus regulations are general and specific. Since bonuses are an integral part of the salary, accordingly, the procedure for their payment can be included in the salary regulations.

The provision on the annual bonus, in turn, is a special case of the provision on bonuses; accordingly, it covers the issues of paying exclusively bonuses related to the merits of employees for the entire past working year.

We recommend drawing up one provision so as not to introduce a significant number of local acts in the company. It can indicate both the procedure for paying bonuses in general and the procedure for calculating annual bonuses. With this approach, a sample provision on an annual bonus will also look like a sample provision on salary and bonuses.

Effective work

Coherence of actions, absence of serious errors - these are the criteria for bonuses for accountants that enterprises should use. It is impossible to completely avoid shortcomings and mistakes in such activities. And here the question is not even about the flaws themselves, but about the speed of their elimination and possible consequences.

To determine the efficiency of the accounting department, you need to take into account the presence of fines from supervisory authorities for late submission of reports and incorrect filling out of documents. If any error was corrected by an employee on time, then we can assume that he is working for the benefit of the organization. For example, an updated tax return was promptly filed.

Also see “Professional standard for an accountant: how and why to apply it.”

In what form and how is the provision drawn up?

In large organizations where employees work in several departments, in which work processes are structured differently, it is advisable to develop several provisions for each department. In small companies, drawing up one document is enough.

It is permissible to include the text of the provision in a local act regulating the procedure for remuneration for work. This may be advisable when there is no desire to approve a significant number of internal documents and complicate paperwork.

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

Of course, depending on the legal form of the company (or institution), the documents will differ. Thus, a sample provision on bonuses for employees of an LLC may differ significantly from the same provision in a PJSC or in a budgetary educational organization, but in essence, these are very similar documents.

Assessing the effectiveness of the employee bonus system

In order for the employee bonus system to be effective and function successfully, it must be regularly analyzed and monitored. If errors are promptly detected and eliminated at each stage, then both the individual employee and the entire company will work much more efficiently.

In short, an effective reward system provides visible economic benefits that exceed the costs of its implementation. At the same time, each employee receives appropriate financial remuneration for his work.

The main criteria by which the bonus system is assessed are:

- compliance of indicators taken into account when awarding bonuses to the goals of the department or enterprise in general;

- assessment of how correctly the basis for calculation is chosen. It is necessary to regularly analyze the degree of implementation of the selected system of indicators over a long period of time. If the installed base is below the actual level of its performance on a regular basis, it needs to be revised;

- the presence of positive dynamics of the assessed indicator from the introduction of the bonus system. If the incentive scheme does not contribute to improving the specified performance indicators, then it has exhausted itself, and therefore you need to think about introducing a different mechanism. In this case, it is necessary to exclude the influence of factors that do not depend on the will of the employee (malfunctions of technical equipment, forced downtime);

- adequacy of the bonus amount. The size of the bonus must exactly correspond to the employee’s achievements. It is quite difficult to assess this, since it is necessary to analyze the impact of numerous factors. If several bonus factors have been established, you need to find out whether there are any imbalances in the labor costs required to complete them. It is worth understanding that bonuses in the amount of 7% or 10% of the salary or tariff rate are not stimulating;

- correct appointment of employees to implement the incentive system.

Quantitative assessment is carried out in different ways, but the main thing here is the benefit of using the incentive system for the manager, whether it is economically effective for him.

Absolute efficiency = change in efficiency indicator in money - bonus costs

Relative efficiency = change in monetary performance indicator / bonus costs

Example of the content of a provision on the payment of bonus payments

The structure of the document can be absolutely anything. It all depends on what goals the document is being drawn up and what provisions are planned to be included in it.

In general, the structure might look like this:

- General information, including about the organization, its structural divisions, the remuneration system, etc.

- List of types of bonus payments that can be accrued to company employees.

- The procedure according to which bonuses will be calculated. Here you can enter various efficiency coefficients, formulas, take into account different labor indicators, etc.

- A list of reasons on which the bonus amount may be reduced, for example the presence of disciplinary violations, etc.

- List of grounds for refusal to pay bonuses.

This structure is only an illustration, since the head of the organization has significant freedom in shaping the structure of the bonus provision. The law does not prohibit introducing additional elements into the content of the document and establishing additional rules.

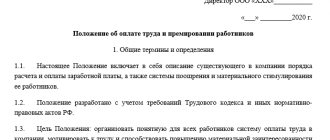

General provisions

In this section, in addition to the above information, you can additionally touch upon the goals for which bonuses are awarded to employees. In particular, these may include motivating employees, improving work performance, increasing productivity, and improving efficiency.

Here you can indicate which specific employees are covered by the document. This could be all employees, employees of individual structural divisions, or individual employees. Additionally, you can indicate that only full-time employees receive bonuses.

List of types of bonus payments

This section reflects various types of awards. They can be:

- Annual, quarterly, monthly.

