Laptops and PCs have long been part of our lives. However, questions related to computer accounting are not becoming less numerous. A lot of clarifications have been issued. Let’s refresh our memory and summarize them. Moreover, to ensure remote (remote) work during the period of coronavirus and quarantine 2021, many companies have spent a lot on laptops and computers to provide their employees with what they need remotely. Let's consider accounting for computers and computer equipment at an enterprise.

Also see:

- Is the computer the main tool

- How to put a computer on accounting records

Accounting for computers and office equipment

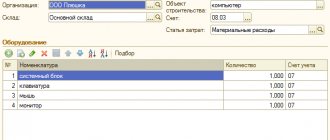

The monitor is supposed to be used on different system units, so the organization decided to separately account for the components of the computer.

The following useful life periods were established for the computer components (Table 4). Let's give an example of how a computer purchase is reflected in accounting. Vozrozhdenie LLC purchased a computer for management purposes on February 21, 2021, the configuration and cost of which are presented in Table 1.

Working with the OCSNG interface

The interface is localized, so it won’t take much time to figure out how to use it. By default, the All Computers tab shows seven main characteristics of client machines.

The "Add column" list allows you to easily add up to 23 more fields. It is very convenient that the data can be edited manually. Also worth noting is the easy search and removal of duplicate systems.

As mentioned earlier, OCSNG has the ability to install applications and run scripts (bat, vbs, etc.). This functionality is a big help. We create a package in Deployment - Build and fill in the New package building fields: name, Priority (installation order) and action in Action. There are three options:

- Store - copy to the target system;

- Execute - copy and execute with a command;

- Launch - copy and launch.

Options in User notifications allow you to display a warning to the user and allow him to cancel the task.

After creating a package, you should activate it in Deployment - Activate. Enter the server URL and click “Submit”. Select the computer on which we will install the package, go to the Customization menu and click the Add package link. We specify the package and start the process by clicking Affect. The task status is displayed in Customization, general statistics are available in the Activate table.

In OCSNG, the connection initiator is an agent that connects to the server once a day, sends status information and receives tasks. If the generated package needs to be installed earlier, you must force the ocsinventory-agent command to run on the client.

How to keep records of low-value fixed assets

So, what does fixed assets mean in accounting in 2021? Let's look at the key points. First of all, we will determine from what amount the organization’s property is considered a fixed asset. To do this, we turn to the current accounting instructions and establish that a fixed asset is recognized as an object that meets the following requirements:

Last year, new federal accounting standards radically adjusted the procedure for recognizing fixed assets. Key changes are enshrined in Order of the Ministry of Finance No. 257n. Officials also presented methodological recommendations for the transition to new standards in Letter No. 02-07-07/79257 dated November 30, 2021.

What else can the program do?

I have described only the main, basic functionality with which you should start getting acquainted with the program in order to immediately evaluate the main capabilities for accounting for office equipment. As I wrote earlier, the program is well suited for a large fleet of equipment and the work of an entire equipment maintenance department. Additionally in the program you can:

- Take into account cartridge refills, the entire history of actions is remembered.

- Import information into the database from Excel files.

- Set up access rights and responsible persons, divide powers.

- Build a branched structure of branches, departments, offices.

- Fix service agreements with third parties.

- Add equipment using a regular USB barcode scanner.

- Record user requests for purchase, repair, replacement of equipment.

- Place orders with suppliers for future periods based on past consumption statistics.

Accounting entries for fixed assets in budgetary organizations

Budgetary organizations are institutions financed from budgetary funds. Accounting in such organizations is carried out on the basis of a special chart of accounts for budgetary institutions with their own entries, which is approved by Order No. 174n of the Ministry of Finance of the Russian Federation dated December 16, 2021. In all budgetary institutions, fixed assets, according to Instruction No. 25n, are accounted for in account No. 010100000 - Basic facilities.

Fixed assets are recorded in accounting registers at their original cost. It includes the costs of purchasing and constructing facilities, consulting services, delivery and other costs required to bring the facility into a state of readiness for operation, taking into account the VAT charged. Accounting in budget accounting accounts is carried out in rubles and kopecks.

Accounting for computer equipment

Modernization is the improvement of something. If, during computer repair, they replace, for example, the processor, hard drive, motherboard, etc. with more powerful ones, this will already be a modernization and it will be necessary to increase the cost of the computer as an inventory item.

The question then arises: “What is the difference between renovation and modernization?” (in terms of accounting). The difference is that modernization increases the cost of fixed assets that are subject to improvement, but repairs do not.

