Home — Articles

Anyone can make a mistake when preparing financial statements. The main thing is to correct the mistake. And the procedure for correcting it depends on two points: whether the error is significant and in what period it was discovered.

Note A significant error is an error that, individually or together with other errors for the same period, can affect the economic decisions of users made on the basis of the accounting records of this period (Clause 3, 5 - 11, 14 PBU 22/2010).

How to distinguish a significant error from an insignificant one

According to clause 3 of PBU 22/2010 “Correcting errors in accounting and reporting”:

“An error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements prepared for this reporting period.”

The degree of materiality influences the economic decisions of users

The degree of materiality of the error depends on the value of correct information for the user of the statements, namely, for the economic decisions he makes.

Consequently, it is necessary to approach the determination of the significance of errors in accounting and reporting economically (qualitatively), and not just formally, mathematically (quantitatively).

It should also be borne in mind that the correction of a significant error from previous years, identified after the approval of the financial statements for the year, as a general rule requires a retrospective recalculation of the financial statements and is reflected in the balance of account 84 “Retained earnings (uncovered loss)” (clause 9 of PBU 22 /2010) during the period of its identification.

Correction of a minor error does not imply a retrospective recalculation, and the result of the adjustment is reflected in other income or expenses of the current reporting period (clause 14 of PBU 22/2010).

Thus, the main differences between significant and insignificant errors of previous years are as follows:

- influence / lack of influence on comparative indicators of financial statements;

- influence / lack of influence on the profit (loss) indicator of previous years.

It turns out that the fact of correcting a significant error forces the user to reconsider his understanding of the organization’s past and the dynamics of its financial indicators, which cannot but affect the assessment of prospects.

This conclusion allows us to identify standard indicators that characterize the financial position of an organization: liquidity ratios, profitability ratios, asset turnover and market value.

It is worth finding out exactly what coefficients internal users (manager, financial and economic service, participants (shareholders) of the organization) of your organization’s reporting are guided by when making economic decisions. Errors in the information used in such calculations will be the most significant.

The degree of materiality is determined based on rationality

Taking into account the information needs of reporting users, but also the principle of rationality, it is worth defining not only qualitative, but also quantitative criteria for the materiality of an error in order to avoid unnecessary labor costs for the accounting department to correct and disclose significant errors in the explanations to the reporting.

Let us make a reservation that in the case when even a small error in amount will have a fateful significance, the accountant will always be able to deviate from the canon and describe it in explanations.

It is traditionally accepted to take 5% of the base value of the indicator that was distorted as the level of materiality. Some organizations choose the percentage differentially for various indicators, the errors in which are considered significant (for some indicators 5%, for others - 7%, etc.).

The materiality of an error in percentage terms can coexist with materiality in absolute (total) terms. For example, in the accounting policy it may be decided to stipulate that “an error is significant if it exceeds 5% of the base indicator, but not less than 100,000 rubles.” or “the error is significant if it is greater than or equal to 5% of the base indicator or exceeds 1,000,000 rubles.” and so on. It all depends on the scale of the organization’s activities and the requests of its management services and owners.

You can approach this issue a little differently and take “punitive” legislation as a guide. Yes, Art. 15.11 of the Code of Administrative Offenses of the Russian Federation, a gross violation of accounting reporting requirements means a distortion of any indicator of accounting (financial) reporting expressed in monetary terms by at least 10%. This - much more formal - option is more suitable for those organizations that do not practice financial analysis based on financial statements and, as it seems to them, are more likely to prepare financial statements for regulatory authorities than to use their indicators for making economic decisions.

Regulatory legal acts (LLA) on accounting do not provide any clear formulations for enshrining in the accounting policy on the issue under consideration. Clause 3 of PBU 22/2010 only notes that the organization determines the materiality of an error independently, based on both the size and nature of the relevant item(s) of the financial statements.

The materiality factor must be taken into account based on the totality of errors

An error that is not significant in itself may turn out to be significant when combined with other errors made in the same reporting period. For this reason, it is necessary to determine the materiality not only of each error individually, but also of their totality, if they can have a joint impact on economic decisions.

For example, the value of an organization's net assets is determined by the formula:

Let's assume that errors were made in the balance sheet items “Revaluation of non-current assets” (line 1340) and “Retained earnings (uncovered loss)” (line 1370). They are both taken into account in the total of Section III of the Balance Sheet. Each error individually is below the level of materiality, but collectively they are significant. Their overall impact would lead to a distortion of such an important indicator as the value of net assets.

