Home — Articles

“Simplers” are not payers of value added tax. That is, this tax is not calculated when selling goods (work, services). However, when purchasing valuables from VAT payers, a so-called “input” tax appears in the “simplified” accounting. Can it be immediately written off as expenses under the simplified tax system, or should it be included in the initial cost of purchased assets? How to reflect “input” VAT on accounting accounts and at what point to write it off? In particular, is it necessary to keep records in special account 19 “Value added tax on acquired assets,” or can payers using the simplified tax system do without it? What documents will confirm the validity of the accounting? You will find answers to these popular questions in this article.

Input VAT under simplified tax system

| Input Tax Accounting Case | What to do with added tax | Conditions to be fulfilled |

| Payment of VAT to suppliers at the time of registration on the simplified tax system | Include in expenses | Conditions:

|

| Transferring activities from the main mode to the simplified one | Restore | Conditions:

|

| Switching from simplified to basic mode | Send to deduction | Conditions:

|

Accounting for input tax in expenses

Input added tax is the amount added by the supplier (performer) to the cost of valuables, services, and work. If the buyer company operates in the main mode, then this tax can be reimbursed by reducing the VAT payable by its amount. A simplified company will not be able to reimburse the tax, since such an economic entity is not recognized as a payer of the tax in question.

It is allowed to take into account the paid added tax in expenses that reduce the tax base. This operation must be performed in the same quarter in which expenses include the cost of acquisitions, services of various types, and work. It is impossible to take into account inventory items, fixed assets, services, and work at a cost that includes tax. It is necessary to take into account the tax separately, including it in expenses as a separate operation.

Article 346.17 determines the time frame within which a simplifier can take into account the input added tax paid to the supplier in his expenses. The following terms vary depending on the type of acquisition:

- Upon sale - in relation to paid assets acquired for resale;

- Upon receipt - in relation to paid material assets, raw materials, services, works;

- Upon the start of operation - in relation to purchased and paid for operating systems.

An important condition is that only paid VAT can be included in expenses under the simplified tax system.

The added tax must be transferred to costs and operations related to the import of valuables. The simplifier cannot reimburse such additional tax, despite the fact that the subject is obliged to pay it under the simplified tax system.

If the additional tax relates to standardized advertising expenses, then it can be included in expenses within the limits of a certain standard. Input tax above this standard cannot be taken into account in costs.

VAT cannot be classified as an expense for tax purposes if the cost of goods and materials for which it was paid is also not included in the expenses taken into account when calculating the tax burden. An example of such expenses is entertainment expenses.

To write off VAT as an expense, you need to wait until the goods are sold (materials are capitalized or fixed assets are put into operation). When tax is written off on goods purchased for resale, the moment of their actual sale should be taken into account. In this case, the attribution of tax to expenses must be carried out in a part proportional to the cost of the realized values.

What has been written above is true for those simplifiers who take into account the difference between income and expense values to calculate the tax burden. If only income is taxed, then there is no point in taking into account expenses, and therefore there is no need to classify paid input VAT as expenses.

Retail

Situation: how to determine the amount of VAT that can be attributed to expenses on goods sold at retail? The organization applies the simplification and pays a single tax on the difference between income and expenses

There are no clear rules for this in the legislation. Therefore, you need to develop your own procedure and consolidate it in your accounting policy for tax purposes.

Remember two important conditions:

– only that part of the input VAT that corresponds to the volume of goods sold can be attributed to expenses (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation);

– goods sold under simplification are those that have been paid to suppliers and shipped to customers (subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation).

As an accountant, you are required to determine what proportion of the total cost of goods sold is input VAT on those goods that were paid to suppliers. For these purposes, it is better to make monthly calculations based on accounting data.

And since you keep records of goods in sales prices (this is what retail trade organizations do), then calculate the amount of VAT by which you can reduce the tax base on the simplified tax system in two stages. First determine the total amount of input VAT that applies to the goods shipped. Then adjust this amount in proportion to the cost of the paid goods. Include the amount obtained in this way into costs and reflect it in the book of income and expenses.

For the calculation you will need the following indicators:

– receipt of goods for the month at sales prices; – the amount of VAT on purchased goods; – average percentage of trade margin; – volume of goods shipped per month; – volume of realized trade margin.

The initial data for determining these indicators can be the balances and turnover of accounts 19, 41, 42, 60, 90.

Let us use an example to show the general principle of calculating VAT attributed to expenses, without distribution according to different tax rates. If you wish, you can use this scheme separately for each VAT rate (18 and 10%).

An example of determining the amount of VAT that can be attributed to expenses in retail trade. The organization keeps records of goods at sales prices

Alpha LLC was registered in January. Type of activity – retail trade. Immediately after state registration, the organization submitted an application to switch to a simplified system. The object of taxation is the difference between income and expenses.

The accounting policy for accounting purposes stipulates that accounting of goods is carried out at sales prices; separate accounting of individual batches of goods is not maintained.

