Correct organization of accounting

For the most part, it is used motor oils that need to be taken into account. They are required to operate the car. Let's consider the main features of their accounting:

- Establishment of the hazard class of oils. In this case, the current waste classifier is used.

- Organization of temporary storage of oil. In this case, you need to take care of the availability of documentation.

- Timely inventory.

Used oil is considered waste if it does not meet the requirements of TR TS030/2012.

Vegetable oil accounting

Vegetable oil, unlike motor oil, may not be a waste. It can be sent for recycling. Used oil is processed, for example, into biofuel. For processing, the oil is sold to other organizations.

Purchase accounting

Oil accounting is carried out according to the Instructions for using the Chart of Accounts established by Order of the Ministry of Finance No. 94n dated November 30, 2000. These accounts are used for accounting:

- Account 10. Used to summarize information about the movement of raw materials.

- Account 41. Needed to summarize information about the availability of inventory items purchased as products for sale.

- Subcount 10-1. Serves to account for raw materials used in the manufacture of goods.

- Subaccount 41-1 “Products in warehouses”. Serves to record the availability or movement of inventories stored at bases.

The raw material accounting method that can be used by enterprises was established by Roskomtorg No. 1-1098/32-2 dated August 12, 1994.

Vegetable oil is accepted for accounting at actual cost or at supplier cost. The latter method can be used by companies that use simplified accounting methods. When the oil enters the kitchen, its cost is written off as expenses. The corresponding operation is recorded in the DT account 20 “Production”. The account corresponds with CT accounts 10 or 41.

If a company is recognized as a micro-enterprise, it can include the cost of oil in its cost structure at the time of purchase. That is, there is no need to recognize raw materials as inventories (clause 13.2 of PBU 5/01). The cost of purchased oil is recorded on the DT account 20. It corresponds with account 60.

The cost of used vegetable oil is included in the structure of material expenses. It is included in this composition at the cost of purchase. This includes transportation costs and other incidental expenses. The basis is subparagraph 1 of paragraph 1 and paragraph 2 of Article 254 of the Tax Code of the Russian Federation. The date of expenditure in the form of raw materials (referred to as direct expenses) is the date they are sent to production (based on paragraph 2 of Article 272 of the Tax Code of the Russian Federation).

Accounting for waste oil accumulation

Paragraph 57, 111 of the Instructions for accounting of MPZ states that waste generated in departments is delivered to warehouses on the basis of invoices. In this case, it is necessary to reflect the name of the waste and its volume in the invoices. The cost of recorded items is included in the reduction in the cost of raw materials released for use.

To account for movement, it is recommended to use count 10 sub-account 10-6. It is account 10 that is needed when waste is planned to be sold (based on paragraph 218 of the instructions). That is, to account for waste raw materials, this entry is used: DT10 subaccount 6 KT20. Oil is stated at selling price.

If you don’t plan to sell the oil, then you don’t need to record it. This is due to the fact that under such circumstances the raw materials will not meet the characteristics of the asset. Assets are funds that should bring income to the company. Waste materials that are not sold will not generate income.

ATTENTION! Waste raw materials are taken into account when they meet the characteristics of accounting objects. For example, these could be the characteristics of the MPZ. Basis - letter of the Ministry of Finance No. 07-01-10/42253 dated July 22, 2015.

Tax accounting

Used oil is considered returnable waste. The latter are residues that arose during the production process and have already lost their operational characteristics. Article 254 of the Tax Code of the Russian Federation states that material costs are reduced by the cost of waste. It is recommended that the reduction be carried out during the period when the waste is sent to the warehouse on the basis of an invoice or other document.

Implementation of mining

The sale of used oil is not the main activity of the company, and therefore income from the sale should be recognized as part of other income. They are recorded in accounting according to CT account 91. Correspondence is DT account 62.

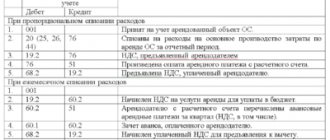

Rented transport

You can obtain a vehicle for temporary possession and use by concluding a vehicle rental agreement with a legal entity or individual.

Under a lease agreement, the lessor (lessor) undertakes to provide the lessee (tenant) with property for a fee for temporary possession and use. Unless otherwise provided by the vehicle lease agreement, the lessee bears the costs arising in connection with the commercial operation of the vehicle, including the cost of paying for fuel and other materials consumed during operation (Article 646 of the Civil Code of the Russian Federation). The parties may provide for mixed terms of payment of rent in the form of a fixed share (direct rent) and payment of compensation for the current maintenance of the leased property, which may vary depending on external factors.

In the case where the costs of fuel and lubricants are borne by the transport employer, accounting for fuel and lubricants is identical to the situation with the operation of his own vehicle. Such a car is simply taken into account not as part of fixed assets, but in off-balance sheet account 001 “Leased fixed assets” in the valuation adopted in the contract. A rental fee is charged for its use, but depreciation is not charged. The rent is included in other expenses associated with production and (or) sales, regardless of who rents the car from a legal entity or an individual (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

At the same time, the status of a lessor affects the tax consequences for other taxes. So, if a car is rented from an individual, he has taxable income. As for the Unified Social Tax, it is necessary to distinguish between renting a vehicle with and without a crew (clause 1 of Article 236 and 3 of Article 238 of the Tax Code of the Russian Federation).

