Almost all employers have switched to transferring wages to their employees’ cards - this is much more convenient than issuing and receiving money at the cash register. And in most cases, the employee is issued a plastic card at the bank in which the organization has a salary project. But what to do if the employee is not satisfied with this card or the bank itself - can he receive his salary on a card from another bank?

You need to understand that the employer chooses a salary project that is convenient for him, and not for his employees, especially since everyone may have different needs. Usually, no money is charged from the employee for servicing a salary card, but despite this, such cards do not always have conditions favorable to their owner:

- Lack of cashbacks and other bonuses;

- Inconvenient location of ATMs and bank branches;

- No interest accrual on the account balance;

- And others.

And ultimately, this can make them less attractive compared to cards from other banks, even those for which you have to pay for the service yourself.

Payroll projects of banks - advantages of comprehensive cooperation

Companies that pay employees salaries on cards, as a rule, work with banks within the framework of so-called “salary” projects. Such cooperation is very beneficial for all parties - the employer, the financial institution and the employees themselves.

Benefits of “ salary ” projects for the bank:

- Attracting a large number of clients – individuals;

- The ability to offer new clients related services and programs (for example, lending);

- Payments on cards (for example, charging commissions) are not carried out with each cardholder separately, but centrally - through transfers from the company’s accounting department;

- If overdrafts are opened on cards, debits also occur automatically after the salary is calculated, which means the bank reduces the risk of non-payment.

Do I need to coordinate anything with the bank?

You do not need to sign any additional agreements or approvals with the financial institution. To receive wages, you must do the following:

- Log in to Sberbank Online.

- Select a bank card.

- ABOUT.

- Create and download an application.

- Fill out and submit the document to your place of work.

- Wait until your salary is transferred.

The salary project is connected automatically. This happens after receiving your first salary. You start receiving push notifications and SMS messages. This allows you to take advantage of the salary project, but you should understand that your employer must have an appropriate agreement with this bank. Individual clients may not be provided with privileges. This nuance must be taken into account.

Benefits for the employer:

- Simplification of the work of cash registers and accounting - salaries are calculated by pressing a couple of keys, and the bank transfers money in the shortest possible time. Thus, there is no need to maintain voluminous payslips or waste employees’ time on issuing salaries;

- Ease of payments to remote departments - employees do not have to come during working hours to receive salaries;

- Ease of accounting;

- No costs for collection of large amounts;

- Favorable conditions for salary projects (the bank can offer a variety of benefits to large companies or completely cancel commissions);

- The bank offers discounts and special conditions for other projects and programs.

How to change the salary bank for an employee

Now employees have the right to choose which bank account they want to receive their salaries into.

And the employer has no right to refuse them. Such norms are included in Article 136 of the Labor Code of the Russian Federation (Article 3 of the Federal Law of November 4, 2014 No. 333-FZ). Does this mean that if an employer has issued cards for transferring salaries to employees in one bank, and the employee wants to receive them in another, he can require the employer to open a salary account for him in another bank? Is the employer obligated to comply with such an employee’s request? And if so, what should the employer do in this case? We asked an independent expert to answer these and other related questions. N.V. Potapov , lawyer, chief specialist for working with assets of OJSC Bank AK BARS

- I’ll start with the fact that the law does not contain a provision that would force an employer (company or entrepreneur) to open individually, at the request of an employee, a salary project in the bank that interesting to the employee. In fact, Article 136 of the Labor Code of the Russian Federation only says that an organization (individual entrepreneur) must transfer wages according to the details provided by the employee in a written application. That is, an employee, in order to receive wages in the bank that is convenient for him, must write an application at least five working days before the day of payment of wages and indicate the account to which he needs to transfer the money. And the employer has no right to refuse him this.

— What is the employer's procedure after an employee provides his account details?

— The employer must accept the application, check it, in particular, make sure that the details contained are correct. This can be done through the company's bank.

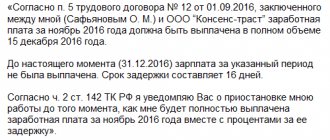

I note that the employee can fill out the application in any form, since there is no approved form. If the application contains correct details and is submitted no later than five working days before the payment of wages, the employer is obliged to transfer the remuneration according to the details specified in the application. For example, a company’s salary is December 10, which means the application must be in the accounting department no later than December 3. Otherwise, the company has the right to transfer wages in the same manner. At the same time, the employer, in cases where the employment agreement with the employee contains specific conditions for the payment of wages, prepares an additional agreement to the employment contract, which specifies new details and the transfer procedure. And one more thing: if the employee submitted an application later than the five-day period before the payment of wages, the employer may postpone its execution until the next payment.

