In order to obtain reliable information about contributions to the authorized/share capital of the organization, the issuance of dividends and other income to participants, shareholders, and members of the partnership, records of settlements with founders and shareholders are kept. In government agencies or municipal enterprises, this section should reflect transactions on settlements with authorized management bodies/government bodies. Let's take a closer look at the nuances of making capital contributions and other types of settlements with the founders of the company.

Consultations: Corporate income tax

- Income tax. If we are talking about legal entities, the rate is fifteen percent, or the rates specified in the Double Taxation Agreements are provided.

- In the case of payment of dividends to a Russian organization: subsection 1.3 of section 1 of the income tax declaration contains the calculation of tax on certain types of income, while Sheet 03 (calculation of income tax, which is withheld by the tax agent - the source of payment of income) includes certain types of income. Information on tax calculation is given in paragraph 2 of Art. 275 of the Tax Code of the Russian Federation, and the rules for filling out sheet 03 are indicated within the framework of Order of the Federal Tax Service of Russia dated November 26, 2014 No. MMV-7-3/

- When receiving dividends from a Russian or foreign enterprise: sheet 04 (calculation of corporate income tax on income, which is calculated according to rates that differ from the rate presented in paragraph 1 of Article 284 of the Tax Code of the Russian Federation) contains information on dividend income from their participation in other organizations.

The transfer of personal income tax must be made on the day of payment of dividends to shareholders (participants) or within the next day after withdrawal of funds from the current account for payment of dividends. The transfer of income tax is made no later than the next day after the dividends were transferred.

Russian enterprises that are tax agents (organizations that are the source of receipt and payment of income) are required to provide income tax reporting.

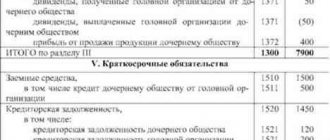

Income from dividends received and issued, as well as the calculation of income tax, are indicated in the income tax return as follows:

If you require more detailed explanations about the application of the zero percent income tax rate, about dividends that are received and issued in kind, or about how dividends and their calculations are reflected in tax and accounting reports, please contact us for a free consultation by calling 8(812) 425- 24-05.

Was the article useful? Share on social networks!

Do you want to receive new information in a timely manner?

Subscribe to our newsletter

Tax Code of the Russian Federation), and income tax on dividends - no later than the day following the day of transfer of dividends (clause 4 of Article 287 of the Tax Code of the Russian Federation). The amounts of accrued taxes on dividends are not reflected in tax accounting. How to reflect personal income tax on dividends in tax accounting "1C: Accounting 8" Income of individuals from equity participation in the activities of an organization received in the form of dividends and the amount of calculated tax on this income for the purpose of reporting personal income tax are registered in the program for each individual using the document Tax accounting operation for personal income tax, which is available from the journal All documents for personal income tax in the Employees and salary section (Fig. 4). Rice. 4.

Dividends: taxation issues and reflection in financial statements

284 Tax Code of the Russian Federation. The total amount of dividends subject to distribution does not include the amount of dividends payable to a foreign organization and (or) a non-resident individual of the Russian Federation (clause 6 of article 275 of the Tax Code of the Russian Federation, clause 3 of clause 3 of article 284 and clause 3 of article 224 dividend amounts due:

- Russian organizations (including those using the simplified tax system, unified agricultural tax and UTII) are subject to income tax at a rate of 9 percent;

- Russian organizations that for at least 365 consecutive calendar days own at least half of the authorized capital of the dividend-paying organization are subject to income tax at a rate of 0 percent;

- foreign organizations are subject to income tax at a rate of 15 percent (taking into account the specifics provided for in Article 275 of the Tax Code of the Russian Federation);

- individuals who are tax residents of the Russian Federation are subject to personal income tax at a rate of 9 percent;

- Individuals - non-residents of the Russian Federation are subject to personal income tax at a rate of 15 percent.

Income tax on dividends, including those received from foreign organizations, is paid to the federal budget (clause 2 p.

We adhere to dividend payment deadlines

The period for paying dividends to LLC participants cannot exceed 60 days from the day when the decision on the distribution of profits was made. For violation of this deadline, participants have the right to recover interest from the company for each day of delay (Article 395 of the Civil Code of the Russian Federation).

