Who has the right to apply the simplified tax system

All issues related to the simplified taxation system are regulated by Chapter 26.2 of the Tax Code of the Russian Federation. The simplified taxation system involves exempting the taxpayer from a number of tax payments:

| Taxes from which taxpayers of the simplified tax system are exempt | Explanation |

| Legal entities | |

| Income tax | Exception:

|

| Property tax | Exception: real estate, the tax base of which is calculated based on the cadastral value |

| VAT | Exception:

|

| Individuals (IP) | |

| Personal income tax | Exception:

|

| Property tax for individuals | In relation to property used for business activities. Exception: real estate, the tax base of which is calculated based on the cadastral value |

| VAT | Exception: import of goods; carrying out operations under a simple partnership agreement, investment partnership, property trust management agreement, concession agreement (Article 174.1 of the Tax Code of the Russian Federation) |

Why simplified tax system?

The simplified tax system is extremely convenient for small and medium-sized enterprises. Since all accounting reports are carried out in a simplified version, they do not need to have an accountant on staff and can outsource bookkeeping. “Simplified” allows you to replace as many as three taxes with one and at the same time also gives you the opportunity to choose the so-called “object of taxation”.

Simply put, the management of an enterprise has the right to decide how it will pay taxes: 6% of income or 15% of income minus expenses . Moreover, once a year, on the eve of the new calendar year, the object of taxation can be changed.

Another undeniable advantage of the simplified tax system is the ability to submit a declaration only once a year. Unlike the General Taxation System, the simplified regime exempts enterprises from certain types of taxes. For example, if we talk about Limited Liability Companies, they may not pay tax on property on the balance sheet of the organization, value added tax, as well as corporate income tax. Individual entrepreneurs who have chosen the “simplified system”, being individuals, are not required to pay tax on income from business activities; they are exempt from tax on property used in their work, as well as from VAT.

Important! Even with the Simplified Taxation System, LLCs and individual entrepreneurs are legally required to pay personal income tax (NDFL) on employee salaries. Neglect or evasion of this duty will inevitably entail punitive sanctions.

Who does not have the right to apply the simplified tax system

The following organizations (individual entrepreneurs) do not have the right to apply the simplified taxation system (Article 346.12 of the Tax Code of the Russian Federation):

- organizations with branches;

- banks;

- insurers;

- non-state pension funds;

- investment funds;

- professional participants in the securities market;

- pawnshops;

- organizations engaged in the extraction and sale of mineral resources;

- organizations engaged in the production of excisable goods;

- organizations engaged in gambling activities;

- notaries and lawyers conducting private activities;

- organizations that have switched to agricultural tax;

- organizations in which the share of participation of other organizations is more than 25%;

- organizations with more than 100 employees;

- organizations whose residual value of fixed assets exceeds 150 million rubles;

- state and budgetary institutions;

- organizations that have not notified the tax authorities about the transition of the simplified tax system by December 31 or no later than 30 calendar days after tax registration for newly created organizations;

- microfinance organizations;

- private employment agencies.

How to account for income and expenses

Taxable income under the simplified tax system is revenue from the main type of activity (income from sales), as well as amounts received from other types of activities, for example, from leasing property (non-operating income). The list of expenses is strictly limited. It includes all popular cost items, in particular, wages, cost and repair of fixed assets, purchase of goods for further sale, and so on. But at the same time, the list does not include such an item as “other expenses”. Therefore, tax authorities are strict during audits and cancel any expenses that are not directly mentioned in the list. All income and expenses should be recorded in a special book, the form of which is approved by the Ministry of Finance.

Under the simplified system, the cash method of recognizing income and expenses is used. In other words, income is generally recognized when money is received in the current account or cash register, and expenses are recognized when the organization or individual entrepreneur repays the obligation to the supplier.

Maintain tax and accounting records under the simplified tax system in an intuitive web service Try for free

When can you lose the right to use the simplified tax system?

Entrepreneurs may lose the right to use the simplified tax system in cases where:

- at the end of the tax period, income exceeded 150 million rubles;

- the average number of employees exceeded 100 people;

- the residual value of fixed assets amounted to more than 150 million rubles.