— Does the employer bear any additional costs associated with servicing the card with a third-party bank?

— The law does not oblige you to bear such expenses. Therefore, the employer may not bear the costs associated with issuing the card, annual maintenance and fees for crediting funds. Moreover, the employee must provide details of an already opened account, which means that the employer will not have expenses associated with issuing the card, etc.

— Nikolay Viktorovich, is the cost of producing a card for an employee subject to personal income tax when the employer issues it as part of his salary project?

— In fact, the employee does not have any economic benefit when the employer includes him in the salary project. Accordingly, the employee will not have any income, and personal income tax does not need to be withheld from the cost of the card. However, as judicial practice shows, the inspectorate often disagrees with this.

In this case, I can recommend the following. Include clauses in employment contracts with employees that contain the employer’s obligation to bear the costs associated with issuing bank cards, and when concluding salary projects with banks, pay attention to who, according to the contract, is responsible for servicing salary accounts (in most cases, such responsibility lies with the employer). If we talk about cases when the employee himself enters into an agreement with the bank to service the card, then he is obliged to pay all banking expenses associated with it (opening, annual maintenance). If the organization pays these expenses, then it will have to withhold personal income tax from these payments. After all, this will already be considered the income of the employee himself (Article 226 of the Tax Code of the Russian Federation).

— Will the bank charge a commission for transferring salaries to a card not issued as part of a salary project?

— Yes, the bank will charge a commission for transferring wages to a card issued not within the framework of a salary project at the tariffs established for services under the contract for cash settlement services when making payments by payment orders.

— That is, the employee will have additional expenses that those who continue to receive salaries as part of the salary project will not have?

- Right. The employee himself pays for the maintenance of his “personal” salary card.

— Please explain, can an employee provide the account details of a card that is issued, for example, to a wife (close relative)?

— I believe that an employee can provide account details of a card that is registered in the name of a close relative or a third party, but the employer has the right to refuse to make payments using the specified details. After all, the employment contract stipulates that wages are paid directly to the employee. However, if the parties to the employment contract determine the procedure for payments, for example, to the card account of a close relative, then such restrictions will be lifted and the salary can be transferred to the account details of, for example, the wife.

Editorial Board of the magazine "Uprashchenka"

Benefits for company employees:

- There is no need to waste time and money on visits to the accounting department and queuing at the cash register;

- Increased security – money on the card is protected from theft;

- The salary card for employees is absolutely free - there are no fees for maintaining an account, etc.;

- Banks offer “salary” clients preferential terms for overdrafts and consumer loans - this is associated with less risk for the financial institution, because it can control the level of income of the borrower and write off the salary card if necessary;

- Clients who have unresolved monetary disputes (for example, there is a court order to pay off a loan debt) can use the card on a general basis; only the portion specified by law will be debited from their salary to pay off the debt. If another debit “plastic” is issued, the funds on it may be blocked completely to pay off obligations.

- The card is issued by the employer, the employee does not waste time choosing a bank and preparing the necessary papers.

Although the benefits of salary projects in comparison with issuing cash through a cash desk are obvious, situations often arise when an employee is not satisfied with the bank with which the agreement was concluded.

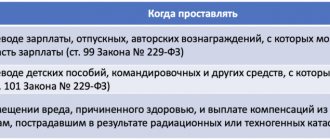

What amounts can be withheld from your salary?

The employer is allowed to deduct from employees' salaries in its favor the amounts associated with:

- reimbursement of unearned advances issued on account of wages;

- repayment of unspent and not returned timely advance payment issued in connection with a business trip;

- return of amounts overpaid due to accounting errors;

- return of amounts overpaid to the employee if the employee is guilty of failure to comply with labor standards (by decision of the labor dispute commission);

- dismissal of an employee before the end of the working year, for which he received annual paid leave (for unworked vacation days).

In what cases may an employee want to change banks?

In fact, situations when an employee does not want to be served by a “salary” bank are not uncommon. However, employees rarely change financial institutions, fearing conflicts with management, accounting, and also not wanting to waste time on obtaining another card and the necessary applications. But still, in some cases such actions will be justified:

- You have changed your employer and need to change your salary card to another bank. This situation in itself is not a problem, but if you have an established relationship with your previous bank and you actively use its services, then it would be desirable for your salary to be transferred there.

