The Tax and Duties Service administers the timeliness and correctness of calculation of tax liabilities to the budget of the Russian Federation, submission of reports and required documentation. The Federal Tax Service has the right to punish an organization or private entrepreneur for violating fiscal legislation on many grounds, but we will focus on the most widespread:

- violation of reporting deadlines;

- violation of deadlines for transferring payments to the budget system of the Russian Federation;

- erroneous determination of the tax base when calculating liabilities;

- failure to provide required documentation;

- concealment of information about current accounts, changes in management, etc.

The Tax Code provides for separate articles regulating the amount of penalties. But not many people know that the amount specified in the request for payment of a fine can be reduced several times. To do this, you will need to submit a petition to the tax office to reduce the amount of the fine.

What are they punished for?

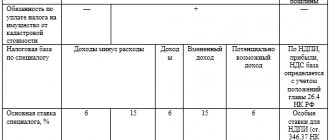

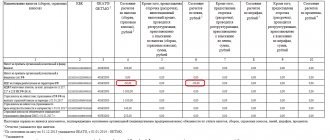

A fine is one of the types of sanctions applied by tax authorities to violators of legislation on taxes and fees. Responsibility for committing tax offenses is established in Chapter 16 of the Tax Code of the Russian Federation. The most frequently applied fines by the inspectorate are shown in the table below:

| Type of violation | Amount of fine | Article of the Tax Code of the Russian Federation |

| Conducting business activities without registration | 10% of income received from illegal business activities, but not less than 40,000 rubles. | 116 p. 2 |

| Submitting an application for registration with the Federal Tax Service in violation of the deadline | 10,000 rub. | 116 paragraph 1 |

| Failure to submit a declaration | 5% of the unpaid tax amount for each month before the date of actual submission of the declaration. The maximum fine is 30% of the above amount, the minimum is 1000 rubles. | 119 |

| Violation of the reporting procedure (submitting a paper report instead of an electronic one) | 200 rub. | 119.1 |

| Gross violation of accounting rules | During one tax period - 10,000 rubles. More than one period - 30,000 rubles. If the violation led to an underestimation of the tax base - 20% of the amount of arrears, but not less than 40,000 rubles. | 120 |

| Non-payment of tax as a result of underestimation of the tax base or other incorrect calculation | By negligence - 20% arrears. Intentionally - 40% of arrears | 122 |

| Failure to fulfill the duties of a tax agent (for example, failure to withhold or transfer personal income tax to the budget) | 20% of the amount to be withheld or transferred | 123 |

| Failure to provide documents or information about taxpayers at the request of the Federal Tax Service | 10,000 rub. | 126 |

Inspectorate notification

The company will have to pay high fines if it does not notify the Federal Tax Service about the opening of a bank account. Yes, when opening an account on the territory of the Russian Federation and abroad in a Russian bank, there is no need to notify the tax authorities; this obligation has been removed since 2014, but when opening an account in a foreign bank, the company is obliged to notify the Service within a month. If the message is not sent, a fine for officials is from 40,000 to 50,000 rubles, and for an organization - from 800,000 to 1,000,000 rubles in accordance with Part 2.1 of Article 15.25 of the Code of Administrative Offenses.

Types of mitigating circumstances

If the fine is applied lawfully, and the taxpayer agrees that he has violated the legislation on taxes and fees, it will have to be paid to the budget. When deciding whether to prosecute, the Federal Tax Service always applies the maximum possible punishment. But it can be easily reduced if there are mitigating circumstances to reduce the tax fine, which include:

- committing an offense for the first time;

- admission of guilt and repentance;

- absence of malicious intent;

- difficult financial situation of the company (large accounts payable, pre-bankruptcy);

- social significance of the organization’s activities in the field of construction, housing and communal services, healthcare, etc.;

- status of a budgetary institution;

- slight delay in reporting due to technical problems;

- no damage to the budget (for example, the declaration was not submitted on time, but the tax was paid on time and in full);

- independent identification and correction of errors in accounting and tax calculation;

- a significant volume of requested documents, and the taxpayer is forced to take active measures to extend the deadline for submission;

- lack of requested documents as a result of their destruction (for example, in a fire);

- If the punishment is imposed on an individual entrepreneur or another individual, then a serious illness, disability, the presence of dependent children, etc. are recognized as a mitigating circumstance.

