Import is the import of products into the Russian Federation from abroad, and export is the sale of products to foreign contractors and their export abroad. Both operations require special accounting.

Question: We import goods and carry out voluntary certification before selling them. Can we take into account these costs as expenses for profit tax purposes, taking into account the fact that these are not our products and certification of this product is not required? View answer

How to keep records of goods exports

Export in economics refers to the export of goods abroad for sale or processing. Goods exported outside the state are recorded by the customs service and drawn up with the relevant documents. Documents accounting for and accompanying the export of goods abroad of the Russian Federation must be drawn up in accordance with the current laws of Russia.

The main laws regulating foreign trade activities are the Federal Law “On Currency Regulation and Currency Control” No. 173-FZ dated December 10 and the Law “On the Fundamentals of State Regulation of Foreign Trade Activity” dated December 8, 2003 No. 164-FZ.

Law No. 173-FZ defines:

- rights and obligations of persons participating in foreign economic transactions;

- currency regulation authorities and foreign exchange control authorities;

- rights and obligations of currency control authorities and agents.

In accordance with Federal Law No. 164-FZ, goods fall under the customs export procedure if the following conditions are met:

- for transactions that are not subject to statutory benefits, all export customs duties have been paid;

- all restrictions and prohibitions are observed;

- For goods included in the consolidated list, a certificate of origin is presented.

Read the article: Modern structure of Russian exports

VAT under simplified tax system

From a tax point of view, exports of goods to EAEU member countries are practically no different from “regular” exports to other countries. In this case, the VAT rate of 0 percent also applies. And it also needs to be confirmed by submitting a package of documents to the tax authority.

Buy the “Kontur.Declarant” service for generating and sending customs declarations

Please note: these responsibilities arise only for organizations and entrepreneurs on the general taxation system (OSNO). After all, in the list of exceptions established by art. 346.11 of the Tax Code of the Russian Federation for payers of the simplified tax system, there is no “export” VAT (as opposed to “import”). This means that for a “simplified” organization, entering foreign sales markets will not bring any special features in terms of taxation at all: no additional responsibilities for collecting documents, drawing up “zero” invoices, drawing up applications and special declarations in this case for they don't arise. Everything is as usual, as if the goods were sold to a Russian counterparty.

Accounting for goods export operations: required documents

When exported from Russia, the goods are taken outside the Russian Federation for subsequent processing or sale, that is, without the right of return. Export is subject to the payment of duties. Their size depends on various reasons and, in particular, is determined by the value of the exported goods, which is declared in the customs declaration. When carrying out export operations, there is a certain procedure.

Accounting for the shipment and sale of goods for export is carried out separately from accounting for the activities of the enterprise in the Russian Federation. The document flow uses primary documents confirming the shipment of goods, their payment, and the services of intermediaries.

All goods transported abroad of the Russian Federation are subject to mandatory customs clearance, which can be carried out:

- by the exporter himself,

- his customs representative,

- by another person on the basis of a power of attorney.

A package of supporting documents is attached to the declaration presented to the customs authority. It is allowed to provide documents in copies, and the customs authority has the right to check any of them for compliance with the original.

Read the article: Customs transit of goods

Receipt of payment from a foreign buyer

According to the conditions of our example, a partial advance payment was first received. Then, at the time of sale, a receivable from the foreign buyer to the Organization was formed under Dt 62.21, calculated at the exchange rate on the date of shipment.

At the moment the buyer repays the debt under the contract in foreign currency, the receivables are revalued at the rate of the Central Bank of the Russian Federation on the day of payment (clause 7 of PBU 3/2006, clause 8 of Article 271 of the Tax Code of the Russian Federation).

As a result, exchange rate differences arise.

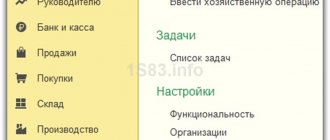

Receipt of payment from a foreign buyer is registered with the document Receipt to current account transaction type Payment from buyer in the Bank and cash desk section – Bank – Bank statements – Receipt button.

The document Receipt to the current account is filled out according to the same algorithm as when receiving an advance from the buyer.

- Amount – payment amount in USD, according to the bank statement.

Postings according to the document

The document generates transactions:

- Dt 62.21 Kt 91.01 – revaluation of accounts receivable in foreign currency;

Calculation of exchange rate differences when revaluing accounts receivable

date Name Amount, USD Well Amount, rub. March 15th Unpaid amount 6 000 62 372 000 March 25 Payment amount 6 000 63 378 000 March 25 Exchange difference +1 +6 000

- Dt Kt 62.21—receipt of payment from the buyer to a transit currency account.

