Strict reporting forms or a strict accounting form (BSO) for LLC, BSO for individual entrepreneurs on the simplified tax system for the provision of services in Moscow, are produced in the printing house (from 2250-00). Buying a strict accounting BSO form means ordering it with already printed details of the LLC or individual entrepreneur (you will not need to do this yourself with a pen or put a special stamp with the details).

Moreover, the cost of BSO depends on the size of the form (A4-A5), circulation, number of layers of self-copying paper and number of numbering places. In cases provided for by law, strict reporting forms replace a cash register when providing services to the public (BSO receipt or BSO + for services).

IN

In accordance with the Law, BSOs must be made in the established form, and the numbering must be done in a typographical way using special printing equipment that is not available in the office. At the bottom of the form, the printing house puts the following marks: circulation, order number, TIN, year of issue, name and address of the printing house that printed the BSO .

When preparing the layout, it is necessary to leave space for the number applied using letterpress printing on an automatic numbering machine. Buy BSO or order BSO forms? You decide. The cost can be seen below.

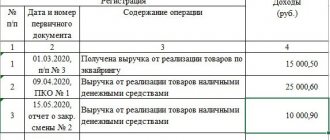

Cost of production of self-copying strict reporting forms (SSR), rub.:

| Circulation/format | layers | 100 | 200 | 500 | 1000 | 2000 | 5000 | 10000 |

| A4 | 2 layers | 2300 | 2850 | 4050 | 7000 | 9250 | 22000 | 38000 |

| 3 layers | 2800 | 3250 | 5500 | 8500 | 13000 | 29500 | 55500 | |

| A5 | 2 layers | 2100 | 2500 | 2950 | 4500 | 7750 | 14500 | 24250 |

| 3 layers | 3400 | 3750 | 4700 | 6250 | 11400 | 18750 | 32500 | |

| A6 (horizontal position only) | 2 layers | 2000 | 2200 | 3500 | 4000 | 5750 | 10750 | 17000 |

| 3 layers | 2300 | 2450 | 4200 | 4500 | 6750 | 12500 | 26250 | |

| Layout | +500 | |||||||

| Numbering | for free | |||||||

The strict accounting form is printed in black. The standard period for printing BSO is 3 business days. Circulations of 100 to 500 forms can be produced in 2 business days or less. Larger runs require more time. When printing on both sides, a coefficient of 1.25 is applied, but not less than 500-00. For circulations up to 2000 A4 (in terms of A4 format), the colors of the paper layers are used from those that are available in the printing house. Starting from 2000 A4, we are ready to purchase self-copying paper in the required colors.

Results

The specifics of the design and use of BSOs are determined by their purpose - to replace cash receipts when making payments to the population for services provided. According to current legislation, a seal is a mandatory requisite of the BSO, despite the fact that LLCs, JSCs and individual entrepreneurs may not use it in their work.

A strict reporting form without a seal is invalid.

The company that issued such a document may be fined. From July 1, 2018, the rules for using BSO are changing due to the entry into force of a number of provisions of Law No. 290-FZ. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Numbering (separate service without BSO stamp)

We produce 1-7 digit numbering using an automatic numberer. Simultaneous numbering with 4 numbering heads is possible. Maximum format - A3 (297x420 mm). The minimum is a5.

Attention! Usually there is 1 number on the form. If you need to number in 2 places, the cost of the form will increase slightly, so before ordering the BSO, check this position. The total cost of BSO printing = production cost + numbering cost.

When ordering a BSO, the sample form below will help you choose the one you need, or based on the BSO samples presented, we can develop an individual type for you.

The main area of application of BSO forms for services to the public is for individual entrepreneurs and LLCs - the provision of services. Instead of a sales receipt, the client is issued a BSO form - a receipt, one of the layers of a strict accounting form.

Application practice

A common example of the use of BSO by cinemas or theaters. The buyer is given a fiscal receipt and the theater/cinema letterhead, that is, a ticket. According to the rules, a ticket without a fiscal receipt is invalid. And this is the inconvenience. If one of the two papers is lost, the buyer may not be able to attend the session.

