From August 13, 2021, a new procedure for paying severance pay upon dismissal due to staff reduction and liquidation of the organization, established by Art. 178 and 318 of the Labor Code of the Russian Federation. The need to make changes, in particular, is related to the recognition of the provision on the payment of benefits in the event of liquidation of an organization as contrary to the Constitution of the Russian Federation. The changes also affected the general procedure for payment of benefits upon dismissal in connection with the liquidation of an organization or reduction in staff. We will talk about innovations in the article.

Benefit amount and payment period

Severance pay is a lump sum payment upon dismissal and is issued or transferred to an employee of the company regardless of the payment of remaining earnings and compensation for unused vacation. The benefit is paid according to certain rules, administrative acts and dismissal orders with corresponding payments are drawn up on the basis of ordinary personnel forms and their unified forms. The following must be indicated:

- reasons and grounds for making a decision;

- amount of benefits and other compensation.

Also necessary in the document is the signature of the employee, confirming that he has read the document.

Compensation upon dismissal, as well as the grounds for its provision, are provided for in labor legislation and regulations or in a collective and labor agreement. The legislation provides for different amounts of monetary compensation - from two weeks' average earnings or more. It depends on the reason for stopping work.

You need to pay taxes and insurance premiums on your severance pay! Find out for free in ConsultantPlus how to do this correctly.

Is compensation paid for unused vacation?

The Basic Law of the Russian Federation guarantees every working citizen of the country the right to rest. In practice, this is expressed in the provision of annual leave paid by the employer. As a general rule, its duration is 28 calendar days. However, certain categories can count on additional leave due to the specifics of their professional activities.

In accordance with Article 127 of the Labor Code of the Russian Federation, upon dismissal, an employee has the right to receive monetary compensation for those vacations that were not actually used by him. Accordingly, this payment is included in the final payment.

The right to receive compensation applies to all existing vacations not taken off, and not just the period that preceded the dismissal.

It should be noted that the law also allows for the possibility of going on vacation with subsequent dismissal without taking into account the current vacation schedule.

How is it calculated

The amount of compensation for unused vacation directly depends on such a parameter as average daily earnings (ADE). It is calculated using the following formula:

SDZ = total amount of earnings for the billing period/number of days actually worked

Accordingly, knowing the STZ indicator, you can derive a formula for calculating compensation for unused vacation paid upon dismissal of an employee:

Compensation amount = SDZ*Unused vacation days

If during the billing period the employee used part of the vacation, then the number of days actually used is subtracted from the resulting value.

In this case, unused vacation days are calculated taking into account that 1 month worked is equal to 2.33 vacation days.

Reference! For certain categories of employees, other variables in the presented relationship may be used.

Calculation example

Master Sidorov worked a full 5 months in the current pay period preceding his dismissal.

Respectively:

5*2,33 = 11,65.

That is, Ivanov has the right to 11.65 days of vacation.

Considering that the average employee income for the period under review is 640 rubles, you can easily calculate the amount of compensation due:

640*11,65 = 7465.

Thus, the corresponding compensation will be 7,465 rubles.

Who will be paid for 14 days

A dismissal payment in the amount of two weeks' average earnings is due in the following cases:

- Upon termination of an employment contract for medical reasons. If an employee is recognized as completely disabled or for any reason does not want to transfer to a new workplace, then he is entitled to severance pay upon dismissal for health reasons, two weeks’ pay and wages for the time actually worked. It is important to note that if an employee quits due to health reasons, but at his own request, then compensation is not paid.

- The legislator established severance pay upon dismissal from the army, which is compensation in the amount of two weeks' earnings and is paid upon conscription into the army or assignment to an alternative service replacing it.

- In case of dismissal upon reinstatement of the employee in service by a court decision.

- If an employee refuses to take a position when the company moves to another city or region.

- If you disagree with changes to the terms of the employment contract in the manner prescribed by Art. 74 Labor Code of the Russian Federation.

In what cases can the final amount be revised?

Situations cannot be ruled out when accounting is forced to recalculate (and even deduct), including in favor of an employee who has already been fired or is about to quit:

- the overpayment was made by mistake;

- the employee had a debt (this was discussed above);

- it turned out that part of the salary was once unpaid;

- payment of premiums late.