Not only the tax office, but also the court can cancel or reduce the fine. Use the free instructions from ConsultantPlus to achieve justice.

Grounds for mitigation of punishment

Circumstances that could lead to a mitigation of administrative liability are specified in the Tax Code of the Russian Federation. They apply to both individuals and legal entities. Directors of organizations can also apply for a reduction in the fine.

There are 4 groups of circumstances, distinguished depending on the status of the tax-paying entity:

- Are common;

- For citizens;

- For organizations;

- For individual entrepreneurs.

The first of them includes the following items:

- Lack of connection between the imposed punishment and the offense committed;

- Difficult financial situation of the taxpayer;

- Funds for the debt were transferred to the tax office account before its employees made a final decision on the case;

- At the end of the current year there is an overpayment of taxes;

- The violation was detected for the first time;

- The deadline for filing a tax return is short;

- Availability of credit debt from an individual or legal entity.

The above reasons are general.

In addition to these, individuals and individual entrepreneurs may refer to the following:

- State awards;

- Participation in the elimination of natural and man-made emergencies;

- Availability of dependent persons;

- Material difficulties.

Procedure for drawing up applications

Initially, a petition for mitigating circumstances to the tax office is submitted to the inspectorate that imposed it. A little time is allotted for its submission:

- 30 working days from the date of receipt of the inspection report, if penalties were imposed based on the results of an on-site or desk inspection (clause 6 of Article 100 of the Tax Code of the Russian Federation);

- one month from the date of receipt of the act of discovery of a violation of the law, if it was detected outside the scope of the audit.

The petition should include all mitigating circumstances that the company has. Usually at this stage it is possible to reduce the size of sanctions.

If an organization has submitted a petition to the tax office to reduce the fine for late submission, but the Federal Tax Service Inspectorate has not responded to it in any way, then it should contact the Federal Tax Service. To do this, a complaint is drawn up to a higher authority, which lists all the circumstances that were not taken into account when the inspectorate made a decision, mitigating the company’s guilt. If the Federal Tax Service does not reduce the amount or reduces it slightly, then it is permissible to challenge the amount of sanctions in court.

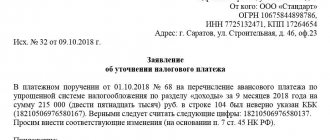

Regardless of where you decide to apply, look at a few rules on how to write a petition to the tax office to reduce the fine, and a sample of such a document.

When drawing up an application, you must indicate:

- name of the tax authority;

- the person from whom the application is submitted;

- circumstances as a result of which penalties were imposed;

- details of the violation detection report;

- circumstances on the basis of which a request for a reduction in penalties is made.

Example of a petition to the Federal Tax Service:

How much will the fine be reduced?

According to paragraph 3 of Art. 114 of the Tax Code of the Russian Federation, if there is at least one mitigating circumstance, the punishment is reduced by at least two times compared to the original amount. At the same time, the Plenum of the Supreme Arbitration Court of the Russian Federation, in paragraph 16 of Resolution No. 57 of July 30, 2013, indicated: in paragraph 3 of Art. 114 of the Tax Code of the Russian Federation establishes only a minimum limit for reducing sanctions. Based on the results of an assessment of the circumstances, the court has the right to reduce the amount of the penalty by more than half and even make it below the minimum amount (see letters from the Ministry of Finance of Russia No. 03-02-08/47 dated May 16, 2012 and No. 03-02-08/7 dated January 30 .2012).

However, neither the Federal Tax Service nor the court has the right to reduce the amount of sanctions to zero, since this is already an exemption from liability for the offense committed.

If there are mitigating facts, only the amount of penalties applied is reduced, but taxes and penalties cannot be reduced on these grounds.

