What are the main nuances of filling out section. 1 and 2 forms 6-NDFL? What errors are most common in these sections of the calculation? What are the latest letters from the regulatory authorities, in which they provided explanations on filling out the calculation in Form 6-NDFL?

Now the next time has come when organizations need to submit a calculation in form 6-NDFL to the tax office at the place of their registration. In the article we will talk about the main mistakes that were made in previous periods, and also present the latest clarifications of the regulatory authority.

First, let us remind you that the calculation in form 6-NDFL is filled out on the reporting date: March 31, June 30, September 30 and December 31 of the corresponding tax period. Wherein:

- section 1 of the calculation is filled out with an accrual total for the first quarter, half a year, nine months and a year;

- Section 2 is completed for the corresponding reporting period. It reflects those transactions that were carried out over the last three months of this reporting period.

How to fill out the 6-NDFL report: learning the rules

How to fill out form 6-NDFL?

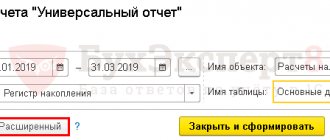

To answer this question, you need to study the procedure for filling out the report. For the form for 2021, the procedure was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] , that is, the same as the form itself. We will consider this order later in the article.

But we warn you that this form and procedure for filling out the report for 2021 will be used for the last time. As of reporting for the 1st quarter of 2021, the form will be new (approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected] ).

ConsultantPlus experts have already sorted out how to fill it out. You can view line-by-line comments in the Ready-made solution by getting free trial access. Also in the legal system is a sample of the new 6-NDFL 2021. And it can be:

Procedure for filling out 6-NDFL for 2021

Filling out 6-NDFL is carried out taking into account the following requirements set out in Appendix 2 to the order of the Federal Tax Service:

- the basis for filling out the report is data from tax registers for personal income tax (mandatory for maintaining by each tax agent);

You will find a sample of filling out the tax register for 6-NDFL here.

- the number of report pages is not limited and depends on the amount of data (taking into account the rows and cells provided by the report);

- for each report indicator - 1 field (except for dates and decimal fractions - the order of their reflection is regulated by paragraphs 1.5, 1.6 of the application);

- in the absence of any total indicators, 0 is entered in the cells intended for them, and dashes are inserted in empty familiar spaces;

- direction of filling cells - from left to right;

- When preparing a paper version of the report, it is not allowed: filling it out with multi-colored ink (only black, purple and blue are allowed), correcting erroneous entries with a correction pencil (or other means), double-sided printing, as well as using a method of fastening that leads to damage to report sheets;

- for a report generated using software, it is allowed to have no borders of familiar spaces and to cross out empty cells, print in Courier New font 16–18 points high, and changing the size of the location and size of the details’ values is not allowed.

Read more about the rules for filling out the calculation here.

Instructions for filling out form 6-NDFL in standard situations

When an employer pays income to an individual, he automatically has the obligation to file 6-NDFL. The amount paid and the number of payments do not matter. How to fill out 6-NDFL for 2021?

To clarify the answer to this question, let’s consider the most common situation - employees receiving salaries.

Are negative values allowed in 6-NDFL? The answer to this question was given by 1st Class Advisor to the State Civil Service of the Russian Federation D. A. Morozov. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

For the 6-NDFL report you will need the following data:

- on wages paid to all employees;

- presence (absence) and amount of tax deductions;

- calendar dates of salary issuance and payment amounts by date for the last 3 months;

- legally established deadlines for transferring personal income tax to the budget.

The main feature of the “salary” filling out of 6-NDFL is the presence of “rolling” payments. We are talking about a situation where the salary was accrued for time worked in the last month of the reporting period, and paid on the calendar dates established by internal regulations for the month relating to the subsequent reporting period.

For example, the salary for June falls into section 1 of the semi-annual 6-NDFL:

- on page 020 - accrued earnings;

- on page 040 - personal income tax calculated from earnings.

