Why do you need a primary?

Any fact of economic life must be recorded in the primary accounting document. This requirement is enshrined in Article 9 of the Law “On Accounting” No. 402-FZ. The primary document must be drawn up at the time of the transaction or immediately after its completion.

When tax specialists or auditors check the statements, they will first of all make sure that there is a primary document for each transaction. No document means no business transaction, which means the reporting is drawn up incorrectly and taxes are calculated incorrectly.

For each type of operation, its own primary documents are used. For example, services rendered are usually recorded in an act of provision of services, the sale of goods - in an invoice, the receipt of money - in a cash receipt order, and the write-off of materials for production - in a demand invoice. All these documents must be stored and presented to controllers upon their request.

Forms of primary documents

Once upon a time, primary documents had to be prepared only according to the forms developed by the State Statistics Committee. But since 2013, there is no such requirement for commercial organizations, with some exceptions, which we will discuss below. Companies themselves can develop forms of documents and consolidate them in their accounting policies.

In the document database of the “My Business” service you will find all forms of primary documents and several options for accounting policies. And by becoming a user of the service, you will completely get rid of the hassle of filling out documents. The service itself generates documents, automatically pulling data and details from the database.

In practice, many organizations and entrepreneurs continue to use unified forms, modifying them if necessary: removing unnecessary fields or adding new ones.

Even independently developed or modified forms must contain the mandatory details listed in paragraph 2 of Article 9 of the Accounting Law:

- Title of the document;

- Date of preparation;

- name of the organization on behalf of which the document was drawn up;

- content of the fact of economic life;

- meters in physical and monetary terms - rubles and, for example, pieces;

- the names of the positions of the persons responsible for the transaction and the correctness of its execution;

- personal signatures of these persons with transcripts.

For some documents, laws may provide for other mandatory details that are not mentioned in the accounting law. When developing such documents, special requirements will have to be taken into account. For example, in relation to a waybill.

All forms of primary documents that the organization uses must be enshrined in the accounting policy and applied for at least a year - until the new policy is approved.

The primary document does not have to be paper. Law 402-FZ allows for the preparation of primary accounting documents in electronic form and signing them with an electronic signature. If this is a bilateral or multilateral primary document, then both parties to the transaction must sign it electronically. Replacing the signature of one of the parties with a handwritten one in this case is unacceptable (letter of the Federal Tax Service of Russia No. ED-4-15/7760 dated April 23, 2021). That is, if you signed the invoice with an electronic signature, your counterparty must do the same. If someone does not have this opportunity, they will have to draw up a paper document the old fashioned way.

If you draw up the primary document on paper, the signatures must be strictly “live”. You must sign with a pen with blue, purple or black ink. Facsimiles cannot be used (letter of the Ministry of Finance No. 03-01-10/8-404 dated October 26, 2005).

Where are they used?

The scope of application of the details of an individual entrepreneur is very wide. The most important role is given to details when concluding contracts. Article 161 of the Civil Code of the Russian Federation obliges transactions to be concluded in simple written form. Despite its special legal status, Article 23 of the same Civil Code of the Russian Federation (in paragraph 3) instructs individual entrepreneurs to follow the letter of the law regulating the activities of organizations. Accordingly, the requirements for concluding contracts for private individuals engaged in business will be similar to the requirements for legal entities.

In addition to contracts, details are very important when preparing accompanying and accounting documents, such as payments, invoices, invoices, invoices, acts, etc. In this case, we are talking about strict reporting when handling finances, which means you should approach it as responsibly as possible to registration of company details.

Details of an individual entrepreneur in one form or another may be present in:

- fiscal cash receipts;

- sales receipts;

- signboards;

- tax returns (including to the Pension Fund);

- official letters;

- email newsletters;

- Internet sites;

- statistical reports;

- internal documents.

Note! According to Article 4.7 of Federal Law No. 54-FZ of May 22, 2003, the indication of details on fiscal checks is mandatory.

When can only unified forms be used?

Organizations and entrepreneurs do not always have complete freedom in choosing the form of the primary document. Sometimes you need to use strictly unified forms.

Thus, when transporting goods by road, you can only use a consignment note approved by Decree of the Government of the Russian Federation No. 272 of April 15, 2011.

When carrying out non-cash payments, payment documents approved by banking legislation are used. In particular, by the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012.