The Mobika service offers to simplify this process for the user. The company's development allows the following options to be implemented:

- On a regular mobile printer connected to the cloud cash register, in addition to the fiscal receipt, additional information is printed (theater logo, time, venue, row and place)

- Fiscal data is entered on a regular ticket form (theater or cinema) in the space provided for this.

That is, the user receives one piece of paper. This format is also convenient if the ticket is purchased remotely or payment takes place on site with a courier, including in cash. In this case, the courier does not necessarily have to have a cash register; all he needs is a mobile printer connected through special software to the cloud cash register of the Mobika service.

If you are interested in details, leave your contacts in the form below to receive advice on using and connecting a cloud cash register.

Numbering cost

| Circulation | up to 1000 | 1001-5000 | 5001-10000 | 10001-30000 |

| Price per room | 1,5 | 1,3 | 1,15 | 0,85 |

| Makeready (adjusting equipment to the required format and numbering location on the product area) | +1000-00 | |||

The numbering can be 1-6 digits, the font is ArialCyr, the font size and type do not change. The positioning of the number on the sheet may differ with an accuracy of 1-5 mm. The minimum length of a product for numbering is 150 mm, there are technical restrictions on the distance from the number to the edge of the product, etc., you must consult with the printing house manager and send a layout.

The minimum order for numbering is 2000-00.

Registration only in a new way

As mentioned above, since February, registration and re-registration of cash registers is carried out only according to the new rules. This means that before registration it will be necessary to conclude an agreement with the fiscal data operator (FDO). Read in more detail about the criteria by which you need to choose an OFD, and also see the step-by-step algorithm for switching to online cash registers.

Connect to Kontur.OFD now and transfer data to the Federal Tax Service for free for 3 months

Find out more

It is worth considering that “old” cash registers do not know how to interact with the OFD and transmit data through it to the tax authorities. Therefore, those who already have a cash register will be faced with a choice: buy new equipment or upgrade existing equipment, if possible. There is no longer any need to check the State Register of CCPs when purchasing or upgrading equipment.

At the same time, manufacturers will submit information about each manufactured copy of a cash register and fiscal drive directly to the Federal Tax Service (see letter of the Ministry of Finance of Russia dated September 1, 2016 No. 03-01-12/VN-38831), on whose website a register of cash register models corresponding to new requirements. Information about which models are subject to modification is published on the manufacturers’ websites, as well as on our portal. See if your cash register model is on this list.

form BO-1

(layer 1)(layer 2)(layer 3)| BSO sample |

New details in checks and BSO

In the previous version of Law No. 54-FZ, which regulates the use of cash registers, there were no requirements for the content of cash register receipts and BSO; they were enshrined in by-laws. Now these requirements are brought together in a new article. 4.7 of Law No. 54-FZ. A comparison of the new and old requirements for the details of cash receipts and BSO is briefly reflected in the table.

Product names

From 02/01/2017, all cash registers registered under the “new rules”, among other details, are required to print on the receipt the name of goods, works, services, as well as their quantity, price and total cost for each item. Previously, it was not necessary to indicate this information on the check; the total total amount was sufficient. The types of documents confirming the purchase, depending on the period of transition to online cash registers and the taxation system, are shown in the table.

This “complication” is scary only at first glance. For an accountant, it can generally be considered a “balm for the soul.” After all, in fact, cash register data will provide the main part of the information that is necessary for organizing commodity accounting in real time - information on sales in the context of each product item. Thus, if goods receipts are entered in a timely manner, a system for accounting for inventory balances will be built automatically.

And periodic inventory will turn from a labor-intensive process, which sometimes blocks the work of staff during the period of its implementation, into a regular reconciliation that can be carried out only occasionally. After all, the manager will have the data to make current business decisions even without it. Note that it is for this reason that many large sellers have long stamped product names on receipts.

At the same time, individual entrepreneurs in special regimes will be required to indicate on checks or BSO the names of goods (works, services) and their quantities only from 02/01/2021 (Clause 17, Article 7 of the Federal Law of 07/03/2016 No. 290-FZ). This relaxation does not apply only to excisable goods.