A waybill is issued for the rented car for the duration of the work, since the organization disposes of the car. And clause 2 of clause 1 of Article 253 of the Tax Code of the Russian Federation allows to include in expenses that reduce taxable income all funds spent on the maintenance and operation of fixed assets and other property that is used in production activities. This also applies to fuels and lubricants that are used on a rented car.

Organization of motor oil accounting

Used motor oil must not be discharged into the environment. It is also prohibited to spray and burn it, pour it into water bodies, or pour it onto the soil. That is, you won’t be able to simply dispose of the oil. This is due to the threat to the environment. It is important to properly organize the collection of used oil. To do this, follow these steps:

- Appointment of those responsible for the collection and storage of raw materials.

- Organization of collection points that contain all the necessary containers.

- Search for opportunities for further use of the oil.

- Ensuring control, creating reporting.

- Providing safety training when interacting with waste.

Used oil must be recycled. An alternative option is regeneration to reuse raw materials.

Accounting Features

Accounting for used oil is the work of specially appointed persons with appropriate responsibility. For accounting, you need to create a waste movement log. It is managed by responsible persons. They must be appointed by order of the manager. These persons will be responsible for the truthfulness of all information entered into the journal. Accounting is carried out by accountants on the basis of invoices.

Legislative regulation

The main provisions and responsibilities for waste management are contained in Federal Law-89. Responsibility for waste disposal lies with the original owner, the organization where it was generated.

Production waste is divided into irrecoverable and returnable. The first are materials with completely lost original useful properties. Their implementation or reuse is not possible. The latter can be used in production or sold for further use.

Is there a list of goods, packaging of goods that are subject to disposal after they lose their consumer properties?

Irrevocable waste is not reflected separately in the balance sheet. These are production (technological) losses, the standard of which is included in the consumption rates of raw materials when calculating the cost of the finished product: shrinkage, volatilization, waste, evaporation. According to the “Basic provisions for calculating the cost of products” clause 27 (approved 20/07/70, valid document), irrecoverable waste is not subject to assessment. This means that the accountant does not need to determine their value and create postings. We can say that indirectly their disposal is paid for by the company itself through the mechanism for calculating production costs. All that is required is their technological accounting.

Returnable waste can be disposed of directly. Federal Law 89 defines waste disposal as its use in the production of products, services, and work. At the same time, for accounting purposes, residues of materials that have retained all their consumer properties and are transferred to other departments and workshops are not recognized as waste (Article 254-6 of the Tax Code of the Russian Federation).

What are the standards for recycling waste from the use of goods?

Accounting for motor oil in accounting

In which account should Tosol be taken into account - 105 36 or 105 33?

In accordance with the dictionary of financial and legal terms, fuels and lubricants as a special type of inventory include:

- fuel (gasoline, diesel fuel, liquefied petroleum gas, compressed natural gas);

- lubricants (motor, transmission and special oils, greases);

- special fluids (brake and coolant).

The definition of fuels and lubricants in the dictionary is taken from the Guidelines for accounting of fuels and lubricants in agricultural organizations, approved. Ministry of Agriculture of Russia 05/16/2005. This is a departmental regulatory act that is applied only by agricultural organizations.

Antifreeze is a trade designation for non-freezing coolant; its main components are water and alcohol derivatives. The composition of coolants is regulated by the document “GOST 28084-89 (ST SEV 2130-80). State standard of the USSR. Low-freezing cooling liquids. General technical conditions", approved. and put into effect by Decree of the USSR State Standard of March 30, 1989 No. 913.

Strictly speaking, Antifreeze and other coolants (antifreeze) are not fuels and lubricants in their composition. If we turn to the data of the Unified Commodity Nomenclature for Foreign Economic Activity, approved. by decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54, antifreezes belong to a different nomenclature group, different from fuels and lubricants.

In the All-Russian Classifier of Products by Type of Economic Activity OK 034-2014 (KPES 2008), approved. By order of Rosstandart dated January 31, 2014 No. 14-st, antifreezes were assigned code 20.59.43.120. They are included in group 20.59.4 “Lubricants; additives; antifreezes,” however, are not classified as lubricants and are accounted for under a separate code.

Therefore, Antifreeze can be classified as other inventory - products of the chemical industry and accounted for in account 105 06.

At the same time, many commercial organizations and state (municipal) institutions decide to take into account special fluids (brake and coolant) in the composition of fuels and lubricants. In particular, for planning purposes this was done by the Russian Ministry of Internal Affairs (letter of the Russian Ministry of Internal Affairs dated November 30, 2016 No. 1/12588 “On measures taken to implement the submission of the Accounts Chamber of the Russian Federation”).

