Receipt cash order (PKO) in 2021

PKO refers to primary accounting documents and reflects the fact of receipt of money at the cash desk.

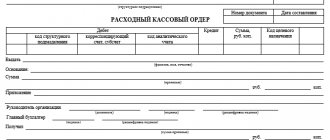

The format and requirements for filling out a cash receipt order are regulated by the Decree of the State Statistics Committee of the Russian Federation “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results” dated August 18, 1998 No. 88. Form KO-1, which remained unchanged for 2021, can be downloaded on our website using the link below.

For information on the document that is used to document expense transactions at the cash register, read the article “Unified form No. KO-2 - cash expense order .

The procedure for registering cash transactions was explained by ConsultantPlus experts. If you don't already have access to the system, get a free trial online.

What property can be contributed to the authorized capital of an LLC?

The most liquid asset is money, so payment of the authorized capital of an LLC most often occurs in cash. Moreover, the minimum amount of the authorized capital cannot be contributed by anything other than money. Although not so long ago, until 2014, the first asset of an LLC could be contributed by inexpensive office property (usually a table, chairs, office equipment).

But now the method of contributing the minimum amount of authorized capital is fixed in Article 66.2 of the Civil Code of the Russian Federation: “When paying for the authorized capital of a business company, funds must be contributed in an amount not lower than the minimum amount of authorized capital.”

In addition to the minimum amount, payment of the authorized capital of an LLC can be made with any amount of money or property. This could be real estate, equipment, transport, intangible assets, shares and shares in other companies, government and municipal bonds.

The founders may establish a ban on the contribution of certain property, for example, non-core equipment, as payment for shares of the management company. The general meeting of participants must approve the amount of the property contribution. And if the value of the property exceeds 20,000 rubles, then an independent expert must be hired to evaluate it.

How to fill out a cash receipt order

The current form of the cash receipt order is mandatory, and only it should be used in cash transactions.

Responsibility for failure to comply with the form of the primary document is disclosed in the material “Primary document: requirements for the form and the consequences of its violation .

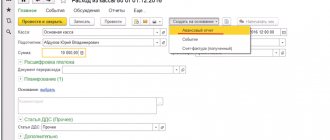

However, the format for filling out a cash receipt order in accordance with Goskomstat Resolution No. 88 can be determined independently: both a hand-filled form and other options are used. Currently, all accounting programs are equipped with the option of filling out such documents; a similar service is also available on specialized websites.

Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U provides for the possibility of registering a PKO:

- On paper - either completely by hand, or the accountant enters information into the KO-1 form on a computer, then prints out the document and signs it with authorized persons of the organization.

- In electronic form - using technical means, taking into account the protection of the software from unauthorized access. In this case, the electronic receipt is signed with an electronic signature (clause 4.7 of instruction No. 3210-U).

conclusions

Let us repeat once again the most important points regarding the contribution of the authorized capital of an LLC:

- The minimum size of the capital of a limited liability company is 10,000 rubles. The exception is some types of activities for which much larger amounts must be deposited.

- Each LLC participant must contribute their share of the authorized capital. The contribution can be in monetary or property form, but the minimum amount of the management company is made only in money. If the value of the property contribution exceeds 20,000 rubles, it must be assessed by an independent expert.

- The deadline for entering the capital is four months after the registration of the company, unless the founders themselves set an earlier deadline. The share of a participant who does not pay his share on time passes to the company.

- Payment for a share of the authorized capital can be made in cash or by transfer to the company's current account. The property contribution is transferred under an acceptance certificate and, if necessary, accompanied by documents on state registration of the transfer of ownership to the LLC.

How to correctly register a cash receipt order (example)

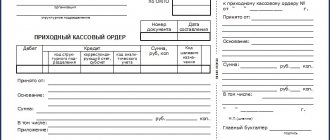

First, you need to pay attention that the cash receipt order has a 2-component form, since it contains the PKO itself and the receipt. They are drawn up in a general copy of the PKO signed by the chief accountant (accountant, cashier and director) and stored in the accounting department. The receipt is signed in the same way, then registered in the cash book and handed over to the person from whom the cash was received.