The fact that employees receive wages will be reflected in the report for 9 months - you must fill out section 2, indicating in it:

- on page 100 - the day of actual receipt of salary (clause 2 of article 223 of the Tax Code of the Russian Federation);

- on pages 110 and 120 - the date of withholding (clause 4 of Article 226 of the Tax Code of the Russian Federation) and the deadline for payment of personal income tax (clause 6 of Article 226 of the Tax Code of the Russian Federation);

- on pages 130 and 140 - the amount of June earnings paid and personal income tax withheld from it.

For earnings issued in installments, the material “6-NDFL - if the salary was paid for several days” .

See also: “How to correctly reflect early salary in 6-NDFL?”

The second “salary” nuance of 6-NDFL is the reflection of advances in the report. The employer is obliged to pay wages twice a month due to the requirements of labor legislation: an advance is one of such payments, issued before the calculation of wages for the past month and representing a “salary” prepayment. Find out what a sample that takes into account the payment of “salary advances” looks like in 6-NDFL from the next section.

Read about the rules for calculating salary advances in the article “How is an advance calculated?”

You can view a sample of filling out 6-NDFL for 2021 with expert comments in ConsultantPlus by receiving free trial access to the system:

How to submit an explanation to the tax office about the failure to provide 6-NDFL

When filling out explanations about failure to submit 6-NDFL, you must remember that:

- It is better to hand them over to the tax authorities during the period allotted to tax agents for providing 6-NDFL (1 month from the end of the reporting period);

- in the head part of the explanations, it is necessary to indicate the details of the merchant and the Federal Tax Service, to which the corresponding 6-NDFL should have been received;

- explanations are formulated in a laconic form (without excessive detail), but indicating all the necessary nuances;

- The manager or authorized representative must sign the explanations (in this case, attach a copy of the power of attorney to the explanations);

- explanations must be recorded in the outgoing correspondence journal.

The listed conditions are not requirements established by the Tax Code of the Russian Federation for explanations addressed to tax authorities in the event of a merchant’s failure to submit 6-NDFL. However, compliance by a merchant with these rules will allow tax authorities to:

- clearly identify the reasons and motives for non-submission of 6-NDFL;

- avoid the negative consequences of such failure to submit (fine and (or) suspension of account transactions).

And a merchant who provides clearly formulated explanations in a timely manner will avoid sudden blocking of his accounts and hasty issuance of additional explanations to controllers.

For one of the options for explaining to the tax office about failure to submit 6-NDFL, see the article “Filling out an explanation to the tax office regarding 6-NDFL - sample .

“Salary” prepayment: sample in 6-NDFL

When filling out 6-NDFL, it is necessary to take into account all income of individuals subject to personal income tax. A “salary” advance is such income for each employee. However, for the purpose of calculating personal income tax, it has the following distinctive features:

- an advance is a part of “salary” income paid in advance, personal income tax on which is not separately determined, withheld or transferred to the budget;

- the advance in 6-NDFL is not reflected separately, but is included in the total earnings accrued for the entire past month (advance + final payment) - this total amount is reflected in the report;

- the date of reflection of the advance in 6-NDFL is the day of accrual of earnings - according to clause 2 of Art. 223 of the Tax Code of the Russian Federation, it falls on the last day of the month for which salaries are calculated.

See also: “How to correctly reflect an advance in form 6-NDFL (nuances)?”

Let's look at the features of reflecting an advance in 6-NDFL (filling example).

Rustrans LLC employs 38 people: drivers, couriers, dispatchers. The monthly total earnings of all employees of the company is 912,000 rubles, for 12 months - 10,944,000 rubles.

The advance is issued in a fixed amount (each employee 10,000 rubles), and the final payment is made personally in accordance with the time worked and the tariff rate (salary).

The issuance of earned money is carried out within the time limits established by the Regulations on the remuneration of Rustrans LLC:

- advance payment - on the 20th of each month;

- final payment is made on the 5th day of the month following the month worked.

To simplify the example, we will assume that employees of Rustrans LLC do not have rights to deductions and, apart from the advance payment and final payment, did not receive any other income in the current period.