Connect Kontur.Market to maintain a product directory and transfer it to the checkout. Optimize product acceptance, pricing and inventory. This is a simple and affordable commodity accounting solution for small retail.

To learn more

VAT

Another equally important innovation is the need to indicate VAT on the receipt. Please note that this rule does not apply if the seller is not a VAT payer or sells goods (work, services) exempt from tax. In addition, in accordance with paragraph 4 of Art. 168 of the Tax Code of the Russian Federation, the amount of VAT in settlement documents must be highlighted as a separate line.

However, paragraph 6 of Art. 168 of the Tax Code of the Russian Federation establishes that when selling goods (work, services) to the population at retail prices (tariffs), the amount of tax on checks and other documents issued to the buyer is not allocated, that is, in this case there is a conflict of norms of documents of equal legal force. Since this “exception” makes up the vast majority of calculations in which cash register is used, in fact we can assume that the mandatory requirement to indicate VAT on the receipt (BSO) has not been established.

There are no sanctions for violating the rules relating to cash receipts established by the Tax Code of the Russian Federation, while sanctions are provided for in paragraph 4 of Art. for failure to indicate mandatory information on a receipt. 14.5 Code of Administrative Offenses of the Russian Federation. Therefore, most likely, even before the requirements of the Tax Code of the Russian Federation are changed, the corresponding norms of tax legislation will not be applied in this part.

Form of payment: cash/non-cash

A less noticeable change is the obligation to indicate on the check exactly how the payment was made (cash or electronic means of payment), as well as the position and surname of the person who made the payment to the buyer (client) - most often the cashier. These requirements were often complied with voluntarily and before the changes came into force.

The remaining changes can be called, rather, technical and/or related to the very essence of the transition to online cash registers (see table with a complete list of details).

Individual entrepreneurs have employees.

According to the instructions for filling out work books, approved by the resolution of the Ministry of Labor of October 10, 2003, each personnel record must be certified by the signature of the employer and the seal of the organization/personnel service. It turns out that an individual entrepreneur with employees does not need to put a stamp in the work book; this rule applies only to legal entities.

But in Decree of the Government of the Russian Federation of April 16, 2003 No. 225, which also deals with work books, no distinction is made between an individual and an organization. They are united by the common concept of “employer”.

This resolution approved the rules for storing and maintaining work books. And according to these rules, when dismissing an employee, all entries that were made in the work book must be certified by the signature of the employee, the signature and seal of the employer. It turns out that this rule applies to all employers. Individual entrepreneurs are no exception to this.

Minimum set

Even if you develop the BSO form yourself, according to clause 3 of the Regulations on cash payments and (or) cards without cash registers, some details must be included. Namely:

- six-digit number and series;

- document's name;

- company name and legal form of organization or full name. IP;

- location and tax identification number;

- the price of the service in rubles and its type;

- payment amount;

- date of payment in cash or card; it is also the date the form was compiled.

Among other things, the completed BSO details must be confirmed by the official who accepted payment for the service. This is done using his own signature and indicating his full name and position.

For organizations and individual entrepreneurs who want to independently develop a form of receipt for payment for their services, it is most convenient to take as a guide the version of the Ministry of Finance, which it approved for budgetary institutions.

Which printing houses have the right to print BSO

Currently, printing activities are not subject to licensing. The only exceptions are protected products, for the production of which special equipment, materials and technologies are used, for example, shares, bills, money, etc. When producing strict reporting forms, security methods are not used, so they can be produced in any printing house that has equipment for printing and consistent numbering.

Moreover, it is possible to produce a BSO using a computer and print it out on a printer, but for this it is necessary to use special programs that guarantee the uniqueness of the form being produced. This is mentioned in the law, but what specific programs need to be used is unknown. Therefore, to avoid misunderstandings on the part of the tax authorities, most entrepreneurs print forms using a typographic method.

This issue is discussed in more detail in a separate article.