The issuer must pay dividends to shareholders registered in the register within 25 business days from the date on which the persons entitled to receive income are determined. And for nominee holders and trustees who are professional participants in the securities market registered in the register of shareholders - within 10 days from this date (clause 6 of Article 42 of the Law of December 26, 1995 No. 208-FZ).

If these deadlines are violated, shareholders can also recover interest for the use of other people's money (Article 395 of the Civil Code of the Russian Federation). An administrative fine may also be imposed under Article 15.20 of the Code of Administrative Offenses of the Russian Federation.

Where to show dividends paid on the balance sheet

The source for paying dividends is the company's net profit. It is calculated at the end of the financial year, although the decision to pay income to participants (founders) can be made once a quarter, every six months or a year.

Important

How operations for accrual and payment of dividends are reflected in the company’s accounting and reporting will be discussed in this publication. The basis for accrual of these incomes in the accounting of the organization are the minutes of the meeting of participants with the decision made on payment within the established time frame and an accounting certificate calculating the amounts due to each of the owners.

To combine information on accrued and paid dividends, use account 75/2 “Settlements with founders” and the subaccount “Settlements for payment of income”. If this type of income is received by a company employee, then account 70 “Payments with personnel for salaries” is used.

Since the amount of dividends to be distributed for all participants is the same, the calculation of the amount of income tax in the form of dividends of CJSC "InvestSoyuz" and the amount of personal income tax on income in the form of dividends of individual residents of the Russian Federation will be the same: H = 1,000,000 / (4,000 000 – 1,000,000) x 9% x (3,000,000 – 2,730,000) = RUB 8,100. The amount of personal income tax on income in the form of dividends of a non-resident individual of the Russian Federation (Tereshchenko E.N.) is calculated as follows: N = 1,000,000 x 15% = 150,000 rubles. How to accrue and pay dividends in “1C: Accounting 8” Reflection of accrued dividends to legal entities and individuals, as well as the accrual of income tax and personal income tax in the program is registered by the document Operation (Accounting and National Accounting), which is available via the hyperlink of the same name from the section Accounting, taxes, reporting (see Fig. 1). Rice. 1.

Reporting year – 2013; Line 010 – 4,000,000; Line 030 – 1,000,000; Line 041 – 3,000,000; Line 043 – 2,000,000; Line 070 – 2,730,000; Line 071 – 2,730,000; Line 091 – 90,000; Line 100 – 8 100; Line 120 – 8,100. The value in lines 040 and 090 is calculated automatically using the formulas specified in the indicators.

10): Line 010 – name of the legal entity - recipient of dividends; Line 020 – address of the location of the dividend recipient; Line 030 – information about the head of the organization - a participant in the company; Line 040 – contact phone number; Line 050 – date of transfer of dividends; Line 060 – amount of transferred dividends; Line 070 – the amount of income tax withheld when performing the duties of a tax agent. Rice. 10. Dividends distributed to participants (shareholders) are reflected in the financial statements as follows:

- in the balance sheet they reduce the amount of accumulated profit on line 1370 “Retained earnings (uncovered loss)” in the period of dividend accrual;

- in the statement of changes in capital (if prepared) - on a separate line 3327 “Dividends” in the period of accrual of dividends;

- in the cash flow statement (if compiled) - on a separate line 4322 “Payments - total for the payment of dividends and other payments for the distribution of profit in favor of the owners (participants)” in the period of actual payment of funds.

Who pays and withholds taxes on dividends A Russian organization paying dividends is recognized as a tax agent (clause 3 of Article 275 of the Tax Code of the Russian Federation).

Info

How to accrue received dividends in “1C: Accounting 8” Registration of received dividends in accounting is carried out manually using the document Operation (accounting and NU) on the date of the decision made by the general meeting of shareholders (Fig. 12). Rice. 12. Registration of dividends received in accounting Reflection of the amount of dividends received in the PR resource (the constant difference in the assessment of the obligation) in this case is necessary, otherwise the key rule of the ratio of transaction amounts will be violated (BU = NU + PR + VR), which will inevitably lead to errors in accounting

After performing routine operations to close the month (March), the program will generate the following transactions for calculating income tax (Fig. 13): Fig. 13. Movements of the regulatory document Calculation of income tax for March Using the document Operation (accounting and NU), you can reverse the entries for accrual of PNA and conditional income tax expense calculated from the amount of dividends received reflected in accounting (Fig. 14). Rice. 14. Manual adjustment of the routine operation for calculating income tax for March Registration of dividends received in tax accounting is carried out manually using the document Operation (accounting and accounting) on the date of actual receipt of funds according to the bank statement (Fig.