Use the free guide from ConsultantPlus experts to correctly submit an application to the tax office and achieve a reduction in the fine.

How to cancel a fine

If the taxpayer is sure that the punishment imposed by the regulatory authority is unlawful, he has the right to challenge it by filing an objection to the tax authority’s act within the same time frame as the petition for mitigation of sanctions. If the objections are not taken into account and the decision to collect a fine is nevertheless made, then the taxpayer has the opportunity to contact the Federal Tax Service with a complaint about the actions of the Federal Tax Service or with a petition to review the decision. According to its consideration by the Federal Tax Service:

- or will satisfy the taxpayer’s demands for the lifting of sanctions;

- or refuse to satisfy the taxpayer’s demands and leave the decisions of the Federal Tax Service in force.

If the decision of the Federal Tax Service does not suit you, then your only option is to file a claim with the arbitration court to cancel the decision of the lower body.

When drawing up an objection to an act, you must indicate:

- details of the Federal Tax Service;

- details of the person from whom the application is being submitted;

- details of the violation detection report;

- circumstances on the basis of which the taxpayer considers the imposition of penalties illegal.

To submit such a petition, we recommend using the form provided by the Federal Tax Service on the official website in the section “Submitting objections to tax audit reports.”

An objection to the PFR inspection report is also prepared in a similar way. The only difference: the legislation on personalized accounting does not stipulate mitigating circumstances. Therefore, the Pension Fund does not have the ability to cancel or reduce sanctions already imposed; this will have to be done exclusively through the courts.

Results

Any decision to impose penalties by the tax office can be mitigated by filing a petition for this. It is important to comply with the deadlines established for this and correctly draw up the relevant document.

Sources

- https://assistentus.ru/forma/zayavlenie/zayavlenie-v-nalogovuyu/

- https://www.audit-it.ru/articles/account/court/a52/972838.html

- https://moezhile.ru/nalogi/hodatajstvo-v-nalogovuu.html

- https://prodatkvartiry.ru/otvet/xodatajstvo-v-nalogovuyu-inspekciyu-o-snizhenii-ili-otmene-shtrafa-obrazec/.html

- https://o-nedvizhke.ru/dokumenty/xodotajstva/primer-xodatajstva-o-snizhenii-shtrafa-v-nalogovuyu.html

- https://gosuchetnik.ru/shablony-i-formy/obrazets-khodataystva-ob-umenshenii-shtrafa-v-nalogovuyu

- https://ahrfn.com/dokumety/obrazec-xodatajstva-v-nalogovuyu-o-snizhenii-shtrafa.html

- https://clubtk.ru/forms/dokumentooborot/obrazets-khodataystva-ob-umenshenii-shtrafa-v-nalogovuyu

- https://ppt.ru/forms/nalogi/hodatoystvo-umenshenie

- https://centersoveta.ru/yurlikbez/hodatajstvo-o-snizhenii-administrativnogo-shtrafa-sostavlenie-obrazets-i-poryadok-podachi-v-2019-godu/

[collapse]

The amount of the fine for late submission of the 6-NDFL report

Absolutely everyone can refer to these circumstances - both organizations and individual entrepreneurs, regardless of the type of violation committed. Universal circumstances include:

- bringing to tax liability for the first time Resolution of the Federal Antimonopoly Service No. F03-5882/2011; FAS ZSO No. A46-15485/2011; FAS MO No. A40-41701/11-91-182;

- lack of intent to commit a violation of Resolution of the Federal Antimonopoly Service of the Moscow Region No. KA-A40/8428-11; FAS CO No. A35-12974/2010; FAS UO No. F09-6797/12;

- repentance and admission of guilt Resolution of the Federal Antimonopoly Service No. F03-6045/2011; FAS VSO No. A33-14958/2009; 3 AAS No. A74-1782/2010; 14 AAS No. A05-9841/2010; 8 AAS No. A81-4424/2010;

- good faith of the taxpayer, which consists in timely payment of all taxes and submission of reports Resolution of the Federal Antimonopoly Service No. F03-5882/2011; FAS SKO No. A32-35211/2010.