In these cases, the employer makes calculations using new data. The amount received is deducted from the first calculation. Depending on the situation, the employer or the dismissed employee will have to return the amount of money received.

Important! An employee who learns about an error must contact the employer with a written request to recalculate.

If the head of the organization does not agree to fulfill the requirements, the employee has the right to contact the labor inspectorate, which will oblige the employer to pay the missing amount.

The employer also has the right to demand from the employee his debt or the excess amount accrued by mistake. If the organization refuses to return the money, it has the right to file a lawsuit.

Who will be paid the monthly income?

Compensation in the form of one month's earnings is paid:

- in case of staff reduction or liquidation of an enterprise (clause 1, 2, part 1, article 81 of the Labor Code of the Russian Federation);

- upon cancellation of employment contracts executed with violations (clause 11, part 1, article 77 of the Labor Code of the Russian Federation).

In case of downsizing or liquidation of an enterprise, payment is made along with the settlement and in the first month after the official severance of the employment relationship. But such payments are not available to seasonal workers, conscripts, and part-time workers.

Reasons for receiving compensation payments upon dismissal

The main reason for assigning compensation payments to an employee is the fact of his leaving work, since the manager guarantees his employees material well-being. Mandatory contributions to extra-budgetary funds throughout the entire period of an employee’s work serve as social guarantees, including for a “cash reserve” in the event of loss of a job.

Another reason for issuing to a former employee all the money due to him is the obligation of the boss to pay the staff at the end of the employment relationship. It is recognized as fulfilled only at the moment the employee receives all the money, and extra-budgetary funds receive all deductions for it.

When a larger amount is due

If the employee has not found a new job

For the second month, benefits are paid if the former employee was unable to find a job within 60 days (in case of staff reduction or company liquidation). In some cases, payment for 3 or even 6 months is possible if the employee applied to the employment center (two weeks and 30 days, respectively), but there was no vacancy and he did not find a job (Articles 178 and 318 of the Labor Code of the Russian Federation).

To confirm that the former employee has not taken a new job, he brings the relevant documents to the former employer. Their list depends on the month for which benefits are paid after dismissal.

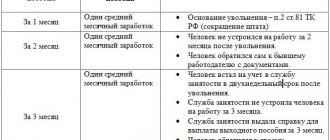

| Period from the date of dismissal | Amount of payment and list of documents to be presented to the former employer |

| After the second month. After the second and third months - for workers of the Far North and equivalent territories | Average monthly earnings. Documentation:

|

| After the third month. After the fourth, fifth and sixth months - for workers of the Far North and equivalent territories | Average monthly earnings. Documentation:

|

If a citizen gets a job at this time, he will be paid only for the time he was registered with the employment service. In this case, instead of the original work book, they bring a copy of it, certified at the new place of work.

Also, the Labor Code (Articles 181, 278, 279) provides for special payments upon dismissal of the enterprise’s managers, their deputies and the chief accountant at their own request in 2020. In this case, for the period of employment, compensation is three monthly earnings.

Types of compensation for dismissed employees

What is paid upon dismissal?

- Compensation for dismissal of an employee due to poor health.

- Payments upon dismissal at the initiative of the employee.

- Payments upon dismissal by agreement of the parties.

- Payments upon dismissal of an employee due to staff reduction.

For any reason for staff leaving the enterprise, the employer must make payments for annual leave that the workers did not have time to take. When leaving work occurred on the initiative of the authorities, those dismissed are also entitled to severance pay (in addition to payment for the time actually spent at the workplace while performing official duties).

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Compensation for early termination of an employment contract

Dismissal in case of early termination of an employment contract must be preceded by notification by the employer to the employee 2 months before the date of his actual departure from work. The employer does not have the right to force an employee to write a letter of resignation of his own free will, since this is beneficial exclusively to the employer, who will not have to pay his employee severance pay.

When reducing staff, the law generally prohibits specifying the reason for dismissal as “personal desire of the employee,” since two grounds for leaving work cannot arise simultaneously. In addition, an entry in the work book upon dismissal due to staff reduction is more beneficial for the worker both in terms of finding a new job and in terms of obtaining various benefits.