Disadvantages of using scripts

If data collection using WMI/PowerShell is quite simple, then all reports and configuration changes have to be controlled manually. Of course, you can complicate your scripts, trying to automate the process, but not everyone wants to spend time on this. It is worth recalling here that Microsoft offers the necessary functionality in SCCM (System Center Configuration Manager), which we already wrote about in issues 08.2009, 09.2009 and 01-02.2010. But in cases where the administrator also has *nix systems, all kinds of routers and other equipment that needs to be taken into account, WMI is no longer an assistant. In addition, the problem of visual presentation of data and reports remains. Here you will have to resort to third-party programs (including those distributed under free licenses), fortunately, there are plenty to choose from.

How to record the purchase of a computer

The initial cost of a computer includes pre-installed software, which is necessary for the full operation of this property (paragraph 2, paragraph 1, article 257 of the Tax Code of the Russian Federation). An organization should not list such software separately.

At the same time, in the initial cost of the computer, also include pre-installed software that is necessary for the full operation of this property (clause 4 of article 346.16, paragraph 2 of clause 1 of article 257 of the Tax Code of the Russian Federation). An organization should not list such software separately.

We recommend reading: Payments of Compensation under State Insurance for Workers from 1985 to 1992

New in fixed asset accounting in 2021 (latest news)

In tax accounting, you can only depreciate property that is more than 100,000 rubles, and only if it was placed on the balance sheet after December 31, 2021. Because amendments to the law were adopted on 01/01/2021. Anything less than 100,000 rubles can be written off immediately. This is stated in Article 256 of the Tax Code of the Russian Federation.

For tax accounting purposes, the cost of a fixed asset cannot include some expenses, for example, interest on the loan through which the fixed asset was acquired. In accounting, on the contrary, loan interest can be included in the cost of the fixed asset.

The difference between the paid version and the free version

In the free version of the program, you can configure monitoring for only 5 printers, and in total you can add no more than 100 pieces of equipment to the database. In principle, this is enough for a small office. The program provides calculation of cartridge balances even without automatic monitoring. In this case, balances are calculated based on previous usage statistics. And data from print counters can be entered manually if you need accurate information on printed pages.

The paid version for the entire local network costs 24,000 rubles , for non-profit organizations there is a 40% discount. It includes monitoring for 10 devices. If you need more, device monitoring packages are purchased separately. Their prices are on a separate page of the site.

The license is unlimited and if you are completely satisfied with the functionality of your version, you don’t have to buy updates, but use the purchased version forever.

Accounting for fixed assets in 2021 in accounting

- Debit 08 Credit 60 – amounts paid to the seller for delivery, etc. are reflected.

- Debit 08 Credit 20, 70 and other accounts - costs of bringing them to readiness for operation,

- Debit 19 Credit 60 – input VAT is reflected,

- Debit 01 Credit 08 – acceptance for accounting and commissioning of the operating system.

- Debit 01 “Disposal of fixed assets” Credit 01 – reflects the initial cost of fixed assets,

- Debit 02 Credit 01 subaccount “Disposal of fixed assets” – accrued depreciation is reflected,

- Debit 62 Credit 91 – revenue from the sale of fixed assets is reflected,

- Debit 91 Credit 68 – VAT accrued on the sale of fixed assets,

- Debit 91 Credit 01 subaccount “Disposal of fixed assets” - the residual value of fixed assets is written off.

Budget accounting of fixed assets in 2021-2021 (nuances)

Each inventory item as a unit of accounting for fixed assets must be assigned a number. And an inventory card is created for each object, with the exception of items costing less than 3,000 rubles and library objects.

One of the main criteria for recognition of fixed assets is the service life of the property, namely an interval exceeding 12 months. In addition, the facility must be used to carry out the activities of the institution permanently or repeatedly. Another feature is that the operating systems are not owned by the institution, but are quickly managed.

First impression of PrintStore

When I installed the program and saw the interface, I felt nostalgic. It’s immediately obvious that the program is very old. Not in the sense of versions, but precisely with its roots in the deep past. I’m not particularly versed in development environments and programming languages, but it’s clear that the program was written a long time ago. About 5 years ago I was lukewarm about old programs, but now for me it’s more of a plus. I'm glad it's not written in Electron. This means there is a chance that it will not be shamelessly slow and eat up memory.

immediately obvious that the program is very old. Not in the sense of versions, but precisely with its roots in the deep past. I’m not particularly versed in development environments and programming languages, but it’s clear that the program was written a long time ago. About 5 years ago I was lukewarm about old programs, but now for me it’s more of a plus. I'm glad it's not written in Electron. This means there is a chance that it will not be shamelessly slow and eat up memory.