- The situation described above may also arise in the case when you did not change your job, but your company decided to change the servicing bank.

- You have a loan from another bank (especially if it is preferential as part of a previous “salary” project). Of course, it will be convenient for you to receive money into an account at this financial institution, and then repay the loan without fees and time spent on withdrawing money from an ATM and visiting the lender's branch.

- There are no offices or ATMs of the bank chosen by your employer in your locality, or you are not satisfied with their work schedule. This situation occurs quite often in large organizations with centralized accounting and a branched structure. The capital bank chosen by the employer can only have branches in large regional centers and cities, and employees from small localities will have to travel there to withdraw their salaries. In such cases, employees, as a rule, strive to change the bank to a large one, the branches and terminals of which are “in every village” - for example, Sberbank.

- There are no benefits for salary clients - loans at reduced rates, bonuses, discounts, overdrafts, cashback, etc.

- You are not satisfied with the bank's services - for example, there is no online account or it has limited functionality, you are not able to transfer money between accounts, open an additional debit account for savings, etc.

Employer's liability

Amendments to labor and administrative legislation on the possibility of changing the salary bank provide for fairly strict liability for employers for imposing their options on employees.

Individual entrepreneur

For the first violation of the law,

they can be fined from 1 to 5 thousand rubles

.

If the individual entrepreneur repeatedly refuses to transfer the salary to the bank specified by the employee, the fine may rise to 30 thousand rubles

.

Fines

provided

for organizations - up to 50 thousand rubles

for the first violation,

up to 100 thousand

for a repeated violation.

Separately, fines are provided for the director or accountant of an enterprise personally—from 10 to 30 thousand rubles.

Employers are punished with exactly the same sanctions for failing to pay employees the money they earned.

Does an employee have the right to change the “salary” bank?

So, you have the motives and desire to change your salary card to a plastic card from another bank. Let's figure out whether the employee has the right to take such actions, or should we trust the accountant who convinces us that such actions are impossible?

The law is clear about the employee’s right to independently choose a bank for service:

- Part 3 Art. 136 of the Labor Code of the Russian Federation: “remuneration is paid in cash or transferred to the bank account specified by the employee under the terms of the employment agreement”;

- Article 1, Part 1 of the Civil Code of the Russian Federation: “citizens (individuals) and legal entities acquire and exercise their civil rights of their own will and in their own interest,” while any infringement of such rights is recognized as a violation of the law.

Thus, an employee of an organization is the only person who has the right to determine into which account he receives his salary. However, in practice, the situation is exactly the opposite - employers enter into a salary agreement with a specific bank and do not seek to make exceptions for employees who do not want to be serviced by this credit institution.

It is worth remembering: your desire to change the bank is legal only if the collective agreement with the employer does not stipulate the latter’s right to independently determine the bank for the salary project. If you have signed such an agreement, it means that you have voluntarily limited your rights in choosing a plastic card.

If there is no such clause in the collective agreement or employment agreement, you have every right to contact the accounting department of the enterprise with an application to change the “salary” bank. However, to do this, you must first select the most suitable card.

Government regulation

In accordance with the Labor Code of the Russian Federation, wages must be transferred to employees at least twice a month.

Moreover, each payment has clearly defined deadlines. The first part is an advance payment, which is transferred before the end of the period.

Full payment is due by the 15th of the month. The law does not clearly establish in what form wages should be transferred. Everything must be regulated by the employer's company regulations.

Transferring funds to an employee’s card is not a prerequisite, but an additional option. It is available if the company’s rules provide permission for such actions, as well as if there is a written application from the employee.

In the same application, the employee must indicate the details to which funds will subsequently be transferred.