Section 1 of the 6-NDFL declaration will look like this:

- line 010 - “salary” tax rate (13%);

- line 020 - total amount of accrued earnings 10,944,000 rubles. (RUB 912,000 × 12 months);

- line 040 and line 070 - calculated and withheld “salary” personal income tax = 1,422,720 rubles. (RUB 10,944,000 × 13%).

A sample of filling out 6-NDFL for 2021 (section 1) is presented below:

We will explain how to place data in the second section of 6-NDFL (filling procedure) in the next section.

6-NDFL for 2021: sample of filling out the second section

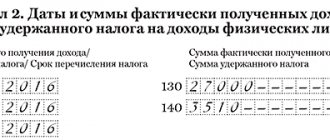

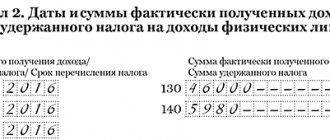

The procedure for filling out the second section of 6-NDFL is regulated by clauses 4.1–4.2 of section IV of the Federal Tax Service order No. ММВ-7-11/ [email protected] :

- blocks pp. 100–140 must be filled out, reflecting the dates and amounts of actual receipt of income and withholding of personal income tax, as well as the timing of its transfer;

- data is provided for the last 3 months of the reporting period;

- blocks of the specified lines are filled out separately for each period of personal income tax transfer (including for income that has the same dates of actual receipt).

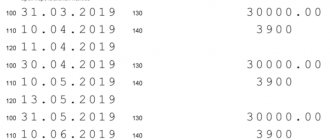

When filling out section 2 of the 6-NDFL declaration in the situation of employees receiving an advance and final payment, the following must be taken into account (example continued):

- 3 blocks are filled in, pp. 100–140, despite the fact that there were 6 payments (including advances);

- on page 100 in 6-NDFL, the dates of actual receipt of “salary” income are indicated (09/30/2020, 10/31/2020 and 11/30/2020);

- on page 110 - dates of tax withholding from final “salary” payments (for example: 10/12/2020, 11/12/2020 and 12/11/2020);

- on page 120 - the deadline allowed by law for the transfer of personal income tax (for wages, this date is the day following the issuance of wages, clause 6 of Article 226 of the Tax Code of the Russian Federation);

- on pp. 130 and 140 - earnings (including advance) and personal income tax calculated from its amount.

A sample of filling out form 6-NDFL (section 2) is presented below:

Section 2 included the June earnings of employees, but did not include the September earnings of employees - this is a feature of the carryover payments, which were discussed in the previous sections. Page 110 is filled out in accordance with the date of issue of the second (final) amount of earnings stipulated by the local act of Rustrans LLC - monthly on the 5th. A separate explanation is required on page 120, which is devoted to the timing of the transfer of personal income tax; this will be discussed in the next section.

* * *

In conclusion, let us remind you that the calculation in form 6-NDFL is signed by the head of the institution or any official authorized to do so by the internal documents of the institution (for example, by order of the head). In particular, the calculation can be signed by the chief accountant, deputy chief accountant, and the accountant responsible for payroll. In addition, Sec. 1, namely lines 010 to 050, must be filled in for each personal income tax rate if the organization paid individuals income taxed at different rates. In this case, these lines include total data on income taxed at a specific personal income tax rate, deductions provided for them and calculated tax. Lines 060 – 090 are general and do not need to be filled out for each personal income tax rate. Section 2 of form 6-NDFL provides indicators only of those incomes on which tax was withheld and transferred to the budget during the last three months of the period for which the calculation is submitted. This means that in this section there is no need to show the amounts of income on an accrual basis from the beginning of the year.

Remuneration in a state (municipal) institution: accounting and taxation, No. 7, 2021

Instructions for filling out line 120 in 6-NDFL

A description of the rules for filling out page 120 is given in clause 4.2 of the Procedure approved by Order of the Federal Tax Service No. ММВ-7-11/ [email protected] The cells of the specified line contain the date no later than which the personal income tax must be transferred.

Here you should not confuse 2 dates - the actual transfer of personal income tax (the day the payment order is received by the bank) and the deadline for transferring the tax. For page 120, the date of the payment does not matter.