Thus, having determined the range of the most important financial indicators, care should be taken to ensure that errors in the parameters involved in their calculation are assessed for materiality, both individually and jointly.

The materiality of the error may vary depending on the reporting period

The materiality of a particular error may vary depending on the reporting period chosen.

Thus, annual reporting is used by a wide range of internal and external users to make, among other things, strategic decisions (regarding the distribution of profits, business structure, assessment of the financial stability of the counterparty).

However, the organization's management may decide to prepare interim financial statements based on the results of each month or each quarter, or at a specific reporting date of the current year.

The purposes for preparing interim reporting may vary. In particular, its data can be used to develop and adjust business plans and estimate the value of participants' shares. Such reporting can be provided to counterparties, investors or banks, etc.

For interim reporting, taking into account the purposes of its preparation, other errors may be significant than for annual reporting.

For example, it may be intended to provide food for thought about the solvency of the organization in the short term. To evaluate it, the so-called indicator is used. quick liquidity, calculated by the formula:

Errors in the indicated balance sheet lines (even not very significant in absolute terms) can seriously distort this indicator, which will lead to incorrect operational assessments of the organization's solvency and negative consequences. When analyzing only annual reporting, the quick liquidity ratio is much less important, because reflects the state of affairs solely at the reporting date and does not provide grounds for drawing conclusions for the long term. It turns out that in relation to interim reporting (depending on the purposes of its formation), its own criteria for the materiality of errors can be determined. They can also be fixed in accounting policies if the organization considers this appropriate.

Materiality and audit risk

The auditor's report largely depends on the auditor's personal confidence in whether the entity's financial statements contain material misstatements. For high-quality work, it is important for the auditor to understand which distortions, inaccuracies and errors are significant and which are not. A significant role is played by the subjective perception of the auditor, his level of professionalism: understanding of the specific aspects of the company’s work; taking into account the level of responsibility of reporting users when making decisions and the consequences of these decisions.

Despite some vagueness of the concept, materiality in an audit has certain characteristics. The materiality of economic information is its quality, which allows one to influence the managerial, economic and other decisions of a competent user of this information. A misstatement of information that exceeds a specified level of materiality is significant.

The level of materiality is a quantitative indicator. This is a distortion of financial statements, a milestone. Starting with it, a competent user will draw erroneous conclusions based on the given indicators and will be deprived of the opportunity to make informed management and economic decisions.

When expressing a judgment about the reliability of accounting data, a specialist takes into account the reasons that limit the complete and absolute correctness of such an assessment:

- The scope and timing of the audit, the amount of information that is subject to verification, is limited.

- Ambiguous interpretation of some legislative norms; This possibility is often included in the legislation itself and in regulatory documents.

- Subjective nuances of assessing the facts of economic life, other business transactions, including at the time of preparation of financial statements, determining the degree of reliability of the data.

In other words, the auditor makes a statement, omitting 100% certainty, but keeping in mind a certain level of acceptable risk.

There is an inverse relationship between materiality and audit risk. Obviously, if less stringent materiality values are used, the auditor is forced to take additional measures to reduce audit risk: conduct additional testing of data, increase the number of audit actions and procedures, spend more time on verification, expand the size of the audit sample. He works with a wider range of deviations in the company's reporting, and under these conditions the probability of not noticing one of the violations increases.

Examples of the wording of accounting policies regarding error correction

In conclusion, we give examples of wording from the actual accounting policies of several largest Russian companies. This may give you food for thought about your own accounting policies on this issue:

Option 1

«Level of materiality for error correction purposes

An error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements compiled for this reporting period.

Level of materiality for the purposes of disclosing individual indicators in the reporting

An indicator is considered material and is presented separately in the balance sheet, income statement, statement of changes in equity or statement of cash flows if its failure to disclose it could affect the economic decisions of interested users made on the basis of the reporting information. The level of materiality of the error is determined as 5% of the value of the basic reporting indicators.”

Option 2

“An error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements prepared for this reporting period. An error is considered significant if it amounts to 5 percent or more of the balance sheet currency or 5 percent or more of profit before tax.”

Option 3

“The company discloses in its annual accounting (financial) statements information regarding significant errors of previous reporting periods corrected in the reporting period. An error is considered significant if, individually or in combination with other errors for the same period, it can affect the economic decisions of users made on the basis of the accounting (financial) statements prepared for this reporting period.”

