Until July 1, 2021, small businesses received exemption from the obligation to switch to new cash registers: individual entrepreneurs on UTII and PSN for almost all types of activities, entrepreneurs and organizations on a simplified basis in relation to the provision of services and performance of work for the population, as well as vending business without hired employees employees.

The bill, approved at the end of November by the Federation Council, provided a deferment from the use of online cash registers until 2021 for most small businesses.

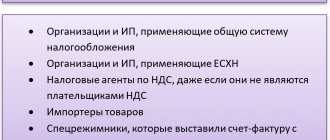

Almost all entrepreneurs and organizations operating under special tax regimes are covered by this benefit.

Let's consider what conditions individual entrepreneurs and organizations must meet to receive benefits.

Postponement of online cash registers in 2021

Recently there was a rumor that the third wave of the transition to online cash registers will be postponed. What's the matter? First Deputy Prime Minister of the Ministry of Finance Anton Siluanov at an expanded board of tax officials proposed to postpone the transition to online cash registers. Thus, in his opinion, the transition to new equipment and a new order for individual entrepreneurs will occur more calmly and comfortably. The Deputy Prime Minister also claims that for individual entrepreneurs without hired employees it is necessary to postpone the transition for at least a year.

Federal Tax Service statistics say: the transition to cash registers with online data transfer has already been made by more than 865,000 individual entrepreneurs and LLCs throughout Russia, more than 2.3 million have been registered. cash registers, receipts worth 90 billion rubles are registered in 24 hours. The figure is a record higher than previous years.

In July 2021, the transition to online cash registers should be made by all those who have previously received a deferment - this is about 3 million entrepreneurs and organizations. According to forecasts, the transition will create a large-scale wave that may proceed with disruptions. Siluanov, based on statistics, believes that a deferment for individual entrepreneurs to online cash registers will create the necessary calm conditions for the transition, without failures.

Siluanov looked at statistics on the number of self-employed entrepreneurs in the country. Considering the experiment on tax for freelancers and other professional income, the Deputy Prime Minister spoke in favor of deferring online cash registers. The new tax system for the self-employed will come into effect in 2021. At the moment, implementation experiments are already actively underway in a number of areas.

What does the new tax system provide? Individual entrepreneurs without employees can re-register as self-employed and pay only 4% of income if they work with individuals or 6% with legal entities. It will be impossible to combine the two tax systems. The head of the tax office spoke in favor of switching to online cash registers, since the new technology simplifies work and will allow one to get rid of reports and declarations.

As we see, the source does not refute the possible postponement, and the abolition of online cash registers for individual entrepreneurs was not discussed at all. The rumor about the cancellation of online cash registers is false. All tax and government authorities see only the positive aspects of the introduction of a new control system. Great importance is given to the reduction of reports and audits, simplified management and control of taxpayers, the ability to collect statistics and increase the transparency of the market as a whole.

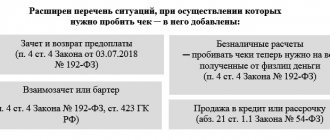

Application of cash register systems for offset and return of advances

The new law has expanded the list of cases when organizations have the right to generate only one cash receipt when making a credit or refund of advance payment previously made by individuals for various types of services.

Now one check containing information about all such payments for the month is allowed to be generated when making payments (clause 2.1 of article 1.2 of Law No. 54-FZ):

- for services in the field of housing and communal services, including utilities;

- for security services and security systems;

- for services in the field of education.

Also, now the generation of such “consolidated” cash receipts is no longer allocated for 1 day following the end of the current month, but as much as 10 days. For example, if an individual pays fees for a kindergarten for the entire year 2021, then the preschool educational institution can issue a check for services provided in June no later than July 10, 2021.

Federal Tax Service and Ministry of Finance: postponement until 2021

The tax office commented on Anton Siluanov’s speech about the deferment for online cash registers for individual entrepreneurs. According to the Federal Tax Service, about 1 million businessmen are projected to switch to online cash registers in 2021. Of these, several tens of thousands are without hired workers. This number of service sector entrepreneurs is expected in June. Siluanov proposed considering a deferment for online cash registers until 2021 for this category, given the introduction of a special tax rate for the self-employed. Many of them will re-register and will no longer need a cash register. As for the category of service sector entrepreneurs with employees, the transition of labor will not be difficult for them. The market is already ready. All necessary assistance is provided. Many people are already purchasing cash register equipment in advance. The point here is not only mandatory; purchasing a cash register of this kind carries a number of advantages. This concerns automation of a large part of the work, simplification of interaction with tax authorities and reduction of reporting.