15). Rice. 15. Registration of dividends received in tax accounting Reflection of the amount of dividends received in the PR resource (the constant difference in the assessment of the liability) in this case is also necessary, otherwise the key rule of the ratio of transaction amounts will be violated (BU = NU + PR + VR).

Dividends on balance sheet

To reflect the amounts of retained earnings (credit balance of the 84th account), line No. 1370 is allocated in the 3rd liability section of the balance sheet. At the end of the year, it records the total amount of profit (both for the reporting year and for previous periods), starting from the moment of existence companies. In this line, retained earnings will be reflected minus accrued but unpaid dividends for the reporting year.

Dividends are reflected in the balance sheet only if they are accrued and paid during the year. We are talking about so-called interim dividends. The sum total of all interim dividends,

paid in the reporting year for which the statements are prepared are recorded in the same place (in the “Capital” section) in a separate numbered line, enclosed in parentheses. Usually it is assigned the following serial number (for example, 1371, 1372).

Dividends declared at the end of the year are usually announced after the financial statements are approved. Consequently, this fact becomes an event after the reporting date, which means that such dividends cannot be recorded in the balance sheet.

Following the recommendations of PBU 7/98, companies that declared annual dividends based on the results of work, in the period of time between the reporting date and the date of approval of the reporting forms for the year, disclose information about accrued dividends in an explanatory note to the balance sheet. Of course, no accounting entries are made during the reporting period either.

Dividends in the income statement

We remind you that the source of dividends is net profit. Information about its availability and amount as of the reporting date is contained in line 2400 of report No. 2. The accrual and payment of dividends are not reflected in this form, since this report was created to inform the user about the amounts and sources of profit and loss. Dividends do not form profit (they are paid out of it), much less are they considered expenses. As a category related to the reduction of capital, dividends are reflected in the statement of capital flows (SFC), and their payment is recorded in the statement of cash flows (CFDS) after the payment has been made.

Let's summarize. The amounts of dividends are reflected in the financial statements as follows:

- If they are accrued but not paid, then:

- in the balance sheet they reduce the amount of profit reflected in line 1370 “NP”;

- in the UDC in line 3327 “Reduction of capital - dividends” (when compiled by the company);

Category: Banks

How to fill line 1520

The group includes the following items that make up the meaning of this row. They relate to payments made, and debts can concern both organizations and individuals, for example, the company’s working personnel:

- All debts of contractors and suppliers cooperating with the organization.

- Available amounts on bills of exchange that must be paid.

- Debts to existing subsidiary organizations.

- Debts to employees regarding wages or other payments.

- Debts to extra-budgetary funds and budgetary organizations.

- Debts to the founders of this organization.

- Advances received by the company.

- Debts to other creditors not listed above.

When completed, balance line 1520 reflects the amount received from the following accounts, taking into account all payments that are due. The sum of all listed values must be indicated in the appropriate line when filling out the documentation:

- Settlements made with any contractors and suppliers cooperating with the organization.

- Settlements directly with customers or buyers in the process of providing services or selling certain goods.

- Payments of fees and taxes, in accordance with existing legislation that regulates the activities of the company.

- Calculations performed for insurance and social security.

- Payments to personnel - accrual for wages or other transactions.

- Transfer to accountable persons.

- Settlements with various founders of the organization.

- Payments to creditors providing borrowed funds to the organization.

If the organization has already received an advance payment as part of the performance of certain work or provision of services, then the accrued tax reduces the size of the credit balance reflected in line 1520. Also, the payable and receivable types of debt are indicated in detail and separately.

The first is in the liability, and the second is in the asset, so these debts are not balanced, even in a situation where a credit and debit balance arises for accounts with the same account. The procedure for drawing up specific debts to certain individuals or organizations may depend directly on the terms of the transaction. Usually it is equal to the specified contract price, but there may be other formation conditions.

Since the line relates to the section of short-term liabilities, when preparing documentation, only those balances that are considered short-term are taken into account, that is, they do not exceed one year in maturity immediately after the reporting date. If the account balance exceeds 12 months in total, then it is necessary to split it into two parts. One of them will be reflected directly in line 1520, and the second will go to line number 1450, which is known as long-term liabilities. This allows you to take into account all calculations when filling out accounting documentation.