This is also important to know:

Forced dismissal: how an employee should behave, what threatens the employer

The procedure for such dismissal is as follows:

- The employee receives a notification and agrees to it.

- The employer instructs the accounting department to pay the employee for the amount of compensation for unprovided vacation and severance pay.

- The employee receives a compensation payment for early termination of his employment contract.

Additionally, compensation is assigned for the period remaining until the end of the notice period. In total, the fired person will receive his due salary with all allowances, compensation for rest that was not given, severance pay and compensation salary for the time that he could still work before the dismissal, but agreed not to work.

The purpose of imposing an obligation by law on an employer to pay severance pay is to provide a means of livelihood for an employee who, through no fault or unwillingness, has lost a source of income while he is looking for a new employer.

It is worth keeping in mind that any misconduct in the workplace that would not have been taken into account before, before dismissal, can serve as a reason for manipulation on the part of the employer in order to force the employee to resign of his own free will. At such a time, you should not allow lateness or other, even minor, disciplinary violations.

Compensation for vacation that the employee did not have time to take

For whatever reason, an employee leaves work, among the obligatory payments for him will be compensation for annual leave not provided before the date of dismissal. Moreover, if he had the right to vacation twice, but did not go on vacation for two years in a row, he will receive double compensation.

However, working for 2 years in a row without rest is illegal, and therefore the employer must give an explanation about this, except in cases where the employee has done something wrong. The procedure is this because compensation for unused vacation is not paid if the employee is fired for serious violations. The day of actual departure from the enterprise will be the last day of rest, and before that the employee will already be given all the compensation due to him for unused vacations.

Employee compensation for staff reductions

The dismissal of employees when reducing the company's staff is recognized by law as independent of the wishes of management and subordinates. Extra-budgetary funds are involved in the implementation of social programs aimed at providing for citizens who have lost their jobs through no fault or initiative.

Dismissed employees receive wages with the allowances and bonuses they are entitled to for the time actually spent at work, compensation for annual rest not provided (if any), severance pay, which is certainly paid in two cases:

- upon closure of the enterprise,

- when staffing is reduced.

The average salary is retained by a dismissed employee only until (but not more than 3 months, and only after such a decision is made by the Employment Service) he signs a contract with a new employer. And if we are talking about a part-time worker who still has a second job, then he is not entitled to severance pay at all.

If there is no part-time job, the dismissed employee contacts the Employment Service within 14 days and leaves an application to find a new job. And in the event that the Employment Center does not find a suitable position at another enterprise, it will receive from the former employer the amount of its average earnings for 3 months instead of the standard two.

Compensation for police officers upon dismissal

Police officers are entitled to full compensation for each vacation not used on time until January 1 of the year in which the dismissal took place (the reason does not matter). Compensation amounts for rest that the police officer did not take during the year of dismissal will be paid:

- upon length of service at which the right to pension payments arises, upon reaching the age limit, upon dismissal due to staff reduction or deterioration of health (for annual leave in full, and for other types of rest - in proportion to the length of service in the year of departure from service in the amount of 1/12 of the vacation for 1 full month of work);

- for all other reasons (for each entitled type of rest in the amount of 1/12 of the duration of leave for 1 full month of service based on the average salary).

This is also important to know:

Dismissal under an article: why they can be fired from work, procedure for registration

When a police officer leaves service, he is entitled to:

- Salary for the entire period of service.

- Quarterly bonus calculated based on actual time served.

- Compensation equal in value to at least two salaries for the year (if it was not paid in the relevant year).

- A one-time financial incentive based on the results of 12 months is proportional to the time actually spent in service.

- Compensation for vacation not provided before dismissal.

- One-time benefit in the amount of:

- 5 average monthly salaries (dismissal due to age, health reasons, staff reduction, illness, after 10 years of service),

- 10 average monthly salaries (with 10-14 years of service),

- 15 average monthly salaries (with 15-20 years of service),

- 20 average monthly wages (with more than 20 years of service),

- 40% of the transferred amounts (if dismissed for other reasons),

- the transferred amounts + 2 salaries (if the policeman was awarded an order during his service or was awarded an honorary title).