Popular models

Finally, we list the main popular models of online cash registers.

| Atol 91 F Autonomous push-button cash register with a receipt printer supporting 3G, Wi-Fi, Ethernet, Bluetooth, as well as a USB connector for operation for 8 hours without recharging. Comes complete with a personal account for convenient addition of items. Find out more |

| Evotor 7.2 Smart terminal for small and medium businesses. Allows you to connect the most necessary equipment. Powered by network. Prints narrow format checks. It has a free cash register program with a personal account and an application store. Find out more |

| Vicky Print 57F Universal fiscal recorder with narrow receipt printing, support for printing QR codes, USB, RS-232 and cash drawer connectors. Suitable for areas with low traffic. Find out more |

| MTS 5 Touch mobile terminal for operation up to 24 hours without recharging. A free cash register program is pre-installed. You can add it by connecting paid goods accounting from MTS using the subscription form. Find out more |

| Wiki Micro It is a mini-POS system consisting of a cash tablet and a fiscal registrar to choose from. Suitable for business in any field, especially for trading alcohol with EGAIS. Find out more |

| Atol Online Online cash register for an online store, which is purchased as a lease. Integrates with most sites and has a personal management account. Technical support and service 24 hours. Suitable for both small and large stores. Find out more |

Need help choosing an online cash register?

Don’t waste time, we will provide a free consultation and select an online cash register that suits you.

Deferment of online cash registers for individual entrepreneurs in 2021

Back in May, the State Duma of the Russian Federation in the 3rd reading adopted a bill on deferring online cash registers. Together with the deferment, this bill simplified the use of online cash registers for passenger transportation; according to the amendments, such organizations do not have to have an online cash register at the point of payment with clients; it is enough to have a remote online cash register, and upon the buyer’s request, provide a QR code for a fiscal receipt using electronic means demonstrations (mobile phone, tablet or similar). The decision to make a deferment for individual entrepreneurs was made by the Ministry of Finance.

You can track the stages of consideration and familiarize yourself with the law here.

Entrepreneurs on PSN

The July amendments allowed individual entrepreneurs with a patent engaged in certain types of activities to work without a cash register. More precisely, the law specifies certain paragraphs of Article 346.43 of the Tax Code of the Russian Federation - they list the activities for which it is necessary to use the cash register. If an individual entrepreneur has a patent for other activities, then he should not use the cash register.

The requirement to use cash register equipment applies to the activities described in subparagraphs 3, 6, 9–11, 18, 28, 32, 33, 37, 38, 40, 53, 56, 63 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation.

Postponement of online cash registers in 2021, clarifications from the Federal Tax Service

Recently, the Federal Tax Service issued a letter regarding the latest bill on online cash registers. Law N 682709-7 has been adopted and has already been signed by the President. The project provides for a deferment in the use of online cash registers for entrepreneurs without employees when providing services, selling goods of their own production and performing work.

The deferment does not apply to organizations and all those entrepreneurs who resell goods.

Recently the category “self-employed” was officially introduced. Today this category exists in experimental mode in several regions of the country. According to forecasts, self-employed people will soon be introduced throughout Russia. Bill N 682709-7 is precisely intended to delay the introduction of funds for the self-employed and prepare the ground for the introduction of a new category of taxpayers. The fact is that self-employed people, by law, may not use cash registers. All those who in the future will belong to the new category received a deferment. Another feature of the self-employed is a simpler tax regime. With the introduction of the new law, entrepreneurs have time to choose their tax regime.

What does 54-FZ require?

We have already talked in detail about the new amendments to the law - what kind of reform it is, how to register and select a cash register:

- Reform 54-FZ and new cash desks

- Online cash registers for online stores

- Tax deduction

In short, now the cash register must connect to the Internet in order to transmit information about sales to the tax office through the OFD and store data about receipts on the fiscal drive.