Electronic PKOs are signed with electronic signatures, and the accountant can send the receipt to the depositor by email (clause 5.1 of instruction No. 3210-U).

The cashier checks whether there are signatures of authorized persons on the PKO; signatures are checked against samples only if the document is drawn up on paper.

Find out how to create a card with sample signatures for a cashier in ConsultantPlus. Get trial access to the system and upgrade to the Ready Solution for free.

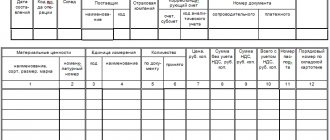

The rules for filling out a cash receipt order are as follows:

- In the “Organization” field, fill in the name of the company or individual entrepreneur.

- “Document number” and “Date of compilation” - number and date, respectively, according to the registration log.

- “Debit - credit” - postings in accordance with the business transaction.

- “Accepted from” - indicate the name of the person from whom the money was received (from the accountant, customer, bank, founder, etc.).

- “Foundation” is the name of the business operation on the basis of which the money was received.

- “Amount” - the amount received is indicated in words.

- “Including” – the amount of VAT (if any).

- “Appendix” - we indicate the documents on the basis of which the money was received: advance report, agreement, etc.

The receipt for the PKO is drawn up by analogy with the cash receipt order.

Read more about the receipt for the PKO in the article “Receipt for the cash receipt order - form, sample” .

Since August 19, 2017, significant changes have occurred in the procedure for conducting cash transactions (directive of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U). Regarding PKO, the main innovation is the following: the cashier can draw up a general CO-1 at the end of the day for the entire amount at the cash desk, which is confirmed by fiscal documents (cash receipts and BSO online cash register).

Punishment of an enterprise for violating the procedure for conducting cash transactions

Enterprises that keep records in violation may receive an administrative fine under Art. 15.1 Code of Administrative Offences. If violations are detected, the control bodies draw up a protocol (Article 28.2 of the Administrative Code), a copy of which is provided to the official or legal representative of the organization. The protocol is provided to the violator for review and signature. Explanations on the issue are attached to the protocol.

| Form of violation | Article | Sanction amount |

| Conducting settlements between companies in excess of the stipulated limit, in case of incomplete receipt of cash | clause 1 art. 15.1 Code of Administrative Offenses | For officials - from 4 to 5 thousand rubles, for a legal entity - from 40 to 50 thousand rubles |

| Violation by payment agents of the procedure for timely posting of funds | clause 2 art. 15.1 Code of Administrative Offenses | For individuals - from 4 to 5 thousand rubles, for organizations - from 40 to 50 thousand rubles |

Enterprises with branches must observe cash discipline in each individual branch. For each violation discovered during an inspection in branches, separate protocols are drawn up (Article 4.4 of the Administrative Code).

An example of the application of sanctions. The organization has several branches with cash register machines for conducting payments. According to internal regulations, cash after the end of the shift is handed over to the head office cash desk. When checking compliance with discipline, incomplete recording of revenue was discovered in all branches. A separate protocol has been drawn up for each violation.

Sample of filling out the PQR when receiving money from a counterparty

Cash payments can also be made between counterparties if there is an appropriate agreement. In this case, a cash receipt order is also applied.

NOTE! Do not forget about the restrictions on cash payments between legal entities - this year it is 100,000 rubles. within the framework of one contract.

If the receipt of money is associated with the receipt of revenue, then simultaneously with the issuance of the PKO, it is necessary to use a cash register and issue a cash receipt. The exception is persons exempt from the use of CCP.

To learn about what changes have occurred in working with cash in connection with amendments to the law on cash registers, read the material “How to keep track of money when using an online cash register?”