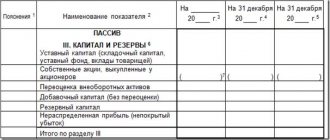

Reporting

In the income tax return:

Positive exchange rate differences are reflected in non-operating income: PDF

- Sheet 02 Appendix No. 1 page 100 “Non-operating income.”

Accounting for export of goods

To obtain reliable information, accounting for the export of goods is carried out in separate sub-accounts, which makes it possible to separate ordinary and foreign economic activities in accounting. Features of accounting and tax accounting for the export of goods include:

1. Settlements under an export contract are most often carried out in foreign currency. To do this you need:

- open foreign currency accounts for each currency separately, and use account 52 in accounting for settlements with the counterparty: Dt 52 Kt 62;

- master currency purchase and sale transactions and reflect them in the report, using account 57 for this purpose (or account 91 depending on the adopted accounting policy):

Dt 57 Kt 52;

Dt 51 Kt 57;

Dt 91 Kt 57 or Dt 57 Kt 91;

- keep records of settlements for each transaction simultaneously in two currencies: foreign and Russian;

- carry out a revaluation of currency balances and debts of counterparties (in currency terms) both on the date of the transaction and on the reporting date, using for this account 91: Dt 91 Kt 52, 62 or Dt 52, 62 Kt 91.

2. Accounting for the export of goods is maintained by the enterprise separately from other accounting, which is due, on the one hand, to the requirements of the law, and on the other hand, to the need to achieve the following goals, which include:

- separation of data on accounting for the export of goods from information on activities subject to VAT at other rates or exempt from this tax (clause 4 of Article 149 and clause 1 of Article 153 of the Tax Code of the Russian Federation);

- control over the completeness of receipt of payment from foreign counterparties (clause 1 of Article 19 of the Federal Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ);

- taking advantage of the opportunity not to charge VAT on advances received from foreign buyers (clause 1 of Article 154 of the Tax Code of the Russian Federation);

- monitoring compliance with the deadlines required to confirm the right to use the zero rate (clause 9 of Article 165 of the Tax Code of the Russian Federation);

- tracking the moment of transfer of ownership of the goods if, according to the international rules for the interpretation of trade terms "Incoterms", it does not coincide with the moment of shipment;

- correct correlation of shipment volumes, which is necessary when calculating VAT.

3. Additional operations arise to account for the export of goods:

- calculation of customs duties and fees (account 76):

Dt 76 Kt 51 (52);

Dt 44 Kt 76;

- in case of a discrepancy between the moments of transfer of ownership of the goods and the moment of shipment, account 45 is used to account for it:

Dt 45 Kt 41 (43);

Dt 90 Kt 45;

- restoration of VAT accepted for deduction and then attributed to export operations (clause 6 of Article 166 of the Tax Code of the Russian Federation);

- penalties and fines for VAT on exports not confirmed on time are charged on Dt 91 Kt 68;

- for unconfirmed exports, VAT is written off as other expenses (Dt 91 Kt 19), three years from the end of the tax period in which the corresponding shipment was made.

The most time-consuming part in accounting for the export of goods is VAT postings. Correct VAT accounting makes it possible to obtain a tax deduction if the right to apply the zero VAT rate is confirmed. In this regard, special attention should be paid to:

- accounting for taxes related to direct export costs;

- distribution of VAT on indirect costs to determine its part attributable to exports;

- correct execution of documents relating to VAT;

- compliance with deadlines for preparing documents confirming the right to tax deductions;

- restoration of VAT accepted for deduction and then attributed to export transactions;

- compliance with the established deadlines for tax accounting when exporting goods for unconfirmed, as well as for later confirmed deliveries;

- a high probability of discrepancy between the accounting periods for export shipments for profit tax purposes and confirmation of the right to deduct VAT on it, which leads to a discrepancy between the tax bases for profit and VAT in the same tax period.

VAT on export costs is accumulated on account 19 with its allocation to a special sub-account: Dt 19 Kt 60.

The tax previously accepted for deduction, when accounting for the export of goods, is restored at the time of their shipment by posting: Dt 19 Kt 68.

The tax on indirect costs is redistributed on account 19 with the transfer of the export part of the tax to the subaccount: Dt 19 Kt 19.

If documents appear confirming the possibility of applying a deduction, then tax is written off from account 19 in the amount corresponding to the documents: Dt 68 Kt 19.

Tax on exports not confirmed on time is charged to the subaccount of account 19: Dt 19 Kt 68.