Line 630 “Debt to participants (founders) for payment of income”

Home/ Accounting statements/ Line 630

Line 630 of the financial statements refers to the balance sheet until 2011.

This line reflects the balance of account 75 “Settlements with founders” subaccount 75-2 “Settlements for payment of income”. This is the amount of the organization's outstanding debt for dividends due for payment.

When compiling the balance sheet for 2009, this line shows the amount of dividends accrued for payment if in the specified period a general meeting of shareholders (participants) of the company was held to distribute dividends and an appropriate decision was made.

The distribution of net profit for the payment of dividends is reflected by the accounting entry:

Debit 84 subaccount “Net profit of the reporting year” Credit 75 subaccount “Calculations for dividends” - reflects the amount of net profit allocated for the payment of dividends.

If the founder (participant) of the company is also its employee, the dividends due to him and other similar payments are accrued on account 70 “Settlements with personnel for wages” subaccount “Income from participation in capital”. The credit balance of this subaccount should be reflected on line 630.

Please note: a loan received by an organization from the founder is reflected in accounting in the same way as any other loan - on account 66 “Settlements for short-term loans and borrowings” or 67 “Settlements for long-term loans and borrowings”. In the balance sheet, the unrepaid amount of such a loan is shown as part of accounts payable: on line 510 (if the loan is long-term) or line 610 (if the loan is short-term) together with the interest accrued under the agreement. Line 630 is intended only to reflect debt to the founders for income from participation in the authorized capital.

Line 1230 of the balance sheet, what it includes

- Balance on the debit side of the account. 62 “Settlements with buyers and customers”, takes into account the debt on products, goods, work, services sold to the buyer;

- Account debit balance 68 “Calculations for taxes and fees,” speaks of the debt of budgetary authorities to the organization. Accounts receivable on this account may arise due to amounts transferred during the year, advance payments for taxes from budget funds. The amount of transferred advance payments exceeds the amount of calculated tax for a certain period of time;

- Debit balance by account 69 “Calculations for social insurance and security” tells us about the debt of the social insurance authorities to your company. It may arise, for example, due to the amount of excess expenses calculated by the organization on certificates of incapacity for work before accrued insurance premiums;

- Balance on the debit side of the account. 70 “Settlements with personnel for wages”. A debit balance is very rare. It may arise, for example, due to transfers of amounts to an employee (employee) for accrued leave (labour or pre- and post-natal leave). This happens when, at the beginning of the month, the organization’s employees are paid arrears of wages accrued on the last day of the month, and payment is also made for accrued maternity and postpartum leave. The accrual amount will be reflected in the accounting accounts only on the last day of the month, and payment will be made on the current date;

- Debit balance of the account. 71 “Settlements with accountable persons.” Payments to persons to account for funds, non-cash and cash are accounted for on the debit side of the account. 71. After payment, submits a report on expenses incurred to the company’s accounting department. This may include payment for business expenses, payment for purchased materials, expenses for staying in a hotel during a business trip, expenses for moving to and from the place of business trip, and others;

- Debit balance of the account. 73 “Settlements with personnel for other operations.” All relationships between employees of the organization are reflected in this active-passive account, except for payroll calculations and payments of funds to the account. The debit of the account reflects the employee's debt to the organization. An employee may be provided with borrowed funds for construction, rent, and other business needs. Also, the employee may have a relationship to compensate for material damage to the company. These are the situations that are reflected in the score 73;

- Balance on the debit side of the account. 75 “Settlements with founders.” The formation of the authorized capital is taken into account according to the D account. 75 and K-tu account. 80 “Authorized capital”. Until the founder deposits personal funds in the amount of the authorized capital, the debit balance will remain on account 75;

- Debit balance of the account. 76 “Settlements with various debtors and creditors.” Account 76 is active - passive, it reflects debts not reflected in account 60, 62 and other accounts. The account may reflect arrears of payment to the insurance company; claims settlements; withholding funds from employee salaries for third-party companies and persons under executive documents (acts).