The salary is the one that was assigned at the time of dismissal. Years of service are not rounded to full years. If dismissal occurs upon re-employment, payments are calculated with the offset of previously paid amounts for length of service. If the total length of service was less than 15 years, and the policeman was dismissed without the right to a pension, his salary is retained for 12 months after leaving service (annual indexation is taken into account).

When retiring

When retiring, an employee can receive not only compensation for vacations and wages.

He may also be entitled to additional payments. But only if the collective agreement specifies special conditions under which accruals are made to employees leaving due to retirement age. Sick leave after dismissal in 2021, according to the Labor Code, must be paid by the employer within a month.

Sick leave pay after dismissal

A former employee has the right to claim sick leave payment through the company from which he was dismissed, provided that no more than a month has passed from the date of registration of the event. Only those citizens who have not been employed since the termination of their employment contract should contact the head of a business entity. The certificate of incapacity for work must be presented no later than 6 months from the date of termination of the employment relationship. When calculating the amount of payment, length of service is not taken into account, and when determining its size, the salary is adjusted to 60 percent. If the sick leave was issued to a close relative, then it is not payable.

Dismissal during illness

In case of serious illness, the employee may be on sick leave for a long time. During this period, he has the right to resign for his own reasons or by agreement of the parties, due to the initiative of the employer due to the need to perform duties by a constantly absent person and assign them to a new employee.

The procedure for dismissing a person on sick leave is no different from terminating a contract with a working employee. He must notify the employer of his desire, and after two weeks receive a payment. For a dismissed employee with an open sick leave certificate, the payment amount can be calculated only after receiving a closed sick leave certificate issued by a medical institution. Payments are made on the nearest payday.

Dismissal of a manager or chief accountant

It happens that managers or chief accountants quit. Payments will be accrued in the following cases:

- they were removed from office by the founders without any guilt;

- The new owner of the business decided to fire them.

There are several situations when a change of ownership of a company occurs:

- privatization of state and municipal property (sale or provision into private ownership);

- retransfer of property belonging to the organization in favor of the state;

- sale of the enterprise as a whole complex of property.

A change in the composition of the company's participants (inclusion of new participants or withdrawal, exclusion of old ones, including a complete change in composition) does not constitute a change of owner.

The employer in accordance with Art. 278 of the Labor Code of the Russian Federation pays the manager money in the amount established by the employment agreement, but not less than three times the average monthly salary.

But there are also nuances in the payment of benefits upon dismissal of managers, their deputies and the chief accountant - amounts of money are not paid if:

- there are illegal actions on their account;

- they made decisions that negatively affected the financial position of the organization.

Registration procedure

Registration of dismissal of an employee is carried out according to a fairly simple scheme, which may vary depending on the conditions of dismissal:

- The employee writes and submits a resignation letter to his superiors. Or the employer and employee draw up an agreement.

- Next, a dismissal order is created, which is transmitted to the accounting department so that the amount of compensation and the need to pay severance pay can be calculated.

- Finally, on the day of dismissal, the employee is given his documents, and all necessary payments are made.

When they will only pay if agreed upon with the employer

Upon resignation of one's own free will

If the contract is terminated at the request of the employee, then no incentive or compensation payments are provided for by law, that is, severance pay is not provided for voluntary dismissal. But if management wants to reward an employee for long and fruitful work, they will award a bonus on their own initiative; such cases are known.

By agreement of the parties

Typically, dismissal by agreement occurs on an individual basis. The amount of the fee is not established, so payment is made by mutual agreement of the parties. The problem of the amount of payment, how to calculate severance pay upon dismissal by agreement of the parties, is solved within the framework of individual agreements.

But the salary, which was not paid to the employee for the period worked, is issued without fail on the last day of work.

Upon retirement

Labor legislation does not provide for severance pay upon retirement, but in accordance with Part 4 of Art. 178 of the Labor Code of the Russian Federation, similar bonuses are allowed to be prescribed in the employment contract or they may be provided for by internal regulations of the organization itself. Such payments are provided at the request of the employer and are not regulated by law. The organization has the right to establish any number of financial assistance measures without restrictions. This type of help is, rather, gratitude for the work.