Option 4

“An error is considered significant if it, individually or in combination with other similar errors for the same reporting period (year) preceding the reporting period to which the identified error relates, amounts to more than 5 percent of the corresponding balance sheet item or the net profit (net loss) of the income statement in the event that an error or a set of errors affects the financial results.

The level of materiality is calculated on the basis of the accounting (financial) statements for the reporting year to which the identified error relates.

The decision on the level of materiality is made at the end of the current reporting year based on information about identified errors or their totality presented in the accounting certificate.

If the Company has previously recalculated comparative indicators (retrospective recalculation), then the level of materiality is calculated based on the recalculated data.”

As you can see, the wording varies from a simple quotation of PBU 22/2010 to much more detailed provisions that meet the ideas and needs of the company.

You can also select the text for your accounting policy using our Accounting Policy Designer

Methods for determining the level of materiality

There are two ways to determine the level of materiality in an audit - qualitative and quantitative. In a qualitative assessment, the auditor determines whether the identified errors are significant if they cannot be determined in total terms. Such errors may include, for example, distortions in accounting policies or the lack of information in the explanatory note about deviations from legal requirements.

In a quantitative assessment, the maximum level of materiality is calculated in the form of a specific amount. If detected violations do not exceed the calculated limit, then they are considered insignificant, and the reporting is considered reliable.

Because In practice, both qualitative and quantitative errors occur, then these methods of determining the level of materiality are used in combination.

How to fix significant errors

Depending on when the accountant discovered a significant error, the procedure for correcting it will vary:

| The principle of correction | Moment of detection | Correction procedure | clause PBU 22/2010 |

| In accounting | In the year of commission – identified before the end of the year | Corrected by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified | 5 |

| Error in the reporting year – detected after the end of this year, but before the date of signing the financial statements for this year* | Corrected by entries in the relevant accounting accounts for December of the reporting year | 6 | |

| In accounting and reporting for the year of the error | Error of the previous reporting year - identified after the date of signing the financial statements for this year, but before the date of submission of the statements to the owners | Corrected by entries in the relevant accounting accounts for December of the reporting year. If the statements were submitted to anyone before the error was corrected, they will be replaced with the corrected one. | 7 |

| Error of the previous reporting year - identified after the presentation of the financial statements for this year to the owners, but before the date of approval by them | Corrected by entries in the relevant accounting accounts for December of the reporting year. The restated financial statements disclose that they replace the financial statements originally presented and the basis for the restated financial statements. The corrected financial statements are submitted to all addresses to which the original ones were submitted. | 8 | |

| In accounting and reporting for the year an error was identified | Error from the previous reporting year - identified after approval of the financial statements for this year | Corrected:

Retrospective recalculation is carried out in relation to indicators starting from the reporting period in which the error was made**. Approved financial statements for previous reporting periods are not subject to correction and re-submission to users | 9, 10 |

* Accounting statements are considered prepared after they are signed by the head of the economic entity (Clause 8, Article 13 of Federal Law No. 402-FZ).

** If a significant error was made before the beginning of the earliest previous reporting period presented in the financial statements for the current reporting year, the opening balances for the corresponding items of assets, liabilities and capital at the beginning of the earliest reporting period presented are subject to adjustment (clause 11 PBU 22/2010).

If it is impossible to determine the impact of a significant error on one or more previous reporting periods presented in the financial statements, the organization must adjust the opening balance for the relevant items of assets, liabilities and capital at the beginning of the earliest period for which recalculation is possible (clause 12 PBU 22/2010).

The impact of a material error on the previous reporting period cannot be determined if complex and (or) numerous calculations are required, during which it is impossible to identify information indicating the circumstances that existed on the date of the error, or it is necessary to use information received after the date of approval of the financial statements for such previous reporting period (clause 13 of PBU 22/2010).

As you can see, PBU 22/2010 provides three approaches to correcting significant errors. They are offered not as a choice, but taking into account the moment the error is discovered.

A significant error was identified during the year

In April 2021, the organization accrued and paid an advance payment of corporate property tax in the amount of 1,000,000 rubles.

In June 2021, it turned out that by mistake the payment amount was overestimated by 200,000 rubles. (the error is significant).

The overpayment amount is offset against future payments.