We recommend reading: Is it possible to apply for a passport replacement at 45 years of age in advance?

useful links

►Economic literature◄ ►Methodology of financial analysis◄ ►Forms of financial statements◄ ►The largest joint stock companies in Russia◄

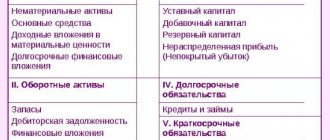

The third section of the balance sheet liability “Capital and reserves” consists of the following items.

| III. Capital and reserves | Line code |

| Authorized capital (80) | |

| Own shares purchased from shareholders (81) | |

| Additional capital (83) | |

| Reserve capital (82) | |

| including: | |

| reserves formed in accordance with legislation | |

| reserves formed in accordance with the constituent documents | |

| Retained earnings (uncovered loss) (99) | |

| Total for Section III |

The table presented above reflects the diagram of the third section of the balance sheet liabilities, indicating the accounts, the balances of which are reflected in the corresponding line of the balance sheet.

“Authorized capital” (line 410). This article shows the amount of the authorized capital (account balance 80 “Authorized capital”) in accordance with the provisions of the constituent documents. An increase or decrease in the authorized capital is made only after changes have been made in the prescribed manner to the constituent documents (charter) of the organization (organization).

The line “Own shares purchased from shareholders” shows the remaining value of the organization’s own shares that were purchased from shareholders, recorded on account 81 “Own shares (shares).”

“Additional capital” (line 420). This line shows the amount of increase in the value of the organization’s property reflected in the asset balance sheet, identified based on the results of their revaluation, as well as the amount of share premium of joint-stock companies (i.e., amounts received in excess of the nominal value of the company’s outstanding shares (minus the costs of their sale) ) and targeted financing received in the form of investment funds. Since the authorized capital is fixed in the constituent documents, it became necessary to take into account the increase in the equity capital of an economic entity. Account 83 “Additional capital” is intended for these purposes.

“Reserve capital” (line 430).

What is accounts receivable

The receivables maturity period is a mathematical indicator that shows the financial strength of a company. It is calculated when it is necessary to evaluate, for example, the liquidity of a company, or the growth rate of accounts receivable. The maturity period shows the average period that passes from the delivery of goods to the buyer until the receivables are repaid. The indicator is calculated using a special formula:

Main tasks of debt management

The maturity period shows the average number of business days it takes a company to collect its receivables. The lower the result, the faster the receivables turn into real money. A high repayment period indicates that the company is having difficulty collecting debts.

An organization that commits violations may face fines and penalties. In some cases, such behavior leads to legal proceedings. All this has an extremely negative impact on the company’s business reputation.

General Audit Department on the issue of the procedure for reflecting dividends in accounting and reporting

This article forms sources in the form of reserve funds, the creation of which is provided for by law (according to current legislation, reserve funds are required to be created by a limited number of commercial organizations) or by the organization’s constituent documents. Only joint stock companies must have it. Account 82 “Reserve capital” is intended for these purposes.

“Retained earnings (uncovered loss)” (line 470). This section provides the amounts of retained earnings, i.e., profits remaining at the disposal of the organization after reflecting obligations to the budget. Retained earnings (uncovered loss) of previous years and profit (loss) of the reporting year are shown as one amount. If there is a loss, this section shows its size in parentheses.

The fourth section of the balance sheet liability is called “Long-term liabilities”, it consists of the following items.

| IV. long term duties | Line code |

| Loans and credits (67) | |

| Deferred tax liabilities (77) | |

| Other long-term liabilities | |

| Total for Section IV |

The table presented above reflects the diagram of the fourth section of the balance sheet liabilities, indicating the accounts, the balances of which are reflected in the corresponding line of the balance sheet.

“Loans and credits” (line 510) The content of long-term bank loans and long-term loans is revealed here. Long-term loans and credits are accounted for on account 67 “Calculations for long-term loans and borrowings.” The balance of this account is recorded in the balance sheet on line 510 “Loans and credits”; this amount does not need to be decrypted.

“Deferred tax liabilities” (line 515). This line reflects that part of the profit tax that should lead to an increase in the profit tax payable to the budget in the next reporting period or in subsequent reporting periods. The balance on the loan of the same account 77 is transferred to this line.

Deferred tax liabilities arise if expenses are recognized in accounting later than in tax accounting, and income earlier. This value is calculated using the formula

| Deferred tax liability | = | Taxable temporary difference | X | Income tax rate | (3) |

“Other long-term liabilities” (line 520). This line reflects other types of liabilities with a maturity period of more than 12 months after the reporting date (tenant's lease obligations under long-term leases, etc.).

