Deductions

Once again, the rightness of the taxpayer, who provided his employees with free lunches at the expense of the organization, was confirmed by the Arbitration Court

We already know that there are active and passive accounts. In this lesson we will look at

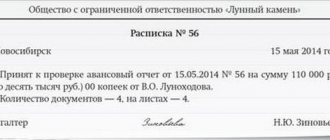

Procedure for conducting transactions The receipt of cash into the organization is formalized by a cash receipt order (form KO-1),

What regulations should be followed when formalizing labor relations with part-time workers? What is the maximum duration

Regulatory framework The legal basis under which organizations must sell and then account for

A fairly common task: determining the number of working days between two dates is

A desk audit is carried out by tax authorities and allows for an analysis of the reliability of reports and their accuracy.

Which card is better to have - debit or credit? For corporate purposes it is possible to issue various

Current as of 01/01/2021, Pavel Sokolov (Expert) The company’s entry into the international space is, of course,

As a general rule, in Russia all payments must be made in rubles (Article 317