Transactions are reflected in accounting using the following entries:

| Contents of operations | Debit | Credit | Amount, rub. |

| In April 2019 | |||

| Advance payment for property tax accrued | 68 | 1 000 000 | |

| Advance payment of property tax transferred to the budget | 68 | 1 000 000 | |

| In June 2019 | |||

| REVERSE For the amount of the overcharged advance payment | 68 | 200 000 | |

How to disclose material data in reporting

If the indicators for individual assets, business transactions, income and expenses are significant, and without knowledge of them an interested party will not be able to assess the financial position of the company, then such data must be reflected separately, that is, breaking the total amount into important items (clause 11 of the PBU 4/99 “Accounting statements of the organization”).

Example of materiality

Stroylesbyt LLC has accounts receivable in the amount of 20 million rubles. And only 15 of them should be alone.

The Stroylesbyt accountant did not go into details and reflected the entire receivables without breaking them down by debtor. However, such information is significant: it will greatly influence the opinions of stakeholders.

The investor, having studied the statements, saw a positive picture and considered that the company owned good assets. But in fact, the company’s budget is highly dependent on Mir LLC, which may go bankrupt and not pay its 15 million rubles. In this case, Stroylesbyt will have difficulties, and the investor may lose his money.

Of course, an accountant may deliberately fail to disclose debtor information in order to attract investor capital. However, this is already a violation of clause 11 of PBU 4/99, because significant indicators must be presented separately. And 15 million rubles. debt from one unscrupulous person is a very significant indicator.

Example of irrelevance

Stroylesbyt LLC has accounts receivable in the amount of 20 million rubles. This amount consists of small debts of each company:

- Vera LLC owes 1.2 million rubles,

- LLC "Mirage" - 2 million rubles,

- LLC "Kitchens" - 1.7 million rubles. etc.

Here the picture changes radically: after all, if one of the debtors does not pay, the work of Stroylesbyt will not stop. He will receive money from other debtors. And it’s easier to pay small amounts to companies than to pay 15 million rubles to one. The enterprise will operate and bring profit to the investor.

In this case, breaking down into small debts will only distract stakeholders from the big picture and make the report difficult to read. Insignificant indicators can be grouped and reflected in a total amount: they still will not affect the opinion of the company.

A significant error was identified before the statements were approved

In March 2021, it was revealed that in 2021 the write-off of advertising expenses in the amount of RUB 3,500,000 was erroneously not reflected. (the error is significant).

The error was discovered after the signing of the financial statements for 2019, after their submission to the tax authority and the participants of the Organization, but before the date of approval by the owners.

Transactions are reflected in accounting using the following entries:

| Contents of operations | Debit | Credit | Amount, rub. |

| Posts for December 2019 | |||

| The amount of advertising expenses is included in sales expenses | 44 | 60 | 3 500 000 |

| Increased cost of sales (in terms of expenses that were erroneously not taken into account) | 90.02 | 44 | 3 500 000 |

| Account 90.02 was closed (in terms of increasing the cost of sales by the amount of expenses that were erroneously not taken into account) | 90.09 | 90.02 | 3 500 000 |

| The financial result was reduced by the amount of expenses that were erroneously not taken into account. | 99 | 90.09 | 3 500 000 |

| Reflected adjustment to retained earnings in terms of erroneously not taken into account expenses (taking into account the impact of recalculated income tax) (3,500,000 – 3,500,000 x 20%) *** | 84 | 99 | 2 800 000 |

***Accounting entries for income tax adjustments are not provided.

A new copy of the revised reporting is compiled, where the indicators are replaced with the correct ones.

The notes to the amended financial statements disclose that they replace the financial statements originally presented, as well as the basis for preparing the amended financial statements.

The corrected financial statements are submitted to all addresses to which the original ones were submitted. In this case, a copy of the financial statements in which the error has been corrected is submitted to the tax authority at the location of the organization no later than 10 working days from the day following the day of approval of the statements (clause 5 of Article 18 of Federal Law No. 402-FZ).

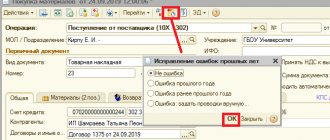

Workshop in 1C on correcting a significant error identified before the statements were approved

The principle of materiality according to the national financial auditing standard No. 1

In accordance with the provisions of the national financial auditing standard KSRF 1, one of the main elements of the audit of financial statements

is the definition of “

materiality

not

without harm to

the quality of the financial statements

and the correctness of the underlying accounting accounts , unless neglect of such adjustments would cause misleading of the user of the

financial statements

.”