By virtue of paragraphs. 117, 118 instructions, approved. By order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, account 105 03 is intended for accounting for fuel and lubricants, which accounts for all types of fuel, fuel and lubricants - firewood, coal, peat, gasoline, kerosene, fuel oil, autol, etc. This list is open.

In addition, according to section. III of Appendix 1 of the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r, the consumption of brake, coolant and other working fluids is controlled and calculated. This circumstance is an additional argument in favor of taking into account Antifreeze in account 105 03.

Due to the fact that there are no clear departmental recommendations or additional clarifications regarding special fluids (brake and coolant), in order to avoid claims from auditors, the institution has the right to fix in the accounting policy the most acceptable accounting account - 105 03 or 105 06.

In our opinion, both options are acceptable and not a mistake. The main thing is that the choice of account is documented. Taking into account current practice, we recommend taking into account special fluids (brake and coolant) on account 105 03 “Fuels and lubricants”.

Accounting for costs of fuels and lubricants (part 3): accounting

Expenses for the purchase of fuels and lubricants are associated with servicing the transportation process and relate to expenses for ordinary activities under the element “Material costs” (clauses 7, 8 of PBU 10/99 “Organization expenses”). Expenses include the sum of all actual expenses of the organization (clause 6 of PBU 10/99)

The organization's accounting department maintains quantitative and total accounting of fuels and lubricants and special liquids. Refueling of vehicles is carried out at gas stations in cash or by bank transfer using coupons or special cards.

Without touching on the specifics of the formation of the initial cost of fuel and lubricants and VAT accounting, let’s say that an accountant, based on primary documents (advance reports, invoices, etc.), receives fuel and lubricants by brand, quantity and cost. Fuel and lubricants are accounted for on account 10 “Materials” subaccount 3 “Fuel”. This is provided for by the Chart of Accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

It is recommended, depending on the location of materials, to use the following groupings of analytical accounting:

- “Fuels and lubricants in warehouses (gasoline, diesel fuel, gas, oil, etc.)”;

- “Paid coupons for gasoline (diesel fuel, oil)”;

- “Gasoline, diesel fuel in car tanks and drivers’ coupons”, etc.

Since there are many types of fuels and lubricants, subaccounts of the second, third and fourth orders are opened to account for them, for example:

- account 10 sub-account “Fuel”, sub-account “Fuels and lubricants in warehouses”, sub-account “Gasoline”, sub-account “Gasoline AI-98”;

- account 10 sub-account “Fuel”, sub-account “Fuels and lubricants in warehouses”, sub-account “Gasoline”, sub-account “Gasoline AI-95”.

In addition, analytical records of issued fuels and lubricants are kept for financially responsible persons - vehicle drivers.

The accountant records the receipt of fuel and lubricants in the materials accounting card according to form No. M-17. An organization can develop its own form of card for recording the receipt and write-off of fuel and lubricants, which is approved by order of the manager or is an appendix to the accounting policy of the organization.

The costs of maintaining the organization's vehicles are written off as the cost of products (works, services). In accounting, costs associated with the transportation process are reflected in balance sheet account 20 “Main production” or 44 “Sales expenses” (only for trade organizations). The costs of maintaining company vehicles are reflected in balance sheet account 26 “General business expenses”. Enterprises with a fleet of cars reflect the costs associated with their maintenance and operation on balance sheet account 23 “Auxiliary production”.

The use of a specific cost account depends on the direction of use of cars. For example, if a truck transported goods for orders from a third-party organization, then the costs of fuel and lubricants are reflected in account 20, and if a passenger car was used for business trips related to the management of the organization, then the costs are reflected in account 26.

In accounting, the write-off of fuel and lubricants is reflected in the accounting entry

Debit 20 (23, 26, 44) Credit 10-3 “Fuel” (analytical accounting: “fuels and lubricants in vehicle tanks” and other relevant subaccounts)

- in the actual quantity consumed based on primary documents.

When releasing fuel and lubricants into production or otherwise disposing of them, their assessment in accounting is carried out in one of the following ways (clause 16 of PBU 5/01 “Accounting for inventories”):

- at the cost of a unit of inventory,

- at the cost of the first purchases (FIFO),

- at the cost of the most recent purchases (LIFO),

- at average cost.

The last method is the most common. The method chosen by the organization must be recorded in the order on accounting policies.

We draw the attention of accountants to the fact that, as a rule, there is always an amount of gasoline (or other fuel) in car tanks, which represents a carryover balance for the next month (quarter). This balance must continue to be taken into account in a separate subaccount “Gasoline in car tanks” (in analytical accounting for financially responsible persons (drivers).

On a monthly basis, the accountant reconciles the results of the issue, consumption and balance of petroleum products in vehicle tanks.

If the cost of expenses for fuel and lubricants accepted in accounting and tax accounting will be different (for example, due to the driver exceeding the standards adopted by the organization for his car), then taxpayers applying PBU 18/02 will have to reflect permanent tax liabilities. This is the requirement of paragraph 7 of this provision, which was approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n.

