The company incurs various types of expenses to ensure its own functioning. Not all of them have a direct connection with the main activity. However, they also need to be taken into account and recognized. Since 2006, the gradation of expenses has been simplified: in addition to expenses for core activities, other expenses are allocated. Operating rooms also fall into this category.

What is included in other expenses for accounting purposes?

What costs can be attributed to this article, how to correctly calculate and take into account operating expenses, as well as evaluate the success of their management, read in this article.

What are operating expenses?

Operating expenses according to the Tax Code of the Russian Federation

Operating expenses are costs of a business that are not related to the production of goods or provision of services. They are necessary for the functioning of the enterprise.

PBU 10/99 does not clearly define the term and does not delimit losses as a result of changes in classification in accordance with Order No. 116n. As is known, until 2006, other expenses were divided into non-operating, operating and emergency. According to today's standards, a simplified version of the gradation of expenses / income has been adopted for enterprises operating in any industry.

Similar to expenses, there are other operating incomes - these are financial receipts not related to the sale of the main product. If there is no evidence of indirect profitability, it is necessary to indicate the profit in subaccount 90 as income from core activities.

Composition of operating expenses

Classification of expenses

If you imagine the complex of expenses existing in an enterprise, you can immediately understand which expenses are basic and ensure the production of the enterprise, and which of them are necessary to support its functioning, and these are the operating expenses of the enterprise.

The list of indirect costs is regulated by PBU 10/99 clause 11, chapter 3. According to the document, operating expenses include:

- leased assets or received in other ways for temporary use on a reimbursable basis;

- leased rights to intellectual products;

- founders' investments into the process of other enterprises;

- any form of alienation of one’s own property – sale, lease, etc.;

- creation of funds to reserve money;

- payment of commissions and interest on bank accounts.

Important: expenses can be classified as operating expenses only if these expenses were not used to create a new product or provide services.

There is also a list of operating costs classified as other:

- repayment of penalties provided for by various contractual obligations;

- payment of losses caused by the company’s actions to third parties;

- losses on financial obligations that are impossible to recover;

- the size of the difference in currency fluctuations, due to which the company incurs losses when the cost of purchasing raw materials increases;

- losses from the write-off of assets that are out of order and, according to the conclusion of the commission, are unsuitable for restoration or partial sale;

- terminal expenses associated with the movement of cargo and business trips through the use of various land, air or road transport.

Operating income includes the same items that only benefit the enterprise, for example, rental of premises and other assets of the enterprise, income from representative activities, interest received on loans or the return of accounts payable that have expired.

The operating costs incurred by an enterprise can be much higher, it all depends on the type of its activity, for example, for a store such costs are the repair of the premises and cash register equipment, payment of salaries and contributions to extra-budgetary funds.

Accounting and management of operating expenses

How expenses are accounted for

All operating expenses must be taken into account and, if necessary, reduced without losing the quality of the enterprise. In addition, they must be planned in advance for such cases as downtime of the enterprise, due to holidays or lack of activity, for the period of occurrence of circumstances independent of the enterprise, for example, fire, force majeure and others.

Among the popular methods for optimizing costs is reducing the wage fund by reducing the number of employees, but such a decision can negatively affect the quality and quantity of products produced.

As a result, there are delays in the delivery of products, and as a result, losses occur for the company.

OpEx and CapEx in IT

The IT sector is also one of those where an entrepreneur can choose: whether to invest capital expenses in this area, purchasing expensive equipment and hiring employees, or limit it to outsourcing.

The pros and cons in both cases are the same as in the situation with a car or an office building. However, there is one caveat: today it is possible to use “cloud” technologies, which allow you to reduce many expense items, for example, the purchase and maintenance of equipment. In addition, it becomes possible to connect capabilities and increase the power of the system as needed. Compared to the classic solution using the CapEx model (purchasing a large amount of equipment and hiring specialists to service it), the cloud option is incomparably cheaper and simpler.

But, if compared with the classic solution according to the OpEx model (give everything to third-party specialists and pay them for services), then creating an IT solution in the cloud and its further support is also cheaper and simpler, because business users can often do most of the functions configure and regulate on your own. As for equipment, in most cases cloud solutions allow you to use regular PCs, laptops and mobile devices.

Reflection of operating expenses in accounting

Account reflection 91

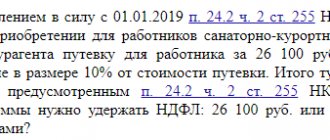

After finding out which company expenses are not core, you need to understand the peculiarities of their accounting. In accounting, they are accounted for in account 91, while income goes in subaccount 91.1, and expenses go in subaccount 91.2.

Important: entries are made to open accounts cumulatively, and at the end of the billing period, the difference between costs and other income is calculated and entered into subaccount 91.9, showing losses as a debit and profits as a credit.