The taxpayer must notify the tax authorities of the loss of the right to use the simplified tax system within 15 days after the end of the reporting period (first quarter, half a year, nine months), i.e. must be reported on time:

- until April 15;

- until July 15;

- until October 15.

In this case, the declaration must be submitted no later than the 25th day of the month following the reporting period, i.e.:

- until April 25;

- until July 25;

- until October 25.

If an organization operating under the simplified tax system has ceased to exist, it is necessary to submit a declaration to the tax authorities by the 25th day of the month following the month of termination of activity. Tax payment must be made during the same period.

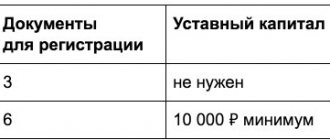

How to switch to "simplified"

Entrepreneurs, already during the procedure for registering an enterprise, are required to decide on the taxation regime under which they plan to operate. You can submit a notification for the Simplified Taxation System either together with the rest of the package for state registration, or submit it later - within 30 days after submitting the main documents to the tax office.

If this does not happen, then the enterprise is automatically included in the general taxation system.

Sometimes it happens that in the process of work, businessmen understand that the simplified tax system is preferable to the operating tax system, and the question arises: is it possible to change the tax payment regime and how to do this? Yes, you can switch to the “simplified” system at any time during the operation of the enterprise. Due to its simplicity, this procedure should not cause any difficulties. To do this, the management of the enterprise must submit a notification to the tax authorities about the transition to the simplified tax system by the beginning of the next calendar year, but this must be done no later than December 31 of the current year. A standard sample notification can be easily found on the website of the Federal Tax Service.

Also read the full version of the material “how to switch to the simplified tax system.”

Who and under what conditions can apply the simplified tax system?

The taxpayer has the right to apply the simplified tax system, provided that the following requirements are met:

- the rules for applying the simplified tax system specified in Article 346.12 in relation to the types of activities of the organization are not violated (the list is indicated in the section “Who does not have the right to apply the simplified tax system?” of this article);

- the share of participation of third parties does not exceed 25%

- the average number of employees is no more than 100 people per year;

- the residual value of fixed assets as of January 1, 2017 does not exceed 150 million rubles;

- the amount of income does not exceed 150 million rubles for 9 months from the beginning of the tax period.

Example 3. ABC LLC in the reporting period for the first quarter of 2021 indicates income equal to 152 million rubles. Thus, ABC LLC is obliged to begin conducting its activities in accordance with the general taxation system from the 2nd quarter. If ABC LLC does not voluntarily express a desire to change the taxation system, it will be forced to work in accordance with the general taxation system.

Cons of the simplified tax system

Before deciding whether to switch to a simplified tax regime, you should carefully weigh the pros and cons. The fact is that, despite the obvious advantages, working under the simplified tax system also has a number of hidden pitfalls. In addition to the above-mentioned restrictions on the number of employees in an enterprise and profit margins, the main disadvantage of working under the simplified tax system is the exemption of organizations from paying VAT.

The essence of the problem

Large enterprises, which, as a rule, operate under the General Taxation System, and therefore with VAT, require their counterparties to fill out invoices. Meanwhile, entrepreneurs working on the simplified tax system are legally unable to issue these invoices. Another disadvantage of the simplified tax system is that in case of loss of the right to work under it, for example, as a result of exceeding the limit on the number of permitted number of employees or exceeding profits, it will be possible to return to it only from next year. Moreover, the application for the transition will need to be submitted on the eve of January 1.

Criteria for a simplified taxation system

In order to make a decision to switch to a simplified taxation system, an entrepreneur needs to very clearly understand the criteria of the simplified tax system:

| Criterion | Description |

| Object of taxation |

|

| Taxable period | calendar year |

| Reporting periods |

|

| Tax rates |

|

Amounts of payments to the state when conducting activities on the simplified tax system

We are talking here not only about payments to the budget in the form of taxes, but also about payments for pension, medical and social insurance of employees. Such transfers are called insurance premiums, and sometimes salary taxes (which is incorrect from an accounting point of view, but understandable for those who pay these contributions). Insurance premiums amount on average to 30% of the amounts paid to employees, and individual entrepreneurs are required to pay these contributions for themselves personally.