Let's give an example of accounting for fuel and lubricants using the example of gasoline accounting for a specific driver.

Required invoice to be reflected in motor oil accounting

On what account is motor oil reflected through the sub-report? Can I use 10536? We buy it in packages and fill it right away.

No. Include engine oil in account 105.33 “Inventories – Fuels and lubricants.”

This account takes into account all types of fuel, fuel and lubricants (including motor oil).

Below is a list of values that are taken into account in account 105.36.

When purchasing engine oil through an accountable person, make the following entries:

Debit 0.105.33.340 Credit 0.201.34.660

— motor oil is accepted for accounting.

Then write off the oil for the needs of the institution.

Thus, if motor oil was included in account 105.36, then it is necessary to correct the error in accounting.

Methods for purchasing fuels and lubricants

Currently, institutions can purchase fuels and lubricants from suppliers (these methods are the most common):

- in cash;

- for non-cash payments (payment through coupons and fuel cards).

Cash. When using this method of purchasing fuels and lubricants, the driver is given cash on account, with which he purchases fuels and lubricants at a gas station and then submits a report on the funds spent.

In this case, the internal local act or accounting policy of the institution must be approved:

- a list of drivers entitled to receive cash against a report for the purchase of fuel and lubricants;

- terms for which accountable amounts can be issued;

- the amount of cash for a month (or other period) required for the purchase of fuel and lubricants.

The process of providing drivers with cash includes:

- submission by an accountable person of an application to the head of the institution to receive cash for the purchase of fuel and lubricants;

- approval of the application by the head of the institution;

- filling out an application to receive cash (f. 0531802) and a cash check, if the institution’s personal account is opened with the OFK, or a cash check, if the institution’s current account is opened with a credit institution;

- receiving cash;

- issuing them to an accountable person.

Drivers submit advance reports on the amounts spent.

In the accounting records of institutions, the reflection of transactions to provide drivers with cash and register purchased fuels and lubricants must be documented in the following account correspondence:

| Instruction No. 162n* | Instruction No. 174n** | Instruction No. 183n*** | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Issuance of funds from the cash register for the purchase of fuel and lubricants | |||||

| 1 208 34 560 | 1 201 34 610 | 0 208 34 560 | 0 201 34 610 | 0 208 34 000 | 0 201 34 000 |

| Receipt of fuel and lubricants based on a report submitted by an accountable person | |||||

| 1 105 33 340 | 1 208 34 660 | 0 105 23 340 0 105 33 340 | 0 208 34 660 | 0 105 23 000 0 105 33 000 | 0 208 34 000 |

| Depositing the balance of cash into the institution's cash desk | |||||

| 1 201 34 510 | 1 208 34 660 | 0 201 34 510 | 0 208 34 660 | 0 201 34 000 | 0 208 34 000 |

* Instructions for the use of the Chart of Accounts for Budget Accounting, approved by Order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n.

** Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved by Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

*** Instructions for the application of the Chart of Accounts for accounting of autonomous institutions, approved by Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

From the cash desk of the autonomous cultural institution, cash in the amount of 10,000 rubles was issued at the expense of a subsidy provided for the fulfillment of a state task. under the driver's report for the purchase of fuels and lubricants (other movable property of the institution). The driver submitted an advance report on the cash he spent in the amount of RUB 9,800. The remainder was returned to the institution's cash desk. Fuel and lubricants are accepted for accounting. The institution's personal account is opened in OFK.

In the accounting records of an autonomous institution, these transactions must be reflected in the following correspondence of accounts:

| Debit | Credit | Amount, rub. | |

| Cash was issued from the institution's cash desk against a report for the purchase of fuel and lubricants | 4 208 34 000 | 4 201 34 000 Increase in off-balance sheet account 18 (340) | 10 000 |

| The receipt of fuels and lubricants purchased by the driver is reflected | 4 105 33 000 | 4 208 34 000 | 9 800 |

| The deposit of the balance of cash into the institution's cash desk is reflected | 4 201 34 000 Decrease in off-balance sheet account 18 (340) | 4 208 34 000 |

Cashless payments. With this method of purchasing fuel and lubricants, payments using cash are not made; they are carried out non-cash between the institution and the supplier.

One of the types of non-cash payment for fuel and lubricants is the purchase of fuel coupons by the institution.

With this method, an institution, under an agreement with a fuel supplier, pays for a certain amount of fuel of the corresponding brand, the latter issues coupons to the institution, which are the basis for refueling cars at a gas station.

Based on the documents received from the supplier (invoice, invoice, acceptance certificate, etc.), coupons are subject to posting as monetary documents to the institution’s cash desk. In this case, the receipt order should indicate the brand of fuel, the series and numbers of these coupons, the denomination of the coupons in liters and the cost of the coupon in rubles (based on the cost of gasoline indicated in the contract and invoice for payment).