How to choose the “ideal” salary card

In the case when the desire to change bank is caused by the fact that you are already a client of another credit institution, and it completely suits you, there are no problems with choosing a card. If you don’t yet know which card to apply for, we offer our recommendations:

- Find out whether your chosen bank will consider your card as a “salary card” - only in this case will the financial institution offer you preferential terms of service and lending along with other participants in salary projects;

- Be sure to issue a personalized card with the maximum number of degrees of protection - this way you will protect your money from fraudsters;

- Check the fees for transfers between accounts, card issuance and maintenance, etc. – after all, if you issue a card yourself, you will have to pay for them;

- Experts do not recommend keeping all funds on a salary card - this is very risky. The ideal option would be to register several products in one bank: a payroll debit for receiving income and current payments, a credit card for unexpected expenses, a deposit account for savings. If you often pay with a plastic card (especially on the Internet), it makes sense to get another debit card to secure the income transferred to your salary. It is very important that the bank makes it possible to quickly and without commissions make transfers between savings, credit and “salary” accounts;

- Familiarize yourself with the capabilities of your online account, find out the amount of commissions for paying for mobile communications, Internet, and housing and communal services;

- If you want to give your family access to your salary account, you will need additional cards - check with the bank to see if the selected tariff allows them.

So, if you have already decided on a bank and are ready to switch to it for payroll services, let’s talk about how to carry out this procedure as quickly as possible.

How to transfer salary to a card of another bank

Initially, you need to decide on a credit institution. This must be a Russian bank. The card does not have to be a salary card - this is a symbol for mainly debit cards to which organizations transfer wages to their employees. If a full-fledged salary project is drawn up, then a legal entity or individual entrepreneur within its framework receives a number of additional preferences.

You can make any card a salary card: the date it was issued does not matter. An employee may have a card in his hands long before he decides to make it a salary card. This is a fairly common practice. You can change the bank to receive your salary as follows:

- Fill out an application addressed to the employer.

- Submit your application to your employer and wait for it to be reviewed.

An application to change a salary card is submitted to the employer, and not to the accounting department. The reason for this is that in most organizations accountants are not authorized to deal with such issues. Moreover, changing the salary card of even a single employee means an increase in the amount of work for the accountant. Disagreements arise precisely on this basis.

How to write an application to change your salary details

There is no unified form for such a statement. In fact, it is compiled in free form. After the “header” (to whom, from whom, for what reason), the following document structure is used:

- Recipient - full name of the applicant.

- The account number for crediting wages can be checked in the Internet bank, through an ATM, or by calling the hotline.

- Name of the credit institution.

- Correspondent account.

- BIC.

To clarify the purpose of the payment, indicate “salary transfer”. On the websites of most major credit institutions, you can download such an application form and submit it to your employer or accounting department.

What needs to be agreed upon with the bank

Using Sberbank as an example, a salary project is opened without additional contracts and approvals. After issuing a Mastercard card, the client, through Sberbank Online, performs the following actions:

- Log in to Sberbank Online and select a card.

- In the card settings, select the “Make a salary card” option.

- Create and download an application.

- Submit your application to your place of work.

- Wait for your salary to be transferred.

After the first salary transfer, the Sberbank salary project is activated automatically. The client receives a corresponding SMS message and push notification. From this moment on, the client enjoys all the benefits of the salary project.

How to change bank - step-by-step instructions

Are you wondering what needs to be done to change your salary tank? We offer you step-by-step instructions:

- Step 1. Determine if you really need it. Changing a bank is fraught with the loss of some benefits, the expenditure of time and effort on issuing cards, and there may also be a conflict with management.

- Step 2. Choose a bank if you are absolutely sure of your decision.

- Step 3. Complete an application for card issue at the selected bank. Depending on the credit institution and your region, issuing a card may take from 2-3 days to several weeks - please note that during this period you will not be able to withdraw your accrued salary from an ATM;

- Step 4. No later than 5 days before your salary is due, make a written application with a request to transfer your income using the details specified in it (you need to indicate the full account details, not the card number).

- Step 5. Sign the application from your manager and accountant.

- Step 6. Receive an additional agreement from the HR department to change your salary card details.

- Step 7. Receive your salary on the card of your choice!

As we can see, the procedure for switching to a salary card of another bank is quite simple. However, it contains several problems that must be discussed.

How to transfer a salary project from one bank to another

To switch to a salary project at another bank, you need to perform the following sequence of actions:

- Notify all employees of the change in banking organization.

- Each employee closes his account by first withdrawing funds from the account.

- The responsible specialist of your company contacts the banking organization with documentation and a corresponding application.

- The financial institution terminates the contract with your company.

After this, a salary project can be opened at the financial institution of your choice. To start cooperation:

- Contact the bank office or submit an application online.

- Please review the list of documentation that needs to be provided.

- Before you sign the contract, find out the service rates.

- Make a contract.

- Give employees new cards.

In order for the contract to be successfully concluded, each employee of your company must write an application, to which a photocopy of the passport is attached.