In January, Alpha purchased goods for resale in the amount of 230,000 rubles. (including VAT at rates of 10 and 18% - 30,000 rubles). Of these, 140,000 rubles were paid. The trade margin is set at 25%. Of the total number of goods purchased in January, goods worth 190,000 rubles were sold during this month.

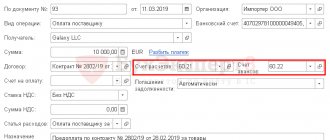

In accounting, these transactions are reflected as follows:

Debit 41 Credit 60 – 200,000 rub. – products are capitalized for resale;

Debit 19 Credit 60 – 30,000 rub. – VAT on purchased goods is taken into account;

Debit 41 Credit 42 – 50,000 rub. (RUB 200,000 × 25%) – the trade margin is reflected;

Debit 60 Credit 51 – 140,000 rub. – part of the purchased goods has been paid for;

Debit 50 Credit 90 – 190,000 rub. – the sales value of the shipped goods is reflected;

Debit 90 Credit 41 – 190,000 rub. – the cost of goods sold is written off;

Debit 90 Credit 42 – 38,000 rub. (RUB 190,000 × 25/125) – the realized trade margin was reversed.

The share of goods sold in the volume of goods purchased in January is:

190,000 rub. : (RUB 200,000 + RUB 50,000) = 0.76

The amount of input VAT that relates to goods sold is equal to:

30,000 rub. × 0.76 = 22,800 rub.

Debit 90 Credit 19 – 22,800 rub. – VAT related to shipped goods is written off as expenses.

The amount of VAT that reduces the tax base for the single tax in January was determined by the accountant as follows:

– purchase cost of goods sold = 152,000 rubles. (RUB 190,000 – RUB 38,000);

– share of paid products = 0.609 (140,000 rubles: 230,000 rubles);

– purchase cost of goods sold for calculating the single tax = 92,568 rubles. (RUB 152,000 × 0.609);

– the amount of VAT that can be accepted as expenses under the simplified tax system = 13,885 rubles. (RUB 22,800 × 0.609).

As of February 1, the organization’s accounting records included:

– balance of goods at sales prices – 60,000 rubles. (RUB 250,000 – RUB 190,000), including markup – RUB 12,000. (50,000 rub. – 38,000 rub.);

– the balance of VAT not written off as expenses is 7,200 rubles. (RUB 30,000 – RUB 22,800);

– unpaid goods – 90,000 rubles. (RUB 230,000 – RUB 140,000).

In February, Alpha did not purchase any new goods for resale and paid suppliers in full for goods purchased in January. Within a month, all goods remaining in the warehouse and on the sales floor were sold.

The following entries were made in accounting:

Debit 60 Credit 51 – 90,000 rub. – part of the purchased goods has been paid for;

Debit 50 Credit 90 – 60,000 rub. – the sales value of the shipped goods is reflected;

Debit 90 Credit 41 – 60,000 rub. – the cost of goods sold is written off;

Debit 90 Credit 42 – 12,000 rub. (RUB 60,000 × 25/125) – the realized trade margin was reversed.

The share of goods sold in the volume of goods purchased in January (taking into account balances as of February 1) is:

60,000 rub. : 60,000 rub. = 1.0.

The amount of input VAT that relates to goods sold is equal to:

7200 rub. × 1.0 = 7200 rub.

Debit 90 Credit 19 – 7200 rub. – VAT related to shipped goods is written off as expenses.

The amount of VAT that reduces the tax base for the single tax in February was determined by the accountant as follows:

– purchase cost of goods sold = 107,432 rubles. (48,000 rub. + 152,000 rub. – 92,568 rub.);

– share of paid products = 1.0 (90,000 rubles: 90,000 rubles);

– purchase cost of goods sold for calculating the single tax = 107,432 rubles. (RUB 107,432 × 1.0);

– the amount of VAT that can be accepted as expenses under the simplified tax system = 16,115 rubles. (RUB 7,200 + RUB 22,800 – RUB 13,885).

Documentary confirmation

Payment orders, cash receipts and other documents with the allocated amount of tax can confirm the payment of VAT (letter of the Ministry of Finance of Russia dated May 31, 2007 No. 03-07-11/147).

To account for input VAT as an expense, you will also need documents confirming its amount (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation). For example, these could be invoices issued by suppliers, invoices (with a separately allocated VAT amount), acts, etc. If an agreement has been concluded with the seller on non-issuance of invoices, the submitted VAT can be included in expenses on the basis of payment documents, checks , strict reporting forms. The main thing is that the amount of VAT in such documents is highlighted. This was stated in the letter of the Ministry of Finance of Russia dated September 5, 2014 No. 03-11-06/2/44783.

Situation: is it possible to include in expenses the amount of input VAT on an invoice issued in violation of the rules? The organization applies the simplification and pays a single tax on the difference between income and expenses

Answer: yes, you can.

Any expenses that can be taken into account when calculating a single tax must comply with the criteria of paragraph 1 of Article 252 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). One of these criteria is confirmation of expenses with documents drawn up in accordance with current legislation.