As necessary, coupons are issued upon reporting to drivers or another responsible person.

When an accountable person provides an advance report with supporting documents received from the gas station that sold fuel and lubricants in exchange for a coupon, the fuel is included as the institution’s inventory.

The autonomous institution, using funds received from income-generating activities, paid the fuel and lubricants supplier in the amount of 15,000 rubles. for fuel coupons. Coupons in the amount of 300 pcs. received at the institution's cash desk. The denomination of the coupon is 20 liters worth 1,000 rubles. From the cash desk of the institution, the driver was given two coupons, according to which he refueled. The accountable person submitted an advance report to the accounting department of the institution.

The following entries must be made in the accounting records of the institution:

| Debit | Credit | Amount, rub. | |

| Coupons for fuel and lubricants have been received at the institution's cash desk | 2 201 35 000 | 2 302 34 000 | 15 000 |

| Two coupons from the cash register were issued to the accountable person (2 x 1,000 rub.) | 2 208 34 000 | 2 201 35 000 | 2 000 |

| Fuel and lubricants received by the accountable person in exchange for fuel coupons are accepted for accounting | 2 105 33 000 | 2 208 34 000 | 2 000 |

Purchasing fuel and lubricants using fuel cards is another type of non-cash payment for fuel and lubricants.

The supply of fuel and lubricants at gas stations is carried out using fuel cards, which are cards containing a magnetic strip or microchip, which store information about the amount of prepaid fuel or limits on the supply of certain types of fuel. That is, a fuel card in this case is a technical means for dispensing fuel and lubricants at gas stations that accept cards.

After refueling using a fuel card, the gas station operator issues a receipt to the driver, which confirms the transaction and reflects the amount of fuel poured into the tank.

The process of providing fuel and lubricants vehicles includes in this case:

1) conclusion of an agreement with a fuel and lubricants supplier, which specifies:

- the name of the purchased fuels and lubricants and their cost;

- cost of a fuel card (if it is given for a fee);

- type of fuel card;

- payment terms (partial or 100% advance payment);

- date of transfer of ownership of fuel and lubricants and other conditions. Typically, ownership of fuel and lubricants transfers when the vehicle is refueled at a gas station;

2) transfer of advance payment for fuel and lubricants;

3) issuing fuel cards to drivers.

At the end of the month, the fuel supplier submits the following documents to the institution:

- invoice for the volume and cost of fuel and lubricants received;

- invoice;

- detailed report on transactions performed using fuel cards.

In the accounting records of institutions, the reflection of transactions for the purchase of fuel and lubricants using fuel cards should be recorded in the following entries:

| Instruction No. 162n | Instruction No. 174n | Instruction No. 183n | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Reflection of costs for production of fuel cards | |||||

| 1 401 20 226 1 109 61 226 1 109 71 226 1 109 81 226 1 109 91 226 | 1 302 26 730 | 0 401 20 226 0 109 60 226 0 109 70 226 0 109 80 226 0 109 90 226 | 0 302 26 730 | 0 401 20 226 0 109 60 226 0 109 70 226 0 109 80 226 0 109 90 226 | 0 302 26 000 |

| Payment for fuel card production services | |||||

| 1 302 26 830 | 1 304 05 226 1 201 21 610 | 0 302 26 830 | |||

| Advance payment for fuel and lubricants | |||||

| 1 206 34 560 | 1 304 05 226 1 201 21 610 | 0 302 26 830 | 0 201 11 610 | 0 302 26 000 | 0 201 11 000 0 201 21 000 |

| Receipt of fuels and lubricants based on reports submitted by the driver and fuel supplier | |||||

| 1 105 33 340 | 1 302 34 730 | 0 105 23 340 0 105 33 340 | 0 302 34 730 | 0 105 23 000 0 105 33 000 | 0 302 34 000 |

| Advance payment offset | |||||

| 1 302 34 830 | 1 206 34 660 | 0 302 34 830 | 0 206 34 660 | 0 302 34 000 | 0 206 34 000 |

A budgetary institution entered into an agreement with a supplier for the supply of fuel and lubricants on a non-cash basis using funds received from income-generating activities. The institution made an advance payment to the supplier for fuel and lubricants in the amount of 12,000 rubles. The institution's personal account is opened in OFK.

According to the supplier’s primary documents and data from gas station receipts presented by drivers to the accounting department, fuel and lubricants (other movable property of the institution) were taken into account in the amount of 12,000 rubles.