Cash documents must be unified: receipt and expenditure orders, a book of accounting for funds accepted and issued by the cashier, a cash book, payment and settlement statements. This is a requirement of Bank of Russia Directive No. 3210-U dated March 11, 2014.

Bank details of the entrepreneur

Despite the fact that theoretically an individual entrepreneur is not required to open a current account, in the vast majority of cases this is necessary for legitimate and convenient business conduct. To carry out a transaction to a merchant's account by bank transfer, the account number or card number alone is not enough.

When generating a payment order, a certain set of details is required. It includes:

- current account number;

- full name of the bank;

- indication of the correspondent account;

- Bank BIC;

- legal address of the bank (in some cases).

Important! The current account number for individual entrepreneurs begins with the combination of numbers 40802.

Is it possible to issue a primary document in foreign currency?

There is no specific provision in the accounting law that primary documents must be drawn up in rubles. But the same law says that accounting objects must be reflected in rubles, and if their value is expressed in foreign currency, they must be converted into rubles. And you need to prepare reports in rubles. Therefore, the primary payment should also be in rubles.

If you need a primary document in a foreign language or currency for a foreign counterparty, you can do this:

- provide in the document several columns for rubles and other currencies;

- draw up two copies - one in foreign currency or in a foreign language, and the second - to confirm the completion of the transaction in accordance with the norms of Russian legislation;

- draw up an additional document (for example, an accounting statement) explaining the contents of the document drawn up in foreign currency (in a foreign language).

Signatures

The manager approves the list of persons authorized to sign the primary accounting document PDF. A power of attorney on behalf of the organization is issued to persons authorized to sign the PUD for the manager or other responsible persons. PDF

Can primary documents be signed by persons who are not employees of the organization?

Sometimes there is a need for primary documents to be signed by outsiders. For example, if the organization is under the accounting services of a third-party legal entity or individual entrepreneur.

The “primary document” can be signed by persons who are not employees of the organization. The Ministry of Finance, in its recommendations to auditors on conducting an audit of the annual financial statements for 2013, noted that in this case, the information contained in the DMP should make it possible to identify the person who completed the transaction, operation and the person responsible for its execution (Letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 N 07-04-18/01).

A power of attorney on behalf of a legal entity is issued signed by its head or another person authorized to do so in accordance with the law and constituent documents (clause 4 of Article 185.1 of the Civil Code of the Russian Federation).

In order for the PUD, signed by an authorized person on behalf of the individual entrepreneur, to be used for tax purposes, the power of attorney to sign the individual entrepreneur’s documents must be notarized (paragraph 2, paragraph 3, article 29 of the Tax Code of the Russian Federation).

A facsimile, electronic copy or otherwise reproduction of the manager’s signature upon receipt of documents that have financial consequences are not supporting documents for the purposes of accounting for corporate income tax (Letter of the Ministry of Finance of the Russian Federation dated April 13, 2015 N 03-03-06/20808, Resolution of the Federal Arbitration Court Court of the Volga District dated June 20, 2012 N A12-13422/2011).

A document signed with a facsimile signature is not the basis for confirming expenses in order to reduce the tax base.

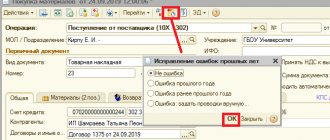

How to make corrections to primary documents

If, after a document has been accepted for accounting, an error is discovered in it, it is no longer possible to replace it with a new one, you can only correct the existing one. An exception is invoices and UPD. Correction forms are provided for them.

To make a correction to a paper document, you need to follow these steps:

- Cross out the incorrect text or amount with one line. So that you can read the corrected one.

- Above the crossed out text, write the corrected text or amount.

- Confirm the correct data with the entry “Corrected” and the signatures of the persons who compiled the document being corrected, indicating their last names and initials (other details that allow identifying these persons), indicate the date the corrections were made.

The organization can decide for itself how to make corrections to electronic primary documents. The chosen method must be recorded in the accounting policy.

Main

- The details of an accounting document are divided into mandatory and additional.

- Without the former, it loses legal force, while the latter clarify the basic data already entered.

- Details must be entered in such a way that information about the fact of economic life is clearly readable, otherwise disagreements may arise with business partners and regulatory authorities.

- Corrections in the document details, if necessary, are made so that the amount being corrected, the date and details of the person responsible for the correction are visible.

Is it necessary to certify the primary document with a seal?