- Current, one-time.

- Targeted and non-targeted.

- Specific, for example, for completing a work plan for a month, or abstract, for example, for good work, quality service, etc. It is recommended to indicate the reasons for payments as specifically as possible.

Procedure for calculating and paying bonuses

You can specify what documents employees must provide in order for bonuses to be accrued. In addition, you can assign responsible employees for the calculation and payment of bonuses. As a rule, these are accounting employees.

The size of the bonus can be determined in various ways and can be:

- fixed;

- as a percentage of salary or wages;

- as a proportion of salary or wages.

Grounds for reducing the size of the premium or depriving of bonus payments

This section, as a rule, indicates violations, if committed by employees, the amount of bonus payments is reduced. For example, this could be various kinds of disciplinary sanctions, failure to fulfill the plan, lack of material assets, etc. In addition, the grounds may include violations in the field of labor protection, non-compliance with labor regulations, failure to comply with management orders, damage to property and material assets belonging to the employer.

Types of bonuses for employees: brief classification

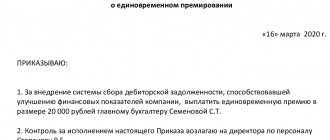

The diagram below shows a sample of types of bonuses for employees.

There are bonuses:

- production. They are issued if employees fully solve production problems and cope well with their job responsibilities. Production bonuses are systematic. That is, companies can make payments every month, every quarter or at the end of the year;

- incentive. Such bonuses are not directly related to the employee’s performance of his official duties.

Payments are made in one go:

- At the end of the year, based on the results achieved;

- Every year for length of service;

- Bonuses are given to employees with high performance indicators;

- Payment of bonuses is tied to memorable dates, anniversaries, etc.

According to the forms of payment, bonuses are:

- monetary;

- commodity (we are talking about memorable gifts, for example, personalized watches, sets of stationery, household appliances, all kinds of certificates).

Depending on the assessment of labor performance indicators, bonuses for company employees are:

- individual - the bonus is awarded to one or more employees taking into account their personal contribution to the activities of the enterprise;

- collective - the bonus is given to all personnel for achievements in their work activities. Such payments are calculated based on the collective performance of the department or company as a whole. Next, the received amount is distributed among employees depending on their personal contribution. Personal contribution is determined taking into account time worked, basic salary and labor participation rate.

The methods for calculating bonuses can be:

- absolute, which are paid in a fixed amount of money;

- relative, calculated as a percentage.

According to frequency they are distinguished:

- systematic bonuses, which are made on a regular basis;

- one-time bonus. That is, the company financially rewards employees, for example, for solving a task of increased complexity.

The frequency of payment of bonuses depends on several factors, these are:

- Features of the activity of the enterprise, its departments or specific employees;

- The nature of bonus indicators;

- Accounting for labor results over certain periods of time.

According to the intended purpose, bonuses can be:

- general, when bonuses are given for success at work;

- special, when employees are rewarded for solving specific problems.

You may also be interested in: How to establish crisis management in an enterprise

How to approve a position

The regulation on the payment of bonuses is a local act, and accordingly, the procedure for its approval corresponds to the procedure for approving any local act.

The employer approves the document. If the company has a trade union (which is rare in Russian realities), then it is necessary to take into account the opinion of this body, even if it consists of a small number of employees.

The form of the document is written. It should be familiarized to the performers who are appointed responsible (for example, accounting employees), as well as to the employees who are affected by the position (actually, those receiving bonuses).

Thus, if desired, the organization can adopt a Regulation on bonuses. This is not a mandatory document, but it is recommended that it be drawn up if you plan to clearly systematize the procedure for awarding bonuses to employees. A sample bonus clause can be downloaded from the link below.

What kind of comments are there?

First of all, the amount of remuneration is affected by the number and severity of comments made against the accountant. After all, the efficiency of the processes occurring in it often depends on the work of the company’s settlement service. Serious flaws may lead to a decision not to issue a reward.

As you can see, the bonus criteria for accounting employees consist not only of positive aspects. The following errors can reduce the level of reward (see table):

| Omission | Consequences |

| Late payment of bills | As a result, supplies of materials, tools, equipment, and goods may be delayed |

| Payment of wages late | Causes dissatisfaction among employees and may lead to the need to pay interest |

| Lack of primary documents or their untimely preparation | Deliveries may be delayed. Sometimes this leads to damage to goods. |

For more information, see “The Most Common Accounting Irregularities.”