To correctly indicate the deadline for tax remittance, you must proceed from the requirements of tax legislation. The period indicated on page 120 depends on the type of income received by the individual.

For example, the deadline for transferring personal income tax (clause 6 of Article 226 of the Tax Code of the Russian Federation):

- from salaries and bonuses - no later than the day following the day of cash issuance (from cash receipts or money received from the bank for “salary” purposes), or the day of transfer to the employee’s card;

- vacation and sick pay - no later than the last day of the month in which they were paid.

An important nuance in filling out page 120 lies in the need to shift the date indicated on it by 1 or several days if the deadline for transferring personal income tax falls on a non-working day (weekend or holiday).

In this situation, the rule established by paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation: the last day of the period for payment of income tax is considered to be the next working day following a weekend or holiday.

In the previously discussed example, the tax payment deadline in July was shifted to 2 weekends. From the “salary” income received on July 5, personal income tax is withheld on the day the income is paid - July 5, but the deadline for transferring the tax is not July 6 (Saturday is a day off), but the first working day after rest - July 8.

Say a word about the dates...

Many questions arise regarding the reflection of the dates of withholding and transfer of personal income tax amounts in the calculation using Form 6-NDFL. For convenience, all situations for which there are instructions in regulatory legal acts or explanations from regulatory authorities are summarized in table. 3.

Table 3. Dates of receipt of income, withholding and transfer of personal income tax

| Payment name | Date the employee received income (page 100) | Date for withholding personal income tax (page 110) | Date for transfer of personal income tax (page 120) |

| Advance payment for the first half of the month | On the last day of the month for which the salary was accrued (paragraph 1, paragraph 2, article 223 of the Tax Code of the Russian Federation) | On the day the salary is paid for the second half of the month, if the organization paid the advance not on the last day of the month (letters from the Ministry of Finance of Russia dated 10.27.15 No. 03-04-07/61550 and dated 07.22.15 No. 03-04-06/42063, Federal Tax Service of Russia dated 03/24/16 No. BS-4-11/4999 and dated 01/15/16 No. BS-4-11/320). On the day of payment of the salary advance, if the organization paid the advance on the last day of the month (Decision of the Supreme Court dated 05.11.16 No. 309-KG16-1804) | No later than the next day after payment of the advance, if the company issued it on the last day of the month (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation). No later than the next day after payment of wages for the second half of the month, if the organization issued an advance before the end of the month (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation) |

| Final monthly salary payment | On the last day of the month for which the salary was accrued (paragraph 1, paragraph 2, article 223 of the Tax Code of the Russian Federation) | On the day of payment of salaries for the second half of the month from the cash register or transfer to a bank card (letters from the Federal Tax Service of Russia dated 03/15/16 No. BS-4-11/ [email protected] , dated 02/26/16 No. BS-3-11/ [email protected] , dated 02/12/16 No. BS-3-11/ [email protected] ) | No later than the next day after payment of wages for the second half of the month (paragraph 1, paragraph 6, article 226 of the Tax Code of the Russian Federation) |

| Vacation pay | On the day of receipt of vacation pay (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation, articles 106, 107 of the Labor Code of the Russian Federation, letter of the Federal Tax Service of Russia dated 05.24.16 No. BS-4-11/9248, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02.07.12 No. 11709/11) | On the day of payment of vacation pay from the cash register or transfer to a bank card (letter of the Federal Tax Service of Russia dated May 11, 2016 No. BS-4-11/8312) | No later than on the last day of the month in which the company paid vacation pay (paragraph 2, paragraph 6, article 226 of the Tax Code of the Russian Federation) |

| Disability benefits | On the day of receiving benefits (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation, article 183 of the Labor Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 10, 2015 No. 03-04-06/20406) | On the day of payment of benefits from the cash register or transfer to a bank card | No later than on the last day of the month in which the company paid the benefit (paragraph 2, paragraph 6, article 226 of the Tax Code of the Russian Federation) |

