Deductions

Report on financial results The need to submit a report to the Federal Tax Service and its form are established by three

Law No. 290-FZ, which amended Law No. 54-FZ, with its Article 7 (clause 7) allows some

An ordinary desk audit of a document submitted upon completion may turn out to be an unpleasant “surprise” for a company or individual entrepreneur.

The operation of fixed assets (FPE) in the production and economic activities of any enterprise is inevitably accompanied by their wear and tear, which

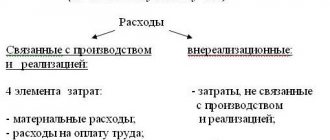

The company incurs various types of expenses to ensure its own functioning. Not all of them have a direct connection

Receipt of a bill of exchange from a buyer When receiving a bill of exchange in payment for goods (work, services)

Organizations can use cars for business trips. In the 1C Accounting 8.3 program it is automated

Subtleties of reflecting individual payments in the DAM - Natalya Vladimirovna, explain how to act in such

Remuneration Denis Pokshan Expert in taxes, accounting and personnel records Current on 1

Home / Real estate / Purchasing real estate / Buying an apartment / Deduction Back Published: 12/28/2017