The seal is not mentioned in the mandatory details of the primary documents. Therefore, organizations have no such obligation. But there are exceptions.

- Stamping is required in some documents, the form of which is approved by regulations not related to the field of accounting. For example, settlement (payment) documents.

- If you decide to use previously used unified document forms without making any changes to them, a seal is needed because these forms contain seal details.

If the documents that you developed yourself and secured in your accounting policies contain seal details, it should always be affixed to such documents.

It is advisable for organizations to certify executed documents with a seal. This minimizes the possibility of its falsification and allows for the most reliable identification of the organization and the powers of its authorized representatives.

How to organize the storage of primary documents

According to clause 6 of the Regulations of the USSR Ministry of Finance dated July 29, 1983 No. 105, primary documents that are used in current activities, before being transferred to the archive, must be stored in the accounting department in special rooms or locked cabinets under the responsibility of persons authorized by the chief accountant.

After documents are no longer used in current activities, they are placed in an archive for storage. You can use your own archive or use the services of specialized third-party organizations.

You can also store the primary document in electronic form, but only if it is certified with an electronic signature. At the same time, it is necessary to store means for reproducing electronic documents and verifying the authenticity of an electronic signature.

It is better to specify the procedure for storing documents and the procedure for transferring documents to the archive in the internal documents of the organization.

We described in detail the storage periods for documents with the latest changes in this article. For most accounting and tax documents, the retention period is 5 years, and for documents on personnel and information that affects the calculation of pensions - 50/75 years.

Types of business documentation details

Design elements are certain information structures or blocks that describe in detail the purpose of the document and allow you to determine the following information:

- Who is the compiler of the official document: name, address (actual, legal, TIN, KPP, OGRN, etc.).

- What type of specific paper should be classified as: invoice, payment order, order, instruction, notification, instruction, action plan, etc.

- Who approved, agreed and signed it: details allow you to obtain information about the body, position or object that initiated the order.

We will divide all details into two groups: constant and variable:

- Constant elements should include those elements that are used for standard forms and forms. An organization's letterhead is an approved unified form for a specific enterprise.

- Variable elements are the information that is indicated on the standard form and allows you to identify its contents.

Another type of grouping divides the composition of document details into basic and additional information:

- Basic data is the data that determines the legal status of the paper. Without the basic elements, it loses legal force and is considered void.

- Additional is information that details the main ones. It is not necessary to indicate such data; the paper will not lose its status. But they allow us to clarify the situation.

What to do if documents are lost

It is necessary to investigate the reasons for the loss and find or restore documents. A special commission is appointed to investigate. If necessary, with the participation of government agencies. Based on the results of the investigation, a report is drawn up.

If the documents are not found, you need to send written requests to counterparties, banks and the tax office to provide duplicates.

If some part of the documents cannot be restored, you need to draw up a report about this and indicate the reasons.

All documentation supporting the investigation and document recovery work must be retained. These are acts, requests, correspondence, etc.

Details

Change of details

As for individual entrepreneurs, details such as OGRNIP and TIN remain unchanged throughout the entire activity. If the TIN does not change throughout life, then the OGRNIP is not saved when the activity is suspended and a new number is assigned when the individual entrepreneur is opened again.

Details that may change include:

- personal data that changes during divorce proceedings or vice versa after marriage;

- registration and contact information may change if you change your place of residence or location of the company;

- changing the bank also entails changing the details and account number.

Notification of a change in the above details is not considered mandatory. If the name or surname has been changed, the department regulating this process reports this to the tax service; when closing a bank account or changing it, the bank itself provides the data.

Important! The entire procedure for informing and changing registration data may take 20 working days. 15 of them are allocated for notification, 5 are provided to the tax inspectorate to make all changes to the register. For the individual himself, it is necessary to change his passport within 30 days.

Responsibility for lack of documents

The absence of primary documents is considered a gross violation of accounting rules. Tax authorities may fine you for this:

- by 10,000 rubles for a violation in one tax period;

- for 30,000 rubles for violation in several tax periods;

- by 20% of the unpaid tax or contributions, but not less than 40,000 rubles, if the violation led to an understatement of the tax base.

Failure to submit primary documents for tax control will result in a fine of 200 rubles for each document. Plus there is administrative liability, which can reach 50,000 rubles depending on the type and consequences of the violation.

Become a user of the “My Business” service, and you will be able to automatically generate primary documents, fill out reports, calculate taxes and receive expert advice.