| One-time bonus paid separately from salary | On the day of receiving a one-time bonus (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 03/27/15 No. 03-04-07/17028, Federal Tax Service of Russia dated 04/07/15 No. BS-4-11/ [email protected ] ) | On the day of payment of a one-time bonus from the cash register or transfer to a bank card | No later than the next day after payment of the one-time bonus (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation) |

| Regular bonus paid along with salary | On the last day of the month for which the salary was accrued (paragraph 1, paragraph 2, article 223 of the Tax Code of the Russian Federation) | On the day of payment of salaries for the second half of the month from the cash register or transfer to a bank card | No later than the next day after payment of wages for the second half of the month (paragraph 1, paragraph 6, article 226 of the Tax Code of the Russian Federation) |

| Advance payment for an employee who quit before the end of the month | On the last day of work (paragraph 2, paragraph 2, article 223 of the Tax Code of the Russian Federation) | On the day of the final settlement with the resigned employee for this month from the cash register or by transfer to a bank card | No later than the next day after settlement with the resigned employee (paragraph 1, paragraph 6, article 226 of the Tax Code of the Russian Federation) |

| Remaining salary for an employee who quit before the end of the month | On the last day of work (paragraph 2, paragraph 2, article 223 of the Tax Code of the Russian Federation) | On the day the balance of salary is issued from the cash register or transferred to a bank card (letter of the Ministry of Finance of Russia dated February 21, 2013 No. 03-04-06/4831) | No later than the next day after settlement with the resigned employee (paragraph 1, paragraph 6, article 226 of the Tax Code of the Russian Federation) |

| Compensation for unused vacation upon dismissal | On the day of receipt of compensation (subclause 1, clause 1 of Article 223 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated May 22, 2015 No. 03-04-05/29453, dated May 15, 2013 No. 03-04-05/16928) | On the day of payment of compensation from the cash register or transfer to a bank card | No later than the next day after payment of compensation (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated May 11, 2016 No. BS-3-11 / [email protected] ) |

| Daily allowance over 700 rub. per day for business trips within the Russian Federation or over 2500 rubles. per day for foreign business trips | On the last day of the month in which the head of the organization approved the advance report for the business trip (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 21, 2016 No. 03-04-06/2002). Daily allowances paid in foreign currency are converted into rubles at the Bank of Russia exchange rate on the date of approval of the advance report (letter of the Ministry of Finance of Russia dated March 27, 2015 No. 03-04-07/17023, Federal Tax Service of Russia dated April 7, 2015 No. BS-4-11/5737 ) | On the day of the next payment of income to the employee (for example, when paying wages for the past month) | No later than the next day after the payment to the employee of the amount from which the organization withheld personal income tax from daily allowances (clause 4 and paragraph 1 of clause 6 of Article 226 of the Tax Code of the Russian Federation) |

| Material benefits from saving on interest on a preferential loan | On the last day of each month during which the employee used borrowed funds on preferential terms (subclause 1, clause 1, article 212 and subclause 7, clause 1, article 223 of the Tax Code of the Russian Federation). In the month of loan repayment, he does not have taxable income (letters of the Ministry of Finance of Russia dated 04/11/2016 No. 03-04-06/20463, dated 03/18/2016 No. 03-04-07/15279) | The lending organization withholds personal income tax from any upcoming payment to the borrower. Deductions should not exceed 50% of the payment amount (paragraph 2, paragraph 4, article 226 of the Tax Code of the Russian Federation). If a company does not pay the borrower money, it is obliged to inform him and the inspectorate that it was unable to withhold personal income tax. The deadline for sending this message is no later than March 1 of the next year (clause 5 of Article 226 of the Tax Code of the Russian Federation) | No later than the next day after payment to the borrower of the amount from which the organization withheld personal income tax on material benefits (clause 4 and paragraph 1 of clause 6 of Article 226 of the Tax Code of the Russian Federation) |

| Income in kind | The day of transfer of income in kind (subclause 2, clause 1, article 223 of the Tax Code). If wages are paid in kind, the date of actual receipt of such income is the last day of the month for which the income was accrued | Withholding of personal income tax calculated from income received in kind is made at the expense of any funds paid to the employee (clause 4 of article 226 of the Tax Code of the Russian Federation) | Personal income tax is transferred no later than the day following the day of actual tax withholding (clause 6 of Article 226 of the Tax Code of the Russian Federation) |