The program's website has a clear description and good documentation. However, I warn you right away that the initial setup is not very intuitive. It is precisely this gap that I want to fill by describing in detail how to quickly put the program into operation so that it begins to help keep track of equipment. Despite all the misunderstandings, after I set it up, I was convinced that it solved the task well.

I’ll immediately emphasize that the program is more niche than general purpose. It will be most useful to those who have a lot of printers and MFPs in service, starting from several dozen, and at the same time need order and accounting. In this case, the program will make life much easier. I will talk about this in detail a little later when I list the main features. If you don’t have a lot of equipment, then the free version of the program may well be enough. It is not limited in time and provides the same functions as the paid one. For example, I would be interested to know how much money was spent on a printer over its entire service life from purchase to write-off.

The program is updated every week. The project is live and constantly being improved. The project team fixes bugs, introduces new functionality, adds new equipment to the database, and documents the program.

Accounting for an organization's office equipment in a WEB browser

- Download the latest version of the source HERE

- Copy/unpack them into the folder with the site.

- Run the installer site_name_or_IP/install/index.php

- Open config.php, enter the data for connecting to the database, set the permissions for the images, templatec_c folders to 775

- Let's try to launch it.

- Delete the install folder

- on the main page you can display the latest news for employees of your organization

- every employee sees what is assigned to him

- authentication possible via Active Directory

- When moving property, notifications are sent to owners of inventory items

- You can attach a photo to each inventory item “for recognition”

- quite extensive reporting system

- uploading status in XML format for interfacing with other accounting systems

- the 1C concept of “mark for deletion” has been implemented

- history of movements and repairs

- modularity of the system. You can join the development of the project via SVN

Installing Ocsng

The required package is available in the repositories of most distributions, although it is usually not the most current version. Self-assembly from source texts should not cause difficulties if you are careful. The setup.sh installation script, located inside the archive, will check for the presence of the required components and provide recommendations for troubleshooting, if necessary. In Debian/Ubuntu, for manual assembly you need to download the following packages:

$ sudo apt-get install libapache2-mod-perl2 libdbi-perl libapache-dbi-perl libdbd-mysqlperl libsoap-lite-perl libxml-simple-perl libnet-ip-perl libcompress-zlib-perl php5-gd

And XML::Entities from the CPAN repository:

$ sudo cpan -i XML::Entities

During the installation process, all necessary configuration files and aliases for the web server will be created. Since the files that can be distributed using OCSNG are often large, you should set the desired values for the post_max_size and upload_max_filesize variables in the /etc/php5/apache2/php.ini files (8 and 2 MB by default) and ocsinventory-reports. conf. After all the settings, call the browser and run the installation script https://localhost/ocsreports/install.php, where we specify the parameters for accessing the database. During the installation process, an “ocs” account with a “ocs” password will be created to access the ocsweb database. If access to the database is not limited to the local system, for security purposes the default password should be changed. To install the agent on Linux, you will need to have some Perl modules (XML and Zlib) and dmidecode.

$ sudo apt-get install libcompress-zlib-perl libnet-ipperl libnet-ssleay-perl libwww-perl libxml-simple-perl po-debconf ucf dmidecode pciutils

After which the agent is installed in the standard way for Perl applications:

$ tar xzvf Ocsinventory-Agent-1.1.2.tar.gz $ cd Ocsinventory-Agent-1.1.2 $ perl Makefile.PL $ make $ sudo make install

Next, the script will begin asking a series of questions about the placement of configuration files. We enter the server data, create a tag (to group systems), activate the cron task. Once the setup is complete, the collected computer configuration data is sent to the server. If the connection is established and we receive a “Success!” response, the agent installation can be considered complete. Its data will appear in the web console, in the “ All computers” section. An XML file containing the current computer configuration will be created in the /var/lib/ocsinventory-agent directory. If the connection does not occur, run the agent in debug mode:

$ ocsinventory-agent -l /tmp –debug –server https://ocsng-server/ocsinventory

Usually the information obtained is enough to diagnose errors. Agent for Windows can be installed in several ways. The simplest is manually or using the included logon script.

After installing the server, the agent installation file can be imported into the OCSNG database. Simply select the “Agent” tab and indicate the location of the file, after which it will be accessible from any computer on the network. The installation is standard: at the last stage we report the name or IP address of the OCSNG server, and in order to immediately generate and send a report, check the “Immediately launch inventory” checkbox. Next, the agent is registered in startup and starts as a service.

Features of accounting for computer equipment in institutions

• in the case of an exchange of components of similar functional purpose between different workstations, the fact of replacement is reflected in the inventory cards of the corresponding workstations by changing the data on the composition of the components of the workstation without changing its book value.