“Current liabilities” are the fifth section of the balance sheet liability, which consists of the following items.

| V. Current liabilities | Line code |

| Loans and credits (66) | |

| Accounts payable | |

| including: | |

| suppliers and contractors (60.76) | |

| debt to the organization's personnel (70) | |

| Debt to state extra-budgetary funds (69) | |

| debt on taxes and fees (68) | |

| other creditors | |

| Debt to participants (founders) for payment of income (75) | |

| Deferred income (98) | |

| Reserves for future expenses (96) | |

| Other current liabilities | |

| Total for Section V |

The table presented above reflects the diagram of the fifth section of the balance sheet liabilities, indicating the accounts, the balances of which are shown in the corresponding line of the balance sheet.

Loans and credits (lines 610). This subsection reflects the organization's borrowed funds in the form of bank loans and loans that are subject to repayment within 12 months after the reporting date. Line 610 records the balance of account 66 “Settlements for short-term loans and borrowings.” Moreover, there is no need to decipher how much the organization borrowed from the bank, other companies or citizens.

Accounts payable (lines 620). This line reflects the organization’s short-term liabilities:

— to suppliers and contractors;

— before the organization’s personnel;

— to state extra-budgetary funds;

— on taxes and fees (before the budget);

- before other creditors.

It is important to note that the amounts of the unified social tax in part of the federal budget are recorded in the line “Debt on taxes and fees”.

Debt to participants (founders) for payment of income (line 630). The organization's debt for accrued but unpaid dividends must be indicated in line 630 “Debt to participants (founders) for payment of income” of the balance sheet. There is no separate account in accounting to reflect settlements with shareholders for dividends, therefore these calculations are taken into account on account 75 “Settlements with founders”. The same account also takes into account the debt of the founders on contributions to the authorized capital, therefore, account 75 is shown in detail in the assets and liabilities of the balance sheet, and under the article “Calculations for dividends” they show not only the amount of debt on accrued dividends, but also on interest on their own valuables securities (stocks and bonds, etc.).

Deferred income (line 640). This line reflects the balance of deferred income accounted for in account 98 of the same name. These are the so-called income received in the reporting period, but related to future reporting periods, for example, rent received in advance is transferred to line 640 “Deferred income” of the balance sheet. It is important to note that receiving money as a prepayment or advance is not deferred income.

Reserves for future expenses (line 650). To distribute expenses evenly, an organization can create reserves (to pay for vacations to employees, expenses for repairs of fixed assets, to pay remunerations based on the results of work for the year, etc.). Such a decision should be enshrined in the accounting policies.

The accrual and use of the reserve is reflected in account 96 “Reserves for future expenses.” The credit balance on it is transferred to line 650 “Reserves for future expenses.”

The article Other short-term liabilities (line 660) reflects the organization's liabilities with a maturity period of less than 12 months, which were not included in the previous subsections of the fifth section of the balance sheet liabilities.

Date of publication: 2014-11-02; Read: 3220 | Page copyright infringement

The source for paying dividends is the company's net profit. Calculation of it

is made at the end of the financial year, although the decision on the payment of income to participants (founders) can be made once a quarter, every six months or a year. How operations for accrual and payment of dividends are reflected in the company’s accounting and reporting will be discussed in this publication.

Let's summarize. The amounts of dividends are reflected in the financial statements as follows:

- If they are accrued but not paid, then: in the balance sheet they reduce the amount of profit reflected in line 1370 “NP”;

- in the UDC in line 3327 “Reduction of capital - dividends” (when compiled by the company);

- in the ODDS on line 4322 “Payments for the payment of dividends and other payments for the distribution of profits in favor of owners (participants).”

More about accounts payable

Before talking about debt in accounting, it is worth recalling what these two definitions mean:

- Balance sheet is one of the main types of accounting. It contains information about the organization’s assets, its liabilities and capital status. It is expressed in two equal parts - an asset and a liability, the first of which reflects the value of all the organization’s property, and the second - how much money the company receives from outside thanks to its activities. Thus, using accounting, you can evaluate the financial and property status of a legal entity.

- Accounts payable on the balance sheet is a calculation of the organization’s debts to individuals and legal entities that must be covered within 1 year. It is included in liability, since it does not relate to the property of a legal entity, in section 5 “Short-term liabilities”.

The term accounts payable has several meanings, but they all say approximately the same thing - it is not long-term, and the calculation consists of:

- Debts to suppliers and contractors.

- Advances.

- Debts to subsidiaries and the country's budget.

- Amounts on bills.

- Debts to staff, etc.

Read more about which accounts include balance calculations below.