| Advance payment, final payment or reimbursement of expenses under a civil contract with an individual who does not have the status of an individual entrepreneur | On the day an individual receives the remaining part of the remuneration under a civil contract (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated August 28, 2014 No. 03-04-06/43135, dated May 26, 2014 No. 03-04- 06/24982, dated 08/05/2015 No. 03-04-06/45204, dated 01/23/2015 No. 03-04-05/1733 | On the day of payment of an advance, remuneration or reimbursement of expenses from the cash register or transfer to a bank card | No later than the next day after payment of remuneration to an individual (paragraph 1, paragraph 6, article 226 of the Tax Code of the Russian Federation) |

Important!

When the last day of the period falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the end of the period is considered to be the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). Therefore, if the deadline for transferring personal income tax falls on a non-working day, line 120 of the 6-personal income tax calculation is filled out taking into account the transfer rules (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-4-11 / [email protected] ), and the date of actual receipt of income is not is postponed (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-3-11 / 2169).

Non-standard situations in 6-NDFL: how to fill out correctly?

Filling out form 6-NDFL in non-standard situations raises many questions among specialists whose responsibilities include personal income tax reporting.

If you have access to K+, check whether you correctly reflect financial assistance in 6-NDFL. If you don't have access, get a free trial access and go to the Ready Solution.

Let's consider certain types of non-standard situations.

Maternity benefit in 6-NDFL

Payment of maternity leave in some companies is a relatively rare event. At the same time, some employers seek to support expectant mothers and compensate them for the loss of earnings when they go on maternity leave.

When reflecting such payments in 6-NDFL, the following must be taken into account:

- maternity benefit (maternity benefits) is the employee’s income that is not subject to personal income tax and is not reflected in the 6-NDFL report;

- Additional payment to a maternity leaver before her actual earnings is not considered a benefit and is subject to personal income tax in the full amount (if the amount paid exceeded the amount of maternity benefit paid by social insurance), which requires reflection in 6-personal income tax.

Line by line filling out 6-NDFL (letter of the Federal Tax Service of Russia dated 08/01/2016 No. BS-4-11/ [email protected] ):

- date of receipt of income (p. 100) - the day the maternity worker receives the additional payment;

- date of personal income tax withholding (page 110) - coincides with the above;

- The tax payment deadline (page 120) is the next day after the additional payment is issued.

Read more about maternity leave in 6-NDFL here.

Advances under the GPC agreement

Hiring individuals to perform work (provide services) is often practiced by employers if the work performed is one-time in nature or there are no specialists with the required qualifications on staff.

In such situations, a civil law agreement (CLA) is concluded between the customer and the contractor, one of the conditions of which may be an agreement on the payment of advances during the execution of work.

An advance under a GPC agreement is fundamentally different from a “salary advance”; each advance payment to the contractor is equated to the payment of income that requires reflection in 6-NDFL (letter of the Ministry of Finance of Russia dated July 21, 2017 No. 03-04-06/46733, dated May 26, 2014 No. 03-04 -06/24982).

For example, if during the quarter 3 advances were paid to the contractor and the final payment was made, all these 4 events must be reflected in 6-NDFL in separate blocks on pages 100–140 for each date the money was received by the contractor.

We described in this article how to correctly reflect a contract in 6-NDFL.

Gift for a pensioner

Often employers do not ignore former employees - they give pensioners gifts and provide other financial assistance. Such an obligation is usually enshrined in a collective agreement or other internal act. For 6-NDFL this means the following:

- the cost of the gift is reflected in the report on line 020;

- when calculating personal income tax, a deduction is applied (no more than 4,000 rubles per tax period) - it must be indicated on page 030;

- calculated tax (p. 040) is calculated from the difference between the value of the gift and the tax deduction using a rate of 13%;

- in section 2 of 6-NDFL, “gift” income is detailed: on pages 100 and 130 it is necessary to show the date and amount of income, and pages 110, 120 and 140 are filled in with zeros (if cash income was not given to the pensioner and it is not possible to withhold personal income tax).