Current legislation does not provide guidance on whether parts of a personal computer (monitor and system unit) should be accounted for as separate fixed assets or only as a single complex.

We recommend reading: How much can you get for a tax deduction on property of individuals in 2021

Examples of application of articles 310 KOSGU and 340 KOSGU in 2021-2021

A cartridge is a spare part for a printer, copier, or scanner, that is, a consumable item. Therefore, in accounting it must be reflected as part of inventory under article KOSGU 340. But services for replacing the cartridge are under expense item KOSGU 225.

Spend expenses on batteries according to article KOSGU 340 “Increase in the cost of inventories.” Batteries are consumables, so take them into account as part of the MH (clause 118 of Instruction No. 157n), and write them off as expenses when replacing them.

Accounting for computers and office equipment in organizations

Accounting for computers and office equipment in organizations 04/23 - AS "KORUS" (Computers, Office Equipment, Consumables - Accounting and Maintenance) is focused on accounting for the computer equipment and technology available in any organization. The system is designed to solve a wide range of different problems related to accounting for computers and office equipment and calculating certain parameters for them.

The system allows you to: — take into account equipment purchases; — carry out its registration and write-off (with the formation of relevant acts); — take into account the movement of equipment across organizational units; — take into account the repairs carried out, replacement of parts and maintenance carried out on the equipment in question; — take into account the purchase of software and its installation on computers; — take into account cartridges and their refills; — take into account the change of cartridges on printers, copiers and other printing equipment; — take into account the purchase and issuance of consumables to the organization’s divisions; — take into account the distribution of office equipment among hubs and switches; — receive all kinds of reports on any information stored in the AS.

Ready-made utilities and applications

If you search the Internet well, you can find dozens of ready-made WMI scripts in a variety of programming languages that can easily be adapted to your needs.

My attention was drawn to the HTA application Hardware Inventory (www.robvanderwoude.com/hardware.php) with a web shell. Just enter the computer name and get information about the installed equipment. If necessary, you can edit the raw file in a text editor, adding the necessary parameters to it (poll of WMI objects is implemented in VBScript).

Third-party developers have created a number of special cmdlets that simplify writing scripts. The Computer Inventory Script (CompInv), which is available on the website powershellpro.com, allows you to obtain information about hardware, OS and save all collected data in an Excel file for further analysis. After launching, the script will ask several questions, answering which the administrator selects the data collection mode. The list of computers to scan is determined using a special text file, and the script can also automatically scan all systems or servers included in the domain. As an option, the computer name is specified manually. By default, the current account is used, but by answering “Yes” to the question “Would you like to use an alternative credential?”, you can specify the required account.

In order not to run the created script yourself, we will entrust this to SchTasks. For example:

> SchTasks /CREATE /TN CheckScript /TR "powershell.exe ` -noprofile -executionpolicy Unrestricted ` -file check.ps1" /IT /RL HIGHEST /SC DAILY

As a result, a task called CheckScript is created, which will execute the PS script check.ps1 daily, and with the highest priority. Together with the NetPoint hardware and installed applications inventory system (www.neutex.net), a set of PS scripts (GetNet*) is offered, designed specifically for collecting a certain type of data about slave systems. For example, let's look at the availability of free space on the hard drive:

PS> Get-NetLogicalDisk -DriveType "Local Disk" | where { $_.FreeSpace / $_.Size -lt .10 } | % { $_.ComputerSystemName }

Now let's try to collect information about installed programs:

PS> Get-NetProgram -System synack.ru -Uninstalled $False | % { $_.DisplayName } | sort -unique

In total, the delivery includes 20 cmdlets. A free version of NetPoint Express Edition is available and runs on 32/64-bit WinXP/2k3/2k8/Vista/Se7en and can be used in networks of any size. To install NetPoint you will need PS 2.0, IIS and SQL server (Express Edition is sufficient).

By the way, you can get a list of installed programs by simply reading the desired registry branch:

PS> Get-ItemProperty HKLM:\SOFTWARE\Microsoft\ Windows\CurrentVersion\Uninstall\* | Format-Table DisplayName,Publisher | Out-GridView

The Out-GridView cmdlet displays data in a separate window with the ability to search and sort.

Accounting for Computers and Office Equipment in the Organization Since 2021

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service. For detailed information about the service, contact your service manager.

