Today, the list of details that must be indicated on the check is stipulated by law. At first, the government stipulated 7 mandatory points, later their number increased to 24.

Also, from the beginning of January 2021, the old version of the fiscal data format has lost its legal force, and its use has become unacceptable. Now you will need to use equipment with the 1.05 or 1.1 format. Such devices include a larger amount of information, so often cashiers and entrepreneurs cannot figure out how the operation should be carried out. This article will help you learn more about the new details in check documentation.

Calculation method in a cash receipt: what is it, when is it used

The “payment method attribute” attribute indicates which payment scheme was used when concluding the transaction. The list of its values was published in the Order of the Federal Tax Service No. ММВ-7-20/ [email protected] Subsequently, the document was changed by Order No. ММВ-7-20/ [email protected] After the update, the list looks like this:

Let's look at a few examples of how to correctly set the payment method attribute in a cash receipt.

- Setting up an online cash register

2 reviews

1 000 ₽

1000

https://online-kassa.ru/kupit/nastrojka-onlajn-kassy/

OrderMore detailsIn stock

- Technical support

1 review

6 000 ₽

6000

https://online-kassa.ru/kupit/tehnicheskoe-soprovozhdenie/

OrderMore detailsIn stock

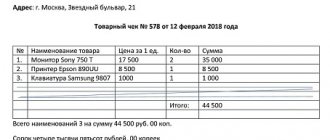

Sales with prepayment

The buyer purchases furniture and transfers the entire amount in advance (before delivery). The check is issued twice:

- When an advance payment is received – “Advance payment 100%”.

- Upon delivery of the goods to the customer - “Full payment”.

Sale with prepayment in installments

The client purchases furniture and pays part of its cost immediately, and part - after the furniture has been delivered to his home. The receipt is printed twice:

- When paying part of the cost - “Advance payment” for the amount paid.

- When the cabinet is handed over to the buyer - “Full payment” for the amount of the additional payment.

If an advance is made

If an advance is made against future purchases, and it is unknown which goods and in what volume will subsequently be ordered, then we use the “Advance” payment attribute in the cash register receipt. For example, when it comes to gift cards.

Let's say a customer buys a gift certificate. After some time, another client uses this certificate when purchasing goods - he pays part of the amount in cash, and the rest - from the certificate. We punch it twice:

- When selling a card - “Advance”.

- When registering sales – “Full payment”.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Installment plan without down payment

An individual entrepreneur buys office equipment with deferred payment. The money is transferred 2 weeks after delivery. We format it as follows:

- When goods are transferred – “Transfer on credit”.

- When all funds have been received – “Loan payment”.

Installments and down payment

If the buyer contributes the money partially, and intends to repay the debt over several months, making monthly payments, then it will be like this:

- When the goods are transferred to the client - o.

- Every month, each time you pay a share of the debt, “Loan payment” is indicated.

For cash registers working with FFD 1.1 and 1.05, the “Settlement method attribute” in the cash receipt is required.

You may be interested in: How an advance payment is formed at online cash registers

Select the name of the service

Here you need to adhere to three principles.

- A unique service must have a unique name. The customer must be able to distinguish one from the other.

- The length of the service name should not exceed 128 characters.

- If at the time of payment you are sure of the number of services you will provide to the client, the name of the specific services should be reflected in the check. And if necessary, their quantity and cost of each.

Example: You provide car repair services. A client comes to you with a request to change the engine oil. Having specified all the details, indicate the services in the check:

- Removing and installing crankcase protection

- Changing the engine oil

- Replacing the oil filter

Another example: A client goes to a cosmetology center to see a specific specialist. At the time of payment, you can indicate “visit to a cosmetologist” and his name on the receipt.

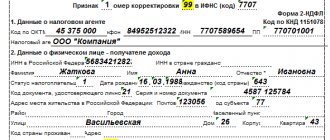

Correction check – which calculation feature to choose?

Such a check is generated if a payment was previously made without a cash register or in violation of the law. The cashier or the owner of the cash register can himself detect and eliminate the error by making a correction, or do this according to an order received from the Federal Tax Service.

On cash register systems with different FFDs, the correction checks are different - different calculation signs are indicated (an explanation is given in the letter of the Federal Tax Service No. ED-4-20 / [email protected] ).

If cash register was not used when making payments:

- For FFD 1.05 – when receiving funds, set “Income”, when paying out – “Expense”.

- For FFD 1.1 - “Receipt” and “Expense” we indicate similarly to FFD 1.05, if a purchase is being returned - we indicate “Return of Income”, if the client returned the funds issued to him earlier - “Return of Expense”. If there is an error in the check (for example, VAT is entered incorrectly), the same for FFD 1.05 and FDF 1.1: create a “Receipt Return” check, identical to the incorrect one, and generate a “Receipt” check.