At the end of the calendar year, amounts of income tax not withheld by the tax agent are subject to reflection on page 080 of the 6-NDFL report.

To learn how the generated report is checked, read the material “How to check 6-NDFL for errors?”

Where to submit the calculation

Calculation of personal income tax amounts as a general rule is submitted by tax agents to the inspectorate at the place of their registration (clause 2 of Article 230 of the Tax Code of the Russian Federation). Features of the presentation of the calculation in form 6-NDFL are given in table. 2.

Table 2. Where to submit the calculation using Form 6-NDFL

| Categories of tax agents | Income for which calculation is submitted in Form 6-NDFL | Tax authority to which the calculation is submitted in Form 6-NDFL |

| Russian organizations with separate divisions | Income received by employees of separate divisions of the organization, as well as individuals under civil contracts concluded with separate divisions | Tax authorities at the location of such separate divisions (separately for each separate division, even if they are registered with the same tax authority - letter of the Federal Tax Service of Russia dated December 28, 2015 No. BS-4-11 / [email protected] ). |

| Organizations classified as the largest taxpayers | Income received by individuals (including income received by employees of separate divisions of these organizations, as well as individuals under civil contracts with separate divisions) | To choose from (letter of the Federal Tax Service of Russia dated February 25, 2016 No. BS-4-11/[email protected]): — either at the place of registration as the largest taxpayer; - or at the place of registration of the organization for the corresponding separate division (separately for each separate division). There is no need to send payments to two named addresses at the same time (letter of the Ministry of Finance of Russia dated September 2, 2015 No. 03-04-06/50652). Personal income tax calculated and withheld from the income of an employee of a separate division must be paid at the place of registration of the organization; at the location of the separate division (letter of the Ministry of Finance of Russia dated 01.02.2016 No. BS-4-11 / [email protected] ) |

| Individual entrepreneurs registered with the tax authority at the place of activity in connection with the use of UTII and (or) the patent taxation system | Income received by employees | Inspection at the place of registration of an individual entrepreneur in connection with the implementation of such activities |

If an organization has changed its location and, accordingly, OKTMO during the period, tax agents, as a rule, submit several reports with different OKTMO, splitting payments between reports in accordance with tax transfers made to the budget. The fact is that the Federal Tax Service's software cannot correctly separate data into different OKTMOs, and inspectors are not always ready to break down the report manually. In addition, this rule is enshrined in clause 1.10 of the Procedure for filling out and submitting the calculation of the amounts of personal income tax calculated and withheld by the tax agent in Form 6-NDFL (hereinafter referred to as the Procedure for filling out Form 6-NDFL), approved. by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

For a closed separate division, the 6-NDFL calculation is submitted at the place of registration of the organization's head office, although inspectors recommend submitting the calculation before the division is closed (letter of the Federal Tax Service of Russia dated March 2, 2016 No. BS-4-11/3460).

Let us also note that an organization that has separate divisions, when filling out the calculation on form 6-NDFL, in the “KPP” field, puts down the checkpoint at the place of registration of the organization at the location of its separate division (clause 2.2 of the Procedure for filling out form 6-NDFL). If an incorrect checkpoint was indicated, an updated calculation is submitted indicating the corresponding adjustment number. Such clarifications were given by the Federal Tax Service of Russia in a letter dated March 23, 2016 No. BS-4-11/ [email protected]

Results

For all cases of reporting income and income tax in 6-NDFL, the instructions are the same - it was approved by order of the Federal Tax Service. And unusual and complex issues of registration of 6-NDFL are explained by tax specialists and officials in separate letters.

Our materials will tell you about how various payments are reflected in 6-NDFL:

- “How to correctly reflect vacation pay in form 6-NDFL?”;

- “Form 6-NDFL - compensation for unused vacation”;

- “How is material benefit reflected in Form 6-NDFL?” and etc.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.