Tax rates under the simplified system are significantly lower than the tax rates of the general taxation system. For the simplified tax system with the object “Income”, the tax rate is only 6%, and from 2021, regions have the right to reduce the tax rate on the simplified tax system for income to 1%. For the simplified tax system with the object “Income minus expenses,” the tax rate is 15%, but it can also be reduced by regional laws down to 5%.

In addition to the reduced tax rate, the simplified tax system for income has another advantage - the ability to reduce advance payments for the single tax due to insurance premiums transferred in the same quarter. Legal entities and individual entrepreneurs-employers operating under this regime can reduce the single tax by up to 50%. Individual entrepreneurs without employees on the simplified tax system can take into account the entire amount of contributions, as a result of which, with small incomes, there may be no single tax payable at all.

On the simplified tax system Income minus expenses, you can take into account the listed insurance premiums in expenses when calculating the tax base, but this calculation procedure also applies to other tax systems, so it cannot be considered a specific advantage of the simplified system.

Thus, the simplified tax system is undoubtedly the most profitable tax system for a businessman if taxes are calculated based on the income received. The simplified system may be less profitable, but only in some cases, compared to the UTII system for legal entities and individual entrepreneurs and relative to the cost of a patent for individual entrepreneurs.

We draw the attention of all LLCs to the simplified tax system - organizations can pay taxes only by non-cash transfer. This is a requirement of Art. 45 of the Tax Code of the Russian Federation, according to which the organization’s obligation to pay tax is considered fulfilled only after presentation of a payment order to the bank. The Ministry of Finance prohibits paying LLC taxes in cash. We recommend that you open a current account on favorable terms.

Deadlines for submitting reports and paying taxes under the simplified tax system

The calculation of tax under the simplified tax system is carried out incrementally from the previous one and is taken into account in advance payments; the final payment will be calculated in the tax return. The timing of advance payments does not depend on the status of the taxpayer (legal entity or individual entrepreneur):

| Taxable period | Payment due date |

| First quarter | until April 25 |

| Half year | until July 25 |

| Nine month | until October 25 |

The deadline for submitting a tax return for the tax period and paying the finally calculated tax depends on the status of the taxpayer:

| Taxpayer | Deadline for filing returns and paying taxes |

| Individual entrepreneur | Until April 30 |

| Entity | Until March 31 |

The tax return is submitted after the end of the tax period, i.e. next calendar year.

In case of violation of the deadlines for submitting a tax return and payment of the simplified tax system or violation of the deadlines for making advance payments, tax legislation provides for fines and penalties for negligent taxpayers.

How to calculate a single “simplified” tax

First of all, you need to determine the tax base (that is, the amount of income, or the difference between income and expenses). The tax base is calculated on an accrual basis from the beginning of the tax period, which corresponds to one calendar year. In other words, the base is determined during the period from January 1 to December 31 of the current year, then the calculation of the tax base begins from scratch.

In addition, it is necessary to transfer advance payments to the budget based on the results of the reporting periods (quarter, half-year, 9 months).

Tax (advance payment) is calculated this way.

If income does not exceed 150 million rubles, and the average number of personnel does not exceed 100 people, we proceed as follows. We take the tax base for the reporting (tax) period and multiply it by the rate of 6% or 15%. From the resulting value we subtract the advance payment for previous reporting periods.

If in the middle of the year the income fell into the range of “more than 150, but less than 200 million rubles.” or the average number of employees falls in the range from 101 to 130 people, we follow the algorithm:

1. We are looking for the tax base for the period preceding the quarter in which income exceeded 150 million rubles, or the average number of employees exceeded 100 people. We multiply this base by the rate: 6% or 15%;

2. We calculate the taxable base for the entire reporting (tax) period. From it we subtract the base obtained in the previous step. We multiply the found number by the rate: 8% or 20%.

3. Add up the numbers obtained from steps 1 and 2.

Taxpayers who have chosen the “income minus expenses” object must compare the resulting single tax amount with the so-called minimum tax. The latter is equal to 1% of income. If the single tax, calculated in the usual way, turns out to be less than the minimum, then the minimum tax must be transferred to the budget. In subsequent tax periods, the difference between the minimum and “regular” taxes can be taken into account as expenses. In addition, those for whom the object is “income minus expenses” can carry forward losses to the future.