Accounting is carried out in such a way that it is easy to conduct analytics for each previously performed operation.

How to reduce capital costs?

So, in practice, the capital expenditure budget is reduced quickly and clearly, for example:

Reducing building costs: do not buy a new building, but rent a used one, which will transfer costs from the area of capital expenses to the level of operating expenses. The same applies to the organization of a separate warehouse that is not part of the building involved and is located, perhaps, in another part of the city or even in another area.

To organize communication channels, do not use your own infrastructure built from scratch, but rent a cloud service or a separate Internet server.

Calculation of the efficiency of operating expenses

Efficiency calculation

The efficiency index for incurred operating expenses is established by the management body for each regulated company. One of the methods used is the efficiency of investment capital or indexation of established tariffs to optimize their level.

Investments raised to reduce costs are taken into account, and their impact on the level of costs at the stage of development and implementation of the application plan is studied.

Important: if, thanks to the implemented investment program, expenses can be reduced by 5%, then the efficiency index is applied at a 5% value.

At the same time, for enterprises:

- for thermal energy production, an index of 1%, maximum 5% is applied;

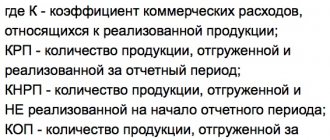

- for enterprises transmitting energy, the index obtained by applying the following formula IORj = max (IORj inv; IOR jcomp) , but not more than 5%.

After establishing the method, the management team monitors the activities of enterprises every 5 years and analyzes their activities through comparison. As a result, after comparative activities, an index of the efficiency of the companies' work process is determined.

Such a calculation of the efficiency index and comparative analysis are necessary to determine the level of costs and find ways to optimize them. So that the cost of production can be reduced if it turns out to be too high. The coefficient gives a clear idea of what percentage goes to maintaining the company's activities.

By drawing up graphical dynamics of activity using a coefficient, you can increase the company’s productivity by completely eliminating costs.

Factors Affecting Operating Expense Ratio

Main factors influencing the profitability of an enterprise

In order to operate efficiently, it is necessary to optimize non-operating expenses - this is the main goal of the management team. When they decrease, the rate of development of productivity and profitability of the enterprise is observed. There are several factors influencing the level of costs, and they are divided into internal and external.

External factors

External factors influencing the amount of operating expenses do not depend on the will and activity of the company and include:

- Inflation. The higher its level, the more companies incur additional expenses - this includes paying salaries and bonuses, interest on loans to banks, transportation or services of third-party companies;

- Increase in tax rates for extra-budgetary expenses. Deductions take up a significant percentage of the company's expenses and an increase in their rates significantly affects the growth of expenses.

Internal factors

Internal ones include:

- Volume of production and sales of finished goods. Despite the fact that increasing production capacity requires additional expenses, production costs can be significantly reduced due to the constant number of service personnel. For example, a mechanic was servicing one machine, when there were 3 of them, and the mechanic’s salary was the same, three machines were already being serviced, and there were more products, which meant their cost was lower.

- Duration of the production cycle. With its reduction, the level of investment costs, cash transactions, costs of storing products is reduced, the costs of accounts receivable, and the costs of paying employees and managers are reduced.

- Labor productivity indicator per one workplace. The higher this value, the lower the amount for operational settlements with employees.

- Technical condition of fixed assets at the enterprise. The more worn out the equipment is, the more money is required for depreciation. As a result, the question arises about the effectiveness of purchasing new machines.

- The amount of own working capital. The higher the percentage of equity capital used in the company's activities, the less the need for borrowed capital, which means there is a decrease in servicing loans and borrowings.

Purchase of fixed assets

The acquisition by a company of an expensive object (real estate, equipment, etc.) that will be used in the operational process most often does not cause problems - such costs are naturally capitalized.

But in practice, there are often cases when several small inexpensive objects are purchased, spare parts for equipment, and leased real estate is modernized.

Each of these cases can cause difficulties.

To resolve the issue, you should know that in accordance with international reporting standards (IFRS), the acquisition of fixed assets should be classified as capital expenditures.

Accordingly, for the above and similar methods, if capitalization of expenses is necessary, the conditions for recognizing a fixed asset must be met.

To do this, the 4 criteria listed below must be met, the first 2 of which determine the fixed asset, and the last 2 are mandatory conditions for recognition.

- Objects are intended for use in the operational activities of the enterprise (production of products, provision of services, supply of goods, rental, management, etc.).

- It is assumed that the objects will be used for a long time, which is many times longer than the duration of the reporting period.

- The use of the facilities makes it likely that the enterprise will receive economic benefits in the future.

- The cost of objects can be estimated.

If all criteria are met, costs can be capitalized, for example, many small office furniture, or spare parts, or tools are taken into account as one fixed asset; when the cost of this item is insignificant, the cost of purchasing a batch turns out to be serious for the company.