In the accounting records of an autonomous institution, these transactions must be reflected as follows:

| Debit | Credit | Amount, rub. | |

| Pre-payment for fuel and lubricants has been made | 2 206 34 560 | 2 201 11 610 Increase in off-balance sheet account 18 (340) | 12 000 |

| Fuel and lubricants issued to the company's drivers at gas stations have been capitalized | 2 105 33 340 | 2 302 34 730 | 12 000 |

| Advance payment for fuel and lubricants has been credited | 2 302 34 830 | 2 206 34 660 | 12 000 |

Changing engine oil: everything an accountant needs to know. How to write off oil as consumption according to NU and BU

› › Based on the results of the inspection, act No. 4 dated June 28, 2013 was drawn up... An act for writing off motor oil sample An act for tires subject to write-off due to manufacturing defects or. Legislative and regulatory acts by date of adoption. An example of calculating the engine oil consumption of an onboard truck MAZ-5335: Initial.

engine oil consumption rate - 2.9 l / 100 l of fuel consumption;. Motor oil "Castrol" semi-synthetic 10W-40. 000351. The procedure for drawing up a materials consumption report (incl.

its form), as well as a list. The write-off of fuel and lubricants is carried out on the basis of the Guiding Document.

Accounting for motor oil in accounting

- The procedure for accounting and writing off fuel and lubricants according to waybills in 2017-2018

- The concept of fuels and lubricants

- Appendix No. 1

- Interesting publications:

- Write-off of fuels and lubricants.

- Write-off of motor fuel in public sector institutions

- Used grease must be properly disposed of

- Interesting publications:

- Accounting and disposal of used motor oils

Write-off of fuels and lubricants.

The basic fuel consumption value is determined for each model, brand or modification of the car as a generally accepted norm.

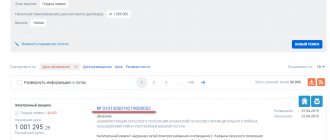

Accounting for fuel and lubricants in 1C 8.3: step-by-step instructions

From simple for individual companies to complex automation of large holdings.

Submission of regulated reporting in accordance with the legislation of the Russian Federation.

Institutions and organizations with vehicles are forced to buy gasoline, diesel fuel and other fuels and lubricants every day. The most common ways to purchase fuel and lubricants are in cash or with an advance report, as well as using fuel cards.

Let's look at how these methods of accounting for fuel and lubricants are implemented in 1C: Accounting 8.3.

About the device and operation of the car

Does a medical institution need to issue waybills? What form should this primary accounting document have? What violations in the issuance of waybills are revealed during control activities?

By what standards is fuel and lubricants written off? What mistakes are most often made in writing off fuel and lubricants?

7 Instructions No. 157n and art. 9 of the Accounting Law. Accepted for accounting

How to draw up an act for writing off motor oil and spare parts for a car used in production?

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

- Accounting and Taxation

06/27/2014 subscribe to our channel How to correctly draw up an act for writing off motor oil and spare parts for a car that is used for production purposes?

Is it necessary to indicate in the report the reason for replacing a particular part of a car or special equipment? The procedure for writing off inventories is provided for in paragraph 98 of the Methodological Instructions for Accounting for Inventories, approved.

by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, which in particular states: “For actually consumed materials, the division receiving the materials draws up an expense report, which indicates the name, quantity, accounting price and amount for each name, number (code) and (or ) order name

Accounting for costs of fuels and lubricants (part 2): waybills

The purchase of fuel and lubricants does not yet indicate their actual consumption on a car used for business purposes. Confirmation that the fuel was spent for production purposes is a waybill, which is the basis for writing off fuel and lubricants as cost. This is confirmed by the tax authorities (letter of the Moscow Tax Administration No. 26-12/31459 dated April 30, 2004) and Rosstat (letter of the Federal State Statistics Service dated February 3, 2005 No. IU-09-22/257 About waybills)

The waybill contains speedometer readings and fuel consumption indicators, and indicates the exact route, confirming the production nature of transportation costs.

Primary documents can be accepted for accounting if they are drawn up in a unified form (Clause 2, Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”).

Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78 approved the following forms of primary documentation for recording the operation of vehicles:

- waybill logbook (form No. 8);

- waybill for a passenger car (form No. 3);

- waybill for a special vehicle (form No. 3 (special));

- passenger taxi waybill (form No. 4);

- waybill for a truck (form No. 4-s, form No. 4-p);

- bus waybill (form No. 6);

- waybill for a non-public bus (form No. 6 (special));

- waybill (form No. 1-T).

Since most organizations operate company cars or trucks, they use waybill forms for these vehicles.

A truck waybill (forms No. 4-c or No. 4-p) is the main primary document for payments for the transportation of goods, writing off fuel and lubricants as expenses for ordinary activities, calculating the driver’s wages, and also confirms the production nature of the expenses incurred. When transporting commercial cargo, waybills of forms No. 4-c and No. 4-p are issued to the driver along with the consignment note.

Form No. 4-c (piecework) is used subject to payment for vehicle work at piecework rates.

Form No. 4-p (time-based) is used subject to payment for vehicle work at a time-based rate and is designed for simultaneous cargo transportation for up to two customers during one working day (shift) of the driver.

Tear-off coupons of the waybill, forms No. 4-c and No. 4-p, are filled out by the customer and serve as the basis for the organization-owner of the vehicle to present an invoice to the customer. The corresponding tear-off coupon is attached to the invoice.