How are deductions made and in what amount?

The employee's debts to the employer are also taken into account in the final calculation. These include:

- unearned advance payment issued against salary or travel allowances;

- amounts overpaid as a result of an error;

- vacation provided in advance.

The head of the organization does not have the right to assign debt on additional grounds. The situations presented above are the only ones in which a withholding can be made.

The total amount cannot exceed 20% of the salary of the dismissed employee.

Most often, deductions are made for unworked vacation. Accounting must complete three steps:

- calculate the number of unworked days;

- calculate the amount of unearned vacation pay;

- adjust tax reporting (reflect data when preparing a report on calculations for dismissal).

The number of unworked days is calculated using the following formula:

Unused vacation = number of vacation days used for the entire period of work - (28 / 12 x number of months of work in the organization)

The amount is calculated as follows:

Amount of vacation pay debt = number of unworked vacation days x average daily earnings

Other cases

If an employee was illegally fired and he is reinstated to his previous place of work, then he is entitled to severance pay upon reinstatement at work for the entire period of the employee’s absence (forced absenteeism). The organization is obliged to calculate the average salary (if it was an illegal dismissal) or compensate the difference in wages (if it was an illegal transfer).

Since an individual entrepreneur is not a company or a legal entity, a number of labor laws are not applicable to it. According to the decision of the Supreme Court No. 74-KG16-23 dated 09/05/2016, employees working for individual entrepreneurs count on benefits, but they are not always paid:

- upon liquidation of a business, termination of activities as an individual entrepreneur;

- when staffing is reduced.

However, an individual entrepreneur is obliged to notify the employee of the upcoming dismissal and pay him the amounts due if such conditions and guarantees are included in the employment contract.

The law enforcer proceeds from the fact that this employer is an individual, and severance pay for cumulative accounting of working hours is paid in the same way as for any other accounting.

Who is obligated to pay severance pay?

Severance pay means a certain amount paid by the employer to the employee at the time of termination of the employment contract, in connection with his dismissal not on his initiative. This payment is a kind of compensation to the employee for losses incurred upon dismissal.

Expert commentary

Platonov Alexander

Lawyer

According to Article 178 of the Labor Code of the Russian Federation, an employer, which is a legal organization or enterprise, is obliged to pay the benefits due to the employee upon the occurrence of the grounds established by law.

When the employer is a private entrepreneur, who, by virtue of Article 307 of the Labor Code of the Russian Federation, is classified as an individual without forming a legal entity, the issue of providing severance pay to a resigned employee is resolved on the basis of an employment contract. In it, the entrepreneur, together with the employees, determines the grounds for payment of benefits and its amount. If this document does not contain a clause on the payment of farewell benefits, then the calculation of this amount remains the prerogative of the entrepreneur himself.

Table of benefit amounts depending on the circumstances of dismissal

| Grounds for dismissal | Benefit amount |

| Liquidation of a company | In the amount of average monthly earnings for all categories of workers, with the exception of those specified in Art. 178 Labor Code of the Russian Federation:

|

| Reduction in headcount or staff | __//__ |

| Refusal to transfer for medical reasons | Average earnings for two weeks |

| Conscription into the army or alternative service | __//___ |

| Due to the reinstatement of an employee who previously performed work, by a court decision or labor inspectorate | __//___ |

| Refusal to transfer together with the organization to another location | __//___ |

| Recognition based on a medical report as completely incapable of performing relevant duties | __//___ |

| Refusal to work under new conditions | __//__ |

| Violation of the rules for concluding an employment contract established by law, which occurred through no fault of the employee, if such a violation precludes transfer or continuation of activity | Average monthly earnings |

For whom is the benefit not provided?

The labor legislation lists the reasons for the dismissal of an employee, for which payment of material support after termination of employment at the enterprise is not provided. Basically, they are an expression of the personal desire of the employee himself or the result of his violation of labor discipline and dishonest performance of his duties.