An invoice is a document necessary in order to accept input VAT for deduction (clause 1 of Article 168 of the Tax Code of the Russian Federation). Organizations using the simplified tax system do not have the right to a VAT deduction. This follows from the provisions of paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation. Therefore, the amount of input VAT can be written off as expenses even without an invoice. For example, if VAT is highlighted in an invoice, act, payment documents. The main thing is that the costs for which VAT is charged to the buyer are included in the list of expenses, which is given in Article 346.16 of the Tax Code of the Russian Federation. And also that these expenses are economically justified and documented (clause 2 of article 346.16, article 252 of the Tax Code of the Russian Federation).

In addition, from October 1, 2014, organizations, by mutual agreement, may not issue invoices (subclause 1, clause 3, article 169 of the Tax Code of the Russian Federation). In this case, VAT can be taken into account in expenses on the basis of payment documents, cash receipts, strict reporting forms with an allocated amount of VAT (letter of the Ministry of Finance of Russia dated September 5, 2014 No. 03-11-06/2/44783).

Thus, an invoice is not a mandatory or exclusive document for accounting for VAT in expenses. Therefore, even if it is executed with violations, the inclusion of VAT in expenses can be justified on the basis of other documents confirming the amount and fact of payment of VAT.

VAT included in advance payment

Situation: is it possible to reduce the tax base for a single tax by the amount of input VAT paid as part of the advance payment? The organization applies simplification. Object of taxation – the difference between income and expenses

Answer: no, you can't.

When calculating the single tax, input VAT can be taken into account only for those expenses that reduce the tax base (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation). Advances issued are not included in the calculation of the tax base. To include expenses in the calculation of the tax base, in addition to payment, a counter termination of the obligation is necessary (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). Therefore, before receiving the property (performance of work, provision of services) for which the advance was transferred, the amounts of preliminary payments cannot be included in expenses (letter of the Ministry of Finance of Russia dated March 30, 2012 No. 03-11-06/2/49). Consequently, before recognizing these expenses, the input VAT paid as part of the advance does not reduce the tax base for the single tax (letter of the Ministry of Finance of Russia dated June 29, 2006 No. 03-11-04/2/135).

If an advance is paid towards the upcoming supply of goods intended for resale, the amount of input VAT can be taken into account after the sale of these goods. That is, after the organization includes the purchase cost of goods sold as expenses.

An example of VAT accounting for purchased goods for subsequent sale

August 10, 2021 I bought 100 office chairs with a total cost of 590,000 rubles. for further resale. The supplier included an added tax of 90,000 rubles in this price. The chairs were paid to the supplier on August 12.

In August, 20 chairs were sold, the buyers paid the full price.

Costs include the cost of twenty chairs sold - 20*5000 = 100,000 rubles.

For the chairs sold, the corresponding share of the added tax can be attributed to expenses.

VAT = 100,000 * 18% = 18,000.

Tax can be paid

Procedure for calculating the amount of compensation

To determine the amount of VAT compensation for enterprises using the simplified tax system, a special formula was developed:

Formula for calculating the amount of VAT compensation

Coefficients for overhead costs and estimated profit were developed specifically for enterprises using a simplified taxation system. They must be applied whenever determining the amount of VAT compensation, regardless of the type of work performed. When determining overhead costs, it is recommended to adhere to the instructions of MDS 81-33.2004.

The purpose of the estimate is to include the minimum amount of costs that are planned to be incurred in the course of the contractor fulfilling its contractual obligations. Even the cost of used office supplies can be included in overhead costs.

Accounting for input tax when transferring activities to the simplified tax system

When switching to the simplified tax system from the main mode, it is necessary to restore the input tax shown in accounting as reimbursed. This is due to the fact that, being on OSNO, the company subtracts input VAT from the total amount of tax payable, and in the simplified system this opportunity is lost.

It is not necessary to restore all VAT deductible, but only its share related to:

- Products purchased on OSNO, but not sold at the time of transition;

- Materials purchased at OSNO but not used;

- Intangible assets and fixed assets - in terms of their value in the residual value on the day of transition.

The restoration procedure boils down to the calculation of tax payable in an amount equal to the restored amount. Having switched to the “simplified” system, the company needs to pay the restored added tax, corresponding to the balances of inventory items in warehouses (purchased and paid for OSNO), as well as the cost of fixed assets and NAMA of the residual type. If a revaluation was performed for a non-current asset, its results are not taken into account when restoring.

The restoration process is carried out in the tax period preceding the transfer of the business to a simplified tax system. The restored value is recorded in expenses (it is not taken into account in the cost of these inventory items, intangible assets, fixed assets).

The restored input tax must be entered into the Sales Book, entries are made on the basis of those invoices on the basis of which the tax was previously deducted. It is necessary to take the same invoices and register the fact of restoration.

If a non-current asset was acquired a long time ago, but its useful life did not end at the time of transfer, then it is possible that there is no longer an invoice for it due to the end of its shelf life. In this case, the registration entry in the Book is made on the basis of a certificate - a document drawn up by an accountant in free form.