The waybill, which remains with the organization that owns the vehicle, repeats identical entries about the time the vehicle was operated by the customer. If goods are transported by a vehicle operating on a time-based basis, then the numbers of the invoices are entered in the waybill and one copy of these invoices is attached. Waybills are stored in the accounting department together with shipping documents for their simultaneous verification.

The waybill for a company car (Form No. 3) serves as the main primary document for writing off fuel and lubricants for expenses associated with managing the organization.

The journal for recording the movement of waybills (form No. is used by the organization to register the waybills issued to the driver and the waybills handed over to the accounting department after processing.

is used by the organization to register the waybills issued to the driver and the waybills handed over to the accounting department after processing.

All waybills are issued in one copy and stored for five years.

The waybill is issued to the driver by the dispatcher or another employee authorized to release him for the trip. But in small organizations this may be the driver himself or another employee who is appointed by order of the head of the organization.

The waybill must include the serial number, date of issue, stamp and seal of the organization that owns the car.

The waybill is valid for one day or shift only. For a longer period, it is issued only in the case of a business trip when the driver performs a task for more than one day (shift).

The route of transportation or official assignment is recorded at all points of the vehicle's route on the waybill itself.

Responsibility for the correct execution of the waybill lies with the heads of the organization and those responsible for operating the vehicles and participating in filling out the document. This is once again emphasized in the already mentioned letter of the Federal State Statistics Service (Rosstat) dated 02/03/2005 No. ИУ-09-22/257 “On waybills”. It also says that all details must be filled out in unified forms. Employees who completed and signed the documents are responsible for the accuracy of the data contained therein.

If the waybill is filled out incorrectly, this gives the inspection authorities grounds to exclude fuel costs from expenses.

An accountant who takes into account fuel and lubricants should be especially interested in the right front part of the waybill. Let's look at it using the example of a passenger car waybill (form No. 3).

The speedometer readings at the beginning of the day of work (the column next to the signature authorizing departure) must coincide with the speedometer readings at the end of the previous day of operation of the car (the column when returning to the garage). And the difference between the speedometer readings for the current day of work should correspond to the total number of kilometers traveled per day, indicated on the reverse side.

The “Fuel Movement” section is completed in full with all details, based on actual costs and instrument performance.

The remaining fuel in the tank is recorded on a sheet at the beginning and end of the shift. The calculation of consumption is indicated according to the standards approved by the organization for this machine. Compared to this norm, the actual consumption, savings or excess consumption in relation to the norm is indicated.

To determine the standard fuel consumption per shift, you need to multiply the vehicle mileage per working day in kilometers by the standard gasoline consumption in liters per 100 kilometers, and divide the result by 100.

To determine the actual fuel consumption per shift, the amount of fuel filled into the car tank during the shift should be added to the remaining fuel in the car tank at the beginning of the shift, and from this amount subtract the remaining gasoline in the car tank at the end of the shift.

The reverse side of the sheet indicates the destination, time of departure and return of the car, as well as the number of kilometers traveled. These indicators are the most important; they serve as the basis for including the cost of consumed fuel in expenses and confirm what operations were associated with the use of the machine (receiving valuables from suppliers, delivering them to customers, etc.).

The lower part of the reverse side of the waybill is important for the drivers' payroll.

At the end of this section, a few words about whether waybills should be filled out only for drivers.

Sometimes such a conclusion is drawn from the text of the Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78 (hereinafter referred to as Resolution No. 78) and the sheet forms themselves. And they draw the following conclusion: if the staffing table does not directly provide for the position of a driver, then there is no obligation for the organization to draw up the corresponding document. In the author’s opinion, this is incorrect; a driver is a function, not just a position. It is important that the organization’s official vehicle is operated, and who controls it is the organization’s business. For example, a company car can be driven by a director or manager, and expenses for it will also be taken into account only on the basis of a travel document. In addition, if this document is not available on the road, the employee who actually performs the functions of a driver may have problems with traffic police officers.

Formally, waybills are issued by organizations. This is stated in Resolution No. 78. Entrepreneurs, on formal grounds, should not fill out a waybill, since, according to Article 11 of the Tax Code of the Russian Federation, they are individuals. But they use transport for production purposes. And the Ministry of Taxes and Taxes of Russia, in a letter dated October 27, 2004 No. 04-3-01/ [email protected], drew attention to the fact that waybills should be used by them.

Fuel and lubricants: organization of accounting and write-off

Important September 08, 2021

13:16 Author: Magurina L., expert of the information and reference system “” Does a medical institution need to issue waybills?

7 Instructions No. 157n). Primary accounting documents are accepted for accounting if they are compiled according to unified document forms approved in accordance with the legislation of the Russian Federation, legal acts of authorized executive authorities, and documents whose forms are not unified must contain the mandatory details listed in paragraph.

About the device and operation of the car

The presence of vehicles forces an autonomous institution to purchase fuel and lubricants.

The main purpose of accounting for this type of non-financial assets is to ensure the legality of its expenditure. Strict compliance with the requirements of regulations governing its regulation is of particular importance. As inspection practice shows, the largest number of violations are associated with the deregistration of fuel.