The old autonomous cash register can no longer be optimized: you need to buy a new one. Your cash register complies with 54-FZ, if it is in the cash register register.

Tax deduction

We remind you that entrepreneurs have the right to receive a tax deduction for an online cash register when purchasing it on time. Compensation is provided in the amount of 18,000 rubles. for each unit of cash register equipment. This rule applies to entrepreneurs on UTII, patent and forms of taxation combined with UTII and patent.

If you don't currently have employees, but plan to expand soon, it would be wiser to purchase the cash register before July 1, 2021, to offset the purchase.

The Federal Tax Service warns that if you decide to take advantage of the deferment in applying the cash register, you will not be able to receive a tax deduction for the cash register later. If you subsequently hire an employee, you must set up an online cash register within 30 days.

If you do not plan to register as self-employed in the future, but intend to continue your activities as an individual entrepreneur, then it is also better to purchase a cash register now, and you can start using it from July 1, 2021.

Thus, you can buy a cash register now, receive compensation for it, and start using it only in 2021. This applies to all entrepreneurs who are subject to the deferment.

Did you like the article? Share it on social networks.

- Lyudmila 07/16/2019 09:23

Comment I am a pensioner. I help my husband, we fry pies at the market and sell them. We work from 8-00 to 12-00. And so 8 days a week. We buy medicine (my husband has hypertension), pay for utilities, and help our son (he has type 1 diabetes). Why do we need a cash register? It’s hot in the carriage in summer, cold in winter, not a single machine can withstand it. Whoever comes up with laws, he needs to first live like us, and work like us, and then make decisions.Answer

- Sveta 07/02/2019 12:18

Comment What is the deduction? Nothing comes of it if you pay EBIT.

Answer

- Irina 06.26.2019 20:25

Comment But we are not entitled to a tax deduction of 18,000, since the amount of payments to the Pension Fund and the Medical Care Fund exceeds the amount of tax on UTII. And there are many like us. So think for yourself, decide for yourself who this benefit is for?

Answer

- Tatyana 06.25.2019 16:51

Comment Not funny anymore!!! There are small businesses and there are very small ones. We must purchase a cash register for 50,000 rubles in order to receive an 18,000 tax deduction. And let the tax office sleep peacefully, seeing that we are working at a loss. It is probably beneficial for our government that we close individual entrepreneurs (and there will be quite a few of them) and join the ranks of the UNEMPLOYED.

Answer

- Anyuta 06.25.2019 17:48

Comment There are many budget solutions for very small businesses, for example, Atol 1F, Atol 91F Lite, Agat and others. You may well meet the deductible amount.

Entities on UTII, except for trade and catering

The deferment is valid for organizations and entrepreneurs on UTII, regardless of the presence of employees who do not sell retail or provide catering services. There is one condition - at the buyer’s request, you must issue him a document confirming the payment. It should contain the following details:

- Name, number and date of issue.

- Seller parameters: name of organization / full name of individual entrepreneur, as well as TIN.

- List and quantity of goods, works or services that were purchased.

- Amount and method of payment (cash or card).

The document must be signed by the issuing person indicating his full name and position.

Fines for violations of the use of cash register equipment

Supervision over the correct use of cash register equipment is carried out by employees of the Federal Tax Service, who also have the right to issue fines.

Non-use of CCP

- For officials - from 25% to 50% of the purchase amount, but not less than 10,000 rubles.

- For legal entities - from 75% to 100% of the purchase amount, but not less than 30,000 rubles.

Repeated non-use of CCP

- For officials - disqualification from 1 to 2 years.

- for individual entrepreneurs and companies – suspension of activities for up to 90 days.

Use of a cash register that does not meet the requirements, or in violation of the procedure for registration, re-registration and application

- For officials - a warning or a fine from 1,500 to 3,000 rubles.

- For legal entities - a warning or a fine from 5,000 to 10,000 rubles.

Failure to provide information (documents) at the request of the Federal Tax Service (in violation of established deadlines)

- For officials - a warning or a fine from 1,500 to 3,000 rubles.

- For legal entities - a warning or a fine from 5,000 to 10,000 rubles.

Failure to send a cash receipt or BSO to the client (in electronic or paper form)

- For officials - a warning or a fine of 2,000 rubles.

- For legal entities - a warning or a fine of 10,000 rubles.