Such grounds include:

- dismissal of an employee at his own request (clause 3, part 1, article 77 of the Labor Code);

- the employee has not completed the probationary period established by the employer (Part 1 of Article 71 of the Labor Code);

- dismissal by agreement of the parties between the employee and the employer;

- dismissal, as an extreme measure of administrative punishment, at the initiative of the employer (Article 81 of the Labor Code);

- dismissal due to the employee’s inadequacy for the position he or she occupies;

- termination of a temporary contract concluded for a period of less than two months.

The procedure for calculating the payment and the formula for calculation

The calculation formula looks like this:

Severance pay = average daily wage × number of working days in the month following the month of dismissal.

To calculate severance pay, you need to determine the following values:

- billing period;

- the number of days that the employee actually worked;

- total salary;

- the number of days recognized as workers during the period for which benefits are paid.

Calculated payment period

The 12 calendar months preceding the month in which the employee is laid off are taken.

Actual days worked

All working days when the employee worked are taken into account.

The time spent on annual leave and sick leave is not taken into account.

How to react to incorrect calculations

There is a contradiction in the judges' decision - we divide the employee's earnings accrued for the pay period by working days, and multiply them by working days plus holidays. This is not correct, but it is the optimal calculation. The amount of severance pay will not fluctuate too much from month to month, employees will receive more money and there will be no claims from inspectors against you.

If you refuse to take holidays into account when calculating, be prepared for the fact that you will lose the dispute in court. And in this case, you will have to pay the employee compensation for the delay, and also, possibly, compensation for moral damage. In addition, keep in mind that even before the ruling of the Constitutional Court, judges often took the employee’s side in such disputes. Here are some examples for different districts:

- appeal ruling of the St. Petersburg City Court dated November 29, 2016 No. 33-23589/2016;

- appeal ruling of the Yaroslavl Regional Court dated April 16, 2018 in case No. 33-1984/2018;

- appeal ruling of the Supreme Court of the Republic of Tyva dated March 26, 2019 in case No. 33-377/2019. In this dispute, the judges ordered the company to pay for regional holidays.

Examples of calculations

Let us show with examples how benefits are calculated.

Example 1.

Svetlyachkov I.S. worked at Vesna LLC. On 10/16/2020 he was fired due to the liquidation of the organization. Svetlyachkov’s monthly salary was 23,000 rubles, and his vacation was used in full. Upon termination of the contract, Svetlyachkov must be paid:

- wages for days worked;

- severance pay.

In October 2021, there are 22 working days, of which the employee worked 10. His earnings will be:

23,000 rub. / 22 × 10 = 10,454.50 rubles.

To calculate severance pay, the average earnings are used. Over the past 12 months, Svetlyachkov worked 260 days.

23,000 × 12 / 260 = 1061.54 rubles.

There are 20 working days in November, which means the severance pay will be:

1061.54 × 20 = 21,230.80 rubles.

Example 2.

Romashkina Maria Petrovna was fired on September 31, 2020 due to staff reduction and immediately registered with the employment service. Upon dismissal, she was given a salary for September in the amount of 30,000 rubles. The vacation was fully used, therefore, there was no compensation for it.

During the previous billing year, she worked 249 days. Let's calculate monthly earnings:

30,000 × 12 / 249 = 1445.78 rubles.

In September there were 22 working days, therefore, Maria Petrovna received severance pay in the amount of:

1445.78 × 22 = 31,807.16 rubles.

But this month she was unable to find a job. Due to the fact that she contacted the employment service on time, she is entitled to benefits for another 30 days. There are 22 working days in October, therefore, Maria Petrovna will receive benefits in the amount of:

1445.78 × 22 = 31,807.16 rubles.

She will no longer be paid.

What you need to know

Dismissal occurs in several stages, the last of which is the receipt by the employee of a work book, as well as monetary compensation.

An employee can mainly claim:

- wages for days worked after the last payment;

- compensation paid in case of unused vacation.

Also, if the company’s local act indicated the presence of the so-called “thirteenth salary”, then it must also be provided to the employee.

Responsibility for violation of terms and amounts of payments

In accordance with Art. 236 of the Labor Code of the Russian Federation, in case of violation of the due date for payment of wages, vacation pay, payments upon termination of an employment contract and other payments due to the employee, the employer will pay them with interest in the amount of not less than 1/150 of the key rate of the amounts not paid on time for day of delay, starting from the next day after the due date for payment, up to and including the day of actual settlement. In case of non-payment, workers have the right to appeal to the state labor inspectorate, the prosecutor's office and the court to hold employers accountable.