We will tell you how to avoid accounting errors in this article. Consumption rates of fuels and lubricants The autonomous institution carries out its activities in accordance with the financial and economic activity plan.

Planning of expenses for fuels and lubricants, as well as maintaining statistical reporting, determining the cost of transportation of vehicles is carried out in accordance with the Order of the Ministry of Transport of the Russian Federation dated March 14, 2008 N AM23r “On the implementation of Methodological Recommendations “Consumption standards for fuels and lubricants in road transport” (hereinafter referred to as Recommendations )

How to write off motor oil

Contents In order to legally write off fuels and lubricants, as well as to correctly draw up the act, a special commission consisting of at least two people must be created in the organization. For her appointment, the head of the enterprise issues a separate order.

The commission should include employees from various departments, as well as a financially responsible person.

In this case, it is advisable to allocate a chairman and ordinary members to the commission.

The commission’s tasks include reconciling actual fuel costs with the standards established by the company (it should be noted that they are different for each type of transport and must be approved separately), conducting test trips with drivers to check the amount of daily fuel, oil consumption, etc. , as well as collection of waybills for the reporting period. NOTE! The creation of a commission is required only in large organizations; small businesses can do without it: here, to write off fuel and lubricants, a simple written decision of the head of the company is sufficient.

Receipt of fuel and lubricants according to advance report

To reflect the driver’s independent purchase of gasoline using cash issued to him, we draw up an advance report. In this case, you first need to formalize the issuance of funds to the reporting employee. The issuance of money from the cash register is recorded in the document “Issuance of cash” with the type of operation “Issue to an accountable person.”

Now let’s create the “Advance report” itself through “Bank and cash desk” - “Advance reports”.

Using the “Create” button, we create a new document in which we fill out the first tab “Advances”: we record the document for issuing the advance (we have “Cash Withdrawal”), and at the bottom – the documents attached to the report. Next, we proceed to filling out the tabular part, in which we select the purchased product range (Ai-95 Gasoline), indicating the quantity and price.

Thus, we capitalized fuel and lubricants through an advance report. His postings are Dt. 10.3 - Kt. 71.01. By clicking the “Print” button we get a printed form of the document.

Systematization of accounting

12/27/2018 Contents The write-off of fuel and lubricants is carried out on the basis of the Guiding document RZ112194-0366-03 “Standards for the consumption of fuel and lubricants in road transport” approved by the Ministry of Transport of Russia on April 29, 2003.

Fuel consumption standards are intended for organizations operating automotive vehicles in the Russian Federation, regardless of their form of ownership. The basic fuel consumption value is determined for each model, brand or modification of the car as a generally accepted norm. The write-off standards for fuel and lubricants are set in liters per 100 km.

To establish fuel consumption standards.

lubricants and correction factors that increase or decrease the basic rate for each vehicle are established by order of the manager in accordance with the requirements of the Fuel Consumption Standards.

Fuel consumption rates may increase under the following conditions: 1.

Systematization of accounting

12/27/2018 Contents The write-off of fuel and lubricants is carried out on the basis of the Guiding document RZ112194-0366-03 “Standards for the consumption of fuel and lubricants in road transport” approved by the Ministry of Transport of Russia on April 29, 2003.

Fuel consumption standards are intended for organizations operating automotive vehicles in the Russian Federation, regardless of their form of ownership. The basic fuel consumption value is determined for each model, brand or modification of the car as a generally accepted norm. The write-off standards for fuel and lubricants are set in liters per 100 km.

To establish fuel consumption standards. lubricants and correction factors that increase or decrease the basic rate for each vehicle are established by order of the manager in accordance with the requirements of the Fuel Consumption Standards.

Fuel consumption rates can increase under the following conditions: 1. When vehicles operate in the winter season, depending on the climatic conditions of the country's regions - from 5 to 20%.

zakon-nedvizhimost.ru

RAL -430; -43202; -5557; -4320 2.8 0.4 0.15 0.35 KamAZ-4310, -5320, -5321 all modifications 2.8 0.4 0.15 0.35 KrAZ -255B; -257 2.9 0.4 0.1 0.3 Magirus Deutz 2.5 0.4 0.1 0.3 Mercedes Benz 2.5 0.4 0.1 0.3 MAZ-5551 dump trucks of all modifications 2, 9 0.4 0.15 0.35 9. For cars and their modifications for which there are no individual consumption standards for oils and lubricants, the following temporary consumption standards for oils and lubricants per 100 liters of total regulated fuel consumption are established: Name Motor oils (l) Transmission and hydraulic oils (l) Special.

When driving the first thousand kilometers with new cars (break-in) and cars that have come out of major repairs, as well as during centralized transportation of such cars under their own power in a single state - up to 10%, when driving cars in a paired state - up to 15%, in a triple state - up to 20 %. For cars in operation for more than 5 years - up to 5%, for more than 8 years - up to 10%.