Materiality principle

Also covered in International Standard on Auditing

ISA 320,

Materiality

in

Planning and Conducting an Audit.

A significant error was identified after the statements were approved

In December 2021, the Organization identified a significant error made in 2021: when assessing a capital construction project put into operation in December 2021, part of the capitalized expenses (RUB 1,000,000) was erroneously reflected in account 97, instead of account 08. As a result, the amount was not included in the initial cost of the object, and remained taken into account in the debit balance of account 97.

The error is significant.

A similar mistake was made in tax accounting. The organization decided to correct it in the 2021 tax period, taking into account the opportunity provided by Art. 54 Tax Code of the Russian Federation. As of the reporting date (December 31, 2020), there are no temporary differences in this situation (assets are valued identically in accounting and accounting records, depreciation charges also coincided).

To correct errors from previous years, the following transactions are made in December 2021:

| Contents of operations | Debit | Credit | Amount, thousand rubles |

| Increase in the initial cost of an asset | 01 | 84 | 1 000 |

| Reduced amount of deferred expenses | 84 | 97 | 1 000 |

The entry for December 2021 additionally accrues the amount of depreciation for the object for the period 2021 (the accountant calculated depreciation for January - December 2021 in an underestimated amount, so the error in the reporting year was corrected in this part). Conventionally, we will accept the amount of additional annual depreciation – 20,000 rubles.

| Contents of operations | Debit | Credit | Amount, thousand rubles |

| Depreciation calculation for 12 months of 2021 | 25 | 02 | 20 |

The mistake led to the incorrect reflection in the balance sheet of the value of fixed assets and the amount of inventories as of December 31, 2019.

The organization’s annual financial statements for 2021 included the following data (in thousands of rubles):

| Reporting form | Line, column | Amount, thousand rubles |

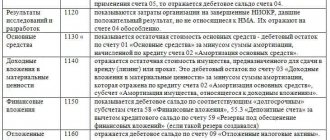

| in Sect. I of the Balance Sheet in the column “As of December 31, 2019” | 1150 “Fixed assets” | 10 800 |

| in Sect. II of the Balance Sheet in the column “As of December 31, 2019” | 1210 "Stocks" | 1 030 |

After adjustment:

| Reporting form | Line, column | Amount, thousand rubles |

| in Sect. I of the Balance Sheet in the column “As of December 31, 2019” | 1150 “Fixed assets” | 11 800 |

| in Sect. II of the Balance Sheet in the column “As of December 31, 2019” | 1210 "Stocks" | 30 |

Workshop in 1C on correcting a significant error identified after approval of reporting

Correction of significant errors in simplified accounting methods

We also note that by virtue of clauses 9, 14 of PBU 22/2010, organizations that have the right to use simplified methods of accounting, including simplified accounting (financial) statements, can correct such a significant error without retrospective recalculation by entries in the corresponding accounting accounts, including month of the reporting year in which the error was detected. Profit or loss arising as a result of correcting this error is reflected as part of other income or expenses of the current reporting period.

In the explanations to the annual financial statements, the organization must disclose the following information regarding significant errors of previous reporting periods corrected in the reporting period (clauses 15, 16 of PBU 22/2010):

- nature of the error;

- the amount of adjustment for each item in the financial statements - for each previous reporting period to the extent practicable;

- the amount of adjustment based on data on basic and diluted earnings (loss) per share (if the organization is required to disclose information on earnings per share);

- the amount of adjustment to the opening balance of the earliest reporting period presented.

If it is impossible to determine the impact of a material error on one or more previous reporting periods presented in the financial statements, then the explanations disclose the reasons for this, and also provide a description of the method of reflecting the correction of a significant error in the financial statements of the organization and indicate the period from which the corrections were made.

See also:

- Correcting accounting errors

- Correcting errors in NU

- Correcting VAT errors

- The procedure for correcting errors in 1C

- The amount of last year's expenses was underestimated: accounts receivable were not written off. Correction of a significant error before the statements are approved

- The original cost of the fixed asset is distorted. Correction of a significant error after approval of statements

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- The costs for the services of the current year supplier are inflated. In this article we will look at how to reflect the correction in the buyer’s accounting...

- Transferring the implementation document to another quarter of the current year...

- The amount of last year's revenue is underestimated. Correcting an error before signing the statements Errors in accounting are not uncommon, incl. when issuing primary...

- The original cost of the fixed asset is distorted. Correction of a significant error after approval of statements Reflecting costs on the wrong account may lead to errors not...