To eliminate errors and make a correct calculation of severance pay upon dismissal, you should first contact a specialist to obtain advice on the application of the law. For this purpose, it is necessary to preserve all payment forms, employment contracts and other personnel documents issued by the employer during the course of employment. It is possible to get free consultations from representatives of government agencies, for example, federal or regional social protection authorities. Phone numbers and other details of these bodies are freely available on administration websites, etc.

It is necessary to take into account the date of dismissal, since the absence of benefits or its insufficient amount can be challenged only within three months from the moment the employee received news of a violation of his rights (Article 392 of the Labor Code of the Russian Federation).

Are bonuses given to departing employees?

As a rule, the bonus is included in the employee’s salary, paid as the balance for the days worked before termination of the employment contract , if it is due to the dismissed employee.

Payment of a dismissal bonus is not made only if the employee is dismissed due to his own guilty actions (regular violation of discipline, committing gross violations once, theft of the organization’s property, etc.).

It is also important to note that premiums exceeding 4 thousand rubles are subject to taxation.

Entry in the work book and personal card upon dismissal of an employee

Depending on the reasons for dismissal, the following entries are made:

| Paragraph | Part | Article | Cause |

| 3 | 1 | 77 | at the employee's initiative |

| 1 | by agreement of the parties | ||

| 2 | upon expiration of the contract | ||

| 5 | transfer of an employee to a new place of work or to an elected position | ||

| 6 | employee refusal to work due to reorganization | ||

| 7 | refusal by an employee to continue performing duties due to a change in certain terms of the contract | ||

| 8 | impossibility of transferring to a new position due to health reasons or lack of a suitable place of work with the employer | ||

| 9 | the employee did not follow the employer to a new place of work | ||

| 11 | the rules for signing an employment contract were violated |

In case of dismissal before or at the end of the probationary period, the entry “dismissed due to the establishment of inadequacy for the position held during the probationary period” is made.

Typical design mistakes

Mistake #1. The employee only worked for 1 month; upon dismissal, the employer only paid him a salary.

Even after working for such a short time, the employee receives the right to compensation for unused rest (on average 2 days for each month worked).

Mistake #2. The employer promises to pay the payments and compensations due to the employee in the near future, when he has a sufficient amount.

All payments upon dismissal of an employee must be made as of the employee's last day of work. If he was not at the workplace, the money is issued maximum the next day after the employee applies for payment.

Payments to internal part-time workers

Calculate severance pay and average earnings for the period of employment in the general manner.

The main job and part-time work are documented in two different employment contracts. Therefore, calculate severance pay and average earnings for the period of employment separately for each employment contract. That is, if an employee is laid off from both places of work, severance pay and average earnings for the period of employment must be calculated separately for both contracts: based on payments for the main job and based on payments for part-time work.

If an employee is laid off in one of his positions (either his main position or a part-time position), then he is not entitled to average earnings for the period of employment. He only needs to pay severance pay. To calculate severance pay, take into account payments only for the position being eliminated. That is, if a part-time worker is laid off, to calculate benefits you need to take payments received from part-time work. If your main position is laid off, calculate the benefit based on payments at your main place of work.

This follows from Part 1 of Article 178, Article 287 of the Labor Code of the Russian Federation.

Necessary documents for registration

List of documents that are the basis for launching the dismissal procedure:

- An employee's statement of desire to resign.

- Agreement between employee and employer on termination of employment relationship.

- Notice of termination of a fixed-term employment contract.

This is also important to know:

The meaning of Article 33 of the Labor Code upon dismissal: official text, what has changed

List of documents for the dismissal procedure:

- Order from the authorities according to f. N T-8, T-8a with designation:

- reasons for employee leaving work,

- articles of the Labor Code.

- Work record book with a note about the reasons for leaving the enterprise.

- Note-calculation according to f. No. T-61 with a list of amounts paid.

- Personal card of the employee by f. N T-2 with a note of dismissal.