In this case, the tax on expenses related to it is taken for deduction: Dt 68 Kt 19.

Penalties and VAT fines for exports not confirmed on time are charged on Dt 91 Kt 68.

If the export is subsequently confirmed, then this part of the tax is accepted for deduction (clause 10 of article 171, clause 3 of article 172 of the Tax Code of the Russian Federation): Dt 68 Kt 19.

For unconfirmed exports, VAT is written off as other expenses - Dt 91 Kt 19 - three years from the end of the tax period in which the corresponding shipment was made.

Read the article: Analysis of Russian exports

Transfer of advance payment to customs

The transfer of the advance payment to customs is reflected in the document Write-off from the current account type of operation Other settlements with counterparties in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Let's look at the features of filling out the document Write-off from a current account using an example.

Filling out the document:

- Type of operation – Other settlements with counterparties ;

- The contract is the basis for settlements with customs. Type of contract Other .

- Settlement account - 76.09 “Other settlements with various debtors and creditors.”

Postings according to the document

The document generates the posting:

- Dt 76.09 Kt 51 – advance payment transferred to customs (customs duty).

Features of tax registration

When goods cross the border, the exporter charges and pays VAT at the usual rate. The basis for calculating VAT is the amount consisting of the value of the goods according to the declaration, as well as duties and excise taxes. If VAT is not paid, the goods will not be able to leave the temporary storage area at customs. If payment is late, a penalty will be charged on the unpaid amount. Upon subsequent confirmation of export, the exporter has the right to deduct the amount of paid “unconfirmed” VAT if the following conditions are met:

- The goods have been registered.

- Revenue from transactions with goods is subject to VAT.

- All primary documents for the goods and their transportation have been collected.

- Customs VAT has been paid in full.

If a simplified taxation scheme is used, then when accounting for the export of goods, VAT is not applied to the deduction. In this case, actions with VAT depend on what object of taxation is used. If “income” is used as the object of taxation, then VAT is included in the cost of the goods or fixed assets. When applying the “income minus expenses” scheme, the tax amount is included in the costs that reduce the taxable base.

Results

Reflection of export-related transactions in accounting occurs with certain features.

They are determined both by the need to use those accounting accounts (or analytics on them) that may not be in demand in the absence of exports, and by the special procedure for conducting transactions on VAT accounts. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for the export of goods outside the Customs Union

Below is a table with questions related to the export of goods, tax and accounting of export transactions, which most often arise in the practical activities of exporters. For each of them, the table provides links to the relevant legal acts in which answers to them can be found. We are talking about accounting for the shipment and sale of goods for export outside the Customs Union.

A detailed analysis of accounting for the export of goods requires a large amount of information about the market, which the enterprise often does not have. Therefore, it is worth turning to professionals. Our information and analytical department is one of those that stood at the origins of the business of processing and adapting market statistics collected by federal departments.

Find out more

Quality in our business is, first of all, the accuracy and completeness of information. When you make a decision based on data that is, to put it mildly, incorrect, how much will your loss be worth? When making important strategic decisions, it is necessary to rely only on reliable statistical information. But how can you be sure that this information is reliable? You can check this! And we will provide you with this opportunity.

You can find out all the details by calling: +7 (495) 565-35-51 and 8 .

Request a call back

I'm not guilty!

But there are other arguments to avoid a fine.

So, almost every exporter who finds himself in such trouble has a completely fair question: why should he be responsible for the actions of the buyer?

Indeed, according to Article 1.5 of the Code of Administrative Offenses of the Russian Federation, a fine can be imposed on an organization only if its guilt in the violation has been established and proven. And a legal entity is found guilty only when it is established that it had the opportunity to comply with the rules and regulations, but it did not take all possible measures to comply with them (Article 2.1 of the Code of Administrative Offenses of the Russian Federation). Moreover, it is the body that made the decision to impose a fine that must prove the organization’s guilt (in our case, this is the customs authority, where, by the way, materials about the violation can easily be transferred by tax authorities checking the validity of the organization’s refund of “export” VAT).

However, despite the fact that the burden of proving the guilt of the organization lies with customs officers, it also does not hurt the exporter to take care of collecting evidence confirming his innocence. In particular, the fact that he took all measures within his power to ensure the timely receipt of foreign currency earnings. For example , evidence of such a fact may be information collected before the conclusion of the contract about the reliability and business reputation of the foreign partner. On the same scale will fall the direction of various types of claims, demands, etc. to the counterparty who has violated contractual obligations, as well as the filing of a corresponding claim in court.