It is not necessary to correct the error on the device where it was made, or which has not been used before. The legislation of the Russian Federation does not oblige this. An organization or individual entrepreneur can generate a correction document on any cash register they own, if it is registered and operates in compliance with all standards.

Modes of use of CCP

When registering cash register equipment with the tax authority, you must indicate how it will be used. For this purpose, a number of additional details are used, which includes, among other things, such details as a sign of the applied taxation system; cash register sign for payments only on the Internet; sign of a lottery, etc.

The new cash register equipment can be used in several modes (clause 2 of Appendix No. 2 to the Order). They are used to describe the format of fiscal data:

- offline mode - a cash register operating mode that does not provide for the transfer of FD to the tax authorities in electronic form through a fiscal data operator (FDO). This mode is possible if the CCP is used in an area remote from communication networks (Clause 7, Article 2 of Law No. 54-FZ);

- data transfer mode - the cash register operating mode, which provides for the mandatory transfer of FD to the tax authorities in electronic form through the OFD;

- automatic mode - the mode of using a cash register as part of an automatic device for settlements when making settlements with a buyer (client) in an automatic mode using a cash register without the participation of an authorized person of the organization or an individual entrepreneur (cashier).

Indicator of the subject of payment in a cash receipt: what does it mean?

This designation appeared starting with FFD 1.05. Used to indicate goods, payments, etc.

Main categories:

- Goods (on which excise duty is not charged) – “GOOD” or “T”.

- Goods that are subject to excise taxation are “EXCISABLE GOODS” or “AT”.

- Payment/payment (bonuses, advance, fines, various types of remuneration, deposit, etc.) – “PAYMENT” or “P”, “PAYMENT” or “B”.

- or "U".

- Work – “JOB” or “R”.

A complete list of characteristics of the subject of payment in a cash receipt is given in Order No. ММВ-7-20/ [email protected]

You may be interested in: Sample of an online cash register receipt - what it looks like, requirements and details

If prepayment or advance payment is made

In this case, you will have to generate two checks.

The first check is printed at the time of transfer of money and is generated with the payment attribute “advance”. The amount transferred by the client is indicated.

After the transfer of goods or full provision of services, a second check with the payment attribute “full payment”. It must indicate all lists of goods or services, quantities and prices per unit. When accepting client funds, it is necessary to indicate that part of the funds was previously accepted from the client with the advance amount included in the check. Also, if necessary, indicate how much the client paid you extra.

Fiscal sign of a cash receipt (document): how it is formed, what to do in case of an error

It is briefly designated FPD and is a digital code that defines the characteristics of the calculation performed when sending OFD data and to the tax office.

Generated by the fiscal drive based on the following information specified during registration:

- User's TIN;

- TIN OFD with which the agreement was concluded;

- cash register numbers – registration and factory;

- registration dates indicating the exact time;

- serial number of the check.

If the tax service has refused registration because the fiscal attribute of the cash receipt is incorrect, check whether the above items match the registration report and the receipt itself.

Registration may also be denied if the individual entrepreneur or organization has not completed the registration procedures within 24 hours of receiving the registration number.

Common mistakes made during registration:

- The time and date settings at the checkout are incorrect (for example, 2000).

- On the diagnostic receipt, the serial number of the device differs from the number that was indicated in the registration application.

- Inaccuracies in the registration number, user INN and OFD INN.

What to do:

Be careful when entering all data. It is impossible to correct them once they have already been added to, and the fiscal drive will have to be changed. It is impossible to close it in normal mode - you need to perform an emergency closing.

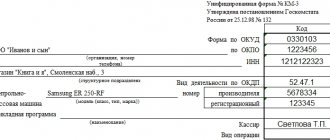

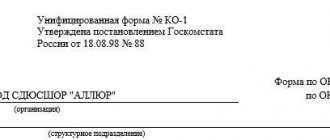

Fiscal document formats

A fiscal document is fiscal data presented in established formats on paper and (or) in electronic form (Article 1.1 of Law No. 54-FZ) - information that the tax authority receives from the taxpayer.

The order approves three versions of fiscal document formats (FFD) - 1.0, 1.05 and 1.1 (Table 3). According to paragraph 2 of the Order, format 1.0 becomes invalid as of 01/01/2019.

Table 4 of Appendix No. 2 to the Order provides a general list of details of fiscal documents, more than 100 items. Basic details are established by Law No. 54-FZ, additional details are established by the Order.

The order provides for 11 fiscal documents (Table 6). Each fiscal document has its own set of details:

- Registration report (Table 7).

- Report on changes in registration parameters (Table 7, 8).

- Report on the opening of the shift (Table 17).

- Report on the current state of calculations (Table 18).

- Cash receipt (Table 19).

- Correction cash receipt (Table 30).

- Strict reporting form (SRF) (Table 19).

- Correction strict reporting form (Table 30).

- Shift closing report (Table 32).