Important nuance

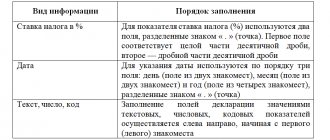

When signing an employment contract with an employee, the wording on the components of the salary is of great importance (see table).

| Formulations | Interpretation |

| Salary includes salary, allowances and bonuses | The payments in question are part of remuneration, not incentives. Therefore, the employer does not have the right to take them away from the employee, otherwise he will be held accountable. The legal grounds for withholding wages are listed in Art. 137 and 138 of the Labor Code of the Russian Federation. |

| The contract states that the salary consists of a constant (salary + allowances) and variable (bonuses) parts | Payments have the status of incentive bonuses. If the conditions of the internal regulations are not met, the employee is simply not awarded a bonus. To do this, if necessary, they provide a link to an internal document, which the employee must familiarize himself with under signature. |

EXAMPLE Ponomarev, holding the position of driver, committed a disciplinary offense - he repeatedly violated the schedule for the start and end of work on the route. The director of the organization reprimanded the employee and refused to award the bonus.

Payment for additional features

Sometimes accounting employees have to perform additional tasks. And extra labor costs must also be paid.

For example, very often such employees have to correct documentation brought by other employees several times. And assistance in eliminating errors is not the direct responsibility of an accountant.

Many managers often go straight to an accountant with primary documents. And he has to make corrections, explain what exactly was done wrong. At the same time, these functions must be performed by managers. They are the ones you should contact to check your papers. And only after receiving approval, the documentation should be sent to the accounting department.

Practice shows that often this work is performed by an accountant. This takes away time that could be spent processing primary documentation, studying laws, analyzing or writing reports. If such a situation occurs, the accountant's bonus can be increased by reducing the remuneration of managers. Therefore, bonus indicators for an accountant do not have a clear framework.

Training other employees

Often an accountant has to teach something to a new employee or an employee entering his position. Bonuses for the chief accountant, a sample of which can be developed by the organization independently, are most common in this case. Since it is he who has to pass on his knowledge to others.

Acting as a mentor, the employee performs functions unusual for him. A competent employer in such a situation always pays a bonus, developing unanimity and a desire to help each other. If one of the accountants wants to quit, other employees will be able to teach the newcomer everything he needs.

Also see “Assignment of responsibilities from and to the chief accountant.”

What to encourage

The main question when introducing rewards is what can accounting departments be rewarded for? Any bonus acts as motivation for more efficient work of the employee. So, at the end of the reporting period, you can issue an accountant a bonus for the intensity of work. Also see “Annual bonus for 20216 how to apply.”

An accountant, at his core, is a seasonal worker. After all, before submitting reports, the workload increases many times over, and rush jobs often occur. Any reports submitted late will result in fines. During such periods, additional responsibilities are added to the usual ones: filling out reports, sending them, collecting the necessary information.

Next in the picture are absolutely real bonus indicators for the chief accountant of one of the schools in Moscow. If desired, they can be adapted to the needs of any commercial class=”aligncenter” width=”1052″ height=”525″[/img]

How to organize a bonus reduction system

Developing a bonus system for employees is not an easy task. Employers often make mistakes that ultimately have the opposite effect. Here are the most common of them (see table):

| № | Error | What's wrong |

| 1 | Informing an employee about the deprivation of a bonus only upon receipt of a pay slip | Over the past period, a person may forget what exactly he violated. As a result, motivation to work is lost. |

| 2 | Inaccurate wording about incentive conditions in local acts | The employee must know exactly for what amount of work and achievements he is entitled to additional payments, as well as their amount. An example of a good wording: |

Responsibility for illegal deprivation of bonuses to employees

When a company illegally deprives an employee of bonus payments, which is documented, it is brought to administrative liability under Art. 5.27 Code of Administrative Offences. Possible penalties are presented in the table.

| Status | Amount of fine for the first violation, rub. | Types of penalties for violation again |

| Executive | 10 000 – 20 000 | • fine: 20 – 30 thousand rubles; • deprivation of the right to practice for up to three years. |

| Businessman | 1000 – 5000 | Fine 10 – 30 thousand rubles. |

| Firm | 30 000 – 50 000 | Fine 50 – 100 thousand rubles. |

Errors when filling out

The most common mistakes:

- The document does not contain types of awards.

- Adoption of regulations on bonuses without publicity of representative bodies.

- There is no procedure for paying material rewards.

- If the regulations do not stipulate the conditions for receiving the bonus.

- Incomprehensible bonus criteria and their absence.

- There are no bonus payment periods.

- And any other shortcomings.

Regulations on remuneration and bonuses for employees are needed in every company in order to increase employee motivation, productivity and speed of work. Read articles from our experts about who in the company draws up the material incentive document and how the bonus amount is set.

Deprivation of bonuses to employees: Labor Code

The legislation does not provide for such a penalty as deprivation of bonuses. There are only three types of disciplinary sanctions. They are listed in Article 192 of the Labor Code of the Russian Federation: warning, reprimand and dismissal. And there is nothing about the abolition of incentives.

The Labor Code allows the employer to provide for these types of punishments for certain categories of employees in its internal documents, but directly declaring deprivation of bonuses is not encouraged. It is better to just list the conditions on the basis of which a bonus can be assigned. And proceed from the opposite: violated/did not violate any condition.