Rationale for the conclusion: The current legislation does not contain a list of objects that can be classified as office equipment or computer equipment. Consequently, the procedure for classifying objects for the purpose of assigning them to one group or another should be fixed in the accounting policy of the institution. The decision to classify objects as office equipment or computer equipment lies within the competence of the relevant officials of the institution. In accordance with the All-Russian Classification of Products by Type of Economic Activities (OKPD 2) OK 034-2021 (KPES 2021), adopted and put into effect by Order of the Federal Agency for Technical Regulation and Metrology dated January 31, 2021 N 14-st, the list of objects in question can be distributed as follows: - MFPs can be classified under code 26.20.18.000 “Peripheral devices with two or more functions: data printing, copying, scanning, receiving and transmitting fax messages”; — printers — to code 26.20.16.120 “Printers”; — monoblock — to the corresponding code from the group 26.20.13.000-26.20.15.000. All these codes are included in group 26.20.1 “Computers, their parts and accessories” of section 26 “Computer, electronic and optical equipment”. We believe that MFPs, printers and all-in-one PCs can be classified as computer equipment.

Reports about printers, printing, etc.

The program implements a set of the most current reports. The program worked for me for several days, so the reports did not gain much relevance, but nevertheless, I will show you what happened. More detailed information can be found on the program website in the documentation, in the Reports section.

An example of a counter report where you can estimate the number of printed pages for each printer at a given interval. I've had this for a few days.

An example of a report on the availability of consumables in a warehouse.

List of equipment broken down by manufacturer.

These are just examples of some reports. There are a lot of them, 78 pieces, plus you can make your own. But you will need to figure it out; you won’t be able to customize your report at random.

PURCHASE OF COMPUTERS IN 2021

Fixed assets are tangible assets, regardless of their value, with a useful life of more than 12 months, intended for repeated or permanent use by the accounting entity on the basis of the right of operational management (the right of ownership and (or) use of property arising under a lease agreement (lease of property) or agreement for gratuitous use) for the purpose of performing state (municipal) powers (functions), carrying out activities to perform work, provide services, or for the management needs of the accounting entity. The specified material assets are recognized as fixed assets when they are in operation, in reserve, on conservation, as well as when they are transferred by an institution for temporary possession and use (clause 7 of the GHS “Fixed Assets”). An object of fixed assets is an object with all fixtures and accessories, or a separate structurally isolated object, intended to perform certain independent functions, or a separate complex of structurally articulated objects, representing a single whole and intended to perform a specific job. A complex of structurally articulated objects is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only as part of the complex, and not independently ( clause 41 of Instruction No. 157n, clause 10 of the GHS “Fixed assets”). Currently, there are two main approaches to accounting for a computer as a fixed asset:

We recommend reading: Monthly Supplement to the Pension of a Mother of Many Children Living in St. Petersburg Decree Number

These federal standards are mandatory for use by institutions. At the same time, accounting instructions continue to apply, in particular the Instructions for the application of the Unified Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated December 1, 2021 No. 157n (hereinafter referred to as Instruction No. 157n). Recommendations for accounting, according to the GHS “Fixed Assets”, are communicated by system letters from the Ministry of Finance of Russia:

Accounting for fixed assets for public sector employees: what has changed since 2021

There are few significant differences in the definition of the accounting unit and the procedure for accepting fixed assets for accounting. It is worth mentioning that the FSB introduces the concept of “OS complex”, that is, it allows objects with an equal useful life and insignificant cost to be considered as an inventory unit.

- Linear method. It involves the accrual of equal amounts of depreciation monthly over the entire useful life (USI). To calculate the payment, you need to divide the initial cost of the object by the investment cost.

- Reducing balance method. Convenient for those objects that quickly become obsolete or are operated in difficult conditions, in an aggressive environment. The method allows for accelerated depreciation by applying an increasing factor from 1 to 3 to the annual amount. The residual value of the object is taken as a basis (costs of purchase and commissioning minus accruals already paid off at the beginning of the reporting year), the depreciation rate is also taken into account based on the SPI and wear indicator.

- Method of calculating the amount of depreciation proportional to the volume of production. The method is good for objects for which the production potential inherent in them is indicated (that is, it is clear how many products the object can produce over its entire service life). The calculation is based on the actual volume of products produced for the reporting period, multiplied by the depreciation rate (initial cost / estimated volume of products over the useful life).

What applies to office equipment: list

- Duplicating equipment, if it is not connected to a computer.

- Copiers.

- Telephone exchanges for company work.

- Typewriters.

- Landline phones and cell phones.

- Devices for holding general meetings. For example, a microphone or a projector.

- Document shredder.

- Bill counter.

Nowadays, few people imagine their life without office equipment. At the same time, the concept of this device is not always identical to the special classifier approved by law. The accountant must correctly set the asset code and reflect it in a special account. Therefore, when reflecting office equipment, he relies precisely on this regulatory document.