Pitfalls of changing banks

Although the process of changing the salary bank is quite simple, in practice only a few use this opportunity. The reasons for this are quite compelling:

- The employer is not required to bear the costs of changing a bank employee. This means that you pay all fees for issuing a card and maintaining an account, transferring funds, and additional services on the new card yourself.

- Registration, re-issuance, and issuance of a new card is carried out by the employee personally and at his own expense, which leads to a loss of time and money.

- If crediting to cards within the framework of salary projects occurs instantly (or within a few hours), since the transfer takes place between accounts in the same bank, then you will have to wait. Depending on the conditions and agreements between banks, crediting can occur either on the same day or within several days.

- An employee, as a rule, loses most of the privileges and benefits available to salaried clients, including fast processing of loan applications and reduced loan rates. The exception is when the new bank is ready to consider your card as a salary card.

- The main problem in case of changing banks, which stops many employees, is the risk of spoiling relations with management.

If the client clearly understands possible problems regarding the first three points, then the last point is quite controversial and such contradictions can be dealt with.

What to do with a card on which wages were received before changing banks

Such issues are resolved at the discretion of the client. Most salary projects involve free service and the use of a number of additional preferences. It is beneficial for credit institutions to have as many clients as possible use their bank cards. With free card servicing, the bank's profit consists of commissions from the payment system and paid services and options that holders can activate at will.

After excluding the card from the previous salary project, most of the previously existing preferences will be canceled. The service will become paid, and banking services (loans, mortgages, deposits) will be provided on general terms - as not for salary clients of the bank.

The client can keep the card for use or close it to minimize their expenses. There are no restrictions in this case, since an employee of the organization is no longer a salary client. If the card is not needed, it should be closed according to the rules established by the bank.

If the employer is against

So, you want to change your salary card because you don’t like the servicing bank, but you are afraid of the wrath of management. It is worth clearly understanding that the Labor Code has been regulating this issue since 2014, and qualified personnel and accounting specialists are well aware of your rights. In any case, in large companies that value their reputation, there are no problems with moving to another bank.

If we are talking about a small private organization where the rights of employees are not observed so zealously, then there is a way out: you can remind the employer of the need to comply with Labor Code standards and your right to contact the labor inspectorate regarding the violation. As a rule, after this the application is still executed without any questions asked.

Note that there is another way out: if you do not want to enter into a conflict, and the management flatly refuses to fulfill your demands, then you can be the holder of two cards - a salary card imposed by your company, and an additional debit card, which will suit you in all respects. In your online account, set up an automatic transfer of funds from one card to another - and the problem is solved without wasting time, effort and nerves arguing with your boss or accountant.

Do you need employer approval to change banks to receive a salary?

The situation with the choice of card and issuer is such that the norms of the law mentioned in the Labor Code are often ignored by the employer. In 2014, Law No. 333-FZ confirmed the right of a person to agree to receive funds on the card of the proposed bank, or to refuse by transferring the details of another banking organization to the accounting department.

According to the proposed procedure, an employee of the enterprise has the right to change the bank in which the account will be serviced. Since changes must be documented in the enterprise’s documentation, which requires the participation of the administration, it is often not possible to transfer funds to another card. In practice, either the employee shows loyalty to the company that employed him or is looking for another job.

conclusions

Each of us has every right to independently choose which bank account to receive our salary (or even require the employer to issue funds in cash). This right is separately stipulated by the Labor Code of the Russian Federation. The reasons for not agreeing to service at the bank chosen by the employer may be different, but in any case, you only need an application indicating new details for the employer’s accounting department to begin making transfers using them.

You should not think that management will spend a lot of time or effort on executing your application - as a rule, it is enough to make the required settings in the program once and then not return to this issue. However, changing banks may entail additional time, fees and other difficulties, so it is worth determining in advance how much you need another salary card.

How to correctly write an application to change the details for receiving wages?

There is no single form of document. He writes freely. This does not mean that it should not include any mandatory items. The header always comes first, and the further structure includes the following points:

- Full name of the applicant.

- Payroll account number. Be sure to check your bank details. You can view it at an ATM, online banking, or by calling the hotline.

- Name of the financial institution.

- BIC and correspondent account.

It is imperative to indicate that this is an application for the transfer of wages. Many large financial institutions post a ready-made form on their official websites specifically for clients. It can be downloaded, printed and filled out.