- Report on closing the fiscal accumulator (Table 33).

- Operator confirmation (Table 34).

As you can see, the cash register receipt and BSO, as well as the correction cash receipt and the correction strict reporting form have the same composition of details (see Tables 19 and 30).

Some fiscal documents can be generated both in printed form and electronically. In this case, the composition of the FD details may vary (see, for example, Table 5 of the Order). The need to indicate one or another detail in documents depends on the version of the fiscal document format (clause 3 of Appendix No. 1 to the Order).

The letter M on receipts for marked products and display of the brand code

When selling labeled products and strong alcohol, the printed form of the KKM receipt must contain a special symbol [m], and the electronic form must display the code of the brand or excise stamp.

Currently, labeled products include tobacco, footwear, medicines and tires.

When selling tobacco products at the checkout, it is necessary to scan excise stamps from bottles of strong alcohol, as well as stamp codes from labeled products.

If, when selling these categories of goods, the cash register does not request to read the brand code, then you need to check and set the “Marked Products” and “Product Group” flags in the merchandise accounting program and load this item onto the cash register.

To quickly fill out details in a new item, it is recommended to use the “Filling in Details” mechanism. To do this, a rule is assigned to a group of goods in advance and when creating a new item, the details are set automatically.

Who is required to use the online cash register?

From January 1, 2019, even more organizations and individual entrepreneurs have a need to use online cash registers.

In addition, the number of situations where check generation is mandatory has increased. Thus, the overwhelming number of businesses working with individuals are currently required to use online cash registers in accordance with the law. The use of online cash registers is regulated by the law “On the use of cash register equipment when making payments in the Russian Federation” dated May 22, 2003 No. 54-FZ.

The following are exempt from this obligation:

- Individual entrepreneurs without employees providing services, performing work or producing products (Article 2 of Law No. 129-FZ dated 06.06.2019);

- entrepreneurs with a patent for certain types of activities, subject to the issuance of a document confirming the calculation (clause 2.1 of Article 2 of Law No. 54-FZ);

- Individual entrepreneurs and legal entities for certain types of activities (clause 2 of Article 2 of Law No. 54-FZ contains a closed list of such);

- Individual entrepreneurs and organizations located in remote and hard-to-reach places, subject to the issuance of a document confirming the calculations (clause 3 of article 2 of law No. 54-FZ).

The rest must use the online cash register when making payments.

Art. 1.1 of Law No. 54-FZ: “Settlements - acceptance (receipt) and payment of funds in cash and (or) by bank transfer for goods, work, services, acceptance of bets, interactive bets and payment of funds in the form of winnings when carrying out activities on organizing and conducting gambling, as well as accepting funds when selling lottery tickets, electronic lottery tickets, accepting lottery bets and paying out funds in the form of winnings when carrying out activities related to organizing and conducting lotteries. For the purposes of this federal law, settlements also mean the acceptance (receipt) and payment of funds in the form of advance payment and (or) advances, offset and return of advance payment and (or) advances, provision and repayment of loans to pay for goods, works, services ( including pawnshops lending to citizens on the security of things belonging to citizens and activities for storing things) or providing or receiving other consideration for goods, work, services.”

Based on the above definition, it is sometimes necessary to use an online cash register not only when paying in cash. Let's return to this statement later.

Thanks to the mentioned law, a cash receipt has become a complex document that contains a lot of details. In the article we will dwell in detail on such details as the attribute of the calculation method and the attribute of the subject of calculation.

Parameter product code and new requirement regarding this detail

This attribute (Tag 1162) was introduced on December 1, 2018, instead of the old attribute “Product nomenclature code”.

In the process of introducing the “Honest Sign” marking system, this requisite began to be used to transmit data on disposal. The basis for this was Resolution No. 174 dated February 21, 2019.

In addition, on April 28, 2020, a requirement appeared on the receipt to indicate the “product code” details in relation to some personal protective equipment (protective mask, respirators, gloves), the marking of which is not mandatory.

for which it is necessary to indicate the “Product Code” detail in the receipt.

Application “Checking a check from the Federal Tax Service of Russia” and its new functionality. Why is it important?

Not so long ago, many information sources were full of headlines about the next update of the application “Checking the receipt of the Federal Tax Service of Russia.” The regulator uses bonuses to motivate people to report violations, and now app users can:

- scan, check receipts. The application will show whether the check format is correct and determine its authenticity;

- for completed checks you can receive rewards in the form of bonus points;

- fill out and send to the Federal Tax Service a statement of violation;

- when logging in using the credentials of the State Services resource or Personal Account FL, you can make a detailed request;

- receive reports from the Federal Tax Service if an inspection has been ordered based on the application;

- take part in an inspection of violations of the use of cash register systems as a witness.

The application is available on two main platforms: iOS and Android.

Obviously, the easier it is to report a violation, the more often it will be done.