Filling out the fields is as follows:

- Postings in PKO - Dt 50 - Kt 62, 76.

- The name of the counterparty organization will be indicated in the “Accepted from” field.

- “Base”—the contract number should be indicated.

- “Including” - you need to enter the VAT amount.

- The annex will be the contract.

The data in the receipt for the PKO will be similar.

Give the receipt to the counterparty. Attach to it a cash receipt or BSO, printed using an online cash register.

IMPORTANT! A receipt for a receipt order cannot replace the BSO issued to individual clients.

How much money should be contributed to the authorized capital of the LLC?

There is often no connection between the actual volume of required investments and the size of the company's authorized capital. You can still find large construction projects that are being built by companies with minimal authorized capital. In this case, the amount needed for the business is raised from third-party investors or through a bank loan. Sometimes an organization receives an interest-free loan from its founder, i.e. He just uses the owner’s money for a period of time. Such raised funds do not constitute authorized capital.

However, the law determines that each founder must contribute his share in the authorized capital. What this amount will be depends on the scope of the company's activities. In general, the authorized capital of an LLC for all founders must be at least 10,000 rubles.

But for insurers, alcohol producers, banks, gambling organizers, employment agencies providing personnel, and some other areas, the minimum Criminal Code is much higher. For example, to create a private security organization you need to contribute at least 250,000 rubles. And to produce ethyl alcohol it will take 10 million rubles.

As for the upper limit, i.e. the maximum size of the authorized capital, it is not established by law. But the founders need to know that when receiving dividends from their share in the management company, they will have to pay a tax at a rate of 13% (depending on the status of a tax resident of the Russian Federation).

Free tax consultation

Results

A cash receipt order should be issued for each cash payment. Filling out the PQS was discussed in detail in the article, which will allow you to avoid problems when completing it.

You can find the latest changes in the procedure for conducting cash transactions in the article “Procedure for conducting cash transactions in 2021 - 2021.”

Sources:

- Resolution of the State Statistics Committee of the Russian Federation “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results” dated August 18, 1998 No. 88

- Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for contribution of authorized capital

The deadlines for contributing the authorized capital are established by Article 16 of the Law “On LLC” - no more than four months from the date of registration of the company. However, an earlier date may be specified in the agreement on establishment or in the decision of the sole founder.

There is no special administrative sanction for violating the deadline for contributing the authorized capital of an LLC upon creation. But when this period exceeds a year, the organization may be forcibly liquidated at the initiative of the Federal Tax Service.

If only some of the founders have not contributed their share to the authorized capital, then their unpaid shares pass to the company. It is also possible to provide in the establishment agreement for the collection of penalties in the form of a fine or penalty in relation to such debtors.

Participants can deposit funds to pay their share in cash or transfer them by bank transfer. If money is deposited into the cash register, then confirmation of payment will be a cash receipt order. But the organization does not always have a cash register, then you need to make a non-cash payment.

How to deposit the authorized capital into the LLC current account? There is nothing complicated about this procedure. A transfer to an organization's account can be made from your individual account or deposited in cash through a bank. The main thing is that any document confirming the contribution of a share to the capital company should indicate its purpose. For example, “Payment by the founder of a share in the authorized capital” or “Contribution of a participant to the authorized capital.” The payment order, PKO or payment receipt must be kept by the participant.

If the share in the company is contributed by property, then the registration procedure will be different. After receiving an independent assessment and approving it at the general meeting, an act of acceptance and transfer of property is drawn up.

The act must indicate:

- data of the parties (the company itself and the participant);

- information about the size and nominal value of the paid share;

- description of the property and its estimated value.

- confirmation that the property belongs to the participant by right of ownership and is transferred to pay for his share in the authorized capital.

In addition, if property is transferred, the ownership of which requires state registration (real estate, transport, shares, etc.), then additional documents must be drawn up. We recommend that you obtain a free consultation on this issue.

Free registration consultation